2019 has been the year in which crypto lending has really taken off. Centralized and decentralized finance have been majo...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Documents

Form C

SEC.gov

Form C

SEC.gov

Opportunity

- The first app for non-tech savvy to invest in Decentralized Finance (DeFi)

- Linen App is offering up to $300,000 investment in their company for early members

- Access DeFi liquidity pools like the Compound interest rate protocol that do not depend on the performance of stock or bond markets

- Backed by Coinbase, Polychain Capital, HashKey Capital, Youbi Capital, and Wyre

- 6,000+ downloads, over 300 early access program participants as of April 2020

- Your participation is technically an investment, but no USD payment is required

- Participation is limited to U.S. residents

Ways to earn

Download Linen App from the App Store or Google Play for free. Complete registration to earn Rewards via Sharedrop. Then, invite your friends and manage assets using the app to earn additional future equity.

Notes related to the Sharedrop:

- Maximum balance of assets managed via Linen App eligible for this Sharedrop is $50,000 for a maximum of $500 in future equity earned rewards.

- 1% APY earn can be independent of the Registration and Invite friends actions.

Notes related to Linen App:

- Displayed APY (Annual Percentage Yield) is for illustrative purposes only and does not reflect the actual interest rate available in blockchain-based liquidity pools or through partners of Linen Mobile, Inc.

- Linen Mobile, Inc. is not a bank, and any digital cash (stablecoin USDC, cryptocurrency, digital assets) you manage through Linen App will not be stored in a bank. Funds managed using Linen App software and tools are not insured by the Federal Deposit Insurance Corporation (FDIC), Securities Investor Protection Corporation (SIPC), or any other federal, state, or local agency.

Problem

Returns in traditional financial markets like stock and bonds in the U.S. depend on the performance of the broader economy. The stock market and interest rates usually fall and rise together. In other words, if the economy is not doing well, financial markets would reflect that.

Solution

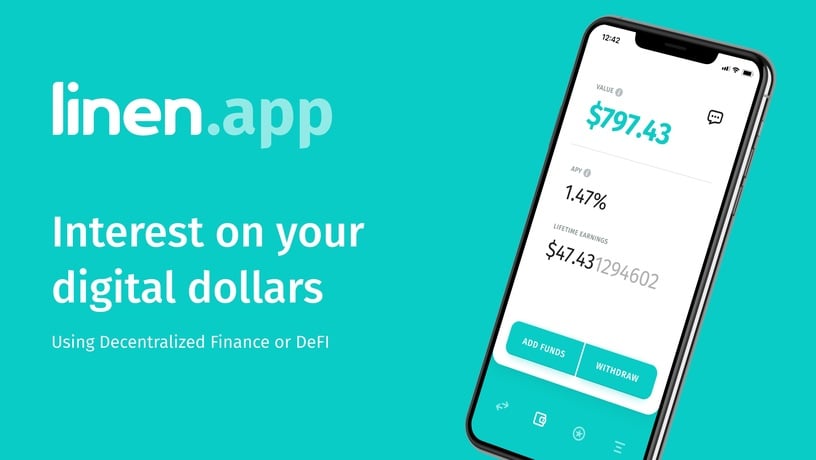

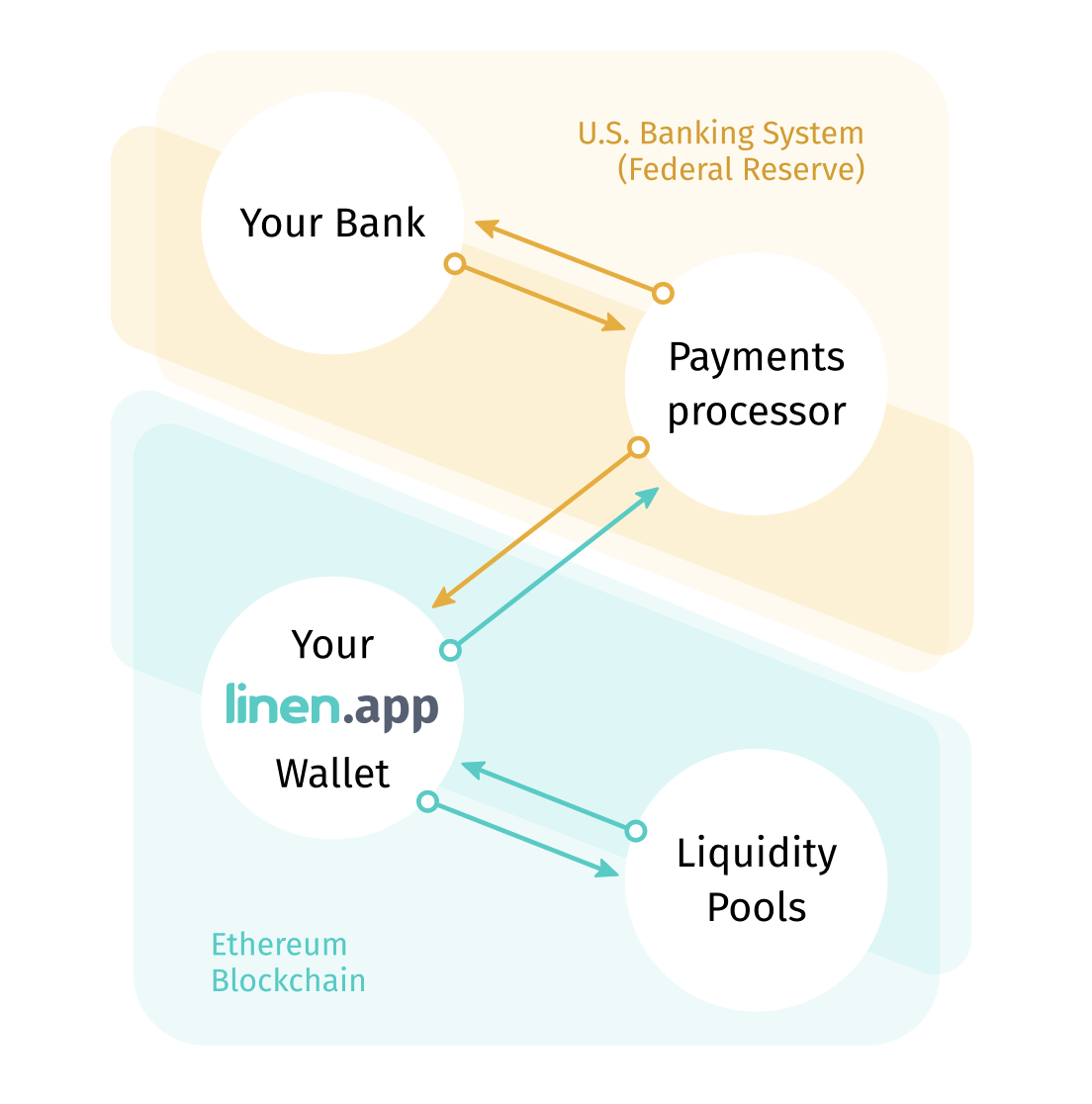

We saw a knowledge gap between the tech and finance-savvy, who earn interest on digital assets (digital dollars, stablecoins) in Decentralized Finance (DeFi), and the rest of the public. Linen App provides a streamlined user experience for the non-tech-savvy to earn interest on digital assets supplied to blockchain-based liquidity pools. Our members can deposit and withdraw digital assets with a couple of clicks using their bank account.

Technology

- The core of Linen App is a self-custody digital assets wallet that is integrated with liquidity pools (decentralized applications) on the Ethereum blockchain

- Digital dollar (stablecoin USDC) issued by Circle/Coinbase

- Payments processor and compliance provider

Decentralized Finance (DeFi)

In the past two years, a new field of programmable finance or DeFi has emerged. It attempts to recreate traditional financial services via a decentralized financial infrastructure that is based on blockchain technology. Approximately $770M of value has been held in DeFi applications as of April 24, 2020 according to DeFi Pulse. These opportunities are powered by autonomous interest rate and exchange liquidity pools on the Ethereum blockchain, such as Compound and others, and are difficult to access for the non-tech savvy.

Eligibility

Linen App will be available to U.S. residents first. This Sharedrop campaign is for U.S. residents only.

TL;DR

Linen App is an iOS and Android mobile wallet that allows our members to link their bank account, exchange dollars for digital dollars (stablecoins), and deposit digital dollars to liquidity pools on the Ethereum blockchain to earn interest.

Built by a team of ex-bankers, technologists, and product designers.

$1.6M in funding to date

Leading FinTech venture investors, including Coinbase, Polychain Capital, HashKey Capital, Youbi Capital, and Wyre invested in us. Now, we want to build a community and reward our early users in the form of future equity in Linen App. Our early users can benefit from our success if we do well.

You, our community, are the key reason we exist.

Ways to earn

Download Linen App from the App Store or Google Play for free. Complete registration to earn Rewards via Sharedrop. Then, invite your friends and manage assets using the app to earn additional future equity.

Notes related to the Sharedrop:

- Maximum balance of assets managed via Linen App eligible for this Sharedrop is $50,000 for a maximum of $500 in future equity earned rewards.

- 1% APY earn can be independent of the Registration and Invite friends actions.

Notes related to Linen App:

- Displayed APY (Annual Percentage Yield) is for illustrative purposes only and does not reflect the actual interest rate available in blockchain-based liquidity pools or through partners of Linen Mobile, Inc.

- Linen Mobile, Inc. is not a bank, and any digital cash (stablecoin USDC, cryptocurrency, digital assets) you manage through Linen App will not be stored in a bank. Funds managed using Linen App software and tools are not insured by the Federal Deposit Insurance Corporation (FDIC), Securities Investor Protection Corporation (SIPC), or any other federal, state, or local agency.

Deal terms

Non-cash contribution

No payment required. Join the Linen campaign by providing your email address, which the issuer values at $0. Learn more

$1K — $300K

0% of $1K minimum offering amount has been reached. Maximum offering amount is $300K.

$19,800,000

The maximum valuation at which your investment converts

into equity shares or cash.

Learn more

Learn more

Crowd SAFE

A SAFE allows an investor to make a cash investment in a company, with rights to receive certain company stock at a later date, in connection with a specific event.

·

Learn more

Documents

Form C

SEC.gov

Form C

SEC.gov

About Linen

Linen Team

Everyone helping build Linen, not limited to employees

Press

This site (the "Site") is owned and maintained by OpenDeal Inc., which is not a registered broker-dealer. OpenDeal Inc. does not give investment advice, endorsement, analysis or recommendations with respect to any securities. All securities listed here are being offered by, and all information included on this Site is the responsibility of, the applicable issuer of such securities. The intermediary facilitating the offering will be identified in such offering’s documentation.

All funding-portal activities are conducted by OpenDeal Portal LLC doing business as Republic, a funding portal which is registered with the US Securities and Exchange Commission (SEC) as a funding portal (Portal) and is a member of the Financial Industry Regulatory Authority (FINRA). OpenDeal Portal LLC is located at 149 E 23rd St #1314, New York, NY 10010, please check out background on FINRA’s Funding Portal page.

All broker-dealer related securities activity is conducted by OpenDeal Broker LLC, an affiliate of OpenDeal Inc. and OpenDeal Portal LLC, and a registered broker-dealer, and member of FINRA | SiPC, located at 1345 Avenue of the Americas, 15th Floor, New York, NY 10105, please check our background on FINRA’s BrokerCheck.

Certain pages discussing the mechanics and providing educational materials regarding regulation crowdfunding offerings may refer to OpenDeal Broker LLC and OpenDeal Portal LLC collectively as “Republic”, solely for explanatory purposes.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC make investment recommendations and no communication, through this Site or in any other medium should be construed as a recommendation for any security offered on or off this investment platform. Investment opportunities posted on this Site are private placements of securities that are not publicly traded, involve a high degree of risk, may lose value, are subject to holding period requirements and are intended for investors who do not need a liquid investment. Past performance is not indicative of future results. Investors must be able to afford the loss of their entire investment. Only qualified investors, which may be restricted to only Accredited Investors or non-U.S. persons, may invest in offerings hosted by OpenDeal Broker.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC, nor any of their officers, directors, agents and employees makes any warranty, express or implied, of any kind whatsoever related to the adequacy, accuracy or completeness of any information on this Site or the use of information on this site. Offers to sell securities can only be made through official offering documents that contain important information about the investment and the issuers, including risks. Investors should carefully read the offering documents. Investors should conduct their own due diligence and are encouraged to consult with their tax, legal and financial advisors.

By accessing the Site and any pages thereof, you agree to be bound by the Terms of Use and Privacy Policy. Please also see OpenDeal Broker’s Business Continuity Plan and Additional Risk Disclosures. All issuers offering securities under regulation crowdfunding as hosted by OpenDeal Portal LLC are listed on the All Companies Page. The inclusion or exclusion of an issuer on the Platform Page and/or Republic’s Homepage, which includes offerings conducted under regulation crowdfunding as well as other exemptions from registration, is not based upon any endorsement or recommendation by OpenDeal Inc, OpenDeal Portal LLC, or OpenDeal Broker LLC, nor any of their affiliates, officers, directors, agents, and employees. Rather, issuers of securities may, in their sole discretion, opt-out of being listed on the Platform Page and Homepage.

Investors should verify any issuer information they consider important before making an investment.

Investments in private companies are particularly risky and may result in total loss of invested capital. Past performance of a security or a company does not guarantee future results or returns. Only investors who understand the risks of early stage investment and who meet the Republic's investment criteria may invest.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC verify information provided by companies on this Site and makes no assurance as to the completeness or accuracy of any such information. Additional information about companies fundraising on the Site can be found by searching the EDGAR database, or the offering documentation located on the Site when the offering does not require an EDGAR filing.

To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. Therefore, when you use the Services we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver's license, passport or other identifying documents.

Republic and its affiliates are not and do not operate or act as a bank. Certain banking services are provided by BankProv, member FDIC / member DIF. Digital (crypto) assets and investment products are not insured by the FDIC, may lose value, and are not deposits or other obligations of BankProv and are not guaranteed by BankProv. Terms and conditions apply.

Made in SF/NYC