TÖST TÖST is a sparkling non-alcoholic drink made from white tea, cranberry, and ginger. It's somewhat akin to a cider or...

Problem

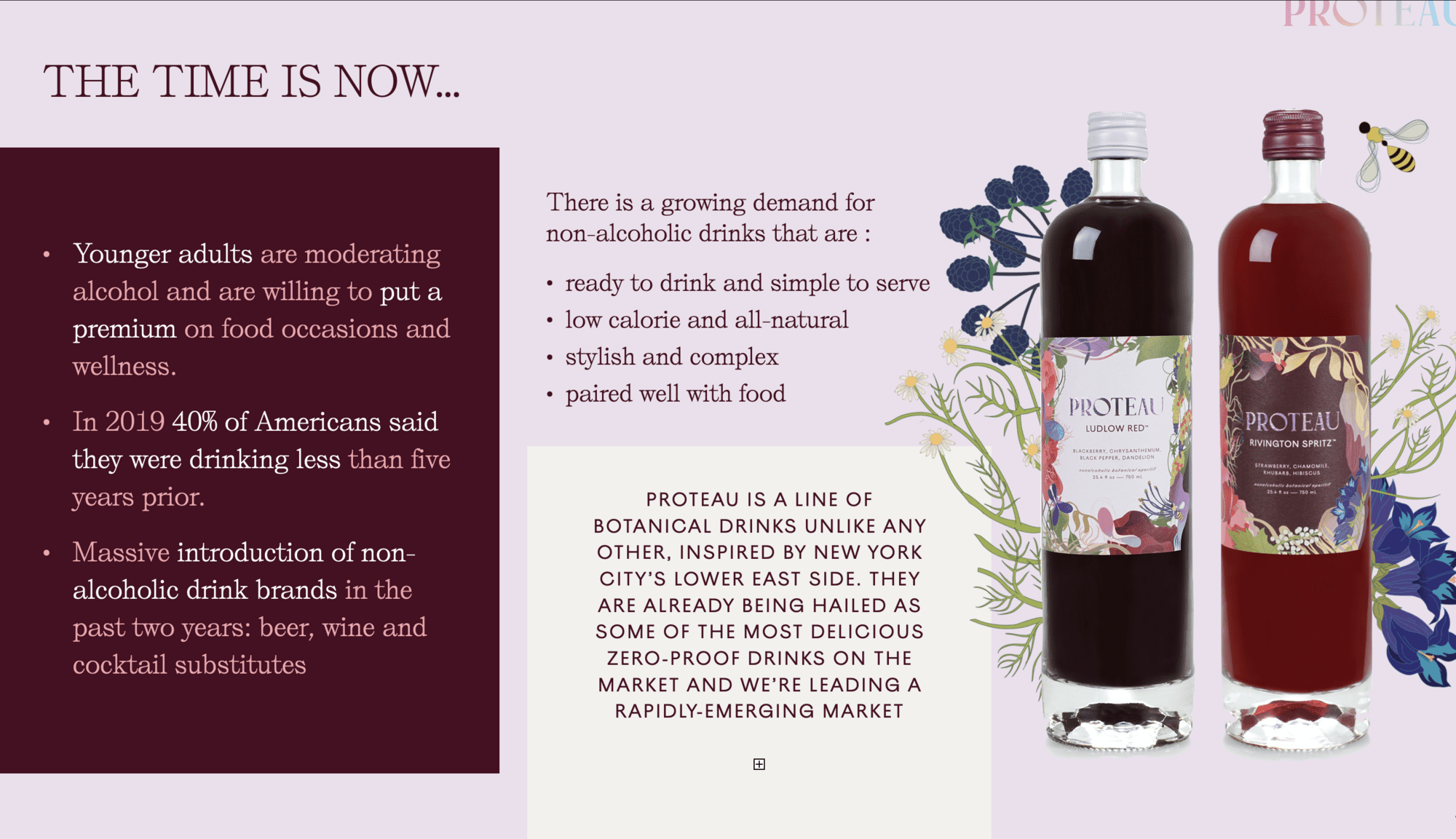

Non-alcoholic beverages are trending, but the experience is lacking

The growing demand for non-alcoholic drinks has brought about a massive introduction of new non-alcoholic drink brands over the past few years. Despite the influx of offerings (mostly beer and wine), there's still a key consumer demand left unanswered—a non-alcoholic beverage that pairs well with food and offers the luxurious experience expected from fine dining.

Solution

Proteau, the zero-proof botanical drink unlike any other

Proteau is a line of botanical drinks unlike any other, inspired by New York City’s Lower East Side. We’re already being hailed as some of the most delicious zero-proof drinks on the market, and are leading a rapidly emerging market segment.

Product

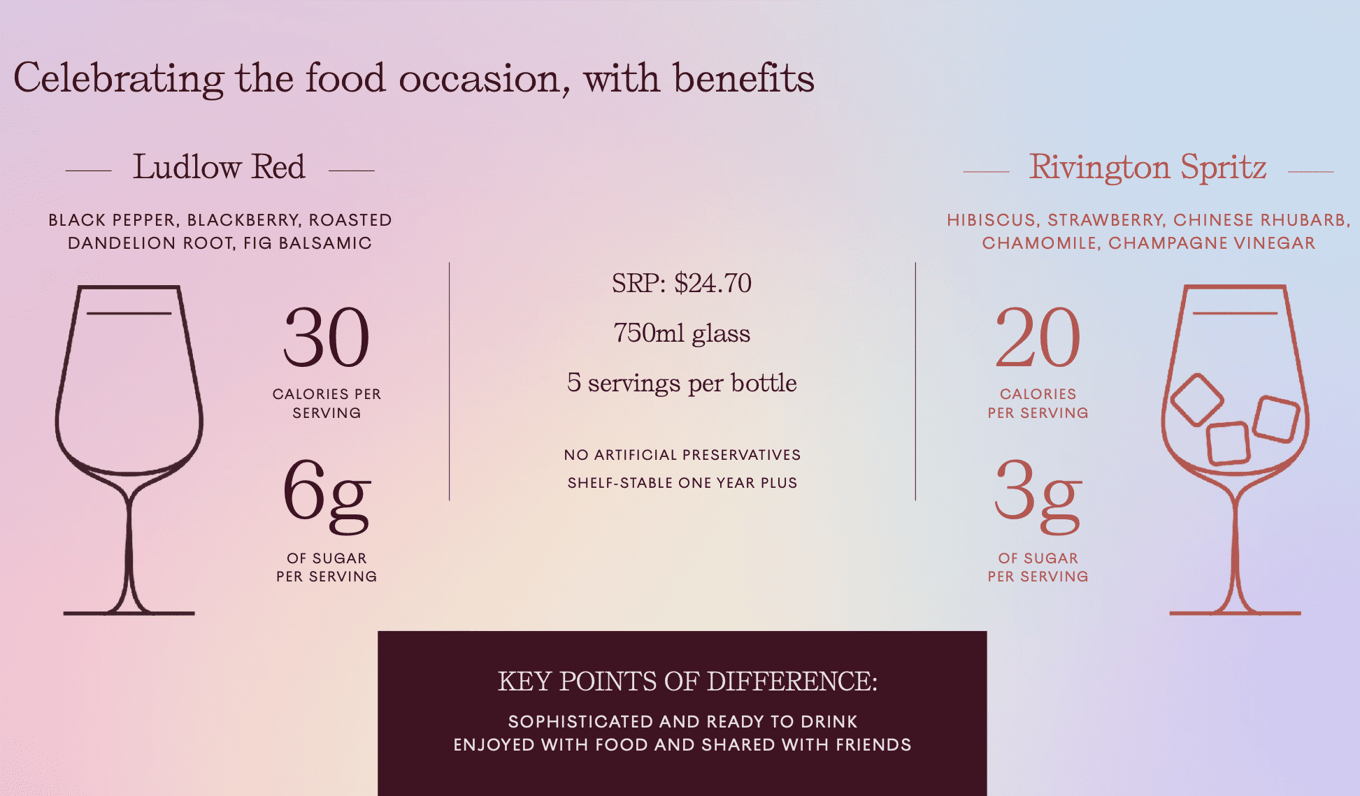

Celebrating the food occasion, with benefits

Created by award-winning mixologist, author and worker-rights advocate, John deBary, Proteau stands apart from the crowd of non-alcoholic spirits. It's ready to drink, right from the bottle—no mixing required. Both of our bottles (Ludlow Red and Rivington Spritz) are expertly designed, non-alcoholic, low-sugar botanical recipes with no preservatives.

The drinks:

Traction

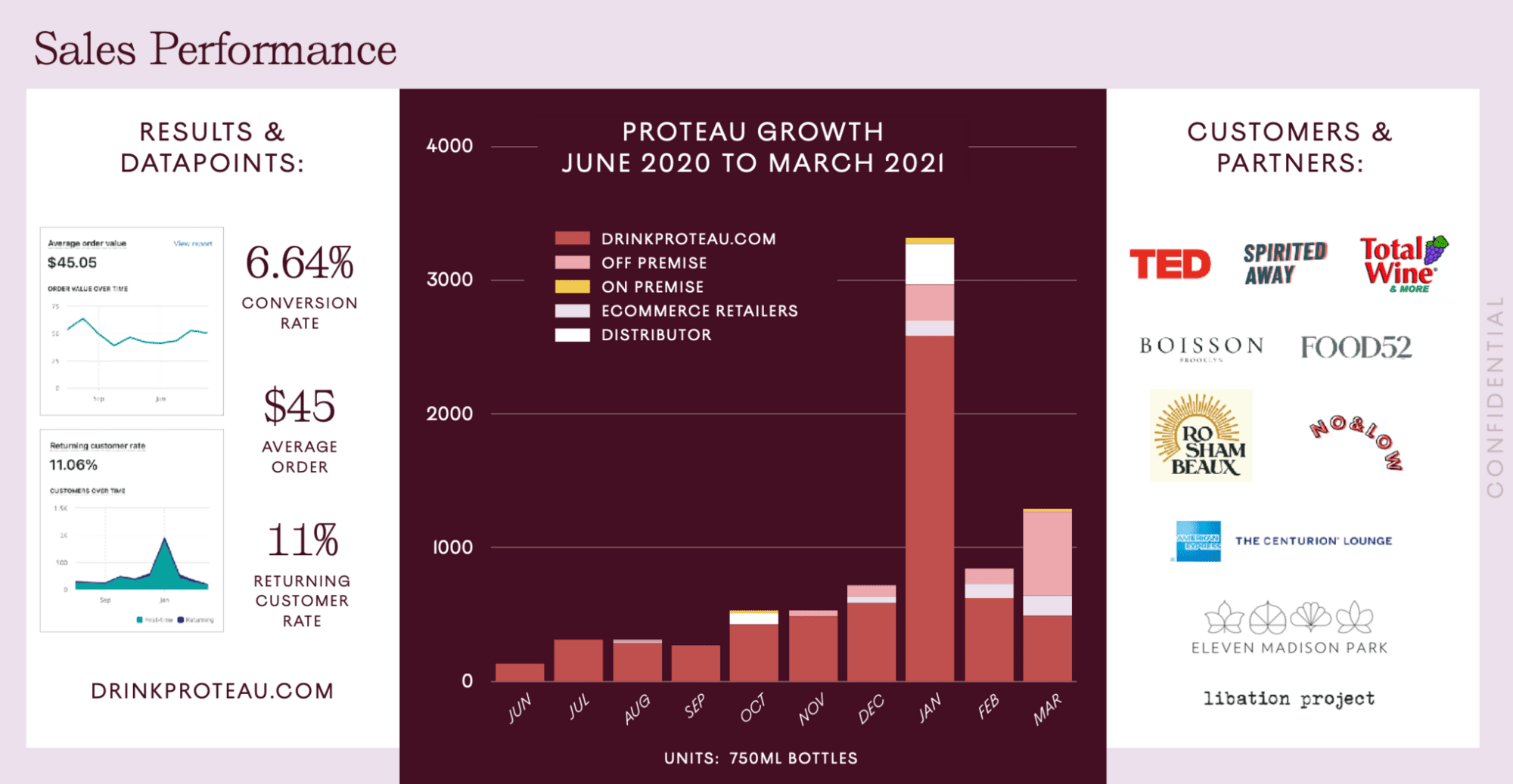

~$20K MRR with minimal marketing spend

Currently, we’re seeing ~$20K/month sales based on minimal marketing spend. Earned PR is steady; and we are adding wholesale accounts weekly. Our revenue has grown exponentially YoY from $40.8K in 2019 to $83.1K in 2020. The first six months of 2021 has seen $141.89K in revenue. We're projecting a total revenue of $340K for the year.

We've received a huge amount of favorable press since launch from publications including GQ, New York Times, Wirecutter, Food & Wine, The Takeout, The Infatuation, Saveur, Huffington Post, and Washington Post.

*MRR as of Jan-Jun 2021

Customers

Consumers are shifting towards healthier, non-alcoholic experiences

58% of consumers are drinking more non-alcoholic beverages than last year while 61% of consumers want better choices when it comes to NA drinks. In 2019, 40% of Americans said they were drinking less than they were five years ago. Proteau provides those who prefer a non-alcoholic beverage with an option that doesn’t add huge amounts of sugar and that fits most dining occasions.

Business model

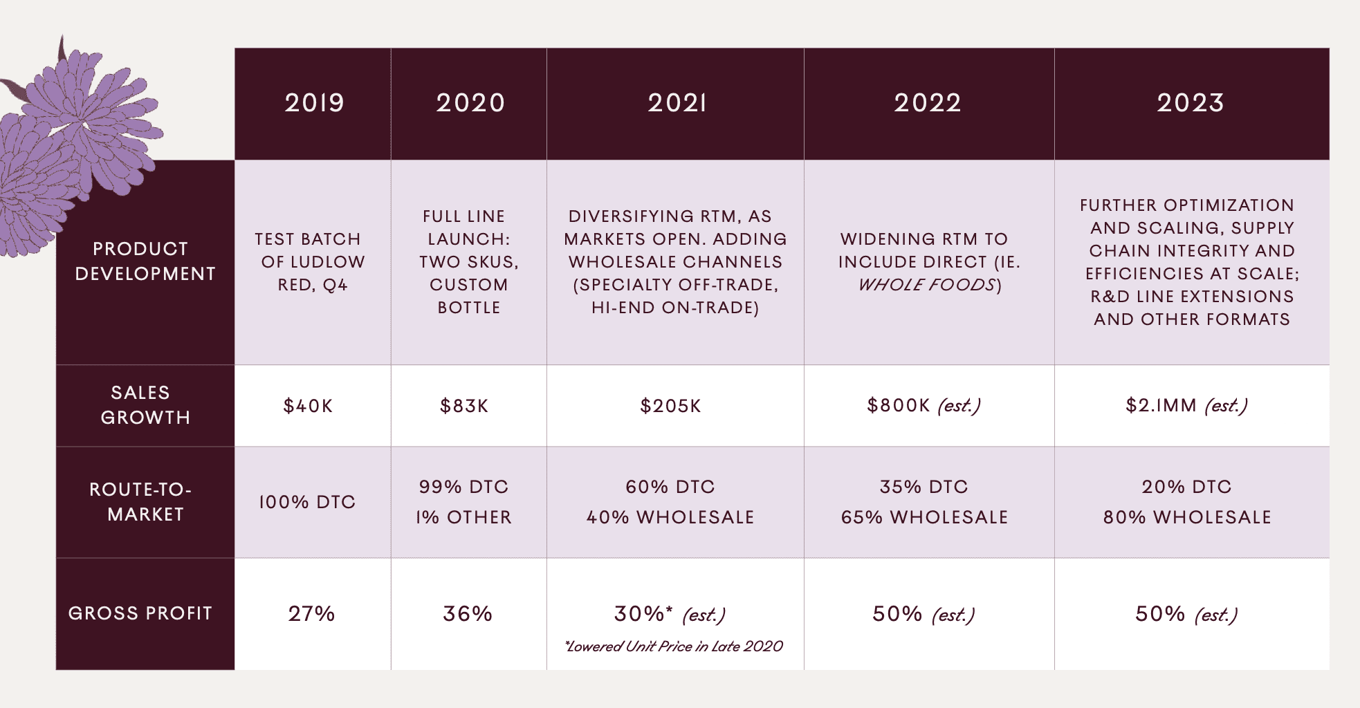

DTC and B2B with a 30% projected margin in 2021

We make money through a blend of DTC and B2B sales, with B2B being our most dominant channel. In 2021, we'll expand to include wholesale to retail and dining establishments, as well as beverage distributors that are able to provide added value though their sales teams. Right now, our product costs about $5 per bottle to produce, without any supply chain optimization or volume discounts, and our gross margin is projected to be 30% in 2021.

Market

Carving out a leading role in the rapidly developing zero-proof drinks space

Zero-proof is an early stage category with strong consumer trends supporting it. It is already an established market in the UK and has gained significant traction in the US over the past two years. Proteau is positioned to go after the much bigger wine market that captures a wider range of occasions, most notably food pairings, while maintaining a leadership role in the zero-proof category.

Competition

Other brands focus on complex cocktails or casual beer

Proteau is making a name for itself as a ready-to-drink botanical beverage that serves the same function as wine when paired with food. Other brands in the emerging market are focused on complex cocktails or casual beer. Our ability to capture the wine-drinking market differentiates us from others, and provides unusual market adaptability in the restaurant industry.

Vision and strategy

Growing 300%+ over the next 3 years

We’re seeking a $100M valuation in 5 years based on specialty retail, on-premise sales, and DTC/e-commerce. Our immediate goal is to add wholesale channels in the specialty off-trade and high-end, on-trade streams. After that, we plan to onboard strategic national retailers such as Total Wine and Whole Foods, which will allow us to further scale our supply chain. In addition to our focus on national growth, Proteau will continue R&D on new line extensions and other formats of our winning formulas.

Funding

Previously raised $1.6M

We are seeking early stage financing to be in 100 key and trendsetting accounts in NYC/SoCal in 2021. We also need to build inventory and service existing demand, grow our team, and establish a compelling digital presence for branding, product info, and e-commerce. Our plan is to deploy full time sales managers in NYC/SoCal, build a digital marketing team, build out in-store merchandising, and continue to leverage John deBary as our founder and ambassador. Proteau has previously raised $1.6M from 2019-2020 through a strategic advisor.

Founders

John deBary, CEO and Creator

Proteau was developed by John deBary (or JdB), thanks to the culinary diversity available in New York City, the place he calls home.

For nearly a decade, JdB has been crafting unusual concoctions for some of the world’s most renowned bars and restaurants. He worked at the acclaimed neo-speakeasy PDT (Please Don’t Tell) and most recently served as the Bar Director for the Momofuku restaurant group. For years he assisted Food & Wine magazine with their annual cocktail issue, and is a frequent contributor to Liquor.com, GQ, and PUNCH. John's cocktail book, Drink What You Want, was just released by publisher Clarkson Potter.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...