So-called micro-investing in private real estate is an increasingly accessible option for investors looking to diversify ...

Investors in Alabama, Arizona, Florida, New Jersey, North Dakota, Texas and Washington will be required by state law to purchase shares through an accommodating broker. As we have yet to engage an accommodating broker, investors from these states will not be able to invest in this offering.

The property

Downtown Miami’s hottest neighborhood celebrates a true architectural icon. The luxury Brickell condos located at 1000 Brickell Plaza are an urban oasis developed by Ugo Colombo and designed by Luis Revuelta. Brickell Flatiron’s innovative architectural design introduces flowing curvilinear forms that soar sixty-four stories high—providing expansive bay and city views.

Brickell Flatiron’s exclusive lifestyle brings hotel-inspired living home. With five-star service and elite amenities, residents will experience the benefits of unsurpassed convenience and luxury at Brickell Flatiron.

The remarkable Sky Club on the 64th floor features 360-degree views of Miami and Biscayne Bay. The fully-attended swimming pool offers plush day beds, inviting lounge areas and a refreshing juice bar while the Sky Spa features a hydrotherapy circuit with steam, sauna, relaxation and treatment rooms.

The rooftop fitness center features stunning views of the Miami skyline as well as cutting-edge gym equipment, Pilates Studio, Spin Room and Yoga Studio. Additional amenities include the Flatiron Theater, Clubroom, Lounge, Billiards Room, Outdoor Lap Pool, Children's Playroom and separate Children's Pool.

*Some of the images above are renderings.

Our Unit

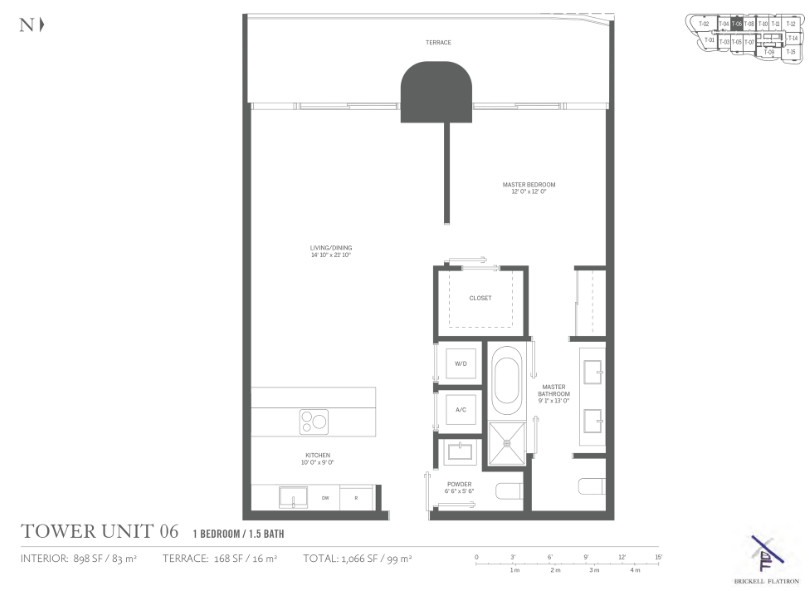

Unit #3006, an 898 square foot, one bedroom, one and a half bath apartment with West-facing views of Downtown Miami.

Each private residence at Brickell Flatiron is designed to an exceptionally high standard, of uncompromising quality and originality. Meticulously selected materials blend seamlessly with Italian design to ensure that this gem becomes a Brickell landmark.

The kitchen includes Italian made, custom designed and fully accessorized Snaidero kitchen cabinetry with stainless steel back splash and Caesarstone counter tops, and Miele cook top with custom designed stainless steel exhaust hood.

The bathrooms include Italian manufactured and custom designed Milldue suspended cabinetry, Polished, imported Italian marble floor, base, and accent walls made in Italy.

*Images of units above are model units and not the actual unit we are purchasing.

Floor Plan

Offering

At Compound Projects ("Compound"), we think everybody should be able to participate in the growth and prosperity of the cities and neighborhoods they are helping to build.

We slice each apartment into 100,000 equity interests so investors can realize the economic benefits of ownership without the hassles and headaches. Receive potential dividends from rental income and build wealth through potential appreciation.

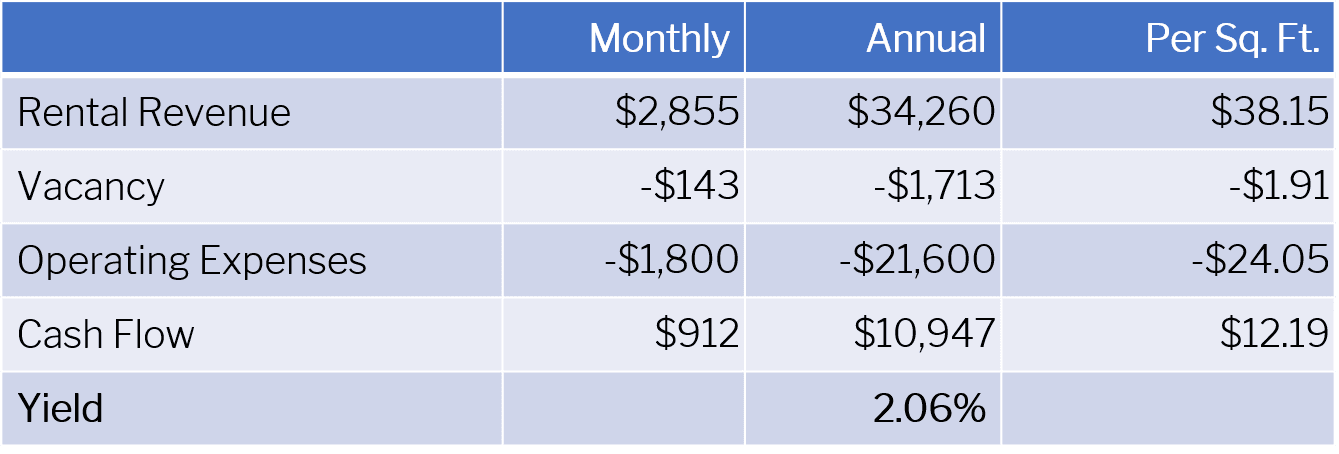

Financial Overview

On May 29, 2020 we entered into a purchase and sale agreement to acquire unit #3006 at Brickell Flatiron for $465,000. This acquisition closed on August 31, 2020.

The total capitalization for the acquisition is estimated to be $532,000 which includes closing costs associated with the purchase of the property, offering costs, fees paid to Republic, and operating and capital reserves.

The unit is currently leased through the end of September 2021 for $2,855 per month. We intend to make semi-annual dividend payments based on cash available.

* All financial figures are estimates only. These estimates are not based on actual investment results and are not guaranteed of future results.

Returns

Compound is primarily focused on sourcing opportunities that have the potential for capital appreciation. We intend to hold the property for a period of 3-5 years after we complete the acquisition. Total return on investment will consist of a combination of current income that will be received during the time we hold this property and capital appreciation that may be realized when we sell the property.

Please refer to the FAQs for more information about return estimates.

Location

1000 Brickell Plaza, Miami, Florida

Miami

Known as one of the world's most popular vacation spots, with trendy nightlife, beaches, art galleries and world-class hotels, Miami is also a major center and leader in finance, commerce, culture, arts, and international trade and the cultural, economic and financial center of South Florida.

Home to one of the country’s most spectacular waterfront skylines, Downtown Miami is the central business and finance center in South Florida and serves as an important commercial and cultural nexus between the United States, Latin America and the Caribbean.

Brickell

Brickell

Brickell, also known as Miami's business district, is home to a large number of international banks such as HSBC, Espirito Santo Bank, and Banco Santander among other Fortune 500 companies. Brickell is considered to be one of South Florida’s most prestigious neighborhoods and is a favored place to live for young professionals.

Although it’s smack dab in the middle of Miami, Brickell gives off serious New York City vibes — but with 10x better weather. In Brickell, you’ll find the perfect marriage between skyscrapers, beach-like rooftop bars and a place to dock your yacht. Everything a person needs to live, work, and enjoy life can be found within walking distance.

Market Data

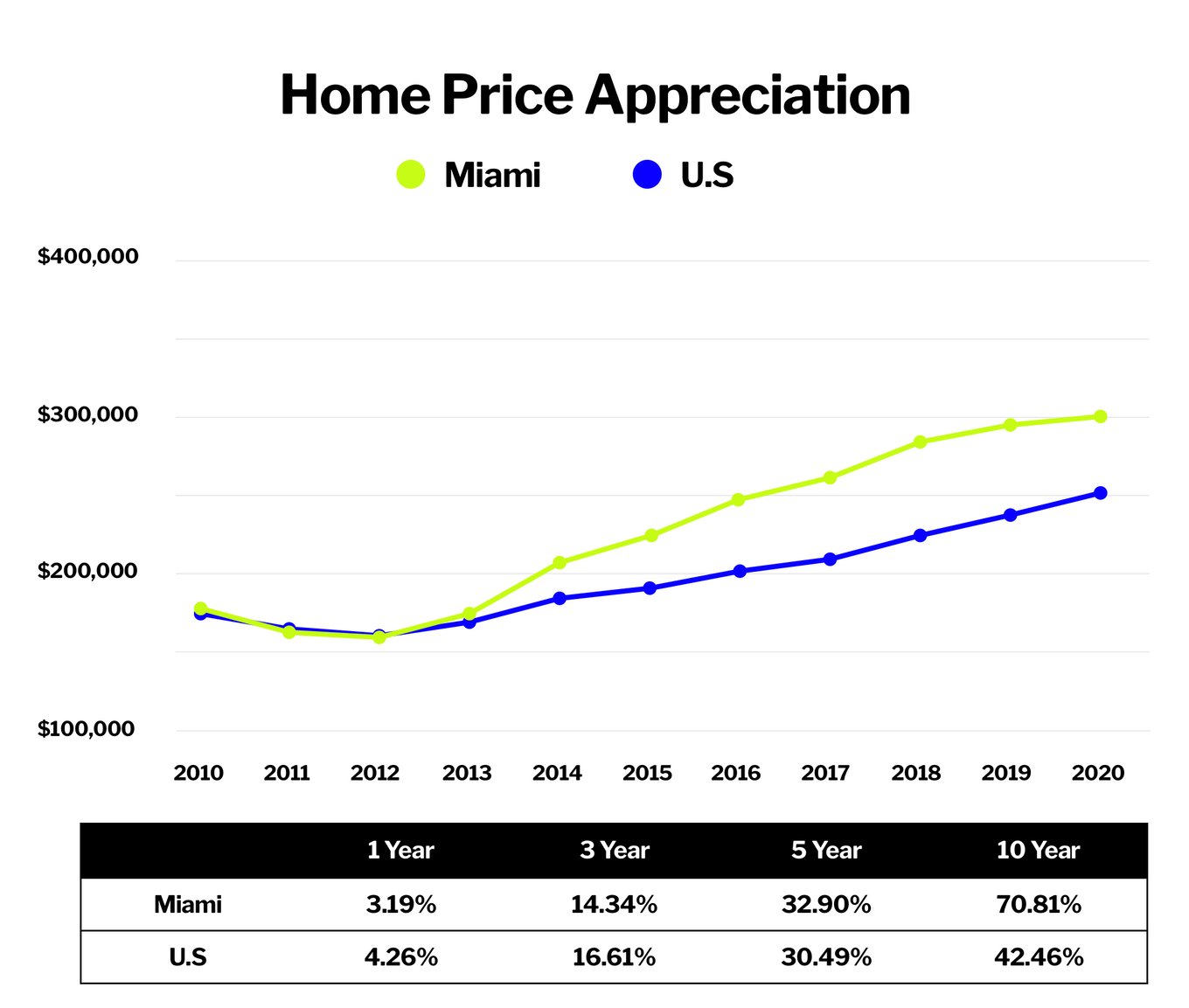

Home values in Miami have appreciated by 70.8% over the past 10 years including 3.2% over the past year.

* Zillow Home Value Index (ZHVI): A smoothed, seasonally adjusted measure of the typical home value and market changes across a given region and housing type. Based on data as of 4/30/2020.

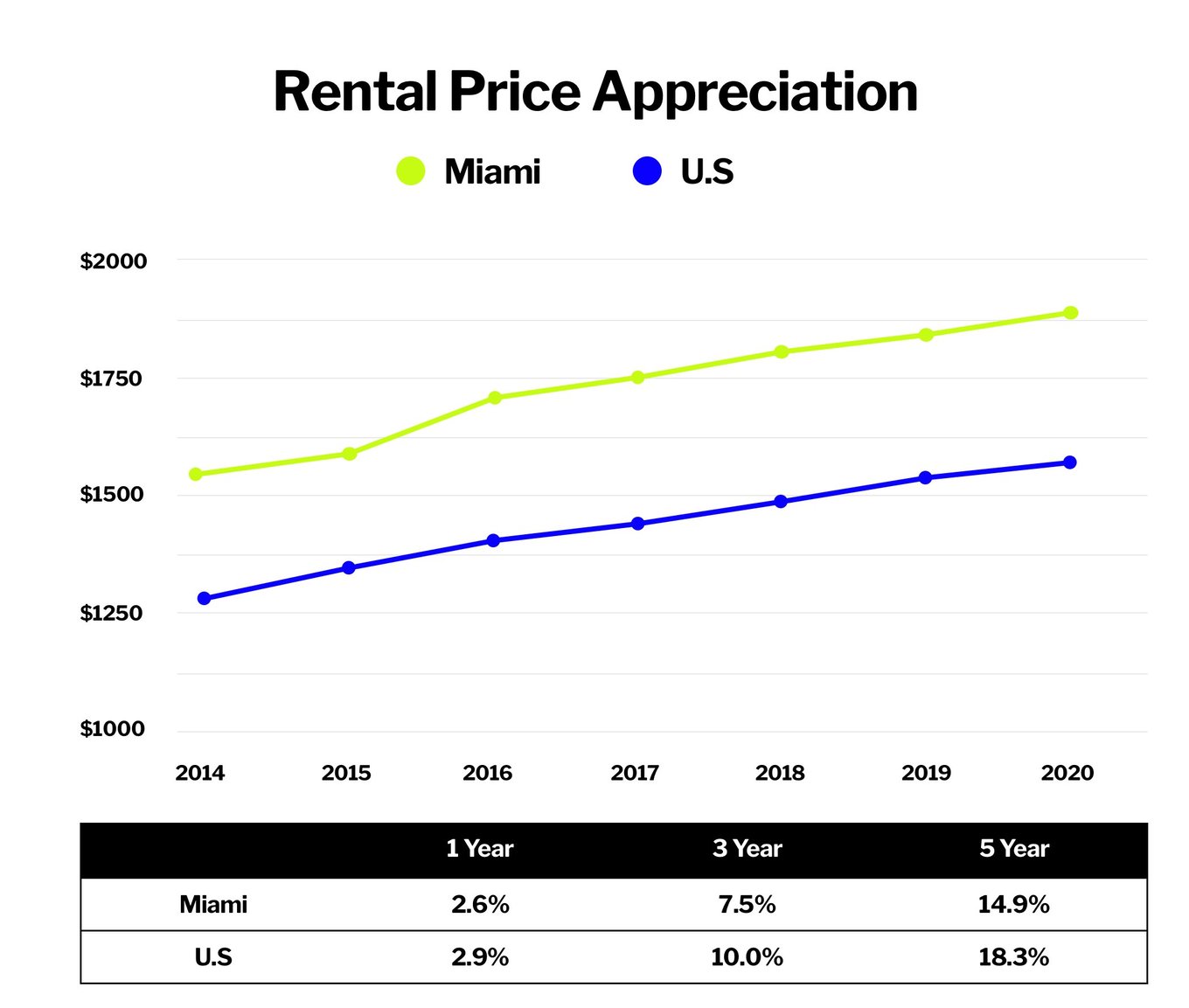

Rental rates in Miami have appreciated by 14.9% over the past 5 years including 2.6% over the past year.

*Zillow Observed Rent Index (ZORI): A smoothed measure of the typical observed market rate rent across a given region. Based on data as of 4/30/2020.

Disclaimers

Your investment is binding and irrevocable, although we reserve the right to reject it for any reason or no reason at all. Funds committed will remain in an escrow account maintained by Prime Trust, LLC until such time as a closing occurs. We have engaged Securitize, LLC our transfer agent and registrar. Investors in Alabama, Arizona, Florida, New Jersey, North Dakota, Texas and Washington will be required by state law to purchase shares of Compound Projects, LLC, Series #Flatiron through an accommodating broker, as we have yet to engage an accommodating broker, investors from these states will not be able to invest in the offering.

An offering statement relating to Compound Projects, LLC, Series #Flatiron has been filed with the Securities and Exchange Commission and became qualified on January 8, 2020. Prior to any investment Compound Projects, LLC, Series #Flatiron, you should review a copy of the offering circular, or by contacting Compound Projects, LLC by writing at 335 Madison Avenue, New York, NY 10017. No offer to sell any securities, and no solicitation of an offer to buy any securities, is being made in any jurisdiction in which such offer, sale or solicitation would not be permitted by applicable law.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...