* Click here for important information regarding Financial Projections which are not guaranteed.

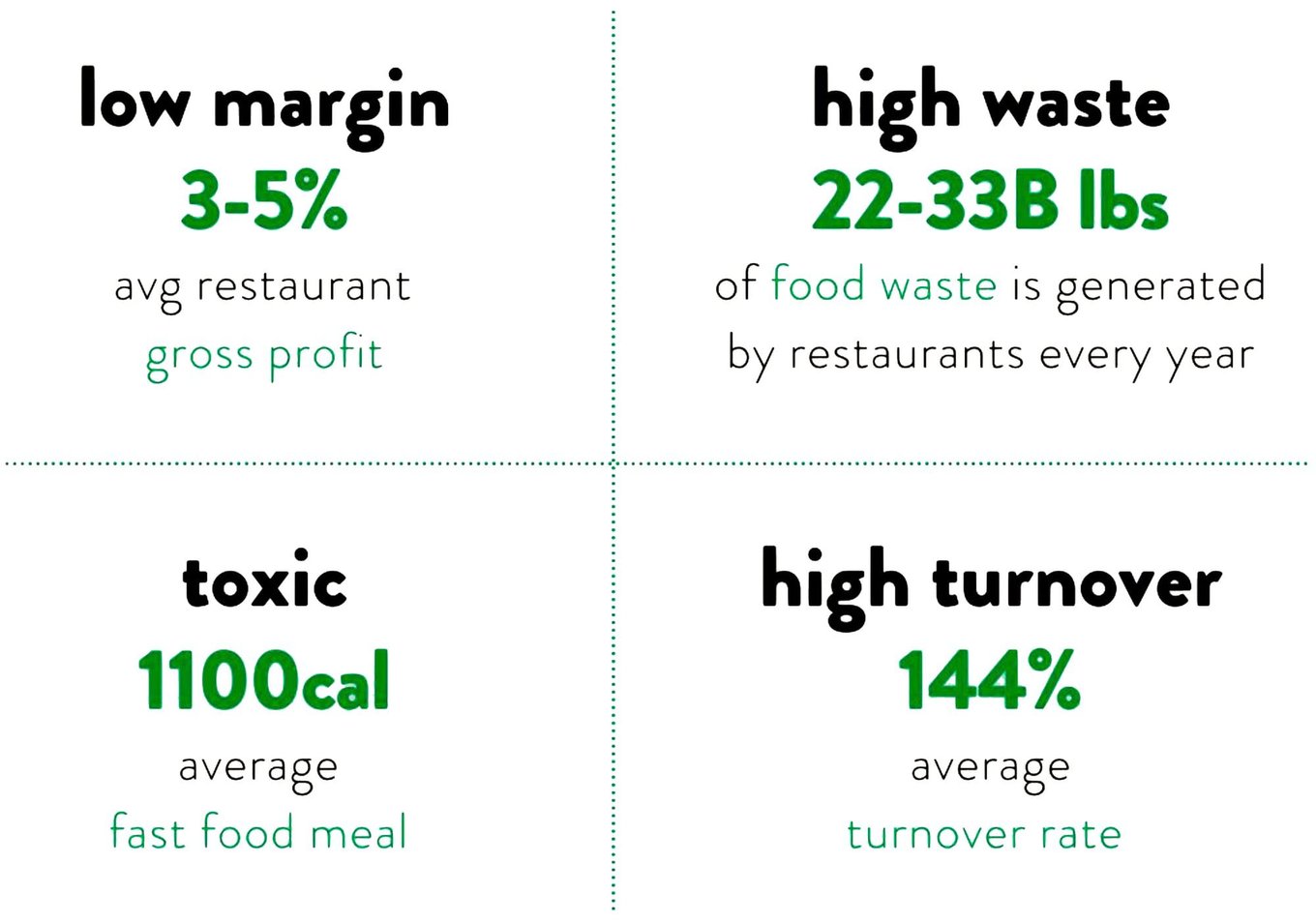

Problem

The typical Quick Serve Restaurant (QSR) is:

Solution

Imagine a world where you can make a selfless choice by making a selfish one

Un·cooked is a plant-based food company revolutionizing the way people consume healthy food.

Unlocking the power of plants to transform our collective well-being, our communities, and the planet.

Come feed tomorrow with us!

—

Mission driven

Omnichannel

Experiential

Return to source

—

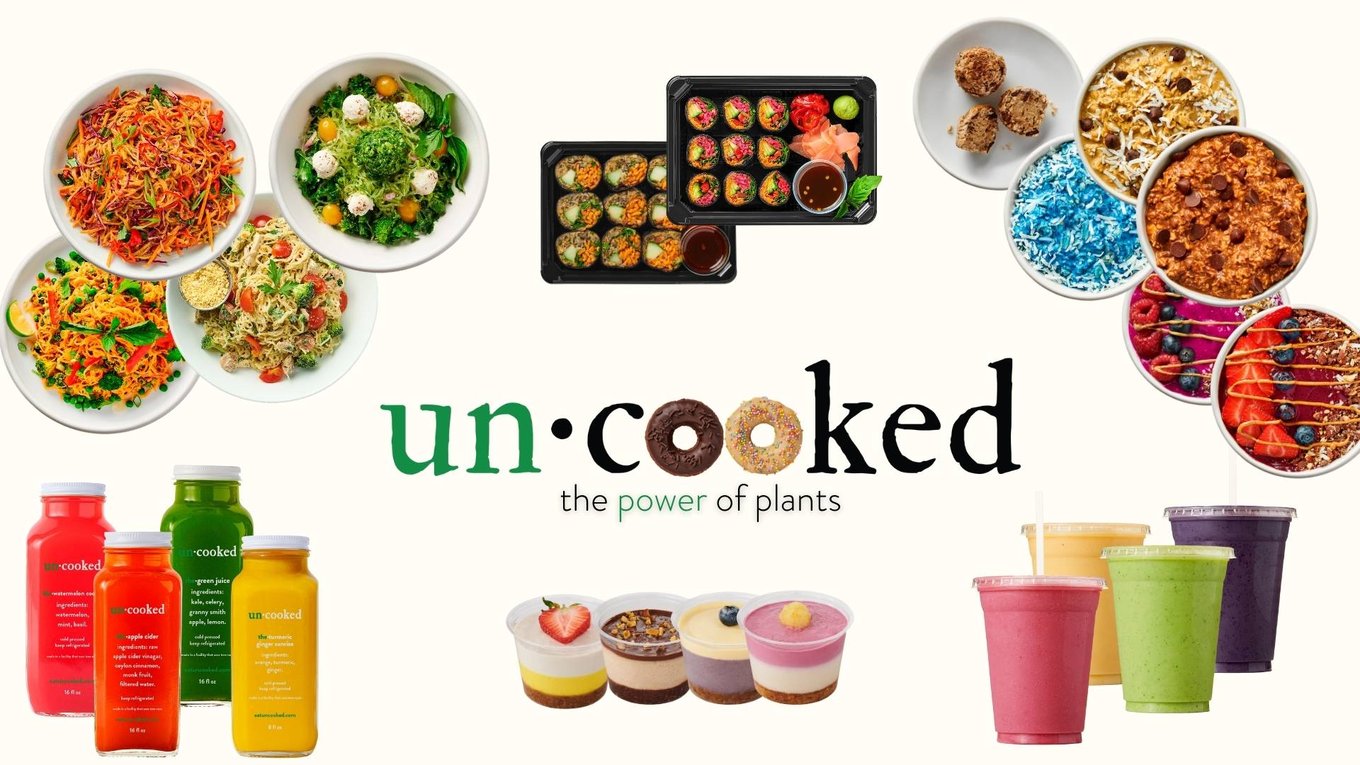

Product

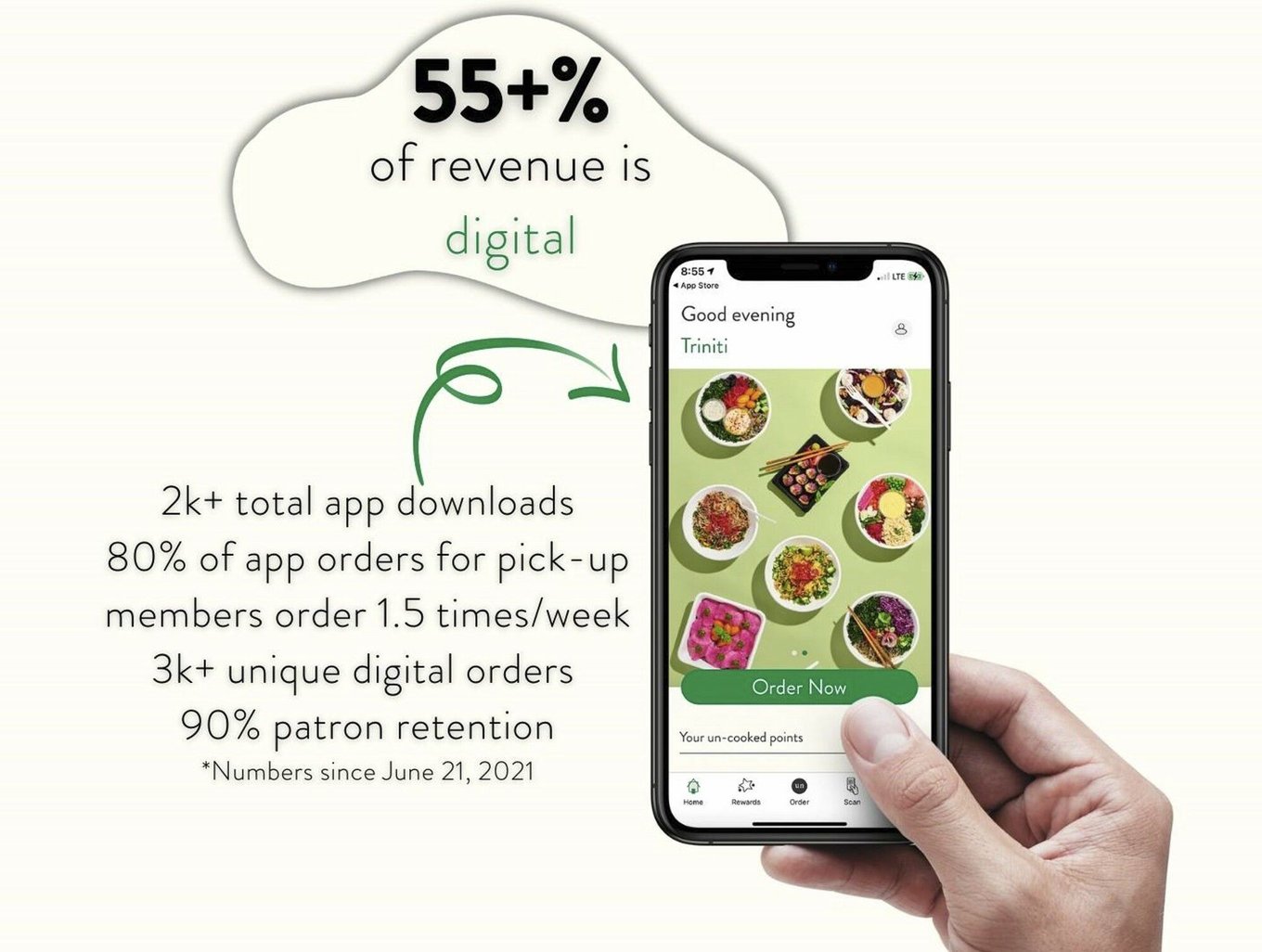

Traction

212% Year over Year growth*

$1M+ lifetime revenue

$150k+ revenue for Q1 2022

$1.5M run-rate for 2022

$10M forecasted run-rate by 2024

* Click here for important information regarding Financial Projections which are not guaranteed

In the news

Customers

Identifying our demographic

Customer Values

health-minded

digitally native

curious

conscious

desire to return to source

—

Customer breakdown

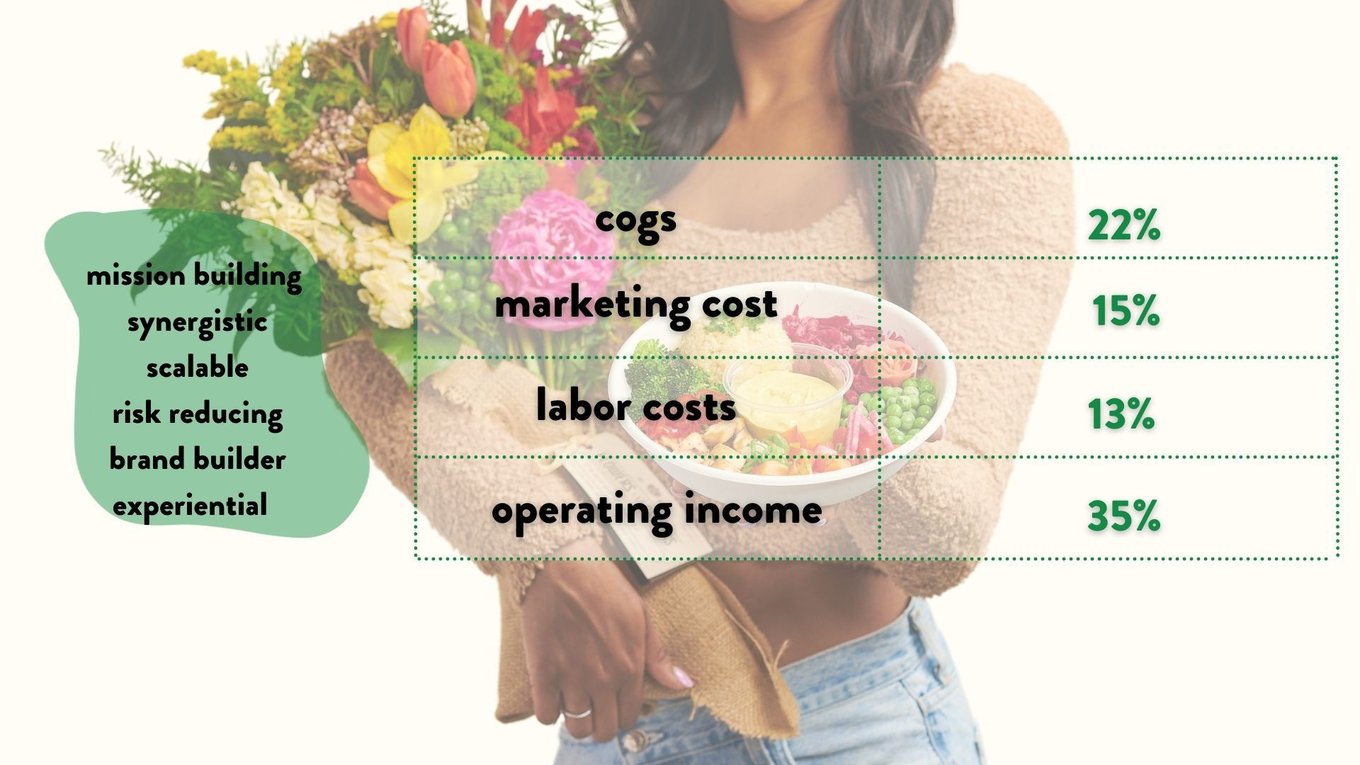

Business model

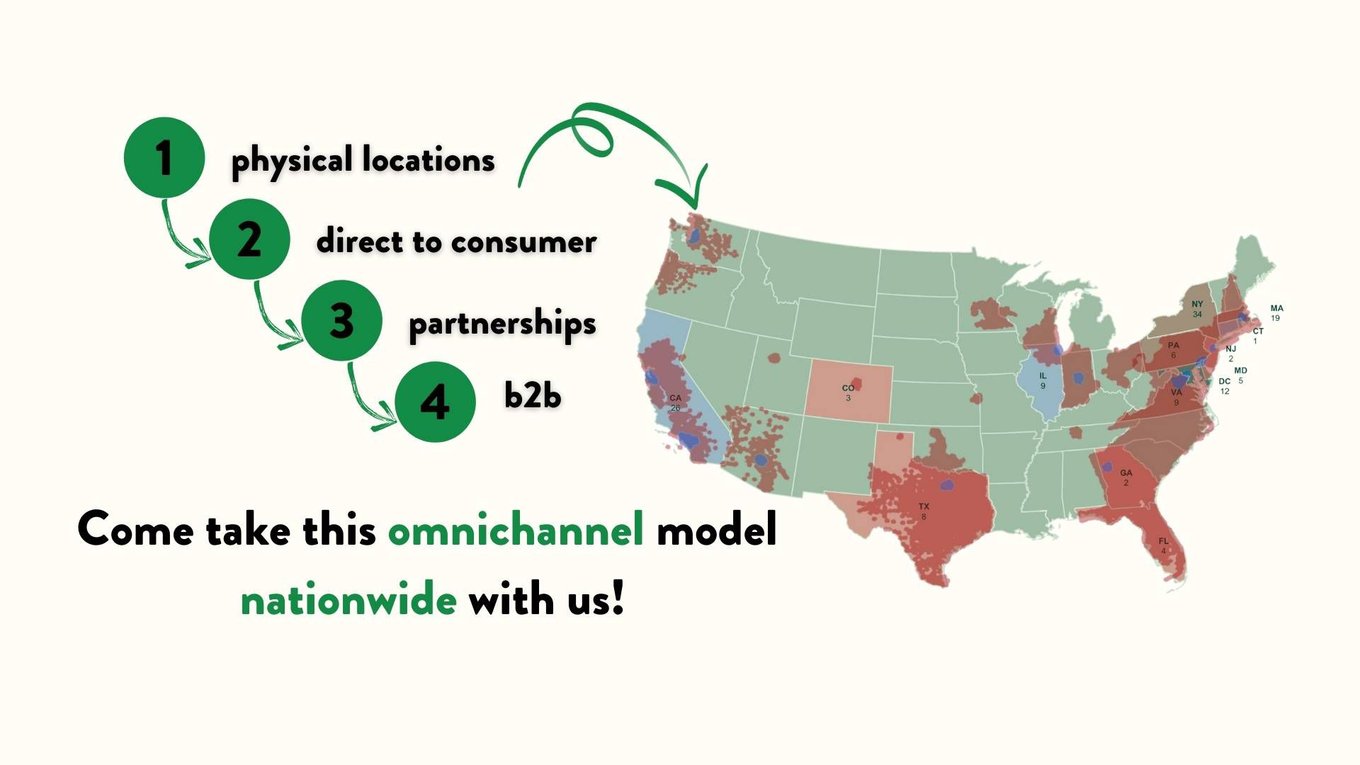

4 revenue channels

1. Physical locations

2. Direct to consumers

3. Partnerships

4. B2B

Market

$74.2B plant-based food market by 2027

Continued aggregate growth ~12% from 2020 to 2027

66% of consumers have increased their spend on fresh food, and 75% are actively looking for healthier food.

80+% of millennials and gen-x expect companies to publicly commit to doing good.

Competition

Un·cooked vs the typical QSR

—

Comparables

Vision and strategy

Community growth, and expansion

—

Near Term

- Build out digital infrastructure to offer 1 day shipping.

- Grow run rate to $5M.*

- Look for 2 additional locations informed by our community.

- Open a 3 partnership locations.

- Expand b2b presence in local grocers and specialty stores.

*Click here for important information regarding Financial Projections which are not guaranteed.

—

Medium Term

- Open a new market informed by our community and robust 1 day ship points.

- Florida, Texas, Northeast, or California.

- Flesh out distribution in advance to national distribution.

—

Long term

- National distribution in all major markets.

- Be the first omnichannel food business in the USA offering whole plant-based food at scale!

Funding

Bootstrapped to

prove the concept!

We have a laser focus on doing business the right way, and only bringing people on board that believe in what we are doing.

Founders

Our family

Jeremy

The “Why” CEO

- 10+ years experience in health and wellness

- 3 years in b2b sales with national brands

- Expert in finding win-win-win opportunities

—

Kaitlyn

The “How” CBO

- Spearheads creative vision and branding for uncooked

- Leads the charge for all logistics, planning and packaging

- Leader of the most profitable division of one of the largest corrugated companies in North America

—

Carole

The ”What” COO

- 15 years experience as a plant-based Chef

- Highest rated plant-based chef in Chicago

- The creative force behind un·cooked’s food

- Sparkplug to our culture

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...