So-called micro-investing in private real estate is an increasingly accessible option for investors looking to diversify ...

Investors in Alabama, Arizona, Florida, New Jersey, North Dakota, Texas and Washington will be required by state law to purchase shares through an accommodating broker. As we have yet to engage an accommodating broker, investors from these states will not be able to invest in this offering.

The property

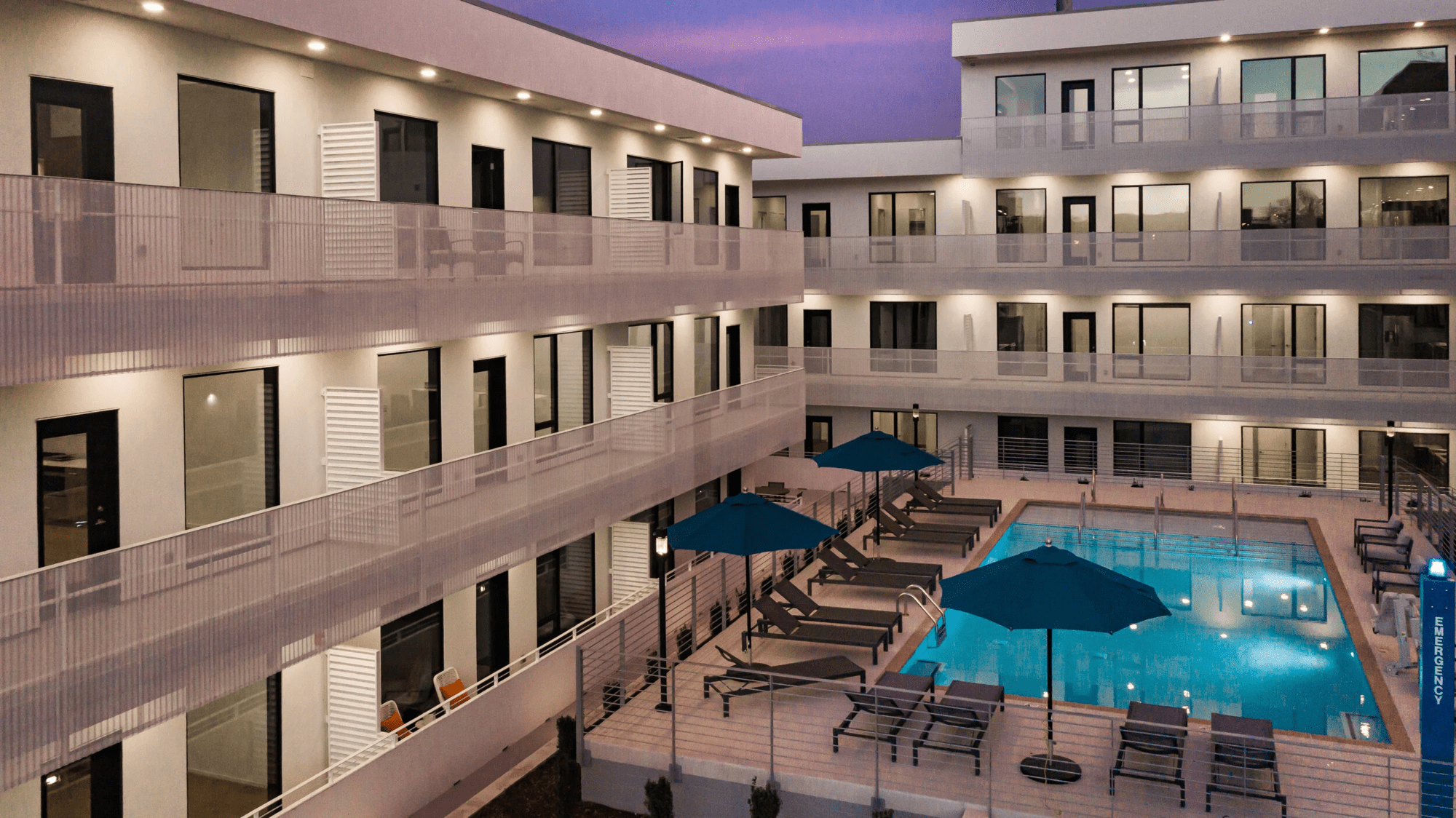

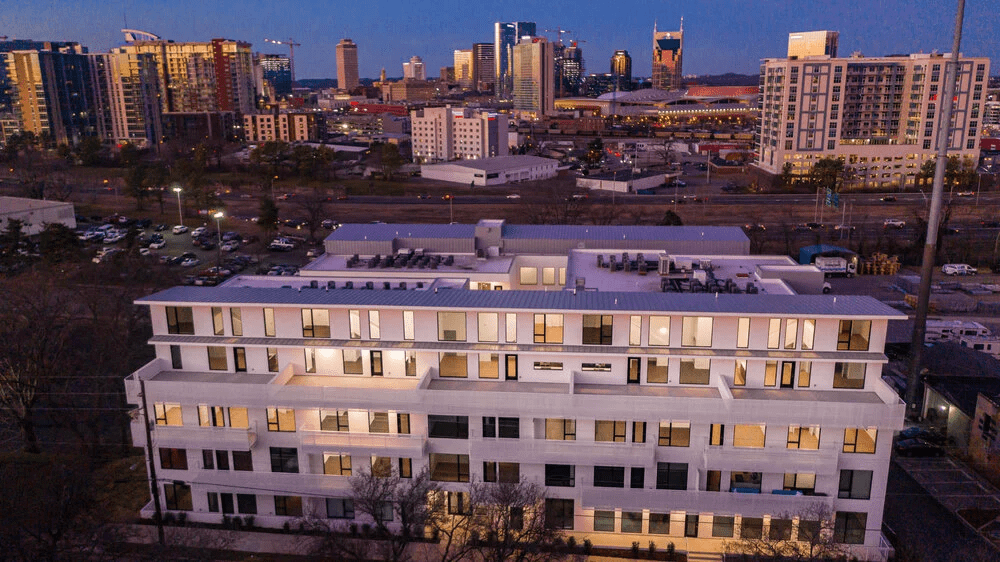

Illume is a 77-unit boutique residential condominium located in the Gulch View neighborhood of Nashville. Organized as a multi-sensory urban escape, Illume's lushly landscaped courtyard, custom pool, and fitness center invite residents to connect with the outdoors and all that Nashville has to offer.

Designed by celebrated and local Nashville architect, The Bradley Projects, Illume was designed based on clean lines, airy interiors with abundant natural light, and carefully curated finishes—the design references Gulch View's current emergence.

Our Unit

Unit #302, a 772 square foot one-bedroom, one-bath, corner unit overlooking the pool.

Grand ceiling heights of over 10 feet with expansive glass give homes and open and airy feel. Custom stained flooring and natural accents complement the sophisticated color palette.

Green features and forward-thinking design is paramount—with incorporated energy efficient HVAC systems, appliances, a green roof, and storm-water treatment system.

Floorplan

Unit 302 | 772 Sq. ft. | One Bedroom | One Bathroom

Short-Term Rental Program

Illume was developed within a special zoning district and the condominium was organized to allow for short-term rentals. We intend to partner with Turnkey, a premium service for branded hospitality services for private accommodations. Turnkey, established in 2012, manages over 4,800 upscale vacation properties throughout the U.S. The developer of Illume has negotiated favorable pricing with for Turnkey management as they will be managing multiple units at Illume.

The offering

Compound Projects ("Compound") thinks everybody should be able to participate in the growth and prosperity of the cities and neighborhoods they are helping to build.

Compound is the easy way to build a diversified portfolio of beautiful apartments in some of the world's best cities. Compound slices each apartment into 100,000 equity interests so investors can realize the economic benefits of ownership without the hassles and headaches. Investors receive potential dividends from rental income and build wealth through potential appreciation.

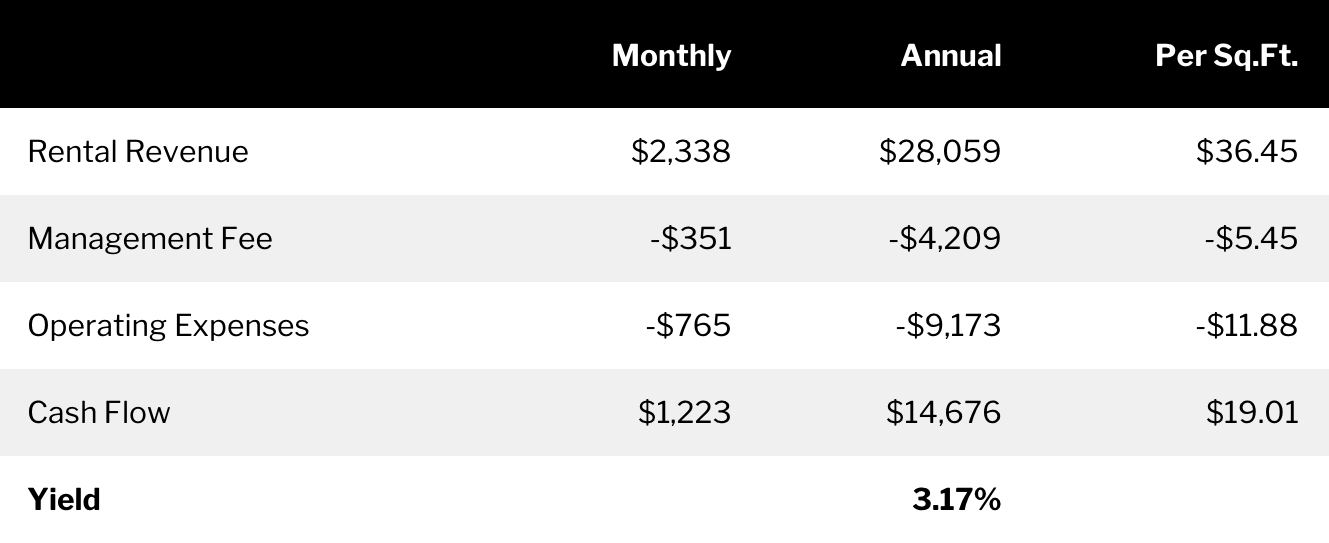

Financial Overview

On August 31, 2020 we closed on the acquisition of unit #302 for $411,000. Under the terms of the purchase and sale agreement, the seller agreed to provide a credit of up to $23,500 towards the furnishing and decoration of the apartment and an additional $5,000 credit towards closing costs. We have estimated a total capitalization for the acquisition to be $463,000 which includes closing costs associated with the purchase of the property, offering costs, (for this offering and potentially other equity offerings), fees paid to Republic, and operating and capital reserves. In the event that we have overestimated the total capital required, we intend to distribute any excess capital to investors. The closing of the acquisition is expected to occur prior to August 31, 2020.

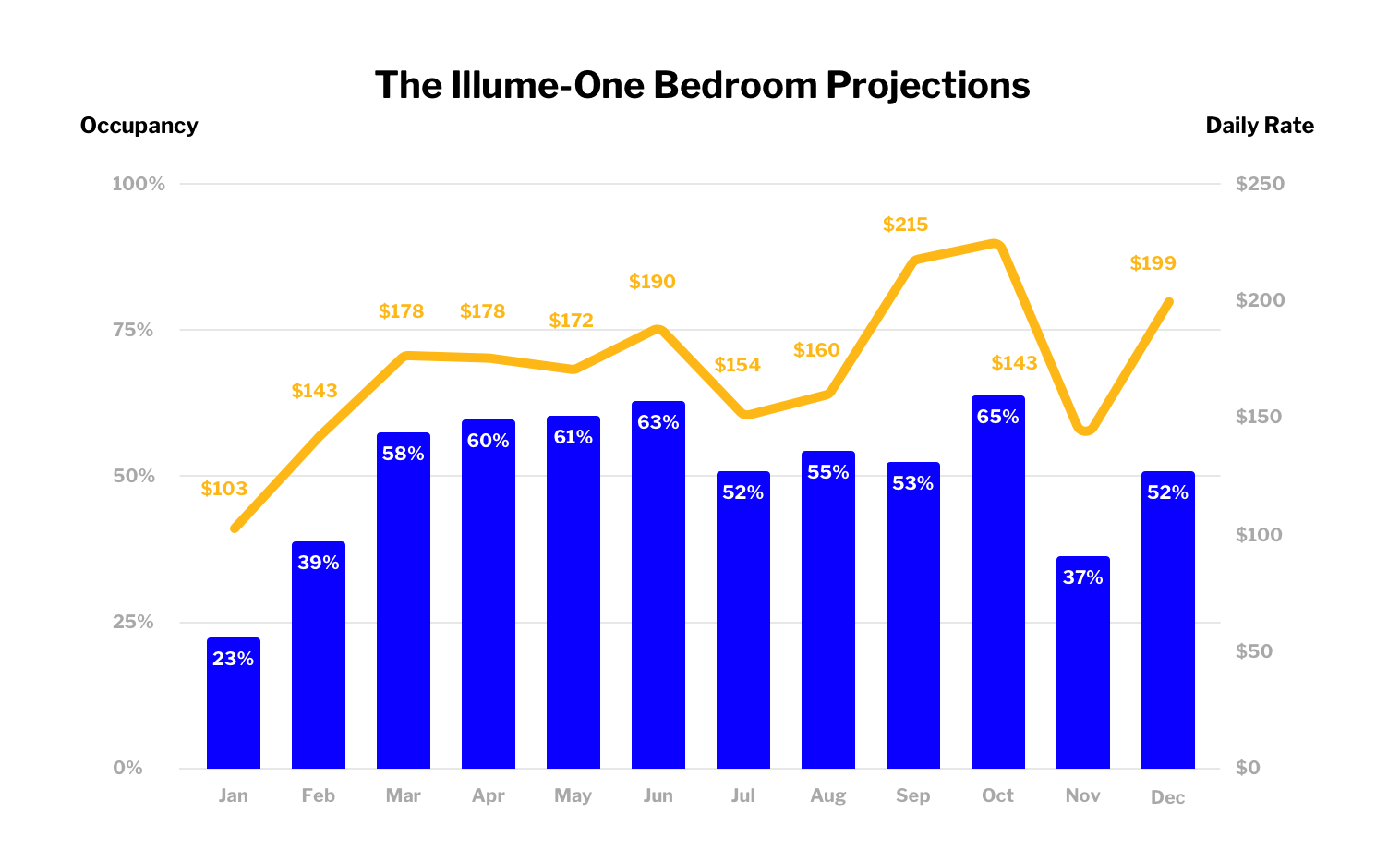

Beginning in October 2020, the apartment became part of the Turnkey Vacation Rental Program. Turnkey has made the following occupancy and average daily rate projections for one bedroom units at Illume:

While we are confident in the projections that Turnkey has provided ($171 average daily rate, 52% occupancy), we have used more conservative estimates ($154 average daily rate, 50% occupancy) to base the operating assumptions shown below.

* All financial figures are estimates only. These estimates are not based on actual investment results and are not guaranteed of future results.

Returns

Compound is primarily focused on sourcing opportunities that have the potential for capital appreciation. We intend to hold the property for a period of 3-5 years after we complete the acquisition. Total return on investment will consist of a combination of current income that will be received during the time we hold this property and capital appreciation that may be realized when we sell the property.

Please refer to the FAQs for more information about return estimates.

The location

920 South Street, Nashville, Tennessee

Nashville

With more than 180 music venues around town ranging from large arenas and concert halls to small clubs, and featuring nearly every genre of music, it's easy to see why Nashville is often referred to as "Music City." Recently, Nashville has also evolved into a tech hub coinciding with Amazon’s impending 5,000 job Operations Center of Excellence announced in 2018.

Drawn not only by the vibrant live music joints that line its downtown streets, but also its low unemployment rates, welcoming vibe, and notoriously diverse and recession-resilient local economy, Nashville has experienced major population and tourism booms in recent years.

The Gulch View

Drawing from Nashville’s rich The Gulch neighborhood—Gulch View is set atop Nashville. Gulch View is among Nashville’s most sought after areas—just minutes to the city’s integral music culture, boutiques, nightlife hot spots, and modern hotels.

Illume’s central position places it within close proximity to other popular downtown neighborhoods, such as The Gulch, Music Row and Edgehill Village.

Market Data

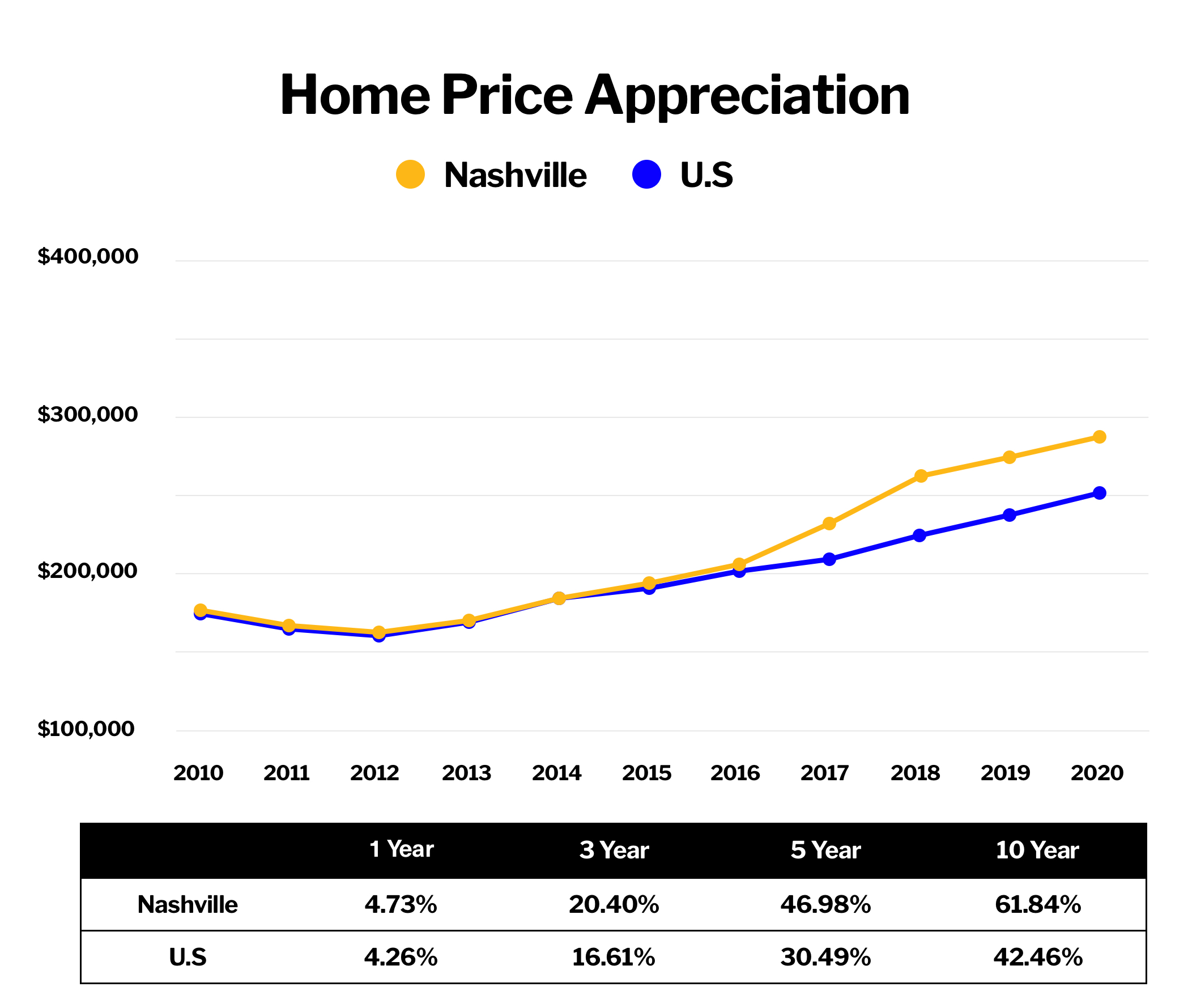

Home values in Nashville have appreciated by 61.8% over the past 10 years including 4.7% over the past year.

* Zillow Home Value Index (ZHVI): A smoothed, seasonally adjusted measure of the typical home value and market changes across a given region and housing type. Based on data as of 4/30/2020.

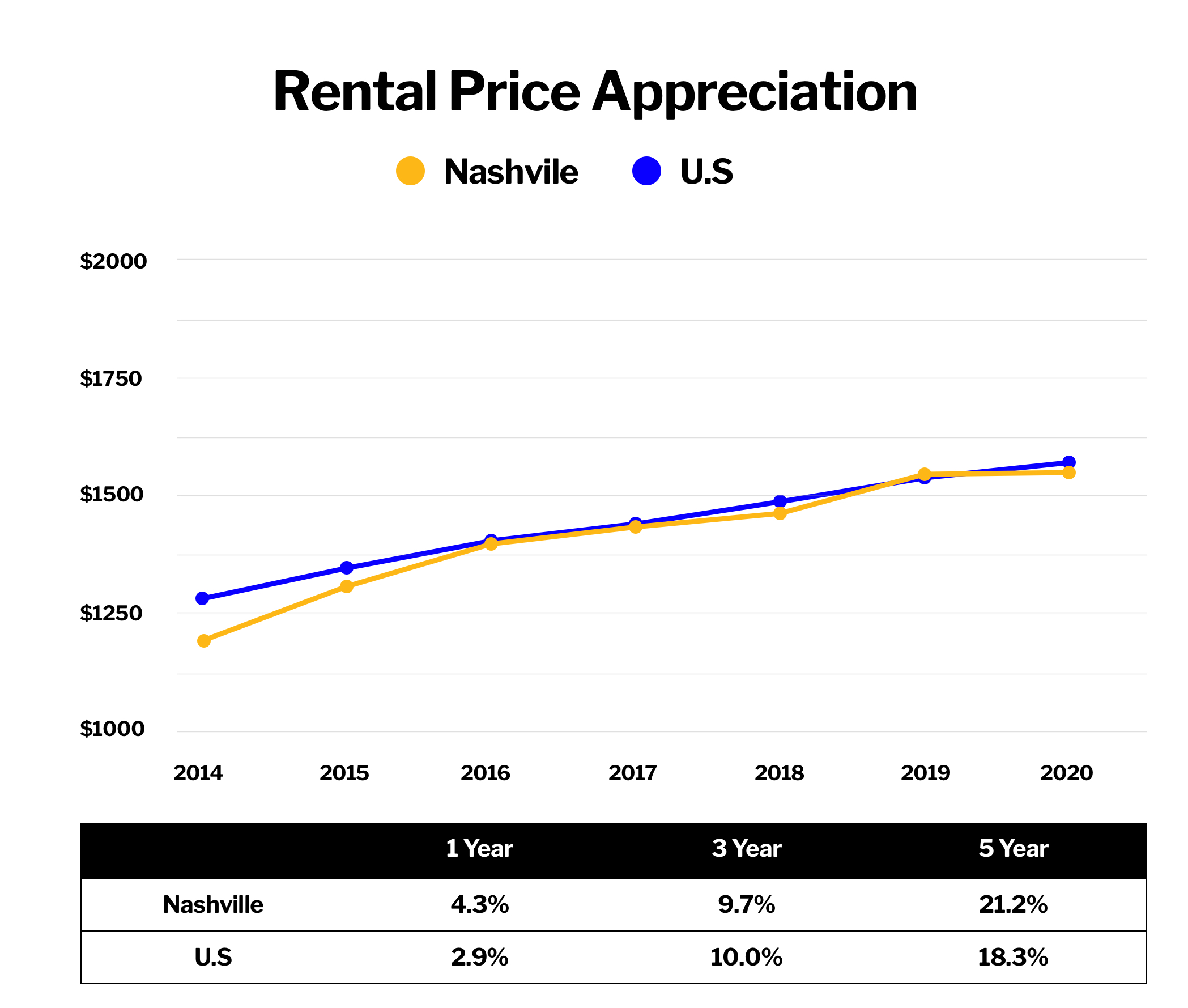

Rental rates in Nashville have appreciated by 21.2% over the past 5 years including 4.3% over the past year.

*Zillow Observed Rent Index (ZORI): A smoothed measure of the typical observed market rate rent across a given region. Based on data as of 4/30/2020.

Disclaimers

Your investment is binding and irrevocable, although we reserve the right to reject it for any reason or no reason at all. Funds committed will remain in an escrow account maintained by Prime Trust, LLC until such time as a closing occurs. We have engaged Securitize, LLC our transfer agent and registrar. Investors in Alabama, Arizona, Florida, New Jersey, North Dakota, Texas and Washington will be required by state law to purchase shares of Compound Projects, LLC, Series #Illume through an accommodating broker, as we have yet to engage an accommodating broker, investors from these states will not be able to invest in the offering.

An offering statement relating to Compound Projects, LLC, Series #Illume has been filed with the Securities and Exchange Commission and became qualified on January 8, 2020. Prior to any investment Compound Projects, LLC, Series #Illume, you should review a copy of the offering circular, or by contacting Compound Projects, LLC by writing at 335 Madison Avenue, New York, NY 10017. No offer to sell any securities, and no solicitation of an offer to buy any securities, is being made in any jurisdiction in which such offer, sale or solicitation would not be permitted by applicable law.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...