Lebron James, Tom Brady, and JJ Watt enjoyed long and successful athletic careers. Turns out they’re also all private investors in an emerging asset class: English football clubs.

While they all might have different reasons for investing, one trait unites them: English football has the potential to be an increasingly valuable asset.

Lebron and his partner, Maverick Carter, pioneered the movement in 2011 by investing $6.5 million in Liverpool, one of the most famous teams in the world. That stake is now valued at roughly $44 million.

Of course, club valuations are highly influenced by the team’s performance on the field and the financial performance off the field. Lebron’s investment has benefitted from the best recent period in Liverpool history on both fronts including Premier League, FA Cup, and Champions League victories.

English football’s promotion and relegation system can lead to significant swings in valuation. Teams moving up the ladder see their valuations rise, especially in moving from the EFL Championship, England’s second flight, to the Premier League. Relegation to the next league down has the opposite effect, leading to a fall in club value and losses for investors.

That’s exactly what just occurred to Tom Brady and the investment firm, Knighthead Capital Management with Birmingham City. The group purchased a controlling stake in the club just before the 2023-24 season with major plans to renovate the stadium. The firm is trying to help the team to the Premier League, which comes with a big boost in overall valuation, but will now have to jump up two leagues to do so.

Watt jokingly referred to his 2023 investment in Burnley Football Club as something for a bored, retired guy to do. During the club’s Premier League season, Watt has often attended matches, hitting the pubs beforehand and mixing with the crowds inside the stadiums.

In a moment, we’ll explain how this kind of investment, previously unavailable to anyone but the wealthiest investors, will soon be in reach around the world.

The Dual Attraction of English Football

The experiences of Lebron and Watt demonstrate two major attractions of investing in English football clubs.

For Watt, the passion for the crowd, community pride, and singing in the stands have drawn him into fan culture. While his investment will pay off if Burnley wins its fight to maintain Premier League status, he’s also just enjoying the experience as a diehard football fan.

Lebron’s investment turned out to be very well-timed, as the last decade has seen an explosion in the valuation of football clubs.

Nowhere is that more apparent than the English Premier League, now the most watched and most valuable football league in the world, with revenues reaching $6.8 billion in 2022-23.

Much of that growth comes from rising television rights fees. The Premier League now has broadcast deals in 212 territories around the world.

Club valuations have increased significantly as well. The top 10 Premier League clubs now carry a collective value of $27 billion, with individual clubs increasing in value up to 51% in just one year.

Getting promoted to the Premier League is the fastest way to increase a club’s value. Some clubs looking to make the leap take on too much debt or overextend themselves. If violations of Financial Fair Play regulations are found, points can be deducted, making the likelihood of a drop in league and a loss in investment value more likely.

A move to the Premier League can also have a dramatic impact on a club’s revenue. Take Brentford as an example. They are a smaller club in West London that first reached the Premier League in 2021. During their first season in the Premier League, their revenue increased from $19 million to $175 million.

Brentford’s valuation continues to grow season by season as an established Premier League club and is now estimated at $500 million.

We’ll soon be sharing news on a club with similar ambitions, and a way for you to take part in their progress.

A New Ownership Model for Fans

Here at Republic, we’ve provided several deals where fans had the chance to back their team via a personal investment.

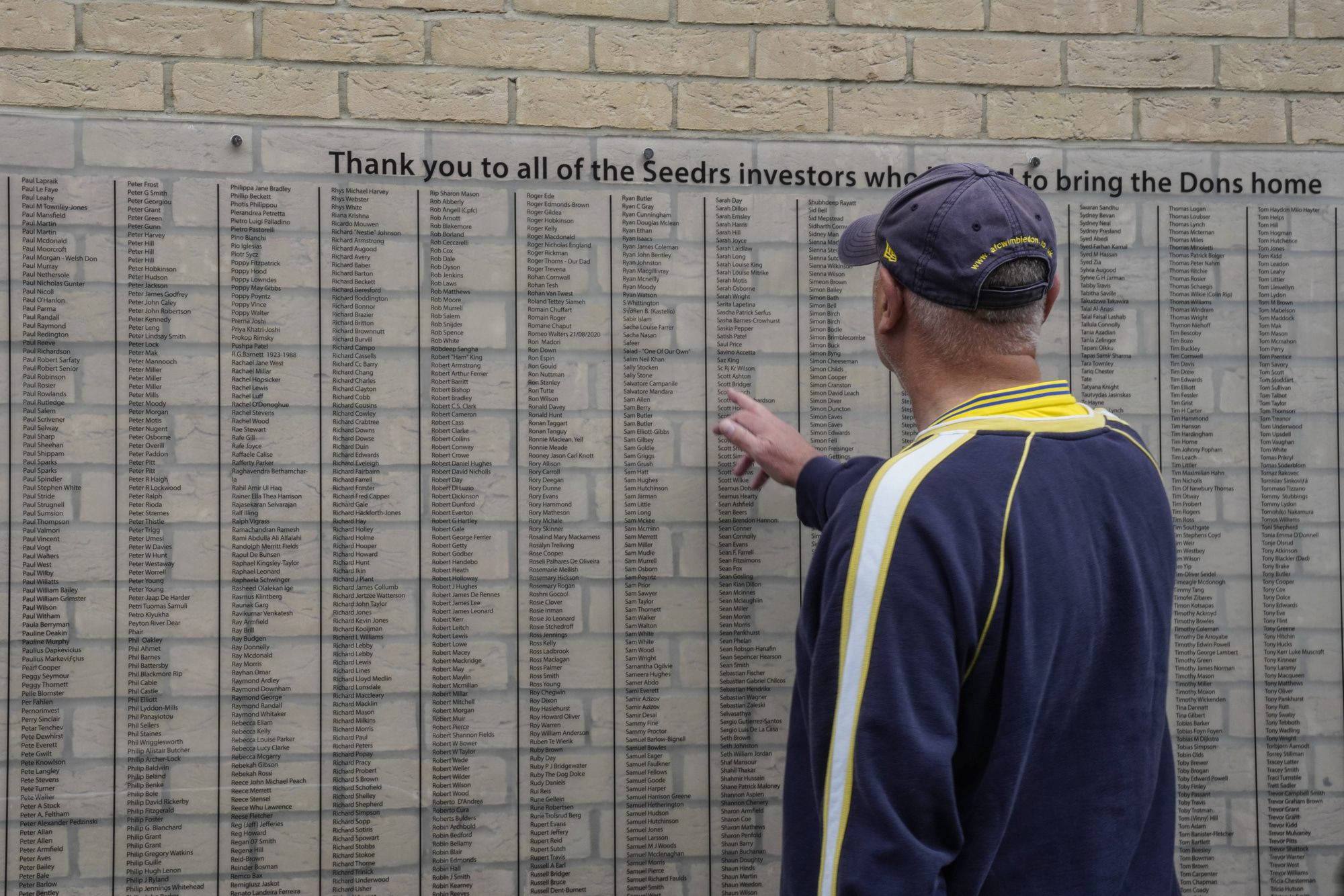

Seedrs, our UK affiliate, helped AFC Wimbledon raise more than $4 million from 5,000 investors in 2021 to build a new stadium. The photo below shows the Investor Wall at the new stadium.

As AFC Wimbledon chief executive, Joe Palmer, said about this achievement, “One of my favorites was the opportunity for fans to get their names physically stamped on the fabric of Plough Lane so generations to come will always be reminded of who helped bring us home.”

Orange County SC, a US team that plays in the USL Championship (one tier below Major League Soccer), raised nearly $595,000 earlier this year with the help of 1,463 investors on Republic.

Soon we’ll be releasing our most prominent sports deal ever: an ambitious English club looking to make the leap to the Premier League. We’ll be doing it in a way that gives you real ownership and an SEC registered secondary market. Whether for the love of the game or as an investment, you will want to review this upcoming opportunity.

Investing in sports teams does not come without risks. Investors should only invest an amount they can lose. Investing of any kind is risky and may result in total loss of investment.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

1 comment