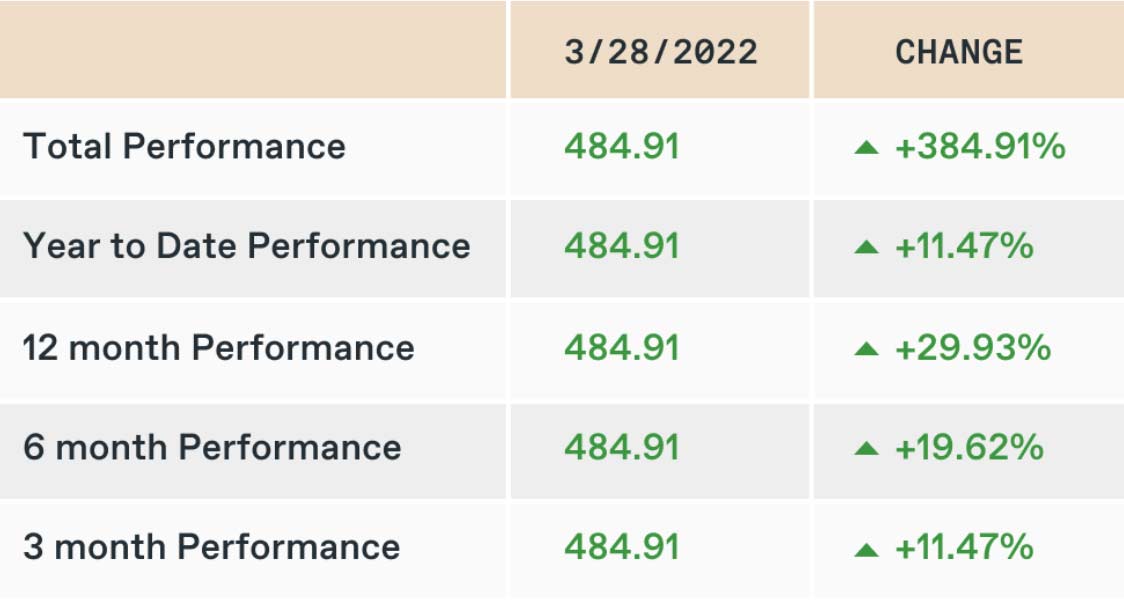

Fine wine is an alternative investment that wealthy people have targeted for decades. Over the past year Vinovest has ret...

* Learn how to potentially get paid and make a return in the FAQ below

Investment opportunity

Discover wine & whiskey investing

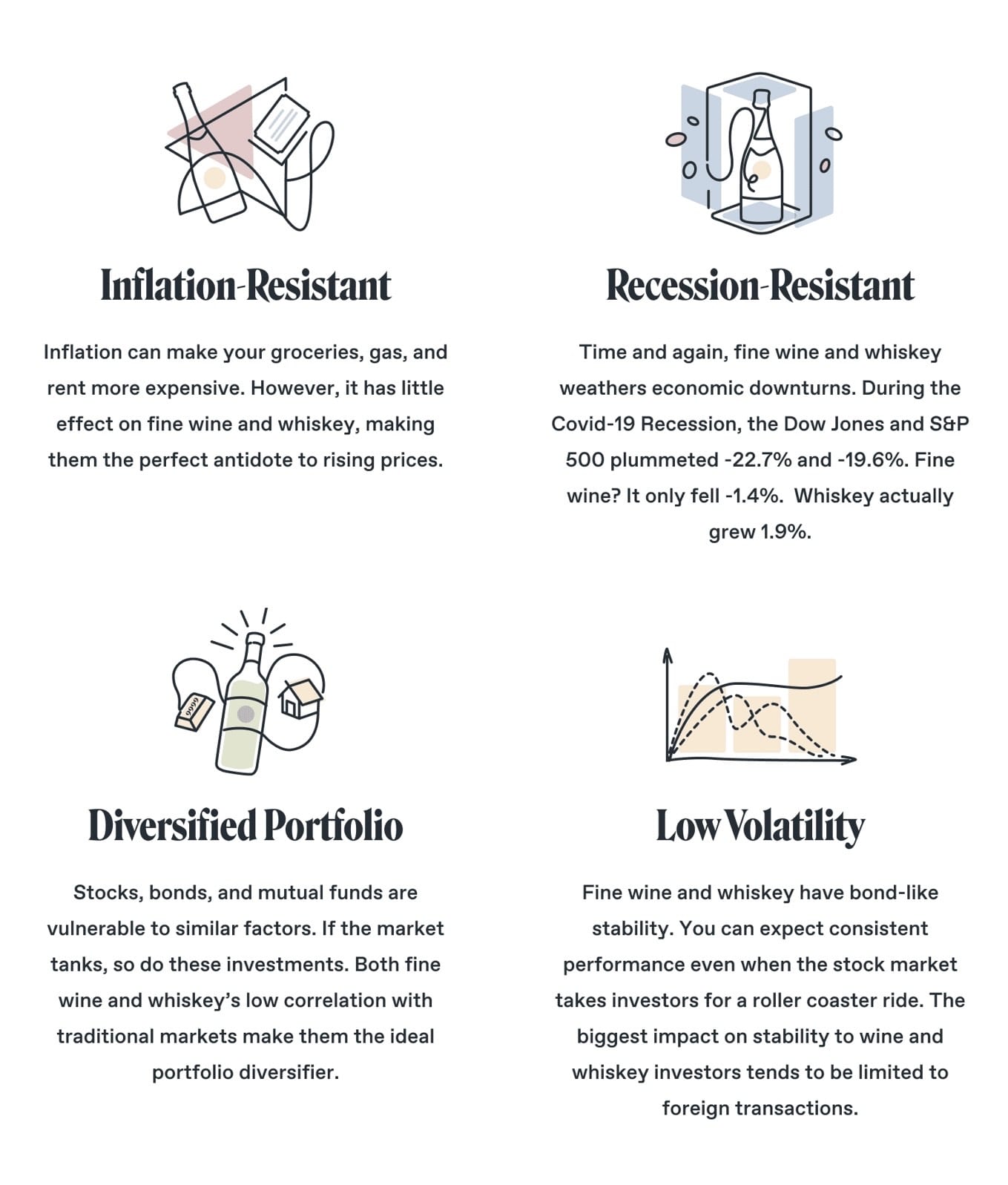

Pairing fine wine and whiskey with traditional assets like stocks and bonds can add attractive returns and portfolio diversity to your investments, as well as preserve your wealth by potentially making your portfolio more resistant to inflation and recessions.

However, investing in fine wine and whiskey has historically been difficult due to:

- Extreme difficulty in accessing investment grade wine and whiskey without a deep knowledge of their secondary markets

- Significant resources are typically required for broker fees and auction house commissions

- High cost involved in sourcing and managing suitable storage and insurance

Solution

Vinovest:

Your Investment Sommelier

Vinovest is a modern platform handling the end-to-end process of wine & whiskey investing:

- Sourcing and acquiring investment-grade wines and whiskeys

- Providing professional custody solutions, storage, and insurance

- Managing ongoing buying and selling activities

The Vinovest team hails from the investment, technology, and wine industries, and operates from Burgundy vineyards to Silicon Valley to Wall Street.

Characteristics of wine & whiskey investments

Product

Uncorking your portfolio's potential

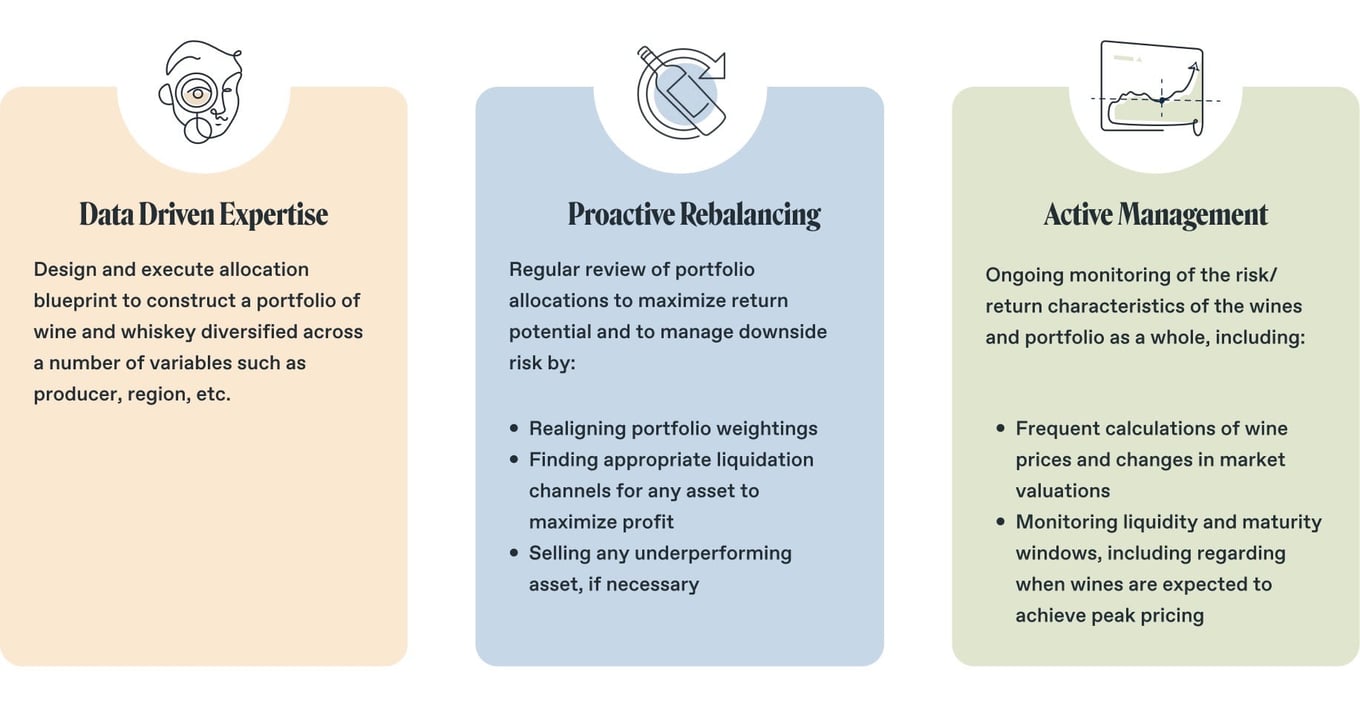

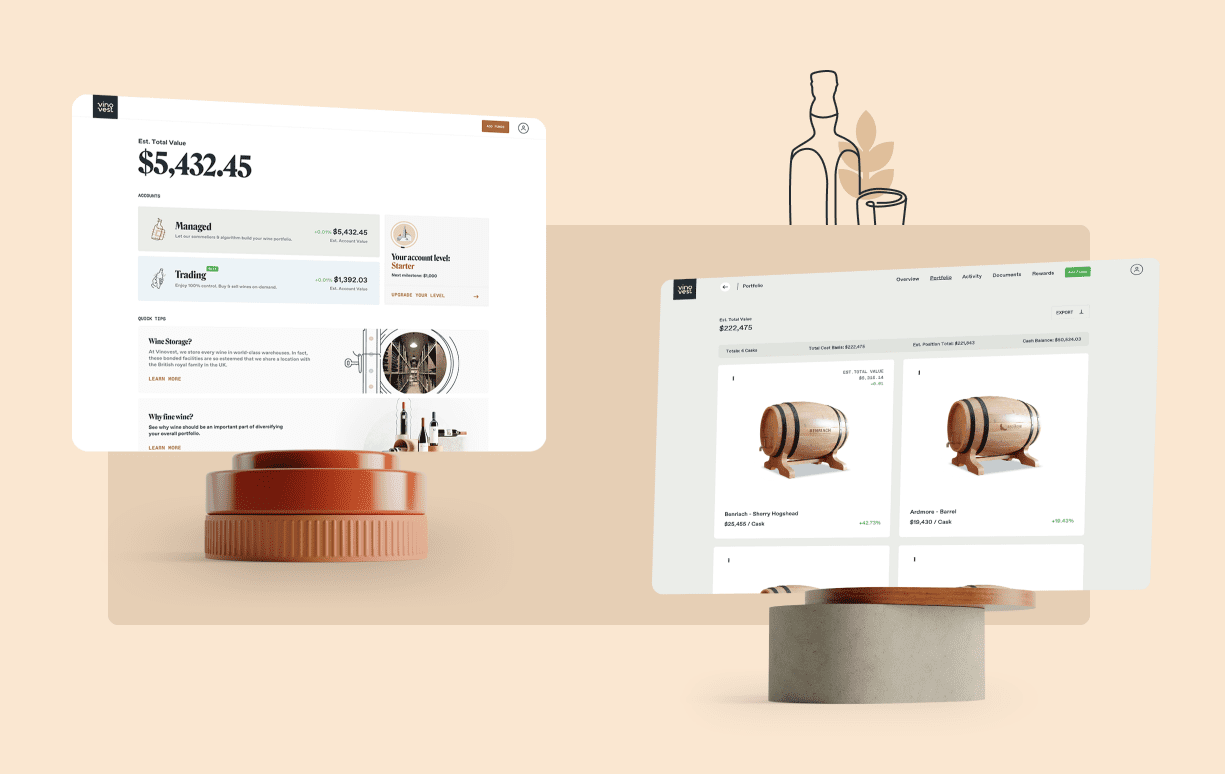

Bottle & Barrel I LLC, a series of Vinovest Capital, LLC, combines the experience of wine and spirits professionals with quantitative investment analysis.

The portfolio’s primary investment objectives are to generate attractive risk-adjusted returns by investing in physical cases and bottles of fine wines and physical casks of whiskeys.

The portfolio utilizes Vinovest’s capabilities and expertise from purchase to sale of each bottle and cask, to seek to achieve the high appreciation potential of fine wine and whiskey.

Investment strategy overview

Vinovest manages portfolios to deliver their investment objectives through a combination of strategies:

Customers

A global network of wine & whiskey lovers and experts

Vinovest’s clients comprise many investor types looking to invest in alternative asset classes. We’ve created a global network of wine & whiskey lovers and experts.

Business model

Wine & whiskey investing for you, personalized by experts

Wine investment strategy

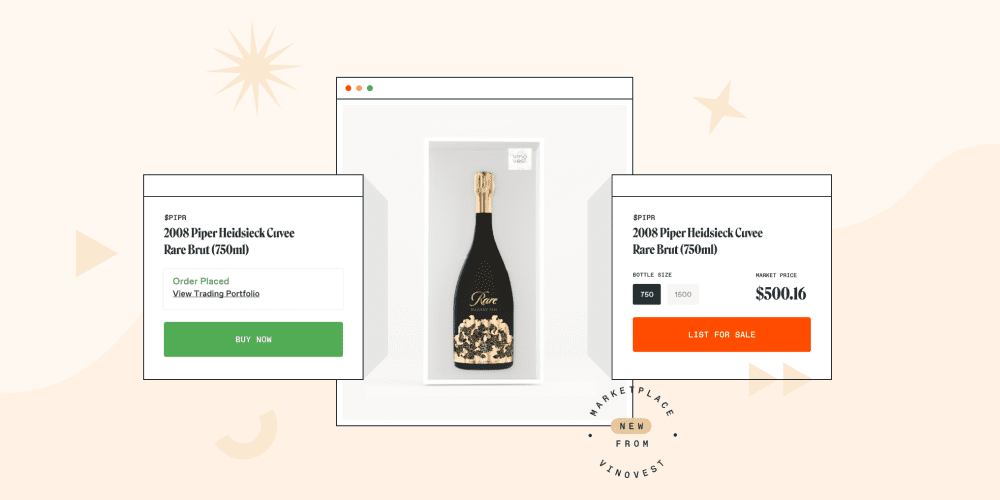

Vinovest seeks to achieve wine's high appreciation potential from purchase to sale of each bottle.

Vinovest sources wines directly from wineries, global wine exchanges, and merchants, and uses its network of relationships to strive to acquire wines at the best market value possible.

Vinovest’s proprietary algorithm analyzes wine market data from a variety of sources on a number of factors, including critic score, varietal, production year or historical pricing.

Whiskey investment strategy

Whiskey investing happens in three stages: investing, aging, and selling.

Investing in Casks

We only invest in whole casks, because unlike wine, whiskey stops maturing and enhancing its flavor and quality once it is removed from the cask. This arrested development limits bottled whiskey’s potential return on investment.

Aging the Casks

The Fund’s casks remain at the distillery or at a bonded warehouse while aging. A few things happen to whiskey while it ages: 1) it decreases in volume due to evaporation; 2) it loses alcoholic strength; 3) it develops more flavor.

Selling the Casks

We expect to hold casks for at least five years. When the time is right, there are a number of potential selling options such as selling at auctions, selling to a distillery or independent bottler or selling to a private collector.

Market

Bottle your wealth

Investing in wine

Several factors drive wine prices over time.

Scarcity

Wineries often produce investment grade wine in limited quantities.These wines are already in high demand so low supply only enhances this.

Aging

The drinking quality of investment grade wine generally improves as it ages, when it is stored properly.

Brand Equity

Some of the most prestigious wines in the world can command six-figure prices for a single bottle.

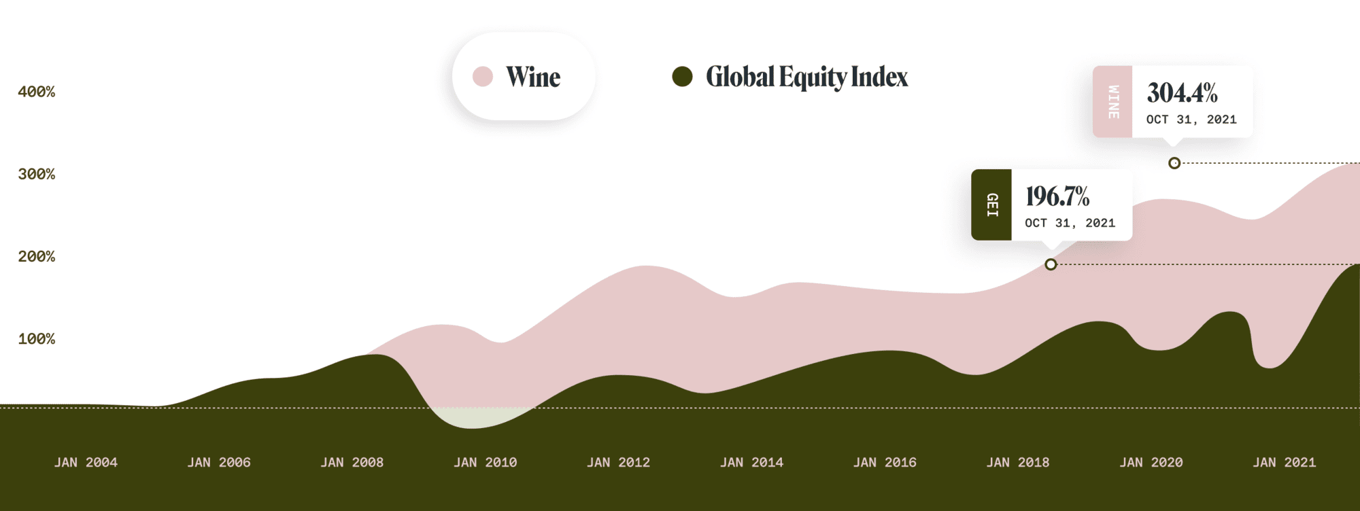

Fine Wine has demonstrated consistent and stable returns over the last 18+ years

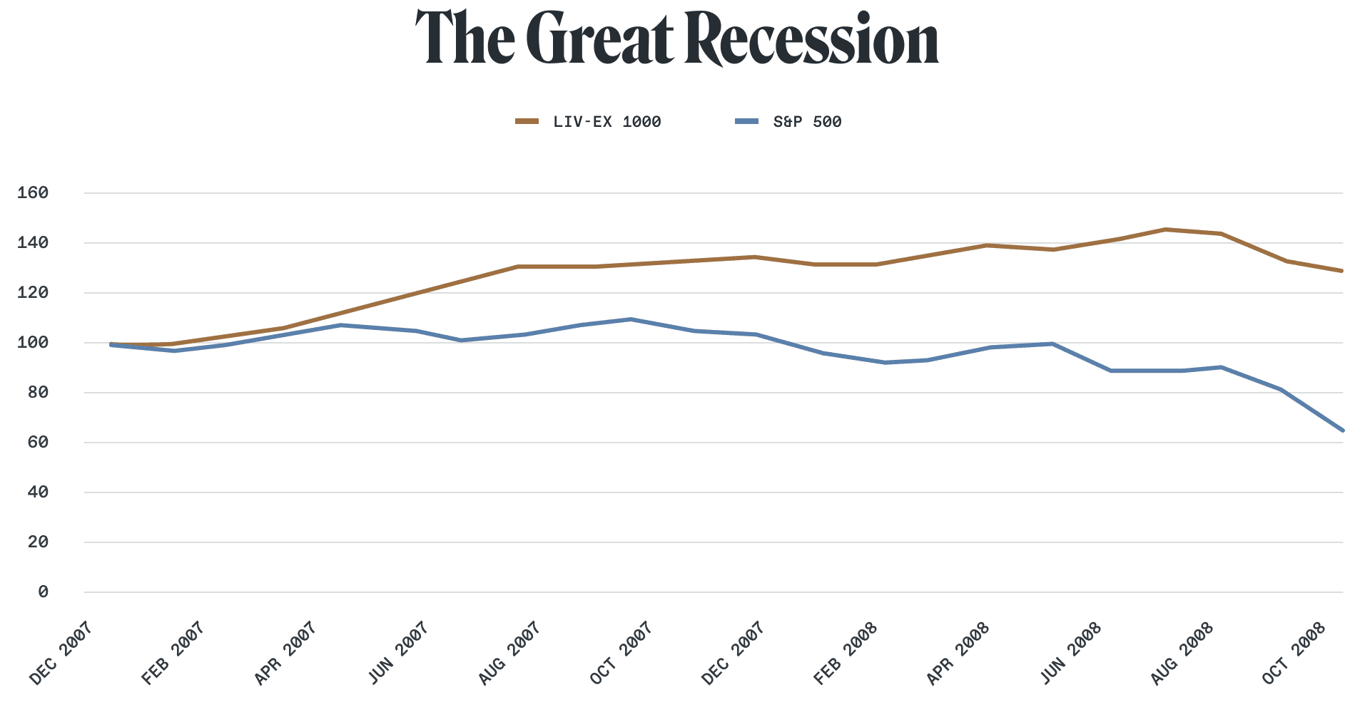

Hedge against recessions

During the 2008/2009 recession, when the S&P 500 plunged almost 50%, fine wine actually grew 29%.

Investing in whiskey

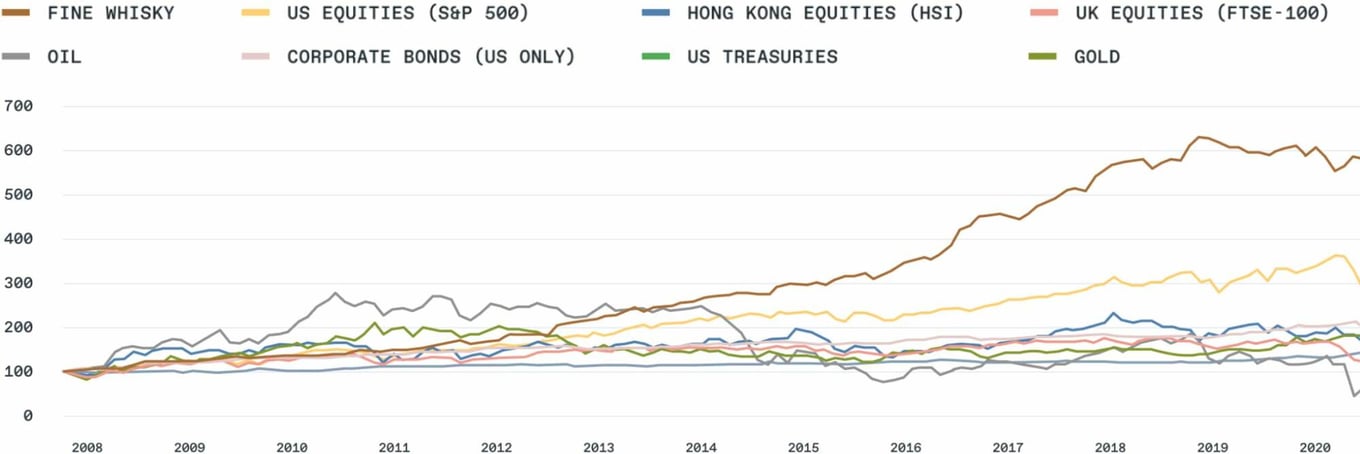

Whiskey has the potential to increase exponentially in value. We reference the Rare Whiskey Icon 100 Index – an index comprised of the top 100 traded whisky bottles. It offers valuable insights into market trends and certain future cask values.

Fine whisky has outperformed mainstream assets since 2008

Competition

Exclusively offered via Republic by Vinovest

Vinovest is pleased to offer an exclusive offering via Republic providing access to fine wine and whiskey with a single investment.

Vision and strategy

Democratizing investment in fine wine & whiskey

Vinovest believes that adding alternative assets, like fine wine and whiskey, to investment portfolios of primarily traditional assets, like stocks and bonds, can help investors reduce portfolio volatility and downside risk, thereby increasing risk-adjusted returns.

Bottle & Barrel I LLC offers a way for investors to access wine and whiskey investment opportunities.

At Vinovest, our mission is to help investors enjoy the profits of investing in fine wine and whiskey as an asset class, while we take care of the selection headaches, inventory management, and authenticity verification.

Funding

VC backers and sponsors

Sponsors at:

Founders

Meet the founders

Anthony Zhang

Anthony Zhang

Previously founded 2 companies (both acquired)

Formerly Head of Marketing and Business Development at Blockfolio (acquired)

Thiel Fellow

Brent Akamine

Brent Akamine

- Founding team member at Flipagram (raised $70M led by Sequoia and then acquired by Bytedance)

- Led redesign of US launch of TikTok

- Formerly Director of Design at Blockfolio (acquired)

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...