SharpMed, LLC is pleased to announce its 2nd issued United States patent (Issued on August 31, 2021). This 2nd patent rel...

The ask

Pioneering a new era in healthcare

SharpMed is seeking $1.2 million in funding to finalize the commercialization of the Turbo® O₂. With FDA Class I clearance already obtained and a robust patent portfolio including 2 issued patents and 4 more pending for Turbo® O₂, SharpMed is strongly positioned to deliver our suite of transformative medical devices.

This strategy is carefully designed to generate an initial revenue stream, providing capital to propel our pipeline of current and future innovations. Our commitment to strategic growth demonstrates financial prudence while also mitigating investment risks, as each product creates value for the company.

Together, we can ignite the future of medical technology and create a healthier tomorrow.

Vision

We aim to be the top medical device incubator in the world

Saving lives and enhancing care through a clear product roadmap

Problem

The medical device market is broken

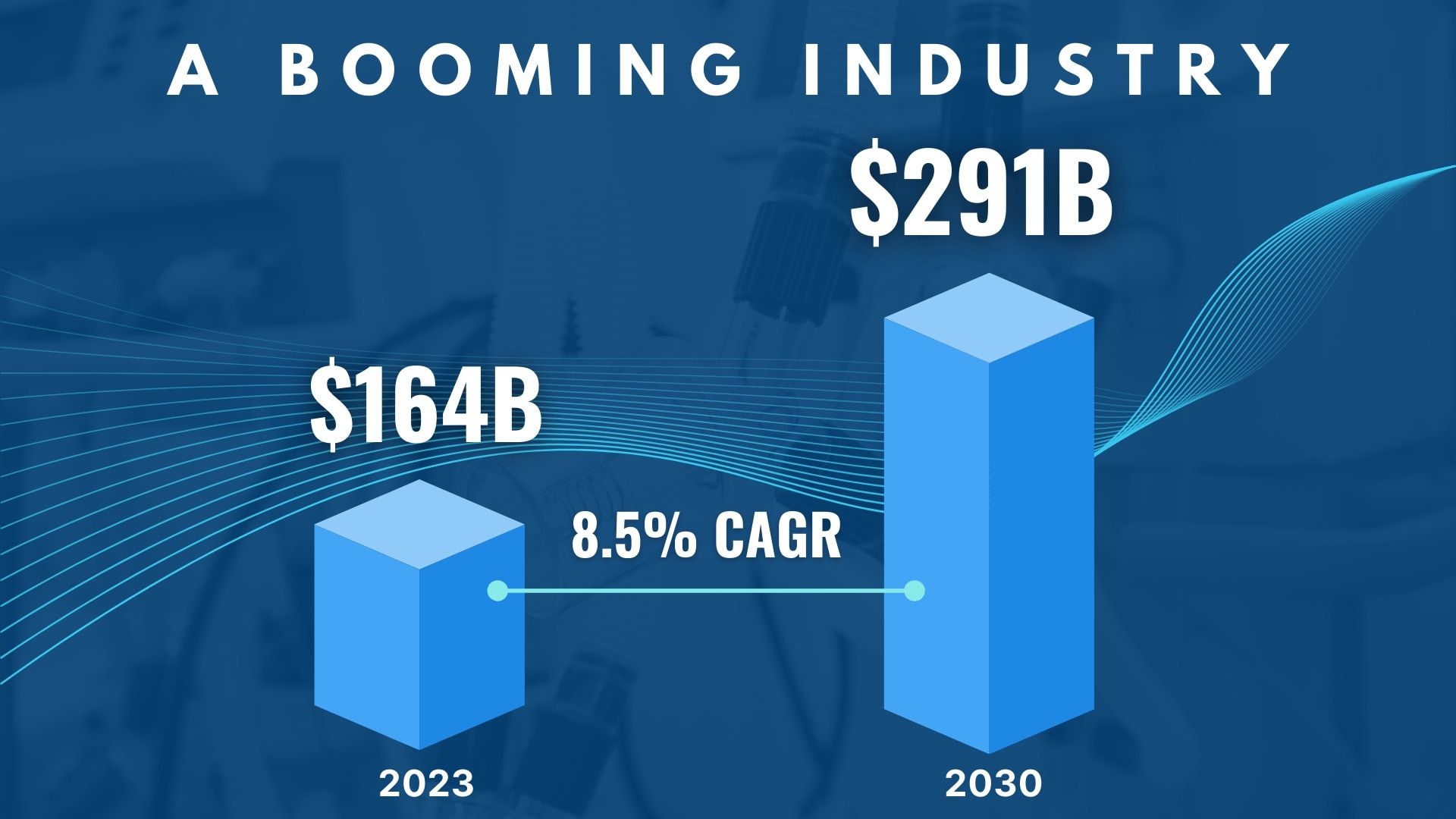

Even as a $164 billion market in the US, many life-saving medical devices never make it to market.

Solution

We create the devices doctors need, hospitals want, and patients deserve

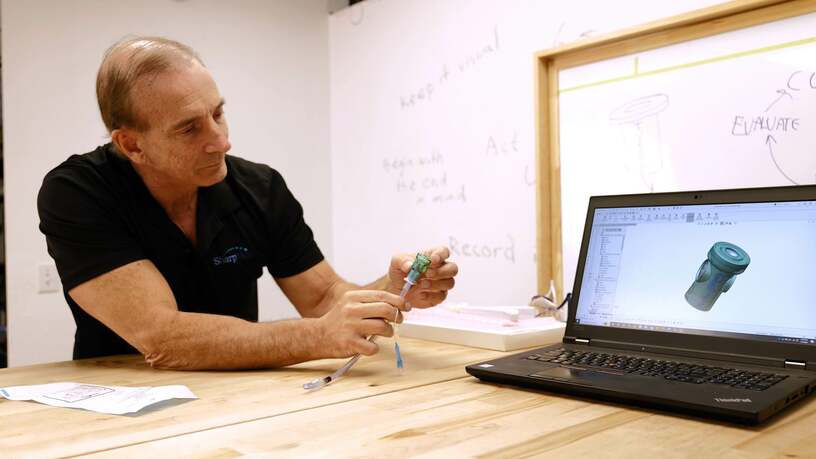

At SharpMed, we specialize in designing and launching medical devices tailored to doctors' needs and hospital requirements. We rigorously assess the feasibility of each idea, advancing only those with confirmed viability. This streamlined process takes ‘wickedly cool’ ideas and transforms them into fully market-ready medical devices that are both cutting-edge and practical.

Competitive advantage

We manage the entire development process under one roof

Our integrated approach sets us apart from the pack

Market

A $164B market today— a $291B giant tomorrow

Our strategic approach positions us to benefit from the industry's projected 8.5% CAGR over the next 6 years.

Products

From the lab to the frontline

Your investment paves the way for transformative impact across the healthcare landscape.

By investing in SharpMed, you're supporting both our current suite of innovations primed for strategic licensing and acquisition, as well as our pipeline of future game-changing inventions.

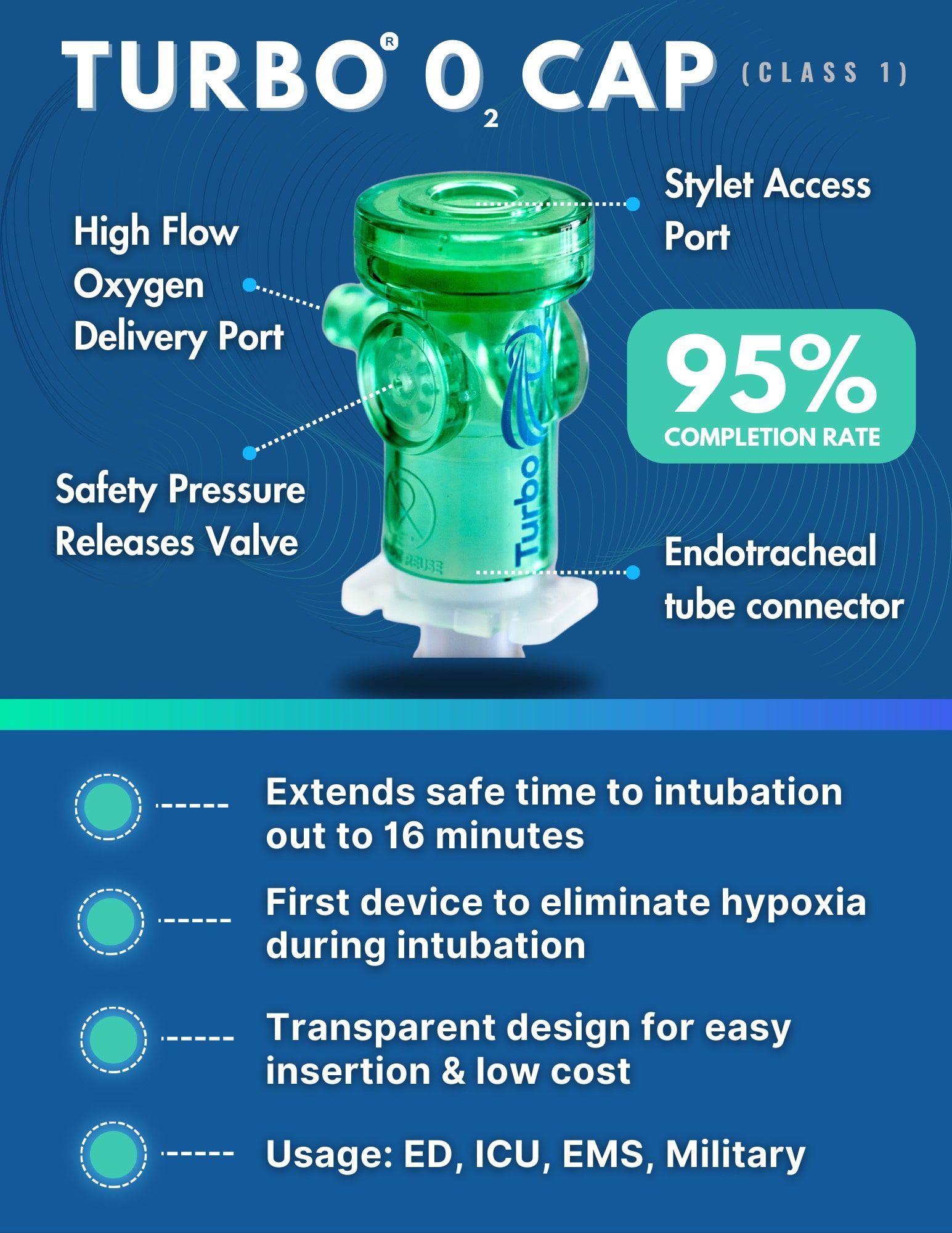

Turbo® O₂ Cap

A lifeline in critical moments that prevents dangerous drops in oxygen levels during intubation.

Healthcare Problem:

During emergency intubation, there is a constant risk of lethal hypoxia. Oxygen levels can rapidly drop below 70% in less than a minute. Without intervention, the next step is a high-risk tracheotomy, with a survival rate of less than 25%. Existing oxygen delivery methods like bag-mask ventilation and nasal cannula are difficult to perform correctly in emergencies and don’t provide sufficient oxygen flow.

SharpMed’s Solution:

Enter Turbo® O₂ Cap—what we believe to be the first and only device that can effectively eliminate hypoxia during emergency intubation procedures. Turbo® O₂ extends safe time to intubation out to 16 minutes, maintaining oxygen saturation above 97%. This extra time can mean the difference between life and death.

Market Readiness:

95% ready - poised for a 2024 commercial launch.

Video Summary:

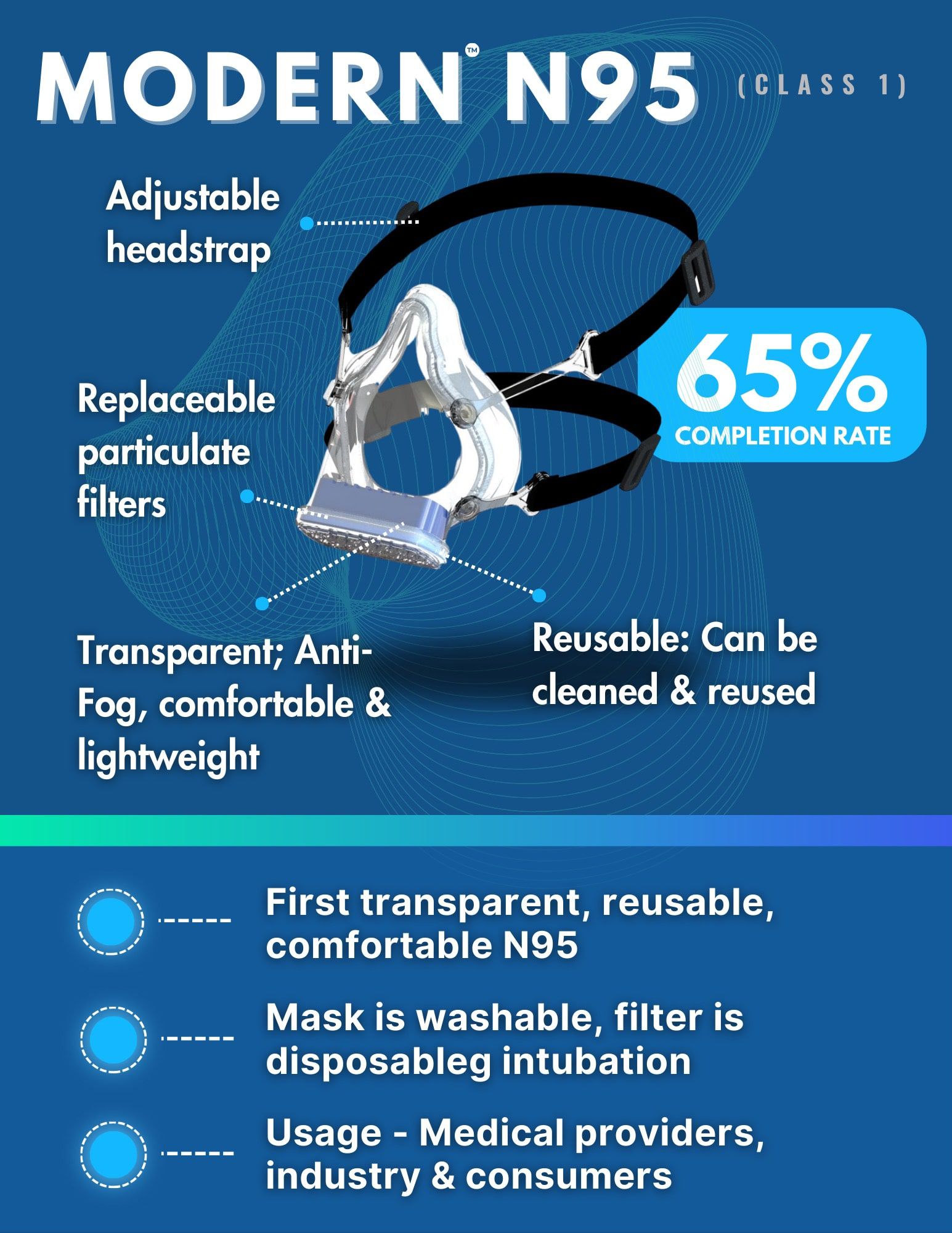

Modern™ N95

The clear revolution in protective masks.

Healthcare Problem:

N95 masks have been the go-to for airborne particle protection for decades. However, they come with challenges like skin erosions, obscured expressions, and discomfort that limit use. In settings where both protection and communication matter, traditional N95 masks fall short.

SharpMed’s Solution:

Introducing the Modern™ N95 mask—a revolutionary blend of protection and transparent design that’s on the cusp of FDA approval. More than a traditional respirator, Modern™ N95 is a comfortable, adjustable, and reusable shield that improves visual cues for effective communication. Our filtration tests hint at a future where N99-level protection is possible, redefining safety.

Market Readiness:

65% - anticipated to launch commercially in 2025 - 2027.

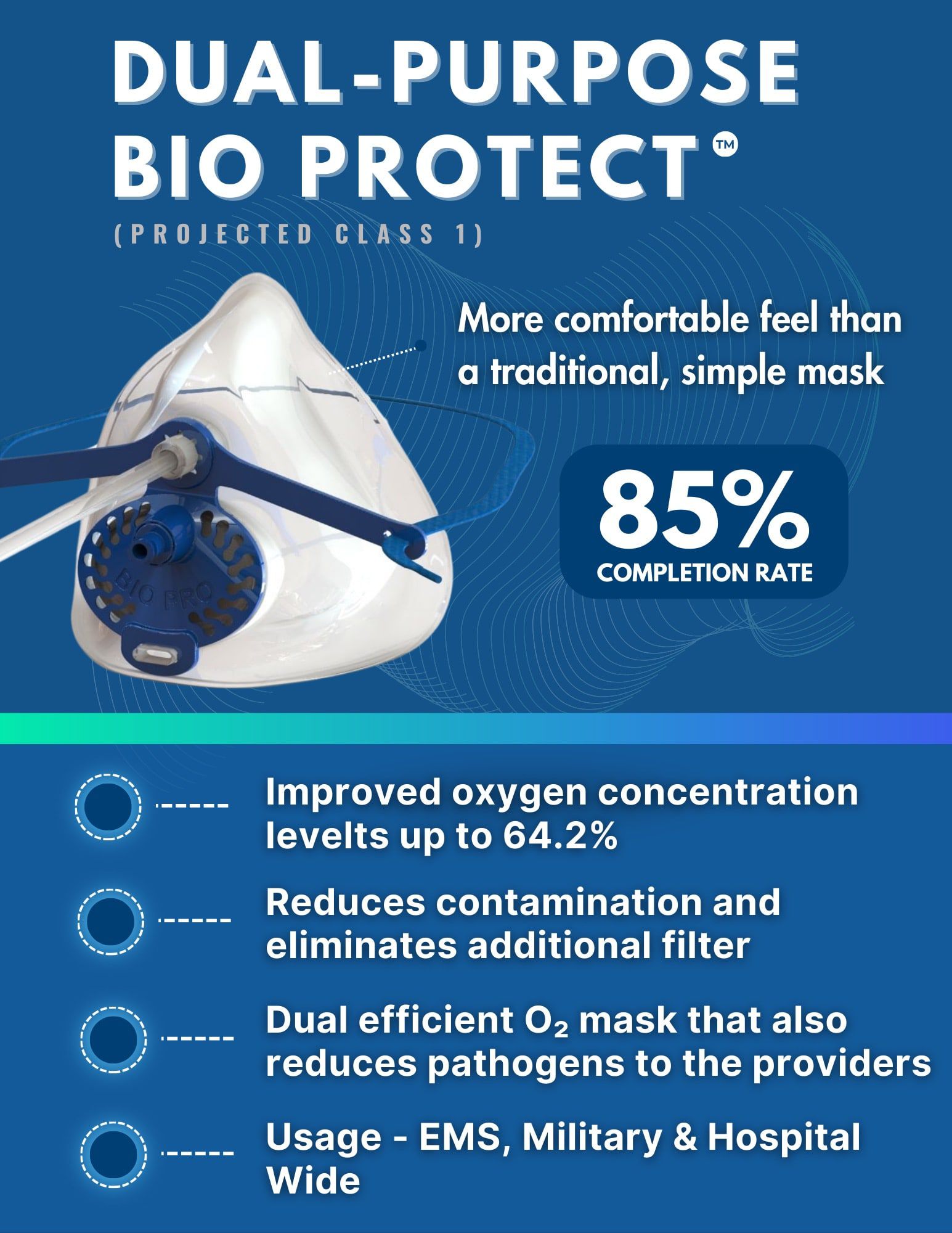

Bio Protect™

A dual-purpose shield in the fight against pathogens.

Healthcare Problem:

Administering oxygen to patients exposes healthcare workers to infectious airborne particles. Traditional cup-shaped masks are ill-fitting and allow exhaled breath to escape, failing to protect staff from viruses, bacteria, and other pathogens. Improved oxygen mask technology is urgently needed to provide respiratory support and shield frontline healthcare professionals from exhaled pathogens.

SharpMed’s Solution:

The dual-purpose Bio Protect™ oxygen mask revolutionizes respiratory care for patients and providers. Its patented design delivers up to 64% more oxygen than traditional masks and captures over 99% of exhaled particles to protect healthcare professionals. Designed for comfort and compliance, it provides a secure and adjustable fit with dual integrated ports for CO2 monitoring and oxygen delivery.

Market Readiness:

85% - anticipated to launch commercially in 2024 - 2026.

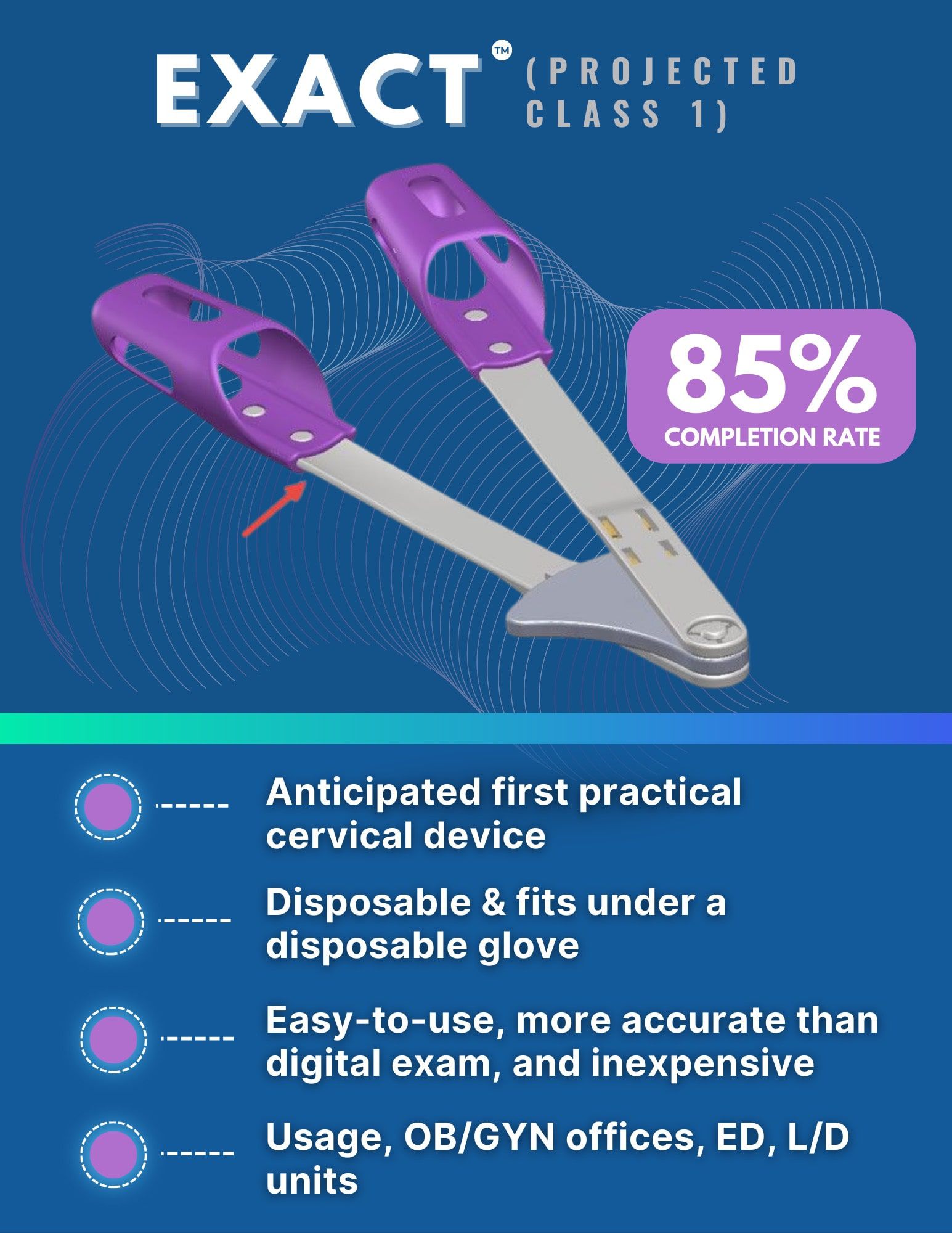

Exact™

Precision in childbirth, safety for generations.

Healthcare Problem:

Accurate cervical dilation measurement is crucial for safe childbirth. But the standard two-finger method of testing—used since ancient Greece—is as inaccurate as 19%. This practice influences decisions on hospital admission, medication, and the rising rate of C-sections. Should a baby's and woman's well-being rely on such guesswork?

SharpMed’s Solution:

Exact™ brings unparalleled precision to cervical dilation measurement. It equips obstetricians and midwives with the tools to make evidence-based decisions, enhancing the safety and predictability of deliveries. This innovation is set to modernize labor progression standards, leaving outdated methods where they belong—in the past. Testing using early prototypes has been very encouraging; we anticipate research will demonstrate that the Exact™ is much more accurate than the old-fashioned two-finger approach.

Market Readiness:

85% - anticipated to launch commercially in 2024 - 2026

Video Summary:

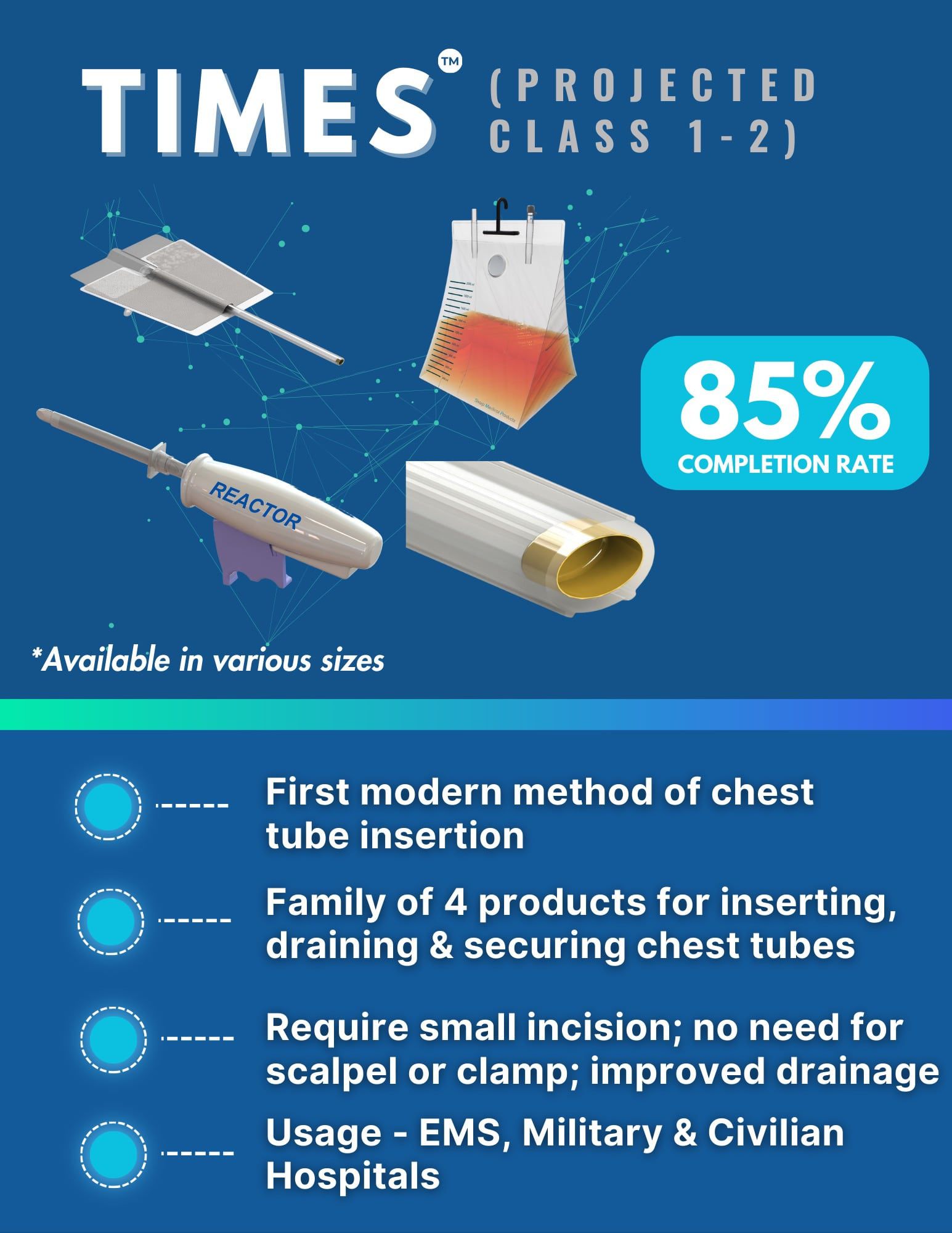

TIMES™

The pinnacle of chest tube management.

Healthcare Problem:

The technology for large chest tube insertions is from the 1860's; there must be a better way! The placement and maintenance of traditional chest tubes require a high level of precision, which can vary significantly among clinicians. This variability often leads to inconsistent patient outcomes and increased safety concerns.

SharpMed’s Solution:

TIMES™ revolutionizes chest tube management with its state-of-the-art approach. Our groundbreaking platform simplifies procedures for healthcare providers while enhancing patient safety and elevating the standard of thoracic care. The TIMES™ System is a family of 4 products. It is the belief of SharpMed that the Reactor Generation 2 will also be an FDA Class 2 product via a 510(k) submission. SharpMed also is confident that the other three products in this family (closed chest tube, sutureless attachment system, and temporary drainage bag) will be considered FDA Class 1 products. Experience a new era in chest tube management with TIMES™.

Video Summary:

Single page product summaries

Clinically proven and physician approved

From pioneering research to clinical application

To date, the medical research behind our products has been published in these highly-esteemed medical journals:

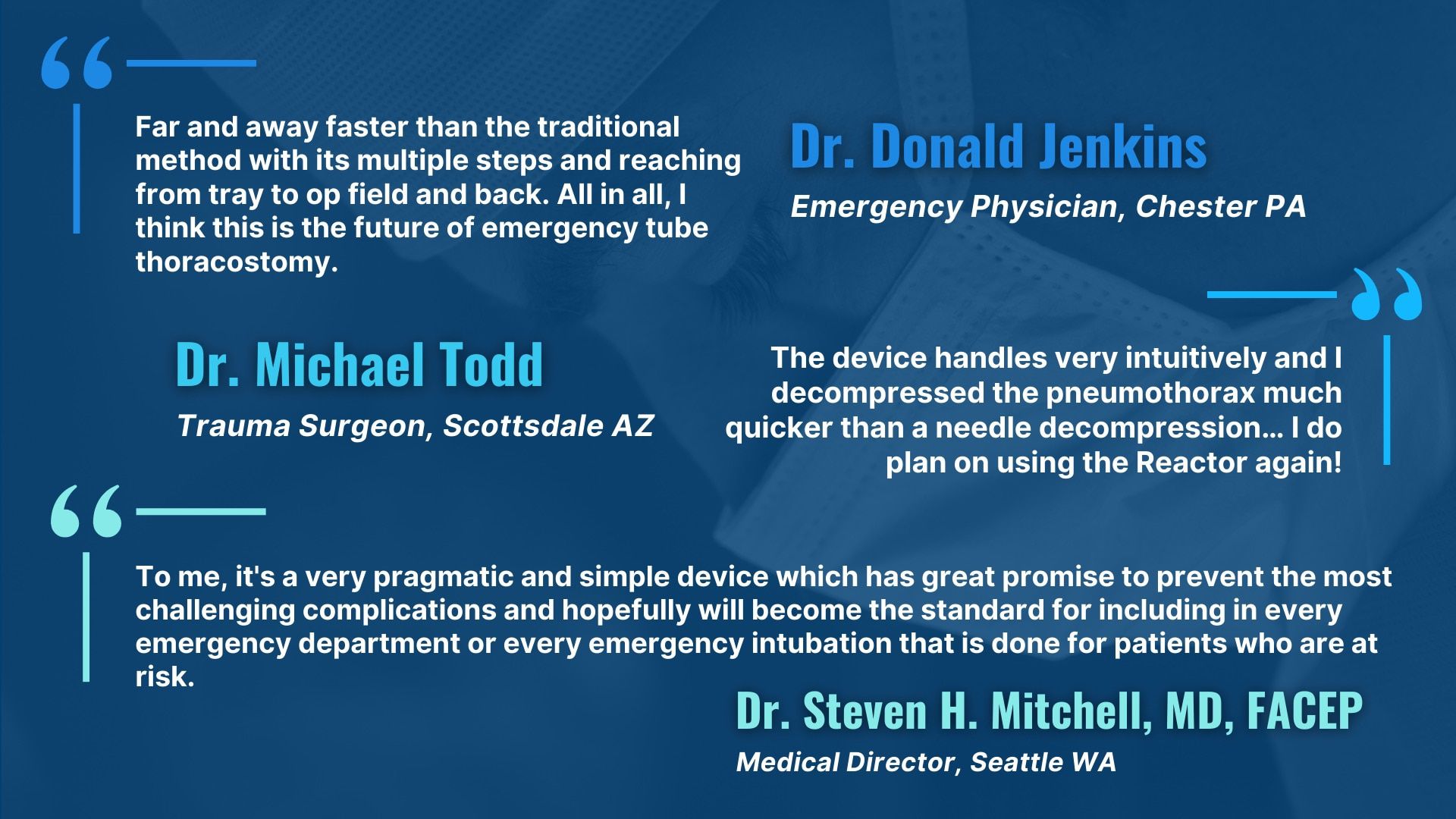

What frontline heroes are saying about SharpMed

Our real-world impact according to trailblazing doctors: The firsthand accounts of the healthcare professionals who use our products proves our impact on patient care. Each story is a testament to our commitment creating a future where SharpMed is synonymous with excellent care and enhanced patient experiences.

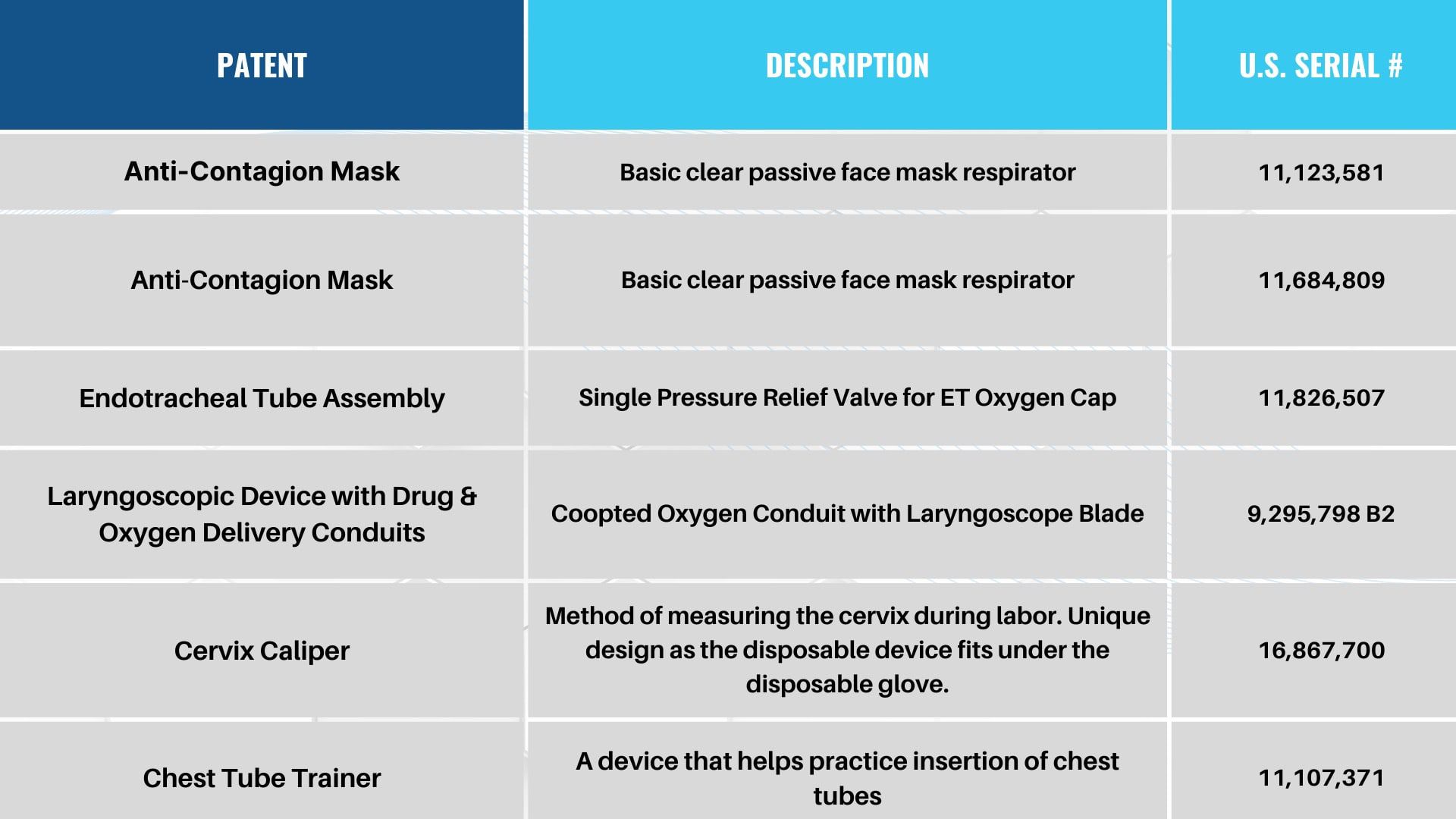

Patents

Our intellectual milestones

A glimpse at our 6 issued and 16 pending patents.

Our remarkable IP portfolio consists of 6 issued and 16 pending patents, showcasing our unwavering commitment to innovation and reinforcing our unique technologies. Our issued patents safeguard crucial innovations, encompassing the key features of all 5 of our products. Simultaneously, our pending patents serve as a protective shield for our technological domain, thwarting imitations by competitors. This ensures exclusive market rights and a formidable competitive advantage for years to come.

Grants and founder commitment

Empowering our vision through strategic funding

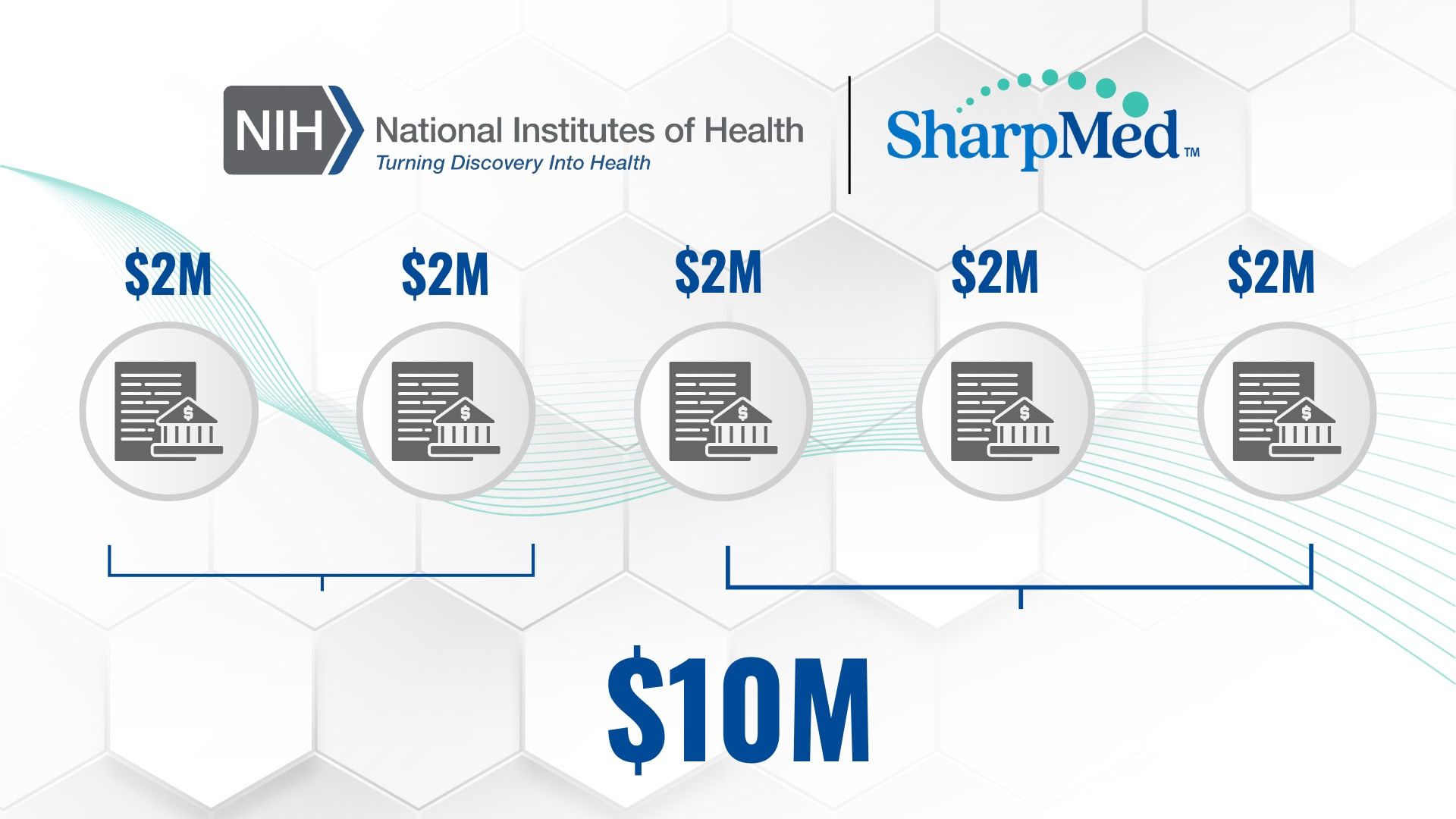

Now SharpMed is actively seeking additional non-dilutive funding opportunities to strengthen our resources. We are currently applying for 5 National Institutes of Health NIH grants, with a target of securing up to $10 million to expedite our growth.

Leadership

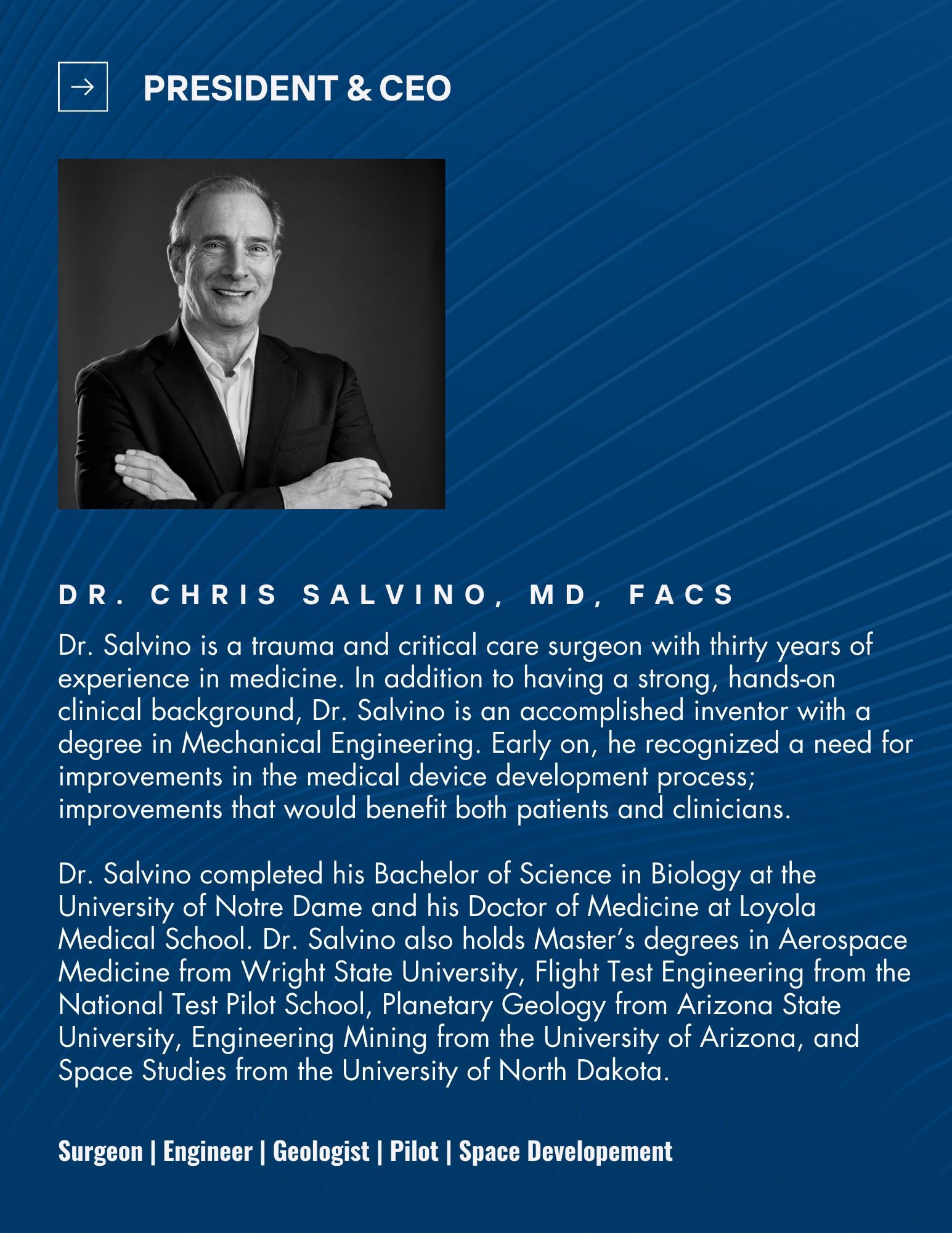

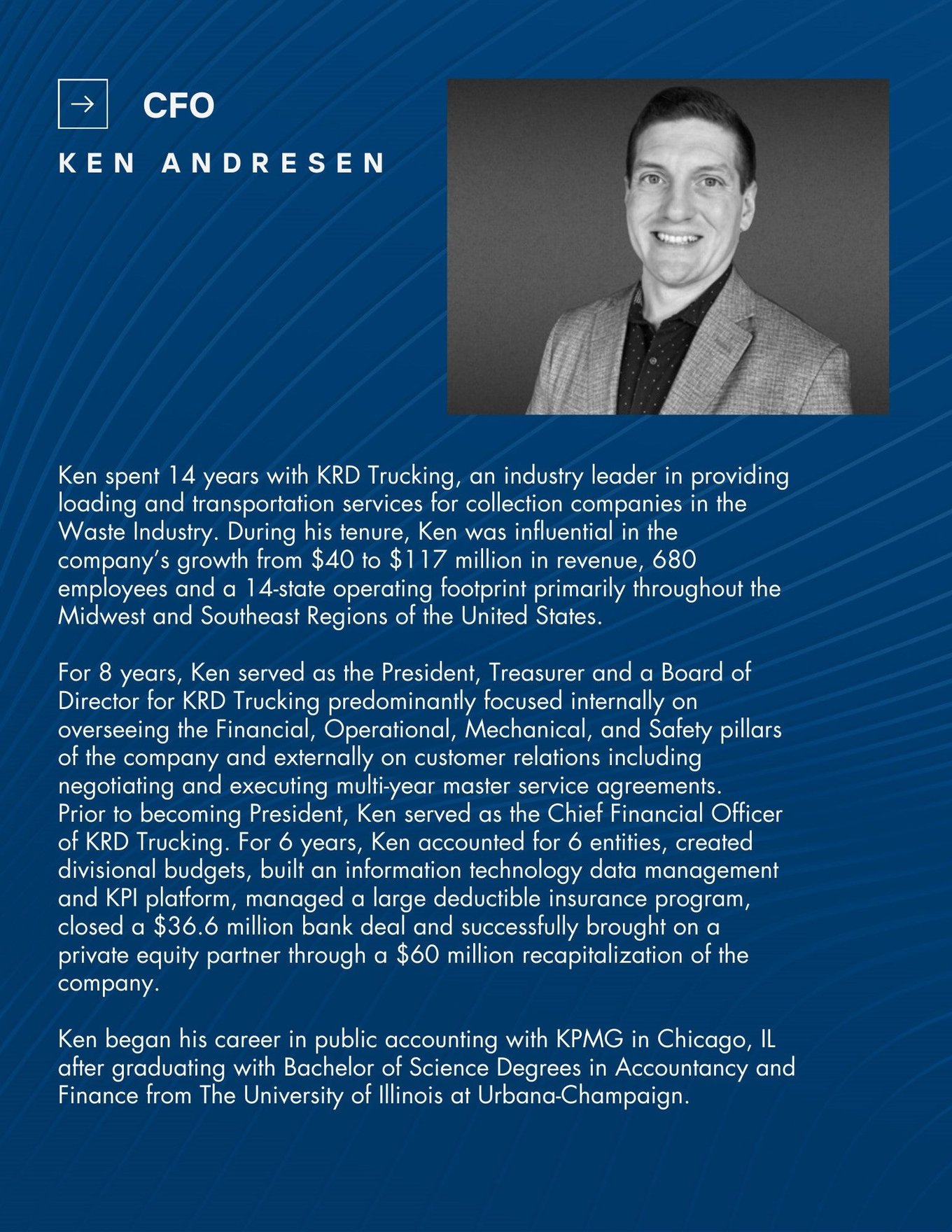

We Meet the pioneers behind SharpMed

A leadership team as innovative as our solutions

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...