Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Maven: a16z

bets millions on online learning

How two EdTech vets raised millions from Tier 1 VCs and major angel investors.

Maven: building the university of the future

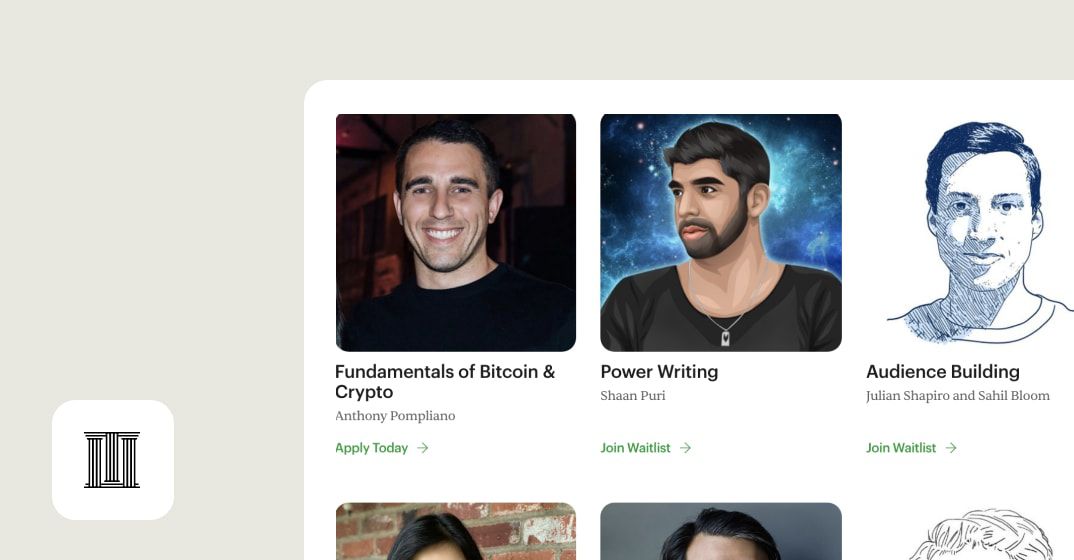

Maven empowers the world’s experts to offer cohort-based courses directly to their audience. Since launching in January 2021, instructors have already sold over $1 million worth of courses on their platform. Maven’s founders are no strangers to online learning.

Data as of 12/31/21

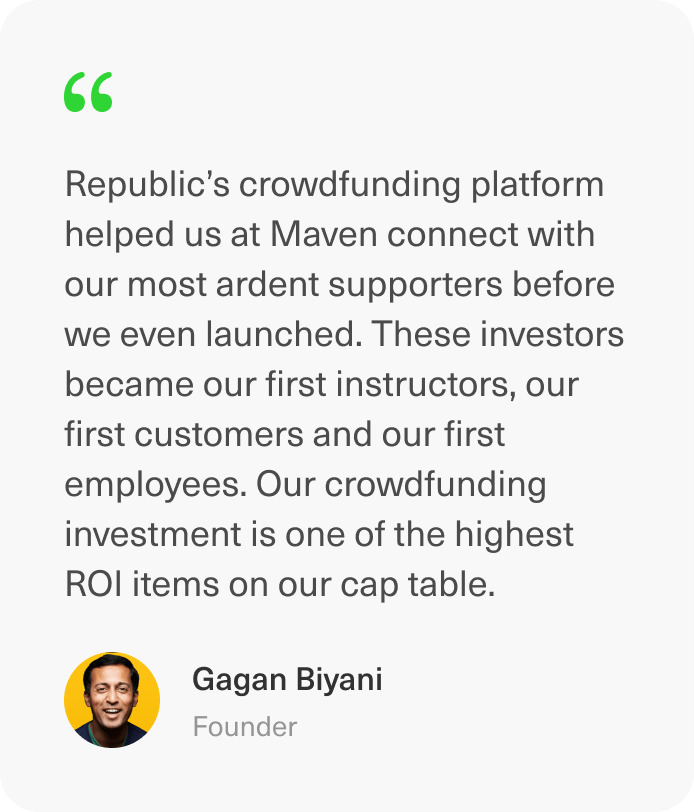

Choosing community funding

Maven could have easily raised from VCs, but that didn’t align with their core values that center around building communities and challenging the status quo. This is one of the reasons they decided to raise on Republic, where everyday investors were able to participate alongside major VCs.

Founders with experience

Wes Kao

Gagan Biyani

479 investors backed the future of education

Maven’s Reg CF campaign on Republic set a minimum investment amount of only $100, but that didn’t stop investors from pouring in an average of ~$1,500. In less than a month, Maven was successfully funded.

Previous to the campaign, Maven had already raised over $4M in seed financing, led by Tier 1 venture capital firm First Round Capital. Other investors included Naval Ravikant, Sahil Lavingia, Li Jin, Arlan Hamilton and co-founders from Lambda School, Outschool, Superhuman, and Udemy.

Founders Wes Kao and Gagan Biyani, believed in a community first model that centered around bringing their early investors in to become more than just fans— to become investors.

In addition to the experience the notable traditional venture capitalists brought in from investing in companies like Uber, Robinhood, Notion, Twitter, Postmates, and more, Maven now had a community of educators, students,

Reviews on Republic

Scroll to read more reviews

Najva Sol

As someone who's attended, taught in, and designed cohort-based experiences, I'm personally aware of the way we're hacking solutions together. A proper platform will hopefully let creators + educators focus on quality content rather than building the container for the classes. Can't wait for this to exist.

Tara Gilboa

I invested in Wes and Gagan because I believe the future of learning should be driven by relationships that catalyze growth. Wes' deep understanding of culture and community can bring about the scalable, sustainable, more authentic experiences we want for a new decade of global societies of leaners. LMSes (learning management systems) and CMSes (Community Management Systems) will be part of our past, and these two will create our future.

Yash Tekriwal

As a cohort-based course creator myself and a founder in this space – Wes and Gagan are tackling a massive problem and bringing a wealth of experience to the table.

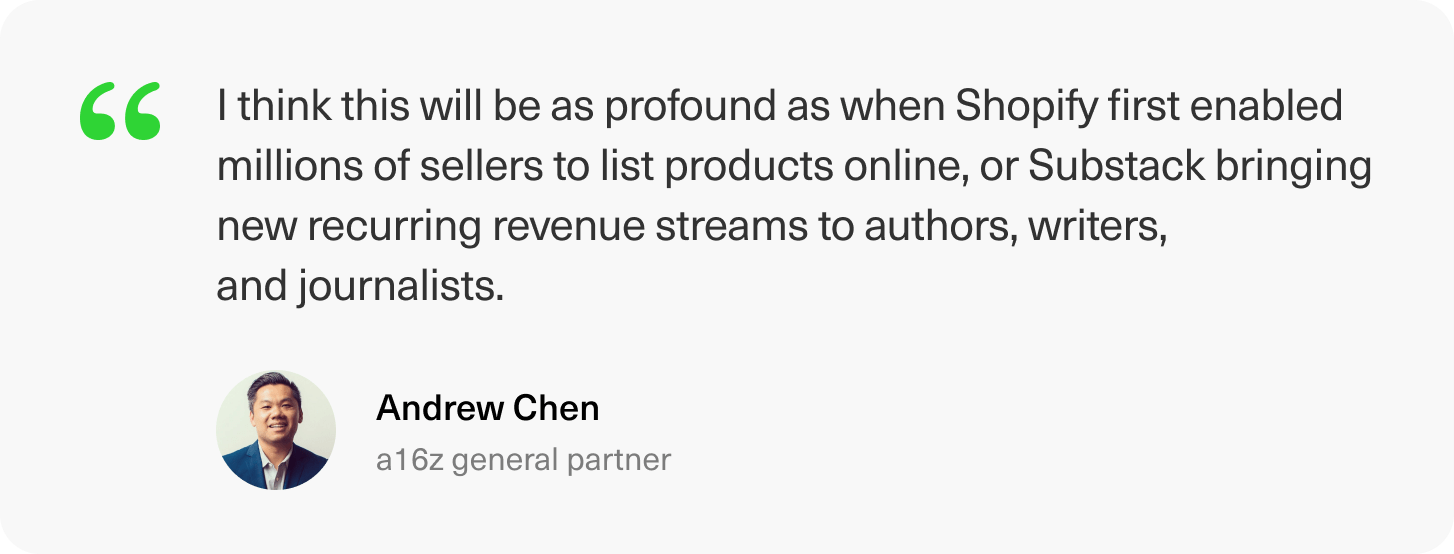

Raising additional capital from a16z

Just three months after their campaign on Republic, Maven went on to raise $20 million in a Series A round led by Andreessen Horowitz — a leading venture capital firm with ~$19 billion in assets under management.

Andreessen Horowitz has also invested in some of the biggest companies in the world including Coinbase, Lyft, AirBnB, Stripe, and Robinhood to name a few.

The round places a16z general partner Andrew Chen on Maven’s board. Here’s what he had to say about Maven:

The Wrap

Invest now

Browse current investment opportunities on Republic.

All companies are vetted & pass due diligence.

This site (the "Site") is owned and maintained by OpenDeal Inc., which is not a registered broker-dealer. OpenDeal Inc. does not give investment advice, endorsement, analysis or recommendations with respect to any securities. All securities listed here are being offered by, and all information included on this Site is the responsibility of, the applicable issuer of such securities. The intermediary facilitating the offering will be identified in such offering’s documentation.

All funding-portal activities are conducted by OpenDeal Portal LLC doing business as Republic, a funding portal which is registered with the US Securities and Exchange Commission (SEC) as a funding portal (Portal) and is a member of the Financial Industry Regulatory Authority (FINRA). OpenDeal Portal LLC is located at 149 E 23rd St #1314, New York, NY 10010, please check out background on FINRA’s Funding Portal page.

All broker-dealer related securities activity is conducted by OpenDeal Broker LLC, an affiliate of OpenDeal Inc. and OpenDeal Portal LLC, and a registered broker-dealer, and member of FINRA | SiPC, located at 1345 Avenue of the Americas, 15th Floor, New York, NY 10105, please check our background on FINRA’s BrokerCheck.

Certain pages discussing the mechanics and providing educational materials regarding regulation crowdfunding offerings may refer to OpenDeal Broker LLC and OpenDeal Portal LLC collectively as “Republic”, solely for explanatory purposes.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC make investment recommendations and no communication, through this Site or in any other medium should be construed as a recommendation for any security offered on or off this investment platform. Investment opportunities posted on this Site are private placements of securities that are not publicly traded, involve a high degree of risk, may lose value, are subject to holding period requirements and are intended for investors who do not need a liquid investment. Past performance is not indicative of future results. Investors must be able to afford the loss of their entire investment. Only qualified investors, which may be restricted to only Accredited Investors or non-U.S. persons, may invest in offerings hosted by OpenDeal Broker.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC, nor any of their officers, directors, agents and employees makes any warranty, express or implied, of any kind whatsoever related to the adequacy, accuracy or completeness of any information on this Site or the use of information on this site. Offers to sell securities can only be made through official offering documents that contain important information about the investment and the issuers, including risks. Investors should carefully read the offering documents. Investors should conduct their own due diligence and are encouraged to consult with their tax, legal and financial advisors.

By accessing the Site and any pages thereof, you agree to be bound by the Terms of Use and Privacy Policy. Please also see OpenDeal Broker’s Business Continuity Plan and Additional Risk Disclosures. All issuers offering securities under regulation crowdfunding as hosted by OpenDeal Portal LLC are listed on the All Companies Page. The inclusion or exclusion of an issuer on the Platform Page and/or Republic’s Homepage, which includes offerings conducted under regulation crowdfunding as well as other exemptions from registration, is not based upon any endorsement or recommendation by OpenDeal Inc, OpenDeal Portal LLC, or OpenDeal Broker LLC, nor any of their affiliates, officers, directors, agents, and employees. Rather, issuers of securities may, in their sole discretion, opt-out of being listed on the Platform Page and Homepage.

Investors should verify any issuer information they consider important before making an investment.

Investments in private companies are particularly risky and may result in total loss of invested capital. Past performance of a security or a company does not guarantee future results or returns. Only investors who understand the risks of early stage investment and who meet the Republic's investment criteria may invest.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC verify information provided by companies on this Site and makes no assurance as to the completeness or accuracy of any such information. Additional information about companies fundraising on the Site can be found by searching the EDGAR database, or the offering documentation located on the Site when the offering does not require an EDGAR filing.

To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. Therefore, when you use the Services we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver's license, passport or other identifying documents.

Republic and its affiliates are not and do not operate or act as a bank. Certain banking services are provided by BankProv, member FDIC / member DIF. Digital (crypto) assets and investment products are not insured by the FDIC, may lose value, and are not deposits or other obligations of BankProv and are not guaranteed by BankProv. Terms and conditions apply.

Made in SF/NYC