Republic Note

For February, 2024

Private Equity Portfolio

With Note you can earn dividends from Republic’s venture portfolio with deals that aren’t accessible to 99% investors.

The complete portfolio

769 assets from 623 companies

1World Online

A Blue Egg Corp

Aavrani

Accredible

ACFN

Actipulse Neuroscience

AdWallet

AERA

Aftrparty

Agnetix

AHP Investments

AET

Akin's Army

AKUA

Albedo

AlgenAir

ALL3D

Alpha'a

Alpine-X

Altaneve

AltoIRA

Altwork

American Provenance

Amped Innovation

Ample Foods

Amplio.ai

Amulet

Analytical Space

Antares Industries

Apollo Neuroscience

Arbol

Arcana

Are.na

Arka

ArkHAUS

Arlene

Array Labs

Asaak

Asarasi

Astaria

Astra

Asymmetry

ASX

Athyna

Atsign

Attn: Grace

AudioCardio

Audios

Aura

Austin Flipsters

Authereum

Automatic

Avalanche

AVEC Drinks

Avenify

Avivid

Axiom Space

Axle.ai

Ayoba

Azure Printed Homes

B.T.R. NATION

B&J Studios

Back Porch Homes

Backend Capital II

Backstage Capital

Backyard Bev Co.

Balloonr

BANDWAGON

BAOBAB

Beacons

Begin

Below the Fold

Benson Watch Co

BidsNFT

Biobot

BioCertica

BioLight

Bioverge

Bit.Country

BitGreen

Blended Sense

Blinkmoon

Blockdaemon

Blocklords

BlockSwap

Bloomi

Blue

Bobbie

Bokksu

Book+Main

Borrow

Botkeeper

Bounty0x

Bowr

Bright Trip

Brik + Clik

Bucket List Studios

Buff Bake

BuildStream

Buki

Busha

BuyAlerts

Cabinet Health

Cafe X

Campground

Cannabox

Canopy

Canvino

Caraway

CardBoard Live

Carta

CAVU

Cerveza Tulum

Champion Lender

Chasin' Dreams Farm

Cherrish

Chilling

Chingari

Choose Health

Citiesense

Citizens

Cityfund: Austin

Cityfund: Dallas

Cityfund: Miami

Claystack

Clockout

Clocr

Cloudastructure

CNS Pharma

COI Energy

CoinDCX

CoinFund Ventures

Comm Technologies

Comrad

Cool Beans

CountertopSmart

Cria Hair

CricClubs

Crowdfind

Cultos

Cupcake Studios

Curastory

Curios

Customer.io

Cybolt

Dapper Labs

Data Gran

Day One

dClimate

Delee

Dex

Dexalot

dexFreight

DigiBuild

Digital Dream Labs

Dispatch Goods

Dollaride

Doorage

Dope Dog

DoraHacks

Double Jump

Down to Cook

Draft Ventures

Drink LMNT

Drink Monday Inc.

DrinkBev

Drop Delivery

Dryvebox

Duradry

DuraFi

Earth

Easy Expense

Edge Tech Labs

Edible Garden

Edify.ai

ElectroSpit

Elemeno Health

Element Finance

Ember Fund

Emrod

Epoch Financial Group

EquipmentShare

Event Hollow

Everytable

Evolution Devices

Fanalyze

Fandom

Fareplay

Farm from a Box

Fashwire

FCF – Beasts

FCF – Glacier Boyz

FCF – Wild Aces

FCF – Zappers

FetchFind

Fierce

Firefly Aerospace

Fitbux

Fleeting

Flipside

Fluent Forever

FluentPet

Focusmate

FOMO Pay

Fonbank

FreightPal

Frequency Machine

FreshMynd

FullSkoop

Fund the First

Furry Fortune

Galaxy Eco

Galaxy Fund

Gamer Gains

Genies

Genius Juice

Genobank.io

Geoship

Gesture

GMI Computing

Gnosis

Gnosis

GoBe

GoGoPool

Golden Hearts Gaming

Golfkicks

Golightly

Good Eggs

GoPillar

goTenna Inc

GrapeStars

GRID

GRIT BXNG

Growing Talent

Growmotely

GRRRL

Gryph & IvyRose

Gryphon Online Safety

Guac

Gumroad

Gunzilla

HA! Snacks

Harry Hurst

Hawaiian Bros

Health Cost IQ

Healthy Hip Hop

Hedge

Hedgehog

Helios

HelloAva

HelloSubs

HelloWoofy.com

Hemster

HEVO

Heywell

Hidrent

Hike

HireClub

Hive

Hold The Magic

Hubble

Huddle

Humanode

Hydro Hash

Hydro Wind Energy

illumnus

Inahsi Naturals

Incept

Indemnis

Ingenii

Insense

Inside.com

Instafloss

InTheMarket

IQ Protocol

Iris

Irrigreen

It's By U

Ivee

Jane West

Janover Ventures

Jar Goods

Jelli

Jet Protocol

Jetty

Jiritsu

Juna

JuneBrain

K2 Space

Kado Money

Kafene

KAIYO

Kangaroo

Kapitalwise

Kencko Foods

Kibo

Kift

Klarna

Kombucha Town

Koning

Kraken

KUL MOCKS

kweliTV

Laddercaster

Lambs

Lavabit

Levered Learning

LEXI

Light

Lil Bucks

LILA

Linen

Lipa Later

LootMogul

Lover Boy

LTSE

Ludus

Lunar Hard Seltzer

LUPii

Lynx City

madeBOS

Magic Square

Magpie

Maine Craft Distilling

Mainvest

Manta Biofuel

Maternova

Maven

Maybe

Mediar

Menthol Protocol

Merkle Science

MetaEngine

Metaintro

Metalink

Metaplex

Mighty Monkey

Mighty Well

MINNA

mIQroTech

Modern Picnic

Mojoverse

Moksha

Moku Foods

Mona Lisa by Lil Pump

Moonray

Moriondo

MotoRefi

Mr Bing Foods

Mugatunes

Mullybox

Multicoin

MyndVR

Myro

myUDAAN

Nada

Nanotronics

NanoVMs

NatureTrak

Nav.it

Navigate Accelerator

NC Beach Rental Portfolio

Near Protocol

Nectar Tulum

nēdl

Neopenda

Nested Finance

Nectar Tulum

Neopenda

Nested Finance

Neureka for Epilepsy

NeXtGen Biologics

Nibiru

Nickelytics

Noble

Nobody Studios

NoRamp

Nori

NotVC

NovaXS Biotech

NPCx

Nuburu

Nunbelievable

NUOVO

Oasys

Obi

Obscuro

OhmniLabs

Oonee

OP Games

OP3N

Ordermark

Orthogonal Thinker

OTIS Dental

Overland Bound

Paint Nite

Pakt

Paragon One

Parlay

Parlor Beverages

Passport

Pathbooks

PenPal Schools

People First RH

Petra

Phantom Phood

Philo

Phoebe

Phuc Labs

PhunCoin

Pickzen

Pigeonly

Pipe

PittMoss

Plaid

Plain Sight

Plant an App

PlayChannel

Plei

Po Campo

Pocket Network

Podetize

Pods Finance

Polygon

Pontem

Popshop

Portal Defi

Power Trucks USA

Predictiv

Preemadonna

PrePO

Primal Life Organics

Prismatext

Privateer

Procertas

Proof Of Learn

PROPS

Provenance

Public

PuffCuff

PÜL

Punch

Pure Culture Beauty

Pure Green

Pylons

Pyth Network

Qoins

Todd & Rahul's Angel Deals

QuantmRE

Quantum Music

Quarters

QuickLoadz

Quim

R3 Printing

RaaS 99

Raindrop Studios

Rappi

Rarible

Ratio

Ratio Finance

Ready Set Jet

RealtyFeed

Recovered Health

RedThread

Referrizer

Reflex Protect

RehabPath

Relativity

Relay On Demand

Renewal Mill

Rentberry

Rescale

Responsum Health

ReThink Ice Cream

Revelator

Revero

Revival

Rhymella

Riders Share

Rocket Dollar

Root One

Rose Sisters Chips

Rule Breaker Snacks

Runner

Ryan Delk

Saber

Salone Monet

Salsa God

Sapient

Saya Life

School16

Scooterson

Scripx

Securisyn Medical

SeeMe

Self ID

Sentry AI

Series Finance

Share Scoops

Shima Capital

ShipRocket

Shrug

Sienna Sauce

SilkRoll

SimpleShowing

SkillMil

Skyryse

Slate Click

Slated

Smart Soda

Smart Yields

SMBX

Snailtrail

Snailz

SnapDNA

Snowball Money

Soar Robotics

Solvpath

SoMee

SOMOS

Soon

SpaceX

Space Perspective

Sparkle

Sphere

Spinster Sisters Co

SpongeBath

Squads

Staked

Star Atlas

Stareable

Status Money

StayFi

Steeped Coffee

Steer Protocol

Stock Card

Stojo

Stonebridge Alpha

Storybook App

StyleRow

Subspace

Sugar

Sugarfina

Sunscoop

SuperBetter

Superpedestrian

SuperPhone®

Supersapiens

Supra Oracles

Surya Spa

Sweetberry

Swing

SWIPEBY

Sybil Capital

Symbiosis

TagMango

Tailwind 3

Tallyfy

Tapa

TapRm

Tax Lab, Inc

TaxDrop

tbh

TeamUp

TEMPLE I

Tempo

Tempo Games

Terraformation

Terran Orbital

The 420 Hotels

The Axle Workout

The Cru

The Free Spirits Company

Thomsen's Inc.

TIBU Health

Tiny Organics

Tombot

Uncooked

Upshift

Utobo

Utsav Samani

Volley Tequila Seltzer

VonMercier

VRRB

WV

Zest

Evergreen upside

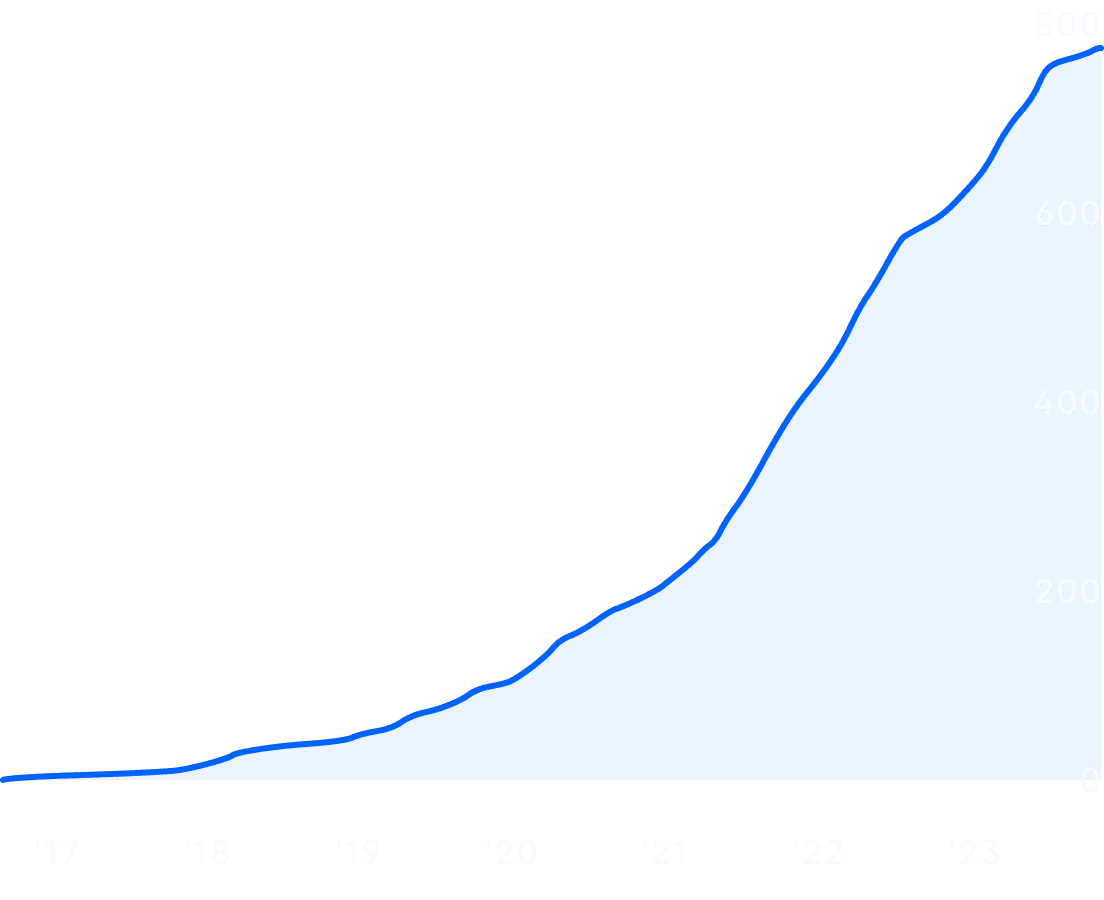

The portfolio grew by 154 new assets in 2023. There is no limit to the number of companies in the pool and we anticipate it to keep growing.

Dividend-generating

When portfolio positions are liquidated with profit, the dividends accrue for Note holders.

Portfolio company

| Amount

| Source

| Sector

| Received

|

|---|---|---|---|---|

Dapper | +$510,599.82

| Capital

| Gaming, web3

| 2019-2022

|

Robinhood | +$104,810.47

| Retail

| Fintech

| Q2-Q4 2021

|

Shiprocket | +$94,297.40

| Retail

| Logistics

| Q3 2022

|

avalanche | +$53,975.64

| CAPITAL

| web3

| Q1 2024

|

Dodo | +$39,512.05

| Capital

| Web3, defi

| 2021-2022

|

Acala | +$37,041.95

| Capital

| Web3, defi

| 2021-2022

|

Investors join the community and receive

Perks & Monthly Portfolio Updates

→ Win a rocket launch trip!

→ Upcoming events

→ Portfolio and Republic updates

→ Additions highlights

→ Portfolio sector breakdown

→ February wins and losses

→ Merch update

→ Our answers to your questions

→ What we’re excited for in 2024

With the Note you own a piece of Republic’s upside and join our journey

Summary

- 01Unique digital security

Republic Note is not just a token; it is a digital security and Republic’s flagship investment product.

Backed by our brand, deal flow, and regulated capital markets experience, the Note is a unique investment asset that provides investors with exposure to Republic’s ever-growing venture portfolio, comprising 750+ real-world assets.

- 02Unparalleled access

A key feature of the Note is its availability to retail investors globally* with no minimums. For the first time ever, the non-accredited investor can gain exposure to the upside of a large venture portfolio, actively developed by a professional investment firm, and have it all in a single digital asset.

For the list of countries supported at trading.

- 035 years in the making

Republic Note is not just a token; it is a digital security and Republic’s flagship investment product.

Backed by our brand, deal flow, and regulated capital markets experience, the Note is a unique investment asset that provides investors with exposure to Republic’s ever-growing venture portfolio, comprising 750+ real-world assets.

- 04Backed by Republic’s community

Republic Note is not just a token; it is a digital security and Republic’s flagship investment product.

Backed by our brand, deal flow, and regulated capital markets experience, the Note is a unique investment asset that provides investors with exposure to Republic’s ever-growing venture portfolio, comprising 750+ real-world assets.

- 05Tradable (soon)

Republic Note is not just a token; it is a digital security and Republic’s flagship investment product.

Backed by our brand, deal flow, and regulated capital markets experience, the Note is a unique investment asset that provides investors with exposure to Republic’s ever-growing venture portfolio, comprising 750+ real-world assets.

- 06Additional benefits

Republic Note is not just a token; it is a digital security and Republic’s flagship investment product.

Backed by our brand, deal flow, and regulated capital markets experience, the Note is a unique investment asset that provides investors with exposure to Republic’s ever-growing venture portfolio, comprising 750+ real-world assets.

- 07Republic’s flagship investment product

Republic Note is not just a token; it is a digital security and Republic’s flagship investment product.

Backed by our brand, deal flow, and regulated capital markets experience, the Note is a unique investment asset that provides investors with exposure to Republic’s ever-growing venture portfolio, comprising 750+ real-world assets.

F.A.Q.

- What is a digital security?

Digital securities are digital forms of traditional securities, typically represented on a blockchain network. Just like traditional securities, digital securities tend to represent fractional ownership of an asset.

Each Republic Note is a unit of Class B limited liability company membership interests in digital form issued by Republic Core LLC.

- How will dividends be distributed to Republic note holders?

Republic Note Holders receive dividend distributions from the Dividend Pool each time it reaches a threshold amount of $2 million. In the event of a dividend distribution, each Republic Note entitles its holder to a pro-rata amount from the Dividend Pool, after operational transaction fees have been deducted. The dividend distributions may be made in USDC stablecoins. Republic Note holders will be made aware of upcoming dividend distributions at least four weeks prior to such an event.

The parameters of the dividend payment process, like the threshold amount and the form and currency of the dividend payments are subject to change at the sole and reasonable discretion of the Republic management team.

- How can Republic Note holders access community benefits?

The beta program of community benefits is live and Note holders enjoy invitations to special events, investor newsletter updates, access to an online forum (in development) Certain new benefits will be announced and rolled out provided to Republic Note holders in early 2024. It is likely that the number and type of benefits available will correlate with the amount and duration of Republic Notes held by a community member.

The full release for Republic Note community benefits is in development and will become gradually available over the course of Q4 2023 and 2024.

- Where can I find more answers?

Please take a look in the Republic Note section of our FAQ

- How do the assets get to the Portfolio?

Republic is a multi-faceted investment firm. We operate platforms, broker-dealers, advisors and portals across different continents. Our two largest investment businesses in the US are Republic Portal and Republic Capital.

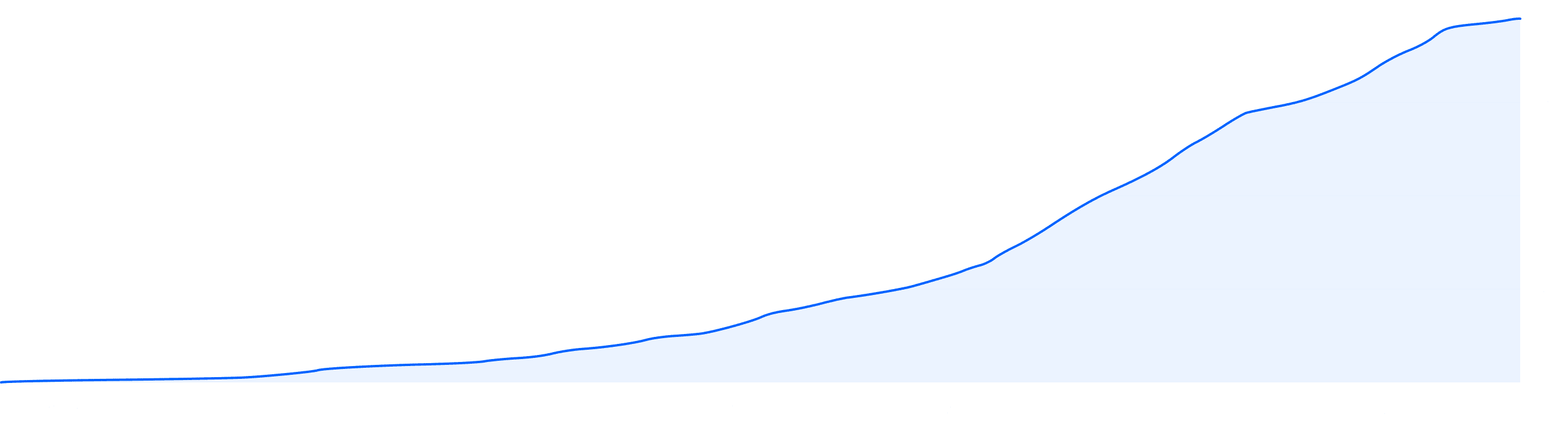

1. Republic Portal accepts and hosts hundreds of startups every year and helps them raise funding from their community. After each raise, Republic keeps 2%* of the raised amount in the form of securities — typically equity or SAFEs. This constitutes the source of assets for the Republic Portal Portfolio. The Note is exposed to every single startup that goes through Republic Portal.

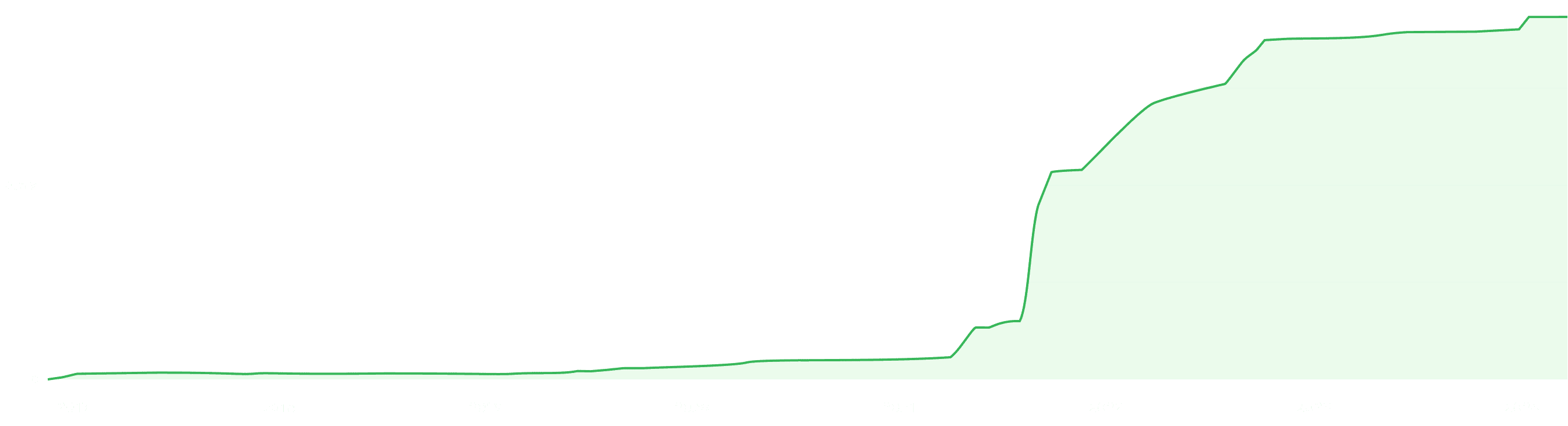

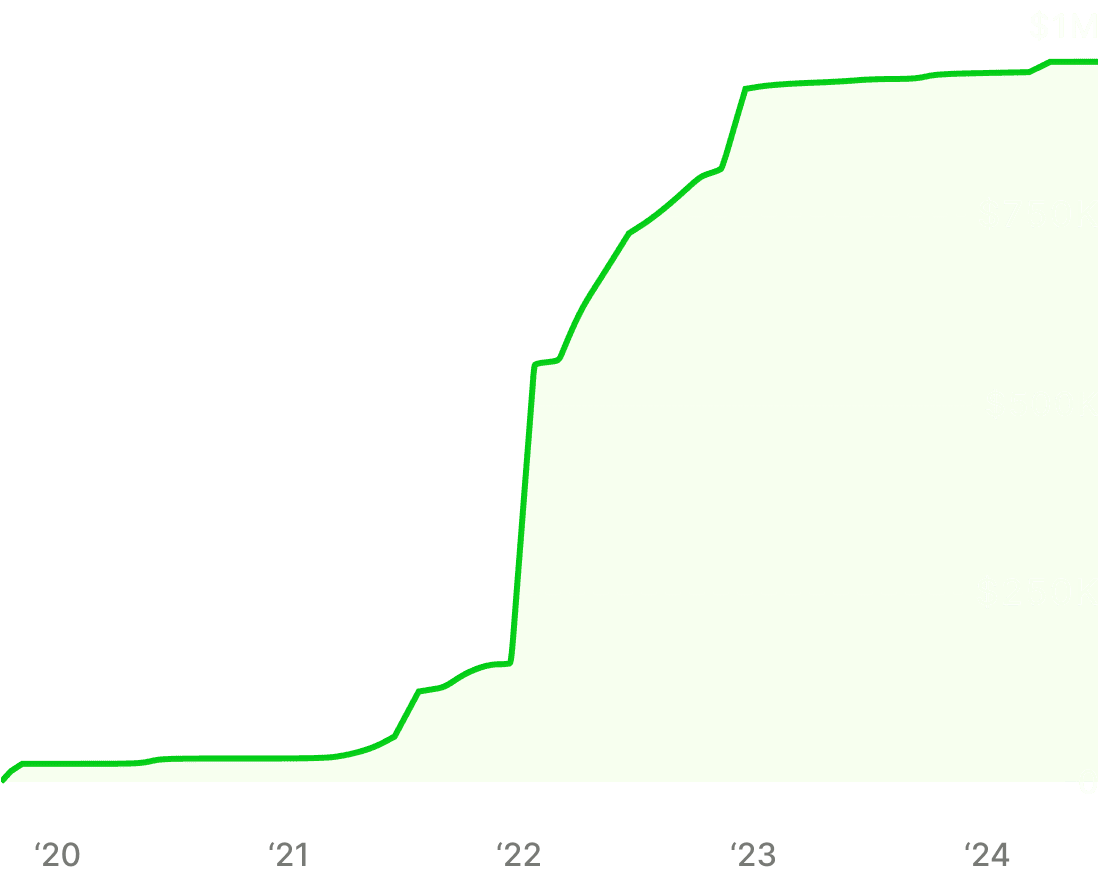

2. Republic Capital is a venture arm that invests in larger, later-stage and harder-to-get deals. Unlike Portal, it does not retain a commission, but rather earns Carry — the carried interest right. It is a type of performance fee that pays when portfolio assets are sold and make a profit to LPs — Limited Partners who provide the capital for the investments.

When Portal earns a profit by selling any of its portfolio assets — it shares 100% of the net profit with the Note. When Capital earns a profit on their carry rights — it shares 25% of the net profit with the Note.

- Can I trade Republic Notes?

Yes! The Note is live 24/7 trading on INX. Residents of most countries are allowed to trade. View the market or get set up for trading.

- What is the total supply of the Republic Notes?

800,000,000. There will never be more than 800 million Republic Notes in circulation. Read the Republic Note white paper for more details.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...