The SEC's Office of Investor Education and Advocacy is issuing this Investor Bulletin to educate investors about investin...

OpenDeal Broker LLC charges you a two percent (2%) administrative fee on the gross principal transaction with a minimum fee of $5 and a maximum of $300. The fee is added to the total amount of your investment at checkout.

Past financial results are no guarantee of future performance. Click here for important information regarding Financial Projections which are not guaranteed.

Investments in private companies are particularly risky and may result in total loss of invested capital.

This Issuer operates from a foreign jurisdiction; and therefore, many of your country's common laws may not apply or be enforceable.

Risks of early stage investment. Not an offer to buy or sell securities. This is a long-term speculative illiquid investment. Investment is not FDIC or SiPC insured.

Opportunity

The first sports-centric loyalty platform

Engaging & capturing the uncounted 90% of fans, and building new revenue channels for teams and sponsors

Fans feel invisible to sports teams. And sports teams can’t—and currently don’t—have the means to recognize and reach the majority of their fans. Sure, they count the fans who show up on game days, but that’s missing out on the 90% of fans who cheer from afar, with only about 10% of a given team’s fans attending a game. Ticket prices are often inaccessible and in an increasingly global world, many fans live far from their favorite team’s home venue (think of all the Man U fans who have never set foot in England!)

The sad reality is that, by only counting fans who attend in person, the majority of fans are left unseen on the sidelines. And teams miss out on the chance to connect with those fans, foster additional loyalty, gain fan insights and create more relevant revenue streams. Meanwhile, team sponsors are often frustrated because they lack the information, data and results to determine the success of their sponsorship investment.

FanMore solves for all of this with an entirely personalizable fan rewards platform. FanMore seamlessly integrates into a team’s existing website/app, where fans are already flocking and engaging. It’s easy to get fans connected with FanMore, which means that it’s easy for teams to start connecting with fans and fan insights. It brings fans back into the fold and extends the game experience beyond the arena through exclusive content, offers and interactive elements. FanMore rewards fans, gathers 1st party data for teams and sponsors to meaningfully connect and engage with fans and manages the backend so that teams and sponsors can focus on rewarding fans and generating new revenue streams.

Traction

iVirtual is partnering with industry leaders to launch FanMore

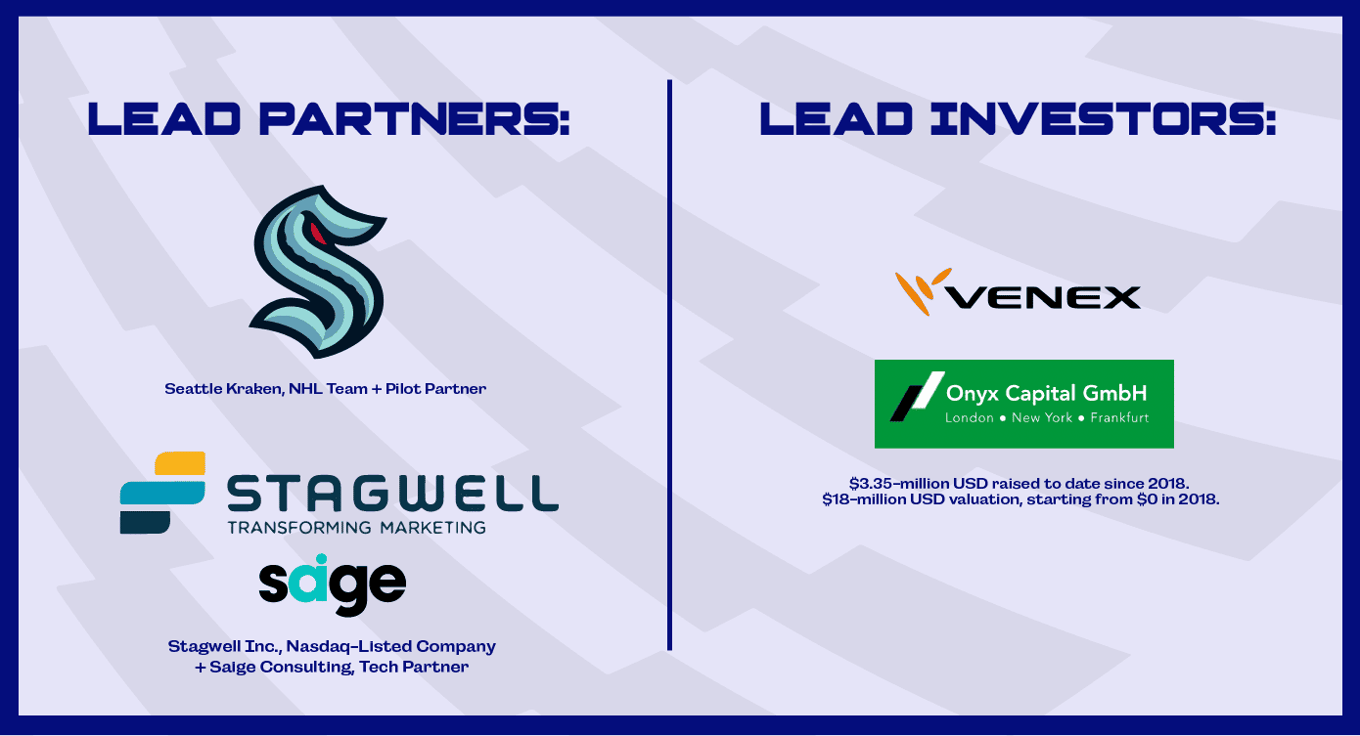

Lead partners:

Seattle Kraken, NHL Team + Pilot Partner

Stagwell, Nasdaq-listed billion-dollar company + Tech Partner

Lead investors:

Onyx Capital GmbH

Venex Capital

$3.35-million USD raised to date since 2018.

$18-million USD valuation, starting from $0 in 2018.

Business model

Rewarding fans for behavior they already engage in

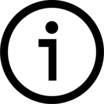

Click here for important information regarding Financial Projections which are not guaranteed.

Our business model picks up on the practices of well-established loyalty program mechanics, similar to those employed by hugely successful loyalty platforms like Alaska Airlines Mileage Plan and Starbucks Rewards. Our ‘earn and burn’ points model sees us making a percentage on all transactions (when users ‘spend’ rewards points, when teams buy points, when teams sell points to sponsors), rather than only profiting on a one-time licensing fee as we take a management fee across all points exchanges. Everyone’s interests—ours, teams’ and sponsors— are all aligned to benefiting the fan. The fan is getting rewarded for behaviour they already engage in with rewards that will ultimately also benefit both the team and sponsors (through sales and fan insight data).

Market

Huge total addressable market with over 1.5B fans of the big 5 leagues alone

FanMore’s potential market is significant. We believe the FanMore rewards platform holds great potential value for sports clubs and brands worldwide. The market in North American major leagues alone suggests tremendous potential value.

Big 5 major league sports verticals (NHL, NFL, MLB, NBA and MLS)

153 teams

132-million attendance

1.5-billion global fan base

$10-billion USD value of the loyalty management market

$120-million ARR potential with 50% penetration of the big 5 major league sports verticals, with even more significant potential with great penetration of the big 5, women’s and college leagues and further global clubs and leagues.

Competition

Leveraging proven models in an untapped market

FanMore presents a unique offering to a large potential audience of fans, teams and sponsors. It picks up on behaviours/models that exist in other successful loyalty programs, but that are currently missing from the sports loyalty market. Our co-founder’s experience leading marketing at some of Canada’s largest brands is particularly relevant here, as Canada has the most developed rewards program market in the world.

We’ve considered several factors while positioning FanMore to effectively compete, including our ability to:

- Capitalize on early foothold advantage

- Establish and maintain a strong reputation and brand awareness among customers

- Expand customer base and engagement across new lines of operation

- Provide comprehensive and varied offerings at competitive prices

- Provide a superior customer experience

- Develop product offerings designed for use across multiple channels

- Maintain a strong culture of environmental, social and corporate responsibility

In analyzing our competition, what we’ve come to understand is that other loyalty and rewards programs will offer a portion of what we do, while FanMore’s is the most complete offering with a rare combination of traits, particularly in the sports loyalty space.

Vision and strategy

Democratizing fan access to sports teams

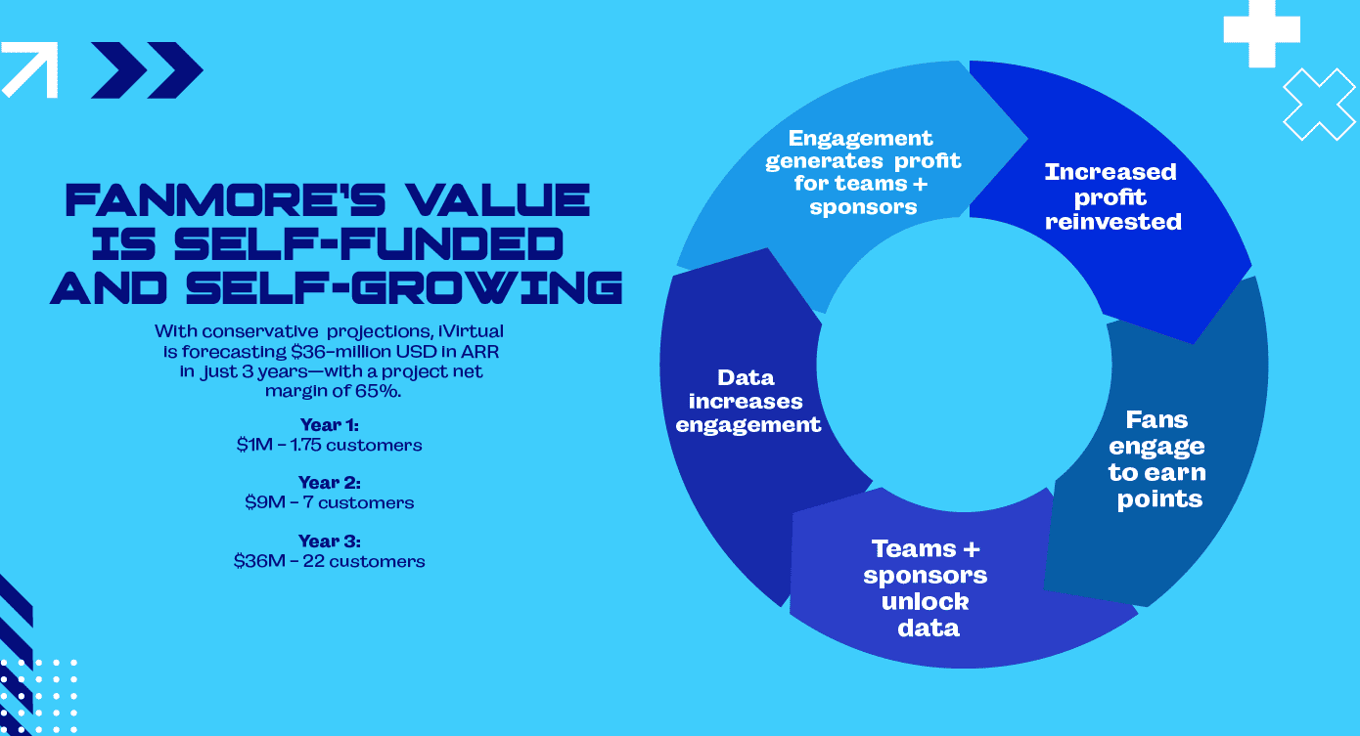

FanMore is grounded in the desire to democratize access to teams for sports fans. We do this by creating 1:1 connections between teams and fans in a highly engaging platform that seamlessly integrates into teams’ own websites and apps.

FanMore:

Connects more fans to sports teams’ digital ecosystems: FanMore creates a 360 degree view of the fan for teams and a larger, reachable database of fans inside and outside of the stadium.

Engage and reward fans: FanMore helps teams give fans points for daily fan engagement through gamification, social messaging challenges and points for purchases that can be exchanged for rewards like merchandise, tickets, food & beverage or "money can't buy" experiences.

Monetize like media: With FanMore, teams can leverage the larger, reachable fan base with sponsors and sell opportunities to buy performance-based media and promotional assets.

Impact

Significant ARR potential for investors and partners

$36-million USD — FanMore by iVirtual’s projected ARR potential of in just 3 years, with a project net margin of 65%.

Based on 22 teams and 11-million fans. ARR driven by: Monthly SaaS license fee, per fan onboarding fee, transaction % fee on all points earned and burned.

$50-million USD — partner team’s new revenue potential in just 3 years and up to $32-million in net profit.

Revenue drivers include: Acquisition uplift, spend uplift due to FanMore driving F&B, retail, season ticket/ticket retention, points sold to sponsor coalition.

Millions of new customers — team sponsors’ will gain greater direct access to fans and fan insights that will help improve ROI.

Drivers: Decrease customer acquisition costs—we believe paying for loyalty points is a better value than providing product discounts, ability to influence actions of a loyal fan base.

Funding

$3.35M already raised and tech that's ready to launch

$3.35-million USD in funds raised. Now raising $2-million USD to scale amid pilot partner launch with NHL team The Seattle Kraken in March 2024.

FanMore’s technology is ready to go. You’ll be investing in technology that already exists, knowing that interested partners are waiting at the sidelines. The funds we’re raising through FanMore will help us build the team we need to scale up. A little more investment will help us launch in a big way, allowing us to do the finishing finessing on our tech and get the people in place to maintain the momentum of launch.

Capital structure:

Use of proceeds: 53% technology & product development, 28% operations, 13% sales and marketing.

Shares issued: 64,156,198

Options: 6,890,124

Warrants: 16,508,732

Convertible debt: 6,950,698

Restricted stock units: 12,000,000

Fully diluted: 106,505,752

Management ownership: ~20%

Founders

Well-established industry leaders and executives

Sherif Khair, CEO/Founder, has a proven track record of building successful companies as a founder, entrepreneur and leader. He brings 30 years of experience in virtual reality, gaming, marketing research and robotics.

Meghan Nameth, Strategy/Founder, is a seasoned executive with 26 years experience leading marketing, analytics, loyalty and sports sponsorships for billion-dollar brands and organizations including P&G, Mars Inc., TD Bank, PwC, Hudson’s Bay and Loblaw.

Disclaimers

Certain information set forth in this presentation contains “forward-looking information”, including “future-oriented financial information” and “financial outlook”, under applicable securities laws (collectively referred to herein as forward-looking statements). Except for statements of historical fact, the information contained herein constitutes forward-looking statements and includes, but is not limited to, the (i) projected financial performance of the Company; (ii) completion of, and the use of proceeds from, the sale of the shares being offered hereunder; (iii) the expected development of the Company’s business, projects, and joint ventures; (iv) execution of the Company’s vision and growth strategy, including with respect to future M&A activity and global growth; (v) sources and availability of third-party financing for the Company’s projects; (vi) completion of the Company’s projects that are currently underway, in development or otherwise under consideration; (vi) renewal of the Company’s current customer, supplier and other material agreements; and (vii) future liquidity, working capital, and capital requirements. Forward-looking statements are provided to allow potential investors the opportunity to understand management’s beliefs and opinions in respect of the future so that they may use such beliefs and opinions as one factor in evaluating an investment.

These statements are not guarantees of future performance and undue reliance should not be placed on them. Such forward-looking statements necessarily involve known and unknown risks and uncertainties, which may cause actual performance and financial results in future periods to differ materially from any projections of future performance or result expressed or implied by such forward-looking statements.

Although forward-looking statements contained in this presentation are based upon what management of the Company believes are reasonable assumptions, there can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The Company undertakes no obligation to update forward-looking statements if circumstances or management’s estimates or opinions should change except as required by applicable securities laws. The reader is cautioned not to place undue reliance on forward-looking statements.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...