I am a firm believer that decentralized networks will win and disruptive token economies will upend every industry vertic...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Access Network isn't accepting new investments

Explore new investment opportunities:

View companies raising now

Access Network

been refunded.

Open for investment

Documents

Form C

SEC.gov

Form C

SEC.gov

Financial Access is a Fundamental Human Right.

Creating access to financial and technological tools for the word's 1.7 billion unbanked adults through the development of a sustainable decentralized bank.

The Highlights: Empowerment via the Access (ACX) Token

Branchless Banking Infrastructure: Mobile Bankers provide door-to-door savings collection and loan underwriting services daily to others, using only a Smartphone.

Over 500 Bankers and 30,000 clients ready to join the Access Network.

Growth is incentivized through ACX token distribution.

ACX token unlocks the usage of new financial tools and applications.

ACX token fund perpetually incentivizes developers to create more and more valuable applications to be used by the Access Network.

Founded by the team at Atlas Money--an experienced VC-backed team with 30 employees across 7 countries that already provides financial access to thousands of people in West Africa.

- Investors on Republic can receive a minimum 10% discount on the public token price.

The Problem

The Problem

1.7 Billion adults lack adequate financial access

We estimate that the total number of people in those unbanked households who lack adequate financial access to be much greater. Communities in the developing world face countless challenges on a daily basis, and lack access to the tools they need to realize their full growth potential.

Banks have decided that the 'other 1.7 billion' unbanked adults are ‘not worth’ banking.

This leaves the underbanked limited to the financial access provided by Mobile Carriers, who typically only provide money sending services for very high fees.

The Solution

World Bank for the Unbanked

Access Network is a decentralized bank that incentivizes people to bank each other, and developers to build better financial tools for them.

- People act as a branchless banking infrastructure for each other.

- With just a smartphone, individuals bank others in their local communities.

- Access users vote on new tools and feature development for the network.

- Developers compete to provide innovative solutions.

Simply put: The People's Bank + The People's Dev Shop.

How it Works

How it Works

Access Network leverages blockchain technology, ACX token and existing distribution networks.

Access Network is constructing a World Bank for the Unbanked, complete with self-governance, incentives, and mass distribution.

Access' own ACX tokens are used to:

- Reward the growth of a decentralized banking infrastructure

- Vote on applications they want built

- Unlock increased application usage

- Pay for fees at a discount or

- Trade-in for useful rewards such as smartphones

Access Network partners with local banking platforms like Atlas Money--- a system of branchless bankers who provide door-to-door financial service to their local communities.

Atlas' self-employed agents attend to the financial needs of their clients daily.

Carrying just a smartphone, Atlas agents service people who were excluded from participating in the global economy.

Gamified Mass Adoption

Access Network is built to achieve a massive global scale. This ambitious adoption can be reached by a quick yet sustainable incentive, such as rewarding users for what they are already doing - banking each other.

Decentralized Development

Developers everywhere are incentivized by a bounty reward to build solutions Access Network end-users are asking for. Specially designed voting systems let anyone with ACX tokens put value on both the most pressing problems and viable solutions. This direct feedback loop is a dream come true for any app developer as it takes the guesswork out of what to build and how.

Access team is kicking things off by building the first apps for free money sending, loans and e-commerce. To further promote inclusive development the Access team will be co-hosting hackathons across Africa.

Self-Governed Community

Every aspect of an everyday African life is within communities. From religion to money, communities make decisions, save money and pray together. Access Network relies on and empowers these established social structures by integrating self-governance. The Governance Protocol and amenable rules allow everyone to equally dictate how the whole network works.

Ready. Set. Grow.

The Team behind Access Network has been building a branchless banking network, Atlas Money, for the past 2 years right from within West Africa. We are taking our on-the-ground banking experience and bringing it over to Access to accelerate the realization of financial and wealth inclusion for all.

Atlas Money is backed by top venture capital funds and angel investors, including Tim Draper, Partech Ventures, 1517 Fund and Shawn Byers. The team has gone through Boost VC and Techstars Barclays.

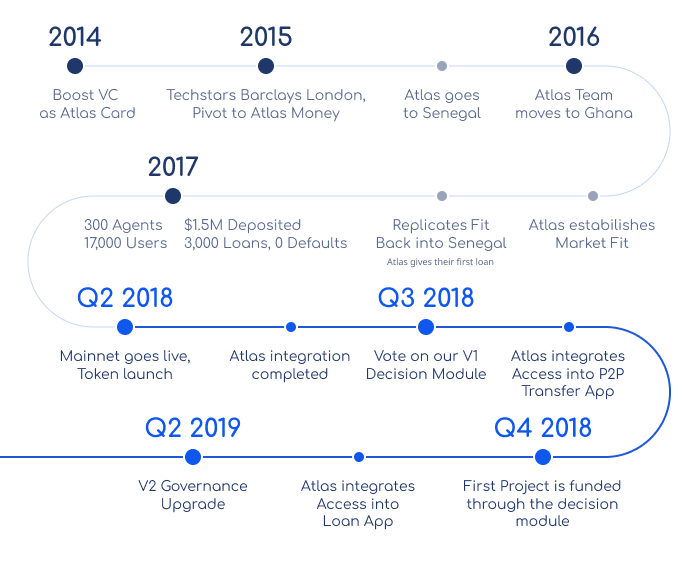

Timeline

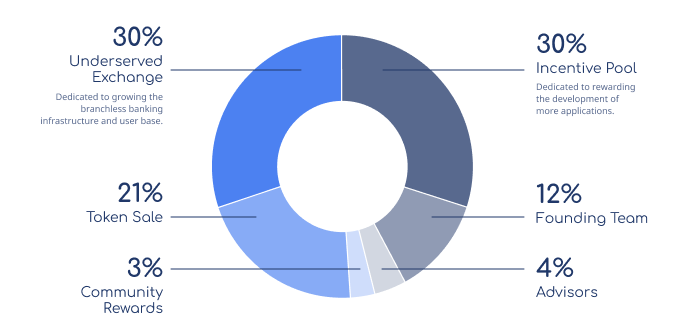

Token Distribution

- 30% of tokens are dedicated to growing the branchless banking infrastructure and user base

- 30% of tokens are dedicated to rewarding the development of more applications

- Team and Advisor tokens are reserved to attract great future talent

- Tokens for current and future team members and advisors will vest over 4 years

Join the first World Bank for the Unbanked.

Deal terms

$1.07M

Access Network must achieve its minimum goal of $100K before the deadline. The maximum amount the offering can raise is $1.07M.

Learn more

Learn more

Token DPA (Late Stage with Escrow)

If the campaign is successful, you’ll receive a Token DPA for your investment.

The DPA is not equity or a token itself, but a loan that payable in tokens in

the future, with interest.

Learn more

3 years

The amount of time Access Network has to pay out your investment in tokens.

If the DPA isn't repaid with tokens after that time, it will be payable in cash

with interest.

Learn more

15%

The interest amount that will accumulate on your investment

if it’s paid back to you in cash.

Learn more

12.5% before 5 months, then 25% if repaid before maturity

The interest amount that will accumulate on

your investment if it’s paid back to you in tokens.

Learn more

75% of net debt amount before 5 years

How much you can get back of your investment if you choose to cancel

the Token DPA before it’s paid back.

Learn more

Documents

Form C

SEC.gov

Form C

SEC.gov

Why others invested

See all reviews (0) See all (0)I want to help solve the problem of unbanked consumers.

The statement alone of "Financial Access is a Fundamental Human Right" speaks volumes as to what this application of blockchain can bring to a equitable, and opportunistic future.

I believe in the promise blockchain offers to change the way we transact across borders, and would like to help Access Network become the platform to achieve this goal.

About Access Network

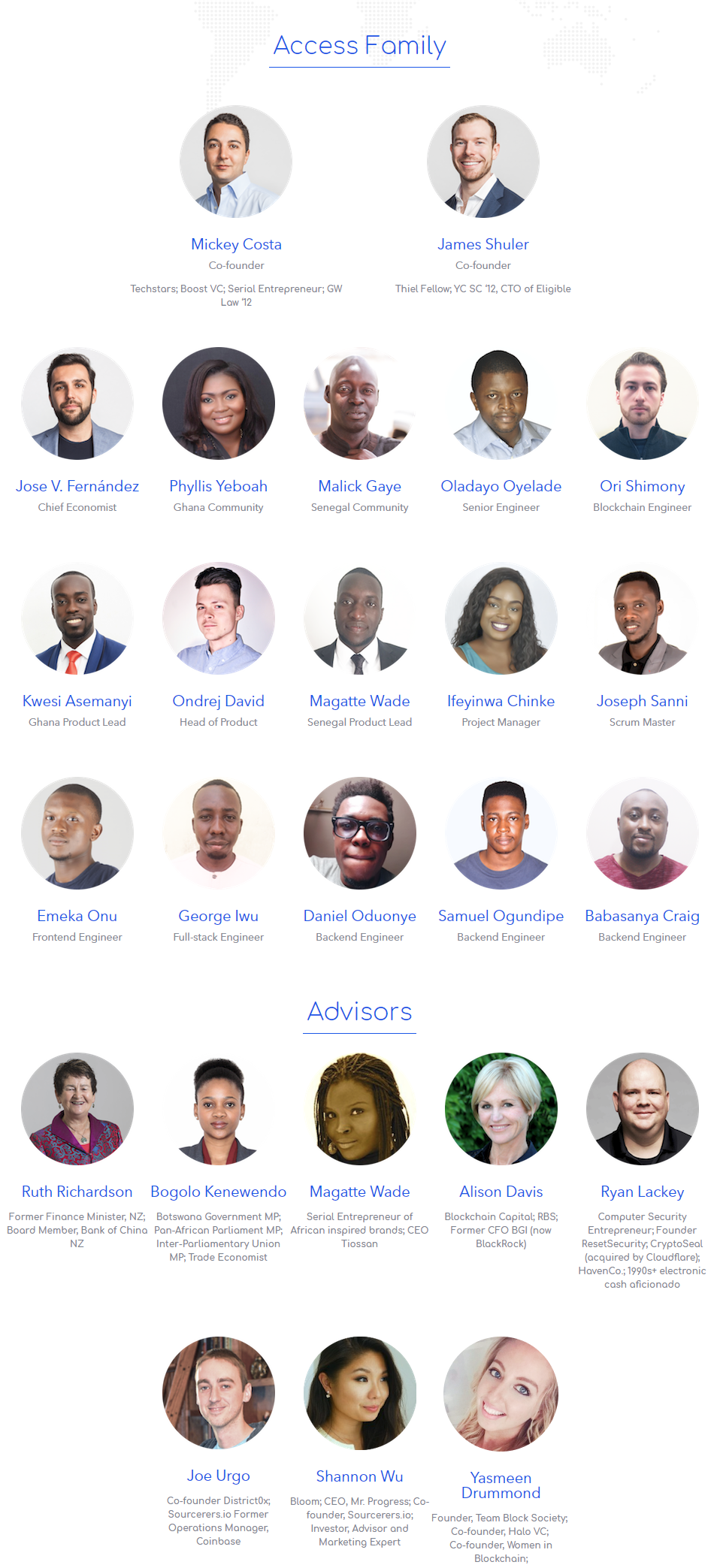

Access Network Team

Everyone helping build Access Network, not limited to employees

Press

FAQ

What did you talk about while at the LAUNCH festival?

Please see the below transcript from Access Network's pitch at the LAUNCH festival.

Jason: Next up is Access Networks, or Access Network.

Micky: It's just one network.

Jason: It's just one network, Access Network. What's your name?

Micky: It's Micky Costa.

Jason: Correct.

Micky: Hello.

Jason: Everybody meet Micky. Micky, you nervous at all?

Micky: More excited I think.

Jason: You're excited?

Micky: Yeah.

Jason: I like it.

Micky: First time in Australia.

Jason: Oh great. Where are you from?

Micky: New York.

Jason: Where in New York?

Micky: The city.

Jason: Manhattan?

Micky: Manhattan.

Jason: Where in Manhattan?

Micky: The financial district.

Jason: Okay, fidi, very good. Three, two, go.

Micky: So there are over six billion people in the world with little to no financial access today. They are most concentrated heavily in sub Saharan Africa. Reason for this is pretty simple. Banking infrastructure costs a lot of money. And when banks look at this, they literally think it's not worth it. And the answer is pretty simple, to have branchless infrastructure, which is basically just people banking each other.

Micky: I'd like you to meet Felix. Felix gets paid to be a banker to those in his community. And he walks around every day with just a smart phone, collecting loans, giving out withdrawals, and can also offer micro loans. For providing this financial access to over three hundred people in his community every month, he's paid $500 dollars from them individually, and he's literally empowering them now to kind of be plugged in and have access to greater things. And he's not alone. Felix is one of 50 banking agents, servicing over 30,000 customers at our company, Atlas Money, that came out of tech stars and has been operational and gone into Senegal for the past two years.

Micky: So what does this infrastructure of Felix unlock and enable? Well, pretty much everything else from loans to eCommerce to micro insurance. In essence, it unlocks trillions of dollars in untapped value. And there's a big need to decentralize this environment. There is too many Felixes we need to get going to be infrastructure, and there's way too many applications we need to build on top of this to get the economy going. And that's why we are proud to announce Access Network, which is a decentralized world bank. And what that means is pretty simple. It's basically the People's Bank and the People's VC Fund. Using block chain technology and our own access token, we are incentivizing the growth of that human banking infrastructure of people like Felix and incentivizing third party developers to build applications for the network.

Micky: People like Felix now will be rewarded for banking other people in his community, and community members will be rewarded with free access tokens as well, for saving more money or getting more people on board. We're also gonna offer this same kind of incentive structure to people outside of my company, Atlas Money, and actually partner with other existing networks across the world. All token holders get to vote on what applications they want built next. And developers compete to build those. And we pick the best one, and they're rewarded in free tokens as well. The tokens are used to unlock greater usage of these applications. And if there's any service fees attached, paying in the token gets a discount on that fee.

Micky: Where are we today? We have all of our block chain governing small contracts built, our first applications ready to go upon launch, which is free money sending, which is a huge deal for those of you that know the continent well, and our earning incentives are all done as well. We're wrapping up here. What's next? We're finishing our token sale. We're launching in Ghana and Senegal with Atlas Money as our first partner, aptly pursuing partnerships with other exchange networks, getting the developer award system up and running while doing hackathons at the same time, and releasing our second and third apps later this year of a loan application, and an ability to literally co invest in infrastructure projects on the ground like solar panels and things of that sort.

Micky: And that's where Access is a two-way street. Basically, we can unlock this market not just for everyone else, but for ourselves. And we can make money while empowering others. So that's Access Network, and it's truly a place where we can all co create together.

Jason: Okay.

Micky: Thank you.

Jason: Well done. Let's give him a big round of applause. Stonely, why don't you start us off.

Stonly: Sure. So I'm curious. So you're building the platform to build banking related applications or financial related applications. I'm wondering what sort of applications you anticipate will be built. Do you feel like this is a lot of applications, like thousands, millions, infinite, what are some examples? And then, second, what ... I'll leave it at that.

Jason: Andrea?

Andrea: I've got a bit of brain blank. I think I'm just a bit excited by it, but a bit overwhelmed because I'm not sure that I understood it that well. So I'd kind of like a little bit more color on how it works really.

Micky: Sure.

Jason: Matthew.

Matthew: Is there anyone else doing this, I guess, with the block chain sites? 'Cause there's other people that do micro loans, right?

Micky: Mm-hmm (affirmative). Sure.

Jason: Yeah. And finally, I too, like Andrea was a bit confused because there's just ACX Network, Access Network, Atlas Bank, and I didn't understand which business is yours. Is Atlas your customer, or is your customer the people, or is your customer the developer? And I understand you're doing something unique, but there's a token sale involved as well. So I'm just a little confuse candidly and wanna know what is Access Networks versus Atlas, which is your business?

Micky: I'll probably lunk you two in together at the end if that's okay. So if I recall you properly, it was kind of what applications do I see being fruitfully developed? Well, first and foremost, it's really important that you kind of put in the incentive and architecture in place where it's a self sustaining development ecosystem. We've lived on the ground for a couple of years, and kind of know the ones that are gonna work. We're gonna build them ourselves as the network kind of nurtures and can develop on its own incentivizing, and voting, and creating more applications it wants.

Micky: That will be pretty endless. It could be feature fixes. It can be a micro loan application. So we know on the ground doing micro loans with success that people want access to loans so badly. I know through partnerships we can create here, that eCommerce will take a market loan from changing no behavior, and making $10,000 a year from $1,000. I know that's important. Micro insurance would do well. A lot of people love funeral insurance in places like Ghana for example. There's just a lot to do. So we're gonna will into existence our own.

Micky: The free money sending is kind of a biggy. Right now, you have billions of dollars being sent in countries like Ghana with competing tele coast that all charge high fees to send money. So making that free, I think, will net a lot of user for us over all. Gotta move on for time, but happy to talk more about that. Lumping you guys in at the end, so real quick if you can remind me ... oh, who else is doing this?

Micky: This is kind of like the holy grail of the block chain space for a long time, and no one's done it. So we were a block chain company the whole time and decided to skip the conferences and move down to Africa and really figure it out and admit we know nothing. And talk to women in the community and figure out what they do. So the biggest disadvantage I'd say to other people is that there's maybe like four or five projects nibbling at this. No one has boots on the ground. If you don't have that, it's all theory. You can't buy theorem or a token in a country where you don't have a bank account.

Micky: Two, they're not architected in a way that really takes care of the needs of that human infrastructure in developing more tools. That ties in to the last thing to give you more color on how we got here. The product market fit we have today as like the Uber for banking, we found in the market of people banking each other, just was kind of like a trustless system. So we came in with smartphone apps and SMS notifications and taking care of the supply chain of money to make it more trustless. And that's really how it works. And that's how Atlas works. It's really this Uber for banking model. We kind of cracked the code.

Micky: And it seems pretty simple on hindsight. Now, that's my company. We become like a crypto exchange on this network and the networks first kind of partner. The whole point of this now is this is a decentralized network. I don't own this. Token holders own this. And it's open. I'm kind of punting on a lot of unicorn value we could have created and for the good of the mission really.

Jason: Okay. Let's give it up for Access Network.

Micky: Thank you.

How do you plan on improving the participation of unbanked people with little to no access to smartphones?

At first we will focus on agents and community leaders who all have access to smartphones. Users will be able to delegate their votes to those they trust within their communities who share the same goals and needs.

Liquid democracy, the ability to delegate voting power of the ACX token, will be crucial to leapfrogging the current limitations of the infrastructure in Africa and in developing countries.

We will also be dedicating some of our proceeds to circulating smartphones to end users in exchange for earned ACX tokens. We also hope to partner with other stakeholders that are aligned around increasing smartphone penetration faster than is currently forecasted. More smartphones will further decentralize the banking infrastructure of Access Network, while also enabling future applications to have more value, such as e-commerce, where a smartphone is necessary to geo-locate end users accurately.

Will the inflation from the incentive pool and the underserved exchange hurt the value of the token?

ACX tokens enter circulation with increased adoption and usage of the network, unlike many inflation schemes which are hardcoded.

UNDERSERVED EXCHANGE

The Access Underserved Exchange (AUE) reserve distributes ACX to underserved populations through partner organizations (like Atlas Money) that work on the ground in the developing world. For example, African users who deposit with Atlas Money Agents will earn ACX for having active and increased fiat balances, which they can stake for premium services like free money-sending or spend for discounted banking fees. Tokens for use on the AUE are distributed to organizations at a limited rate that is proportional to adoption and will be used to provide local incentives to other partner agent networks in countries across the World.

INCENTIVE POOL

The Incentive Pool reserve rewards developers who create apps and tools that increase the usability of the platform and thus drive adoption. Incentive Pool funds are only distributed when a sufficient proportion of ACX holders vote in favor of a project. The Incentive Pool is unlocked at a fixed rate over a 10 year period. ACX holders are incentivized to vote for projects that increase the value of the network by a greater amount than resultant dilution. For example, if I believe that a new ACX loan dapp will increase the long-term utility value of the Access ecosystem by >2% and the corresponding Incentive Pool payout will dilute the value of my ACX by <2%, then I should vote in favor of the project. Over a large number of self-interested participants, the increase in value from new projects will tend to exceed any decrease that would result from inflation.

How are small token holders and the unbanked protected from the influence of whales?

Because of our Radical Trust decision-making module, small token holders pooled together will always have a greater impact than whales for an equal amount of tokens. Thus, communities can come together to direct the development of the tools they really need.

Why do you think an incentive pool is necessary as opposed to requiring voters to commit tokens and ETH to the projects they vote on?

To kickstart the network’s adoption, we need to take away as much risk as possible for the developer community while incentivizing governance participation by ACX holders. Having an incentive pool overcomes the tragedy of the commons problem by removing the need for any one party to finance new projects.

What is Radical Trust and why is it better than just having 1 vote per token?

Radical Trust is a new voting mechanism derived from Quadratic voting. It uses a radical function to calculate voting weight where the weight of each token declines as more tokens are committed by an individual. This way, pooled together, small token holders can have a greater impact than large individual holders. Additionally, to prevent large token holders from using multiple accounts to increase their overall weight, votes will be weighted by an identity score that utilizes existing identity solutions such as Keybase, Civic, Uport, and traditional KYC.

This model gives a greater voice to smaller token holders and brings balance to the ecosystem unlike one token one vote systems that greatly advantage the rich. A one token one vote system would not be a viable way to align interests in a network dedicated to democratizing financial access.

Why is a token needed? Couldn’t this project be achieved with ETH?

We are creating a self-governed network which will develop its own ecosystem of dapps. To succeed, participants need to be aligned around the same incentives. ETH holders don't necessarily care about the future of the unbanked, but ACX holders have a vested interest in their inclusion.

The equitable distribution and built-in value of ACX will incentivize developers, developed world participants, and developing world participants to come together as a community that envisions and implements its own solutions.

A token is necessary to prove a stake in Access that can be utilized to vote in decision-making processes such as rewarding developments, as well as modifications to the governance protocol itself.

How do you make sure selected agents are trustworthy?

1) Agents are required to pre-purchase digital credit to guarantee the safety of end user deposits. ACX will be used to unlock higher usage of given services and get discounts on others.

2) The Atlas ground team sources agents with local community leaders who vouch for their reputation in the community.

3) Successful agents refer new agents as do our mega end users like market-leader women.

What role do agents play in the Access ecosystem?

Agents act as ACX entry nodes, allowing African users to purchase or earn-in to Access Network without any deep blockchain acumen or specialized hardware.They will also act as vote proxies, where users can delegate their voting power to local leaders/agents so they can steer the development of the network on their behalf.

Where has Atlas been operating in Africa?

Atlas began its journey in Ghana and has successfully expanded into Senegal.

What is the role of Atlas in the development of Access Network?

Atlas is the founding company behind Access. Access has a broader scope than Atlas but will be able to leverage Atlas’ network of 30,000 users and 500 agents in Ghana and Senegal to kickstart its go-to market strategy.

Having the agent network already in place is a distinct competitive advantage, as incentivized individuals on the ground will drive adoption across cultural and technological usage barriers.

Atlas is merely a partner exchange network in the greater Access Network ecosystem. Access is actively partnering with other existing networks across the world to speed up adoption and distribution of ACX.

What is Access?

Access is a protocol that helps reward the development of financial tools for the underbanked, and Access (ACX) is a digital token used to incentivize banking and savings activities. Access was built by the team behind Atlas, the successful branchless community banking platform for the underbanked.

Currently, any person with a smartphone in West Africa can download the Atlas app and earn money as a banker to their community. When ACX Network goes live, hundreds of Atlas Agents and thousands of Atlas clients will instantly switch to a token rewards model, effectively turning all agents into ACX nodes and exchanges.

Where can I read the White Paper

See the Form C or view it here: http://acxnetwork.com/whitepap...

Discussion

This site (the "Site") is owned and maintained by OpenDeal Inc., which is not a registered broker-dealer. OpenDeal Inc. does not give investment advice, endorsement, analysis or recommendations with respect to any securities. All securities listed here are being offered by, and all information included on this Site is the responsibility of, the applicable issuer of such securities. The intermediary facilitating the offering will be identified in such offering’s documentation.

All funding-portal activities are conducted by OpenDeal Portal LLC doing business as Republic, a funding portal which is registered with the US Securities and Exchange Commission (SEC) as a funding portal (Portal) and is a member of the Financial Industry Regulatory Authority (FINRA). OpenDeal Portal LLC is located at 149 E 23rd St #1314, New York, NY 10010, please check out background on FINRA’s Funding Portal page.

All broker-dealer related securities activity is conducted by OpenDeal Broker LLC, an affiliate of OpenDeal Inc. and OpenDeal Portal LLC, and a registered broker-dealer, and member of FINRA | SiPC, located at 1345 Avenue of the Americas, 15th Floor, New York, NY 10105, please check our background on FINRA’s BrokerCheck.

Certain pages discussing the mechanics and providing educational materials regarding regulation crowdfunding offerings may refer to OpenDeal Broker LLC and OpenDeal Portal LLC collectively as “Republic”, solely for explanatory purposes.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC make investment recommendations and no communication, through this Site or in any other medium should be construed as a recommendation for any security offered on or off this investment platform. Investment opportunities posted on this Site are private placements of securities that are not publicly traded, involve a high degree of risk, may lose value, are subject to holding period requirements and are intended for investors who do not need a liquid investment. Past performance is not indicative of future results. Investors must be able to afford the loss of their entire investment. Only qualified investors, which may be restricted to only Accredited Investors or non-U.S. persons, may invest in offerings hosted by OpenDeal Broker.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC, nor any of their officers, directors, agents and employees makes any warranty, express or implied, of any kind whatsoever related to the adequacy, accuracy or completeness of any information on this Site or the use of information on this site. Offers to sell securities can only be made through official offering documents that contain important information about the investment and the issuers, including risks. Investors should carefully read the offering documents. Investors should conduct their own due diligence and are encouraged to consult with their tax, legal and financial advisors.

By accessing the Site and any pages thereof, you agree to be bound by the Terms of Use and Privacy Policy. Please also see OpenDeal Broker’s Business Continuity Plan and Additional Risk Disclosures. All issuers offering securities under regulation crowdfunding as hosted by OpenDeal Portal LLC are listed on the All Companies Page. The inclusion or exclusion of an issuer on the Platform Page and/or Republic’s Homepage, which includes offerings conducted under regulation crowdfunding as well as other exemptions from registration, is not based upon any endorsement or recommendation by OpenDeal Inc, OpenDeal Portal LLC, or OpenDeal Broker LLC, nor any of their affiliates, officers, directors, agents, and employees. Rather, issuers of securities may, in their sole discretion, opt-out of being listed on the Platform Page and Homepage.

Investors should verify any issuer information they consider important before making an investment.

Investments in private companies are particularly risky and may result in total loss of invested capital. Past performance of a security or a company does not guarantee future results or returns. Only investors who understand the risks of early stage investment and who meet the Republic's investment criteria may invest.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC verify information provided by companies on this Site and makes no assurance as to the completeness or accuracy of any such information. Additional information about companies fundraising on the Site can be found by searching the EDGAR database, or the offering documentation located on the Site when the offering does not require an EDGAR filing.

To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. Therefore, when you use the Services we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver's license, passport or other identifying documents.

Republic and its affiliates are not and do not operate or act as a bank. Certain banking services are provided by BankProv, member FDIC / member DIF. Digital (crypto) assets and investment products are not insured by the FDIC, may lose value, and are not deposits or other obligations of BankProv and are not guaranteed by BankProv. Terms and conditions apply.

Made in SF/NYC