Pickleball

The sport of Pickleball is exploding in popularity. From its casual roots on Bainbridge Island near Seattle, where Joel Pritchard, Bill Bell, and Barney McCallum invented the game to entertain their bored kids during the summer of 1965, there are now nearly 21,000 pickleball courts throughout America and 85 new pickleball courts opening each week through early 2020. The spread of the sport is attributed to its popularity within community centers, PE classes, YMCA facilities and retirement communities. It attributes much of its popularity to America’s aging and retiring baby-boomer cohort, which needed an active competitive sport that had lower physical demands compared to tennis, squash and racquetball.

Pickleball is played on a smaller version of a tennis court using a paddleball type racket and a plastic ball. The sport requires less running, overall strength, and less strain on aging joints. It is a game that requires skill over strength, but with enough physicality to make it exciting for players at all levels. Over 75% of the current players are baby-boomers and retirees; however, the sport is growing rapidly among younger segments of the population. The sport is most often played as doubles, with four players on the court at a time. The sport continues to grow worldwide as well with many new international clubs forming and national governing bodies now established in Canada and India.

Company

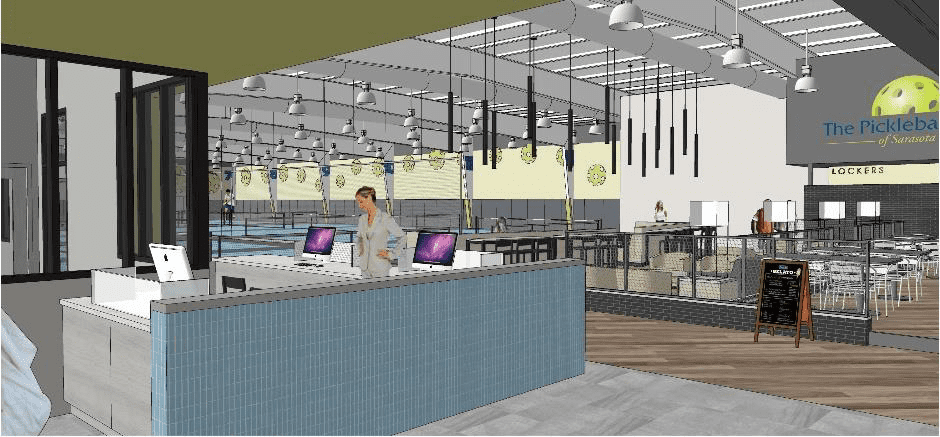

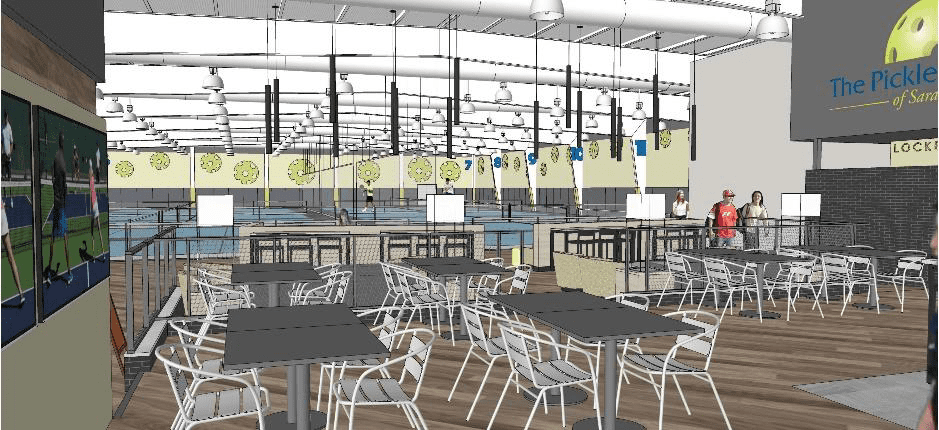

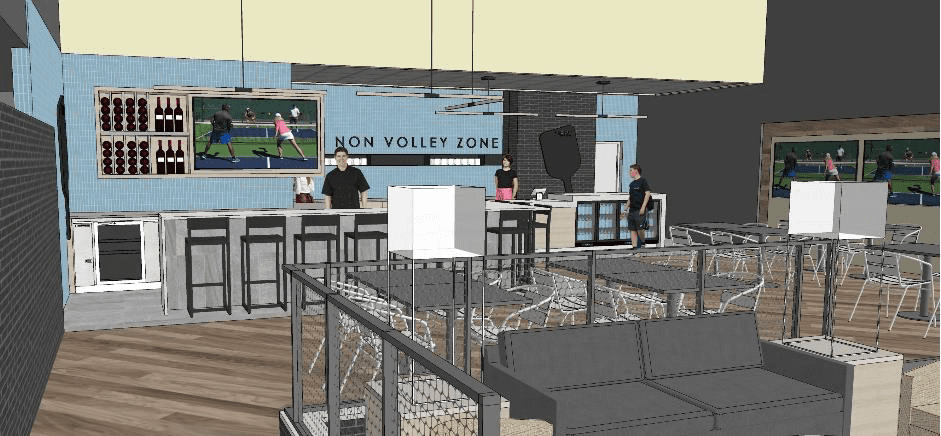

SRQ Pickleball Partners, LLC, (the “Company”) is developing The Pickleball Club™ to be the premier membership-based indoor pickleball facilities in the United States. The Company will begin in Sarasota, Florida, where the first two clubs are under development. The Company’s strategy is to take advantage of the significant unmet demand for a quality indoor sports experience dedicated to pickleball. Each of the Company’s clubs is designed to be approximately 34,000 sq ft with 12 indoor pickleball courts, a pro shop, coffee/juice bar, and locker room facilities. The coffee/bar will be supplemented by a series of rotating food trucks, to accommodate special events and major activities such as tournaments.

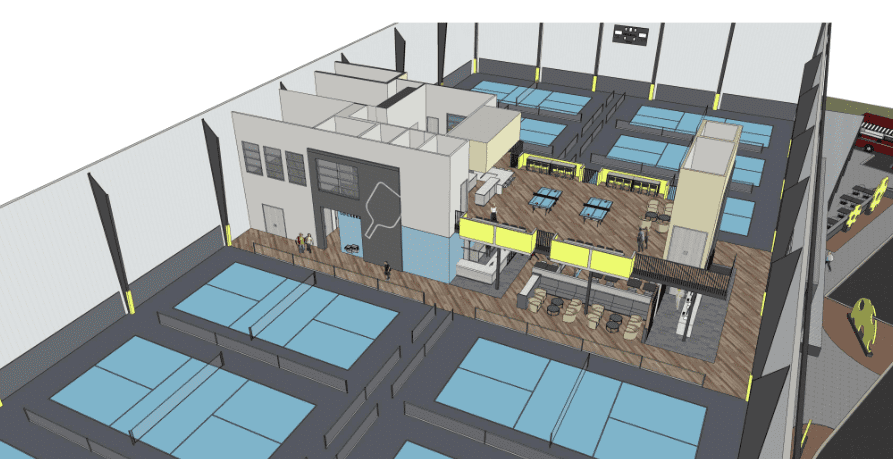

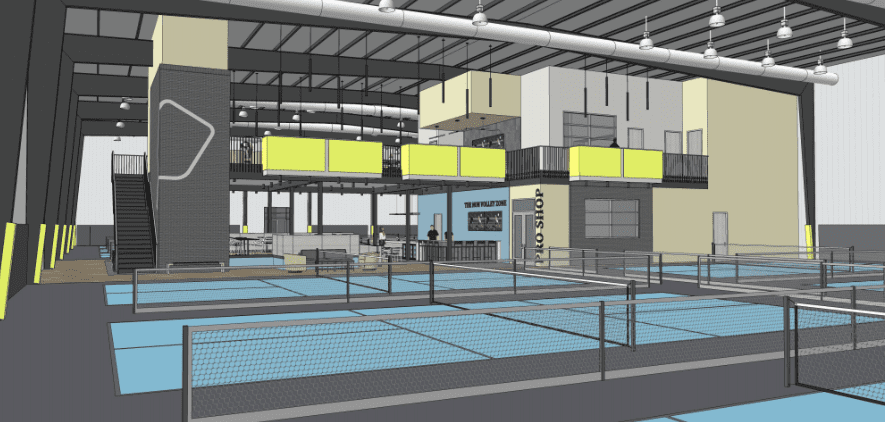

The Club’s positioning is a “Member Only” amenity-based destination. The Clubs will focus on the social aspect of the sport, as well as health & fitness and skill development. Over 10% of the facility footprint will be dedicated to communal social space with ample seating from which members can socialize, watch gameplay and consume food and beverages from the Coffee/Juice bar.

Market

SARASOTA

The Company’s first market is Sarasota, Florida. Management believes the local Sarasota market is ideal for indoor Pickleball facilities. As in all of Florida, rain, heat, wind and humidity frequently disrupt the opportunity to play outdoor sports. Sarasota receives 56 inches of rain a year (compared Dominic Catalano at the APP Masters Tournament in Punta Gorda, FL to U.S. national average of 38) with rain occurring during 106 days per year, nearly one out of every 3 days. For half of the year, high temperatures can affect the desirability and safety of outdoor play for at least part of the day. From April to October, the average high temperature exceeds 85 degrees, and from June to September, the high is 90 or above (83 days per year).

The Sarasota market has a large middle and upper-class retiree population. Sarasota County has a median household income of over $55,000. Thirty eight percent of the population is between 50 and 79 years old. In contrast, only 34% of the total US population is over 50 years old. Sarasota was ranked third most popular destination for retirees.

Pickleball is extremely popular in the Sarasota market. There are currently no indoor facilities dedicated to pickleball in greater Sarasota. Some facilities, such as community centers, have eliminated offering pickleball, as the overwhelming popularity was disruptive to their general mission.

Target Market

The Club’s target audience are those players who desire a higher level of amenity and superior playing conditions. Outdoor facilities will always be utilized by the most budget-conscious players seeking a game at the lowest possible cost. The low-budget segment of the market is willing to endure significant wait times (for a player’s turn due to insufficient supply of even outdoor courts) and weather-related interruptions and cancellations. Likewise, low budget players do turn to nondedicated indoor facilities to avoid weather related issues; however, these facilities significantly limit available court time, as Pickleball interferes with other higher priority uses. The typical gym floor found in these facilities, is not optimal for Pickleball, particularly for those playing competitively.

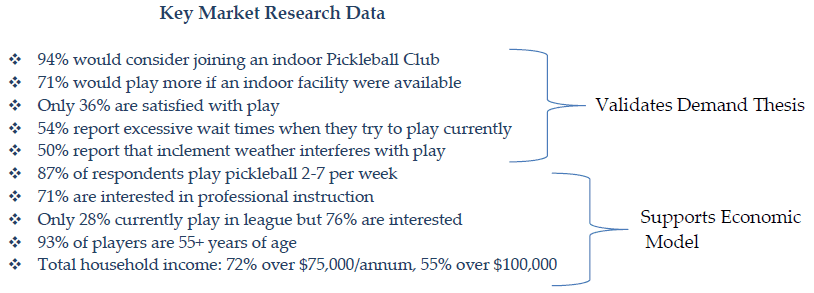

Management believes that the Company’s critical assumptions behind the overall business thesis and drivers of the financial forecasts are validated by third party market research. The Company engaged Kempton Research and Planning (http://kemptonresearch.com/) to conduct individual interviews and surveys. Kempton solicited survey participation from 4,000-5,000 pickleball players in the first market, Sarasota, which it believes will be representative of most of the Company’s initial markets in southern Florida. They received over 300 responses to a 32-question survey of which over 200 completed the survey in full. Key data are summarized as follows:

Validation

During the last several months, other indoor pickleball facilities have opened around the country, each

reporting strong customer metrics:

- Pickle N Par opened in Melville, NY on September 30th. The facility has been averaging 92% court utilization and an average $371 revenue per court per day. By way of comparison, that unit economic metric is 12 times the first year forecast for the Club and 2.4 times the second-year forecast.

- Flemington Pickleball Club opened in Flemington, NJ on October 1st. They signed 100 members during pre-opening and had 280 members in less than 30 days after opening.

- Club Pickleball USA opened in Orem, Utah in January 2021 and reported over 400 membership sales within their first 21 days.

- Pictona, an outdoor facility in Holly Hills, FL, has grown to over 600 members since opening in late July 2020.

Management feels all clubs’ performance, during the pandemic, are a strong validation of The Pickleball Club investment thesis.

The first two clubs

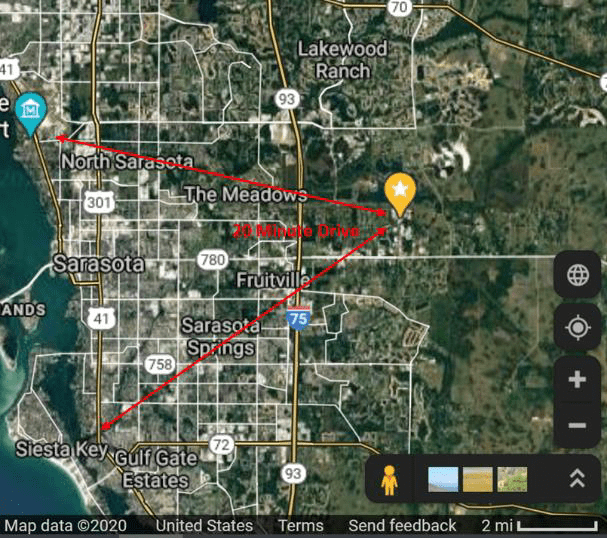

LAKEWOOD RANCH

The first Club will be located at 1251 Global Ct., Sarasota, FL. This is in the southern part of the Lakewood Ranch area of Sarasota. Lakewood Ranch is a suburban area of Sarasota consisting of 18,000 homes and nearly 43,000 residents— and growing rapidly. Lakewood Ranch was named the #1 Best-Selling Multi-Generational Community in the Nation. Virtually all of Sarasota is within a 20-30 minute drive of the Lakewood Ranch location. There are significant populations with prime Pickleball playing demographic cohorts in the close vicinity to the Club. The Club is just a 5-minute drive from I-75 allowing easy access for customers who live in communities to the north and south.

The Company has signed a purchase agreement to acquire a 2.43-acre parcel (105,850 sqft) plot for $820,000. The Company has paid a $25,000 deposit and has agreed to a $14,500 fee to extend the closing date. The closing is planned for first quarter 2021.

The company has received zoning confirmation from Sarasota County and has filed the site development plan with the county. It is in the process of responding to initial comments, none of which are seen as material.

The Company further expects to file for the building permit by in the coming weeks and expects approval within 60 days. There are no variances required for either the site plan or the building permit, accordingly, Management believes that there is no material risk from a permitting perspective that could prevent development of this location.

SARASOTA

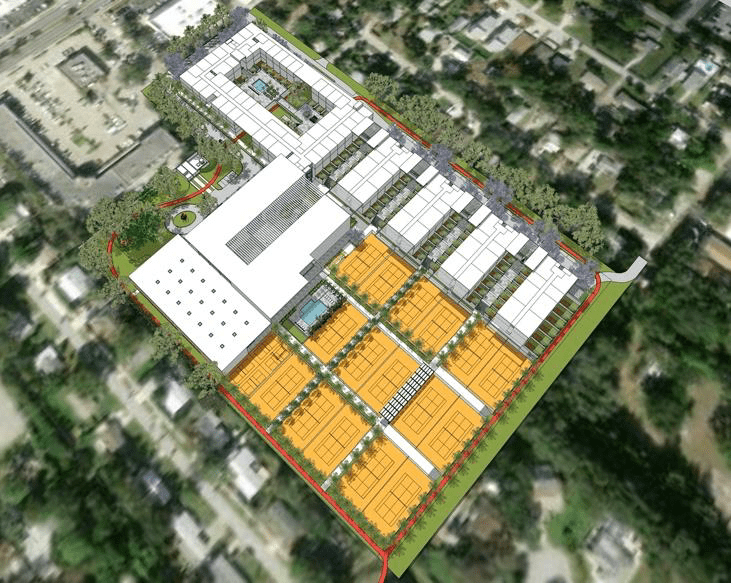

The second Club will be located at 2170 Robinhood Street adjacent to Trader Joes on the east side of South Tamiami Trail.

The property is planned for 207 luxury condominium units, a fitness center, outdoor tennis courts, an indoor Pickleball facility, swimming pool retail shops and public green space with walking trails. The project is expected to be completed in the fall of 2022 or early 2023.

In December, 2020, the Company signed a lease with the owners of the Bath & Racquet Club of Sarasota, Inc., (BRC). The lease requires BRC to construct the facility to the Company’s specifications. The initial lease term is 15 years with three five-year options to extend in favor of the Company. The annual rent is calculated as 6.9% of the development cost, plus an allocated cost of land of $950,000.

The rent increases by 2% after each five-year period. The forecasted development cost is $5.035 million, resulting in a total cost basis of approximately $6 million, for which annual rent would be $414,000, paid in $34,500 monthly installments. Rent begins 90 days following delivery of the facility.

All condo owners will receive one membership in the Sarasota Club. The membership fees will be included in the homeowners’ common charges, in essence making each owner a guaranteed member of the club.

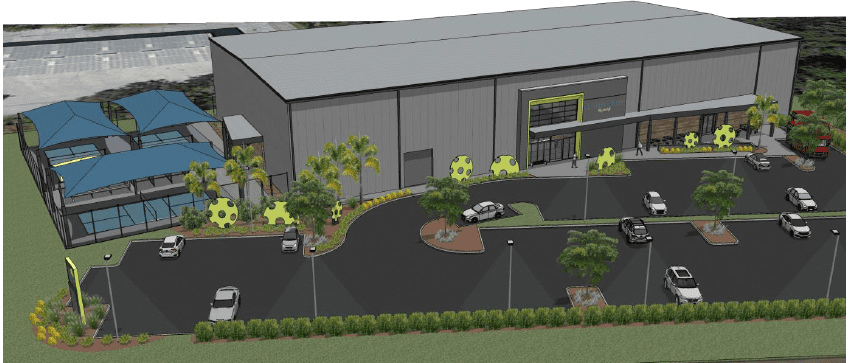

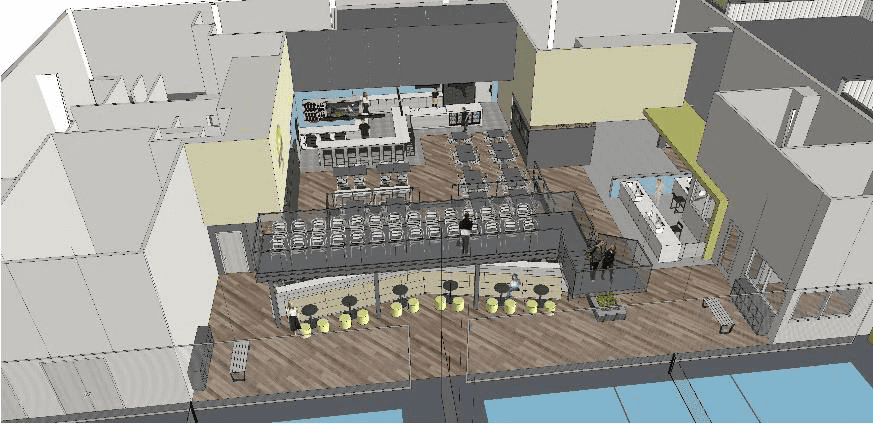

Facilities

The Company has invested a significant amount of time and capital in designing the template for the Clubs. The Club’s plan calls for a 26’ high single-story building containing approximately 34,000 sqft, which will accommodate 12 indoor pickleball courts, a 544 SF pro shop, coffee/juice bar, storage, a 4,000 sqft mezzanine level, 2,000 sqft of communal space for members, locker rooms, storage and administrative space.

The cost for developing each facility is expected to be approximately $5.1 million. The full development budget is detailed below. For full financial forecasts see Appendix A. Please note, final plans for each location is expected to cause changes to the budget; however, the management believes that any differences will not have a material impact on the final budget.

Realty expense is forecasted to be $750,000 to $1.25 million per location. To accommodate the Club footprint and typical parking requirements, each plot is expected to be at least 2.15 acres. Additional land will enable clubs to accommodate a small number of outdoor covered courts.

The fixture and equipment budget for each club (not included in either the realty development budget or expensed as start-up costs) is $239,500.

Revenue model

Each Club’s revenue is forecast to be derived from:

1. Member Initiation Fees

Membership will require a one-time initiation fee that is forecasted to be $150. Additional members from the same immediate family may be added to the membership at a 30% discount. The forecast assumes that 20% of memberships will be family-based.

2. Membership Fees

Membership is expected to be offered at $780/annum, payable in advance, or $65/month. Management may adjust pricing levels as needed. Membership will allow members to use the facility and participate in designated “Open Play” sessions with no additional charge. Open play time will be restricted to non-premium hours and reduced to accommodate the needs of members paying for reserved time and for instructional activities. From an asset utilization perspective, open play allows the Club to offer the members value at virtually no marginal cost, as the open play court time will essentially be surplus court inventory.

3. Court Reservation Fees

Members who wish to access court time either during non-open play hours or who wish a dedicated court during open-play can pay for court time at the rate of $25 per hour. For a typical doubles match, the reservation fee is a very affordable $6.25 per hour per player. Management may employ a dynamic pricing model, based on intra-day demand for court time, to price court time at a premium or discount to the standard rate. The financial forecasts only assume approximately two hours of reserved court time per member each month. Even with such a small amount of court time being on a (paid) reservation basis, the Company forecasts that it will generate approximately one third of revenue from court reservation fees.

4. Instructional Fees (Lessons, Clinics and Academies)

The Company is already receiving strong interest from top teaching professionals, who put a premium on working in a comfortable, climate-controlled environment that allows them to have uninterrupted court access, irrespective of the weather, which can cost professionals a third of their income from cancelled instruction. Management forecasts instructional program fees will account for 20% to 25% of revenue.

5. Leagues & Tournaments

Leagues: The Company will organize leagues based on skill level in which players will either join their own teams or will be placed on a team. Leagues are highly popular in adult sports and in particular among the Company’s prime age cohorts. Leagues are a great benefit in helping maintain higher asset utilization levels at strong margins. Leagues are initially forecast to have only 20 participants, each of whom will pay a $75 fee to participate. Leagues typically generate approximately 80% gross margins. While leagues and tournaments are only expected to account for 5% of total revenue, they are important in creating a strong social fabric among members and generating excitement and publicity.

Tournaments: Management believes the facility has the potential to draw major tournaments. Typical tournaments suffer from one of two significant problems. They are either held indoors in gyms or multisport facilities that do not have the correct type of flooring surface for higher level competitive play; or, they are held outdoors, which exposes the event to weather related interruptions and cancellations. The Club facility would solve both of these problems. Club events would be indoors and also played on a competition-level outdoor flooring surface. Even many outdoor venues do not invest in competitive level flooring materials. Management believes that it can position the facility to be a premier host for “level” competitive events, many of which are televised and attract sponsors.

Management is forecasting one tournament every three to four months, with an average of 250 participants per event. Entry fees are forecast to be $50 per participant, generating over $12,000 in revenue per event. Typical gross margins are approximately 70%, not including any sponsorship revenue.

6. Pro Shop & Café Rental Income

Management plans to have both a Pro Shop and a Juice/Coffee Bar. The Pro Shop is expected to be approximately 600 square feet of retail space. The retail operation will be run by Joe Capuano, who operates Sarasota Pickleball. Joe is one of the preeminent retailers of Pickleball equipment in the entire Southeast, if not the nation.

Operational excellence

The Pickleball Club organization espouses The 12 pillars of Operational Excellence as our core organizational philosophy. This is where problem-solving, teamwork, and leadership results in the continuous improvement within an organization. The Pickleball Club organization focuses on members’ needs, keeping the employees positive and empowered, engagement with the communities in which we operate and continually improving the current activities in our clubs:

1. Respect for Every Individual

2. Lead with Humility

3. Seeking Perfection

4. Embrace Scientific Thinking

5. Focus on Process

6. Assure Quality at the Source

7. Flow & Pull Value

8. Think Systemically

9. Creating Consistency of Purpose

10. Create Value for our Members

11. Systems can create value

12. Facility Templates reduce costs and improves operational efficiency

Vision and strategy

The Pickleball Club™ organization has the potential to support extraordinary growth. The sport of Pickleball has created unmet demand for indoor facilities. Tennis is a good proxy to indicate the growth potential for Pickleball. There are currently about 17.8 million tennis players in the US and who play on a total of 250,000 courts of which hundreds if not thousands are located in indoor court facilities. This is in contrast to 3.4 million Pickleball players who play primarily on 18,000 outdoor courts with less than fifteen dedicated indoor facilities (of four or more courts).

Based on these ratios, there should be nearly 30,000 more Pickleball courts in the US and one to two hundred indoor facilities.

Our bilateral growth strategy is to; (i) develop our own realty, in which we own the land and improvements and (ii) where we lease the facilities, built to our specifications, from a third party. Our first two locations in Sarasota are an example of each.

Planned Growth - Our Expansion Vision

Our growth strategy will allow us to establish a strong competitive footprint in Western Florida, from Tampa to Naples, as our primary area of geographic focus, after which we will continue our expansion throughout Florida. Our expectation is that several competitors will seek to replicate our strategy of servicing the demand for indoor Pickleball facilities. Additional competition will be good for the market and help drive user adoption of the sport. Our plan is to create a strong footprint in each locality where we choose to operate, dissuading others from building competing facilities in that locality.

The pace of our growth will be a function of capital availability. In 2021, our focus will be completing and opening our Lakewood Ranch Club. If sufficient capital is available, our plan is to locate up to two additional sites in Venice, Bonita Springs, Naples or St. Petersburg and commence development during 2021 - to open in early 2022, staggering each timeline by approximately 90-120 days.

The pace of our growth will be a function of capital availability. In 2021, our focus will be completing and opening our Lakewood Ranch Club. If sufficient capital is available, our plan is to locate up to two additional sites in Venice, Bonita Springs, Naples or St. Petersburg and commence development during 2021 - to open in early 2022, staggering each timeline by approximately 90-120 days.

During 2021, we will augment the corporate development team so that we have the ability to initiate an additional seven locations during 2022. This includes our second location in Sarasota (under contract with Bath & Racket Club of Sarasota, Inc.) These locations would start coming on-line during late 2022 and into 2023. This will give us a total of ten locations.

We believe most of our focus will be in Florida, in filling our footprint from Tampa to Naples. Other potential near-term markets include Jacksonville, Orlando, Miami, Fort Lauderdale, Boca Raton and Palm Beach. We will also consider going outside of Florida opportunistically during this time.

During 2022, we will continue to grow the development team so that by 2023 we have the ability to add 30 - 40 locations into the development cycle. Further developing the available Florida markets listed above will be the priority. We will also target growth in other strong Pickleball markets including Dallas-Ft Worth, New Jersey, Scottsdale, AZ, and certain areas of Northern and Southern of California. Our goal is to have these locations operational by the 2025 season.

Exit/Liquidity

Each Club is expected to support at least 1,500 members, which translates into forecasted annual operating profits of $1.5 million. At the scale of 40 locations, the total operating profit of $68 million is expected to support an enterprise valuation of the company of between $680 million and $1 billion. This is 10 to 15 times operating profit, which values each location at $15 to $22.5 million.

For clubs in which the Company is the realty developer and owner, we are forecasting a 6.5% compound return on the realty value over a five-year period. The strategy would be to engage in a sale-leaseback transaction with a REIT or other institutional real estate investor. The assumed exit value of the realty would be $8 million per location. Assuming half the locations were company owned and developed, this would imply an addition $400 million in enterprise value of which $100 million would be capital appreciation above development costs.

The valuation of the company would benefit from the additional lines of business we are able to create, including the tournaments and media properties.

Founders

The Company is led by Rear Admiral Brian McCarthy USN(Ret) who is a Sarasota resident with a long and distinguished career. Admiral McCarthy served in the United States Navy Reserve for three decades and became one of the military’s most accomplished logistics officers. In his civilian life, Admiral McCarthy developed over $500 million of commercial real estate and operated a variety of businesses, including numerous retail operations. Admiral McCarthy earned a BS in Engineering Science from Oakland University and an MBA from the Harvard Business School. He is very involved in our community as a past Governor of the Bird Key Yacht Club, First Vice President of the Pops Orchestra, Past President & Executive Director of the Military Officers Association & Foundation in Sarasota and recent Chairman of United Way’s Mission United initiative serving 88,000 Veterans in Sarasota and Manatee counties.

Matt Gordon supports Admiral McCarthy and the Company as the Chief Financial Officer and General Counsel. Mr. Gordon is an attorney and investment banker with over 20 years of experience. He is a noted policy expert on visa-based foreign investment in the United States and has testified in front of the United States House of Representatives as a policy expert. He is an avid lecturer and writer and serves as the Editor of The EB-5 Book, the leading treatise on the US EB-5 Program. Mr. Gordon is a licensed attorney in New York, having practiced mergers and acquisitions law at Fried Frank and Sullivan & Cromwell. Following his legal career, Mr. Gordon ran the US division of a Swiss multi-national corporation, after which he became an investment banking and finance professional. Mr. Gordon received his B.S. in Policy Analysis from Cornell University and his J.D., cum laude, from the University of Pennsylvania School of Law.

Valarie McCarthy is the Company’s Director of Operations. Mrs. McCarthy has over 20 years’ experience in the fitness industry, including as the executive director for the Palo Alto YMCA Association in California consisting of three facilities totaling an excess of 55,000. Mrs. McCarthy also founded and operated a successful fitness facility in Sausalito, California for nearly a decade. Mrs. McCarthy holds a BS and MS in Exercise Physiology from Kent State University. Dominic Catalano is the Company’s Director of Tournaments and Instruction Programs. Mr. Catalano is an active tournament-level and teaching Pickleball Pro. He is a seven-time US Open medalist and won gold medals at the 2019 Gamm Sundial Grand Slam and the 2018 Delray Beach Classic. Prior to becoming a Pickleball professional, Mr. Catalano was a public and private school physical education teacher. Mr. Catalano received two BA degrees from Bellarmine University where he was a second baseman on the collegiate baseball team. He later coached baseball there for three seasons.

Nova Grande is the Company’s Director of Marketing. Nova has worked in the health & wellness industry for the last 20 years. During this time Nova has worked with both professional and amateur athletes, including such as CrossFit athletes, weightlifters, professional football and her favorite crowd - The Atlanta Roller Derby! Over the past 4 years she’s been working most specifically with pickleball athletes. Ms. Grande also helps run 3D Pickleball with Dominic Catalano bringing top level pickleball tournaments to the Southwest Florida area, including Moneyball Pickleball. Ms. Grand owns The HIVE Media Lab which coordinates social media, branding and design. The HIVE is responsible not only for the marketing of The Pickleball Club, but also for The APP Tour, the First International Pickleball Tour.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...