We are happy to announce the selection of the 10 finalists and participants in the inaugural AWS Clean Energy Accelerator...

Tokenization

Tokenizing our Future Join our Journey

HWE Token + Avalanche + Brickken: a flagship digital asset

This equity round will be fully tokenized. We’re excited to announce that the HWE equity Token will be launching on Avalanche, a leading Layer-1 blockchain network, marking a pivotal technological step in our journey.

A technological milestone for the HWE Token

HWE’s security token is an on-chain digital security, and thus will record all transactions on the distributed ledger. The choice of blockchain is a critical one for our future, and there's no better partner for us than Avalanche.

What is Avalanche?

Distinguished from other Layer-1 blockchains, Avalanche stands out for its unique architecture that offers industry-leading scalability, speed, and flexibility. Its consensus mechanism facilitates rapid transactions with minimal environmental impact. Today it's the 11th largest chain in the world (with over $8B in market cap). Learn more on avax.network.

Understanding Layer-1 blockchains: A Layer-1 blockchain is the foundational layer of a blockchain network, where transactions are processed and secured. These networks, like Ethereum, Bitcoin, and Avalanche, provide the core infrastructure for recording transactions. They are essential because they maintain the network’s security, consensus, and protocol rules, forming the bedrock for decentralized applications and digital assets—like the HWE Equity Token.

Why are we tokenizing our equity?

Because our team believes that tokenization makes private market investing easier, more transparent, and more accessible, and that eventually, any asset that can be tokenized will be tokenized.

Why we chose Avalanche

Selecting Avalanche for the HWE Token was a strategic decision influenced by several important factors:

Scale and speed

Known for its infinite scalability, Avalanche ensures that HWE Token holders will experience lightning-fast, smooth, and low-cost transactions. Blue-chip brands like Amazon Web Services and Mastercard have partnered with Avalanche for its strong technical capabilities.

Mission alignment

Beyond the technical advantages, our partnership with Ava Labs, the team behind Avalanche, is driven by a shared commitment to building a more inclusive future for financial markets through tokenization.

Eco-friendliness

When it comes to the energy required to run, no other blockchain comes close. According to the Crypto Carbon Ratings Institute, Avalanche consumes the same energy as only 46 US households each year — 35,000x less energy than Ethereum and 200,000x less than Bitcoin.

How does Brickken Fit in?

Brickken provide the tools for tokenization. They have created a Token Suite, designed to simplify the creation, selling and managing of digital assets, facilitating tokenization and empowering entrepreneurs and investors alike. Their goal is to make it easy for companies to raise funds and connect with the digital investment community without intermediaries. Much like Shopify streamlined e-commerce, Brickken enables tokenization by providing an all-in-one platform with user-friendly tools and features, making it easy for companies to tokenize and self-manage their digital assets.

Digital wallets

Launching on Avalanche and with Brickken allows seamless integration into any digital wallet. With walletconnect there are 50+ wallets to choose from and you can also use the Republic wallet.

Problem

We are solving three of the biggest challenges of the 21st century

Low cost clean electricity

Grid-scale energy storage

Seawater to fresh water

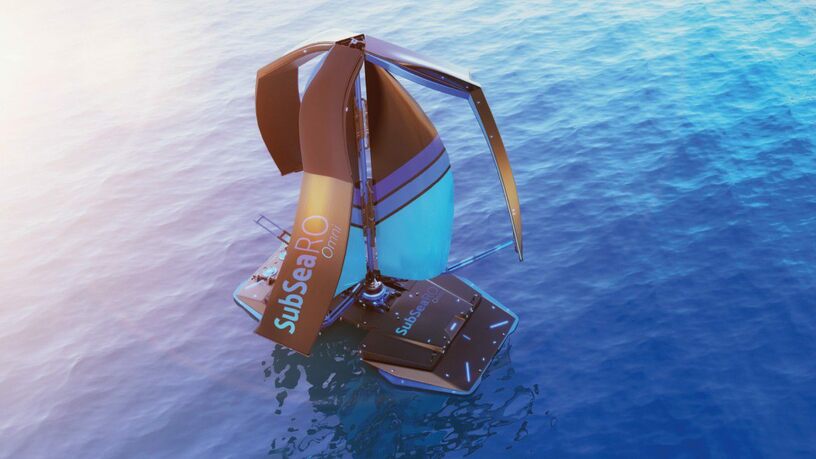

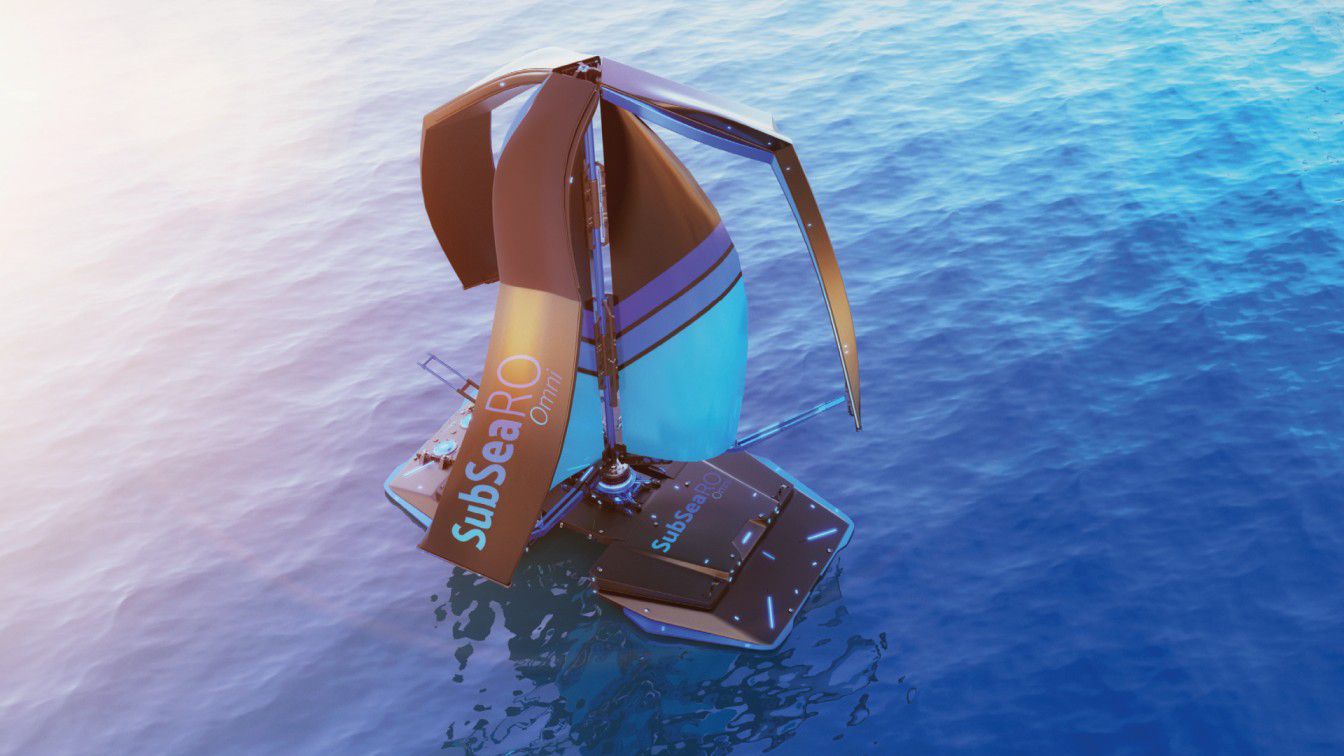

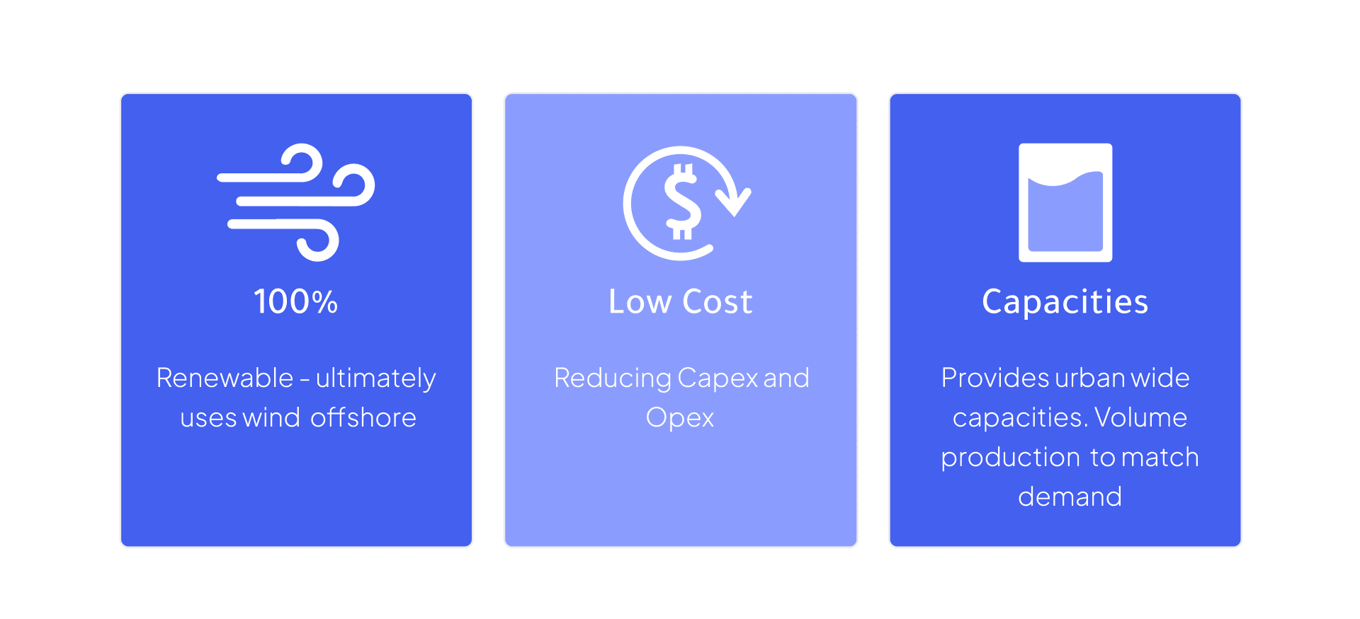

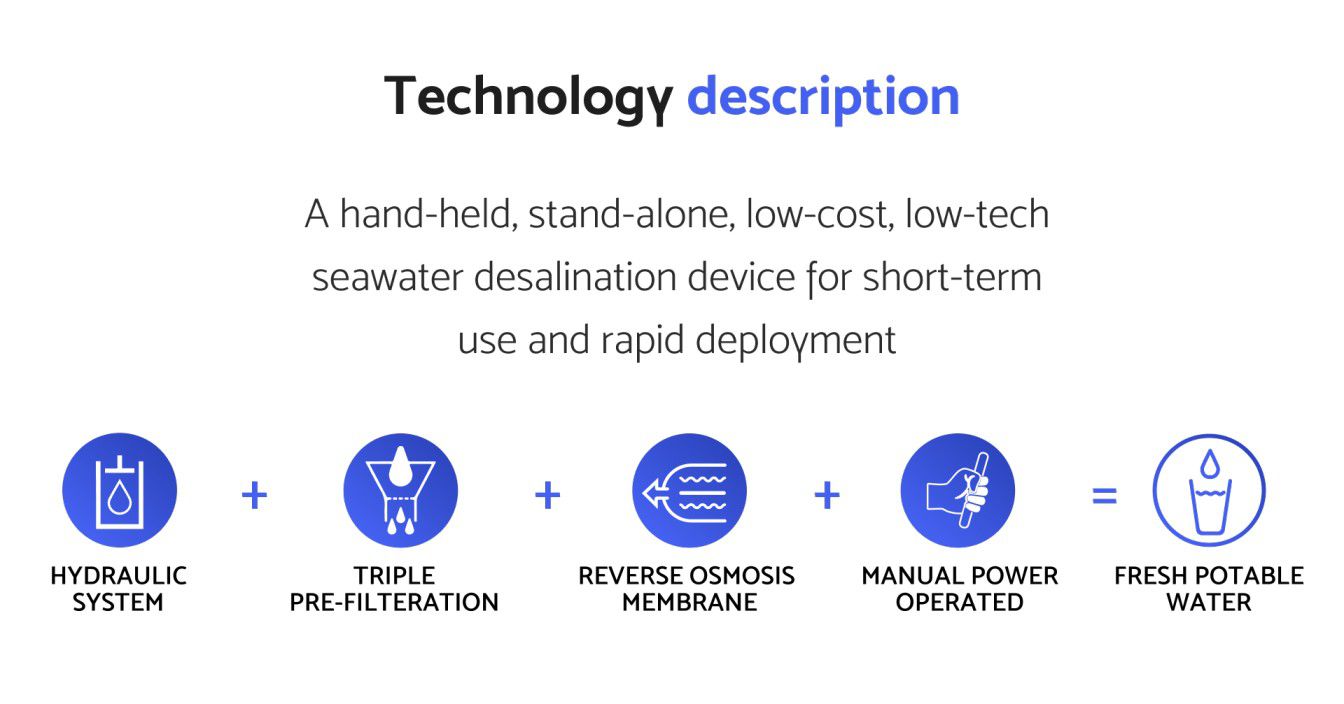

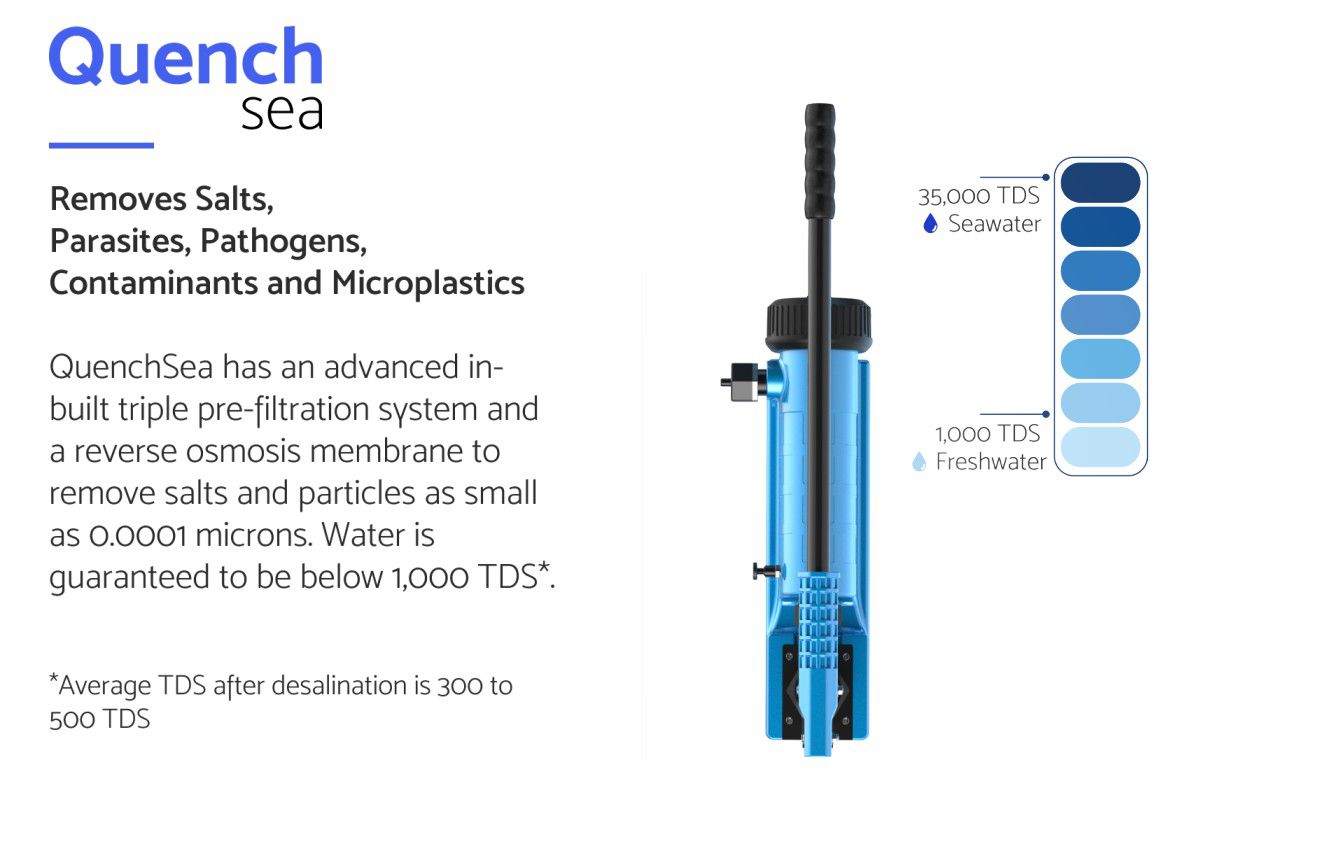

We are a tech startup developing a disruptive technology to solve 3 of the biggest challenges of the 21st century, low cost clean electricity, grid scale energy storage, and seawater desalination. All ultimately from wind offshore using vertical axis wind rotors and offshore based kite systems. We have also developed and commercialised the world's only low cost handheld seawater desalination device (QuenchSea) for humanitarian purposes, disaster relief, and the offshore marine sector.

Solution

Solving the world's

energy crisis

Electrical power generation and energy storage, combining wind, and subsea mechanical based storage

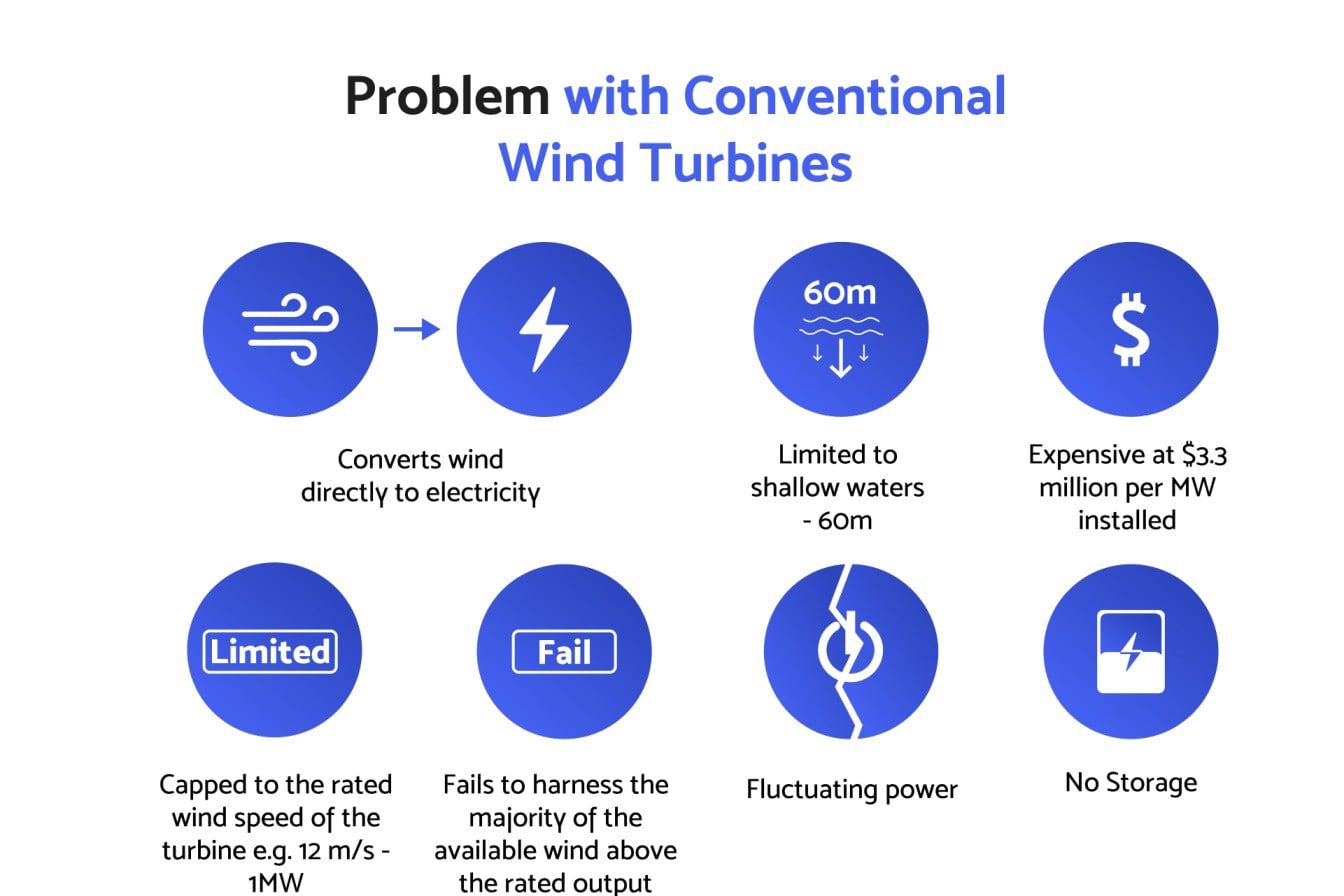

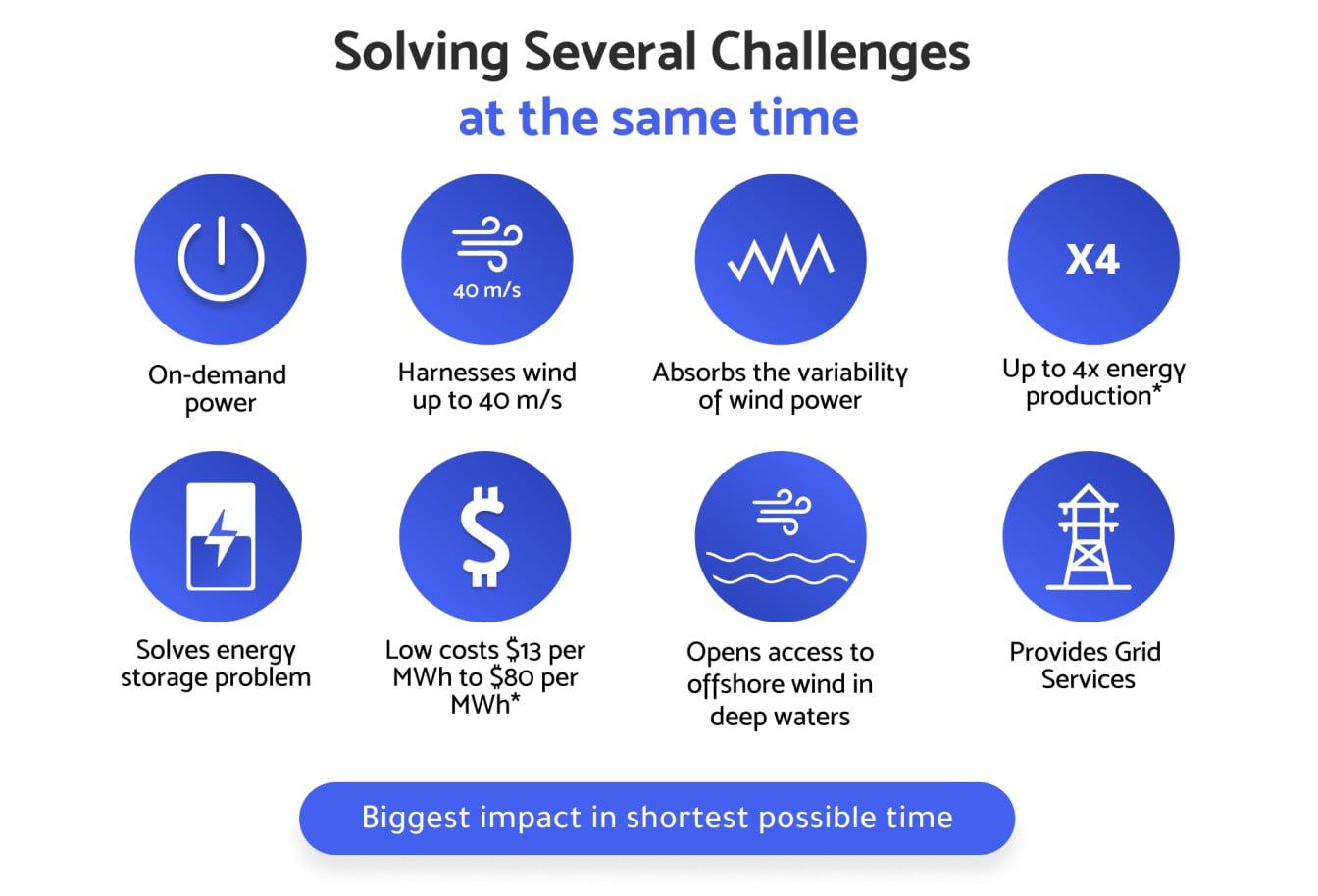

We are developing a unique technology that harnesses wind offshore in deep waters cost effectively. Rather than converting wind directly to electrical energy, as with conventional wind turbines, we are using wind solely for mechanical lift. Lifting a heavy mass by a submerged height in the ocean and in the process absorbing the volatility of wind power. Electrical energy is then generated with a fixed power output when the heavy block is released with a constant velocity to a predetermined sea depth. This hybrid approach allows the wind rotors to capture more of the available wind, up to 40 m/s, rather than being limited to the rated wind speed of a conventional wind turbine (capped at 12 m/s even for the largest wind turbines). This can potentially triple/quadruple energy production from the same surface area because of the cube relationship between wind speed and power and energy output (double the wind speed and energy and power output increase by a factor of 8). In an array and as more units are installed, the implications would be very significant to grid resiliency because of the energy storage capabilities. This system is not really energy storage as such but more of a wind power capturing energy system with a mechanical gravity based conversion to electrical energy. The implications are quite immense and the benefits include lowering the cost of electricity (est. $13 to $80 per MWh), less control mechanisms, omnidirectional wind capture, eliminating the volatility of wind power, harnessing the entirety of the wind resource from 4m/s to 40 m/s, tripling to quadrupling energy generation from the same surface area, opening up access to offshore wind in deep waters where 80% of the world's wind resource exists, providing grid services, building energy storage capability that increases grid stability, lowering deployment and O&M costs, and most importantly, rapid commercialisation with the greatest impact in the shortest possible time. In two years we are already at TRL 6 and soon to be at 7, and our aim is to break the barrier, 1 billion tonnes CO2e reduction before 2030 that is equivalent to 2% of total carbon emissions globally from all sectors. The same technology can be used for seawater desalination at scale.

Problem: 80% of the world's wind

resource is offshore in deep waters

How can humanity access and harness wind

offshore in deep waters cost effectively today?

There is a global need for clean, affordable and secure energy. The global energy market is currently sized at $6 trillion, and energy demand is expected to grow by one-third by 2040. The world still sources 87% of its energy from fossil fuels.

Many of the environmental problems the world faces today—including climate change, ocean acidification, droughts, extreme weather, carbon emissions, and air pollution—are all a direct result of our dependence on fossil fuels.

The world needs to transition to renewables; but, the main problem with conventional renewables is that they have failed to outcompete with fossil fuels on cost, scalability, power and energy density. In addition, they are either intermittent, variable or both and no cost effective energy storage solution has been found to absorb the volatility of renewables or to dispatch them on demand.

Our technology opens up the ability to exploit offshore wind power in deep waters at significantly reduced cost, compared to conventional wind turbines, offshore floating wind, or evolving marine and kite energy technologies.

*Based on internal assessments

—

Solution 2

Solving the world's

water crisis

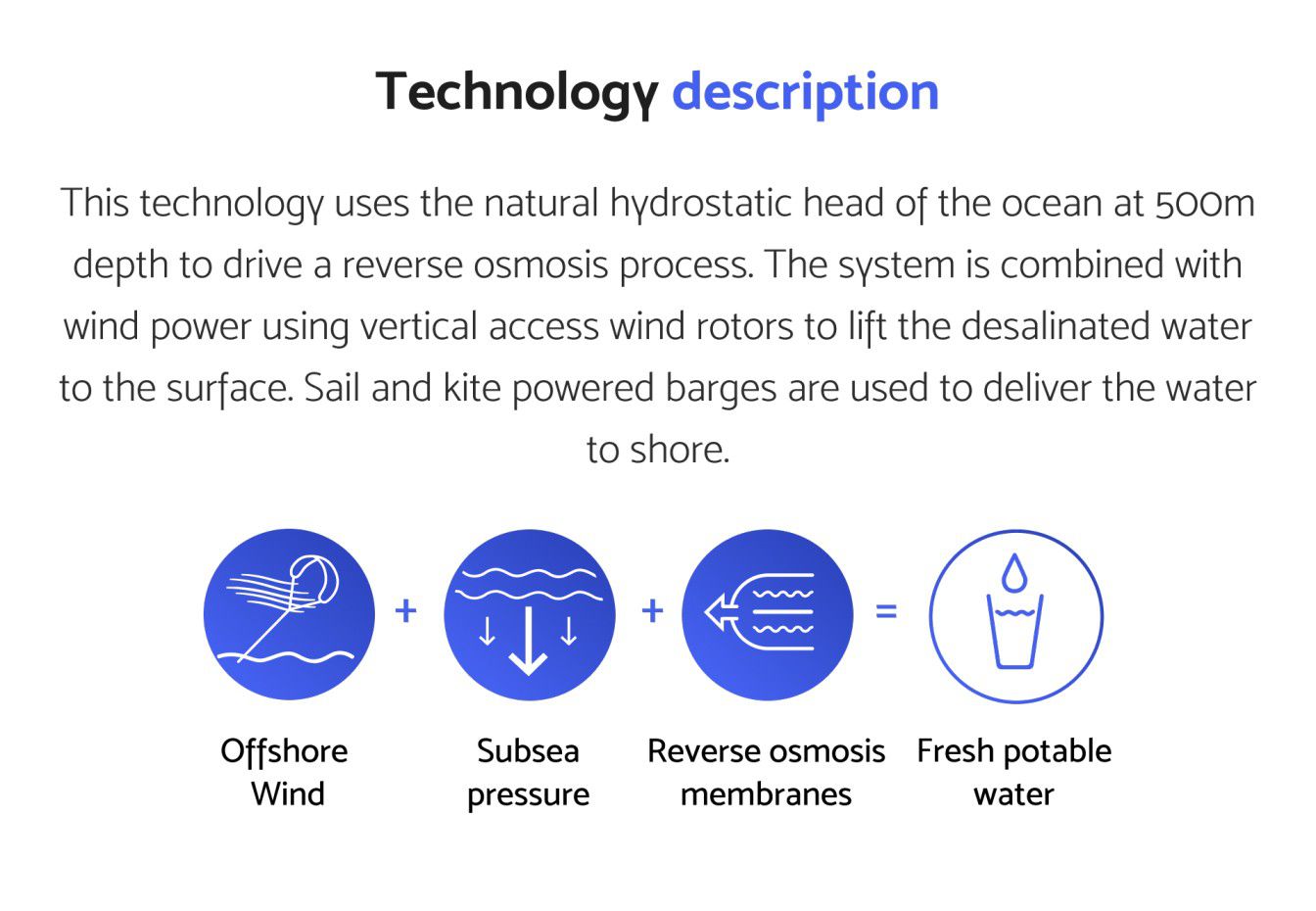

Combining the power of subsea oceanic pressure and wind to solve one of the biggest challenges of the 21st century

Problem: The world needs a solution

to the water crisis

Currently, 40% of the world’s population live in water-stressed areas. This number is expected to increase to 50% by 2025, with 1.8 billion people living with absolute water scarcity. The world population is expected to grow from 7.9 billion in 2022 to 9.9 billion in 2050, adding tremendous risks of water stress.

Along with other megatrends, such as urbanization, modern agriculture and industrialization, human activities have multiplied demands for water consumption. Water contamination from industrial production, and extreme weather (droughts and floods) due to climate change, also put our very limited water resources in danger.

SubSea Ro Wind is highly innovative technology that combines the power of wind offshore, reverse osmosis membranes, and subsea pressure to desalinate seawater into freshwater in unprecedented volumes.

—

Solution 3

Traction

- Raised $2.5 million to date

- Launched QuenchSea version 1 and 2

- Generated sales in excess of $1 million

- Customer base of 10,000+

- Social Media following of over 20,000+

- 3 granted patents

- Reached TRL 6 and moving closer to Technology Readiness Level 7 for offshore technologies

- Backed by Techstars

- Received a commitment of $54 million for an IPO

- Future 100, PwC Future 50, Forbes 30 under 30, WEF Top 100 Startups, COP28, AWS Clean Energy, Shell Startup Engine

Featured in

Customers

We generate electricity in MWh and our initial target market are energy suppliers (electricity supply) and national, regional, and city grids for load balancing and grid services including frequency control, load following, reserve, response, inertia, black start, voltage stability. This is a B2B business model.

Our customers are either B2B customers like municipalities, NGOs, governments or direct to corporate customers. Our business model can be adapted to geographical markets and customer needs to serve in country. The systems are completely mobile and can be deployed in 80% of the world's waters, within 30km off the majority of the world's continents and is 100% renewable. Our technology requires two prerequisites, deep waters of between 300m to 500m, and offshore wind. Both readily available and in abundance globally.

QuenchSea is developing a new product category for portable manually powered seawater desalination devices. QuenchSea was primarily developed to cater for the humanitarian and disaster relief sectors. Over 2.2 billion people worldwide do not have access to clean water and around 50% of the world’s population live in urban areas near the coast. Customers include NGOs, disaster relief agencies, sailors, campers, preppers, and offshore marine operators. We cater also for the B2C market online through our website at www.quenchsea.world

Business model

Market

- The global energy market is subdivided into 3 primary sectors (electricity, heat and transportation) and is anticipated to be worth over $23 trillion by 2030 (US Energy Secretary Jennifer Granholm) with growth projection of 50% by 2050.

- Global electricity consumption 27,000 TWh and is valued at over $3 trillion (retail)

- The global water market is expected to be worth over $500 billion.

Competition

Our technology competes against offshore wind.

The primary advantages of this hybrid system are it's relative simplicity and the ability to harness wind speeds of up to 40 m/s, compared to a maximum 12 m/s for traditional large wind turbines (rated power output).

Our OceanOmni system uses an omnidirectional vertical axis wind capture rotor with a gravity based storage system that has significant advantages:

Omnidirectional wind capture

Closer spacing

Operates in deep waters

Lower starting wind speed (3 m/s)

Lower environmental impact

Easier installation compared to conventional wind turbines

Low O&M costs partly because the gearbox is at the base making it easier to maintain

Operates in extreme weather and turbulent conditions

High energy yield - harnesses full energy resource from 3 m/s to 40 m/s wind speeds

Greater energy yields since we harness wind up to 40 m/s

Lower cost per MWh - region of $13 to $80 per MWh

Rotational movement to mechanical lift - increased efficiency

Absorbs variability of wind power

Rapid development cycle

Uses standard electrical generator for electrical conversion

Dispatchable power

Inbuilt energy storage

Hybrid energy system (energy storage & generation)

Lower centre of gravity, which reduces platform costs

Improved efficiency at multi-MW scales

Reduced O&M costs through removal of active components and platform-level placement of drivetrain

Same technology can be used for seawater desalination at scale

Vision and strategy

Our vision is to play a major role in the global transition to renewables. We have a technology today that can make the biggest impact in the shortest possible time. Our technology will open up access to offshore wind in deep waters cost effectively. We are solving not one but several challenges at the same time.

Our Values

Impact

1 Billion People Global Impact by 2030

Our aim is to impact 1 billion people and reduce carbon emissions by 1 billion tons of CO2e by 2030. This equates to over 2% of total carbon emissions globally from all sectors. We also want to play a major part in alleviating the world's water crisis at small and large scale.

Funding

Backed by TechStars

Founders

Lee King, co-founder and CEO. He is a graduate of the University of Aberdeen holding an MA and MSc International Business. He has over 10 years of experience in business management, business development, investment funds, project finance, investment and technology strategies, as well as within projects focusing on water desalination, water security and energy

Lee King, co-founder and CEO. He is a graduate of the University of Aberdeen holding an MA and MSc International Business. He has over 10 years of experience in business management, business development, investment funds, project finance, investment and technology strategies, as well as within projects focusing on water desalination, water security and energy

Hayk Vasilyan, co-founder and CTO, is a renowned researcher in manufacturing technologies and materials. He holds a Mechanical Engineering BSc, MSc from the University of Turin, Italy, and a PhD in the field of Computational Engineering and Design at the Rolls-Royce Technology Centre from the University of Southampton. He has a wide range of experience in product design, systems integration, manufacturing technologies, robotics, materials science and renewable energy.

Abdulla Ghaly, co-founder and IT Systems Integrator and IT Director. He is a graduate of Queens Mary University and UCL with an MSc in Electrical and Telecommunications Engineering. He has over 10 years experience as a Telecoms Engineer and IT systems integrator for one of the largest utility companies in the UK.

Summary

Why invest

in Hydro Wind Energy

Every year, global energy demand continues to rise. Driven by emerging economies and developing nations, total worldwide energy usage is expected to grow by nearly 50% by 2050 and the water market globally will be worth over $500 billion.

At the same time, scientists are sounding the alarms about rising temperature levels, caused by carbon dioxide and other greenhouse gasses. With temperatures likely to increase by well over two degrees Celsius, many nations are seeking ways to replace fossil fuels with renewable sources of energy. This provides a market opportunity to invest in game changing technologies that will play a major part in the global transition. We have practical solutions to 3 of the biggest challenges of the 21st century, low cost clean electricity, grid scale energy storage and freshwater. Solutions that can be developed and commercialized in the shortest possible time with the greatest impact.

- Raised $2.5 million to date

- Reached TRL 6 (Technology Readiness Level) in 2 years and moving into TRL 7

- Generating revenues now from QuenchSea $1 million plus in sales

- 10,000+ customers

- $54 million signed commitment from an institutional investor for an IPO

- We have 3 innovative solutions!

- 3 granted patents

- 40+ team members and backed by Techstars, Shell Startup Engine, AWS Clean Energy Accelerator, Innovate Masdar City

- Featured in Forbes 30 under 30, Future 100, PwC Future 50

- Climate change represents an existential threat to human civilization, with many nations seeking to reach zero net carbon emissions by 2050

- As the world transitions away from fossil fuels, there is a market opportunity to invest in clean or renewable energy sources

- Global investment in transitional technologies reached $755 billion in 2021

- Wind, solar, hydropower, energy storage and water represent immense future needs and opportunities

- Investments in renewables will need to triple in the coming years in order to reach net-zero carbon emissions

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...