Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

$2.6B+ raised across the Republic ecosystem

We help founders raise money, engage their communities, and scale for the future.

Global investor community1

Capital raised2

Unicorns in portfolio3

A better way to raise capital

Fast and effective

Get started in minutes. Launch in days. Republic has a 90% success rate for companies that have raised on our platform.

More than just money

Companies have tripled user bases, sold millions worth of product, gained press coverage, connected with VCs, and raised follow-on rounds at great terms with the help of their Republic campaign.

VC friendly

Our Crowd SAFE is VC-approved. You can raise capital on Republic before, during, or after your venture round. A crowd round is an important complement to traditional VC, not its replacement.

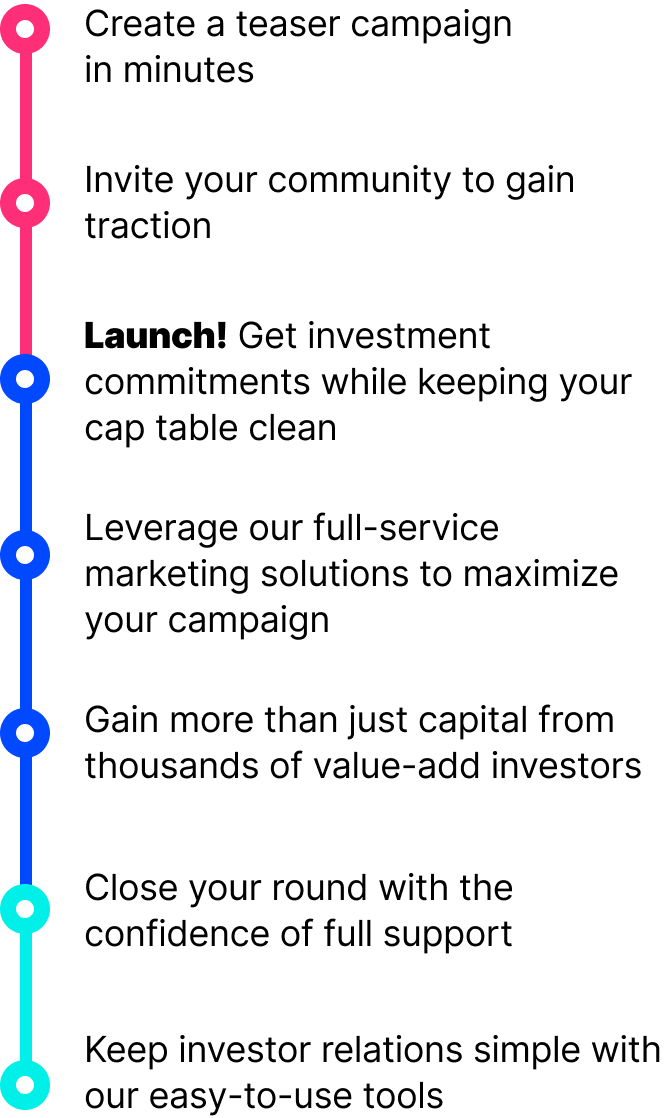

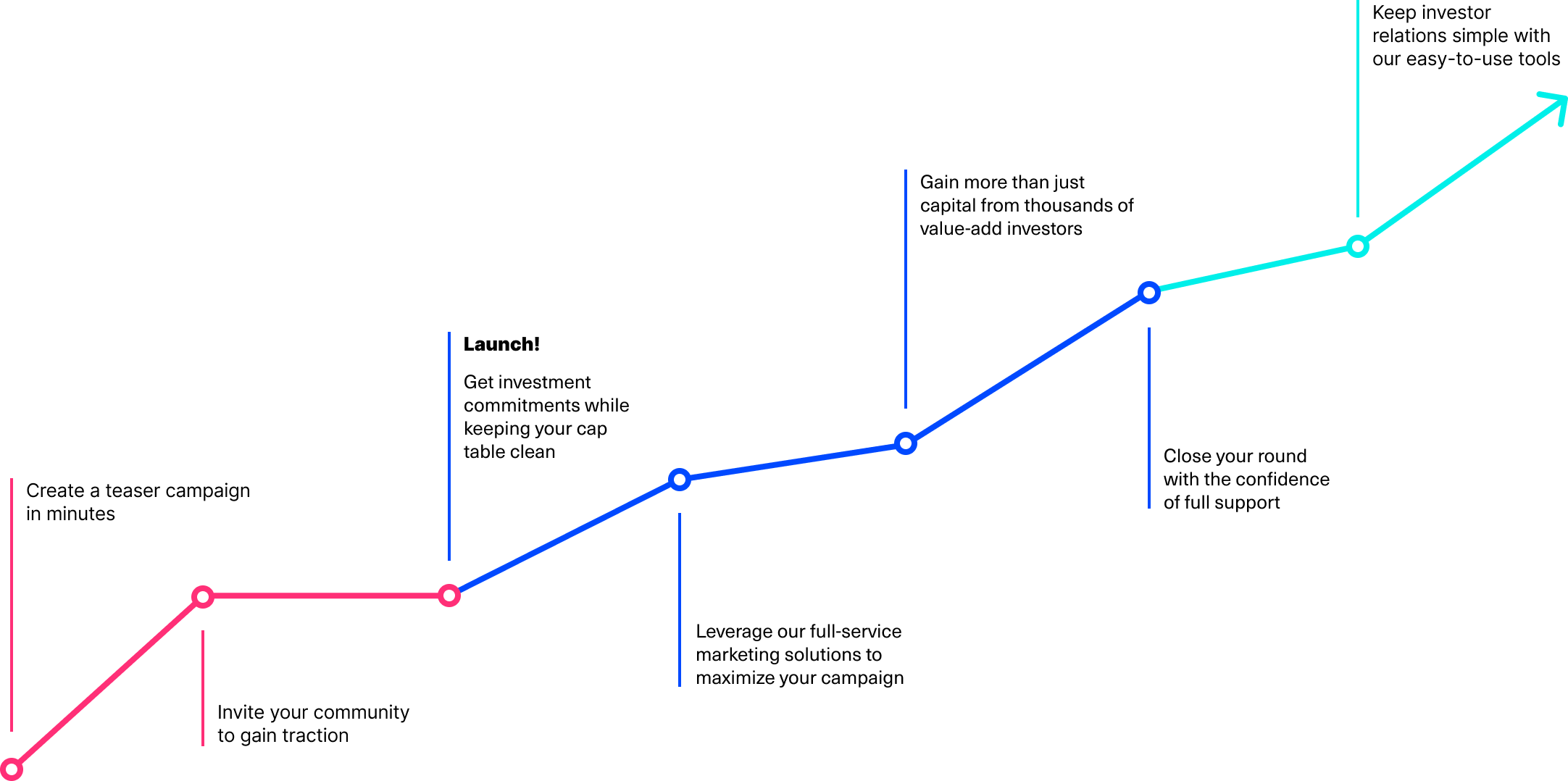

A full-service fundraising journey

Republic is with you every step of the way—before, during, and after your campaign—so you can focus on building your business across the globe.

The ultimate fundraising stack

A seamless experience from start to finish. From pitching to promotion to payments, we've got you covered.

Scalable investor management tools

Our in-house investor relations team and founder-friendly tools make it easier than ever to manage your investors, send updates about your campaign, and more.

Marketing expertise and exposure

Our marketing team will help you craft the perfect pitch and drive traffic to your campaign. Exposure to our 2.5M+ potential investors is part of the package.

Dedicated legal and onboarding lead

Don't go it alone. Launch quickly and efficiently with concierge-level care from our onboarding and legal teams.

Access to founder and partner networks

Get lifetime access to our alumni community and partner network after your campaign closes—not to mention our network of 200+ VC funds.

Success-based

structure

Our fees depend on the success of your campaign so you'll never overpay. We've got skin in the game—which means you can count on us to be all in.

Frictionless

investment flow

We make the payment process quick and easy, with options to suit any user preference. Republic supports payment by credit card, debit card, ACH, and wire transfer.

Crypto payments

Delight your community by allowing investors to pay with crypto.

Raising from your community?

Invite customers and fans onto your cap table and watch them transform into true brand ambassadors. These features are designed with community in mind.

Launch in minutes

Spin up a teaser page and start gathering indications of interest right away.

Put your community first

Offer exclusivity with a whitelist solution designed to reward your most die-hard supporters.

Social capital

Extract value from your community beyond just capital with our networking tool.

Raise with no limits

From small private rounds to Reg D campaigns with no limit, we offer any configuration to fit your needs.

Sharedrops

Republic is the only platform that lets you reward your community with airdrops of equity.

White label campaign

Own the entire end-to-end design of the investment flow for the ultimate branded experience.

Don't just take it from us...

We've helped over 600 founders raise capital—and we're just getting started. Here's what a few of them had to say about Republic.

Chris Boyd

Founder, Drink Monday

2.5 months

Republic made me a true believer in the power of equity crowdfunding. Monday's success on the platform not only yielded critical capital to fuel plans for growth but connected us to investors who truly care about what we're building and became some of our most impactful ambassadors in the process. If you're an entrepreneur or brand looking for any of the above, give Republic a serious look.

Matthew Sullivan

Founder, QuantmRE

campaigns on Republic

We have run two successful capital raising campaigns on Republic. On both occasions our experience was nothing short of excellent. Their onboarding, campaign creation and investor management processes are seamless and intuitive… Republic consistently delivered on their promise and it was a pleasure working with them.

Ediva Zanker

Co-Founder, GRIT BXNG

30 days

Working with Republic on our GRIT BXNG raise was seamless. We worked with them during the height of the pandemic and despite so many uncertainties, Republic was stellar in helping us navigate a raise during a difficult time. I would highly recommend using Republic for anybody looking to raise money for their company.

Jae Bang

Founder, Oracle Health

3,630 investors

It was a pleasure to work with the Republic team. It was a collaborative partnership where we shared ideas, vision and plan for execution. This open communication was extended to all levels of the organization and our investor base.

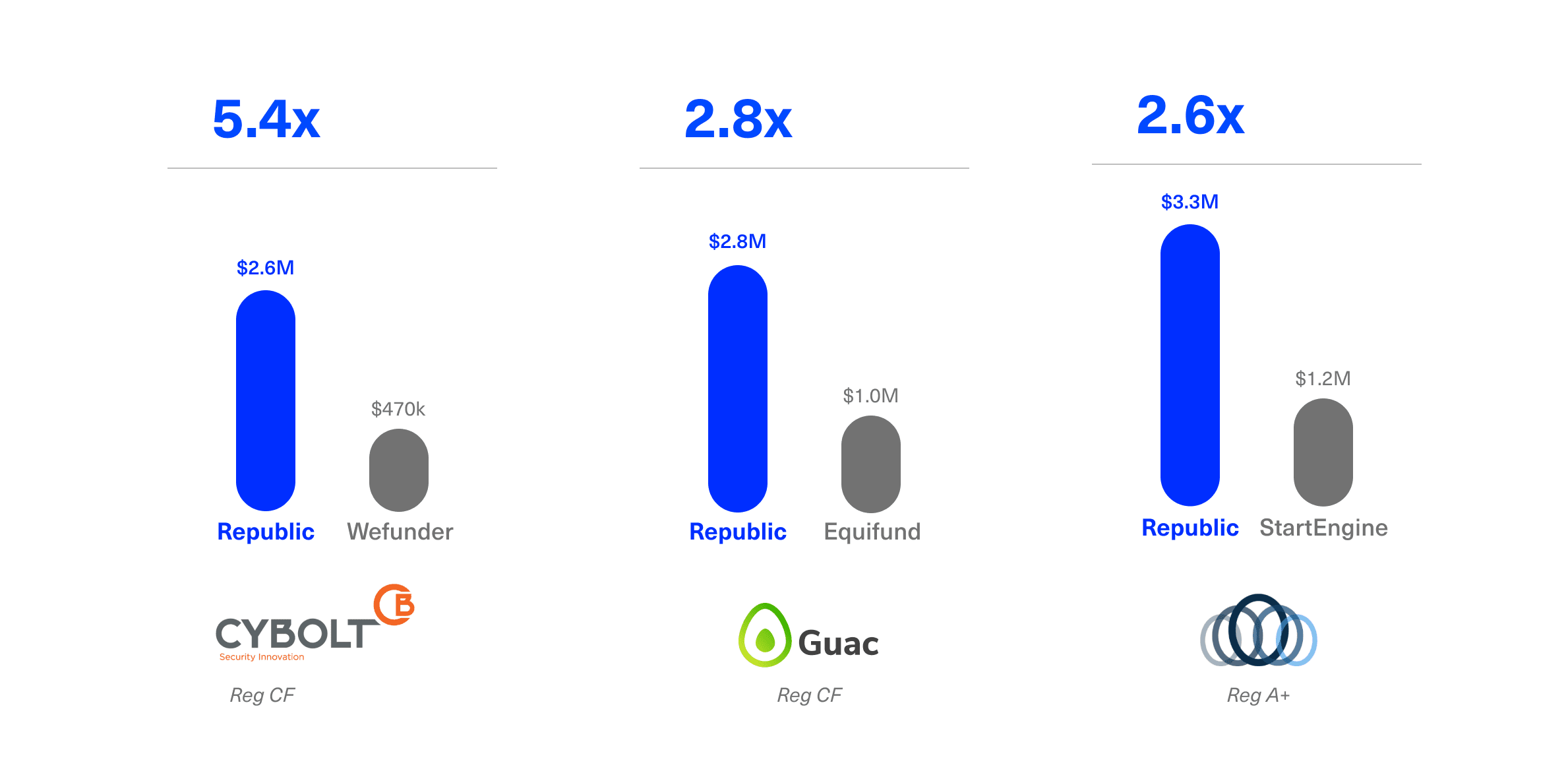

Founders have raised more on Republic

Raising on Republic means getting your brand in front of a diverse group of investors that drive results. The numbers speak for themselves:

A curated marketplace that investors trust

We understand the roles that quality and diligence play in maintaining a quality marketplace for our founders & investors.

Simple, fast, and effective

Our top-tier deal flow has already paid back millions to Republic investors, and we’re just getting started.

Simple, fast, and effective

We tirelessly protect the interests of founders and investors, while driving industry innovation behind the scenes directly with the SEC.

Premier partners choose Republic

Custom partnerships with Carta, Alto, Bitpay, and other industry-leaders can help you manage your cap table, accept IRA and crypto investments, and so much more.

Companies that raised on Republic have secured investments from top-tier VCs, including:

Services exclusive to Republic

From our industry-leading crypto and private capital businesses, to

Broker Dealer

Giving anyone the opportunity to invest in high-growth startups, real estate, crypto, local businesses, video games, and other alternative assets—for as little as $100.⁵

Web 3 Advisory

Seed-to-liquidity solutions via our vertically integrated products including advisory, financing, token engineering, and token offerings that connect top tier blockchain projects with their communities.

Asset Management

Providing access to extensive deal flow to family offices, ultra high net worth individuals, and institutions across multiple stages, sectors, and locations.²

Asian Markets

Providing access to extensive deal flow to family offices, ultra high net worth individuals, and institutions across multiple stages, sectors, and locations.²

European Markets

lorem ipsum lorem ipsum lorem ipsumlorem ipsumlorem ipsumlorem ipsumlorem ipsumlorem ipsumlorem ipsumlorem ipsumlorem ipsumlorem ipsum

More benefits

Scalable investor management tools

Everything you need to manage your investors effectively and quickly.

Pitch & marketing

know-how

Put your best foot forward. Our marketing team will help you craft the perfect pitch and drive traffic to your campaign.

Exposure is part of

the package

Put your company in front of Republic's community of 2.5M+ investors, entrepreneurs, and builders.

Dedicated legal & onboarding lead

Don't do it alone. Launch quickly and efficiently with concierge-level care from our onboarding and legal teams.

Access to founder and partner networks

Get lifetime access to our alumni community and partner network after your campaign closes.

200+ venture capital funds

Get one step closer to hundreds of VCs in our network for potential follow-on funding rounds.

Affordable success-

based fee

6% cash + 2% of the securities sold. Our simplified process keeps legal costs much lower than you think.

Investments

by credit card

Frictionless investing to fit any user preference. Republic supports credit cards, debit cards, ACH, and wire transfers.

Activate your brand's community

Let your customers and fans buy into your mission and turn them into real brand ambassadors.

Applying only takes a few minutes

and our team is ready to help.

FAQ

- What is Republic’s background?

We spun out of our investor, partner, and sister company AngelList in 2016 after the SEC enacted Reg CF—the regulation that allows for everyone to invest in startups. Our CEO Kendrick Nguyen previously was General Counsel at AngelList. More than $1.5B has been raised across the Republic ecosystem.

- How does Republic assign valuation?

Our most common fundraising instrument is the Crowd SAFE, and for that agreement we typically let founders and companies take the first stab at setting the most important term: the valuation cap. Our investment team reviews the proposed valuation cap and justification and may work with the founder to amend it if necessary.

In cases where a company is raising a private round concurrently with their Republic campaign, we ask that they mirror the terms of that round.

- How much can I expect to raise?

Most companies raise between $100k and $1M. The amount raised during a campaign depends on many factors such as the size of your community, growth stage, existing investors, and market conditions. Most companies use Republic to leverage their communities, build fans, and complement the capital they raise from VCs. Our team can help you identify a target raise amount based on a variety of success indicators.

- How likely am I to successfully raise?

Upwards of 90% of campaigns on Republic meet their minimum funding goal. Marketing your campaign to your community & beyond is key to a successful raise.

- What information will I need to disclose?

In order to run a Regulation CF campaign, companies are required to file a Form C with the SEC. This form will include some basic high-level information about the company’s financial history from the past two years: balance sheet, income statement and cash flow. It also will include risk disclosures and cap table structure, but individual investor names don’t need to be shown.

- How much does it cost?

It’s actually pretty inexpensive. Most companies spend about $3k-5k before launching their campaign on making their Form C filing.

Republic takes a success-based commission at the end of a campaign: 7% of the money raised in cash, and 2% of the securities issued. For example, if you were to raise $100,000 on Republic, we would take $7,000 in cash and a $2,000 Crowd SAFE. In the unlikely event a campaign doesn’t meet its minimum target, Republic does not take any fees.

Companies pay for the escrow agent and payment processing at the end of the campaign. This typically comes out to about 1.5-2.25% of the capital raised. (The final cost depends on the volume of investment through different sources like credit card, ACH, or wire transfer.)

- How does this affect my cap table?

Using a nominee structure, investors are represented as a single line item on your company’s cap table summary, and there is no limit to the amount of investors who can participate. We’ve designed the platform and process to eliminate operational overhead and optimize for efficiency with subsequent fundraising or an exit event. Your success is our investors’ success, which is ultimately Republic’s success too. If you choose to convert investors to equity after raising more rounds, those investors who invested via a nominee round on Republic can be converted to a single equity shareholder (and “holder of record”) on your cap table through a custodial arrangement, with the custodian represented as the owner of record.

- What are the post-campaign requirements?

We’ve designed the platform to be as seamless as possible—even after a campaign. Since we use a Crowd SAFE, investors aren’t equity holders and don’t have voting or information rights. While these investors can be pretty powerful from a marketing perspective, we’ve kept them passive from a legal point of view. That said, we do highly recommend that companies use our dashboard to draft and send a twice-yearly updates to investors. It can be pretty top-level, and it’s a great way to let them know how they can help drive the company’s growth: sharing promotions, making introductions, hiring, etc.

Most companies make only one additional disclosure filing post-campaign—the Form C-AR, which is a light refresh to the Form C. It takes about 1-2 hrs to complete, and most companies can do it themselves.

- Has my company raised too much from VCs to use Republic?

Almost certainly not. We’ve had companies that have raised $10M, $17M, and even $50M before running an investment campaign with Republic—from more than 200 top names in venture like Founders Fund, Lerer Hippeau, Bain Capital Ventures, and Greycroft. For companies at this later stage, a Republic raise is usually more about the campaign’s marketing value than it is about the capital itself. B2C companies often see huge increases in product sales, user acquisition and LTV directly attributable to the campaign, and B2B companies use campaigns to source partnerships and drive inbound sales leads.

- How does Republic help me raise funds?

Our community is comprised of hundreds of thousands of investors and a strong network of ecosystem partners. After you have initially engaged your network and community, we’ll help you tap into Republic’s network through dedicated email promotions, newsletter features, social media posts, our ongoing communications with ecosystem and media partners, and more.

Additionally, you will have access to a suite of strategy resources, and to a dedicated campaign manager who will help you navigate and execute your campaign. Through email communication, strategy calls, and office hours, we will guide you through the process of continuously activating your network and engaging Republic investors — from beginning to end.

Learn more about how campaigns get featured in Republic’s marketing materials.

- What is Regulation CF?

Regulation CF, or Regulation Crowdfunding, refers to part of new legislation enacted in May 2016 by the SEC. The law enabled non-accredited investors (the majority of the U.S. population) to invest in private companies for the first time.

- How hard is it to manage a campaign?

Aside from marketing the campaign to your networks and communities, your primary responsibility post-launch will be fielding questions from investors and potential investors. During the campaign, interested investors can ask questions on a public forum for your team to answer. This forum has the benefit of preventing prospective investors from asking the same questions multiple times. You are not obligated to interact with this forum, but the data shows that the team’s engagement level and quality of answers is a key driver of campaign success.

Know a business looking to raise?

Earn a $2,500 referral fee when you refer a business that raises on Republic.

1 Represents users of republic.com, limited partners of Republic Capital Adviser LLC advised vehicles, users of Seedrs.com and clients of other affiliates.

2 Includes aggregate figures from Republic and Seedrs platform to date, including investment opportunities presented by OpenDeal Portal LLC, OpenDeal Broker LLC, Republic Core LLC, Republic Deal Room Advisor LLC and Fig Publishing, Inc.

3 A unicorn is a company worth $1B+

This site (the "Site") is owned and maintained by OpenDeal Inc., which is not a registered broker-dealer. OpenDeal Inc. does not give investment advice, endorsement, analysis or recommendations with respect to any securities. All securities listed here are being offered by, and all information included on this Site is the responsibility of, the applicable issuer of such securities. The intermediary facilitating the offering will be identified in such offering’s documentation.

All funding-portal activities are conducted by OpenDeal Portal LLC doing business as Republic, a funding portal which is registered with the US Securities and Exchange Commission (SEC) as a funding portal (Portal) and is a member of the Financial Industry Regulatory Authority (FINRA). OpenDeal Portal LLC is located at 149 E 23rd St #1314, New York, NY 10010, please check out background on FINRA’s Funding Portal page.

All broker-dealer related securities activity is conducted by OpenDeal Broker LLC, an affiliate of OpenDeal Inc. and OpenDeal Portal LLC, and a registered broker-dealer, and member of FINRA | SiPC, located at 1345 Avenue of the Americas, 15th Floor, New York, NY 10105, please check our background on FINRA’s BrokerCheck.

Certain pages discussing the mechanics and providing educational materials regarding regulation crowdfunding offerings may refer to OpenDeal Broker LLC and OpenDeal Portal LLC collectively as “Republic”, solely for explanatory purposes.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC make investment recommendations and no communication, through this Site or in any other medium should be construed as a recommendation for any security offered on or off this investment platform. Investment opportunities posted on this Site are private placements of securities that are not publicly traded, involve a high degree of risk, may lose value, are subject to holding period requirements and are intended for investors who do not need a liquid investment. Past performance is not indicative of future results. Investors must be able to afford the loss of their entire investment. Only qualified investors, which may be restricted to only Accredited Investors or non-U.S. persons, may invest in offerings hosted by OpenDeal Broker.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC, nor any of their officers, directors, agents and employees makes any warranty, express or implied, of any kind whatsoever related to the adequacy, accuracy or completeness of any information on this Site or the use of information on this site. Offers to sell securities can only be made through official offering documents that contain important information about the investment and the issuers, including risks. Investors should carefully read the offering documents. Investors should conduct their own due diligence and are encouraged to consult with their tax, legal and financial advisors.

By accessing the Site and any pages thereof, you agree to be bound by the Terms of Use and Privacy Policy. Please also see OpenDeal Broker’s Business Continuity Plan and Additional Risk Disclosures. All issuers offering securities under regulation crowdfunding as hosted by OpenDeal Portal LLC are listed on the All Companies Page. The inclusion or exclusion of an issuer on the Platform Page and/or Republic’s Homepage, which includes offerings conducted under regulation crowdfunding as well as other exemptions from registration, is not based upon any endorsement or recommendation by OpenDeal Inc, OpenDeal Portal LLC, or OpenDeal Broker LLC, nor any of their affiliates, officers, directors, agents, and employees. Rather, issuers of securities may, in their sole discretion, opt-out of being listed on the Platform Page and Homepage.

Investors should verify any issuer information they consider important before making an investment.

Investments in private companies are particularly risky and may result in total loss of invested capital. Past performance of a security or a company does not guarantee future results or returns. Only investors who understand the risks of early stage investment and who meet the Republic's investment criteria may invest.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC verify information provided by companies on this Site and makes no assurance as to the completeness or accuracy of any such information. Additional information about companies fundraising on the Site can be found by searching the EDGAR database, or the offering documentation located on the Site when the offering does not require an EDGAR filing.

To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. Therefore, when you use the Services we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver's license, passport or other identifying documents.

Republic and its affiliates are not and do not operate or act as a bank. Certain banking services are provided by BankProv, member FDIC / member DIF. Digital (crypto) assets and investment products are not insured by the FDIC, may lose value, and are not deposits or other obligations of BankProv and are not guaranteed by BankProv. Terms and conditions apply.

Made in SF/NYC