Neil is the Founder & CEO of Bioverge Ventures, an investment platform democratizing access to enable individuals to dive...

Problem

Why can’t you invest in the future of your own health?

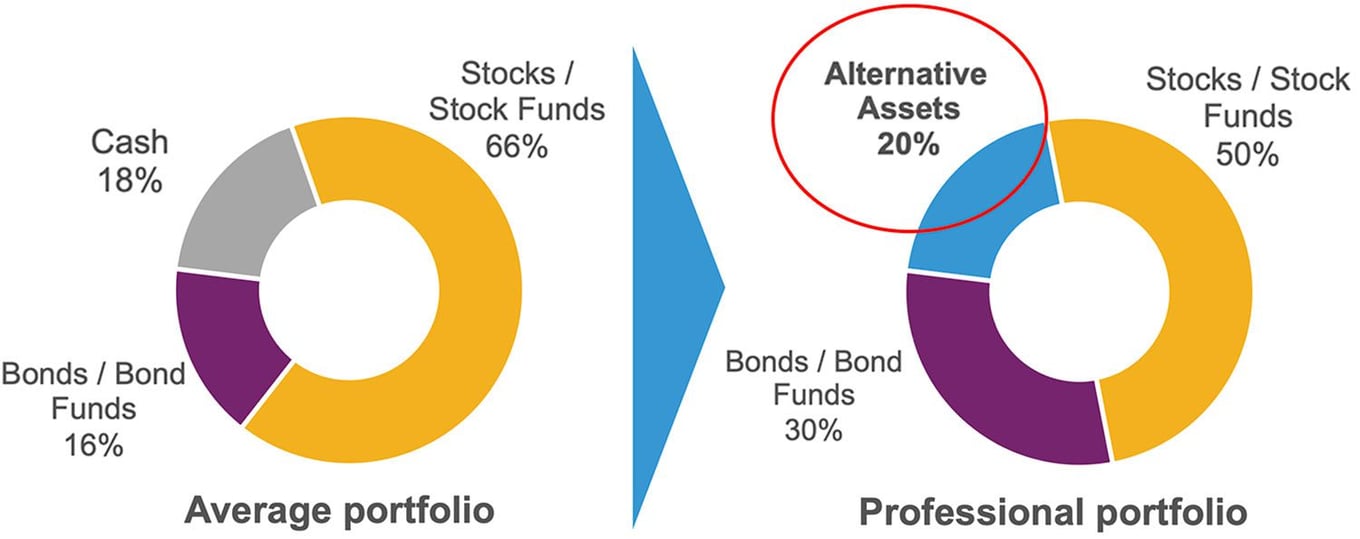

There's a massive shift to

alternative assets among

retail investors...

|

—

...but investing in healthcare innovation

and biotech is hard.

—

According to "Giving USA," over $40 billion is donated annually to health-related causes, however, investing in healthcare innovation continues to be difficult.

Typically, the only option to support early-stage innovation has been to donate to charities tackling diseases you want to support curing.

This is because investors need to source and vet hundreds of startups, constantly follow an ever-changing landscape, and invest against sophisticated professional investors with access to asymmetric information, proprietary research and relationships.

Bioverge is leveling the playing field for retail investors by offering investments in healthcare startups previously only available to premier VC firms.

Solution

The fintech platform for early-stage healthcare investments

Bioverge empowers investors

with exclusive access and options.

Bioverge is a financial technology platform democratizing access to investments in the next generation of startups pushing the boundaries of healthcare. We offer everyone a chance to invest in companies tackling diseases that affect us all, and a chance for great financial returns.

With Bioverge, millions of Americans can invest in companies targeting diseases they care about while also diversifying their portfolio with alternative assets.

—

Breaking down three key barriers &

enabling sophisticated investing for all

—

Now, with Bioverge, it's possible to access private healthcare venture capital investments and support biomedical innovation with low investment minimums.

Product

Invest your way

Bioverge has a variety of investment options, personalized to the unique needs of our investors. Individuals, family offices, investment advisors, and institutions have a chance to invest in next-gen healthcare, and bring science fiction to life.

- Deal-by-Deal Investments

Opt-in to individual investments and build your own portfolio - Bioverge Access Funds

Diversification across a portfolio of 15+ startups - Thematic funds

Special opportunity funds such as longevity, cancer, neuro, digital health, etc.

Artificial Intelligence-driven investments*

Bioverge is building a customized diligence process to evaluate each investment opportunity on a risk-adjusted basis by gathering the input of subject matter and domain experts.

The platform uses an AI super-facilitator model based on Probablistic Computing + Large Language Models (LLMs) to create a predictive model for fast, confident actions. Our investment team is incorporating these models to help make informed investment decisions based on the inputs of our vast network of experts.

*Bioverge is currently working with a collaborator to build these models. There is no assurance of the model's performance, or if Bioverge will ultimately implement these models.

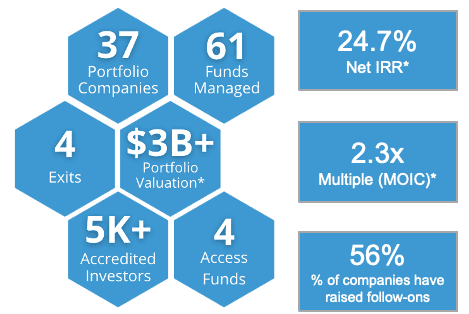

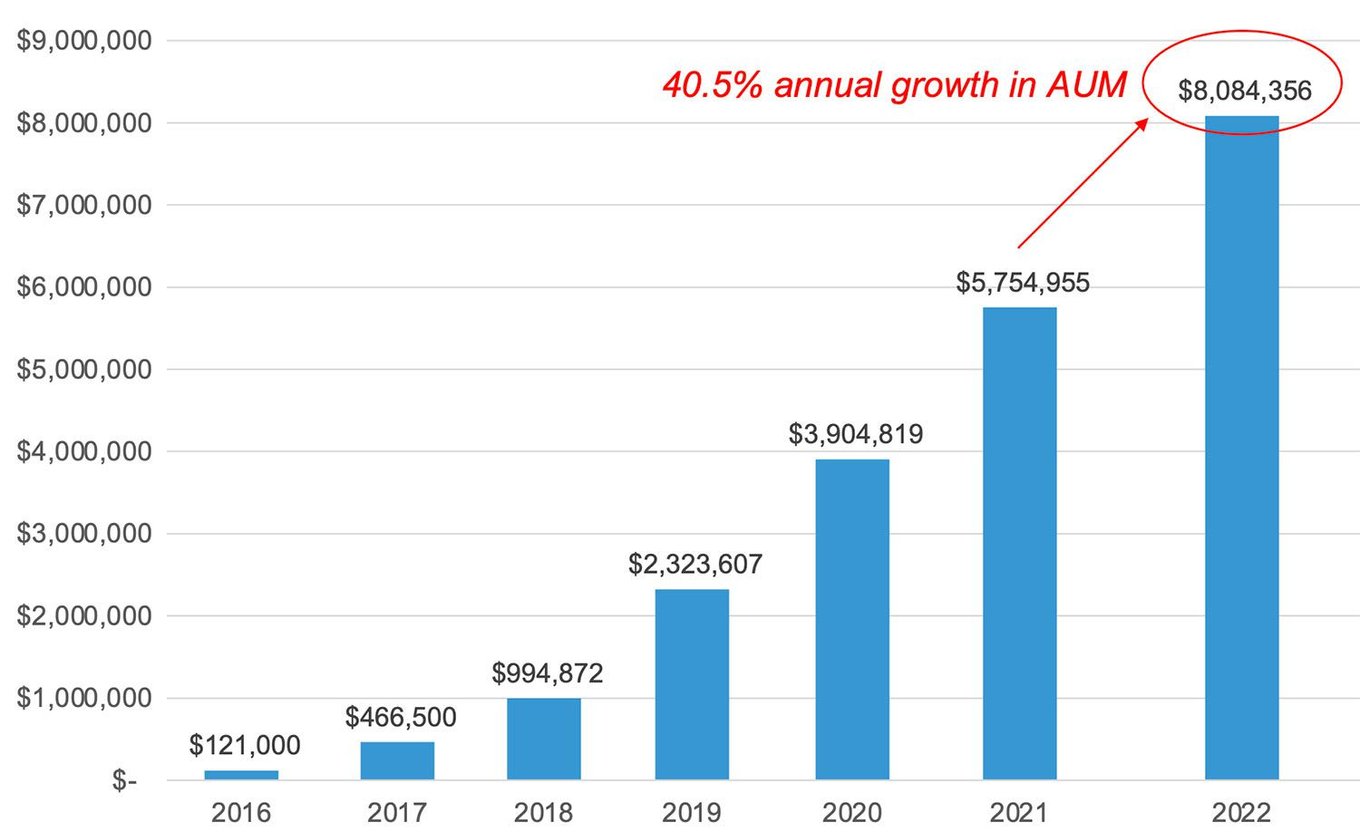

Traction

$3B+ portfolio valuation*,

with 40%+ growth in AUM from 2021–2022.

—

Annual growth in assets

under management

—

*Data as of March 31, 2023. Accredited Investors is based on accredited investors in the Bioverge Network. Realized Net IRR (internal rate-of-return) is net of fees and expenses. MOIC (multiple-on-invested capital) is gross, before taking into account fees and expenses. Realized Net IRR and Realized MOIC are realized values based on the performance of all exits and write-downs or liquidation events, and are limited to companies within our portfolio that have had an exit event or have been shut down, or are otherwise no longer operating. Realized Net IRR and Realized MOIC are based on distributions calculated at the time of transaction close, and include escrows and amounts receivable at a future date but do not include contingent compensation that may not be realized. Realized Net IRR and Realized MOIC may be higher or lower due to the impact of market fluctuations for publicly held securities and the impact of the timing of distributions. Results are not audited. Past performance is not indicative of future results.

Customers

Robust array of companies to diversify investor portfolios

Welcome to the Century of Biology.

Our increasing ability to engineer biology will fundamentally transform how we diagnose, treat, and manage disease.

With the advancements in computational biology (artificial intelligence & machine learning), novel therapeutic modalities (cell & gene therapies), and digital therapeutics, we're building a world we could previously only dream of creating.

And we're not the only ones who see the tremendous value being created...

—

We offer access to invest

alongside top-tier VCs

—

Bioverge has invested ahead of, or alongside firms such as:

Andreessen Horowitz, Sequoia, 8VC, First Round Capital, GV (Google Ventures), Khosla Ventures, Lux Capital, Founders Fund, Y Combinator, StartX, Amgen Ventures, and many others.

We've already invested in 37 companies developing technologies that sound like science fiction....but they are quickly becoming science fact!

|

|---|

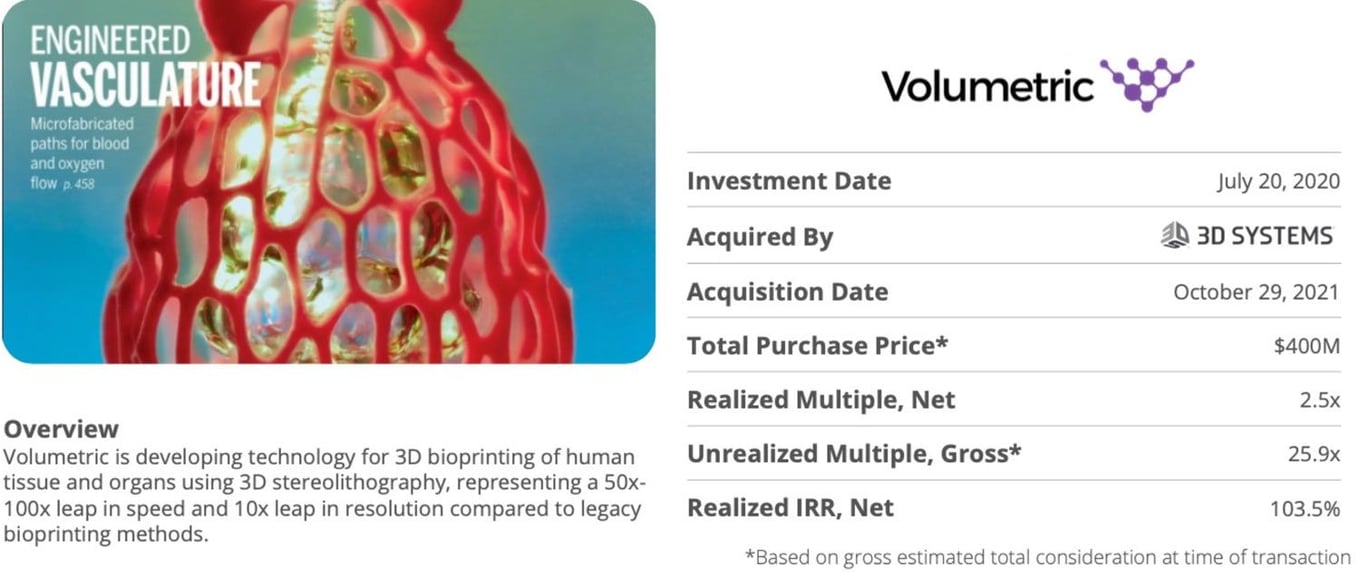

Developing the ability to manufacture human organs using 3D bioprinting. Acquired by 3D Systems for up to $400M.

Clinical-stage precision therapeutics company developing a new class of oncology medicines: Predictive Precision Medicines. |

We believe healthcare venture capital offers: (1) attractive risk-adjusted returns, and (2) a positive impact on society by supporting the development of new technologies, products, and services that can improve people's lives.

But don't take our word for it...

|

|---|

*Realized Net IRR and Realized MOIC are based on distributions calculated at the time of transaction close, and include escrows and amounts receivable at a future date but do not include contingent compensation that may not be realized. Realized Net IRR and Realized MOIC may be higher or lower due to the impact of market fluctuations for publicly held securities and the impact of the timing of distributions. Results are not audited. Past performance is not indicative of future results. |

|

|---|

Katharina is building an innovative machine learning drug discovery platform using digital science to map out, fully understand, and finally cure brain aging, starting with Parkinson’s disease.

|

Business model

Capital for companies. Opportunities for investors.

Online Venture Capital

(Accredited, Family Offices, Investment Advisors)

Our syndication model aggregates accredited investors into a Special Purpose Vehicle (SPV). That SPV then invests directly in a single company, or invests in multiple companies through one of our Access Funds or Thematic Funds.

- Structure: Deal-by-deal SPVs + multi-company SPVs (Access/Thematic Funds)

- Revenue: Management fees

- Deal-by-deal: 2% annually over a period of 3 years.

- Access funds: 2% annually over a period of 6-10 years.

- Upside: Carried interest (15-20%)*

For investors in our crowdfunding offering**

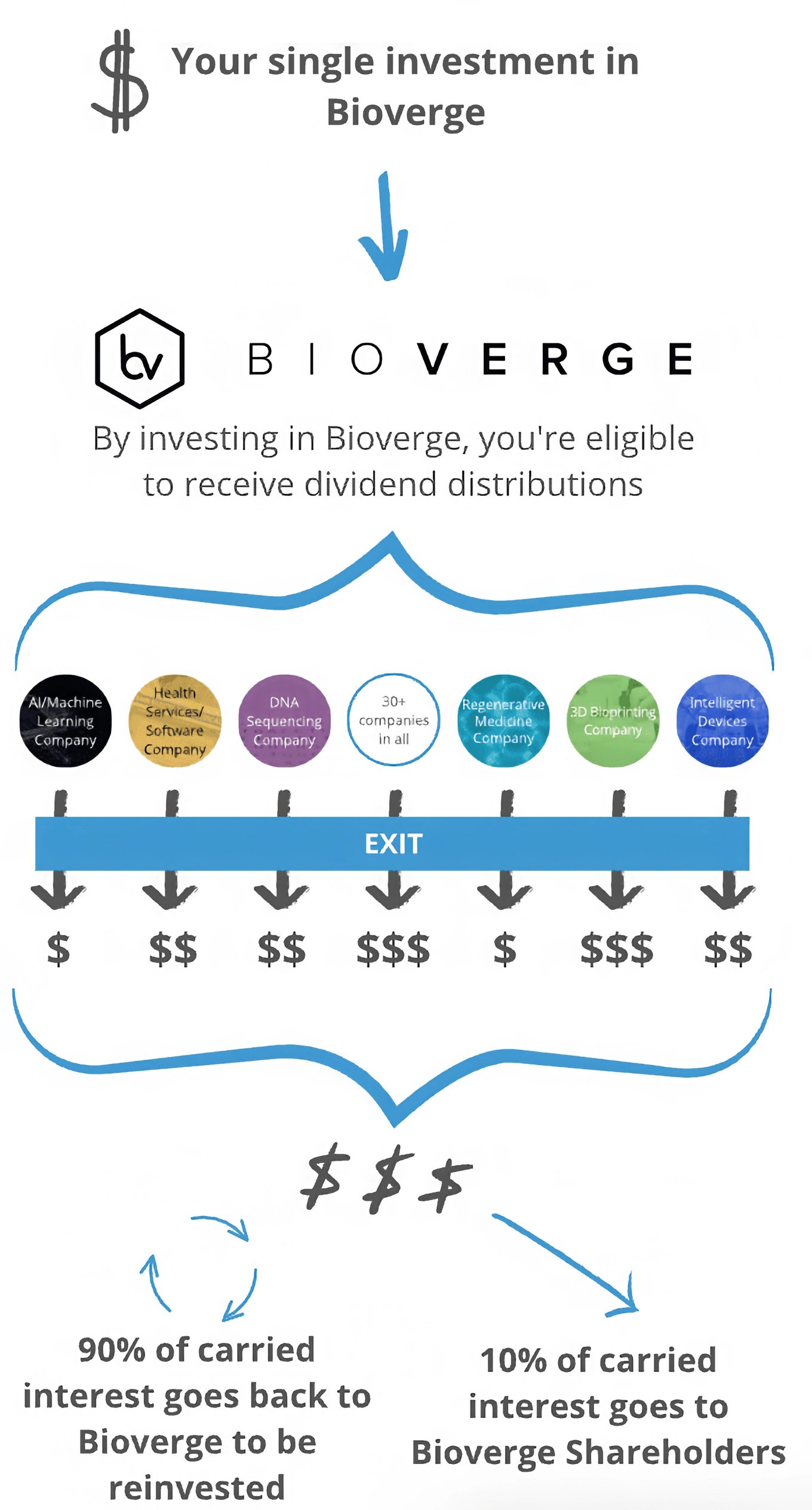

Bioverge offers a unique opportunity for investors. Investing once means that, as a shareholder, you’ll benefit financially from every investment we make, and every fund that we manage.

As our portfolio scales, and more and more companies are added to the portfolio, the potential to generate more dividends grows, along with the enterprise value of our fintech platform.

*Gross carried interest payable to funds managed by Bioverge and Bioverge affiliated entities is typically 15-20%. Carried interest can be waived, reduced or assigned and the amount of carried interest due may vary from fund to fund and is subject to change.

**Bioverge anticipates dividends will accrue to a Dividend Pool. Each time the Dividend Pool reaches a minimum threshold of $250K, proceeds will be distributed to shareholders on a pro-rata basis.

Market

Accredited investors growing at 35%+ CAGR

There are over 13.7 million accredited investors in the U.S. With Bioverge, millions of Americans can now invest in companies targeting diseases they care about while also diversifying their portfolio with alternative assets.

Until recently, the high investment minimums required to tap into the private healthcare venture capital market have been an impenetrable barrier to entry for individual investors. This was the case even for high-net-worth individuals since investment minimums have historically been in the millions or tens of millions.

Now, with Bioverge, it is possible to access the private healthcare venture capital market with as little as $5,000.

Vision and strategy

Enabling revolutionary biological innovation

Our investment platform fuels the unprecedented velocity

of biological innovation — giving us new tools to build

a world we could previously only dream of creating.

Through recent advancement in these areas, we are now routinely curing diseases once thought to be incurable (such as Severe Combined Immunodeficiency, or SCID, just to name one example)

There are three components to our vision. To enable every American to:  Our long-term vision is to be the place for individuals to invest in private healthcare deals. We have the opportunity to put billions of dollars to work every year to benefit our collective future while generating outsized returns for our investors.

Our long-term vision is to be the place for individuals to invest in private healthcare deals. We have the opportunity to put billions of dollars to work every year to benefit our collective future while generating outsized returns for our investors.

We are bringing science fiction to life, and changing the lives of millions.

—

Milestones & Use of proceeds*

—

Funding

You're in good

company

We’ve raised over $2.3 million from a network of 500+ investors.

Our investors include Sonia Arrison at 100 Plus Capital, and individuals who are members of premier angel groups in Silicon Valley, including Sand Hill Angels and Band of Angels.

Many of our investors are doctors, healthcare executives, technology professionals, and many others who invest with us in our deals on a regular basis.

As part of our mission to democratize access, we previously completed a Reg CF raise and are thrilled to open up our latest round on Republic!

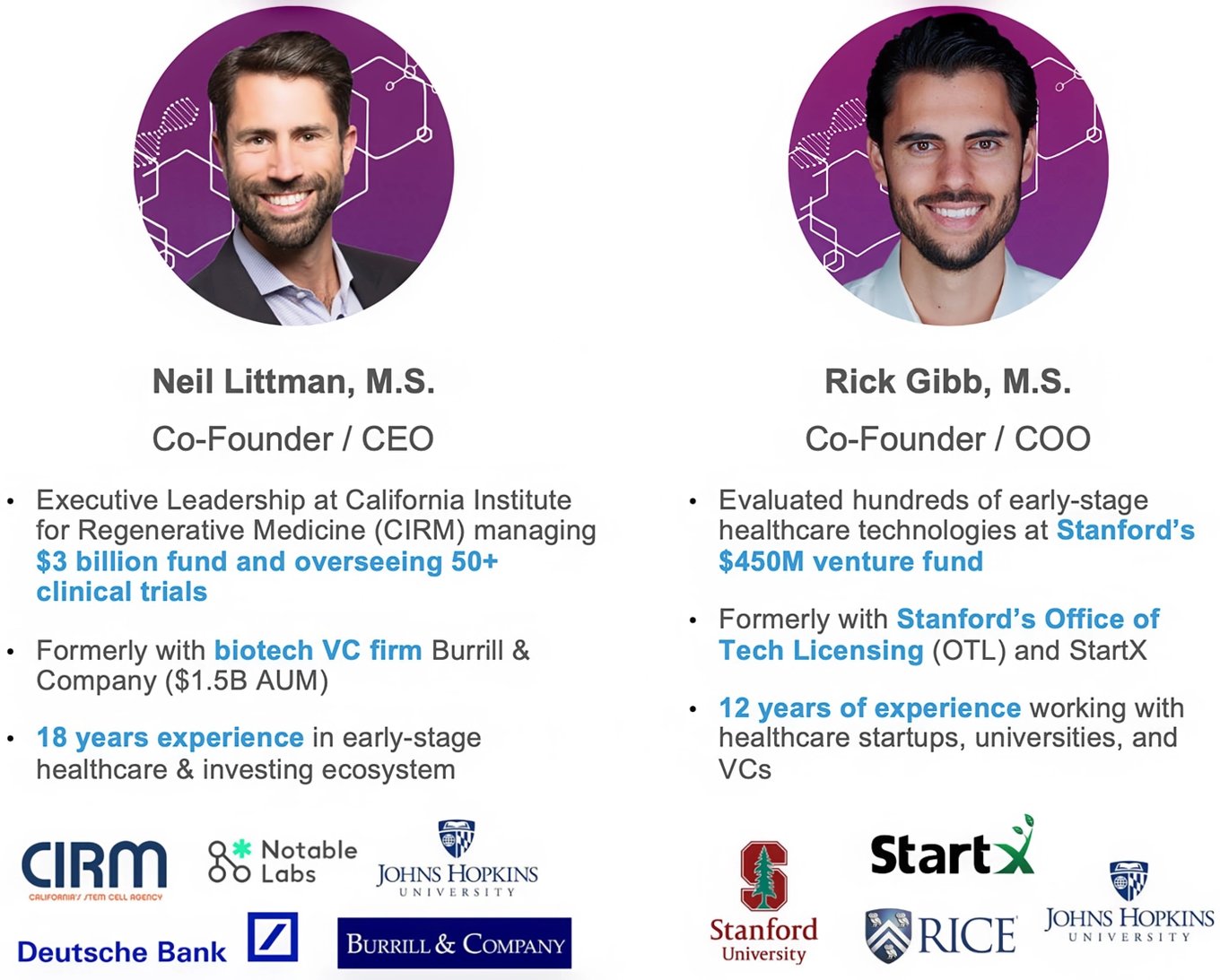

Founders

Passionate team with deep domain expertise

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Using breakthroughs in machine learning, metabolomics, and robotics, Enveda's platform indexes nature’s untapped chemical space for new drug discovery.

Using breakthroughs in machine learning, metabolomics, and robotics, Enveda's platform indexes nature’s untapped chemical space for new drug discovery.

Using cutting edge CRISPR gene therapy platform to generate functional cures for HIV and other viral infectious diseases.

Using cutting edge CRISPR gene therapy platform to generate functional cures for HIV and other viral infectious diseases.

Dr. Katharina Sophia Volz

Dr. Katharina Sophia Volz