A Wallet for the Future of Finance

Since our inception in 2017, Republic has focused on building financial products that improve access to private financial markets. Today, our team is thrilled to introduce a new product that serves that very mission—Republic Wallet.

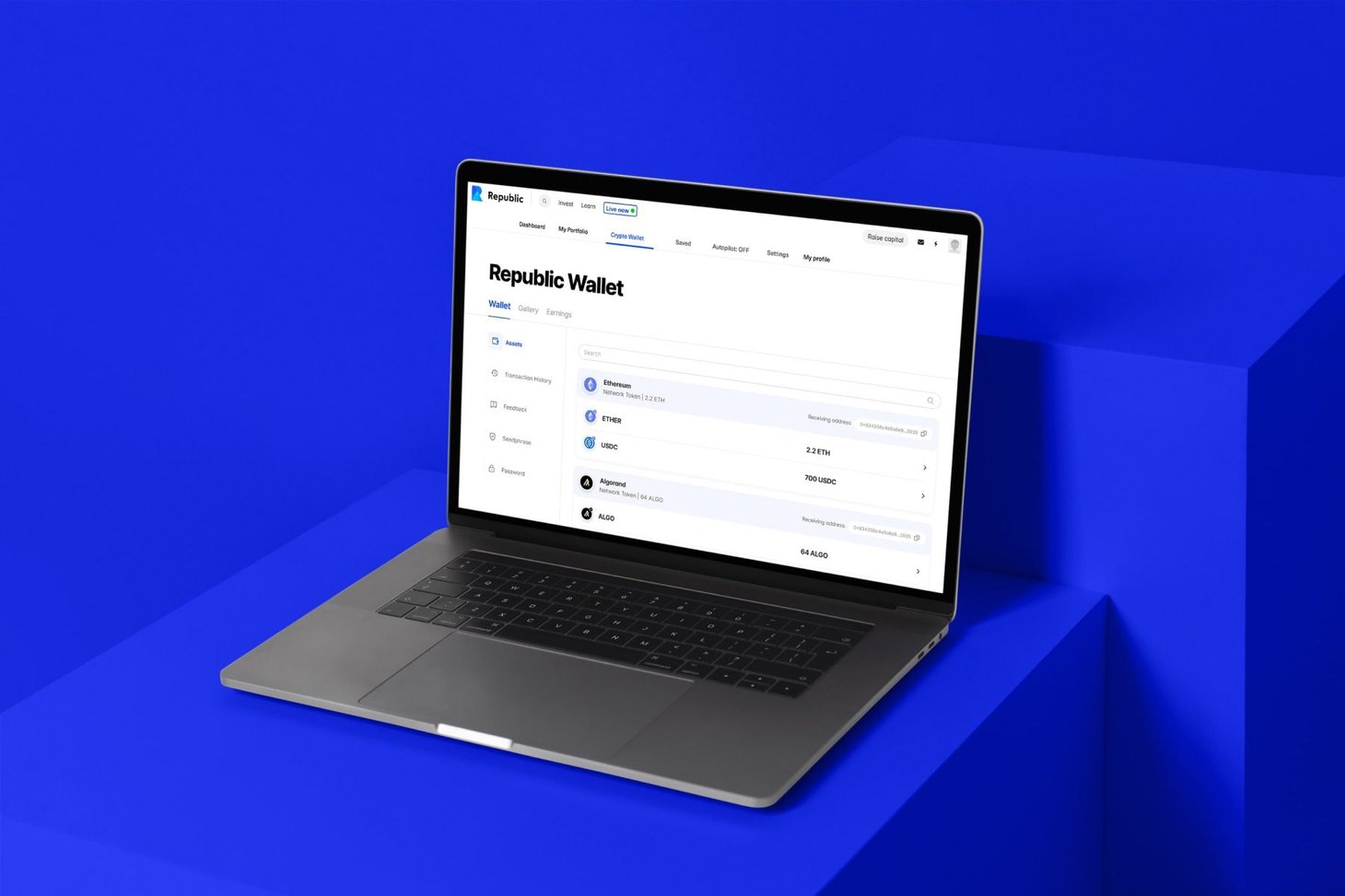

Republic Wallet is a digital wallet designed for Republic investors to securely store, manage, and grow their digital assets. Today, the wallet launches with the following benefits and features:

Seamless Integration: Republic Wallet serves as the hub for participating in token offerings on Republic, where digital assets can be sent directly and stored securely. By integrating Republic Wallet with the Republic product experience, investors can avoid the burdensome process of creating and managing third-party wallets to receive their assets, and view their owed (off-chain) and received (on-chain) asset balances in one unified interface.

Multi-Chain Capability: Considering the breadth of Republic’s investment offerings, Republic Wallet had to be optimized for flexibility. It was engineered to support multiple blockchains, an advanced capability that makes it possible to manage a variety of digital assets within a single, secure platform. Republic Wallet supports digital assets on Ethereum, Avalanche, and Algorand today, with Bitcoin, Polygon, and others coming soon.

Robust Security: Republic Wallet is fortified by rigorous testing by Quantstamp, a leading smart contract auditing firm. It’s also fully self-custodied, meaning Republic does not have any control over your wallet holdings—only you hold the private key to access your assets. To provide an extra layer of investor protection, Republic Wallet will be rolling out multi-party computation to optimize private key management by securely dividing, encrypting, and distributing private keys among multiple parties.

Simple Design: To ensure accessibility to investors of all levels, Republic Wallet’s user experience and interface was designed to feel intuitive even to those who have never interacted with cryptocurrency before. After completing a simple onboarding flow and private key storage, users will be equipped to confidently navigate and transact from Republic Wallet.

Republic Wallet was engineered for flexibility, and is poised to evolve alongside the needs of our growing community of 3+ million global members.

Explore the Republic Wallet here.

The Power of Tokenization: Transforming Finance for All

Our vision for Republic Wallet is inspired by our belief in a future where every asset that can be tokenized will be tokenized—providing greater accessibility, transparency, and opportunity for investors worldwide.

With the emergence of blockchain technology, tokenization has become a powerful force that is reshaping the way we think about assets and investments. But what exactly is tokenization, and why does it matter? Let's break it down:

What is Tokenization?

Tokenization is the technical process of representing real-world assets—such as stocks, startup equity, real estate, fine art, and more—as digital tokens on a blockchain. Imagine these tokens as certificates of ownership that carry all the attributes of the underlying asset—but in a digital form. Tokenization makes global transactions more efficient and transparent and, in line with Republic’s mission, democratizes access to a wide range of assets that were once restricted to a select few.

Benefits for Retail Investors

The impact of tokenization is far-reaching, particularly for retail investors. Here's why it matters:

Global Access: Tokenization breaks down geographical barriers, giving you access to more efficient markets and diverse assets from around the world—all you need is a wi-fi connection and a device.

Fractional Ownership: Tokenization evolves the concept of fractional ownership, making it possible to invest in illiquid, private market assets with even a small amount of capital.

Liquidity: Unlike traditional illiquid assets like private equity that once lacked broad access and efficient means of buying and selling, tokenized assets create opportunities for more liquid secondary markets.

Transparency: Blockchain's inherent transparency ensures that transactions and ownership are traceable and secure, minimizing fraud and enhancing trust.

Diverse Assets, Boundless Opportunities

The beauty of tokenization lies in its versatility. Virtually any asset can be tokenized. Here are just a few examples:

Startups: Tokenized equity makes early-stage startup investing accessible to all, offering potential for trading on secondary markets. It also provides new, untapped liquidity opportunities for founders and startup teams before a potential exit event occurs

Real Estate: Fractional ownership through tokenization democratizes real estate investing, enabling diversification with lower entry costs. This enables individuals to invest in and potentially trade partial ownership in multiple real estate assets.

Art: Similar to real estate investing, investing in fine art was limited to ultra-high net-worth individuals and institutions. With tokenization, participation in art ownership broadens and introduces the possibility of trading valuable artworks like stocks.

The Growth of Tokenization

According to a recent report by CB Insights, the tokenization market is projected to experience massive growth—reaching an estimated $24 trillion in tokenized financial assets by 2027. This surge represents its amazing potential for widespread adoption—and, in parallel, the importance of financial products like digital wallets that make it possible to send, receive, and store tokenized assets.

Empowering Your Investment Journey

Republic Wallet's launch signifies a major milestone on our company’s journey to transform digital finance, and sets into motion an exciting roadmap of possibilities for investors of digital assets.

For example, holders of the Republic Note will soon be able to receive and manage their assets from their Republic Wallet. Or, as our secondary marketplace develops, Republic Wallet will serve an integral function for those trading assets on the exchange.

We look forward to you joining us as we venture towards a digital future for private investing—and encourage you to explore Republic Wallet for yourself right here.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...