Four years ago, on July 18, 2016, we launched Republic. Our mission since day one has not changed — to make startup fundraising and private investing more accessible and more inclusive. But we’ve evolved as a company from a crowdfunding platform to an ecosystem that supports companies of all stages. We’ve built an investment marketplace for all types of investors — from the general public to high net worth and institutional investors.

Today, our family of companies have hosted campaigns for startups to raise community capital under Regulation CF (Reg CF) and, soon, offerings for growth-stage companies in need of public financing under Regulation A (Reg A), both open to accredited and non-accredited investors. We also deploy accredited-only capital into sought-after private deals, often co-investing with the best names in venture, from Andreessen Horowitz to Y Combinator. In addition to tech startups, Republic’s 700,000-strong community of members can now invest in non-tech businesses, real estate, video games, and digital assets — without ever leaving our platform. And through our profit-sharing Republic Note token, we are working to allow everyone to share in our success as the Republic ecosystem continues to grow.

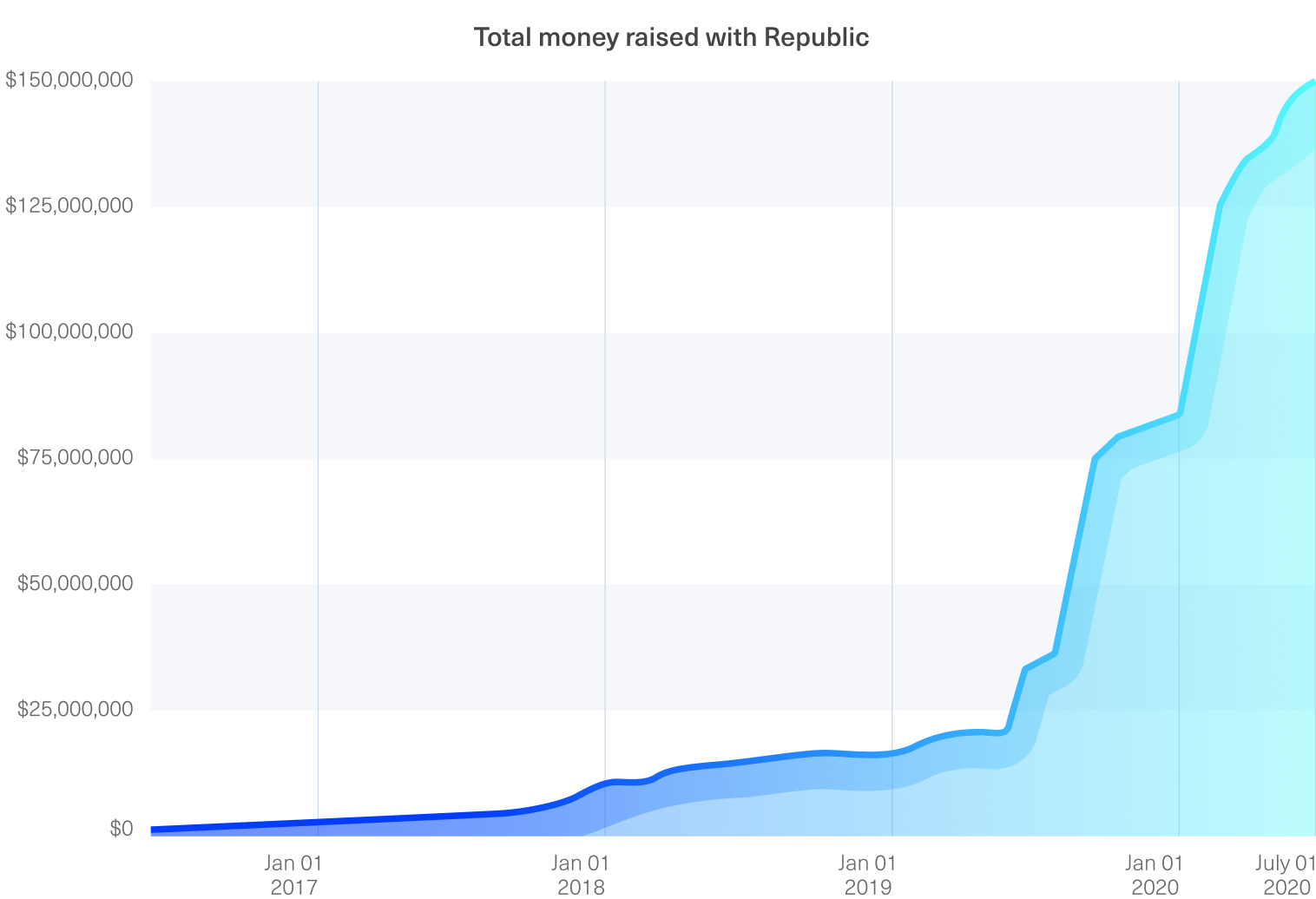

Here are some of the milestones we crossed in the past four years.

And thanks to our fast-growing community, we’re funding more startups month after month at an accelerated rate.

What’s next?

Investing, like buying things, should be as searchable and easy-to-use as Amazon. And for simplicity’s sake, investors should be able to hold all of their private investments on one central wallet, where they can monitor their entire portfolio of alternative assets across all of the verticals we offer today (startups, real estate, video games, crypto, the Republic Note) and those we may offer in the future. These alternative investments should be easy to buy and sell, tradable on an exchange with real-time pricing and liquidity, and available to everyone around the world. This is our vision for the future.

The team at Republic — diverse in our backgrounds and experiences with a shared commitment to access and inclusion — will continue to work at making private investing more compelling, more liquid, and more accessible. We also have plans to expand and support other tech ecosystems around the world, starting with the Middle East and Asia.

The past four years at Republic have had many rewarding moments - from all those $1M raises to launching our Venture Partners program with diverse rising talents. But it’s the daily stream of feedback from our community that has made our team even more motivated today than we were four years ago. Here is one example from Jetpack founder Fatima Dicko:

We couldn’t agree with Fatima more. Founders and investors reach out to us often to express gratitude for the opportunity to raise money and participate in our investment offerings. How many other financial institutions can say the same? That, right there, is why we’re here.

We are so excited to continue building Republic, to raise the bar on quality while maintaining our commitment to serving everyone, everywhere. Republic is more than a company, it’s a thriving community, and we wouldn’t be here without all of you.

Thank you and happy anniversary!

— The Republic Team

Republic Core LLC (“Core”) provides technology and support services to OpenDeal Inc. and its affiliates (collectively, the “Republic Ecosystem”). Republic Note holders and as well as users of the site and services maintained by the Republic Ecosystem, regardless of and their activities on or relating to the Republic Ecosystem, are subject to the applicable terms of service, in their entirety.

Core is currently conducting an offering of Republic Notes under Rule 506(c) of Regulation D under the Securities Act of 1933, as amended (the “Securities Act”) to persons who are accredited investors, as that term is defined in Rule 501. Only accredited investors are eligible to participate in the Rule 506(c) offering. Accredited investors who wish to participate in the Rule 506(c) offering should receive and review carefully the Private Placement Memorandum pertaining to that offering, as it contains important information for potential investors to consider prior to making an investment decision. Accredited investors who wish to participate in the Rule 506(c) offering will be required to (i) complete a subscription agreement, (ii) acknowledge that they have received and read the Private Placement Memorandum, and (iii) provide information verifying their status as accredited investors.

Core is also “testing the waters” with respect to the sale of Republic Notes under Regulation A of the Securities Act. The “testing the waters” process allows companies to determine whether there may be interest in an eventual offering of its securities to qualified purchasers under Regulation A. Core is not under any obligation to make an offering under Regulation A. No money or other consideration is being solicited for an offering under Regulation A at this time and, if sent, it will not be accepted.

Core may choose to make an offering to some, but not all, of the people who indicate an interest in investing, and that offering may or may not be made under Regulation A. For example, Core may choose to proceed with its offering under Rule 506(c) without ever conducting a Regulation A offering, in which case only accredited investors within the meaning of Rule 501 will be able to buy Republic Notes.

If and when Core conducts an offering under Regulation A of the Act, it will do so only once (i) it has filed an offering statement with the Securities and Exchange Commission (“SEC”), (ii) the SEC has qualified such offering statement and (iii) investors have subscribed to the offering in the manner provided for in the offering statement. The information in the offering statement will be more complete than any test-the-waters materials and could differ in important ways. Prospective investors who are interested in participating in the Regulation A offering must read the offering statement filed with the SEC, when that offering statement becomes publicly available.

No money or other consideration is being solicited at this time in connection with any potential Regulation A offering and, if tendered, will not be accepted. No offer to buy securities in a Regulation A offering can be accepted and no part of the purchase price can be received until an offering statement is qualified with the SEC. Any offer to buy securities may be withdrawn or revoked, without obligation or commitment of any kind, at any time before notice of its acceptance is given after the qualification date. Any indication of interest in Core’s offering involves no obligation or commitment of any kind.

This educational article is provided by Republic to help its users understand this area of the market, it should not be construed as investment advice as it is impersonal, disinterested and was produced by Republic for Republic’s users, without remuneration received or expected.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

8 comments