OpenDeal Broker LLC charges you a two percent (2%) administrative fee on the gross principal transaction with a minimum fee of $5 and a maximum of $300. The fee is added to the total amount of your investment at checkout.

Past financial results are no guarantee of future performance. Click here for important information regarding Financial Projections which are not guaranteed.

Investments in private companies are particularly risky and may result in total loss of invested capital.

Risks of early stage investment. Not an offer to buy or sell securities. This is a long-term speculative illiquid investment. Investment is not FDIC or SiPC insured.

There may be other available opportunities that are similar to this investment but have different attributes, characteristics, cost factors, and fees.

Projected IRR (Internal Rate of Return) Disclaimer

The projected IRR provided herein is an estimate based on certain assumptions and inputs, and it is subject to significant uncertainties and risks. It should not be considered a guarantee of future performance or investment success. Investors should be aware that actual results may differ materially from the projected IRR due to various factors, including but not limited to:

Market Conditions: Fluctuations in economic conditions, interest rates, and market trends can significantly impact the actual performance of the investment.

Assumption Accuracy: The accuracy of the assumptions used in calculating the projected IRR, including revenue growth rates, expenses, and discount rates, may vary from actual results.

External Factors: Changes in government regulations, geopolitical events, natural disasters, and other unforeseen circumstances can affect the performance of the investment.

Liquidity Risks: The ability to realize the projected IRR may be hindered by limited liquidity in the investment, making it challenging to sell or exit the investment at desired terms.

Operational Risks: Operational inefficiencies, management changes, and unexpected events within the investment's operations may impact its financial performance.

Currency Risks: Investments denominated in foreign currencies are subject to exchange rate fluctuations, which can affect the value of the investment and the projected IRR. Investors should carefully review all relevant documentation, including offering materials, financial statements, and risk disclosures, before making any investment decisions.

Additionally, investors are encouraged to consult with their financial advisors to assess the suitability of the investment and to understand the potential risks involved. The projected IRR is provided for informational purposes only and does not constitute financial, legal, or investment advice. Past performance is not indicative of future results. Investors should exercise caution and perform their own due diligence before making any investment decisions.

Opportunity

Our unique edge

- US-Based Agri Developer with Real Assets

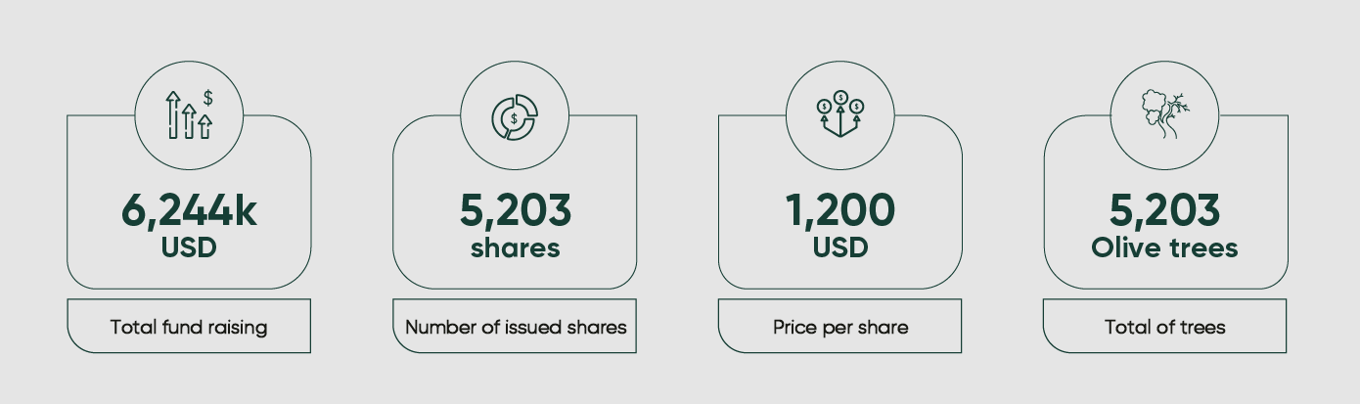

Your investment in olive trees and premium organic olive oil, cultivated and produced in Spain, is facilitated through a US-based Agri Developer. - Hacienda Santa Maria: Optimal Performance Among 700 Properties

Hacienda Santa Maria, our selected olive tree farm, stands out as a top performer globally, scoring among the highest 700 properties. Its exceptional productivity and reliability make it the ideal headquarters for our operations. - Investment Tied to Productive Plots

Investments through Olive Plots are directly tied to plots at Hacienda Santa Maria, ensuring each share corresponds to an individual, highly productive olive tree. This means you invest in a tree with proven productivity. - Financial Returns and Dividends

Annual tree productivity not only covers the entire operational costs of the farm but also generates dividends for investors. Additionally, investors benefit from carbon credits. - Impressive Investment Metrics

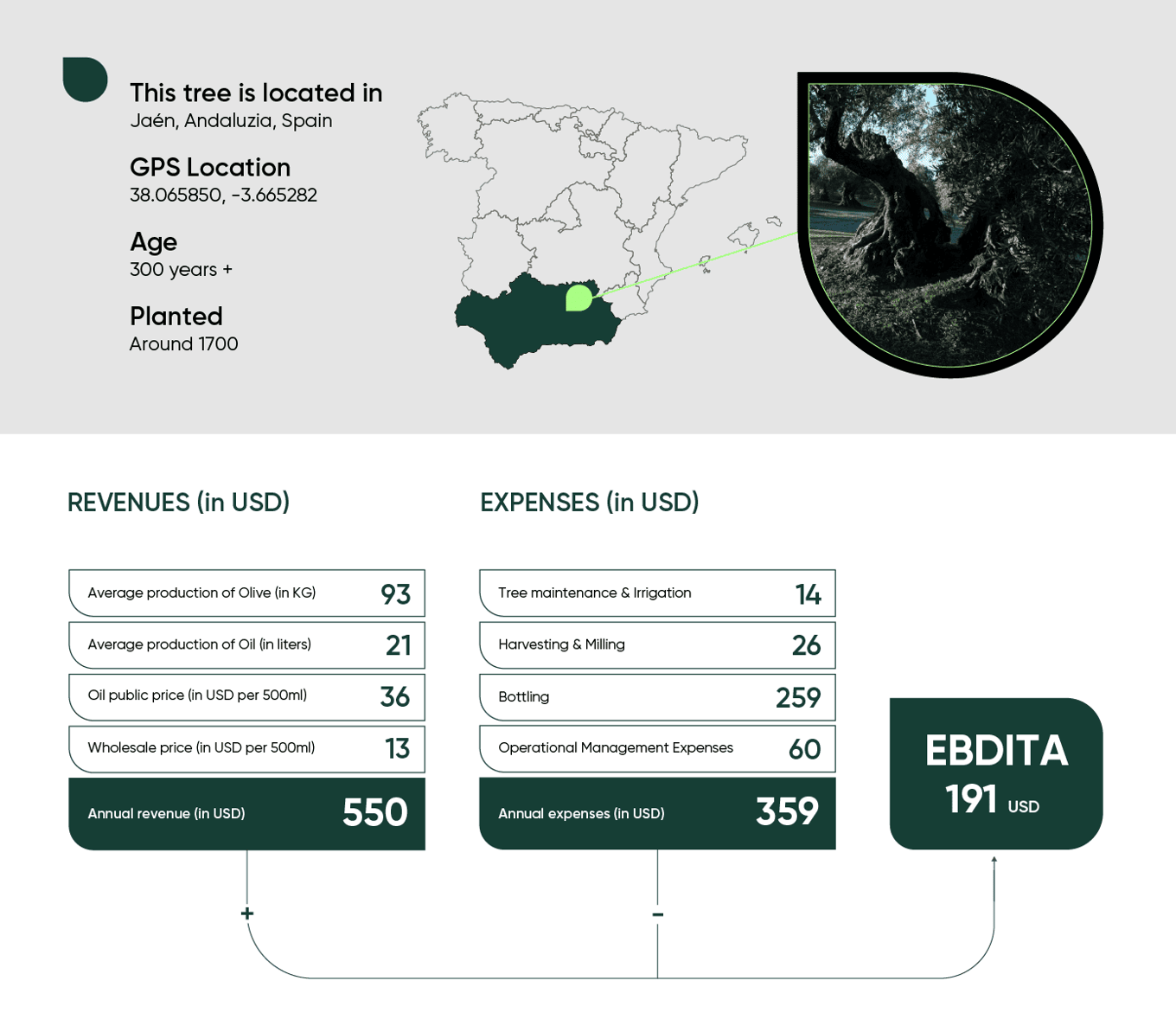

The offered investment boasts an Internal Rate of Return (IRR) of 15.85%, with our olive trees consistently delivering an average revenue of $550US per year—and an EBITDA of US$191. Each tree produces an average of 93 kilos of olives per year, resulting in 21 liters. Comprehensive details are available in our Business Model report. - Tree Health and Productivity

Each of our olive trees has around 300 years and features three trunks, spaced 14 meters apart to ensure optimal health and productivity. Rigorous due diligence by BDO and experts from the Olive School of Spain supports our commitment to excellence. - Strategic Location in Andalucía

Hacienda Santa Maria is situated in Jaen, Andalucía, one of Spain’s iconic regions renowned for the quality of its olive oil. The farm also holds notable olive oil tourism-related potential. - Sustainable Management and Impact

The cultivation and management of the trees will continue to be operated by Hacienda Santa Maria, with ongoing support and monitoring from Olive Plots. Our Impact Management System optimizes environmental and social impacts, including carbon capture evaluation.

Product

Investing in a centenary tree through Olive Plots

Nurturing Centenary Olive Trees in the Global Olive Oil Landscape

Robust Growth ...

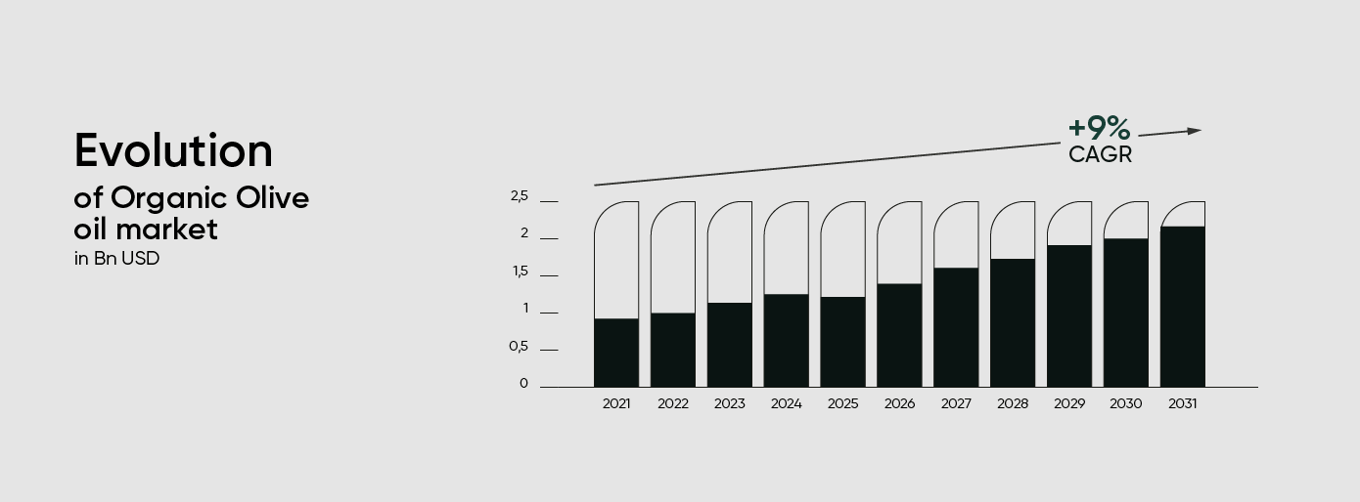

- Organic olive oil market value is expected to grow at an average of 9% per year between 2021and 2031, reaching a total value of 2.2 Bn USD

- Several factors explain that important growth, almost doubling its value share in the global olive oil

market:- Awareness of healthy food, with well-informed consumers who are more willing to pay higher

price for organic olive oil - Public policies encouraging the development of organic crops, such as European Union

strategy to convert 25% of all farmland in the bloc to organic practices by 2030

- Awareness of healthy food, with well-informed consumers who are more willing to pay higher

… facing structural challenges

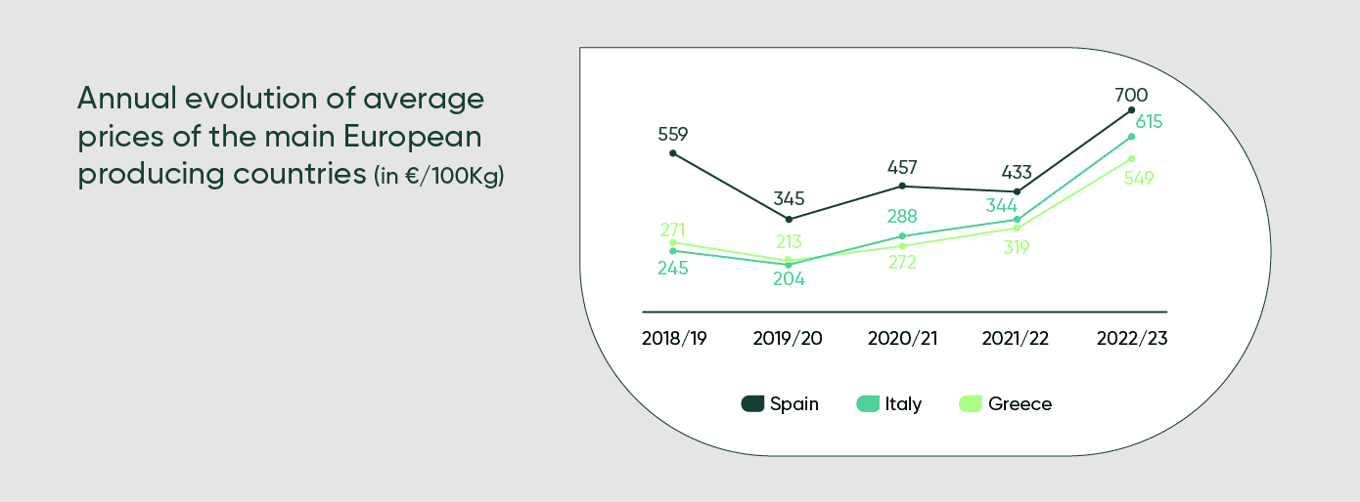

- Primary player on the stock market, recently reported dismal financial figures, due to soaring prices and dearth of products, resulting in low sales and a negative net profit

- Inflation increase this previous period had a significant impact on olive oil consumption and sales

- Olive oil market has seen an increase of fraudulent sales and production channels impacting the customer trust in markets such as Spain and Italy

Traction

8 notable trends are shaping today’s olive oil market worldwide

Olive Plots offers an exclusive opportunity to invest in the very source of this highly sought-after and consistently in-demand commodity: Spanish centenary high-yield olive trees with a proven yield

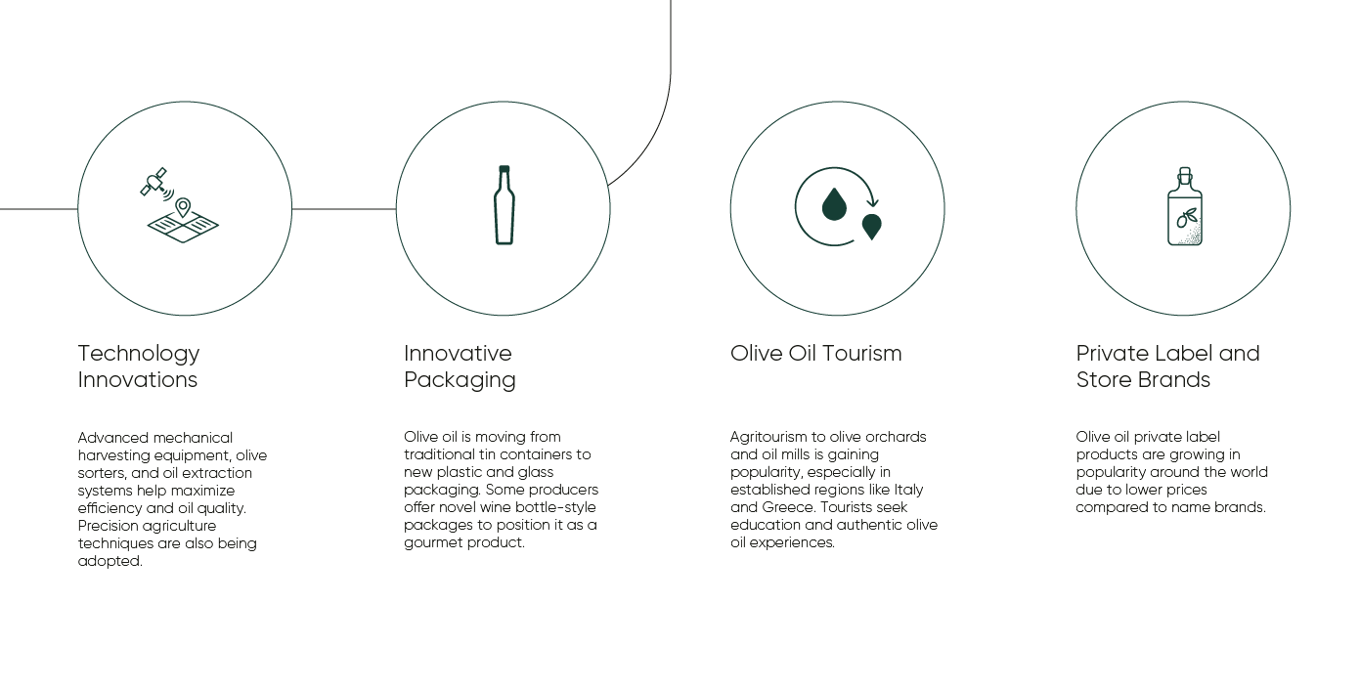

- Olive Plots: Cultivating Sustainable Investments with Nature's Blueprint

At Olive Plots, we meticulously curate premium agricultural investments, focusing on long-term profitability within an environmentally and socially responsible framework.

Following the investment phase, we leverage the Open Oleaster Management System (OOMS) on each asset, ensuring effective oversight for sustained growth and resilience. - Market Selection

We strategically choose high-potential markets through extensive analysis across diverse agricultural industries worldwide. - Tree Curation

We meticulously curate remarkable trees, evaluating hundreds of opportunities across various countries through a comprehensive 360-degree due diligence process. - Investing in Nature

Each share you purchase corresponds to one tree, offering not only the annual return associated with each share but also the added benefits of carbon credit returns.

At Olive Plots, we provide a unique and tangible opportunity to invest in nature, aligning potential financial returns with environmental impact.

Business model

The Six Pillars of Strength in Olive Plot's Investment Proposition

- Asset-Backed Digital Securities

Our investment proposition is underpinned by asset-backed digital securities, securely represented on a blockchain network by tangible green assets that exist and produce value in the real world. - Attractive Returns

Our business model has the potential to generate attractive returns based on a combination of proven past performance, certified productivity of each tree as a yielding asset, and a meticulously projected business outline. Past financial results are no guarantee of future performance. Click here for important information regarding Financial Projections which are not guaranteed. - Carbon Credits

Annual carbon sequestration undergoes third-party auditing, leading to the issuance of authenticated carbon credits, contributing to environmental sustainability. - Resilience and Low Market Correlation

Olive trees and their oil demonstrate a unique blend of low market correlation and resilience to inflation, providing a robust buffer against economic recessions: people buy and use olive oil both in times of economic prosperity and downturns. - Community Impact

Aligning with global trends, our business model actively fosters environmental sustainability and social empowerment. We involve communities and create quality rural jobs, fortifying local economies. - Upcoming Liquidity

Olive Plots LLC is proactively working to enhance liquidity for tokens through a strategic partnership with secondary market platforms. This marks the pioneering tokenization of tangible assets, such as olive trees and their oil, bringing new dimensions to investment opportunities.

Vision and strategy

Earn from Nature, Learn from Nature

Our mission is to empower you to invest in trees carefully curated from some of the world's most prestigious and award-winning Olive Oil properties. With a goal of cultivating a vast orchard of one million trees, we aim to produce the most unique olive oils while driving positive social and environmental impacts.

Algorithmic Selection

We utilize a sophisticated algorithm to identify and score the most unique, award-winning, and lucrative properties in selected markets.

Comprehensive Due Diligence

Prior to investment, we conduct an extensive due diligence process on pre-selected properties. This includes a meticulous evaluation of factors such as soil quality, foliage health, water availability, tree vitality, infrastructural enhancements, property rights, local regulations, and the strength of the agricultural support ecosystem.

Holistic Evaluation

Our investment methodology involves a comprehensive assessment, considering factors like marketing and market penetration, input costs, labor wages, and the social and

environmental impacts of our investments.

Detailed Business Plans

We construct detailed business plans for individual trees, encompassing both historical performance and projected outcomes.

Certified OOMs Deployment

Each property benefits from the deployment of the certified Oleaster Management System (OOMs). This system ensures effective tree management, accurate carbon credit

valuations, and strategic risk assessment, enhancing both the value and sustainability of the investment.

Leadership

- A management team has been assembled to lead the entire value chain: from Land management, tree maintenance, and Olive Oil Marketing to performance monitoring and impact optimization.

- Team comprises leading renowned experts, each with decades of experience in premium Olive oil production, Impact funds setting and management, technology and blockchain projects implementation.

Disclaimers

Certain information set forth in this presentation contains “forward-looking information”, including “future-oriented financial information” and “financial outlook”, under applicable securities laws (collectively referred to herein as forward-looking statements). Except for statements of historical fact, the information contained herein constitutes forward-looking statements and includes, but is not limited to, the (i) projected financial performance of the Company; (ii) completion of, and the use of proceeds from, the sale of the shares being offered hereunder; (iii) the expected development of the Company’s business, projects, and joint ventures; (iv) execution of the Company’s vision and growth strategy, including with respect to future M&A activity and global growth; (v) sources and availability of third-party financing for the Company’s projects; (vi) completion of the Company’s projects that are currently underway, in development or otherwise under consideration; (vi) renewal of the Company’s current customer, supplier and other material agreements; and (vii) future liquidity, working capital, and capital requirements. Forward-looking statements are provided to allow potential investors the opportunity to understand management’s beliefs and opinions in respect of the future so that they may use such beliefs and opinions as one factor in evaluating an investment.

These statements are not guarantees of future performance and undue reliance should not be placed on them. Such forward-looking statements necessarily involve known and unknown risks and uncertainties, which may cause actual performance and financial results in future periods to differ materially from any projections of future performance or result expressed or implied by such forward-looking statements.

Although forward-looking statements contained in this presentation are based upon what management of the Company believes are reasonable assumptions, there can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The Company undertakes no obligation to update forward-looking statements if circumstances or management’s estimates or opinions should change except as required by applicable securities laws. The reader is cautioned not to place undue reliance on forward-looking statements.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...