Revolving Kitchen is changing the restaurant landscape of North Texas.

Problem

Restaurants are facing a multitude of challenges

Capital expenditures—and continuing shifts in lifestyle and demand—are huge risks for restaurants

Solution

Revolving kitchen offers fully-serviced, turnkey kitchens on demand

Complete with operational and technological support

Revolving Kitchen helps industry players alleviate these challenges by providing fully-equipped, on-demand kitchens supported by a variety of complimentary services. We enable our operators/members to run successful food service businesses with the flexibility and support required to remain nimble in an ever-changing environment.

Product

Proven, award-winning concept in a growing industry

Revolving Kitchen has established itself by delivering a consistent and high-quality solution

Turnkey Kitchens

- Fully built-out kitchens with a chef-inspired layout that includes equipment and fixtures necessary for established and new concepts to begin operating in a matter of days

- Inspected and permitted facilities with the required utilities and common/ancillary amenities in place (and included in the cost)

- Kitchens are available in five sizes with appropriate equipment configurations to meet each operator's/member’s needs

- Long-term leases range from $5,000 to $12,000 per month based on the size and equipment configuration

- Hourly rental fees range from $35 to $45 with a minimum of 10 hours of kitchen usage per month

Flexibility

- Ability to rent kitchen spaces on either a short-term or long-term basis through hourly rental or annual leases

- Flexibility to adjust the use of kitchen space to accommodate business needs

- The option to furnish the kitchen with proprietary equipment and fixtures (with management's approval)

- 24/7 access to the building for the private use of kitchens

- Additional amenities include affordable pricing for dry, cooler and freezer storage space

Operational Support

- Leverages economies of scale and industry expertise to provide a seamless operational experience that allows for spending more time on growing and expanding the food businesses

- Provides ongoing building/infrastructure/equipment maintenance and repair, including common area janitorial services, grease trap and duct cleaning, fire suppression, sprinkler maintenance and inspections, cleaning chemicals and supplies

- Includes utilities, IT, internet, trash, pest control, security, surveillance and building/kitchen access control

- Robots collect and transport prepared items from individual kitchens to the front counter staff for delivery, take-out or onsite dining, thus eliminating the distraction of customer/driver interaction and front-of-house hires

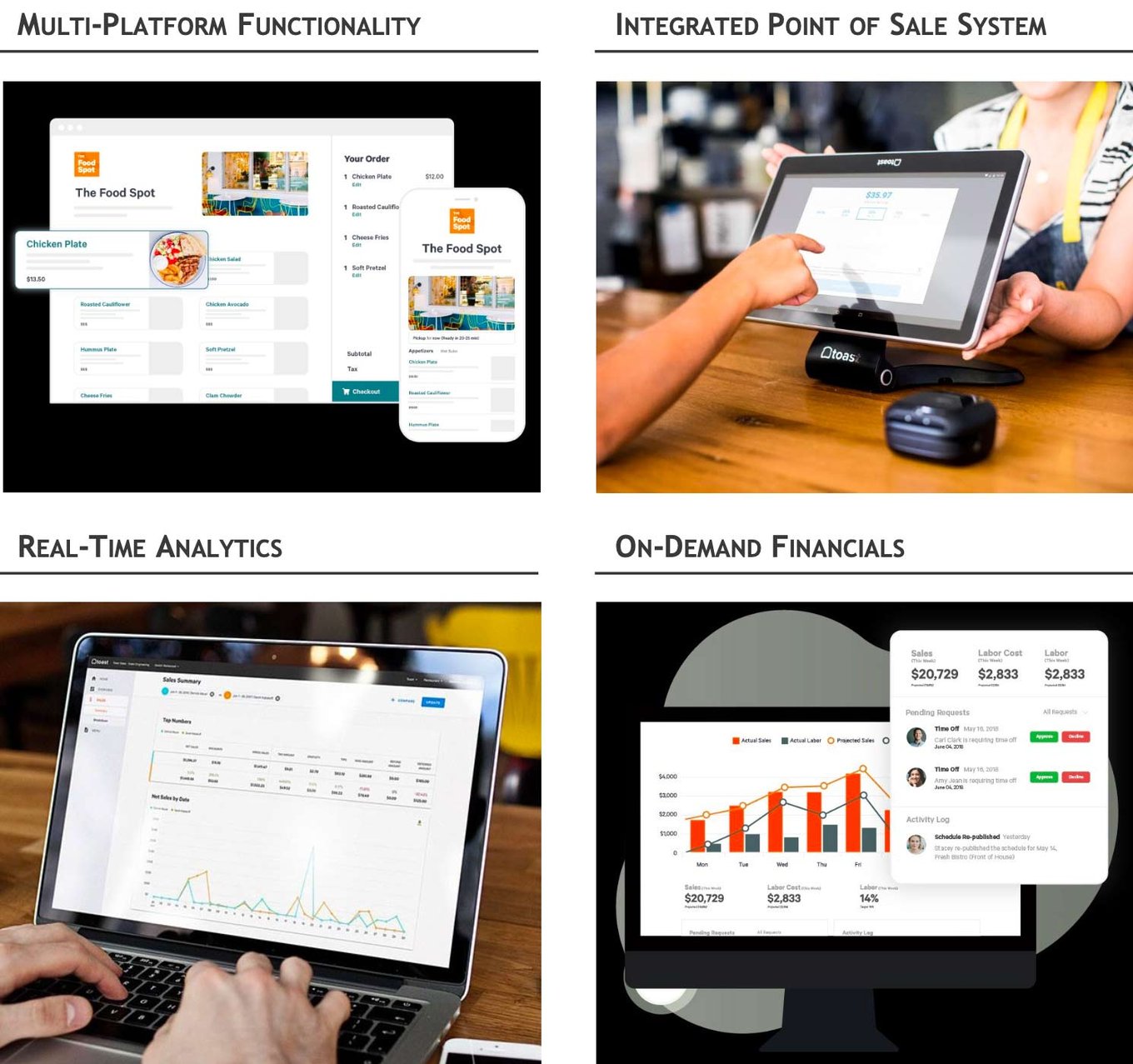

Technology & Strategy

- Pioneering novel technological solutions to streamline off and on-premise orders, optimize operations and logistic efficiencies, maximize operator margins and leverage valuable consumer trends and preferences

- Provides marketing, public relations, advertising and event partnerships to increase revenue and profitability for operators/members

- Offers ancillary support in various aspects of the food business including market data, strategy and vendor options

- Provides a library of supporting documents, guidelines and business requirements to facilitate the start-up process and ensure compliance with local food service laws and requirements

- Online ordering platform integrating point of sale technology and complementary analytics to help manage operations

- Virtual Food Hall, a proprietary online ordering platform that allows customers to bundle orders from multiple operators/members in a single ticket order for pick-up and delivery at a fixed fee, helps improve margins. Fifteen percent of the sales generated through Virtual Food Hall are collected as fees from the operators/members

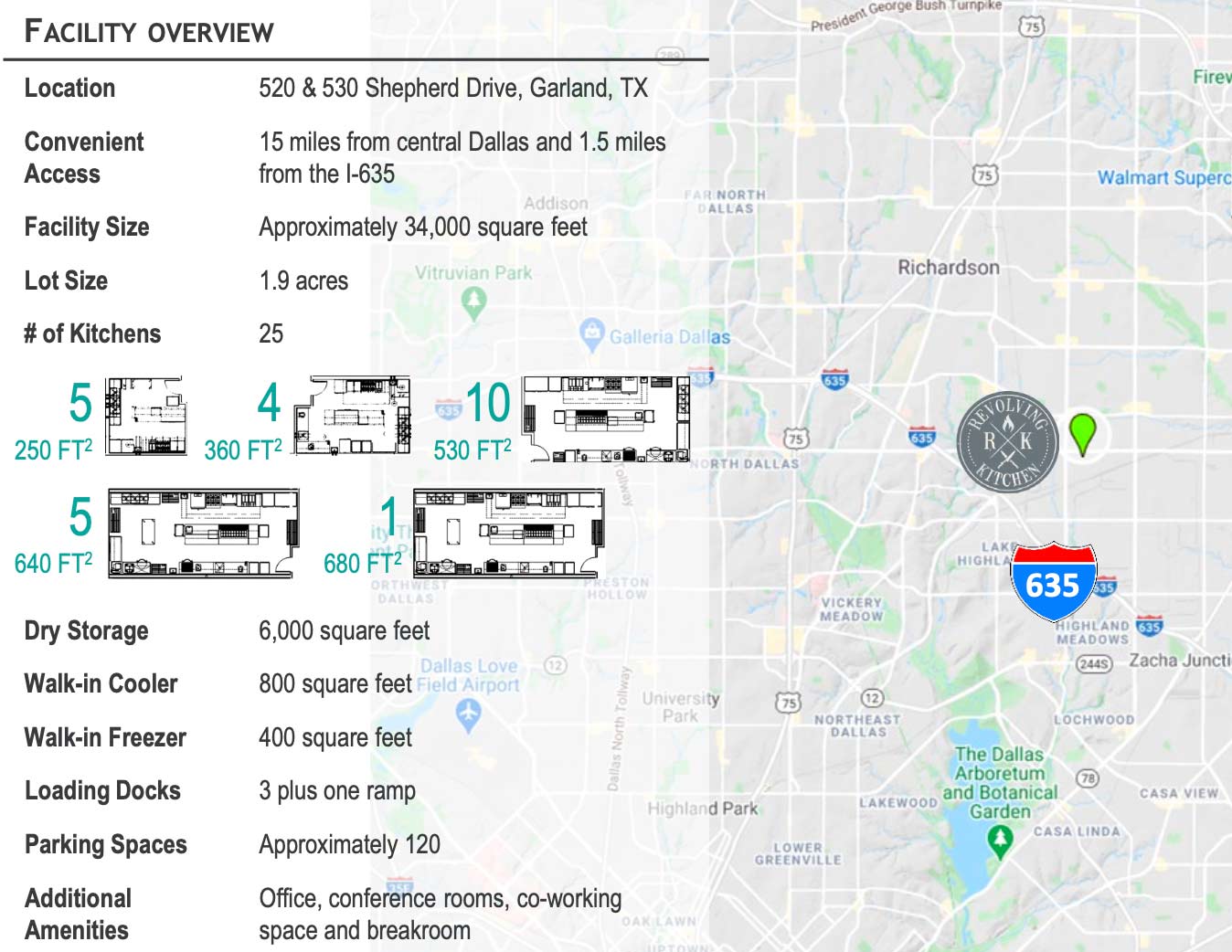

Facility Overview

Maximum Capacity and Efficiency: Each kitchen features multiple floor sinks, drains, water lines, gas hook-ups and electrical outlets designed to accommodate most, if not all, commercial cooking and refrigeration equipment in any configuration

Modern Finish-Outs: Walls, ceiling tiles and flooring are commercial grade, durable, easy to clean and far exceed other commercial/restaurant kitchens

Fully Separated, Private and Contained: Each kitchen is designed to be autonomous, private and secure

Each kitchen maintains its own exhaust and supply hood systems, fire suppression systems, plumbing fixtures with shut-off valves and electrical panels to prevent incidents or issues from affecting other operators/members

Building and individual kitchens have access control systems limiting entry through individually programmed key fobs

Each kitchen is monitored through a CCTV system, with an additional 22 cameras positioned throughout the common areas of the building and outside

Compliance: Revolving Kitchen maintains permits and helps operators/members with the additional support needed to ensure operators/members are in compliance with health department regulations

Amenities: New locations will include indoor dining space, outdoor courtyard space, full bar, and grab & go store

Traction

Revolving Kitchen

is a pioneer

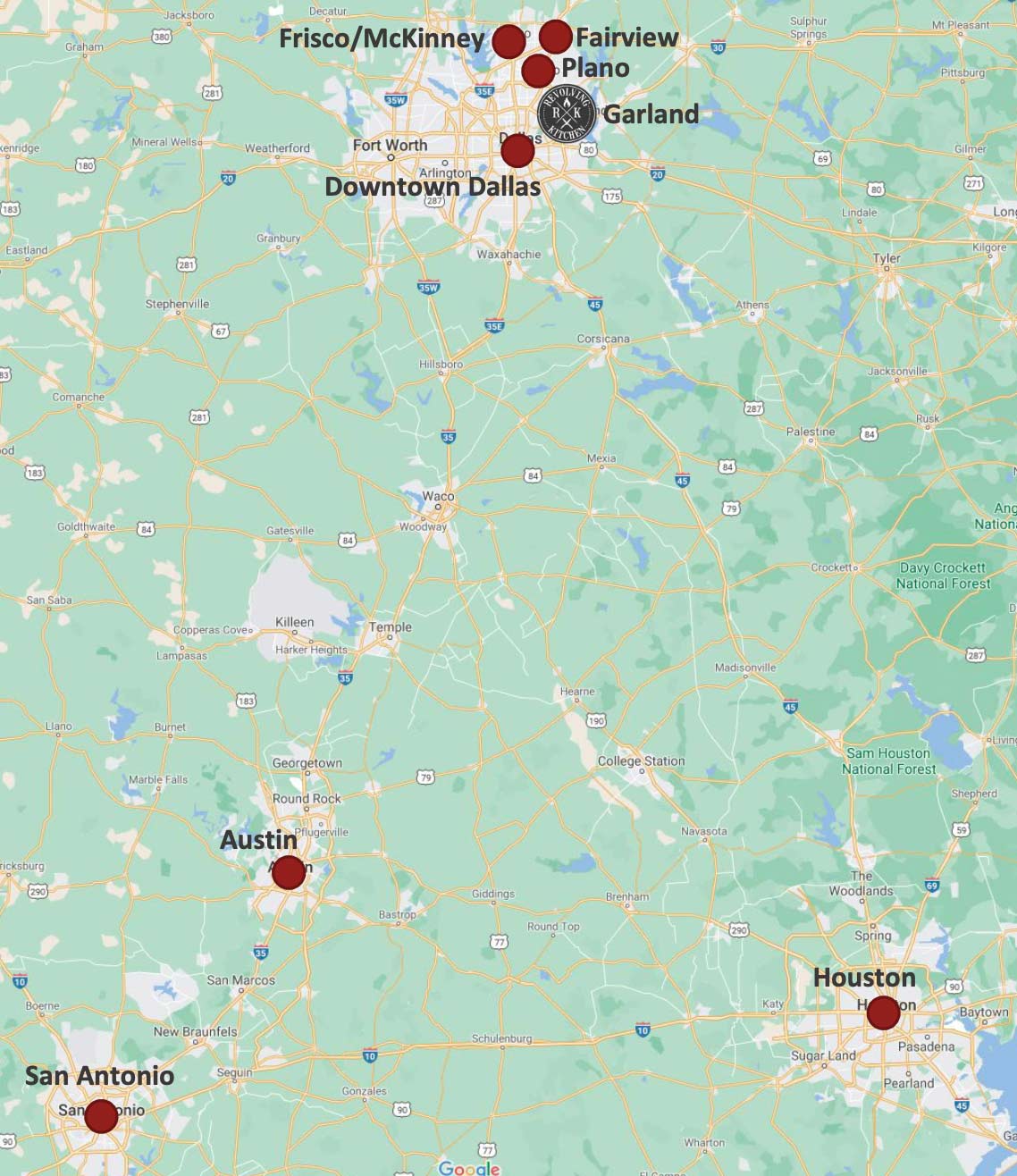

and expanding in the fourth-largest metro area of the US

Capital Raise for 2nd Location in Allen/Fairview/McKinney Market

- 37,000 square foot ghost kitchen facility

- 34 fully equipped commercial kitchens

- State-of-the-art facility that allows foodies access to 20+ delivery restaurants all under the convenience of one check

- Modern technology throughout the facility includes kiosk ordering and in-house robot delivery

- Indoor dining room with seating and outside courtyard

- Full-service bar

- Grab & go store

- Serving NTX communities of Allen, Fairview, Frisco, Lucas, McKinney and Plano

Site selection based on the high demand in the Allen/Fairview/McKinney area and requests by current and potential operators/members for market growth/expansion

Many current operators within the first location have indicated they will expand to the 2nd location

Anticipated pre-leased occupancy prior to the facility's opening is 40% and profitable

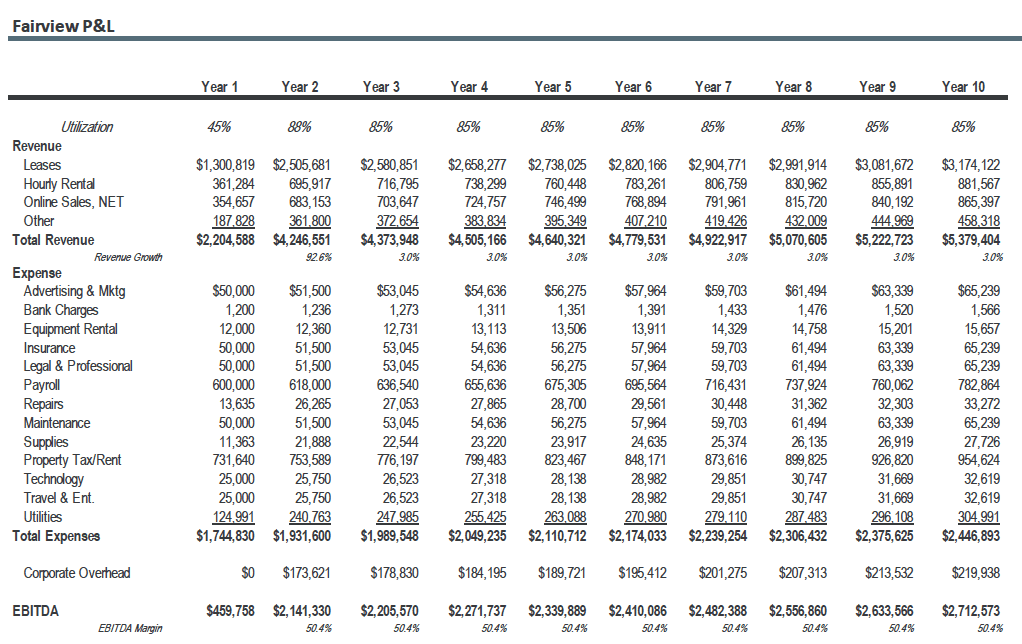

Fairview Financial Projections*

* Click here for important information regarding Financial Projections which are not guaranteed.

Customers

A diverse operator/

member base

Operators/members range from established concepts to start-ups with a variety of culinary offerings

A diverse base of 70+ operators/members in various markets and business stages at the 1st location, including:

Expansions: Move into new markets, introduce new products and concepts or require additional capacity

Virtual: Relocate an existing business to provide delivery and take-out options

Start-ups: Establish new ventures (or legitimize existing ventures) working out of non-commercial kitchen space

Hourly rental members are required to meet a minimum of 10 hours of kitchen usage per month

Business model

Compelling value proposition

Functionality and services at a fraction of the cost of a traditional start-up, relocation or expansion

Revolving Kitchen leverages economies of scale, industry expertise, and technological solutions to offer its operators/members full-service ghost kitchens at an affordable price.

- Minimal Capital Investment - Revolving Kitchen provides turnkey kitchen solutions. Food businesses no longer need capital outlays for expensive mortgages or leases, architectural plans, tenant improvements, building construction, equipment purchases, permitting, front-of-house staff, janitorial staff, or inspections.

- Reduced Upstart Time - Food businesses are operational in as few as two days.

- Scalability and Flexibility - Revolving Kitchen features five (5) unit sizes, multiple equipment configurations, and spacious storage units to meet each operator/member's needs.

- Reduced Administrative Hassle - Revolving Kitchen allows food businesses to jettison administrative burdens (e.g. janitorial services, site inspections, building maintenance, equipment repair, front-of-house staff) and focus on core operations.

- Technological Innovations - Revolving Kitchen is pioneering novel technological solutions to streamline off-premise orders, maximize operator margins, and leverage valuable consumer data.

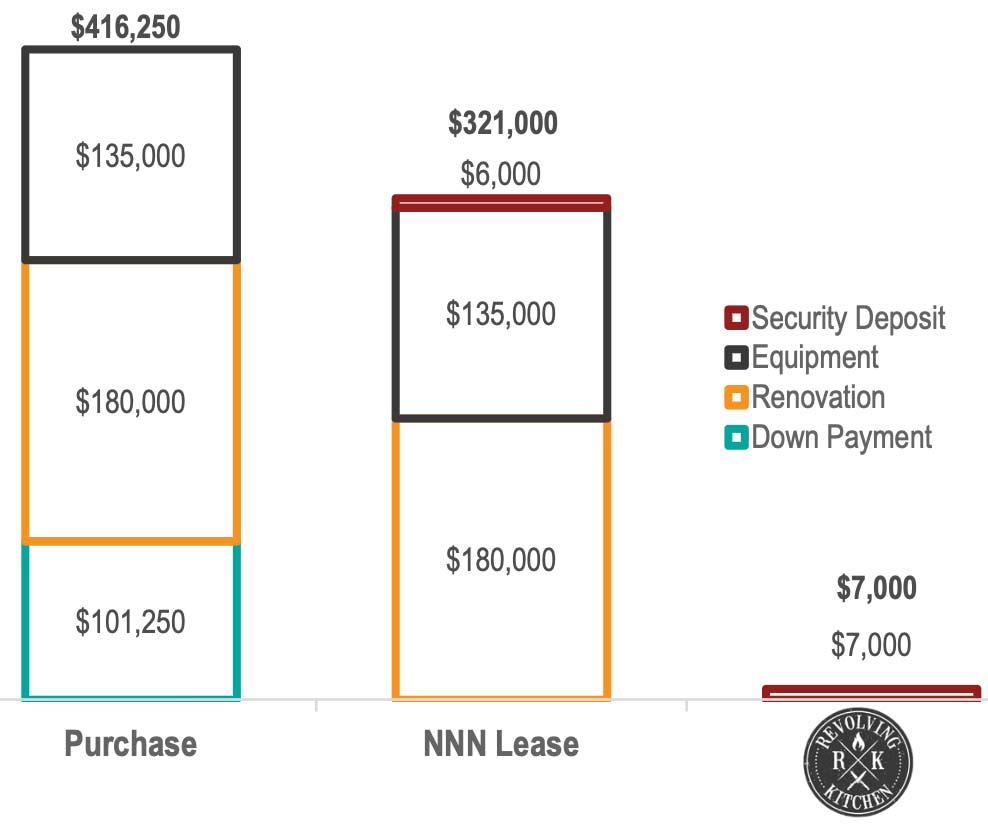

Comparison Analysis

Start-up/Initial Capex

- The initial capital investment required to open a restaurant with a fully functioning kitchen via traditional brick & mortar footprint is significant.

- Revolving Kitchen's turnkey solution eliminates the need for expensive building purchase or lease, planning, permitting, construction, renovation or inspections, all of which require significant time (months to years) to complete.

- Kitchens are already fully outfitted with the latest equipment and fixtures, thus allowing operators/members to begin operating in just a few days.

The analysis below shows the upfront costs of purchase and triple-net lease of a typical 3,000 square foot restaurant space compared to an average annual Revolving Kitchen lease:

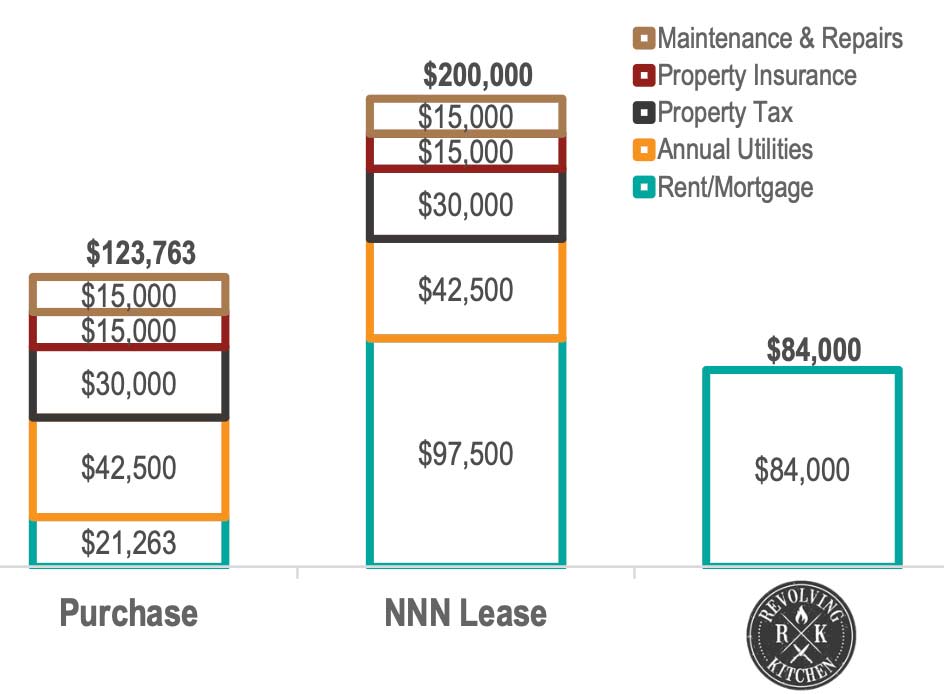

Annual/Ongoing Operating Costs

- All-inclusive pricing for ongoing management, maintenance and repair of the building, infrastructure and equipment minimizes costs and maximizes operational efficiencies so operators/members can focus on products/execution/branding entirely.

- Value-add services by providing IT infrastructure and POS systems, marketing support and opportunities for easy expansion into bigger/more kitchens

The analysis below compares the annual cost of operations between a purchase, triple-net lease and Revolving Kitchen lease:

Market

Business based

on powerful trends

Robust societal, demographic and technological developments are driving the market

The U.S. restaurant/food industry remains highly competitive and fraught with challenges—including capital-intensive and time-consuming start-ups/openings, changes in consumer tastes, fluctuations in demand, lack of trained labor, thin margins and continuously changing regulations and technologies

The U.S. restaurant/food industry remains highly competitive and fraught with challenges—including capital-intensive and time-consuming start-ups/openings, changes in consumer tastes, fluctuations in demand, lack of trained labor, thin margins and continuously changing regulations and technologiesThe most significant industry trend is the increasing demand for food delivery as consumers become more interested in convenience and off-site dining experiences. According to William Blair, digital off-premise dining is the fastest (and only) growing segment in the US restaurant industry

Third-party ordering and delivery companies, such as DoorDash, UberEats and GrubHub, are bridging the gap by creating economies of scale within a highly fragmented market through the aggregation of restaurant menus and delivery services

Increased mobile adoption and expansion of the gig economy, supplying the market with on-demand drivers and couriers, have provided these third-party solutions with a solid foundation for growth

The biggest obstacles operators face in meeting this consumer demand while maintaining profitability are twofold:

Space: Providers, especially existing restaurants who must expand operations to meet demand, face a lack of affordable kitchen space needed for food preparation and cooking

Delivery: The cost to hire, train and employ couriers, as well as increasing distances between restaurants and customers, is making managing delivery costs difficult

As demand for delivery increases, ghost kitchens are uniquely positioned to satisfy this need by providing on-demand, cost-effective, fully equipped kitchen spaces and aggregating delivery-focused food production at centralized locations reducing delivery costs.

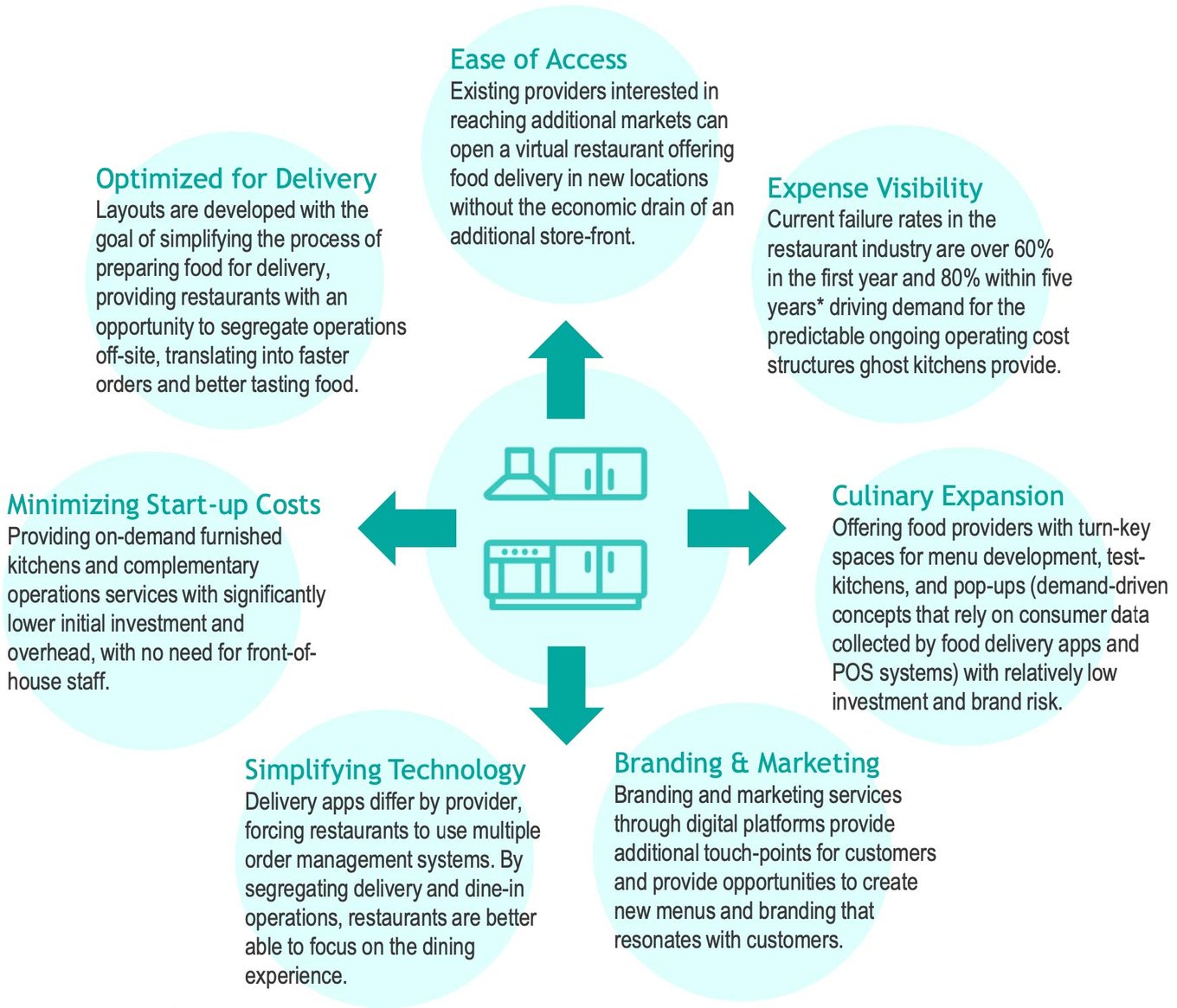

Ghost kitchens are meeting the food business needs

Providing solutions to the challenges

facing new and existing restauranteurs

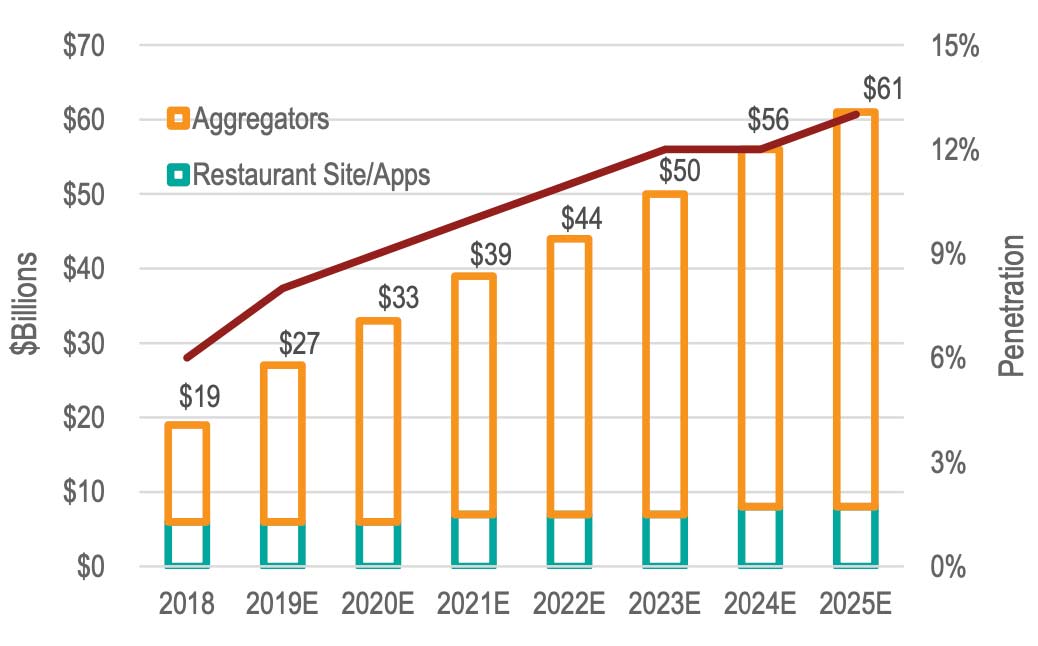

Delivery demand is driving the market

- Consumer preference for off-site dining continues to be the strongest trend

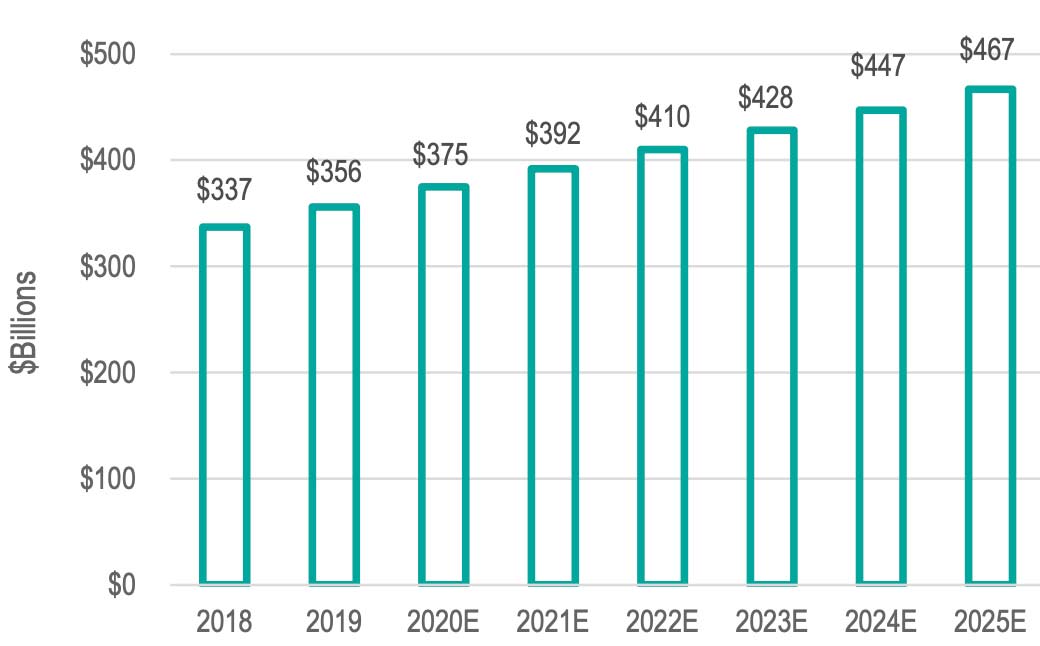

- According to Morgan Stanley, the total addressable market for online delivery expects to grow 5% annually to roughly $470 billion by 2025, and Euromonitor predicts the market will grow to over $1 trillion by 2030

- Online delivery penetration expects to grow from 6% to 13% in 2025, driven primarily by leading delivery aggregators

- The coronavirus pandemic has further driven demand for delivery as restaurants are forced to close dine-in options temporarily, and consumers are choosing to eat at home

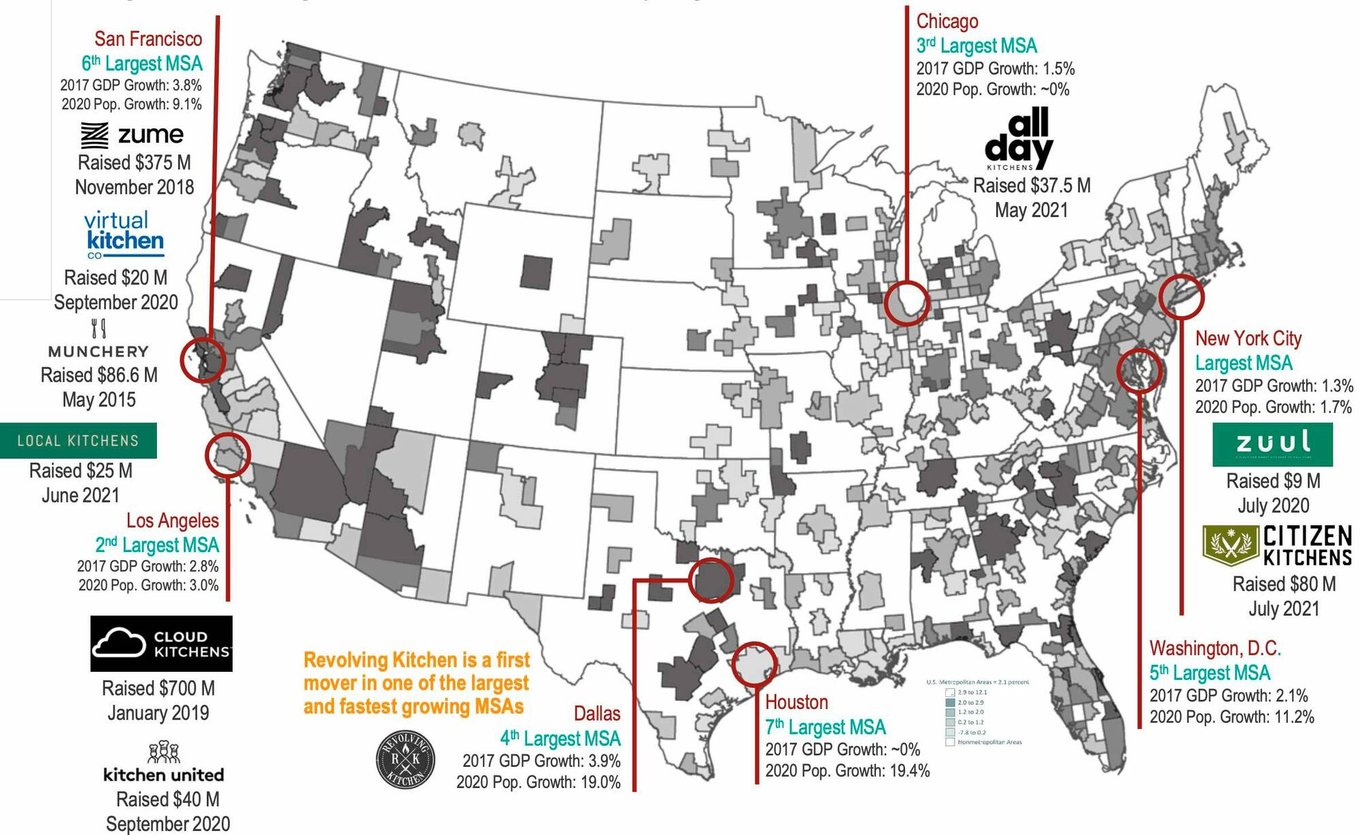

- More than 1,500 ghost kitchen facilities are in the U.S. (Euromonitor, July 2020), primarily located in large, densely packed cities such as New York, Los Angeles and Chicago

- Of these 1,500 facilities, many are either restaurants currently operating as ghost kitchens or locations with just one kitchen (as opposed to a fully-functioning multi-kitchen operator)

- As the most prominent player within the Dallas market, Revolving Kitchen is well-positioned to take advantage of the expanding market and become the leader in the industry

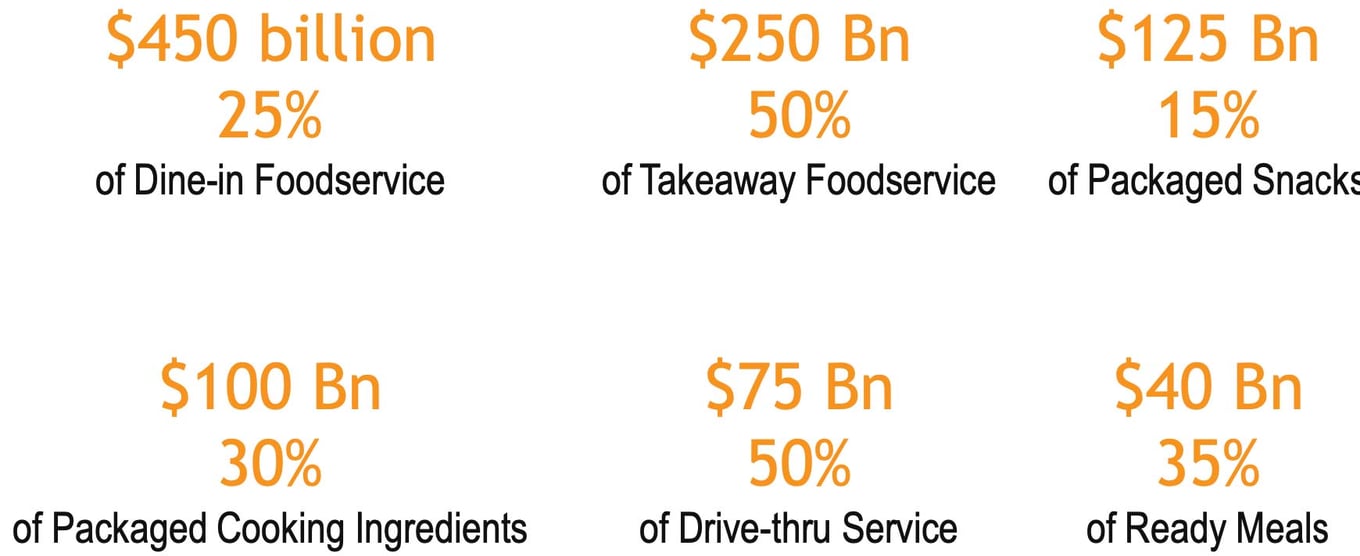

Potential $1 trillion global opportunity by 2030

The Ghost Kitchen industry is poised to capture an increasing share of various food markets

Competition

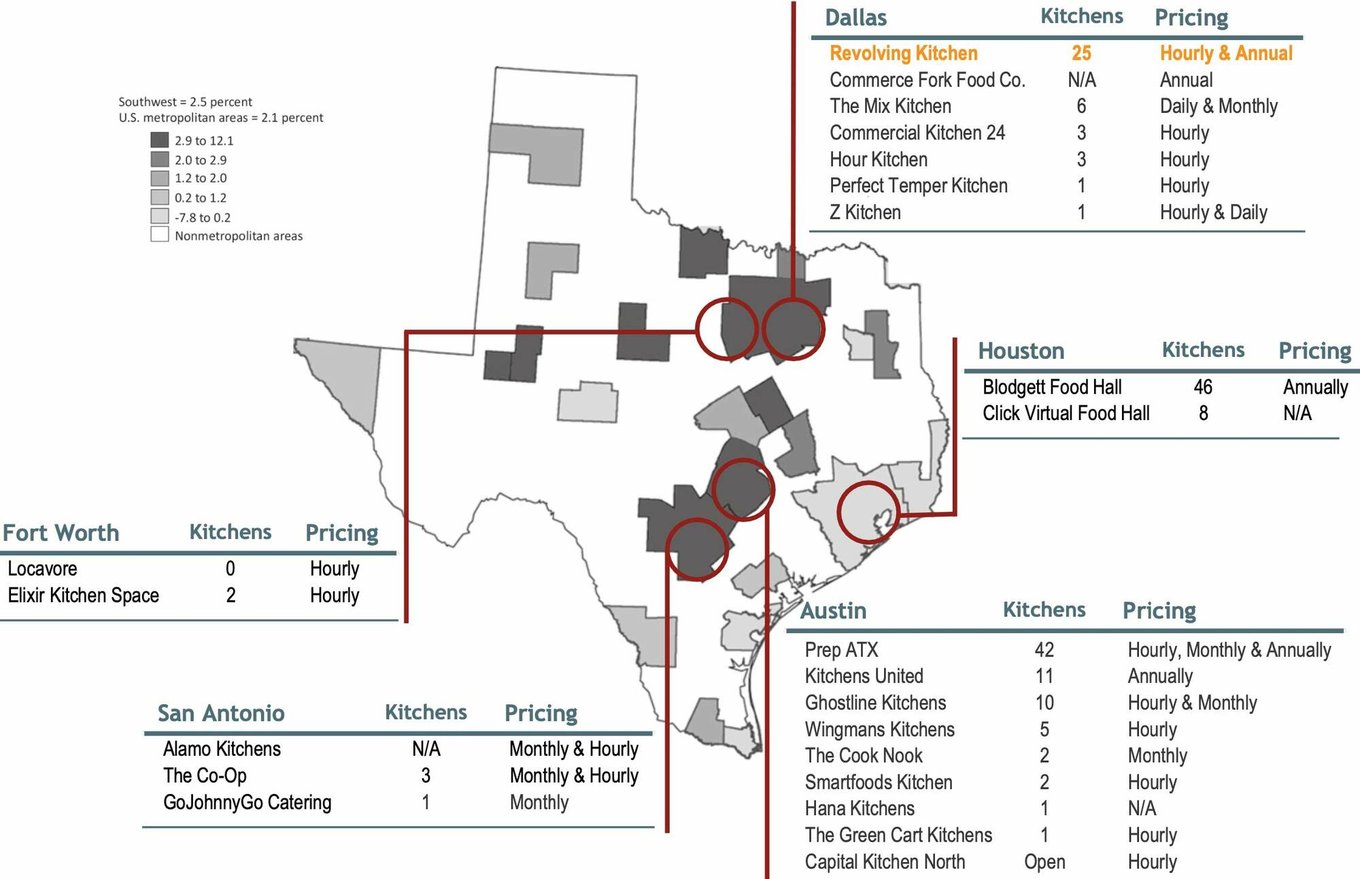

Competition is highly localized

—

Large VC-backed ghost kitchens remain mostly regional

(as of 12/31/2021)

—

Regional competitive landscape

(as of 12/31/2021)

Revolving Kitchen dominates in a

region of smaller players with limited offerings

- The ghost kitchen business model is capital intensive, time-consuming and requires expertise in various areas, including finance, engineering, construction, real estate, project management, IT, restaurant operations, legal, HR and government regulations

- Revolving Kitchen has a proven vision and business model, having been DFW's most significant player within the industry in terms of physical footprint (three years operational and profitable)

Vision and strategy

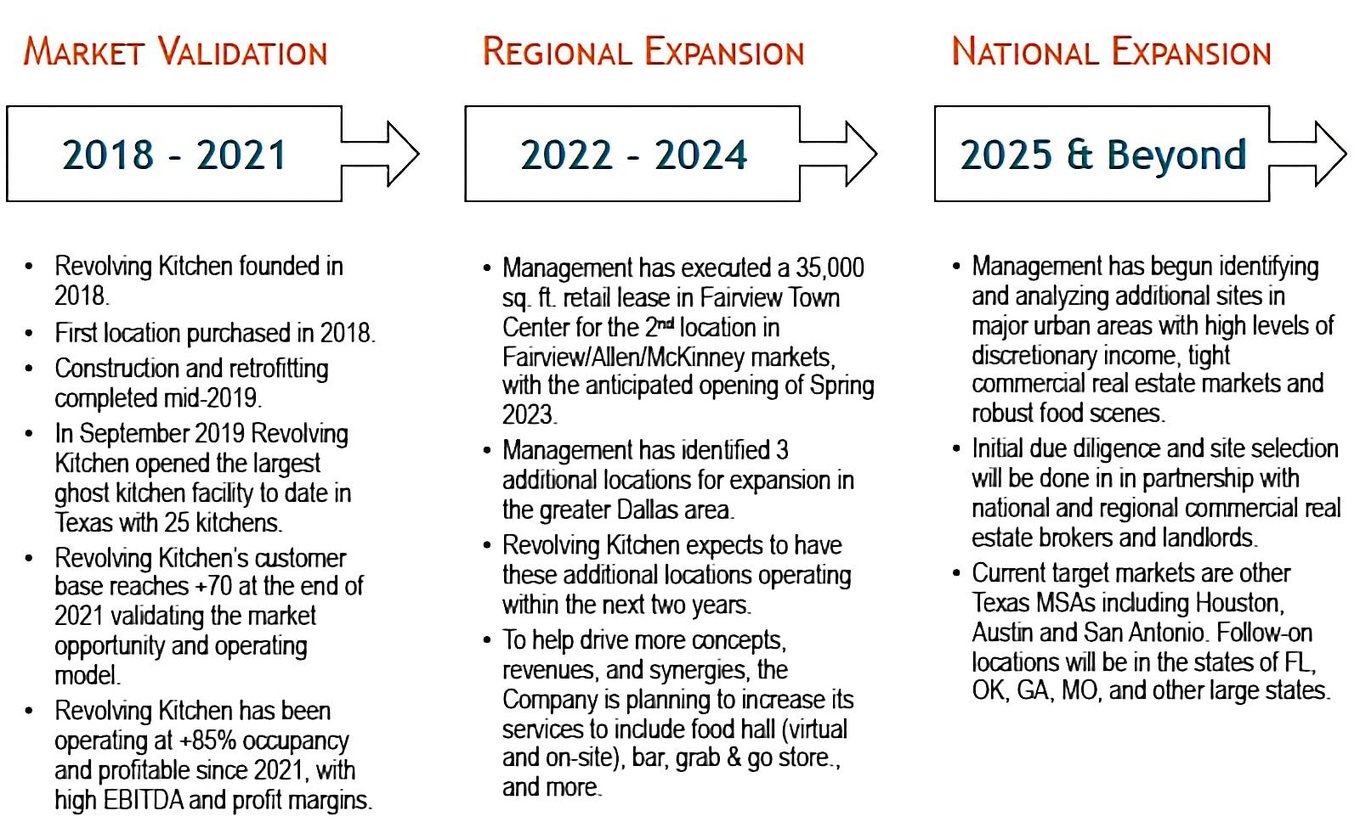

Company milestones

Growth opportunities

A proven concept with an experienced

team capable of growing the business

Comprehensive analysis is underway to develop a roadmap for rolling out multiple locations in target markets

Estimated cost of a new location ranges between $4 million and $6 million, depending on the size of the facility, the number of kitchens and the type of transaction

Expected total project timeline is 12-15 months: three months in diligence and planning, three months for permitting and financing and six to nine months for construction

New locations

Revolving Kitchen’s business model is proven and replicable in any major city. To successfully expand its geographic portfolio, Revolving Kitchen is targeting areas with the population density, household income levels, visibility/ease of access, nearby retail and office space and unit economics that will support additional sites. In addition, it is looking to its current member base to provide input on markets they are targeting for expansion to leverage the existing customer relationships.

Marketing

Historically, resources have not focused on marketing and advertising but on word of mouth and direct engagement with key players to grow the business. Revolving Kitchen has since then developed a comprehensive, integrated marketing plan, including search engine optimization, social media marketing, event partnership and public relations.

Synergies and additional revenues

The Virtual Food Hall is driving additional revenues for operators/members through menu aggregation and complementary marketing and advertising services. Beginning with its 2nd location, Revolving Kitchen will incorporate an indoor dining space, outdoor courtyard, bar, and grab & go store model.

Continued industry expansion/adoption

Consumer preferences expect to continue shifting towards dine-out opportunities, which will continue to drive the need for food take-out and delivery-focused locations. According to Morgan Stanley, online delivery penetration expects to rise from 6% in 2018 to 13% in 2025, supporting continued demand growth for ghost kitchens.

Additional revenues and partnerships

Revolving Kitchen is exploring partnerships and additional revenue-generating opportunities, including a food hall (virtual and on-site), bar, grab & go store, outdoor seating and events. In addition, Revolving Kitchen is exploring a virtual food hall and catering for corporate, residential, office, commercial and government buildings to deliver orders during a specified daily window. Doing so will create substantial customer savings on delivery fees, cash flow predictability and operational efficiencies. With the additional front-of-house amenities planned for future locations, there are significant opportunities for larger events promoting operators'/members' products to help drive additional revenues.

Establishing a dominant presence

Leveraging the success of the current location, Revolving Kitchen is already targeting new sites.

Dallas-Fort Worth, like any large metropolitan area, has significant pent-up demand and will be able to support, if not require, multiple locations

The plan (over the next two to three years) is to solidify market presence by opening four to seven additional locations throughout DFW at least 10-20 miles apart

To continue its Texas expansion, the next target markets will be Houston, San Antonio and Austin

Impact

Aligned mission and culture

Revolving Kitchen is driven by mission and culture to help food businesses succeed and serve local communities with access to diverse food businesses and their products

- Focused on helping food businesses to start/grow/expand economically, efficiently and profitably by providing turnkey kitchens, omni-channel ordering, operational and marketing support, revenue-generating amenities and initiatives as well as other comprehensive service offerings

- Striving to serve local communities by promoting operators/members and providing a convenient omni-ordering channel platform to order a wide range of foods (on-demand, scheduled delivery, take-out, dine-in, bar, grab & go store, catering, meal plans, bulk purchases, etc.) to meet their food and health preferences while bringing food diversity to the community

- Providing operators/members and communities a "one-stop" solution for their business needs and desire to have a convenient, wide range of food options

- Driven to support local businesses, serve local communities, promote entrepreneurship, start-up and small business, provide meaningful job/business opportunities, offer more food options and ultimately cultivate a healthier and thriving food ecosystem for all stakeholders

- The 1st location was awarded a USDA-LFPP Grant in 2019 for initiatives serving the local community and businesses

Funding

Actionable funding and growth strategy

- Raise $1.0 million in Revenue Shared-Note to open 2nd location in Fairview Town Center servicing Allen, Fairview, Frisco, Lucas, McKinney and Plano markets. All capital raised will be used for the renovation/build-out of the Fairview location facility

Anticipated project renovation costs to the 37,000-square foot facility are $4.5 million, of which $3.5 million is already committed

The new facility will be comprised of 34 turnkey kitchens, a food hall with indoor seating, outdoor courtyard seating, a full-service bar, grab & go store, and year-round social/entertainment events

Founders

Experienced

management team

Tyler S. Shin

Tyler S. Shin

Founder & Managing Partner

Tyler Shin is the Founder and Managing Partner of Revolving Kitchen. Since launching Revolving Kitchen in 2018, Tyler has successfully transformed it into the largest facility of its kind in Texas (to date), and he has been awarded the D CEO & D Innovates' 2021 Innovation Award for Innovation in Food and Beverage. Before Revolving Kitchen, Tyler served four years as an Associate Director at ORIX USA Corporation ("ORIX"). At ORIX, Tyler sourced, originated, structured, underwrote and closed private debt and equity investments in various industries, including restaurants, retail, manufacturing, distribution, entertainment and hospitality. Tyler's practice area included special transactions and distressed assets and focused primarily on senior secured, uni-tranche, second lien and subordinated debt and equity co-investments. Prior to ORIX, Tyler served as Vice President at Wells Fargo in the Loan Workout Group in Los Angeles. He managed a portfolio of syndicated bank loans in the LBOs and coordinated primary and secondary loan purchases and sales there. Tyler is a silent partner at an award-winning, upscale Asian fusion restaurant in Dallas. He holds a bachelor's degree in Psychology from the University of California, Los Angeles.

Summary

Proven, profitable concept in a large, growing industry

with an experienced management team

Large and growing industry

Recent trends in food consumption, demographics and technologies have created enormous global demand for turnkey kitchen solutions. Morgan Stanley expects the total addressable market for online delivery to grow 5% annually, or roughly $470 billion, by 2025. Euromonitor also predicts market growth of over $1 trillion by 2030, driving the need for ghost kitchens.

Proven concept in a defensible industry

The ghost kitchen business model is capital intensive, time-consuming and requires expertise in various areas, including finance, engineering, construction, real estate, project management, IT, restaurant operations, legal, HR and government regulations. Revolving Kitchen has proven the market demand, execution, and profitability.

Early mover advantage

Revolving Kitchen was founded in Dallas, TX, in 2018 and, with the building and opening of the largest facility in Texas (to date), began operating in September 2019. Its early successes, strong operator/member base growth and limited competitors demonstrated a glaring need for low-cost, turnkey ghost kitchens in one of the country's largest MSAs.

Diverse and “sticky” customer base

Revolving Kitchen has dozens of operators/members across different market segments and growth stages. The company’s comprehensive turnkey solutions are available in various sizes with complementary operational support and additional revenues. Revolving Kitchen can provide its operators/members significant flexibility, which has helped it maintain a low churn rate.

Strong financial position

Revolving Kitchen's 1st location is profitable and continues to grow revenue while improving profit margin. Roughly 80% of revenue is recurring with good visibility on future revenue/cash flow. Occupancy is averaging 85% - 90%.

Experienced management team

The Revolving Kitchen team has the vision, culture and experience in finance, real estate, technology and restaurant to execute and grow this unique opportunity. The current management team founded the company and has operated it since its inception.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...