While larger assets and single-family homes are attractive targets to institutional investors, small multifamily building...

Disclosures & Disclaimers

This is an offering for Class A Common Stock in GromaREIT. It is not an offering for a share, membership or partnership interest in Groma Fund I or any of its affiliates.

OpenDeal Broker LLC charges you a two percent (2%) administrative fee on the gross principal transaction with a minimum fee of $5 and a maximum of $300. The fee is added to the total amount of your investment at checkout.

Past financial results are no guarantee of future performance. Click here for important information regarding Financial Projections which are not guaranteed.

The company has neither generated significant revenue, nor has it had any significant operating history.

Overview

Groma is blending real estate and technology to:

Groma is blending real estate and technology to:

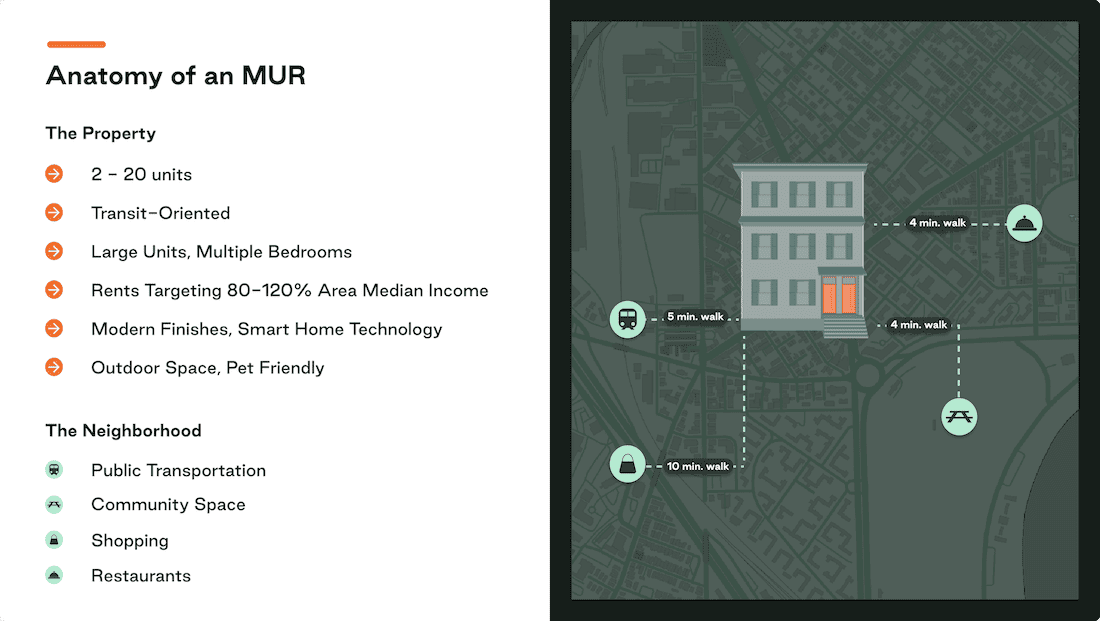

- Modernize inefficient 2-20 unit apartment buildings to improve resident experience, environmental sustainability, and investor returns. We call these upgraded buildings Modern Urban Rentals (MURs).

- Make it easier for individuals, including the residents in our buildings, to invest in this MUR ecosystem alongside us, via the GromaREIT.

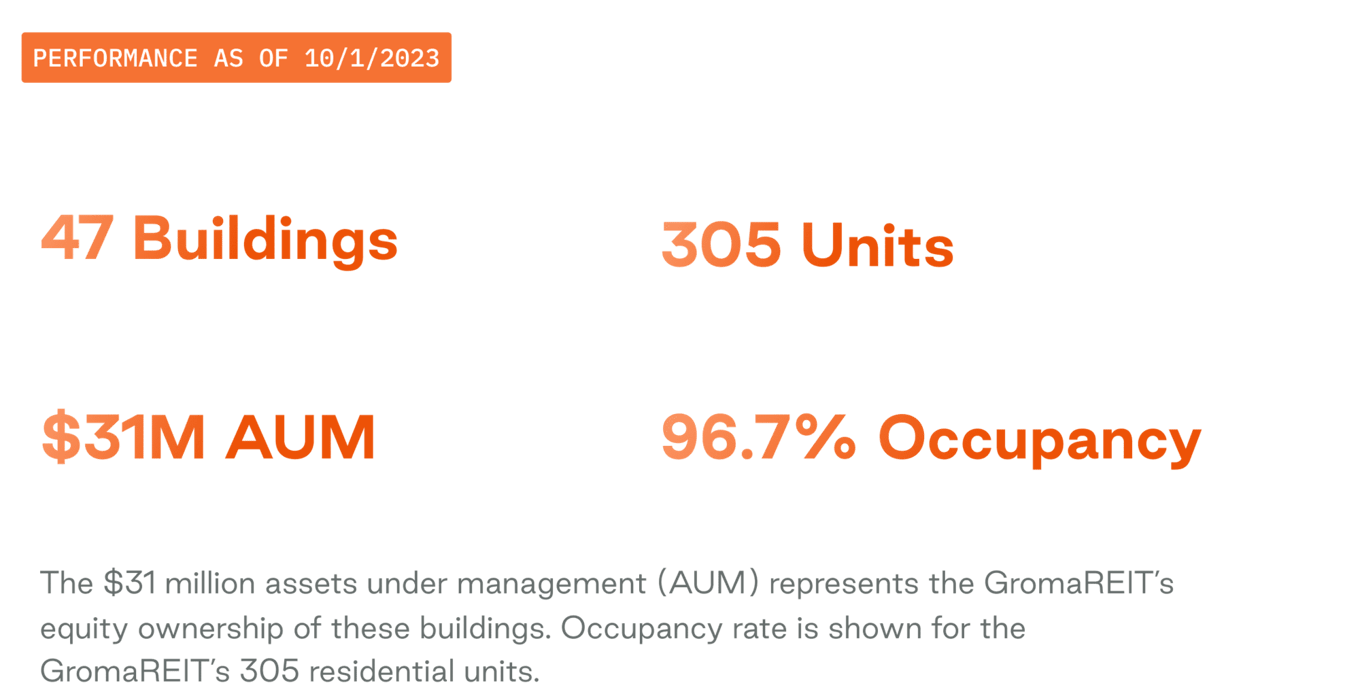

Groma’s platform is purpose-built to take this existing inventory of well-located housing and make it perform better for our residents and our investors. The GromaREIT portfolio includes ~$31 million in assets spread across 47 buildings in Greater Boston.

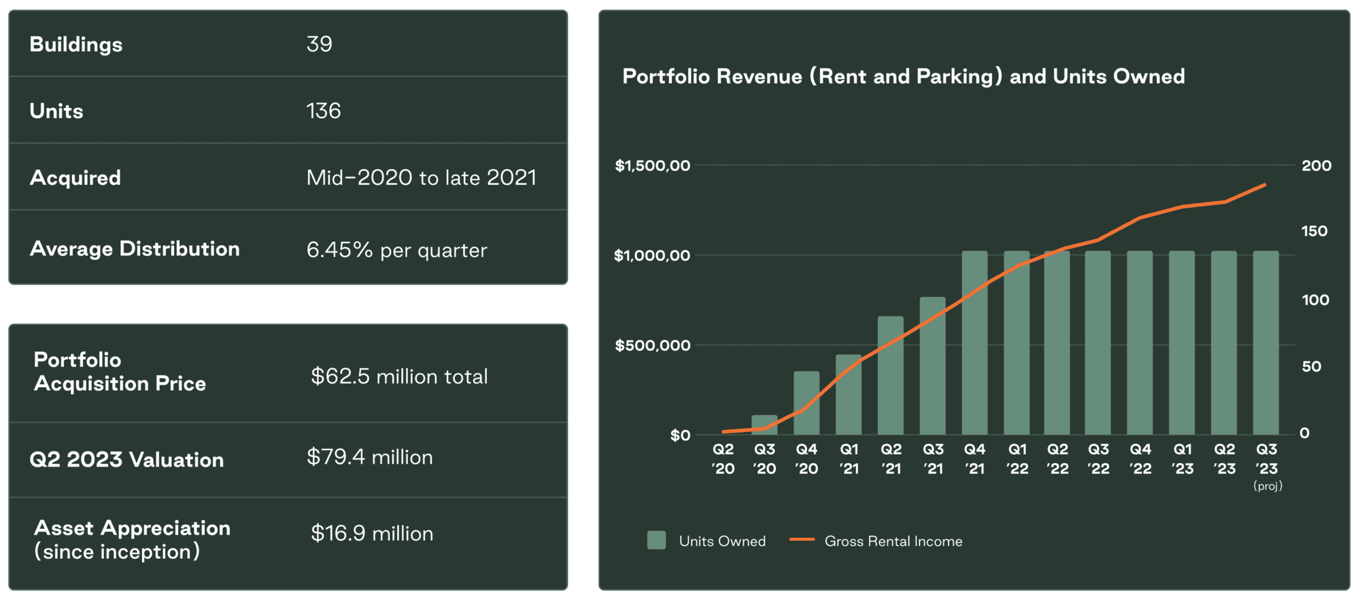

Our initial portfolio, collectively referred to as “Fund I,” is averaging 6.45% annual distributions and $16.9 million asset appreciation over its first three years based on our recent valuation of the fund with third-party appraiser Cushman & Wakefield.

Portfolio

GromaREIT's core asset class is Modern Urban Rentals (MURs):

The MUR asset class provides high-quality living in an environmentally efficient, transit-oriented fashion and is an asset class without significant institutional ownership, offering what may be a meaningful opportunity for a player such as the GromaREIT.

GromaREIT by the Numbers

Currently, the GromaREIT is in its growth phase, focused on asset appreciation. We intend to hold each property for the long-term (at least ten years), enabling us to stabilize the assets and provide consistent passive income to our investors.

While the core focus of the GromaREIT is the Modern Urban Rental (MUR) investment strategy, from time-to-time unique opportunistic situations arise for larger-format multifamily assets in our core markets. One such scenario occurred with GromaREIT's investment into Mosaic (75 Baldwin Street), a 146-unit multifamily property in Lynn, a fast-growing suburb of Boston. The GromaREIT was able to purchase a minority interest in this property, complementing a majority interest owned by an affiliated fund. Occasionally, we may seek to invest in other opportunistic assets outside our core Modern Urban Rental (MUR) focus when we believe it will produce desirable returns for investors.

Source: GromaREIT Q2 2023 Report and Groma Leasing Dashboard, available upon request.

Market

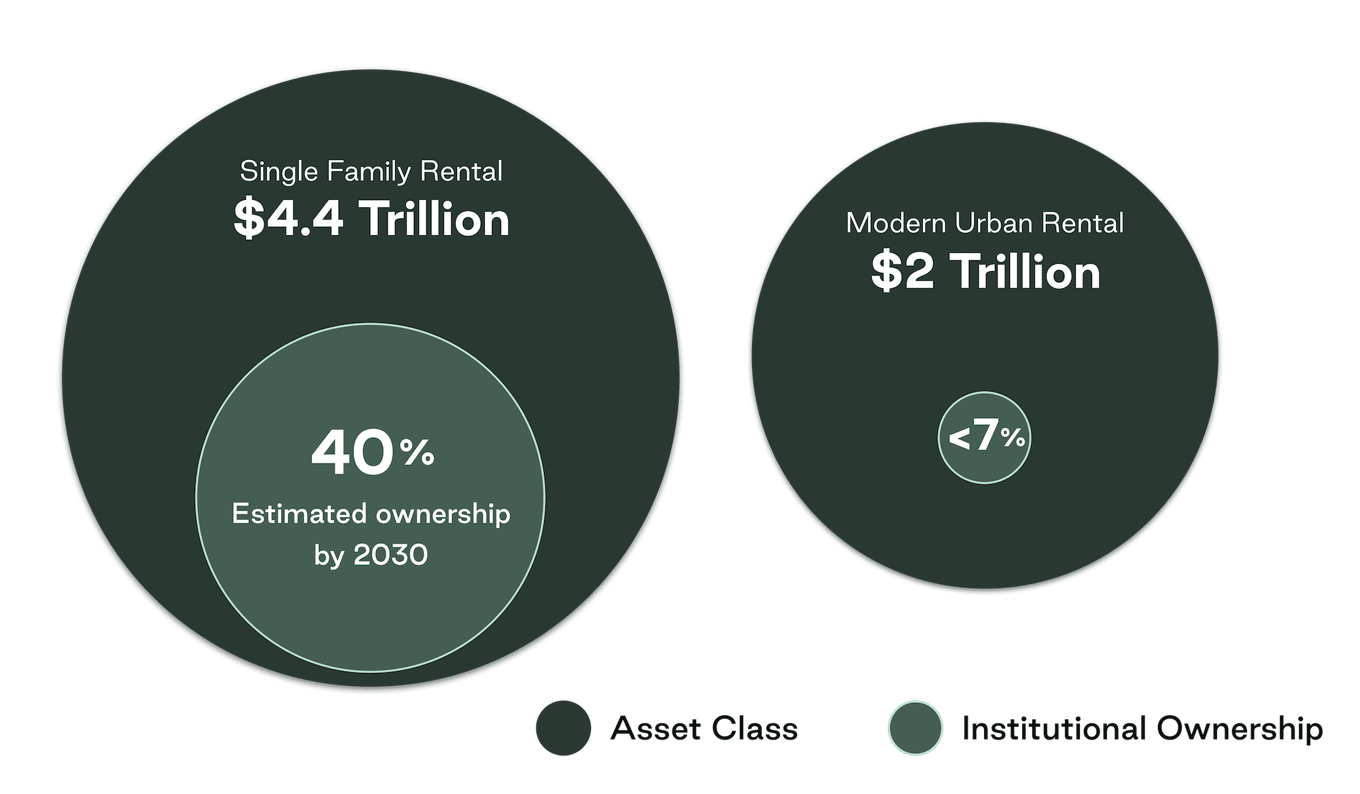

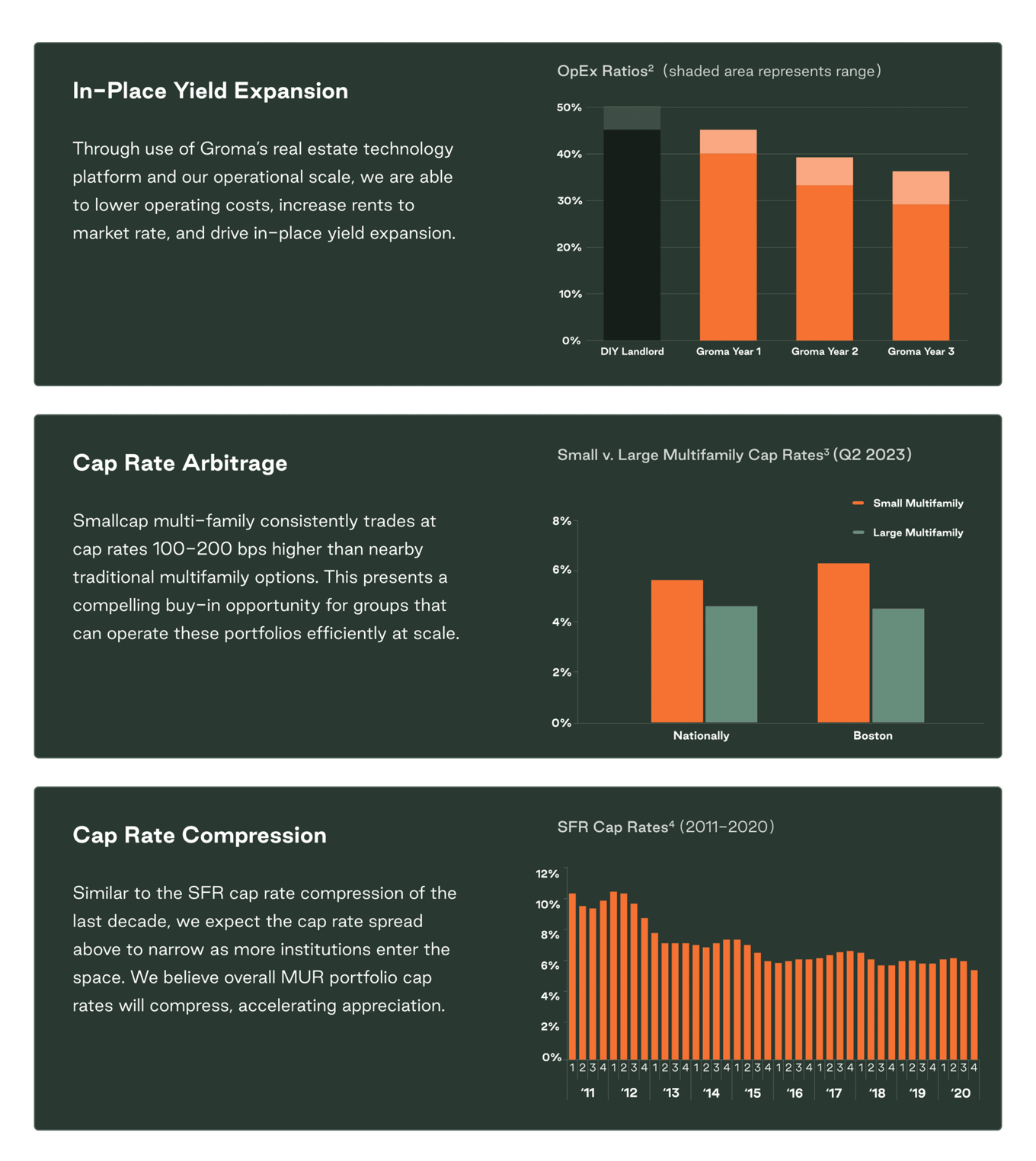

Multifamily real estate is a large asset class that we break down into three subcategories; large multifamily (50+ units), single family assets (1 unit), and our specific focus, Modern Urban Rentals (2-20 units). The large multifamily asset class has a total market of ~$1.2 trillion with roughly 41% institutional ownership. We believe the best analogy for the potential growth of the MUR market is to analyze the SFR market and the growth of institutional investment into that space over time.

The most important aspects of any property are location, location, and location. To that end, Groma picks its markets and submarkets with a significant level of research to ensure we’re investing in regions with strong growth characteristics. While we started in Boston, there are more than 25 cities with high inventory of 2-20 unit apartment buildings that could be upgraded to MURs. New York, Philadelphia, Pittsburgh, Indianapolis, Nashville, Austin, Dallas, and Denver are a few of our likely expansion markets.

AHS Housing Data. (2021)

Strategy

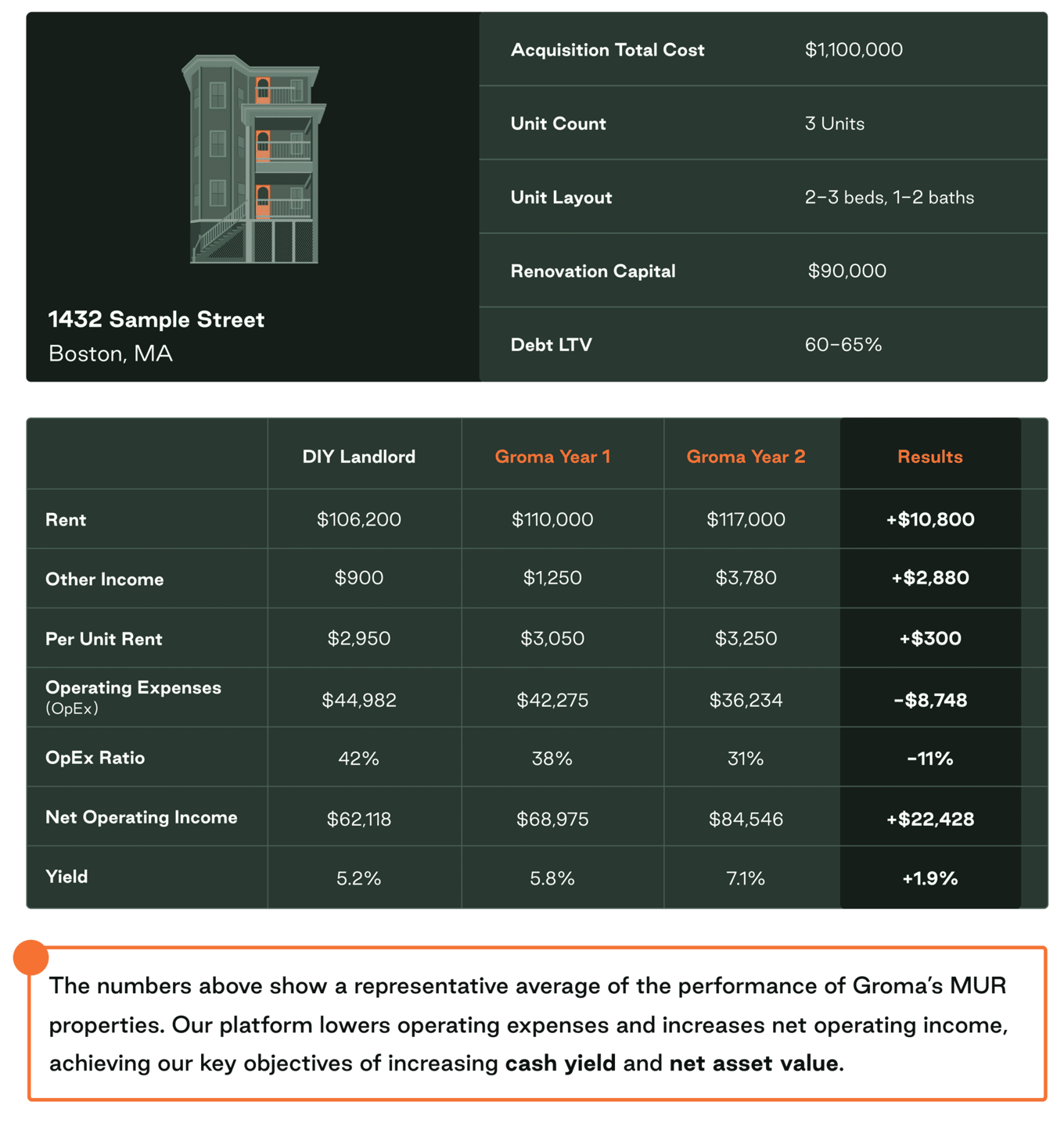

Groma's real estate technology improves the financial performance of MURs and provides a better tenant experience. See below for an example of how our platform decreases costs and increases income at a single sample building.

* The numbers above are a representative average of Groma’s MUR properties, not a specific property. Yield is shown as NOI over the initial acquisition price (inclusive of renovation capital and closing costs), excluding debt service. (1)

On a macro level, we believe the MUR asset class is the multifamily counterpart to the SFR space (single-family rental) and will be the next to be institutionalized. We see a 9-18 month window to buy into the MUR asset class at compelling cap rates and further increase in-place yields. Our strategy adds value to MURs, resulting in outsized appreciation in the early years, with small but growing cash flows, leading to a healthy mix of cash flow and appreciation over time.

We believe our early investors will benefit from MURs being “sold at a discount” today, with the potential to experience outsized appreciation in the early years, blending into stable, durable cash flow over time.

Notably, while the MUR strategy shares many similarities (and key differences) with the single-family rental (SFR) strategy, a key consideration is that rather than limiting homeownership opportunities, MUR seeks to preserve/improve existing housing stock.

Source:

1 Groma's NOI Case Study, available upon request

2 Groma Boston Fund I Performance

3 Chandan Economics Q4 2022

4 Arbor & Chandan Economics Q1 2021 SFR Whitepaper

Operations

Groma’s platform enables us to both lower operating expense ratios through efficient operations and increase market rents through property and management upgrades. This increases in-place yield and drives asset appreciation.

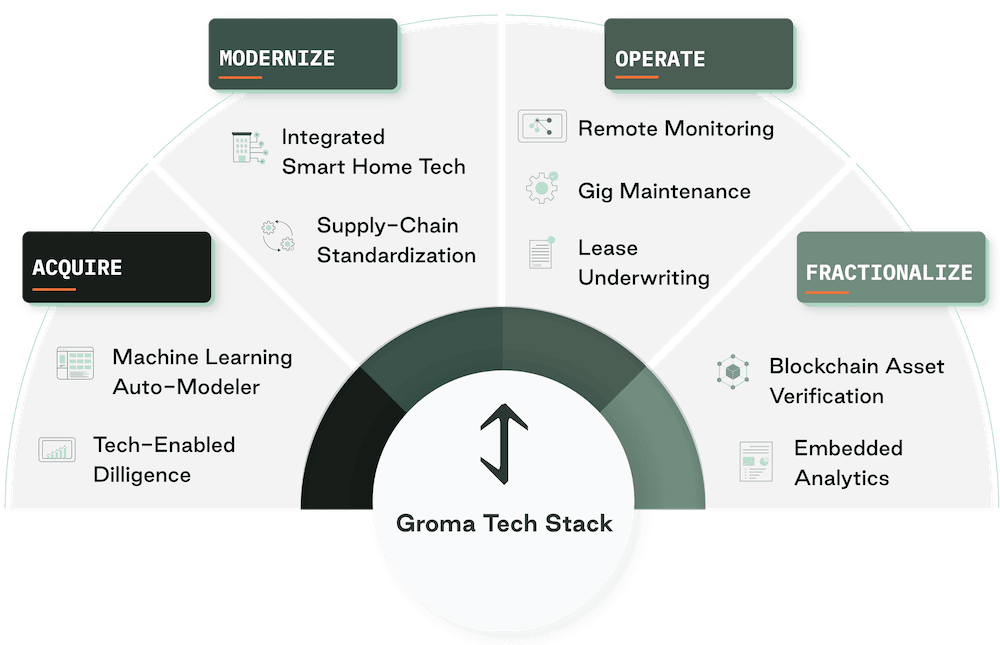

Our tech stack and platform uses proprietary technology to optimize the entire lifecycle of a real estate investment, from acquisition to renovation to operation to investing. This ensures that our properties are able to operate efficiently and profitably. It also makes real estate investing more accessible to a wider range of investors, whether they’re large or small, institutions or individuals, our renters or team members.

Acquire: Our machine-learning-driven property auto modeler uses third-party data to eliminate unqualified properties so our acquisitions team spends time on the right deals.

Modernize: Groma’s in-house construction and renovation team uses standardized materials to upgrade each unit and integrates smart home tech and other tenant-friendly optimizations.

Operate: Our vertically integrated property operations team uses technology like remote temperature management and intelligent maintenance routing to help lower the opex of each property.

Fractionalize: We add each building to the GromaREIT to make investing in MURs accessible to anyone. We use blockchain to make the performance of each asset transparent via our native investor experience.

Track record

Groma Fund I is our first real-world implementation of the Modern Urban Rental (MUR) strategy described above. In three years, the operating expense ratio for this portfolio has dropped from ~45-50% under prior ownership to ~31% in Year 3 of Groma's operation.

Additional disclosures and supporting information on the above data points:

6.45% dividends from Groma Fund I should not be treated as indicative of what investors should expect from the GromaREIT as past performance does not necessarily indicate future results. Among other reasons, GromaREIT invests in new properties continuously, whereas Groma Fund I was a closed-end effort, thus enabling more time for each property to mature and transition from early appreciation in the early years to longer-term, more durable cash flow in years 3 and beyond. Initial years’ dividends were funded in part from debt proceeds, though dividends are being fully covered from operations as of Q1 2023.

Team

Meet the Team behind the GromaREIT

GromaCorp, Inc. (“GromaCorp”) is the operator and sponsor of the GromaREIT.

Groma’s president, Seth Priebatsch, has made his career leveraging technology to redefine industries, first food-service and now real estate.

The team of 35 is led by executives bringing decades of experience in both real estate and technology. Combined, our team has completed over $10B in real estate transactions, and four executives join with the unique experience of successfully growing and exiting high-tech growth companies; LevelUp ($400 million exit, 2018) and Grubhub ($7 billion exit, 2021).

With $30M raised from top VCs and entrepreneurs, GromaCorp is well-funded and ready to scale the GromaREIT and MUR strategy. As well-funded as GromaCorp is, we nevertheless custody GromaREIT assets (properties, cash, equity) separately from GromaCorp, minimizing your exposure to “tech startup” risk.

Meet the GromaCorp Advisory Board

The Groma Advisory Board is composed of industry leaders and experts who help us achieve our vision. They hail from backgrounds in real estate, traditional finance, blockchain, academia, politics, and more.

Offering

Company Details and Targets

Open Ended Structure: $16M+ raised as of July 31, 2023.

Debt Structure: 55-65% target LTV on properties

Fund Horizon: Perpetual-life structure with long-term hold for properties. Property returns are modeled on a 10-year pro forma. Properties within the Company may be sold at opportune moments to re-allocate capital into more desirable markets/strategies.

Growth + Income: We focus on upgrading assets, seeking appreciation in the early years blending into steady, durable income in the later years.

Company Fees and Expenses

GromaREIT pays three types of expenses to its Advisor. These fees are paid by investors at the fund level and are outlined as follows:

- Asset Management Fee: 1.00% of net asset value of the Company (the “NAV”)

- Performance Fees: 12.5% of total return (dividends + NAV increase) after certain hurdles are met (5% and/or 7.5%).

- Entity Operating Expenses: Estimated to be <1.0% of NAV per year. Legal, accounting, filing expenses, other entity-specific structuring, and offering expenses.

Actual amounts will depend upon the Operating Partnership’s actual annual total return. Please see the Private Placement Memorandum for more details.

Core Property Operations Expenses

The fees and expenses are paid by the properties, not the fund, and are provided by GromaCorp and its affiliates.

- Property Management Fee: 4-8% collected rent, dependent on property

- Construction Management Fee: 10% of construction management projects

Actual amounts will depend upon the individual property’s performance. Please see the Private Placement Memorandum for more details.

Impact

Purpose & Profit

We call the GromaREIT a Real Estate Innovation Trust (rather than just investment trust) for good reason. Our technology and approach enables us to blend purpose and profit in everything we do.

Profit: We target a healthy mix of current income and long-term asset appreciation. Adding real estate to your investment portfolio can be an effective diversification strategy, and Groma’s approach enables you to do so without the hassles of managing real estate directly.

Purpose: Our approach preserves and improves upon an important stock of existing rental housing in dense urban areas. Rather than letting them fall into dilapidation or become targets for luxury condo conversion, we upgrade the resident experience, improve environmental sustainability, and create a new type of real estate ownership opportunity for millions of renters.

Funding

The GromaREIT shareholder base ranges from high-net-worth individuals to institutional partners. Seth Priebatsch, the founder and President of Groma has over $5M invested in the GromaREIT and has also invested over $5M in GromaCorp, the operating company.

The GromaREIT has raised ~$16M in equity so far and has ~$31M in assets under management spread across 47 buildings in the Greater Boston area.

GromaCorp, the advisor to the GromaREIT, is well-funded, enabling us to continue to build out our operational and technological platform. Building on its early success, GromaCorp announced in June its $30M Series A funding round, led by Matt Walsh from Castle Island Ventures with participation from other leading investors including: L1 Digital, Echelon Capital, Jonathan Kraft (President, Kraft Group), Mike Gordon (President, Fenway Sports Group), Jeremy Sclar (CEO, WS Development), US Boston and more.

This is an offering to invest in the GromaREIT (the real estate assets) and not into GromaCorp (the operating company) though we believe it is of value to potential investors in the GromaREIT to know the funding status of GromaCorp. Following industry best practices, GromaREIT’s assets (properties, cash, equity) are held in custody separately from GromaCorp’s assets.

Summary

Should you choose to invest in the GromaREIT, what are you investing in?

Groma’s Real Estate Innovation Trust uses a proprietary technology stack to acquire, modernize and operate 2-20 apartment buildings in dense urban areas that we call Modern Urban Rentals (MURs)

An environmentally friendly asset class that preserves critical workforce housing.

A growth and income strategy that aims to blend initial outsized asset appreciation with long-term durable cashflows.

What can you expect as an investor?

An investor platform that is designed to be transparent and leverages blockchain technology to make it easy for you to see what’s in the GromaREIT and make informed decisions and manage your investments.

Clear and consistent communications from our Investor Team including quarterly reporting and personalized account statements.

An aligned team that shares your interest. Every team member of GromaCorp (the advisor of the fund, and operator of the property assets) also has a stake in the GromaREIT.

We are pleased about the prospects for the GromaREIT and look forward to the potential opportunity to have you invest alongside us. If you have any questions, please email investor-relations@groma.com.

Disclaimers

Important Disclosures

This material is being furnished on a confidential basis to a limited number of sophisticated investors for the purpose of providing certain information about an investment in the common stock of Groma NAV REIT, Inc (“Groma NAV REIT”). The recipient agrees that it will, and will cause its representatives and advisors to, use the information only to evaluate its potential interest in Groma NAV REIT and for no other purpose and will not, and will cause its representatives and advisors not to, divulge any such information to any other party. Any reproduction of this information in whole or in part is prohibited. This material is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to purchase Interests. Any such offer or solicitation will only be made pursuant to the confidential private placement memorandum of Groma NAV REIT, as amended and/or supplemented from time to time (the “PPM”), which qualifies in its entirety the information set forth herein and which should be read carefully prior to investment in Groma NAV REIT for a description of the merits and risks of an investment in Groma NAV REIT. Any decision to invest in Groma NAV REIT should be made after reviewing the PPM, conducting such investigations as the investor deems necessary and consulting the investor’s own legal, accounting, tax and other advisors in order to make an independent determination of the suitability and consequences of an investment in Groma NAV REIT. Neither Groma NAV REIT nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein and nothing contained herein should be relied upon as a promise or representation as to past or future performance of Groma NAV REIT or any other entity. An investment in Groma NAV REIT is speculative and entails a high degree of risk. No assurance can be given that Groma NAV REIT’s investment objective will be achieved or that investors will receive any return of or on their capital.

Prospective investors are advised that past performance is not necessarily indicative of future results, and there can be no assurance that Groma NAV REIT will achieve comparable results to any performance data provided herein. Prospective investors are encouraged to contact GromaCorp, Inc. or Republic to discuss the information provided herein.

Except where otherwise indicated, the information herein was compiled as of September 17, 2023 and Groma NAV REIT does not have any obligation to update material.

The offering is not an offer to sell, nor shall any Interests be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. Any securities referenced herein have not been registered under the United States Securities Act of 1933, as amended, or under any applicable state securities laws or the securities lase of any other jurisdiction, nor is any such registration contemplated. The information contained in this material has not been recommended, approved or disapproved by the United States Securities and Exchange Commission or by any State securities commission or any similar body nor have any of the foregoing authorities passed on the accuracy or adequacy of this material. Any representation to the contrary is a criminal offense.

Risks of early stage investment. Not an offer to buy or sell securities. This is a long-term speculative illiquid investment. Investment is not FDIC or SiPC insured.

This site (the "Site") is owned and maintained by OpenDeal Inc., which is not a registered broker-dealer. OpenDeal Inc. does not give investment advice, endorsement, analysis or recommendations with respect to any securities. All securities listed here are being offered by, and all information included on this Site is the responsibility of, the applicable issuer of such securities. The intermediary facilitating the offering will be identified in such offering’s documentation.

All funding-portal activities are conducted by OpenDeal Portal LLC doing business as Republic, a funding portal which is registered with the US Securities and Exchange Commission (SEC) as a funding portal (Portal) and is a member of the Financial Industry Regulatory Authority (FINRA). OpenDeal Portal LLC is located at 335 Madison Avenue, 16th Floor, New York, NY 10017, please check out background on FINRA’s Funding Portal page.

All broker-dealer related securities activity is conducted by OpenDeal Broker LLC, an affiliate of OpenDeal Inc. and OpenDeal Portal LLC, and a registered broker-dealer, and member of FINRA | SiPC, located at 149 5th Ave, 10th Floor, New York, NY 10010, please check our background on FINRA’s BrokerCheck. Investments in private companies are particularly risky and may result in total loss of invested capital. Past performance of a security or a company does not guarantee future results or returns. Only investors who understand the risks of early stage investment and who meet the Republic's investment criteria may invest. Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC verify information provided by companies on this Site and makes no assurance as to the completeness or accuracy of any such information. Additional information about companies fundraising on the Site can be found by searching the EDGAR database, or the offering documentation located on the Site when the offering does not require an EDGAR filing.

Certain pages discussing the mechanics and providing educational materials regarding regulation crowdfunding offerings may refer to OpenDeal Broker LLC and OpenDeal Portal LLC collectively as “Republic”, solely for explanatory purposes.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC make investment recommendations and no communication, through this Site or in any other medium should be construed as a recommendation for any security offered on or off this investment platform. Investment opportunities posted on this Site are private placements of securities that are not publicly traded, involve a high degree of risk, may lose value, are subject to holding period requirements and are intended for investors who do not need a liquid investment. Past performance is not indicative of future results. Investors must be able to afford the loss of their entire investment. Only qualified investors, which may be restricted to only Accredited Investors or non-U.S. persons, may invest in offerings hosted by OpenDeal Broker.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC, nor any of their officers, directors, agents and employees makes any warranty, express or implied, of any kind whatsoever related to the adequacy, accuracy or completeness of any information on this Site or the use of information on this site. Offers to sell securities can only be made through official offering documents that contain important information about the investment and the issuers, including risks. Investors should carefully read the offering documents. Investors should conduct their own due diligence and are encouraged to consult with their tax, legal and financial advisors.

By accessing the Site and any pages thereof, you agree to be bound by the OpenDeal Portal’s Terms of Use and Privacy Policy and/or OpenDeal Broker’s Terms of Use and Privacy Policy. Please also see OpenDeal Broker’s Business Continuity Plan and Additional Risk Disclosures.

Investors should verify any issuer information they consider important before making an investment.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...