MIAMI BEACH, Fla. (BRAIN) - Operating on the belief that successful retailers combine brick-and-mortar storefronts with e...

We have decided to discontinue our crowdfunding campaign and swiftly refund 100% of your investment. We want to thank each and every one of you for your generous support. It has meant a lot to us to see the excitement build around our company over the last couple months. You may be wondering how this impacts you. What happens to my investment? 100% of your investment will be refunded in the form of the payment you used. There is no need to request it. It will be done automatically. There will be no Crowd SAFE or any other security issued. There are so many more opportunities to invest in Republic with great companies that are doing amazing things. We hope that you continue to invest in companies you believe in, and wish you great returns in the future!

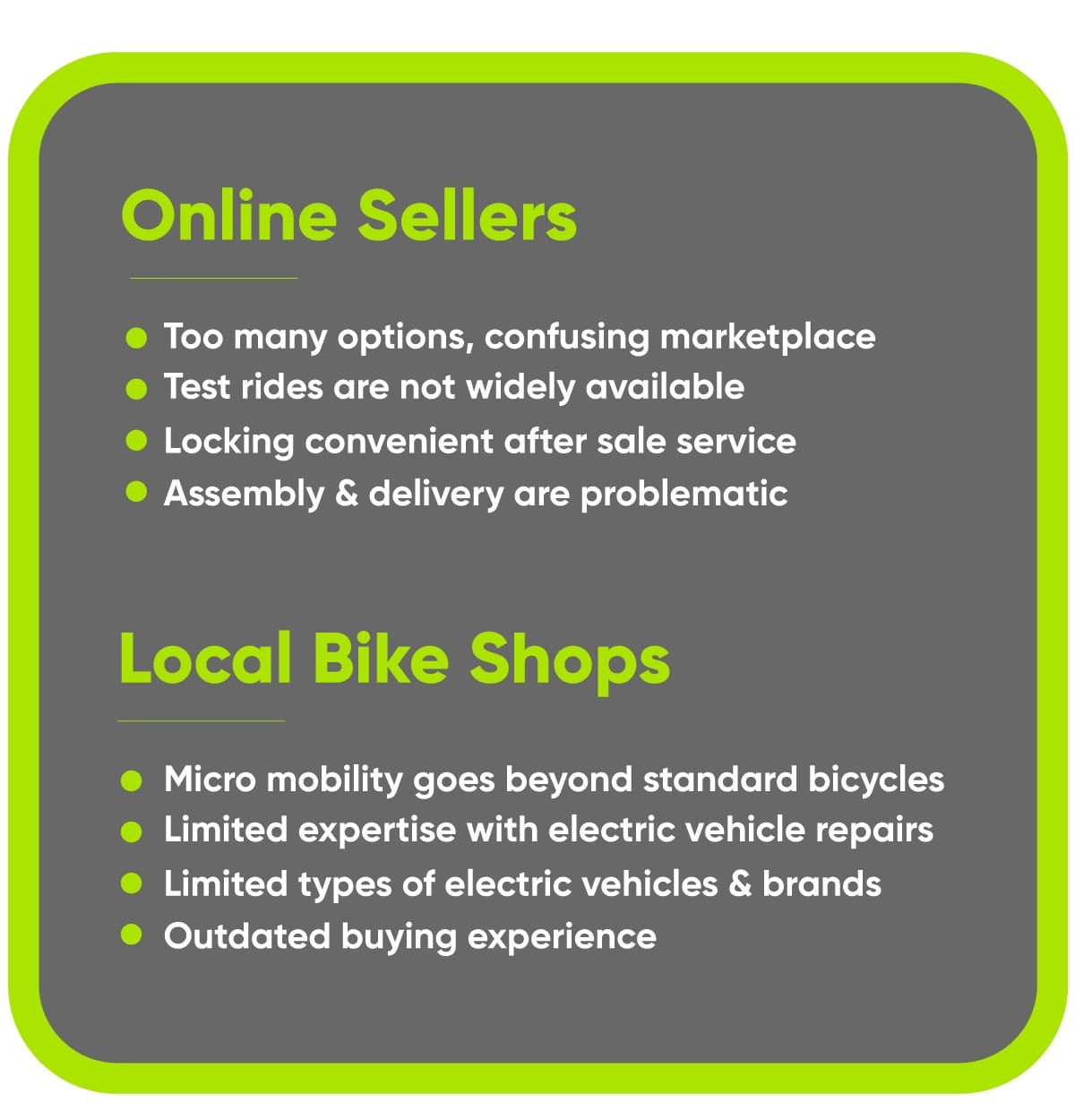

Problem

Everyone’s riding—but stores aren’t stepping up

The Wall Street Journal recently reported that U.S. e-bike sales rose 190% in a single year. This booming market reflects our growing intolerance for the costs of driving:

City traffic congestion

Parking fees

Vehicle and insurance expenses

Air and noise pollution

Sedentary lifestyles

Riders around the world are embracing the affordability and convenience of these Micro Electric Vehicles (MEVs). What’s missing is a trusted retailer, where customers can browse a wide selection of brands in person, buy or borrow their favorite products, and bring their ride in for service—no matter the brand.

Solution

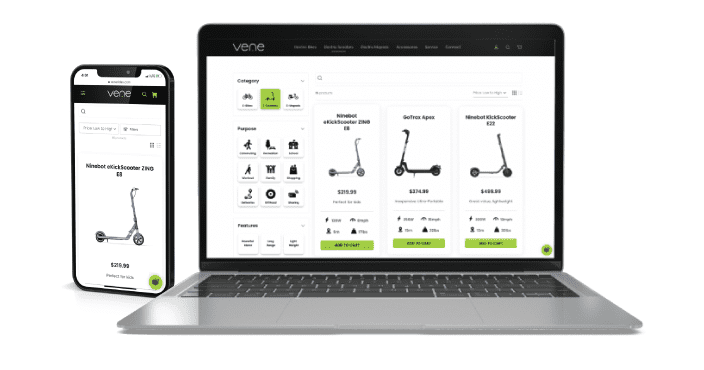

The one-stop-shop for Micro-EV riders

Vene Rides is a new kind of bike shop. Whether online or in-person, consumers can test ride, buy, rent, and service Micro-EVs of all kinds:

E-Bikes

E-Scooters

E-Mopeds

Our product experts curate a selection of Micro-EVs from top brands, with a focus on reliability, serviceability, and quality.

Vene Rides also sells subscription transportation plans that give riders worry-free access to a quality Micro-EV, for a low monthly cost.

Product

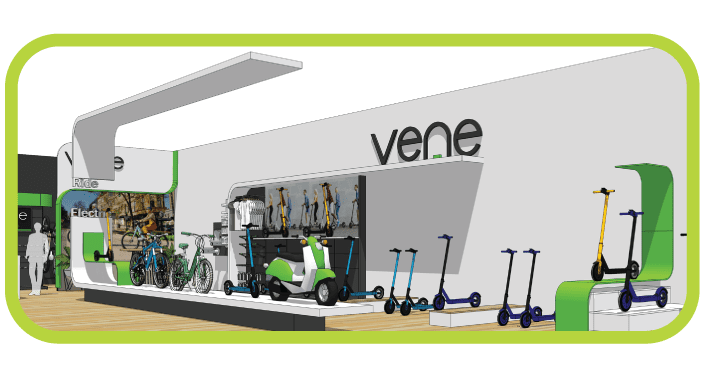

Micro-EV stores with a micro footprint

Vene Rides launched our online marketplace and our first store in the fall of 2020

At just 750 square feet, the Miami store reflects our core concept:

A curated selection of e-bikes and scooters

Repair and service lab

On popular bike paths

Convenient drop shipping—minimal overhead

Functional retail experience—no clutter

In July 2021, Vene Rides opened our second store in Chicago.

Curated selection of Micro-EVs

As micromobility experts, we’re tuned in to the hottest Micro-EVs on the market. We’ve also kicked off our own line of Vene-branded Micro-EVs: the 250w Vene Stria e-bike, and the Vene CITY S1 scooter.

Customers looking for flexible, affordable Micro-EV access have the option to borrow a commuter bike, delivery bike, or scooter through our subscription service.

Traction

Riding the wave

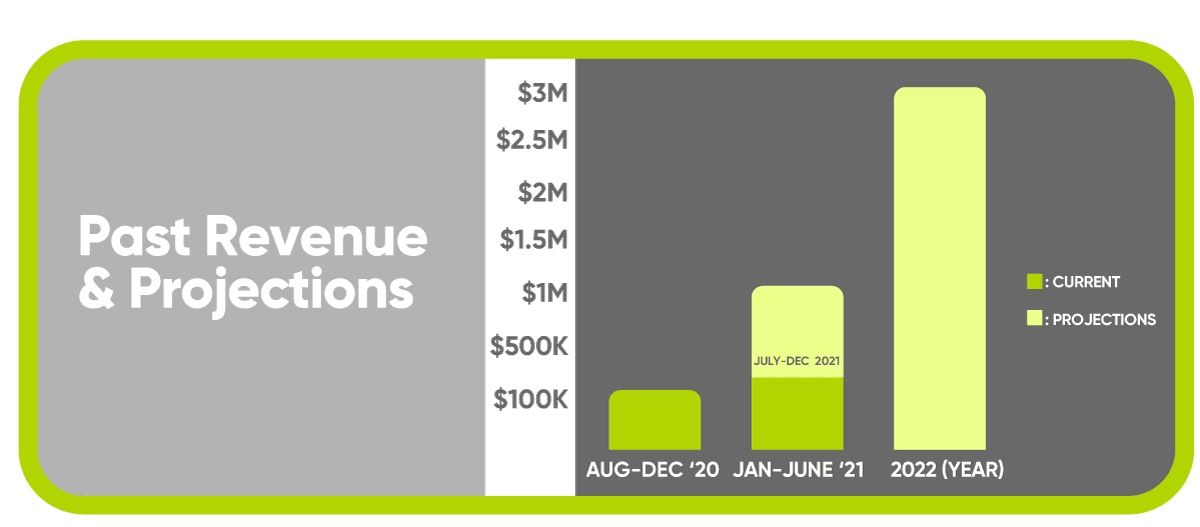

Vene Rides launched in July 2020, and is already proving that there’s demand for our concept.

We are now generating about $50K revenue per month, and are projecting our total revenue for 2021 to reach $600K+.

Customers

A smart solution for Micro-EV Riders

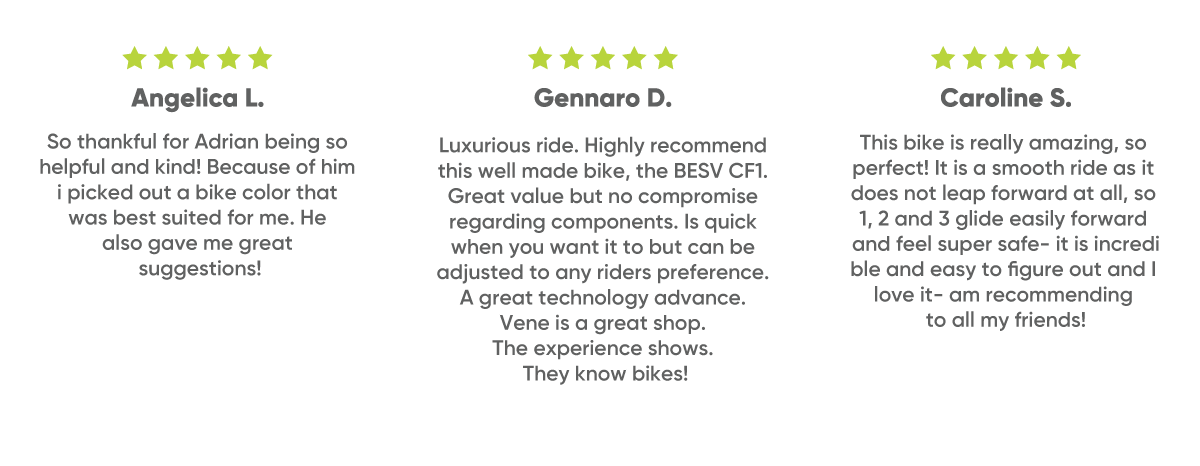

In this new era of Micro-EVs, our customers have different expectations and needs than your typical bike shop. An indispensable part of our business is the pride we take in giving every customer an amazing experience. Our customers give us 4.7 stars on Google.

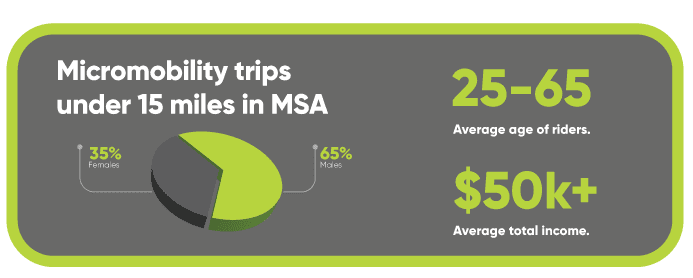

Vene Rides is relying on market research to guide our growth strategy. While we believe that there’s a future in electric vehicles all around the world, we’re starting off by targeting urban areas with urgent transportation needs.

Business model

Solid margins and strategic growth

As of February 2021, Vene Rides’ revenue breakdown favors our sales division:

65% sales

25% service

10% rentals

Average revenue per e-bike sale is $1500, including accessories; scooter sales typically generate $900. Blended margins are currently 35%–45%, and are improving as we increase our e-commerce sales.

We also intend to scale our service and subscription programs to become major sources of revenue. We see a gap in the market for local service centers specializing in micro-EVs, and we want to take advantage of that opportunity—on a national scale.

Market

Sales of micro electric vehicles are soaring

Electric bike sales have grown significantly in the past few years, but still only make up around 5% of total bike sales. Our market research suggests that there’s a huge amount of growth potential in the e-bikes segment.

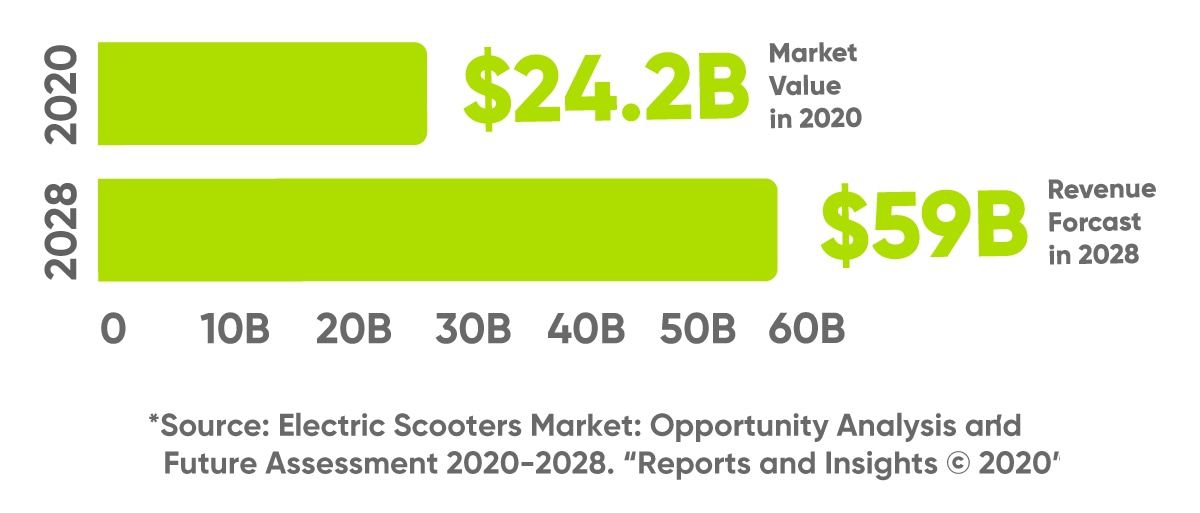

Today, the global market for e-bikes is approximately $41.1B annually, and is forecast to be $70B in 2027. E-scooters today are a roughly $2.6B/year market, which is expected to grow to $5.2B by 2028.

Electric scooter market

Competition

Disrupting the micromobility industry

Other retailers that compete in the Micro-EV space include bike shops, single brand Micro-EV stores, dropship websites, and direct-to-consumer brands.

Relative to these competitors, Vene Rides offers consumers a unique combination of attractive features:

Specialized Micro-EV expertise

Brand selection

Test rides

Convenient service

Vision and strategy

Reimagining the way we move

According to a study by the Federal Highway Administration, 35% of car trips are 2 miles or less, and 60% are 5 miles or less. Vene Rides believes in a cleaner, healthier future, where every household in North America has electric mobility.

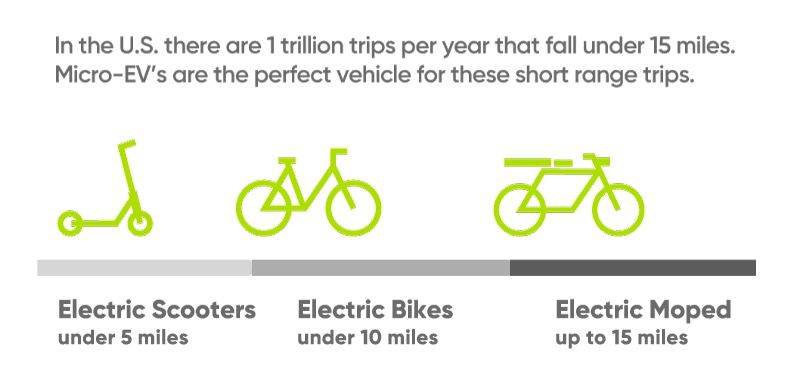

Micromobility trips under 15 miles

100 stores by 2024

It’s our mission to be a positive force in this transition to cleaner energy. To that end, we aim to launch 5 Micro-EV stores in 2022 and 100 stores nationwide by 2024, each selling 1000 Micro-EVs per year.

Funding

A self-supported venture

Vene Rides has been bootstrapped up until this round. We know how to run lean and efficiently, and we’ve proven that we can gain traction without any outside funding.

With this estimated $1.07M round, we’ve set the following priorities for growth:

Launch new stores in our top target markets

Invest in our marketing team

Invest in our product team

Founders

The passion and experience to grow a major mobility brand

CEO Josh Squire has decades of entrepreneurship experience in the mobility space. He launched and operated over 20 shared micromobility cities, and founded a recreational rentals and tours chain. Josh received the first U.S. patent for bicycle rental automation and created the HOPR shared mobility platform.

COO Ruben Figueredo is driven by a love of the outdoors and a passion for cycling. His experience includes mass sporting event technology and bicycle retail/e-commerce sales. Ruben is committed to making Vene the leading Micro-EV shop by focusing on brand marketing and scalability.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...