Problem

Social gaming has lacked significant innovation over the past few years

The mobile games market is forecast to top $109B in 2021 and grow at an annual rate of 10.02%, reaching $160B by 2025.

But it's increasingly difficult for companies to differentiate themselves in a crowded marketplace. User acquisition costs are increasing and there is fierce competition to attract new players.

Solution

Introducing PlayChannel: bringing the thrill of live TV game shows to the fun of mobile games

Our first game Play To Win Casino reached #1 in the Social Casino charts and is already generating significant revenue.

Our first game Play To Win Casino reached #1 in the Social Casino charts and is already generating significant revenue.

The key to Play To Win's rapid success is the live game show-like events broadcast to the world where every player is a game show contestant playing for real-world cash and prizes.

We have built an infinitely scalable, cloud-based platform that enables us to build new games like this quickly, supercharging them with live events, tournaments, and prizes.

- We have proven that event-based gameplay drives engagement and supercharges performance - increasing monetization by up to 40%.

- We have proven that we can generate a return on advertising investment in less than four days compared with an industry average of months.

- We have proven that we can generate revenue from free players - with ad-supported play making us more than $0.60 per player per day.

- We have proven that our platform and team can make great games in a matter of weeks.

Now we are raising money to accelerate our business to the next level.

Product

The thrill of live TV game shows with the fun of mobile games where every player is a contestant playing for cash and prizes

We have proven that Play To Win Casino, featuring live slot tournaments, is not only fun, but makes money. We typically make $0.60+ per free user per day, primarily from advertising, compared with an industry standard of $0.10 to $0.20 per user.

We have proven that Play To Win Casino, featuring live slot tournaments, is not only fun, but makes money. We typically make $0.60+ per free user per day, primarily from advertising, compared with an industry standard of $0.10 to $0.20 per user.

Play To Win Casino is already generating in excess of $1M per quarter, with a 20%+ operating margin. We are raising money to fuel the continued growth of Play To Win Casino and to finish and launch Showtime Bingo which heralds the return of the king of live mobile games, Mr. Scott Rogowsky (HQ Trivia). The game is scheduled to enter beta in June 2021.

Traction

Our first game, Play To Win Casino, is seeing rapid growth and industry-leading metrics

PlayChannel’s first game, Play to Win Casino, is seeing industry-leading growth and metrics and is a Top 5 casino app.

"Braavo's User Acquisition financing algorithms take the guesswork out of identifying high-performing apps with great KPI. PlayChannel's Play To Win Casino ranks near the very top among hundreds of games our system has analyzed."

- Mark Loranger (Co-Founder, Braavo Capital).

Play To Win Casino's revenue has grown impressively since launch in Q2 2020, but is now limited by our ability to spend on user acquisition. We typically return upwards of $3 for every $2 we spend on user acquisition thanks to a combination of mobile game publishing expertise, compelling game design and live tournament and events. This results in 100% ROAS (return on advertising spend) within four days.

Our infinitely scalable, cloud-based game platform enables us to build new games like this quickly supercharging them with live events, tournaments, and prizes.

In early 2020, we built a social casino title for a third-party publishing partner, taking the game from contract to launch within 16 weeks using this game platform.

The fans love Play To Win as well - we have a 4.5-star rating from 21K+ users for our fresh approach to mobile social casino.

Customers

PlayChannel targets the broad demographics of social casino players, fans of game shows, and live event/esports games

Mobile games now represent more than 50% of all global game revenue, with more than 2.4B global mobile gamers in 2020.

It is estimated that nearly 70% of people in the United States (over 211M people) regularly play games on their mobile phones.

More than 50% of gamers are older than 34, with 63% of mobile gamers being female. This demographic split matches interest in social casino, as well as Bingo.

At its peak, HQ Trivia, hosted by Scott Rogowsky, was attracting concurrent audiences in excess of 2M players per day.

Business model

$2.2M+ in revenue in 2020 and $8.6M forecast for 2021

PlayChannel has demonstrated industry-beating metrics across the player lifecycle, from acquisition through retention to engagement, with a Return On Ad Spend of < 4 days. We make money from free players through revenue from advertising and are typically cash positive by day 4 of every user's lifecycle.

With this model, we generated $2.2M+ revenue in 2020 at an average operating margin of 20%+, despite only launching our app in April 2020.

Play To Win Casino continues to grow, hampered only by limited resources to spend on User Acquisition. The addition of live slots tournaments in Play To Win Casino increased monetization by up ~ 30% and our recently released Bingo feature is showing similar increases in monetization.

With additional investment in Play To Win user acquisition, we project that our ARR will reach $10M+ within 6 months.

ShowTime Bingo with Scott Rogowsky not only has the potential to match the performance of Play To Win and generate similar returns but we are confident it will outperform and approach user activity levels close to HQ Trivia.

At its peak, HQ Trivia (Time Magazine's App of the Year, 2017) was attracting audiences of millions of concurrent players, but it might be argued that the app suffered because it was only available at certain times during the day. ShowTime Bingo combines the live event appeal of HQ Trivia with the ability for players to play all day in preparation for the daily main events.

Market

Gaming is one of the fastest growing global markets.

Today gaming is available to consumers at all times and over all devices. More than 2.4B gamers across the world spent ~ $152B on games in 2019, representing an increase of +9.6% year on year. An industry report projects that consumer spend on games will grow to $196B by 2022, a CAGR of +9.0% between 2018 and 2022, with mobile games alone forecast to reach a global market size of $150B + by 2026.

The global gaming market continues to grow at a significant pace, but some sub groups are growing more than others. Social gaming is one of those subsets, along with social casino as a subset of social gaming itself.

Another report by Global Market Insight indicates that "The social gaming market is growing at a rapid pace on account of the increasing adoption of advanced gaming technologies, rising income levels, low cost of games, increase in online content, and digital distribution, which allow users to download the content on their systems. Popular social gaming genres, such as social casino are likely to drive the market growth during the forecast period due to the increasing social gaming traffic."

Gaming is betting big on social gaming, and based on current app usage numbers, so are consumers.

In 2018, the revenue for the social casino market reached $5.2B, according to Eilers & Krejcik. The social casino market grew 10.9% year-on-year in the final quarter of 2018. As a category, it is estimated that slots comprised over 70% of this revenue. Despite the significant revenue generated by slot games on mobile, there has been little innovation in the space. Key developers have focused on improving production values, running live ops, and adding content. This has started to change with the success of Coin Master by the developer, Moon Active. Coin Master features a slot mechanic but its success is based on its metagame systems and social functionality. As a 'Top 15 Grossing' game on iOS, with an estimated $75M+ in annual revenue, Coin Master has proven the top grossing potential for innovative mobile slot games.

Competition

Social Games are big business

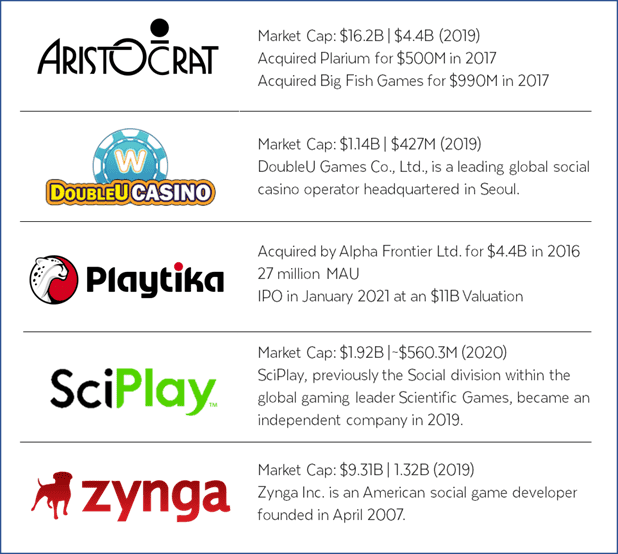

With the addition of capital, the PlayChannel team has the momentum and experience to match the performance of leading social casino games companies.

The market leaders and primary competitors like House of Fun, Slotomania, Hit It Rich, Caesars Slots, Huuge Casino, and Doubledown Casino have all been on the market for several years with some approaching almost 10 years in age. These games continuously update their content but new features and real game innovation has been lacking. Even with this slow pace of innovation these apps generate billions of dollars a year in revenue. Play To Win with live hosted game play has the potential to be a true disruptor to these titles. These antiquated competitor products will likely struggle to respond to the modern technology and live video streaming tech PlayChannel has developed.

There are some new entrants in the Bingo space including

"Bingo: Live Play Bingo game with real video hosts" launched last year which has shown steady growth and adoption. Other titles like Bingo Blitz and Bingo Bash currently dominate the Bingo space with estimates on annual revenues in the hundreds of millions of dollars. Bingo: Live Play captures some of the game show fun but lacks the game show model of real prizes and the market leaders lack the live experience of Live Bingo or Showtime Bingo.

In both cases we believe Play To Win Casino and Showtime Bingo have the potential to become market leaders in these categories with new features and innovations that existing titles simply don't offer.

Comparables support valuations in the 4–5x annual run rate range.

Vision and strategy

Play To Win

PlayChannel is focused on building fun innovative games that take the thrill of playing for real prizes on a game show and combine that with the ease and enjoyment of playing a mobile game. Humans have a basic need to play and to socialize. PlayChannel is committed to delivering on both through exciting entertaining live event experiences, with the added thrill of winning real prizes.

Funding

Raising $1M to grow our existing game Play To Win Casino and launch our next game Showtime Bingo

PlayChannel is entering into our first round of major funding with the aim of raising $1M. To date, the company has raised $995,000 through two previous friends and family SAFEs.

Now that we have proven that our games can be profitable and we have established industry-leading metrics, we are ready to scale our company to the next level.

Funding is expected to be allocated as follows:

$500k will be utilized for Play to Win Casino growth

Our metrics indicate that $500k spent on Play To Win User Acquisition will accelerate daily revenue to ~$25,000 per day, creating an enterprise valuation of ~$35M - $45M (4x to 5x ARR).

$500k will be used to finish and launch ShowTime Bingo

Building upon the proven success and monetization boost of tournament play in Play to Win Casino, Showtime Bingo brings the highly-renowned Scott Rogowsky (formerly host of HQ Trivia) back into the live games arena. In this Live Mobile Game Show where anyone can pick up a phone and be a contestant playing for real prizes everyday.

We are offering investors the opportunity to receive equity in the company, under the terms of a crowdfunding SAFE.

Founders

The right team and the right track record

The PlayChannel team is collectively responsible for over $2B in game sales. We are a lean, experienced team of industry experts, doing it again for ourselves and our investors.

James J ones: Chief Executive Officer

ones: Chief Executive Officer

20 years in gaming leadership with over $2B in lifetime game revenue. Hasbro, WB Games Boston, Publishers Clearing House, Jagex, Artifact

Dungeons & Dragons, Monopoly, Transformers, Lord of the Rings, Magic the Gathering, Scrabble, Yahtzee.

Nick Bogovich: Chief Revenue Officer

Nick Bogovich: Chief Revenue Officer

Formerly Head of Mobile at GSN Games. Executive Producer on GSN Casino (Top 10 Grossing).

Grew division to $100M annual revenue.

Pete Zeppieri: Chief Technology Officer

AWS Solutions Architect at Amazon.15 years as CTO/Cloud Architect.

Amazon, Lazard, Cognizant, Command IT, Astoria Financial.

James Hursthouse: Chief Business Officer

James Hursthouse: Chief Business Officer

20 years in gaming leadership. Nexon / OGSi / BigWorld / Roadhouse / AMPD / TwinV.

Iron Maiden: Legacy of the Beast / Red Bull / Games Workshop etc.

Scott Rogowsky: Live Game Host

Scott Rogowsky: Live Game Host

'Quiz Daddy Emeritus' of HQ Trivia Host of ChangeUp on DAZN since March 2019

12+ years professional comedian/producer

Dom Davies, Head of Growth

Mobile Growth Leader, AppLovin Corp Managed $200M+ in revenues

Managed Relationships with Facebook, Amazon, Apple, Zynga, N3twork, Calm, Storm8, Jam City, Glu, EA, SEGA, GSN, PCH, SKILLZ, Super Lucky Games, MobilityWare, Lucky Day.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...