Real estate investing can seem unnecessarily complicated. You already know much more than you think you do, but there are two top rules to consider to unlock real estate value for yourself. These should form the foundation of every real estate decision you make going forward.

Rule Number 1: “Main and Main”

“Location, location, location” is real estate gospel. It’s one of the most basic, yet important principles of real estate investing. The location of a property is what will primarily determine its value. Why? Though you can upgrade a building or even change its use, you can never move it. People want to be in the heart of a city or a neighborhood, or, in other words, “at the intersection of Main and Main.” So, this desire to be in the center of the action creates demand, and demand drives an increase in real estate value and prices.

Rule Number 2: “Right place right time”

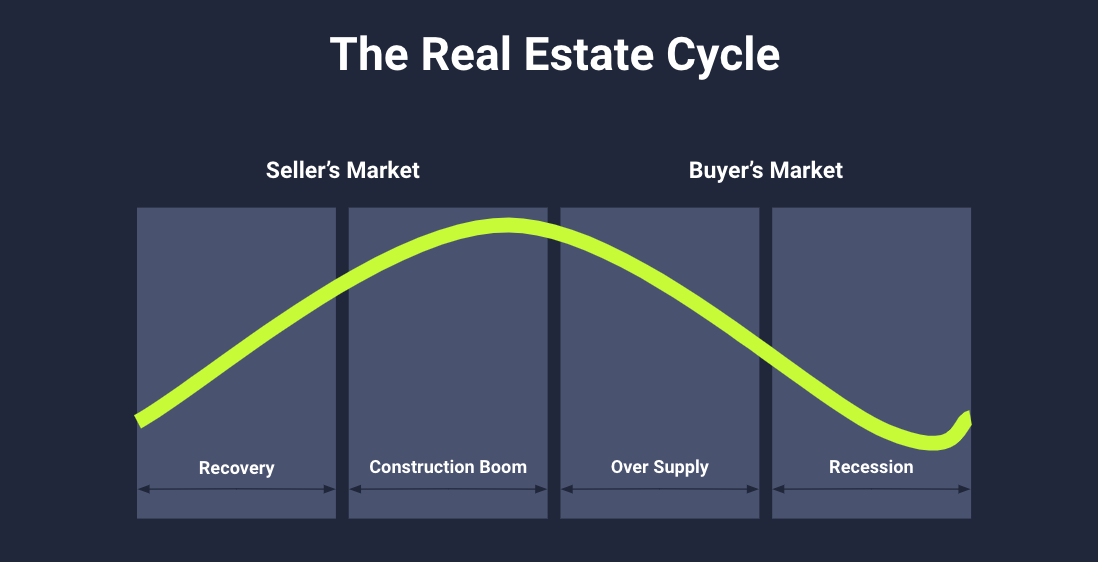

It’s important to note that real estate is cyclical. It has a wash, rinse, repeat nature to it that creates two distinct opportunities: 1) a seller's market and 2) a buyer's market.

A seller's market occurs when demand exceeds supply. This means that multiple buyers could be interested in a single property, which could result in bidding wars, forcing prices higher.

A buyer's market occurs when the supply exceeds demand. This means that there is more inventory than is needed at the time, and if you’re a buyer, you may be able to scoop up a property at a lower price than you would if the market were at a different point in the cycle.

One imperative point to consider is this: no one has a crystal ball. Said in another fashion by Terry Smith, a real estate fund manager, “There are only two types of people: those who can’t market time, and those who don’t know they can’t market time.”

Simply put, no one can time the market. Not even the most expert real estate investors in the biz. But you can, however, look at your surroundings for cues signaling what point in the cycle we might be.

So, what are these visual cues?

Seeing an abundance of cranes, cement, and hard hats? You’re in the midst of a construction boom. Meaning, the market is likely about to peak for sellers and enter a phase of oversupply, which has its own set of cues…

If you’re seeing signs that say: “For sale!” “Two months free rent!” “Space Available!” chances are you’re in the thick of a buyer’s market. These promotions are a tell tale sign of oversupply, and people are trying to offload their inventory.

Since we already established it’s impossible to time the markets, what’s a real estate investor to do?

The short answer: diversify. Diversification is always crucial in investing, but in real estate, there’s another important concept to consider: diversification across vintage years.

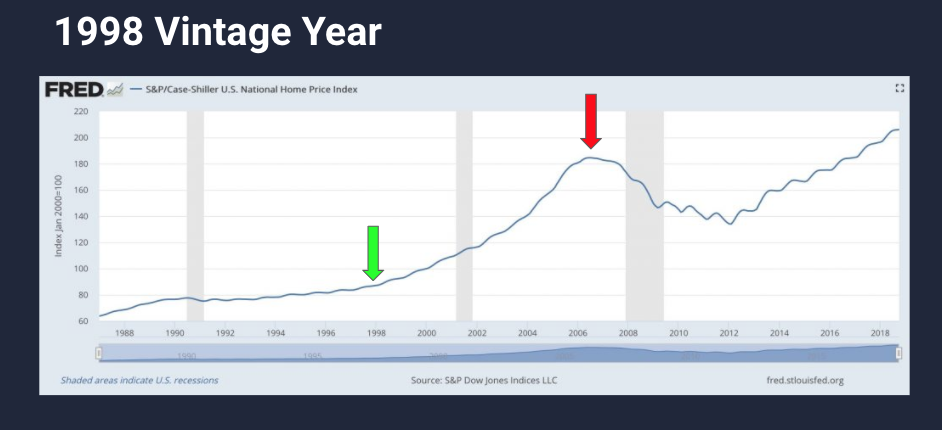

A vintage year is the year an investment was made. A good vintage year for a real estate investment will depend largely on the point in the cycle that the investment was made. You’ve probably heard the phrase “buy low, sell high,” when investing in the stock market. But, it actually applies to real estate, too.

If you buy during a “buyer's market” and sell during a “seller's market,” that means you’re buying low and selling high.

Here’s an example. The chart below shows U.S. home prices. Since real estate fund managers tend to hold onto their assets for about 5-10 years for the duration of the fund’s life, it’s quite possible that an asset purchased in 1998 (low), was held for about ~10 years, and then sold at the top of the market in 2007 (high). Therefore, chances are that 1998 vintage year real estate investments had pretty stellar performance.

Prudent real estate investors diversify their investments across vintage years to avoid taking the concentrated risk of investing only at certain points in the cycle.

With real estate investing, it’s important not to get too hung up on the losses. Renowned real estate investor and entrepreneur Barbara Corcoran famously said, “A funny thing happens in real estate. When it comes back, it comes back up like gangbusters.” What she’s referring to here is the cyclical nature of the real estate market. So keep that in mind when you’re investing, and remember, you know much more than you think.

This educational article is provided by Republic to help its users understand this area of the market, it should not be construed as investment advice as it is impersonal, disinterested and was produced by Republic for Republic’s users, without remuneration received or expected.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...