A year and a half ago, the SEC opened the doors to a new era in startup fundraising: founders can now raise capital for their US-based startups from the public at large, via equity crowdfunding. The opportunity is immense.

While VC capital still dominates the startup funding space ($50B in 2016 – PWC), experts believe that the crowdfunding industry is on track to account for more funding than venture capital (some believe much more). Equity crowdfunding in the US saw $40M invested in its first year. Perk-based crowdfunding platforms, which are less than 10 years old, have already helped raise billions of dollars.

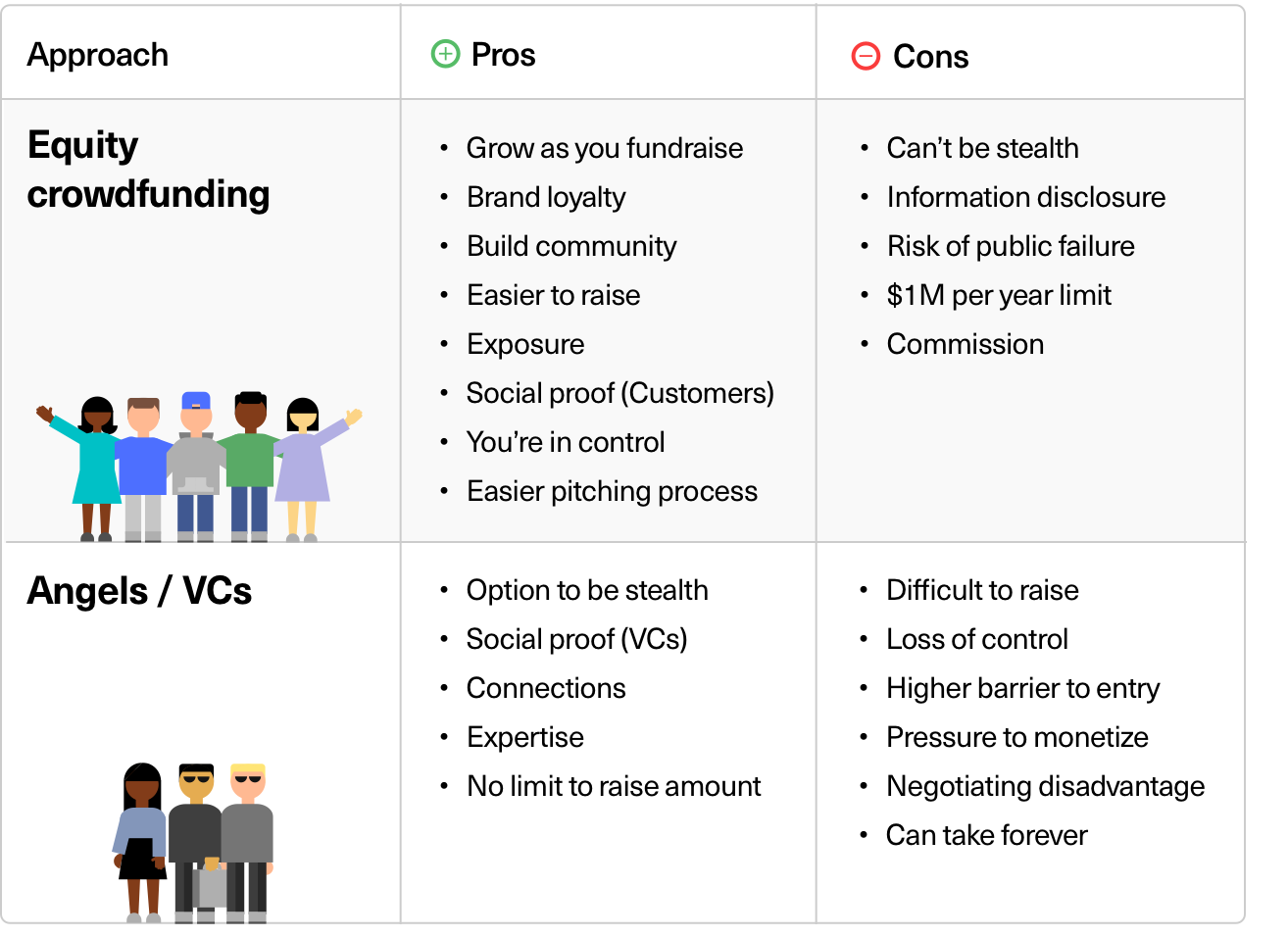

How should founders weigh raising venture capital against equity crowdfunding?

We compare the pros and cons of equity crowdfunding with the classic approach of raising from VCs or angels to help you pick the one best suited for your company.

Equity crowdfunding: Pros

Grow as you fundraise

When raising from VCs, you’re pitching a few folks, who spend their days being pitched to by startups. One of the top advantages of equity crowdfunding is that you’re pitching to hundreds or thousands of your current or potential customers, and picking up new customers for your startup as you raise funds.

Gain exposure

As a result of your public activity during the campaign, you will raise your startup’s visibility in the media, and to potential partners and hires.

Social proof

While big name VCs provide social proof in business circles, raising from hundreds or thousands of people demonstrates that you have a hold on your market – which is especially useful for consumer-facing startups.

You're in control

After an equity crowdfunding campaign, there is no change in management, and no requirement to give up a board seat, which is a very likely outcome after a VC raise.

Increase brand loyalty

Arguably the best way to align interests with your customers and partners and get them committed to your success is to let them invest in your company. Your loyal customers will become true brand ambassadors.

Build community

The best advertising is through word of mouth, and it starts with your core community. Equity crowdfunding brings your fans together as a large and diverse network of investors, each with their own networks, ready to support your startup. If you already have a community, it’s a great way to engage them and let them share in your success.

Straightforward pitching process

With the crowd, you have one pitch to make, one set of terms to decide on, and a known end date. This helps bring the fundraising complexity down so you can stay focused.

Easier to raise!

Because the individual check sizes are smaller, it’s easier to get people to write them. This lowers the barrier of entry for early-stage projects and startups to get off the ground.

Equity crowdfunding: Cons

Can't be stealth

Due to the nature of equity crowdfunding, you will be telling the world about your startup. If that’s not in your plans, this is not the route for you.

You have to share

The SEC requires you to make your financials available to all potential investors, which means virtually anyone can see them.

Unsuccessful raises are public

It’s no fun to fail to raise a round, but at least almost nobody will know about it. If you fail to raise from the crowd, it’s a public failure. (We’re here to help – 100% of Republic campaigns to date have met their fundraising goals).

$1M per year limit

As of July 2017, the regulations allow startups to raise a maximum of $1.07M in equity crowdfunding every 12 months.

Commission on raised capital

Funding platforms that enable you to raise from the crowd will take a commission on the raised capital, ranging from 5% to 15% (Republic takes 6% of cash raised + 2% of securities sold during your campaign). But keep in mind that you get value in return – the platform’s network, mentorship and marketing and legal support.

Pros of raising from VCs & angels

Option to be stealth

For some startups, it’s more strategic to stay stealth, and raising from individual investors or firms allows them to keep their publicity to a minimum.

Social proof

You get social proof from a successful VC raise, especially from a top-name firm. It shows your ability to close big deals, and it can help in securing partnerships and future funding.

Connections & expertise (“smart money”)

VCs have extensive professional networks, which founders can sometimes leverage for important introductions. They also have experience from working with many companies before you, and can be valuable advisors or mentors.

No limit to amount of capital

Raise as much capital as you need. While regulations allow startups to raise a maximum of 1.07M per 12 months via equity crowdfunding, a venture round is only limited by your needs and investor appetite.

VCs & angels: Cons

Difficult to raise

Very few startups raising VC succeed in doing so, and the process—successful or not—is stressful and time consuming. It’s even more difficult for women and underserved founders:

- 97% of venture-backed CEOs are male, 87% are white.

- 11% of venture dollars in the first half of 2017 went to female-founded companies (compare that with 79% of funding on Republic to female-founded companies).

You lose control (eventually)

In addition to giving away equity, startup founders risk giving away sovereignty in management as they raise venture capital. Unless the founders manage to keep most of the equity in their startup or establish super-voting rights, their investors are in control.

Higher pressure to monetize

One of the controversial effects of fundraising from VCs: It raises the expectation to grow fast, meaning you will burn through your money faster (and need more funding sooner). It can also pressure you to make money fast, instead of focusing on building a lasting, sustainable business model.

Raise on their terms

VC’s ability on getting a good deal for themselves is second to none. Be prepared to invest in legal counsel and expertise to understand the nuances of your contract, and what terms to push back on. With equity crowdfunding, the terms you publish are the final terms. Period.

It can take forever

You will pitch... over and over and over again, in elevators, skype calls, office meetings and on the streets. You will think about adjusting each pitch to a specific investor. And until the last signature is set, you never know how much longer it’s going to drag.

Let’s recap the main considerations for founders raising early-stage capital:

So, VC or ECF ? VC and ECF!

Both approaches bring in unique value to your company. If you can, do both and get the best from the both worlds. The complementary nature of ECF is recognized by many leading investors:

"Angels and VCs bring expertise but the crowd brings customers and fans."

— Naval Ravikant (CEO, AngelList. Investor in Uber, Twitter, Yammer and hundreds more)

"Equity crowdfunding gives entrepreneurs access to a new group of investors who might be great assets to their business. I welcome investing in crowdfunded companies. It means that a company has a large number of promoters before I even invest."

— Tim Draper (DFJ. Investor in Baidu, Tesla, Skype, and more)

If you’re looking to raise via equity crowdfunding, consider Republic.

Helpful? Questions, additions, comments? Please let us know in comments below.

This educational article is provided by Republic to help its users understand this area of the market, it should not be construed as investment advice as it is impersonal, disinterested and was produced by Republic for Republic’s users, without remuneration received or expected.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

1 comment