Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

The future of

private investing

Republic is the private

investing platform

for investors seeking

high growth potential.

Invest with the best

Republic curates private investing opportunities with high-growth potential across startups, gaming, real estate, and crypto.

Republic

with Republic

Republic

Republic

The best venture capital firms, family offices, and high net worth individuals already invest in Republic companies.

We partner and work closely with

High-growth platform

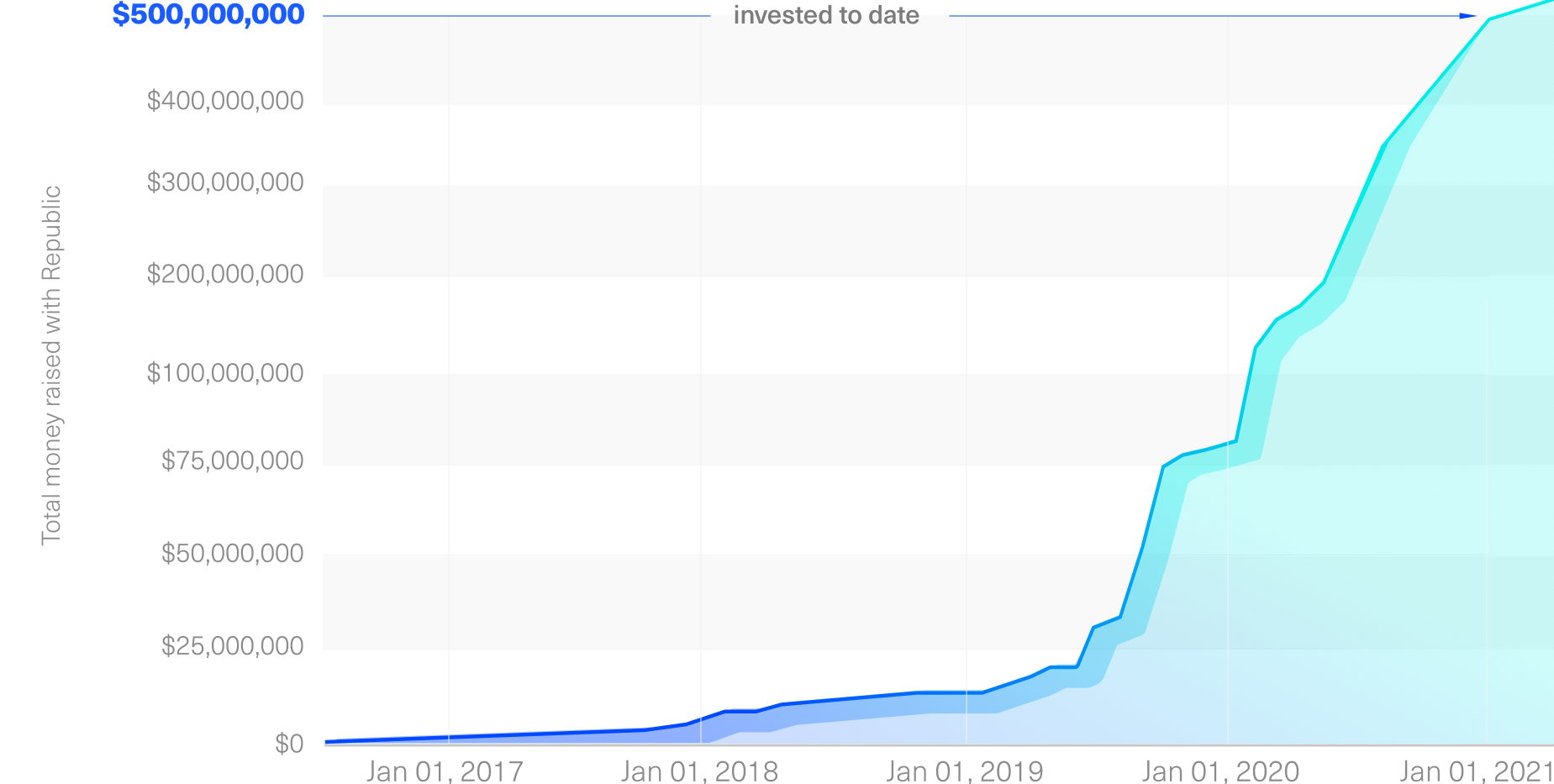

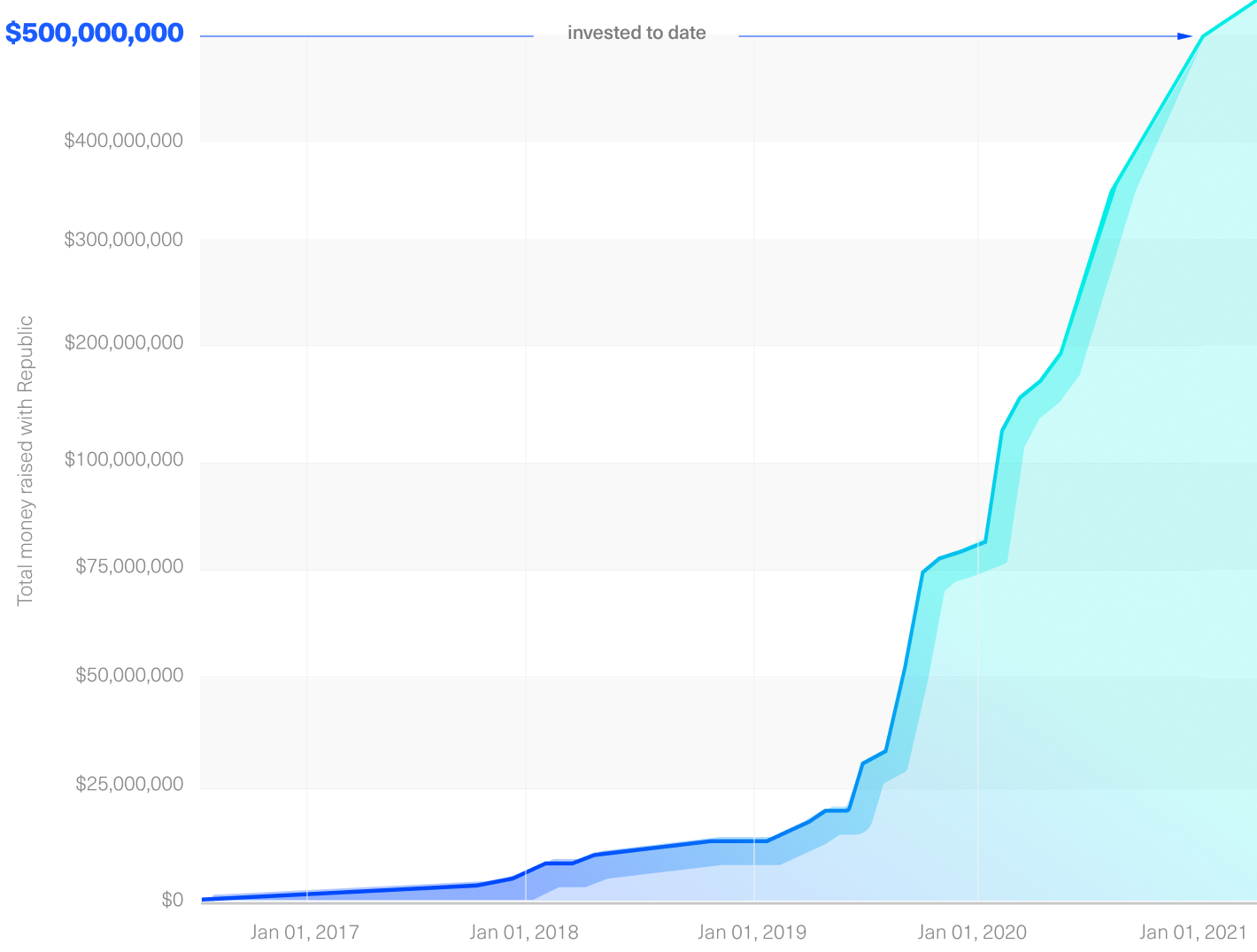

$500,000,000+ invested by 1M+ people in over 500 completed deals.

Growth opportunities for all sides of the investment market

Growth opportunities for all sides of the investment market

Republic is where both accredited and non-accredited investors meet entrepreneurs and access high-growth potential deals across a range of private markets.

Built by a diverse team with deep expertise in private investing

Republic was founded by alumni from AngelList, the largest online platform for private investing. Since then, we have built a team and a network of the top people from the startup, venture capital, and investment worlds.

Abhi Shah

Business

Senior Manager, Investment Team. Previously, Associate at FastPay and Co-Founder of Huntington Angels Network, B.S. in Finance from Northeastern University.

Alex Sukhanov

Tech

Senior Engineering Manager. Founder & CEO at Hoodies company. Co-founder of Checky, a health startup.

Alex Ye

Republic Crypto

Partner, Economist. Previously at ZZ Ventures, UChicago Investment Office, and Top Tier Capital Partners. UChicago Economics.

Andrew Durgee

Republic Crypto

Managing Director. Pioneered early blockchain technology plays including an industry first multi signature wallet. Studied Management Engineering at Worcester Polytechnic Institute. Was a Partner at a leading blockchain advisory group, TLDR Capital.

Anteneh Moges

Tech

PM, Product Support. Previously Service Desk Manager at NYU Tisch School of the Arts, leading technical support for 4+ years. BA in Computer Science and MS in Management of Technology from NYU.

Anwaar AlMahmeed

Business

Managing Director, MENA. Co-founder of the East Chain Co. Lead organizer of The East Chain Open Hub (ECOH). Previously, product development at Boursa Kuwait during its initial privatization phase and Kuwait Investment Authority.

Artem Pishchelev

Tech

Product manager. Previously PM at Yandex Taxi and Alfa-Bank. Formerly an orchestra musician. MA in International Economy at MESI.

Brian Johnson

Republic Capital

Director at Republic Labs. Previously worked at UniCredit Bank AG. Studied finance at Whitman School of Management, Syracuse University.

Britany Jet Bacawat

Business

Investor Relations. 10 years of experience in Customer Service for Student Loan and Freelance companies. BS in Financial and Managerial Accounting.

Britt Cambas

Republic Capital

Director, Republic Capital. Previously strategy at Orchard, venture investor at Elsewhere Partners and US Buyout fund management at The Carlyle Group. Wharton MBA, LSU.

Bryan Myint

Republic Crypto

Partner. Founding Partner at Taureon Capital. Previously Strategy Consultant at Enterey, Ops Manager at Breeze & Medical Device Engineer at Abbott. Studied engineering at UCLA.

Caitlin Szikszai

Business

Senior Associate, Investment Team. Former Associate at University Growth Fund. BA in International Business, emphasis in Chinese & Asia Pacific, from San Diego State University.

christian sullivan

Republic Capital

Venture Partner, Republic Capital. Angel investor in Yandex, Cruise, and other notable tech and social impact startups. I believe everyone should be able to invest in startups. Access and Inclusion is the new AI.

Chuck Pettid

EVP

EVP, Republic. Worked at Merrill, Pinnacle. Repeat founder. Active investor. Studied business at Nebraska and Fordham.

Darren Sandler

Legal & Compliance

Legal Counsel. Previously head of legal at two fintech/blockchain startups. Kirkland and Ellis, Schulte Roth and Zabel alumni. JD from University of Pennsylvania Law School.

Dmitry Chernyshev

Tech

Designer. Previously at Sweatcoin, COUB, Theory&Practice and Trends&Brands. Created Identity and design for web version of Andy Warhol Interview Russia magazine.

Emily Pollack

Business

Deputy Managing Director, US Retail Operations. Previously at Otis, Keurig Dr Pepper, YieldStreet and BofA Private Bank. CPA and accounting at PwC.

Graham Friedman

Republic Crypto

Director, Blockchain. Previously co-founder of TLDR Global and led the camera department at Vayner Media. Passionate for good teams and strong learning curves.

Ingrid Wong

Business

Senior Campaign Manager. Previously Customer Success at BlueCart. BA in East Asian Studies and Business from Brandeis University.

Jawwad Khan

Republic Capital

Venture Partner, Republic Capital. Previously at Compound, CEO at ShareTrade, distressed debt investment professional at Barclays, Waterfall Asset Management, Avenue Capital Group.

Jensen Duy Vu

Business & Community

Principal, Republic Note Lead. CEO @ VietChallenge. Previously drafted reports and prepped experts for testimonies in high-profile litigations for a living. Gov Relations @ Minneapolis Fed prior. Grew up in Vietnam, shows when invited out for coffee.

John-Paul Yezzo

Legal & Compliance

Associate Counsel for Republic Retail. Former litigator and equities broker. LL.M. with dual degrees from Erasmus University of Rotterdam and Warsaw School of Economics. J.D. from St. John's University School of Law.

Julian Jung

Business

Partner at Republic Deal Room. Prev: Co-founder Republic Capital. Investor in: Relativity Space, Carta, Rescale, Avax, Polygon, and Genies.

Kathleen Cooke

Business

HR Manager. Previously recruiting at SingleSprout. Studied International Relations at SUNY Geneseo.

Kendrick Nguyen

Chief Executive Officer

Previously General Counsel at AngelList. Worked at Permal Group and Goodwin Procter. Former Stanford Fellow and securities litigator.

Kevin Xaisanasy

Business

Senior Associate, Finance. Previously, capital markets & private equity at SAB Capital and valuations at Citigroup. B.S. in Finance from SUNY Buffalo.

Kirsten Horning

Business

Managing Director, Deal Room. Formerly Principal at XRC Labs and Nomad Goods. BA, UCSB & MA, Georgetown McDonough School of Business.

Leo Batali

Republic Capital

Investor Relations. Vast experience in management and hospitality within the entertainment industry, specializing in the music industry. Studied management at the University of Michigan.

Maria Chak

Republic Crypto

Project Manager, Republic Crypto Advisor. Previously, founding member of the strategy team at Onyx by J.P. Morgan, a blockchain business unit for payment applications. B.A. in Industrial and Labor Relations from Cornell University.

Mario C. Lattuga

Business & Legal

Director of Diligence and Legal Operations for Republic Retail. Former securities litigator and FinTech startup founder. JD from St. John’s University School of Law, and Masters in Securities and Financial Regulation from Georgetown Law.

Marley Brown

Business

Director, Deal Operations. Previously Public Affairs at Kivvit. Studied Chemistry at Harvard.

Matthew Melbourne

Republic Crypto

Senior Director. One of Republic's first full-time employees. Previously BD at Global Citizen. B.A. in Government & English from Georgetown University.

Peter Mohr

Business

Sales Operations Manager. Previously Founder/E-Commerce Manager at The Seasoned Carte and Business Development Assistant Manager at Mitsui USA. Studied Economics at Rutgers University.

Mario Martins

Legal & Compliance

Retail CCO. Spent 13 years at FINRA. JD from Quinnipiac University School of Law, BA from Rutgers

Maya Aloy

Republic Crypto

Project Manager, Republic Crypto. Previous experience working with Security Token Offerings and consulting management services in Latin America and government entities. B.A. in Communications from PUCRS.

Peter Green

Business

Co-founder and Chief Creative Officer; SVP. Previously founder of Mine, MeetingPulse, Volga Verdi. Worked at Leo Burnett. Masters of management from HSE (Moscow) and Economics faculty of MSU.

Ray Mayo

Republic Capital

Republic Capital. Previously, Debt Capital Markets at JPMorgan. Studied Finance and Accounting at Syracuse University.

Raymond Yu

Republic Crypto

Token Offering Marketing Manager. Previously at Moxtra, Informatica, and Qualcomm. BA in International Business from UC San Diego

Richard Saulon

Business

Accounting Manager at Republic. Previously worked in Forensic Accounting / Non-Profit Finance. BS from Hunter College.

Rohan Suwarna

Business

Chief of Staff. Previously, Investment Banking at Deutsche Bank. B.S. in Finance and Analytics from Boston College.

Ryan McNey

Republic Crypto

Technical Project Manager, Republic Crypto. Previously, Vice President at Mobomo and Technology Consultant at Accenture. B.S. in Business Management, West Virginia University.

Sergei Martynov

Tech

Quality Advocate at Republic. Previously QA Engineer at Align Technology and Yandex. Engineer’s degree from Moscow State Institute of Electronics and Mathematics.

Steven Nguyen

Business

Investor Relations & Business Ops. MBA focused on Finance & Investments at Boston College School of Management. Studied Securities Law at Cornell Law School.

Valentin Gavrilov

Tech

QA engineer, Mobile Team. Previously at ARGO. Specialist Degree from RSUCE.

Youngro Lee

Business

Advisor. Founder/CEO Nextseed. Previously, private funds attorney at Cleary Gottlieb and Kirkland Ellis. BS, JD/LLM from Cornell.

Zhen Cao

Business

Partner - Asia. Founding Partner at venture and crypto arm of JD Capital, the only publicly traded PE fund in China. Previously at HTC Vive, China Central Television. MA from New York University.

Justin Bailey

Advisor

Founder of Fig, studio advisor and game investor, previously COO and Board Member at Double Fine Productions, Corporate Development at PWE and Namco Bandai. Studied at TCU, BA in Finance, BS minor in Computer Science.

Katherine Krug

Advisor

Founder of BetterBack, Everest, Fundrah. First solo woman to break $1M on Kickstarter.

Nisa Amoils

Advisor

Previously VC at Scout Ventures and family office. Securities lawyer. Boards Wharton Entrepreneurship, Institute Blockchain Innovation, other companies. Contributor for Forbes and Blockchain Magazine. UMich Business and Penn Law.

Paul Menchov

Advisor

Head of CoinList Capital. CTO and Co-Founder at CoinList. Previously, CTO at Republic and Head of Fundraising Infrastructure at AngelList. Worked at Zynga. Studied at Cornell University.

Peter Diamandis

Advisor

Engineer, physician, best-selling author and entrepreneur. Founder of XPRIZE, co-founder of Singularity University, Human Longevity Inc., Celularity.

Pialy Aditya

Advisor

Chief Strategy Officer. Angel investor. Previously GM @ShopYourWay, co-founder and President @Mintbox. MBA from Harvard. Finance from New York University.

Shiza Shahid

Advisor

Founder of NOW Ventures and Malala Fund. Investor and social activist. Studied at Stanford University.

Shaherose Charania

Advisor

Co-Founder of Women 2.0, Founder Labs. Board of Directors at Good World Solutions.

todd Ruppert

Advisor

Todd has 40 years of experience in the financial services industry. Previously CEO and President of T. Rowe Price Global Investment Services. Board member of the Rock and Roll Hall of Fame.

You?

Your name could be here.

We are hiring talented people across the board. If you like what

we do, come and join our team!

Republic team members displayed here are employed, engaged or advise OpenDeal Inc.

and its affiliates, the Republic family of companies.

This site (the "Site") is owned by OpenDeal Inc. and maintained by Republic Core LLC (“Core”), neither of which are registered broker-dealers. Core provides technology and support services to OpenDeal Inc. and its affiliates (collectively, the “Republic Ecosystem”). All securities listed on the Site are being offered by, and all information included on this Site is the responsibility of, the applicable issuer of such securities. The intermediary facilitating the offering will be identified in such offering’s documentation.

All funding-portal activities are conducted by OpenDeal Portal LLC doing business as Republic, a funding portal which is registered with the US Securities and Exchange Commission (SEC) as a funding portal (Portal) and is a member of the Financial Industry Regulatory Authority (FINRA). OpenDeal Portal LLC is located at 149 E 23rd St #1314, New York, NY 10010, please check out background on FINRA’s Funding Portal page.

All broker-dealer related securities activity is conducted by OpenDeal Broker LLC, an affiliate of OpenDeal Inc. and OpenDeal Portal LLC, and a registered broker-dealer, and member of FINRA | SiPC, located at 1345 Avenue of the Americas, 15th Floor, New York, NY 10105, please check our background on FINRA’s BrokerCheck.

Certain pages discussing the mechanics and providing educational materials regarding regulation crowdfunding offerings may refer to multiple members of the Republic Ecosystem collectively as “Republic”, solely for explanatory purposes.

By accessing the Site and any pages thereof, you agree to be bound by the Terms of Use and Privacy Policy. Please also see OpenDeal Broker’s Business Continuity Plan and Additional Risk Disclosures. All issuers offering securities under regulation crowdfunding as hosted by OpenDeal Portal LLC are listed on the All Companies Page. The inclusion or exclusion of an issuer on the Platform Page and/or Republic’s Homepage, which includes offerings conducted under regulation crowdfunding as well as other exemptions from registration, is not based upon any endorsement or recommendation by OpenDeal Inc, OpenDeal Portal LLC, or OpenDeal Broker LLC, nor any of their affiliates, officers, directors, agents, and employees. Rather, issuers of securities may, in their sole discretion, opt-out of being listed on the Platform Page and Homepage.

Investors should verify any issuer information they consider important before making an investment.

Investments in private companies are particularly risky and may result in total loss of invested capital. Past performance of a security or a company does not guarantee future results or returns. Only investors who understand the risks of early stage investment and who meet the Republic's investment criteria may invest.

No member of the Republic Ecosystem verifies information provided by companies on this Site and makes no assurance as to the completeness or accuracy of any such information. Additional information about companies fundraising on the Site can be found by searching the EDGAR database, or the offering documentation located on the Site when the offering does not require an EDGAR filing.

Republic Note holders and as well as users of the site and services maintained by the Republic Ecosystem, regardless of and their activities on or relating to the Republic Ecosystem, are subject to the applicable terms of service, in their entirety. Core is also “testing the waters” with respect to the sale of Republic Notes under Regulation A of the Securities Act. The “testing the waters” process allows companies to determine whether there may be interest in an eventual offering of its securities to qualified purchasers under Regulation A. Core is not under any obligation to make an offering under Regulation A. No money or other consideration is being solicited for an offering under Regulation A at this time and, if sent, it will not be accepted.

Core may choose to make an offering to some, but not all, of the people who indicate an interest in investing, and that offering may or may not be made under Regulation A. For example, Core may choose to proceed with its offering under Rule 506(c) without ever conducting a Regulation A offering, in which case only accredited investors within the meaning of Rule 501 will be able to buy Republic Notes.

If and when Core conducts an offering under Regulation A of the Act, it will do so only once (i) it has filed an offering statement with the Securities and Exchange Commission (“SEC”), (ii) the SEC has qualified such offering statement and (iii) investors have subscribed to the offering in the manner provided for in the offering statement. The information in the offering statement will be more complete than any test-the-waters materials and could differ in important ways. Prospective investors who are interested in participating in the Regulation A offering must read the offering statement filed with the SEC, when that offering statement becomes publicly available.

No money or other consideration is being solicited at this time in connection with any potential Regulation A offering and, if tendered, will not be accepted. No offer to buy securities in a Regulation A offering can be accepted and no part of the purchase price can be received until an offering statement is qualified with the SEC. Any offer to buy securities may be withdrawn or revoked, without obligation or commitment of any kind, at any time before notice of its acceptance is given after the qualification date. Any indication of interest in Core’s offering involves no obligation or commitment of any kind.

Republic and its affiliates are not and do not operate or act as a bank. Certain banking services are provided by BankProv, member FDIC / member DIF. Digital (crypto) assets and investment products are not insured by the FDIC, may lose value, and are not deposits or other obligations of BankProv and are not guaranteed by BankProv. Terms and conditions apply.

Made in SF/NYC