Overview

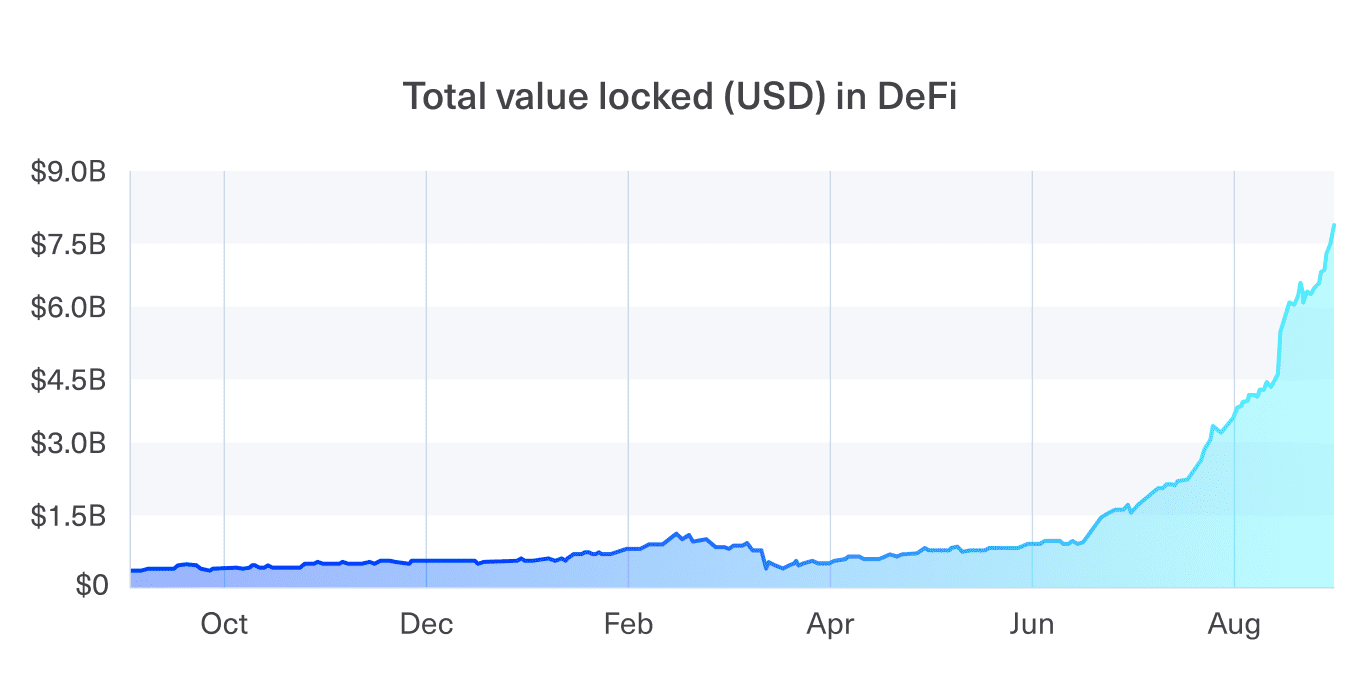

DeFi (Decentralized Finance) is taking crypto by storm. Across the board, DeFi dapps (decentralized applications) have recently seen a surge in momentum with the total value locked up in DeFi apps amplitudes greater than it was just a few months ago. Borderless and decentralized, DeFi cuts out the middlemen in lending, international payments, and on exchanges. As a sector, DeFi has the potential to disrupt our entire financial system and is worth close monitoring.

What it is

Decentralized Finance cuts out middlemen from the financial services industry. By being built on blockchains governed by many different actors, DeFi allows financial applications to run without any single point of failure. What’s more, because they are permissionless, DeFi applications can also be accessed by anyone who has access to a desktop and internet connection.

DeFi also cuts fees from conventional financial services by eliminating profit-seeking middlemen. When making cross-border payments you used to have to pay exorbitant transaction fees. For example, Western Union – a leading International Money Transfer – charges $4.50 just on transfers up to $50 dollars or less!

DeFi can be particularly useful in emerging markets where access to smartphones and laptops is becoming more commonplace. In fact 78% of people had access to a laptop in 2020. While 31% of the world’s population is unbanked, DeFi dapps, accessible to anyone with an internet connection, can extend banking services to a larger share of the worlds’ population than conventional financial services.

Product Categories

In only a few years, DeFi has become an ecosystem spanning multiple verticals of finance. These services can disrupt traditional finance by decentralizing financial services for users. Major product lines include:

Stablecoins: Because of their volatility, the leading cryptocurrencies do not function well for payments or international transfers. By contrast, stablecoins are designed to maintain a certain value. Primarily stablecoins are either fiat-collateralized, crypto-collateralized, or non-collateralized (through algorithmic rebalancing or gamification).

Lending Protocols: Decentralized lending platforms provide loans to people and businesses. Decentralized lending platforms have particularly gained tractions as people look to benefit from their high interest rates and limited to no collateral requirements. By placing lending back in the hands of users, DeFi can take the place of profit-seeking banks which previously performed this function. While the permissionless nature of DeFi makes it attractive to end users, lending has traditionally been a highly regulated space. Decentralized lending’s lack of compliance measures could impede its ability to gain mainstream adoption.

Exchanges: Decentralized Exchanges operate without a centralized authority. They allow peer-to-peer trading and users do not need to transfer their assets to an exchange.

Oracles: The universe of smart contracts is not only defined by ownership but events in the real world happening. Oracles connect external data to blockchains; most unique DeFi projects incorporate Oracles. Chainlink, the leading decentralized oracle network that serves as a bridge between oracles (data feeds, APIs, etc) and smart contracts. Another decentralized oracle service, Witnet, allows blockchains like Ethereum to check the state of other blockchains such as Bitcoin.

Projects to Watch

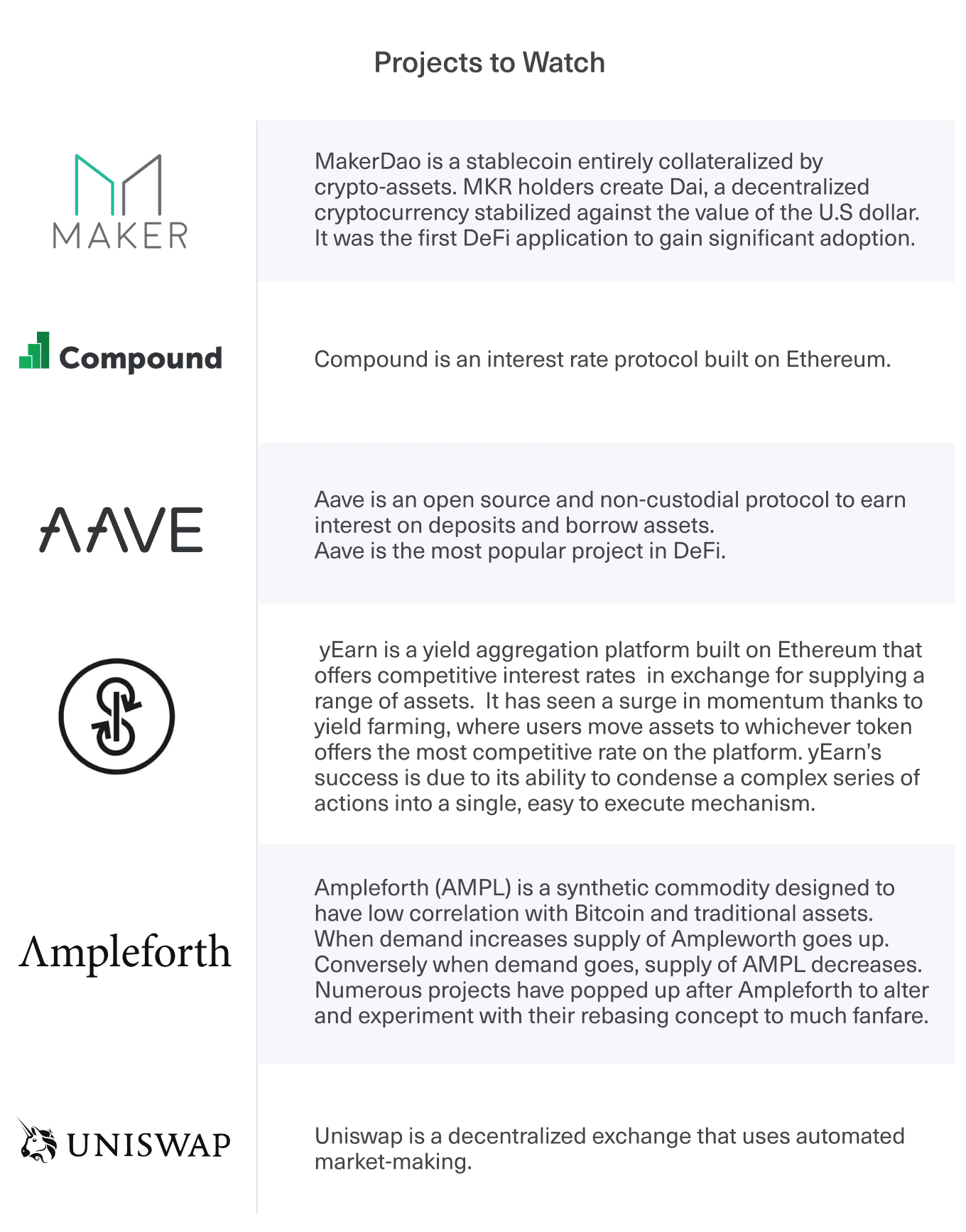

Projects are currently gaining traction in the stablecoin space, yield-farming, and lending. A few of the major projects are:

MakerDao: MakerDao is a stablecoin entirely collateralized by crypto-assets. MKR holders create Dai, a decentralized cryptocurrency stabilized against the value of the U.S dollar. It was the first DeFi application to gain significant adoption.

Compound: Compound is an interest rate protocol built on Ethereum.

Aave: Aave is an open source and non-custodial protocol to earn interest on deposits and borrow assets. Aave is the most popular project in DeFi.

yEarn Finance: yEarn is a yield aggregation platform built on Ethereum that offers competitive interest rates in exchange for supplying a range of assets. It has seen a surge in momentum thanks to yield farming, where users move assets to whichever token offers the most competitive rate on the platform. yEarn’s success is due to its ability to condense a complex series of actions into a single, easy to execute mechanism.

Ampleforth: Ampleforth (AMPL) is a synthetic commodity designed to have low correlation with Bitcoin and traditional assets. When demand increases supply of Ampleworth goes up. Conversely when demand goes, supply of AMPL decreases. Numerous projects have popped up after Ampleforth to alter and experiment with their rebasing concept to much fanfare.

Uniswap: Uniswap is a decentralized exchange that uses automated market-making .

Risks

As a young sector, DeFi faces a number of risks which could limit its adoption. These risks span from unfavorable regulatory environments in many parts of the globe, technical difficulties of DeFi dApps, to the scalability issues of the Ethereum blockchain itself.

Although these projects generally have no single point of failure, they can sometimes have their own technical difficulties. For example, ordinarily MakerDao users receive loans denominated in the stablecoin Dai in exchange as compensation for collateral they put up. But the recent “Black Thursday” crash resulted in hundreds of thousands of lost Eth users had entrusted to the system.

Ethereum’ popularity also does not yet extend beyond the crypto community and the space still holds a negative reputation with certain regulatory bodies. Ethereum is far too technical for the layman to understand, such that adoption of Ethereum dapps still doesn’t extend beyond crypto savvy enthusiasts. As a new market, regulatory standards must be implemented which guarantee open utilization of crypto and DeFi. However, many countries are openly hostile to the cryptocurrency industry

Ethereum, the blockchain which introduced smart contracts, benefits from its own popularity. Because so many dapps have been built on Ethereum and use Ethereum smart contracts, DeFi dapps fit together like pieces of a puzzle. For example, Dai – a stablecoin that uses the Ethereum ERC20 token standard – is the stablecoin most common amongst leading DeFi dapps like Uniswap and Compound. Ethereum also benefits from it's robust community of developers and meme enthusiasts who bring an unparalleled energy to the sector.

Because it is constructed upon the Ethereum blockchain, the DeFi movement also risks being hampered by the technological limitations of the Ethereum blockchain. Given that the contract code for each transaction must be processed by every Etherum node, a proof of work blockchain’s consensus is highly inefficient and cannot process enough transactions at once. DeFi alone has sent prices of gas – the sum paid out to miners who execute transactions and smart contract operations – to up to $50 per transaction, higher than they’ve been at any previous point in Ethereum’s history. To sum up, risks:

Individual projects can have technical vulnerabilities, as well as trust issues with anonymous developers.

Governments must be amenable to crypto and allow DeFi to function in a safe regulatory environment for the sector to take off.

Ethereum – the blockchain on which most of DeFi is based – must have a successful transition to proof of stake. Because it has fewer nodes that need to process each transaction, proof of stake is far more scalable than the proof of work consensus mechanism. Scalability is currently Ethereum’s main technical challenge. Ethereum’s scalability crisis gives room for competing blockchains to rise to the top of the DeFi ecosystem.

Republic Call

DeFi has been called crypto’s killer app and demonstrates public blockchains’ ability to usher in a more open and transparent financial system. While in the past Finance has been marked by opacity, slow-moving services, high fees and a lack of accountability, the DeFi ecosystem gives users possession over their money, provides instantaneous transactions, and can be scrutinized by all.

But for the DeFi ecosystem to continue its march forward it will need to overcome some major technical and regulatory challenges. Firstly Ethereum must have a successful transition to Casper - an implementation that will convert Ethereum from Proof of Work to a scalable Proof of Stake blockchain. If Ethereum cannot overcome its technical challenges, Ethereum will lose its seat at the top of the DeFi ecosystem to forward facing protocols like Algorand and Avalanche. Secondly dapps must safeguard against critical vulnerabilities to ensure users entrust them with their funds. Lastly the regulatory environment under which crypto operates must become more favorable to ensure DeFi dapps can operate without risk of crackdown by governments. And if the DeFi ecosystem cannot surmount these challenges, it will never truly realize the promise of a more open financial system.

This educational article is provided by Republic to help its users understand this area of the market, it should not be construed as investment advice as it is impersonal, disinterested and was produced by Republic for Republic’s users, without remuneration received or expected.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

The discussion will appear here.