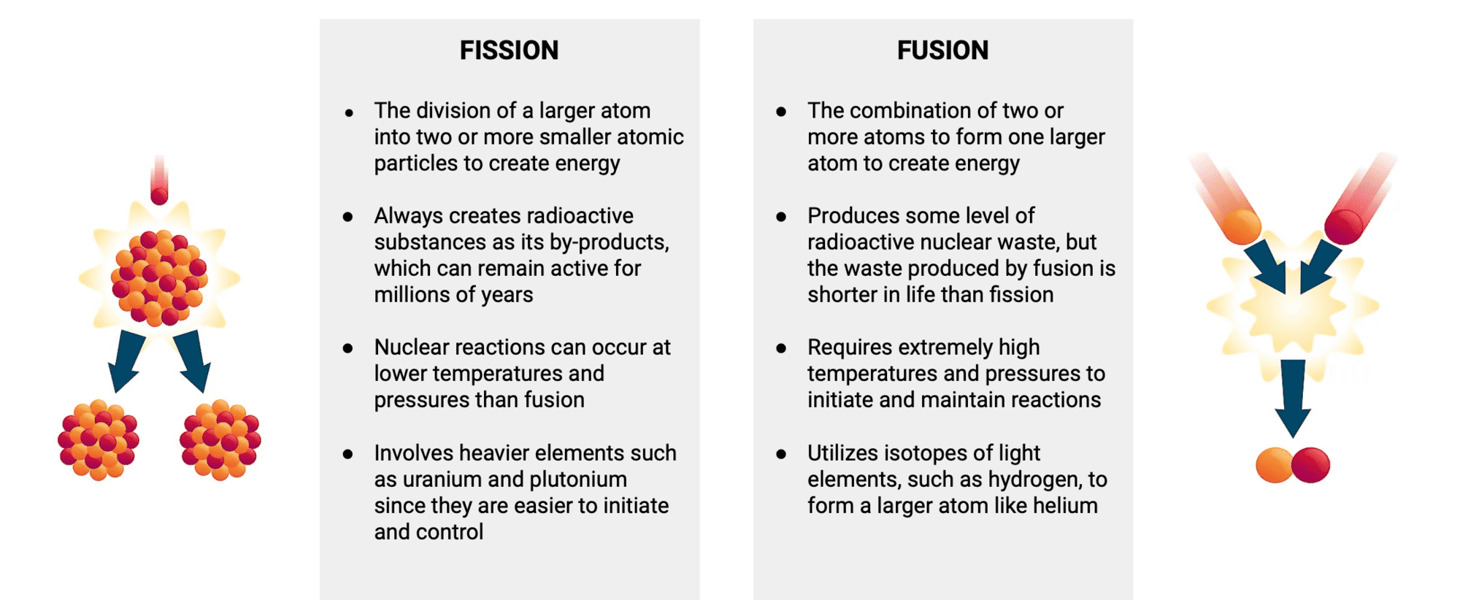

Nuclear reactions are created either through fission or fusion.

Atomic bombs utilize fission, but thermonuclear hydrogen bombs harness both fission and fusion to create much larger explosions.

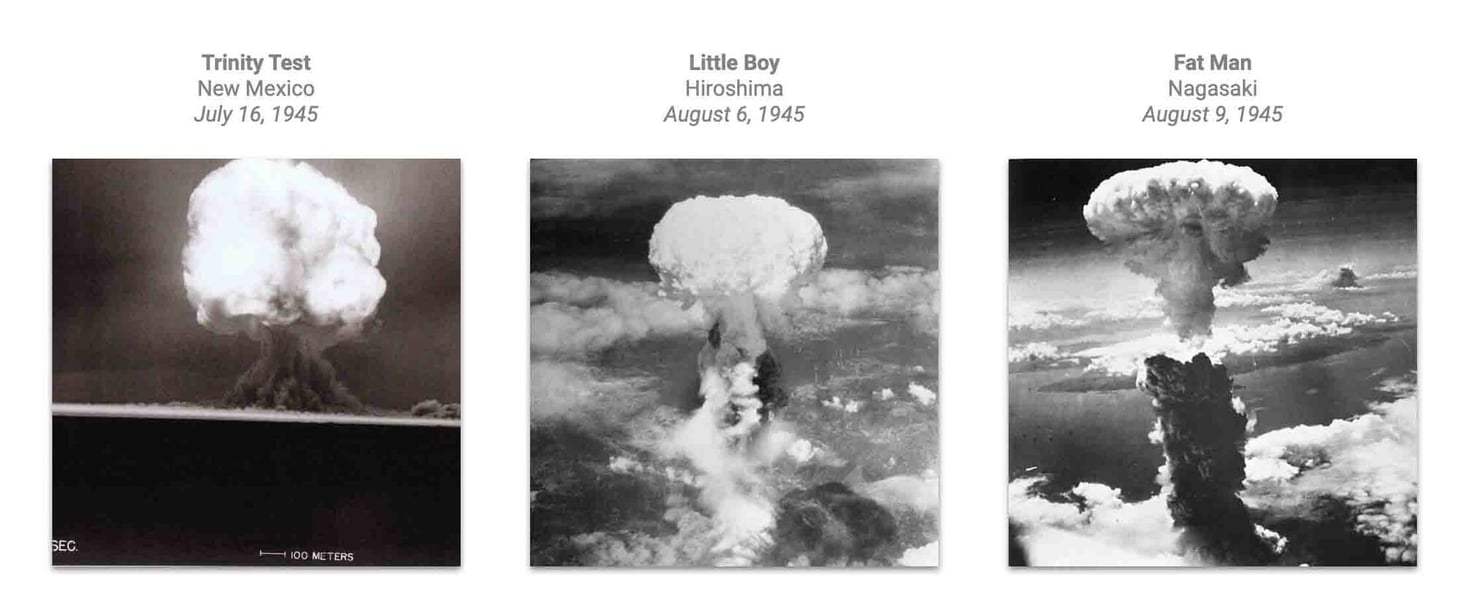

Fission was harnessed to create energy... but weapons came first

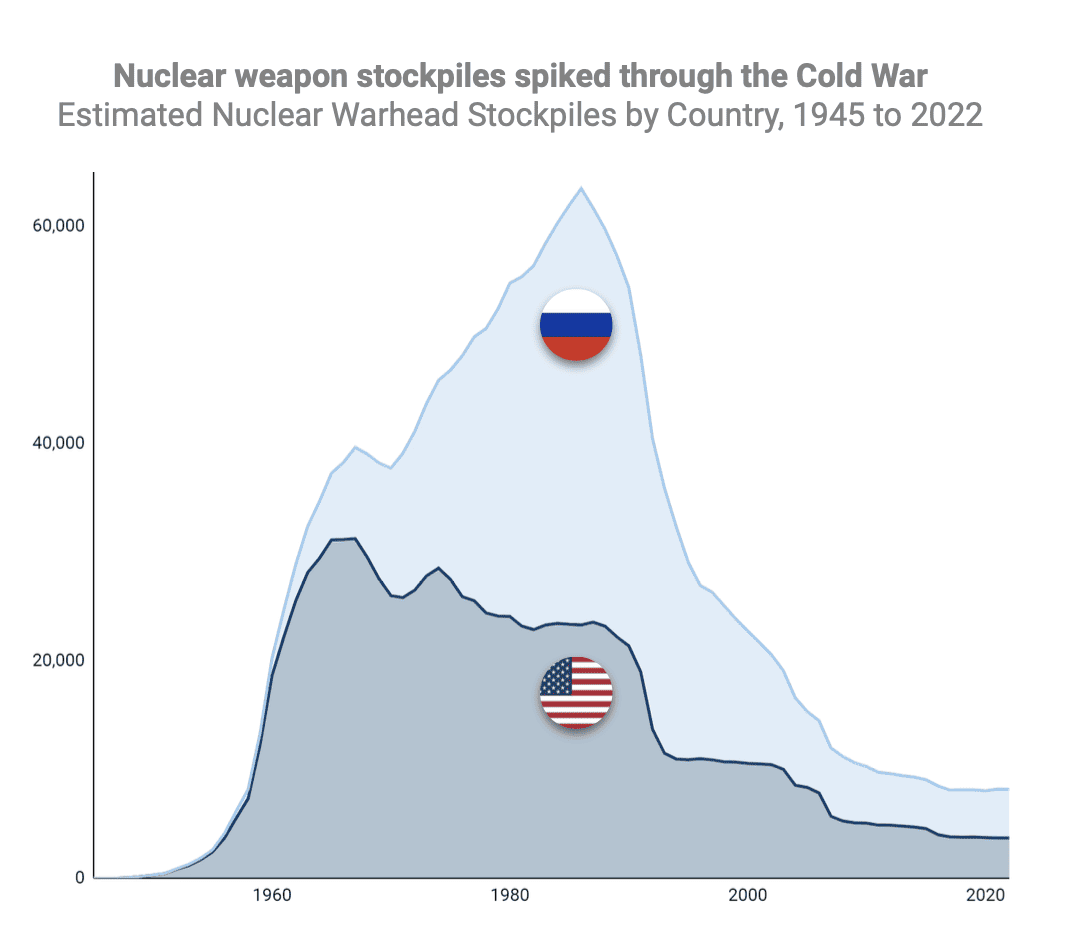

- Following WWII, nuclear weapons technology rapidly evolved. The US conducted numerous tests in the Pacific in the the late 1940s, and the Soviets successfully detonated an atom bomb in 1949. By 1952, hydrogen devices were available, sparking the thermonuclear age and Cold War.

- Before the United Nations General Assembly in December 1953, President Eisenhower addressed the world and proposed a solution to the “fearful atomic dilemma.”

- Eisenhower devoted the US to the development of peaceful nuclear for energy, agriculture, and medicine applications. The debate over nuclear control was transferred from the government to the public.

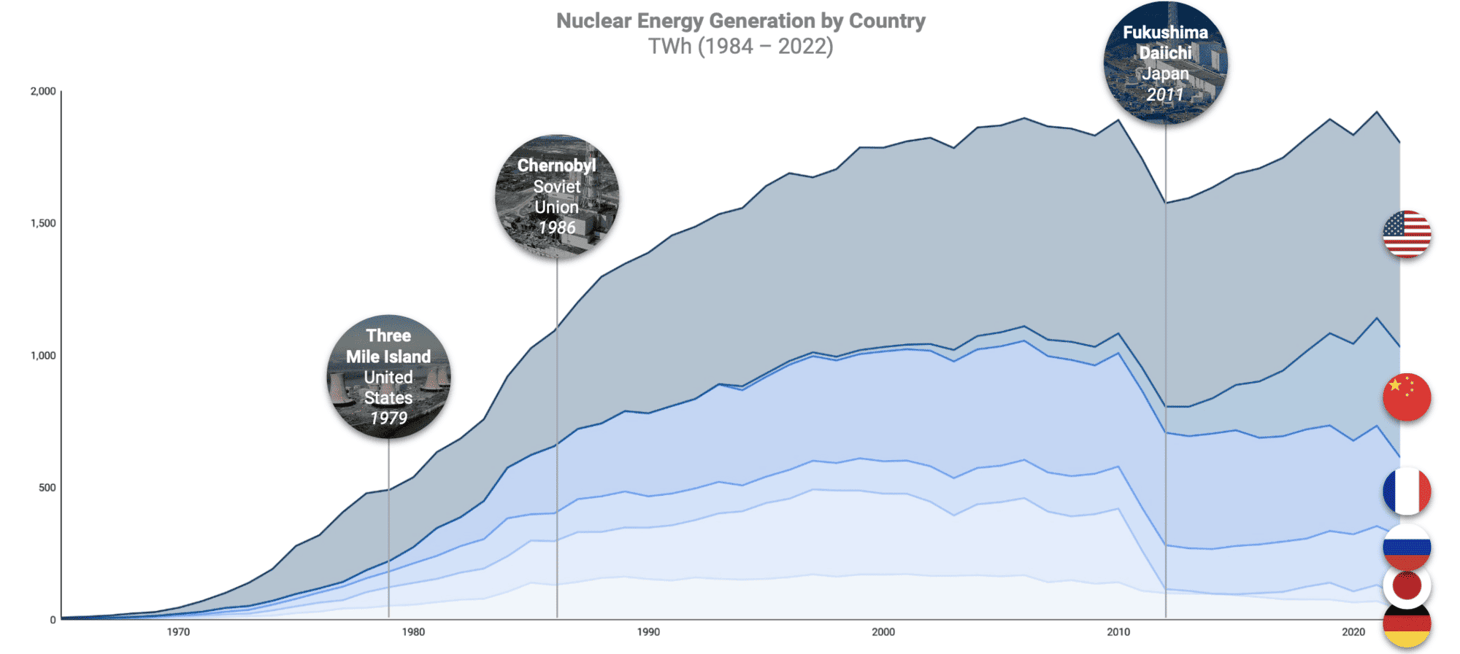

- “Atoms for Peace” resulted in the creation of the International Atomic Energy Agency (IAEA) and launched the civilian nuclear program. Nuclear was now for everyone, even as weapon production escalated. The world adopted nuclear energy as a dense and carbon-free energy source. Since the 1990s, nuclear has accounted for about 20% of the US’s total energy generation.

As nuclear energy ramped, accidents impacted public opinion.

Next-gen reactors will usher in a safe & low-cost era of atomic power.

- Over 60 new reactors are under construction globally with 300+ in the planning / proposed phase. Over 30 governments are working with the IAEA to introduce nuclear power to their countries.

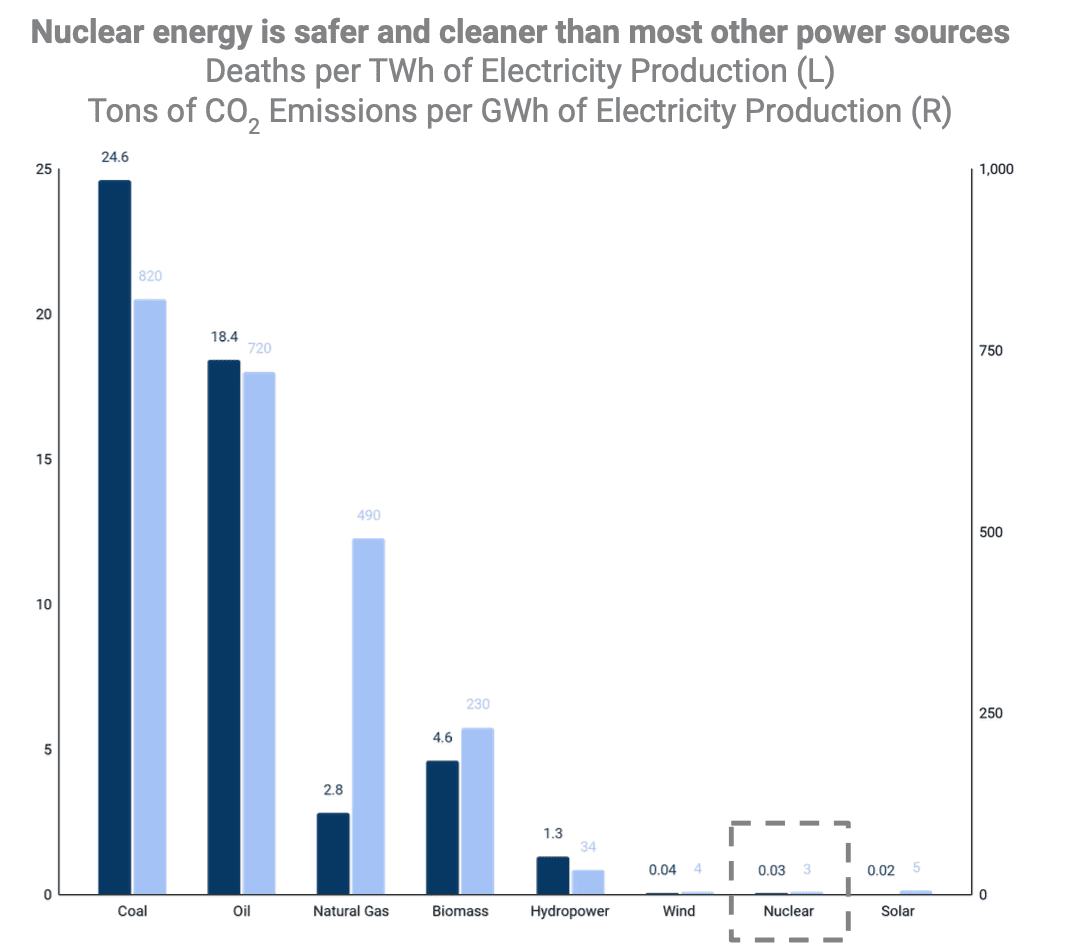

- Nuclear power is considered one of the cleanest energy sources with zero emissions, producing maximum power more than 93% of the time versus 57% for natural gas and 25% for solar power.

- Additional advantages include a small-land footprint and versatility to decarbonize industrial processes.

- Nuclear is also one of the safest energy sources, with only 0.03 deaths per terawatt hour (TWh) of energy generation versus 24.6 deaths per TWh for coal.

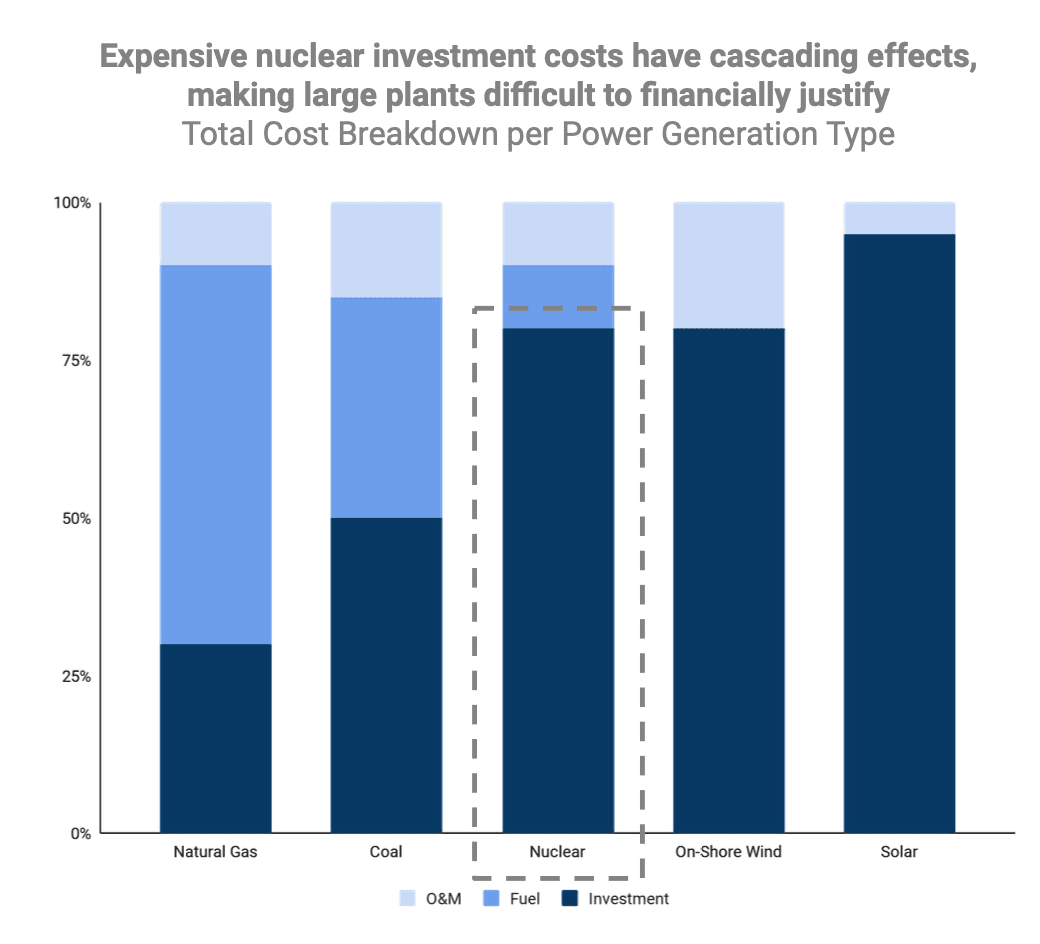

- However, the significant initial cost of new nuclear facilities and outdated scaling methods have limited broader adoption of this energy source. For example, a single large-scale nuclear plant producing 1.6 gigawatts (GW) can cost over $10B to construct.

Regulation

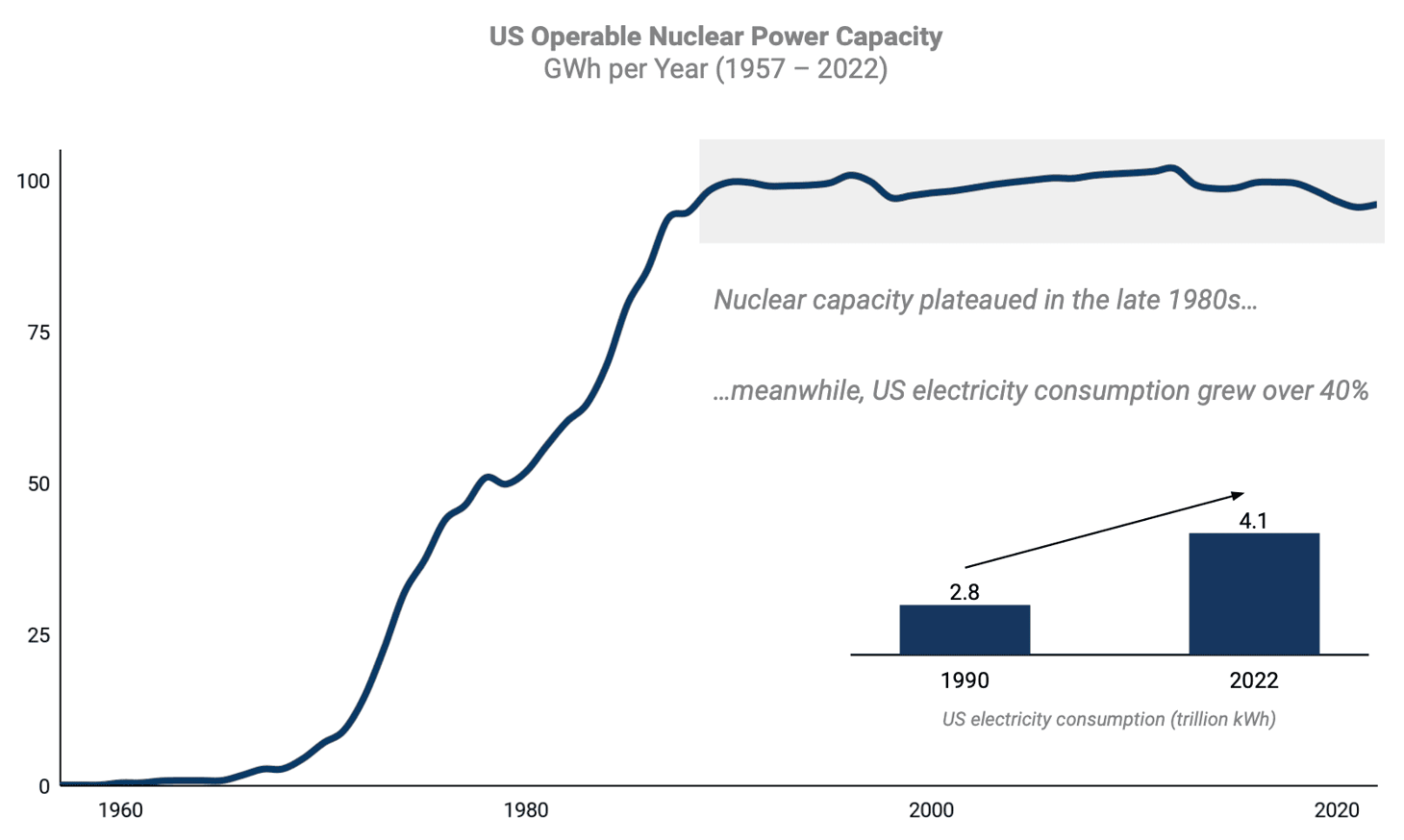

US nuclear capacity has remained stagnant for over 30 years.

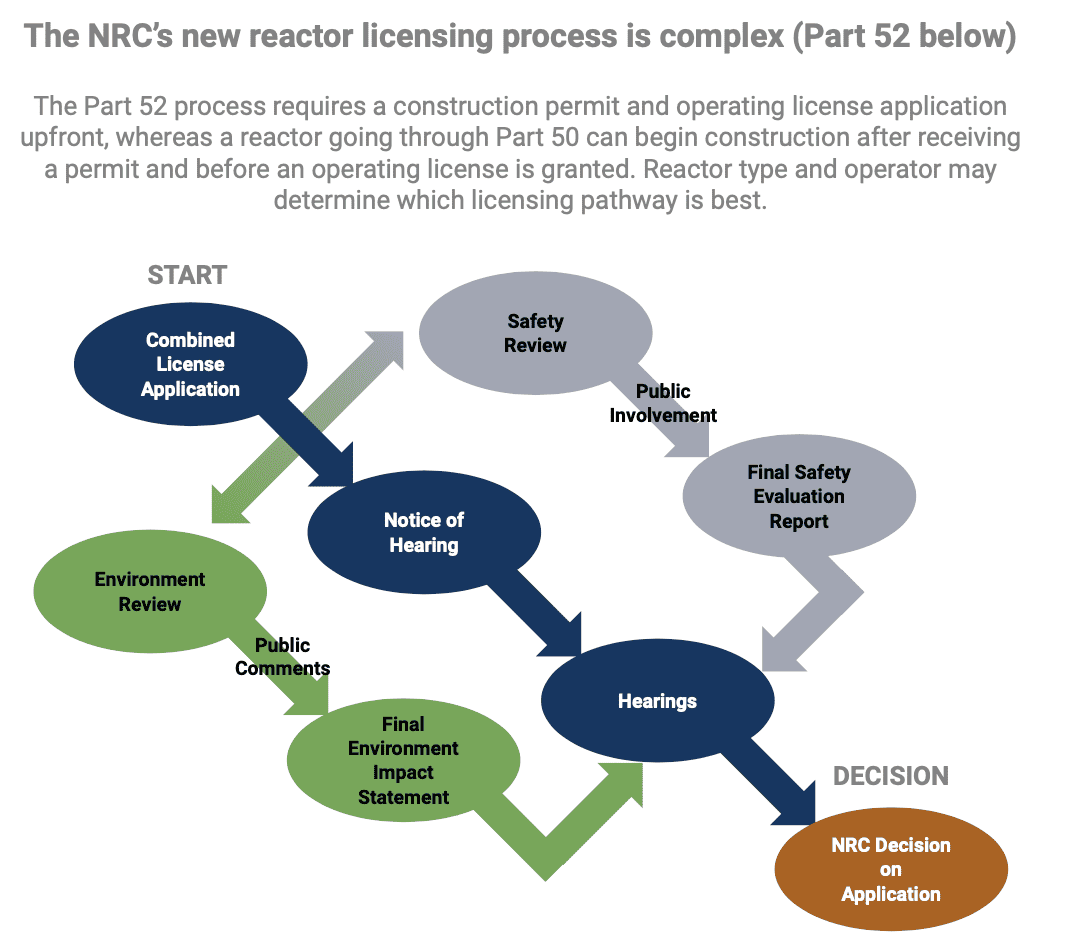

Capacity has stalled in part due to lengthy regulatory requirements.

- Operating nuclear plants are licensed under a two-step process requiring a construction permit and operating license (Part 52). In 1989, a combined license (COL) was introduced to streamline the application process (Part 50).

- The NRC application review process can take up to five years, and involves site selection and design, approval, issuance, and review of the COL. This does not include pre-application engagement nor early site permits.

- In 2020, the NRC approved NuScale’s SMR design, the first SMR ever approved and first new reactor design approved since Westinghouse’s AP1000 in 2005.

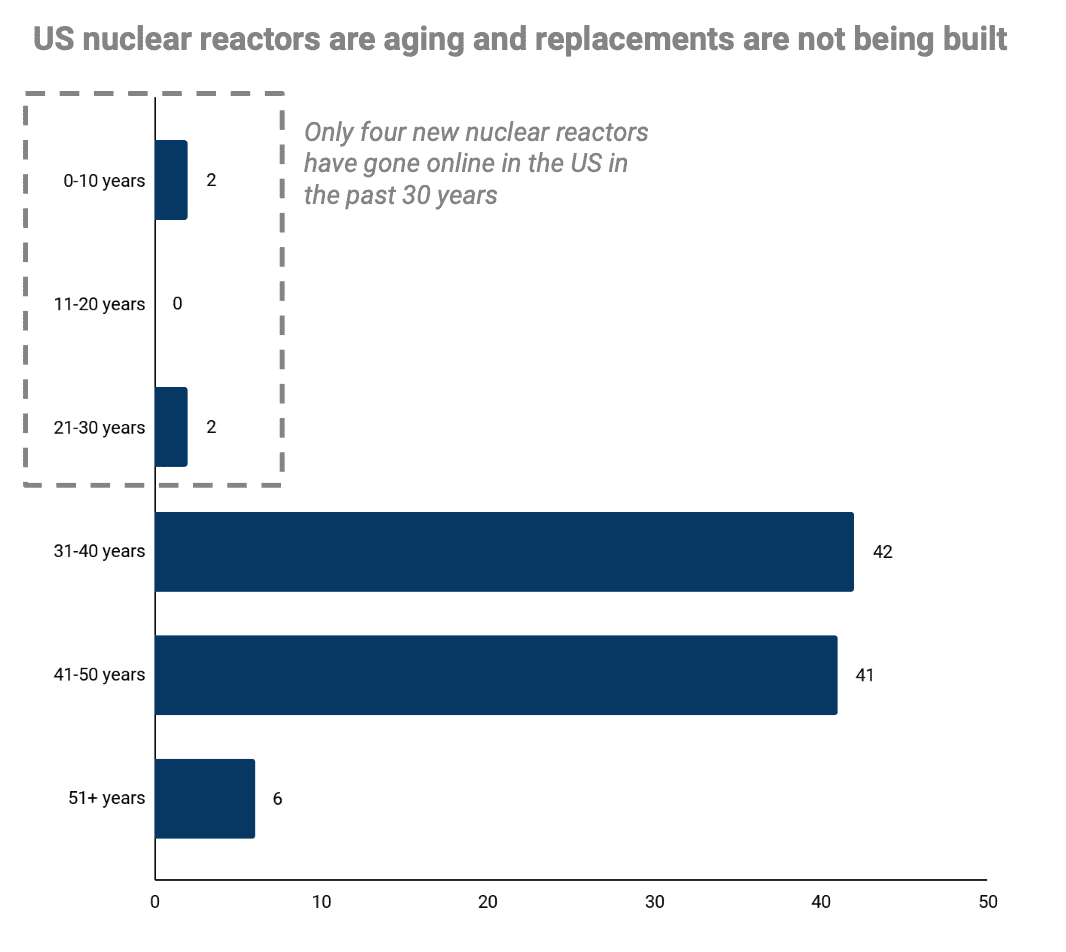

The nation’s nuclear fleet is aging.

- New reactors are granted a 40-year operating lifetime. The NEI notes that half of the US’s nuclear reactors will need to obtain subsequent 20-year license renewals (a decade-plus long process) by 2040. US nuclear reactors can receive two license extensions, for a total operational life of 80 years.

- With old age comes aches and pains. Beyond 60 years, plants begin to experience structural issues, reactor embrittlement, and additional safety concerns.

- Nuclear has provided about 20% of the US’s energy since the 1990s. To address the concern of aging infrastructure, the NRC must fasttrack the licensing process for new advanced reactors.

There are bipartisan political efforts to incentivize nuclear.

Cooperation between Republicans and Democrats throughout Congress has resulted in a number of proposed and passed legislation to spur American nuclear energy leadership. However, there are still political barriers to overcome before all red-tape is lifted.

- In late July 2023, the Nuclear Fuel Security Act passed the Senate 96-3. Through it, the DoE intends to establish a program to increase the production of certain types of low-enriched uranium by US nuclear energy companies. It will also work to make LEU available from its inventories or allies’ to meet the needs and schedules of advanced nuclear reactor developers.

- In July 2023, the ADVANCE Act passed the Senate as part of the NDAA, aiming to boost development and deployment of new nuclear technologies via an overhaul of the NRC. It looks to reduce regulatory costs for companies seeking advanced nuclear reactor licenses, enable the NRC to develop a pathway to timely facility licensing, direct an initiative towards developing advanced fuels, and onboard a specialized staff at the NRC to speed up review of advanced nuclear reactor licenses. Successful implementation could help drastically widen the regulatory bottleneck that advanced reactor companies face today.

- The International Nuclear Energy Act was reintroduced in March 2023 to promote the facilitation of nuclear energy cooperation with ally nations. The goal is to develop a civil nuclear export strategy and offset China and Russia’s growing influence across international nuclear energy development. Bipartisan agreement on combating near-peer adversaries could be the catalyst needed to encourage nuclear innovation.

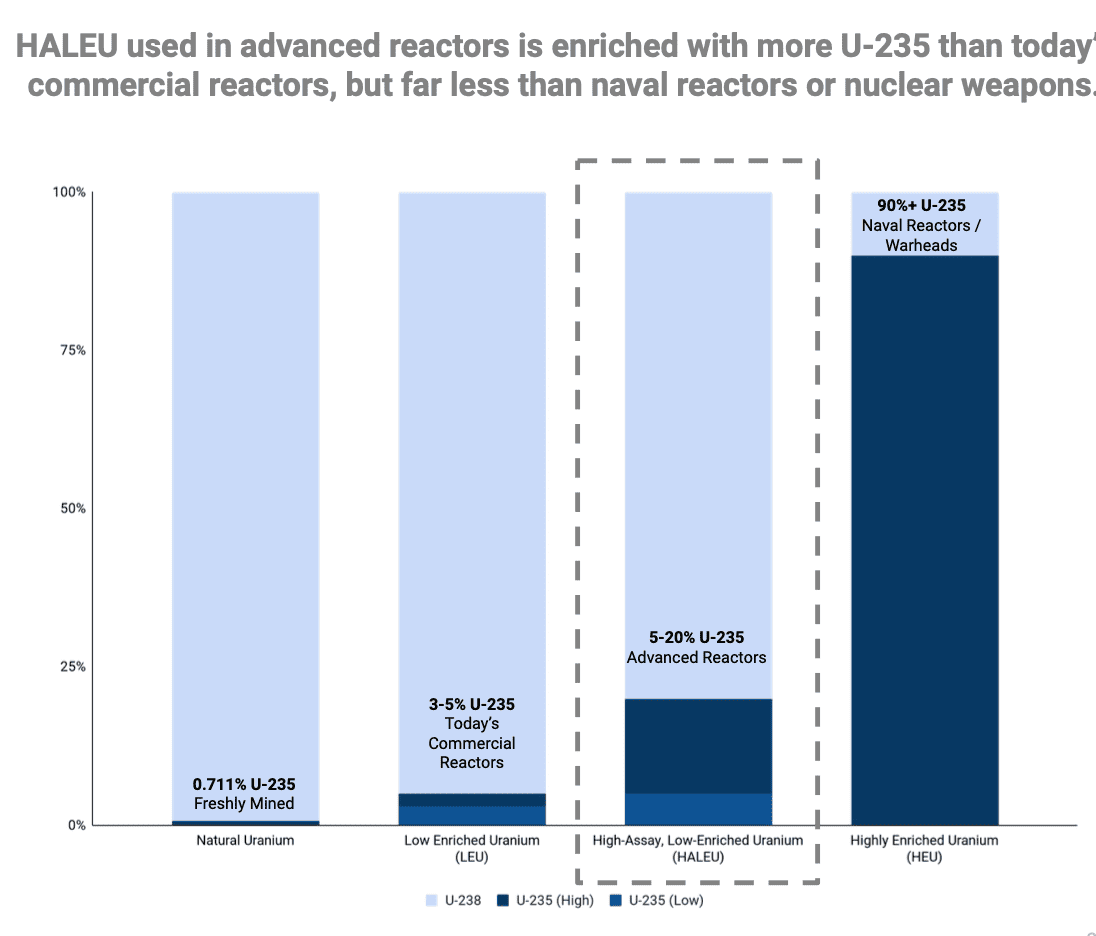

- The 2022 Inflation Reduction Act provided $369B for climate provisions. Benefits for nuclear include: $700M funding for the development of the high-assay, low-enriched uranium (HALEU) supply chain, $40B of loan authority for eligible Title 17 Innovative Clean Energy technology categories (including nuclear), and a zero-emission nuclear power production credit providing up to $15 per MWh of electricity produced by nuclear plants assuming labor and wage requirements are met.

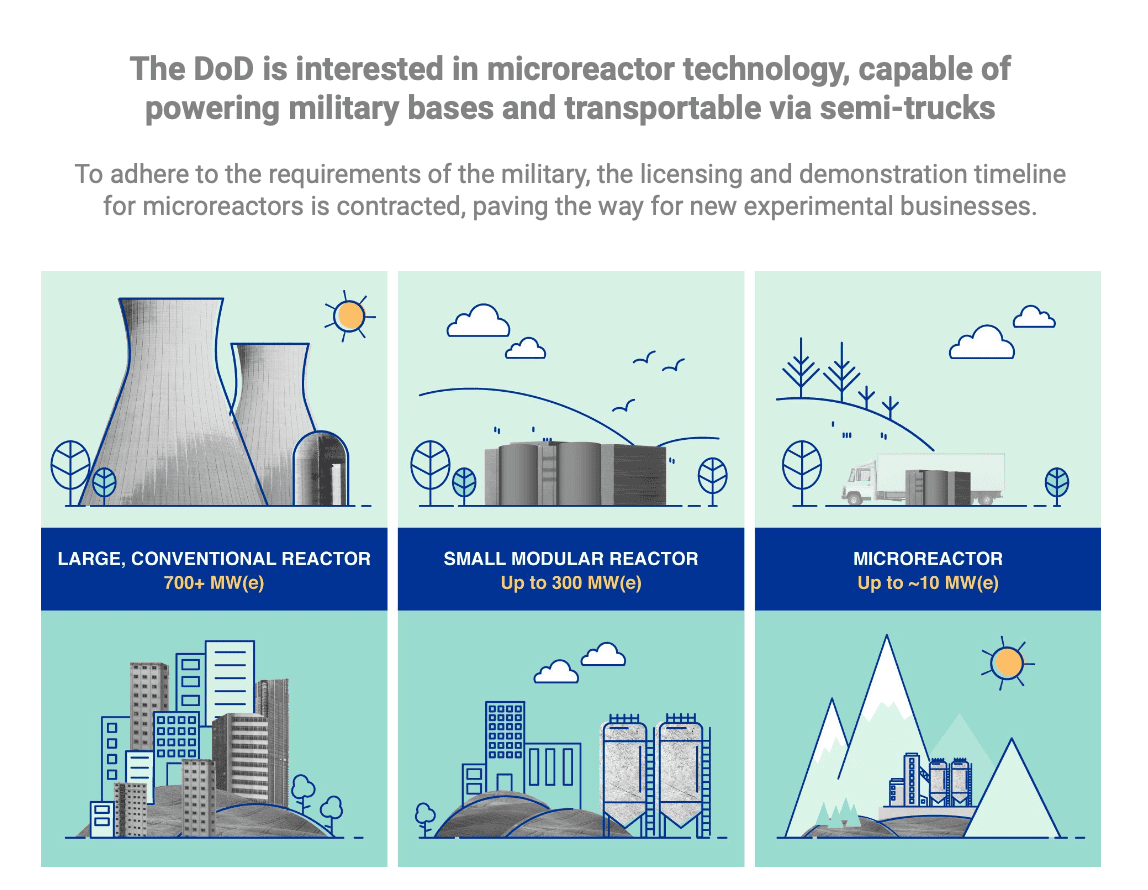

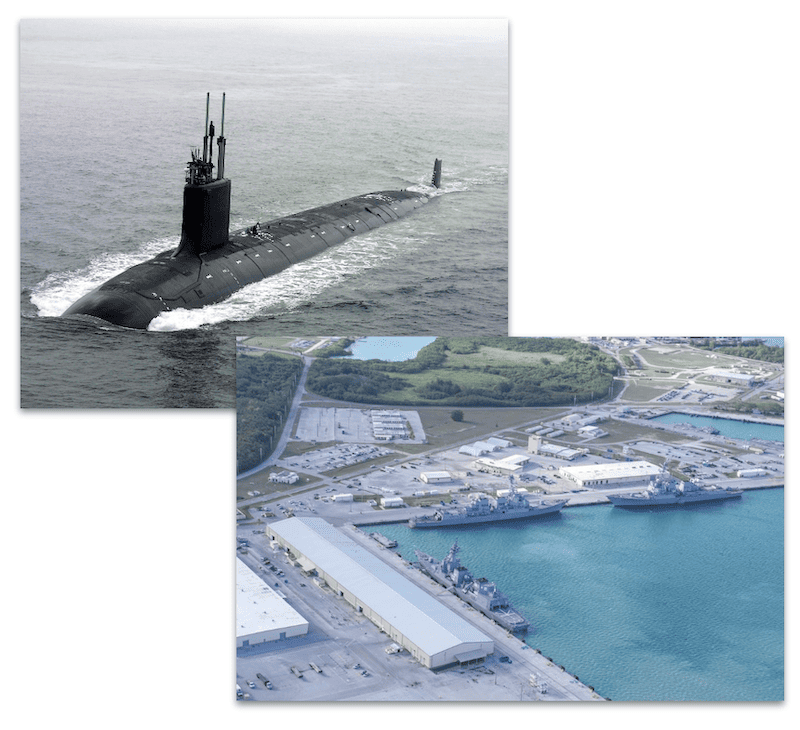

Pathways around the NRC include selling to the Department of Defense.

The US Navy has used nuclear reactors for decades on-board aircraft carriers and submarines. Because these reactors are not for civilian use, selling into the DoD partially circumvents NRC regulations.

- The DoD’s reactor approval process is streamlined to meet strategic needs of the military. China prototyped the first Gen-IV reactor in 2021. Gen-IV reactors are designs that have been under development since 2000. Speed is a top mandate to remain technologically ahead of near-peer adversaries.

- The DoD’s Strategic Capabilities Office is constructing a 1-5 MWe microreactor under Project Pele. This BWXT-designed reactor is slated for operations at Idaho National Laboratory in 2024, and will be the first electricity-generating Gen-IV nuclear reactor built in the US. Project Pele is working with the DoE through a separate regulatory process to reduce future licensing risk and approve module transport.

- The 2024 NDAA includes a briefing on using nuclear microreactors on Guam, encouraging reactor startups to engage with defense customers.

Economics

- While many countries experience rising costs to construct nuclear plants, the United States disproprotionately underperforms, in part due to higher financing and labor requirements.

- 60-80% of nuclear electricity costs come from capital required to build the plant itself. Nuclear plant construction therefore has a large impact on the total cost of electricity produced. Because nuclear plants are expensive with long construction timelines, financing also makes up a large portion of costs, typically around 15-20% of the total.

- To address these capital requirements, nuclear plants are constantly running to produce baseload power, often leading to oversupply and lower (if not negatively) valued electricity prices.

- Additional regulation imposed by the NRC throughout the 1970s and 1980s was responsible for a ~176% increase in plant costs.

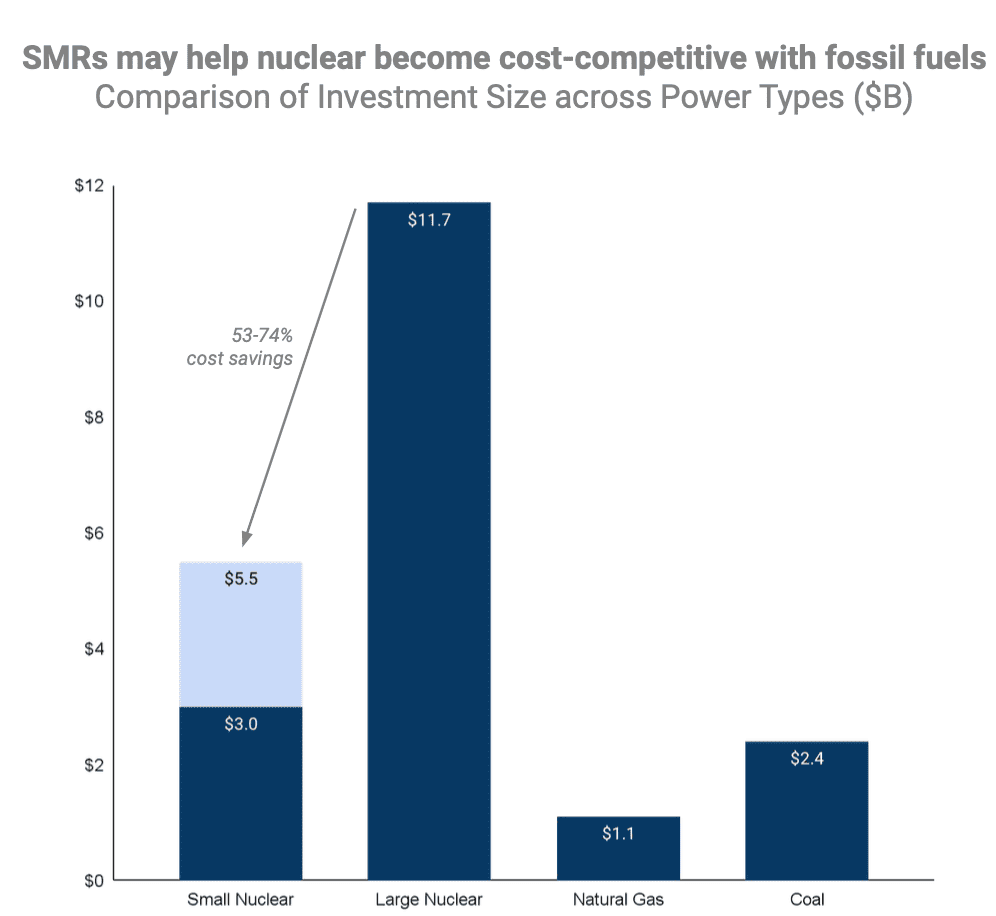

Enter small modular and microreactor technologies.

Small modular reactors (SMRs) and microreactors may offer a lower-scale, decentralized solution to high nuclear plant costs.

- SMRs are a category of advanced fission reactors that have power generation capacities between 50 and 500 MW per unit. Microreactors output less than 50 MW of electricity (MWe) per unit and are 100 to 1,000 times smaller than conventional nuclear reactors.

- Both technologies are safer, and less expensive to build, maintain, and operate. They also offer modular construction, facilitate seamless power grid integration, and in some cases, are transportable.

- Fuel and cooling technologies are the variables that bring SMRs down the cost curve. First though, startups working on advanced reactors will require up-front financing and early contract wins for construction and manufacturing. Further, fuel supply is set to be the largest hurdle for SMR adoption. HALEU is difficult to source following Russia’s invasion of Ukraine, making its domestic production a priority of the DoE.

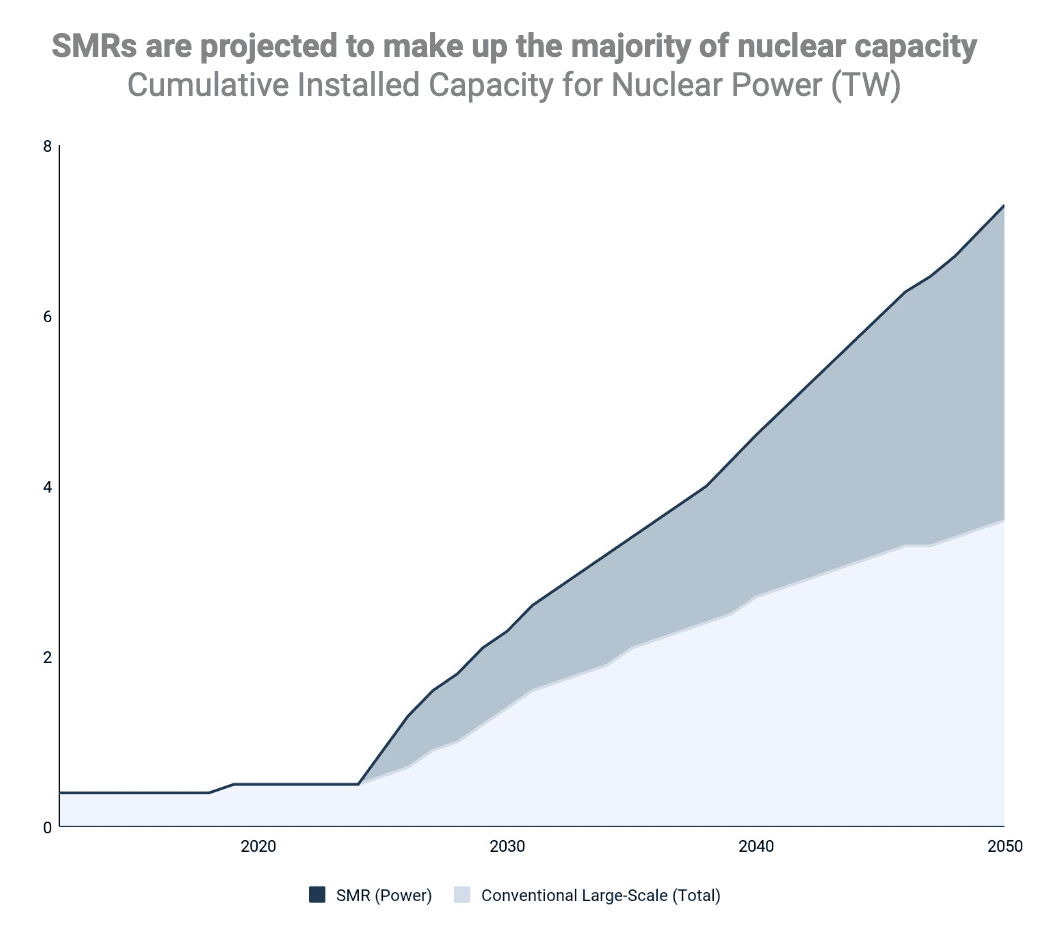

SMRs are on the cusp of upending legacy nuclear-reactor technologies.

- The NRC approved the design of NuScale Power’s SMR, with a 462 MW project set to be running by 2030. This is the first such SMR design to be accepted by the NRC.

- South Korea formed a public-private SMR Alliance partnership comprised of 42 entities to advance Korea's SMR sector. The alliance aims to establish plans to revitalize the country's SMR industry within the next year. Korea is considered an emerging leader in nuclear energy.

- The IAEA created the Nuclear Harmonization Standardization Initiative with 30 countries to accelerate the deployment of advanced nuclear reactors.

- A fleet of Rolls-Royce SMRs in the UK could reduce wholesale electricity prices by 13% and lower price volatility by the early part of the next decade.

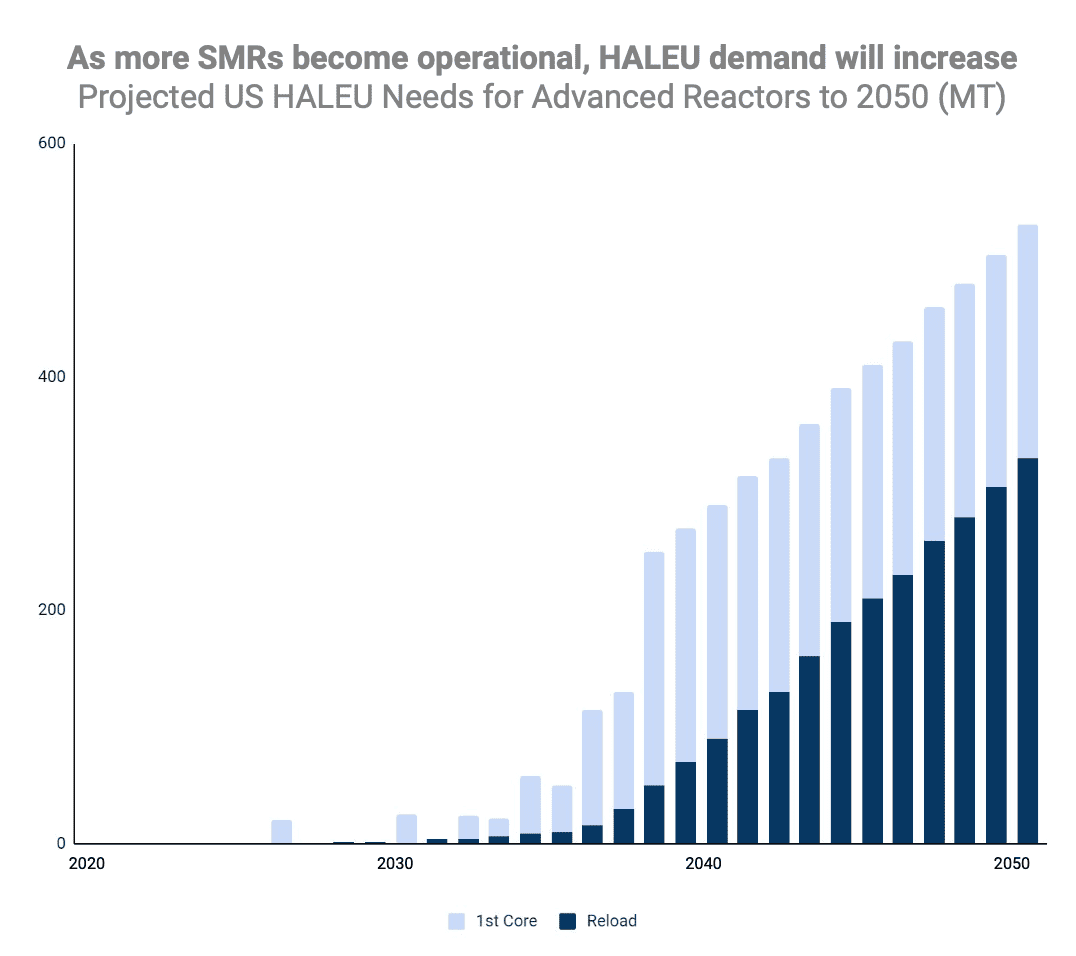

SMR and microreactor growth will drive next-gen fuel demand.

Most SMR and microreactor designs use either high-assay, low-enriched uranium (HALEU) or a subset of HALEU called tri-structural isotropic (HALEU TRISO).

- HALEU is enriched to between 5% and 20% U-235, providing advanced reactors superior power generation characteristics to compensate for smaller reactor size and less overall uranium requirements once fueled.

- HALEU TRISO is a leading-edge nuclear fuel with superior safety features, consisting of a uranium-carbon-oxygen kernel encased in three layers of carbon and ceramic materials, which makes it melt-resistant and capable of withstanding extreme temperatures. It is currently used in China's HTR-10 and Japan's HTTR experimental reactors.

- The US is developing a HALEU fuel supply chain to meet anticipated demand from SMRs and microreactors. Currently, Russia's TENEX is the sole HALEU supplier. According to the DoE, US HALEU demand is projected to reach 40 tons annually by 2030.

Macro

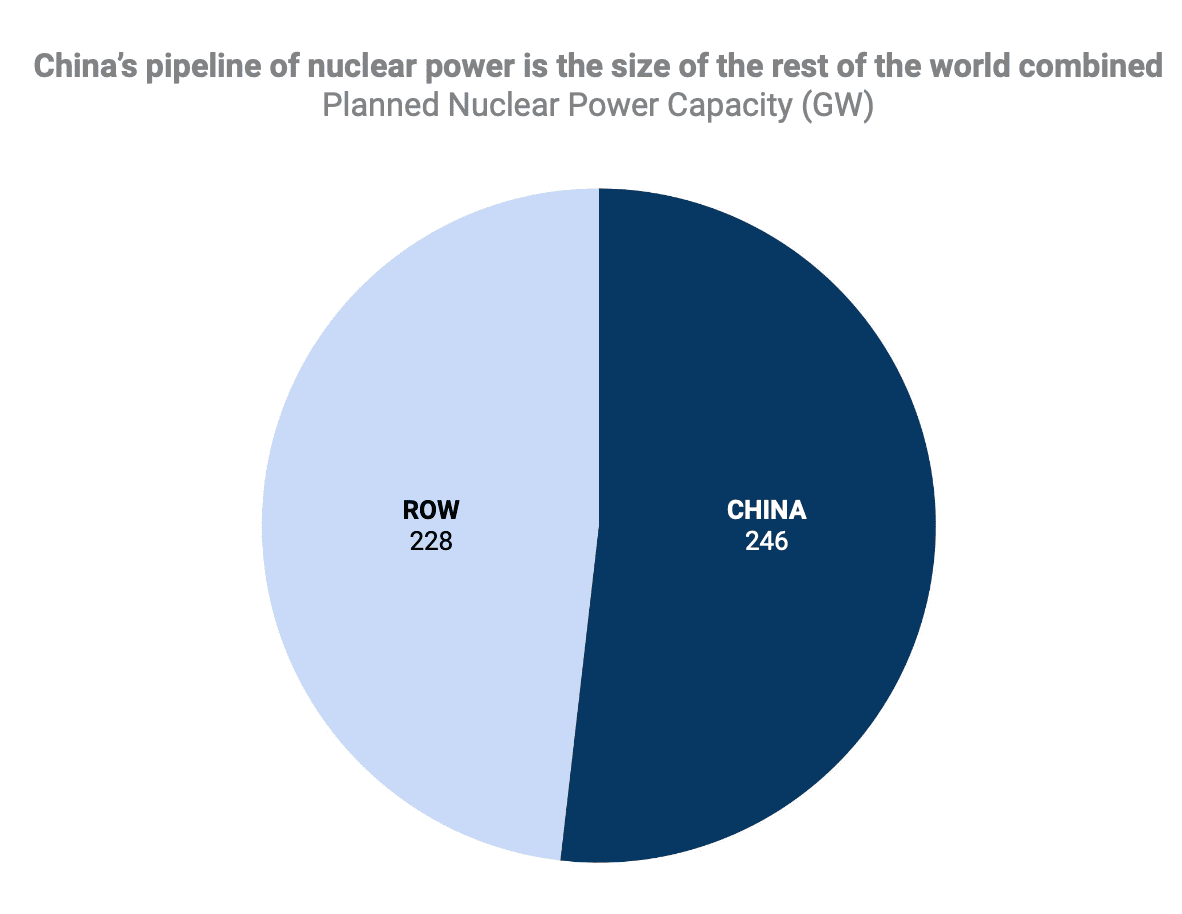

China is quickly bringing its own reactors online.

China was a country late to the nuclear power party. While the US and Europe began building out nuclear capacity in the 1960s, China did not connect its first nuclear power station to the grid until the early 1990s.

- China leads the world in solar, wind, hydro, and coal power generation, but falls short of the US in nuclear power capacity. This is likely to change given China’s future pipeline of nuclear power. The country’s planned 150 reactors, at a cost of $440B, exceeds reactors built by the rest of the world combined over the past 35 years.

- China’s interest in nuclear stems from its climate goals. It has pledged to peak carbon emissions before 2030 and reach carbon neutrality by 2060. Given that ~60% of the country’s power continues to come from coal, nuclear will be a priority as it offers low-carbon baseload power. The country will have to ensure that growing energy demand, which is up 10x since 1990, is not serviced via fossil fuels.

- China’s pipeline is not constrained to its borders, rather it is leveraging surrounding nations for the construction and deployment of these reactors, including Pakistan and Argentina.

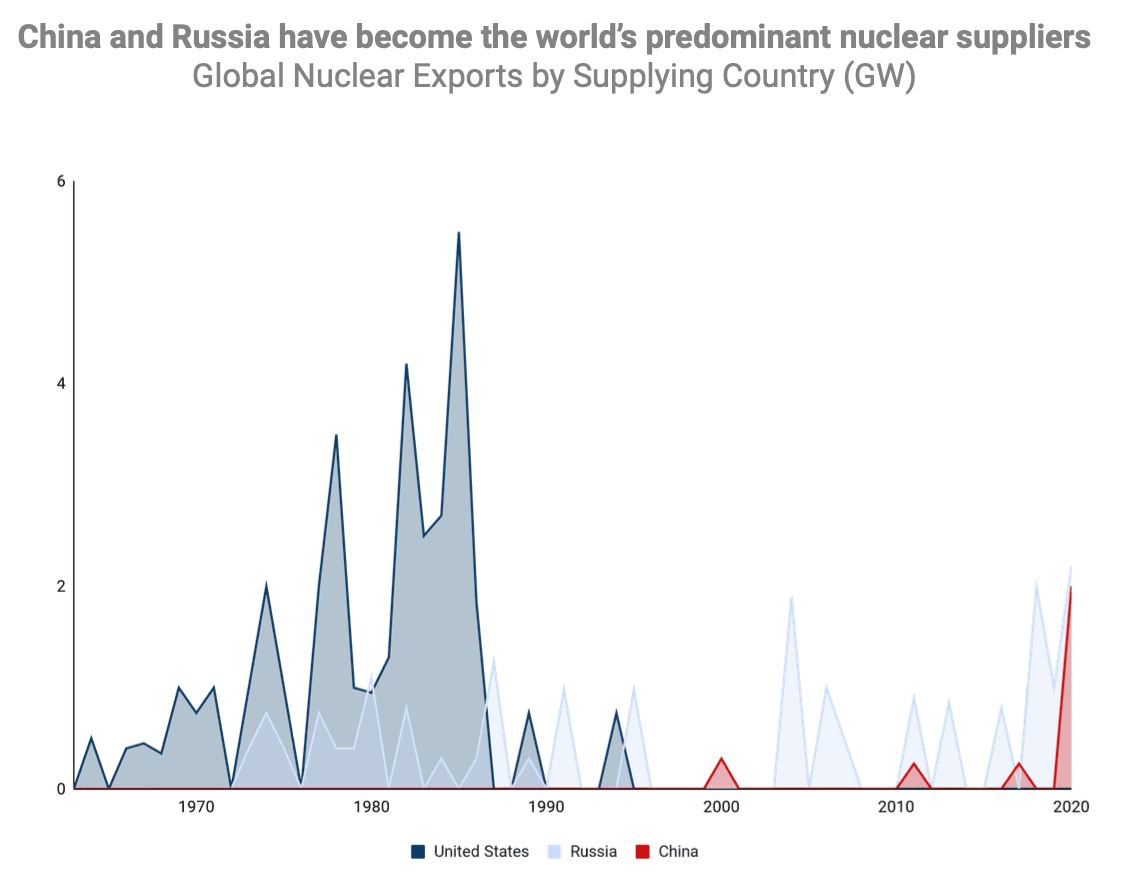

The US lags behind China and Russia in nuclear reactor exports.

Nuclear exports are an important and understudied part of China’s Belt and Road Initiative (BRI). Beijing plans to build and finance about 30 nuclear reactors, worth $145.5B, across BRI countries by 2030.

- China and Russia account for 70% of reactors under construction or in planning worldwide. Nearly half of the countries’ planned reactors are being constructed outside of the country. The larger China and Russia’s share of the nuclear market, then the more pull the countries will have in shaping rules and norms in global nuclear governance.

- China’s homegrown Hualong One reactor is compliant with European safety standards and cheaper and faster to build than comparable American reactors. China is already financing foreign-made reactors across Asia, Europe, and South America, providing up to 85% in total requirements upfront. China expects to overtake the US in nuclear energy generation by 2030.

- The Nuclear BRI will likely increase China’s sphere of influence around the world, providing them access to additional infrastructure projects at the expense of the US. Similarly, Russia’s nuclear power diplomacy is extending to BRICS hopefuls.

Nuclear has a broad spectrum of use cases beyond just power generation.

Opportunity

Republic Capital Nuclear Theses

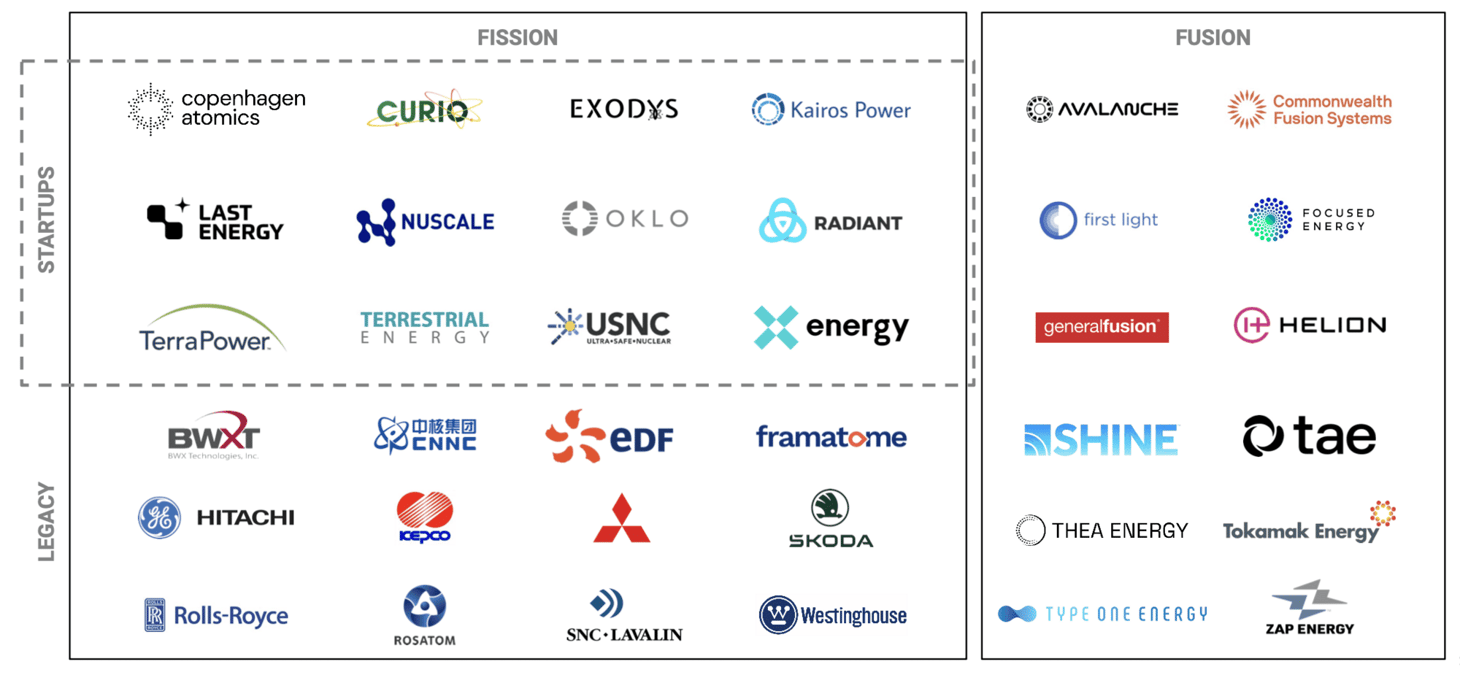

Investing into nuclear reactor companies is crowded and expensive, with unsupported valuations. We believe that the timeline to exit, across both civilian fission and fusion, is incompatible with venture timeline expectations due in part to regulations. Therefore, we have identified four verticals which will support our near-term investments into nuclear.

- Military Applications: The Department of Defense has indicated its interest in nuclear microreactors for various use cases. Companies building reactors for the military will have the opportunity to operate outside of the traditional regulatory oversight of the NRC.

- Nuclear Waste Disposal: There are still opportunities in legacy nuclear. Critical processes, like nuclear waste disposal, are still unsolved and will require government and commercial stakeholders to work together to find a permanent solution.

- Medical Isotopes: The production and utilization of medical isotopes are vital for various diagnostic and therapeutic applications in healthcare. For the next generation of medical innovation to develop, the stable and safe supply of these atoms is crucial.

- HALEU Supply Chain: High-assay, low-enriched uranium (HALEU) is required for many advanced reactor designs. The HALEU supply chain will need to be updated in order for domestic production to support the growing demand backlog.

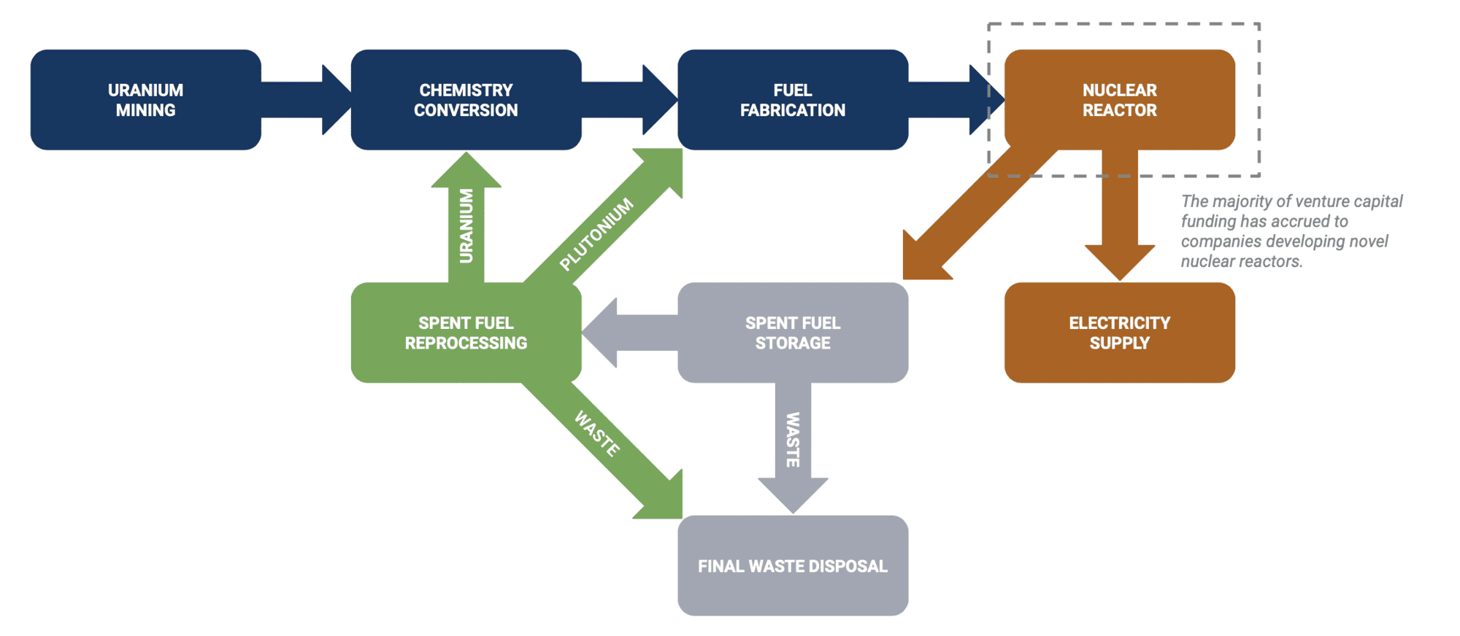

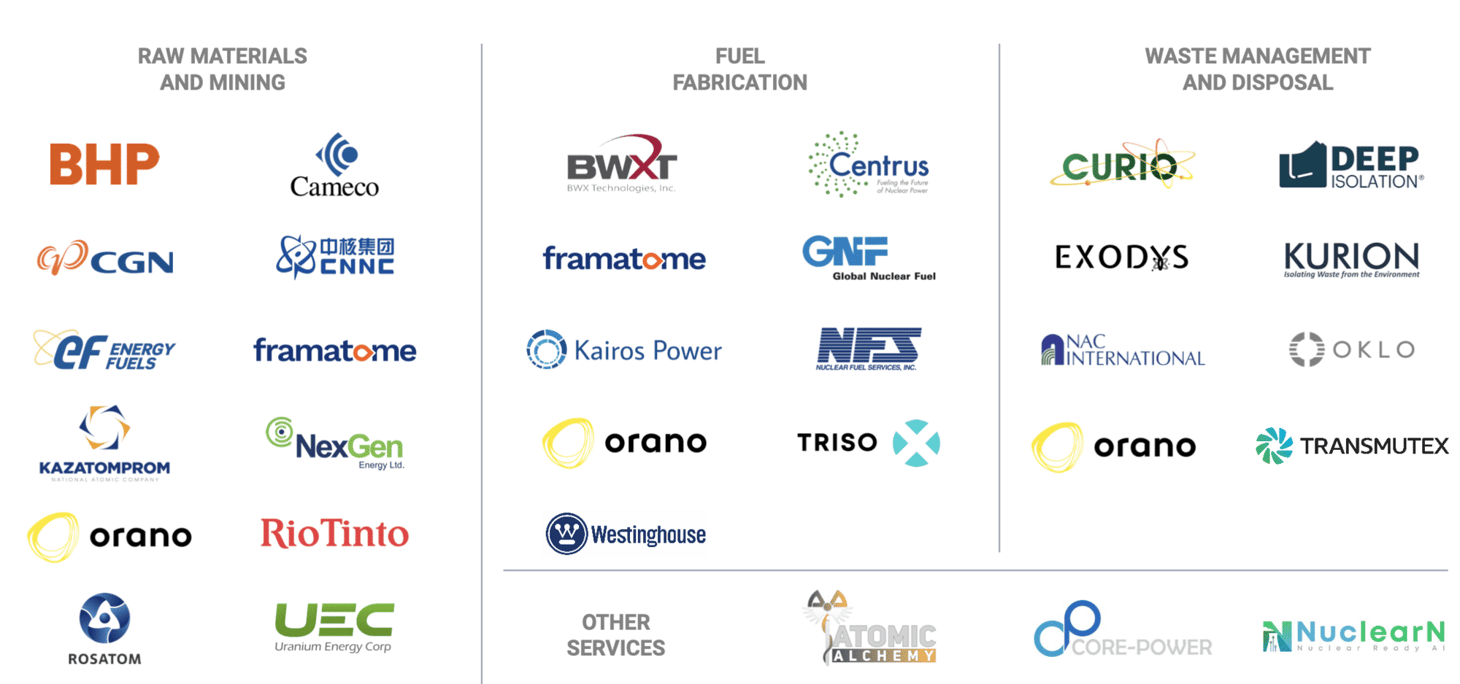

There are investable opportunities across the nuclear value chain.

Non-exhaustive nuclear reactor market map.

Non-reactor companies across the nuclear value chain.

Selling into the DoD enables circumvention of NRC restrictions.

The DoD is a buyer of microreactors and looking to expand its terrestrial and 83-ship strong naval nuclear fleet. A 2016 study found the DoD has a need for a mobile, resilient power source which does not require a long logistics tail. Portable nuclear is the ideal solution to address the military’s needs.

- Energy usage on the battlefield and at military bases is likely to increase significantly over the next few decades, making energy delivery and management a continuing challenge. Project Pele is a cross-governmental initiative developing a transportable microreactor. The first location for a reactor would likely be Anderson Air Force Base on Guam with further plans to deploy a stationary microreactor at Eielson Air Force Base in Alaska.

- Pele aims to address all key areas of nuclear energy uncertainty, streamline a regulatory regime, and act as a pathfinder to advanced commercial nuclear reactors.

- We view Project Pele and the DoD’s interest in nuclear as a stepping stone for companies to develop reactors with regulatory hand holding, before commercializing with approved designs. There is a chance that the DoD develops its own regulatory framework, piggybacking off of the DoE’s guidance over Pele.

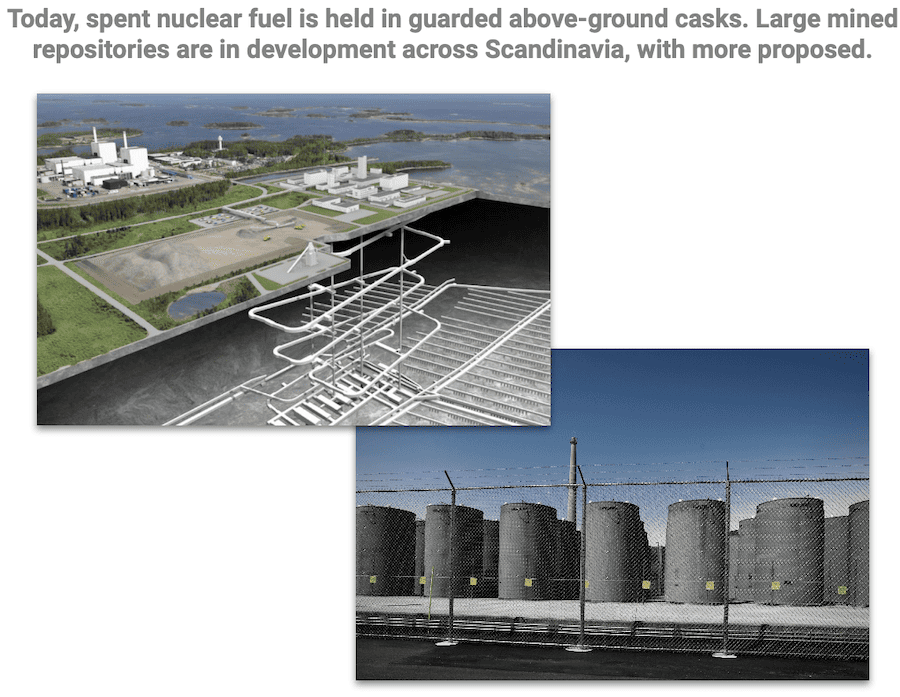

Permanent nuclear waste disposal is still an unsolved problem.

The unanimous top problem that the multitude of stakeholder groups have with nuclear energy is radioactive waste.. While there have been innovations across fission reactor designs, there have been no significant developments that address the $500B+ global unsolved nuclear waste disposal issue.

- The DoE is responsible for the US’s management of spent fuel following a 1987 Amendment to the Nuclear Waste Policy Act. All of this high-level waste is currently sitting in temporary storage in concrete-encased, above-ground casks which are reaching the end of their 40-year lifetimes. Annual spend on maintaining and constructing these sites is estimated at over $2B in the US, with global expenditure exceeding $10B.

- Large mined repositories, like those under development in Finland and Sweden, are another potential waste disposal solution. However, these mega-projects are incredibly complex and expensive, requiring additional regulatory oversight – a primary reason why Nevada’s Yucca Mountain never came to fruition.

- Companies like Deep Isolation are developing novel solutions to permanently store nuclear waste in geological boreholes for a fraction of the cost of mined repositories.

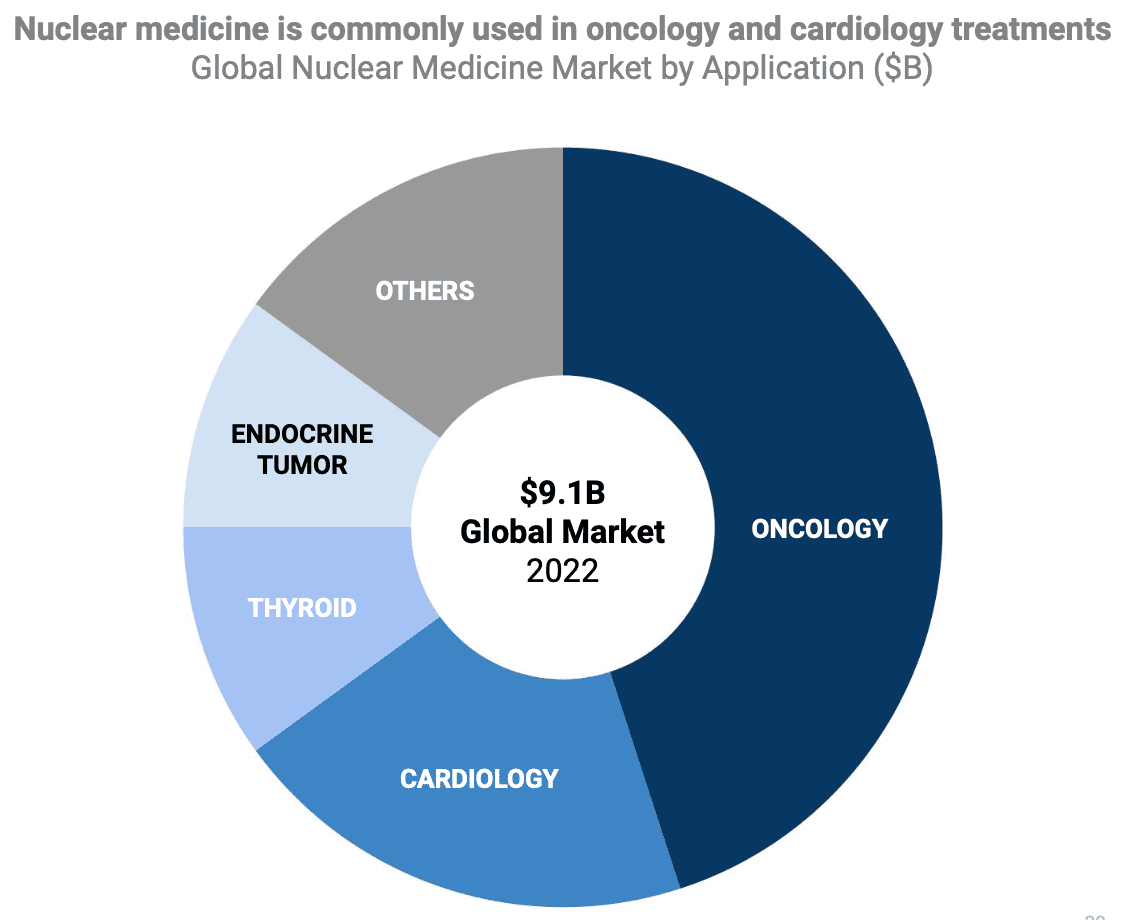

Radioactive isotopes are in high demand in the medical field.

Nuclear medicines use radioactive isotopes to provide diagnostics and treatment. Over 40M nuclear medicine procedures are performed each year, and isotope demand continues to climb. Primary opportunities for medical isotopes lie across scans and cancer therapies.

- There is a worldwide shortage of radioisotopes with supply constrained by high-cost, low-efficiency reactors abroad.

- Radiotherapy is used for cancer treatment by bombarding tumors with ionizing radiation to kill cancer cells. Another common use case is tracers, which are ingested or injected into the body to coat the entire body or target specific organs. The emitted radiation can be captured by various imaging techniques like SPECT or PET, allowing physicians to examine organ function.

- Isotopes for nuclear medicine do not have a long shelf life and long-term supplies cannot be maintained. When research reactors experience unexpected downtime, there can be a shortage of many critical isotopes like Mo-99 and Tc-99m. Securing this supply chain with always online reactors would help address this problem.

- There is currently no domestic supply chain for HALEU in the US, a blow to emerging SMR companies. Potential reactor customers need to have confidence that fuel will be available for the life of the reactor. Centrus Energy received the first NRC license for HALEU production in June 2023.

- In addition to commercial needs, Project Pele’s microreactor will be HALEU-fueled. If the military elects to deploy even a modest number of additional microreactors, it could result in a large demand for HALEU. HALEU is used at many university research reactors worldwide and can also be used for production of lifesaving medical isotopes.

- The Inflation Reduction Act invested $700M to support the development of a domestic HALEU supply chain through September 2026. Allocators have the opportunity to invest with these tailwinds across manufacturing and transportation.

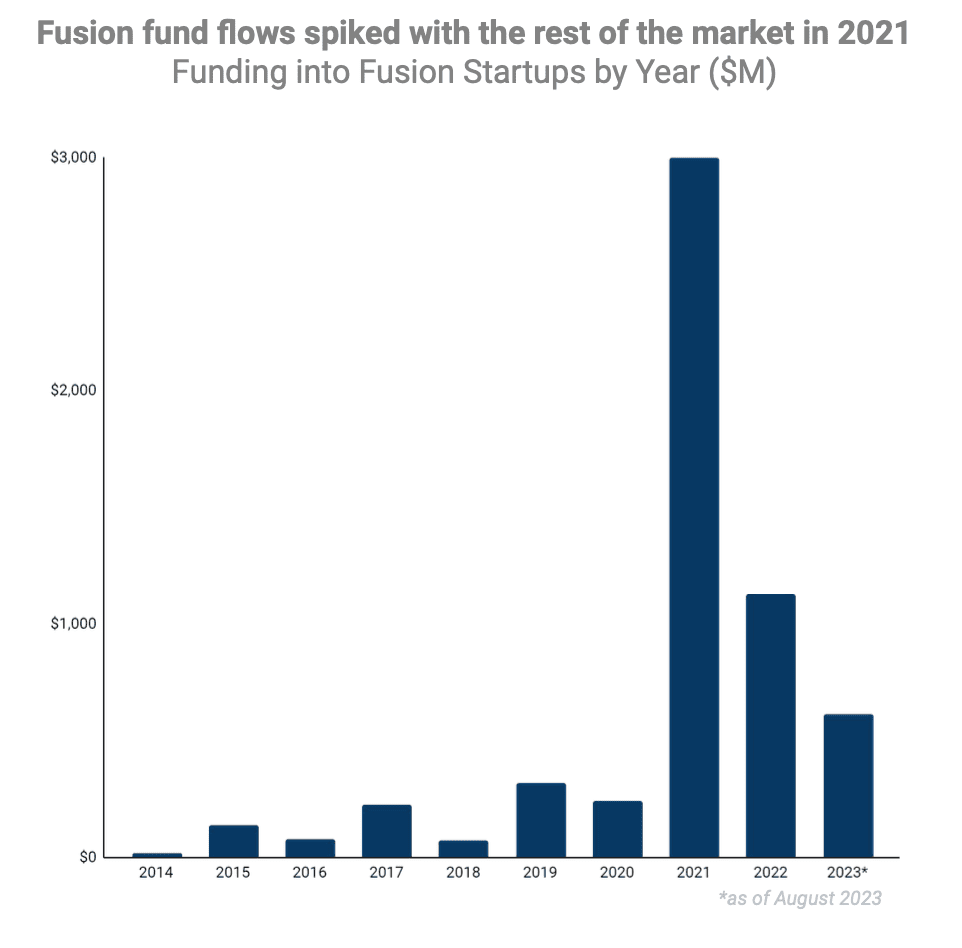

Fusion is far out on the venture curve, but has huge upside potential.

Some experts believe commercial fusion is still 30+ years out. While it may take a while to become commercially viable, the first fusion company to demonstrate clean energy creation at scale will likely be pushed through regulation and distribution, generating a multi-hundred billion dollar outcome.- In December 2022, the DoE achieved fusion energy breakeven at Lawrence Livermore National Laboratory. While there was a 1.5 MJ net energy gain, the reaction used 300 MJ from the grid, so overall energy was lost during the experiment. The reaction was not sustained, and therefore while fusion is possible, it's not yet scalable. In August 2023, the lab replicated the experiment and a higher net energy gain was achieved.

- In early 2023, the NRC officially voted to regulate fusion differently than fission, approving a regulatory framework for fusion systems. It builds on the agency’s existing process for licensing the use of byproduct materials: 10 CFR Part 30.

- Startups such as Commonwealth and Helion have already received considerable funding, $2B and $573M, respectively, at multi-billion dollar valuations. There is some investor appetite for potentially groundbreaking fusion startups which could become generators of near-infinite energy. However, these companies are very difficult to technically underwrite.

Public market activity highlights an exit path for nuclear startups.

We believe the nuclear investment opportunity remains in the private markets for the time being.

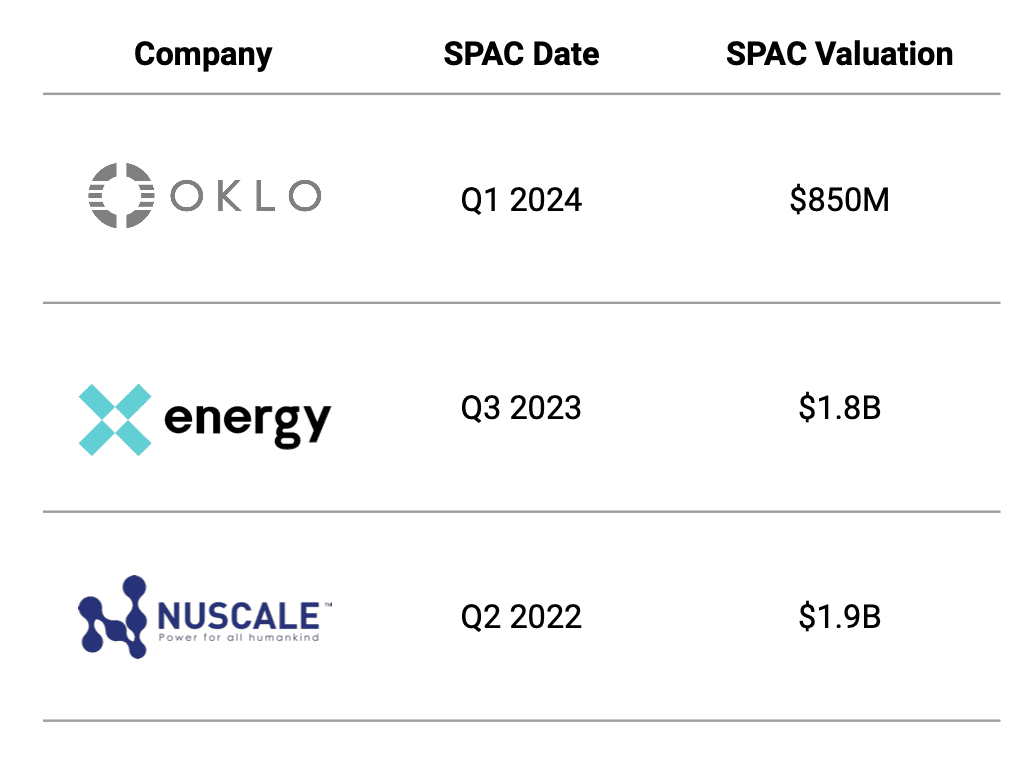

- The public market’s perception of nuclear development has remained relatively strong to start 2023. There have been numerous large SPAC announcements, highlighting investor appetite to back nuclear-based startups and a viable path to exit liquidity for venture investors.

- Recent SPAC announcements include Oklo and X-energy. Oklo is planning to go public in early 2024 at an $850M valuation via Sam Altman’s SPAC and X-energy will go public through Ares Acquisition Corporation at a $1.8B valuation.

- Publicly-listed nuclear stocks include BWX Technologies ($BWXT) and NuScale ($SMR). BWXT, founded in 1867, has a market cap of $6.7B. NuScale, which went public via a SPAC in 2022 at a $1.9B valuation, has since traded down to a market cap of $1.4B.

- Broader ETFs with nuclear exposure are also available on the public markets, with Global X Uranium ETF ($URA) being the primary index. $URA is outperforming the S&P 500 by ~6.2% YTD and underperforming the NASDAQ by ~18.7% YTD.

If you're a qualified investor and want more to learn more about Republic Capital, please email research@republiccapital.co.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...