Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Win-Win

Open for investment

Documents

Form C

SEC.gov

Form C

SEC.gov

Deal highlights

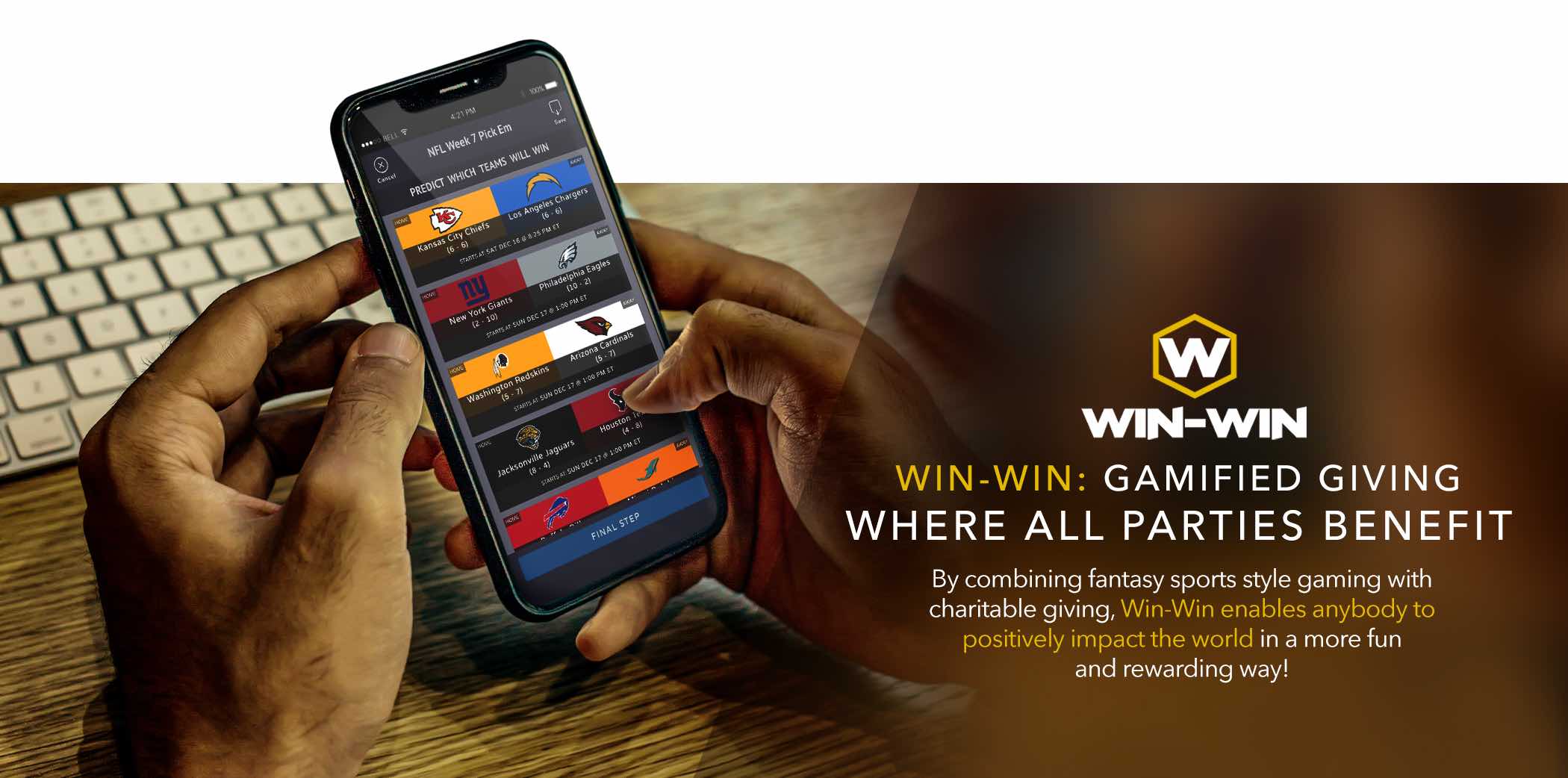

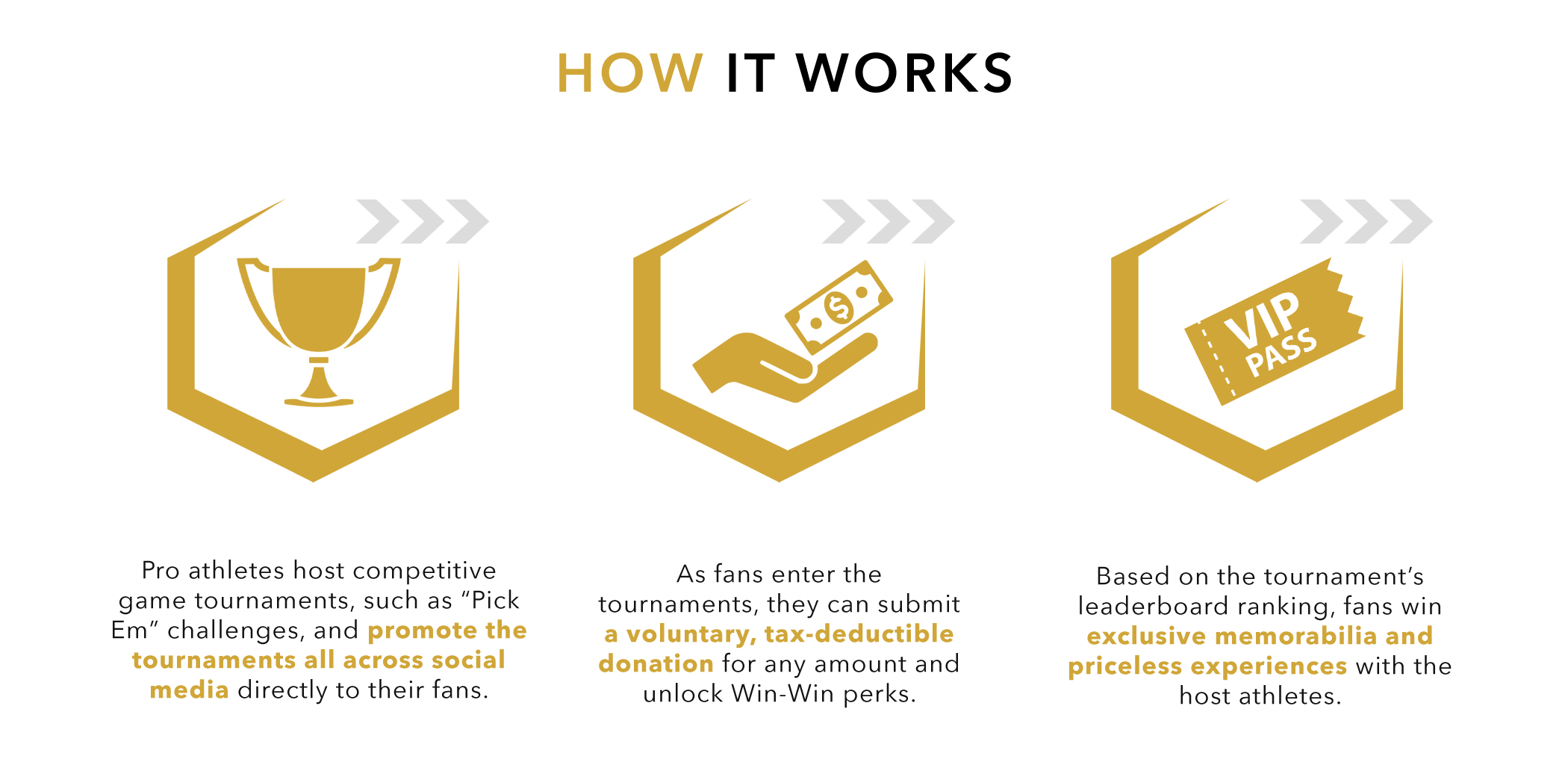

- Engaging donors and influencers to make donating to charity more fun and rewarding

- Leveraging sports gaming and pro athletes to transform the $410B charitable giving industry

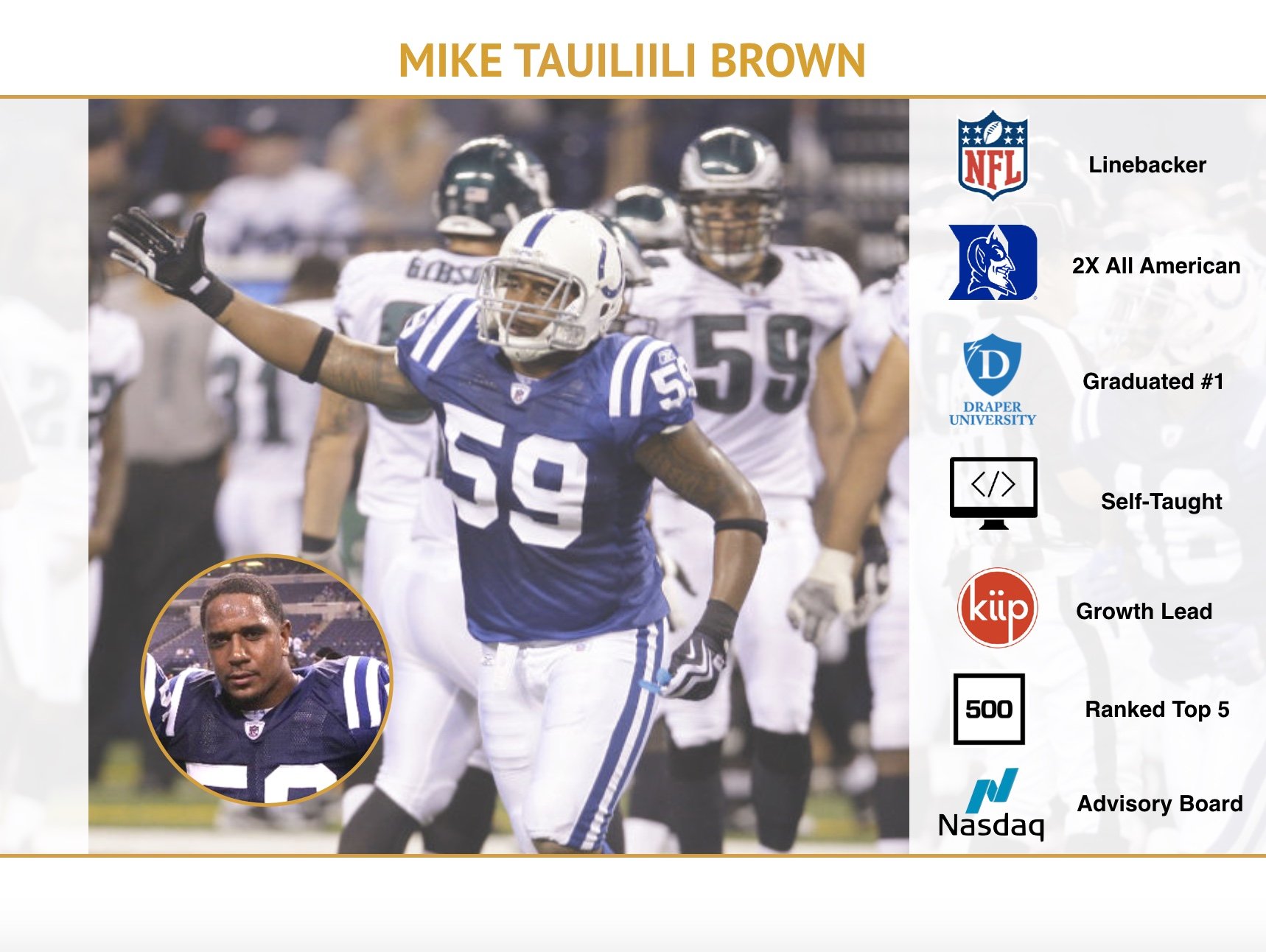

- Founder is a former NFL linebacker, philanthropist, and self-taught coder with direct access to talent

- Engaged 160+ professional athletes across the NFL and NBA, with approximate social media reach of 185M+ fans

- Raised $1.2M pre-seed funding from well respected private investors, including Duke Univ., Sand Hill Angels, Backstage Capital, and pro athletes

- 500 Startups graduate, ranked Top 5 in class by TechCrunch

Now is the time to Win-Win

After 2 years of product development and positive user feedback, Win-Win is now ready for primetime!

Charitable fundraising is ripe for innovation, and Win-Win is leading the effort by improving the giving process for donors. By investing in Win-Win, you’ll enable us to capitalize on our validated product-market fit -- bringing Win-Win to the masses by scaling operations and leveraging our growing network of iconic athlete partners.

With your support, we can drastically improve charitable giving--increasing efficiency and value exchange, so anybody can positively impact the world!

Fewer people are donating to charity in America

Why? Charitable giving methods are stuck in the past.

Influencers have a unique ability to engage donors and raise awareness for charitable causes. For example, NFL superstar J.J. Watt led a fundraising effort across social media to support flood victims that resulted in $38M raised within two weeks.

Over 35% of Americans said they engaged with a cause because of an influencer’s recommendation. Of that 35%, over 50% shared awareness about the cause and made a financial donation. Yet there’s no one efficient platform to connect influencers with charitable causes, and to engage donors through influencer campaigns. Existing platforms feature outdated models that result in declining donor participation.

This has to change!

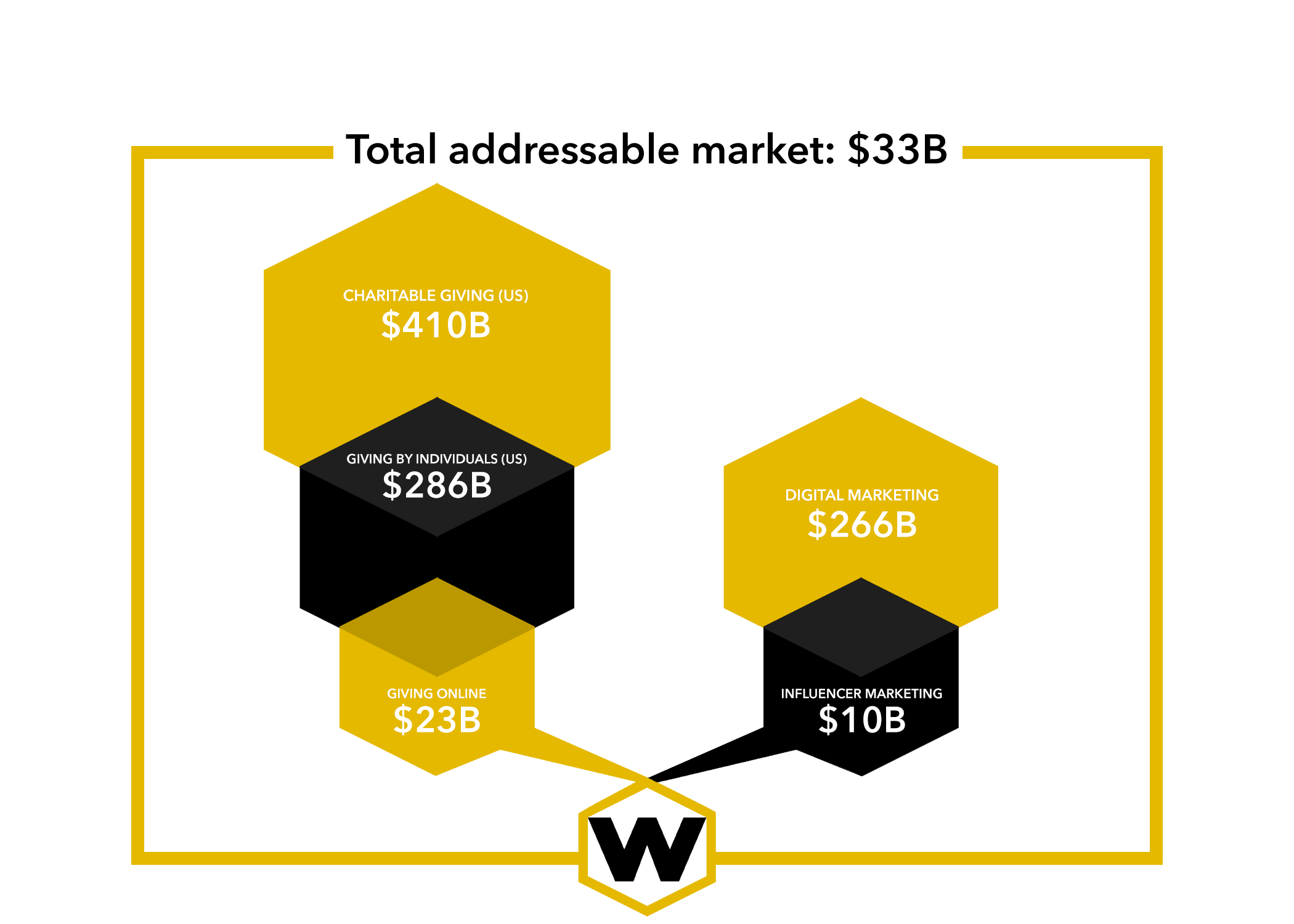

Win-Win taps 2 massive, growing industries

- Charitable giving by individuals: $289B. Total addressable market: Giving online via raffles, auctions, or crowdfunding: $23B.

By making the process of donating online more engaging and fun, we believe we have a huge opportunity to capture and grow this $23B addressable market

Digital Marketing Total Spend: $266B. Total addressable market: Influencer marketing, is predicted to be a $10B market by 2020.

As we scale our influencer campaigns and user base, we will begin tapping into this market by offering customized sponsorships to capture the dedicated Ad spend from brands.

The Winning Edge

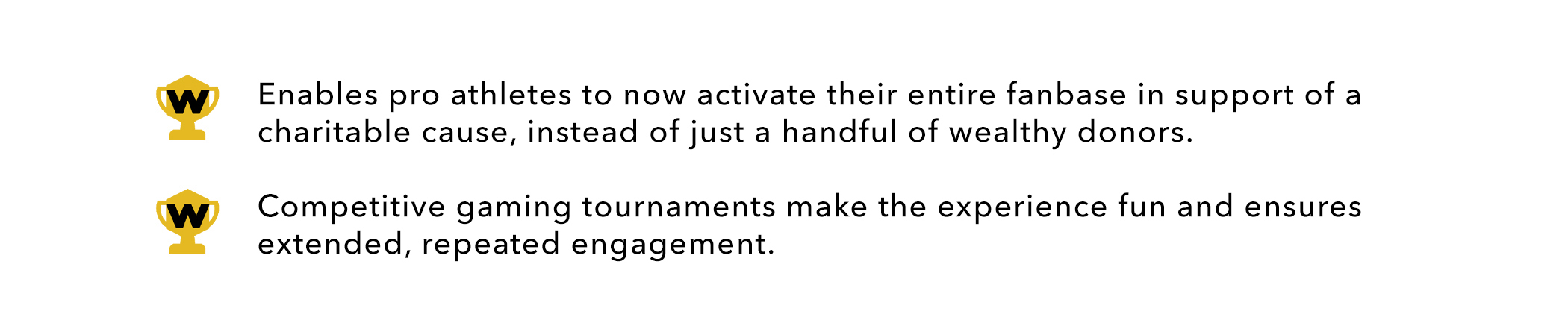

This ensures higher user acquisition and retention -- fans are more inclined to engage knowing they’ll win!

Leveraging the reach of iconic athletes

Distribution channels with direct, authentic communication

Because Win-Win helps pro athletes activate their fanbase more efficiently, in support of causes they care deeply about, the pro athletes promote Win-Win campaigns without being paid their normal influencer campaign fees.

To continue scaling its partnership network, Win-Win has established relationships within several large sports and talent agencies, including Wasserman Media Group and CAA Sports.

Beta: reached early product-market

Industry leading engagement and conversion rates

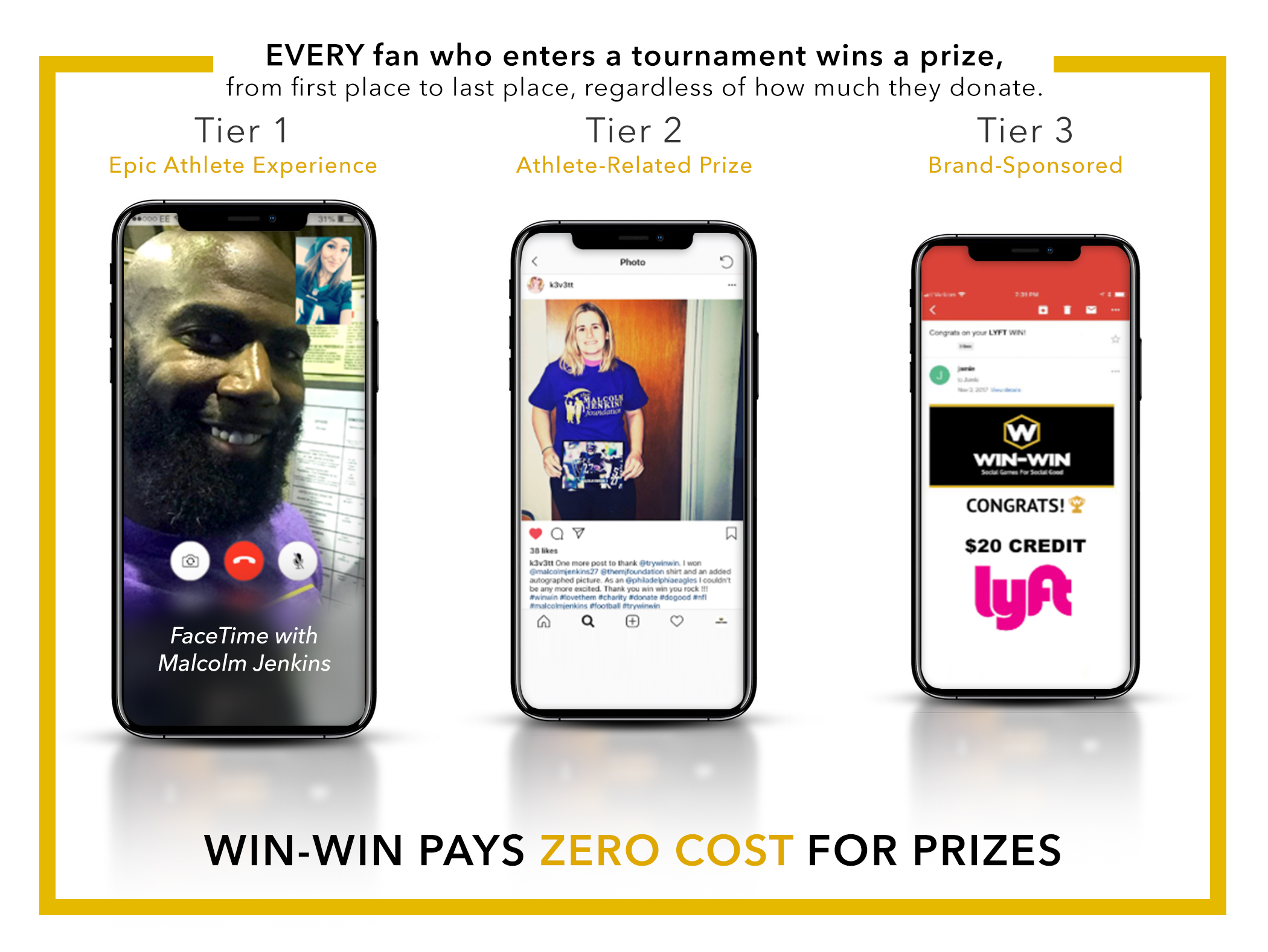

We’ve dedicated 24 months of intense focus on running live test campaigns and making data-driven iterations to improve conversion throughout the user journey.

During our beta campaigns, we reached over 1M social media engagements (likes, comments, views) on live partner campaigns. We’ve doubled the industry standard click through rate (CTR) for organic posts, seeing an average CTR of 1.44% across our latest campaigns.

Today, nearly 5% of people who click an athlete’s promotional link on social media fully convert into paid Win-Win users. The industry average for social media Full Funnel Conversion is 1.2%.

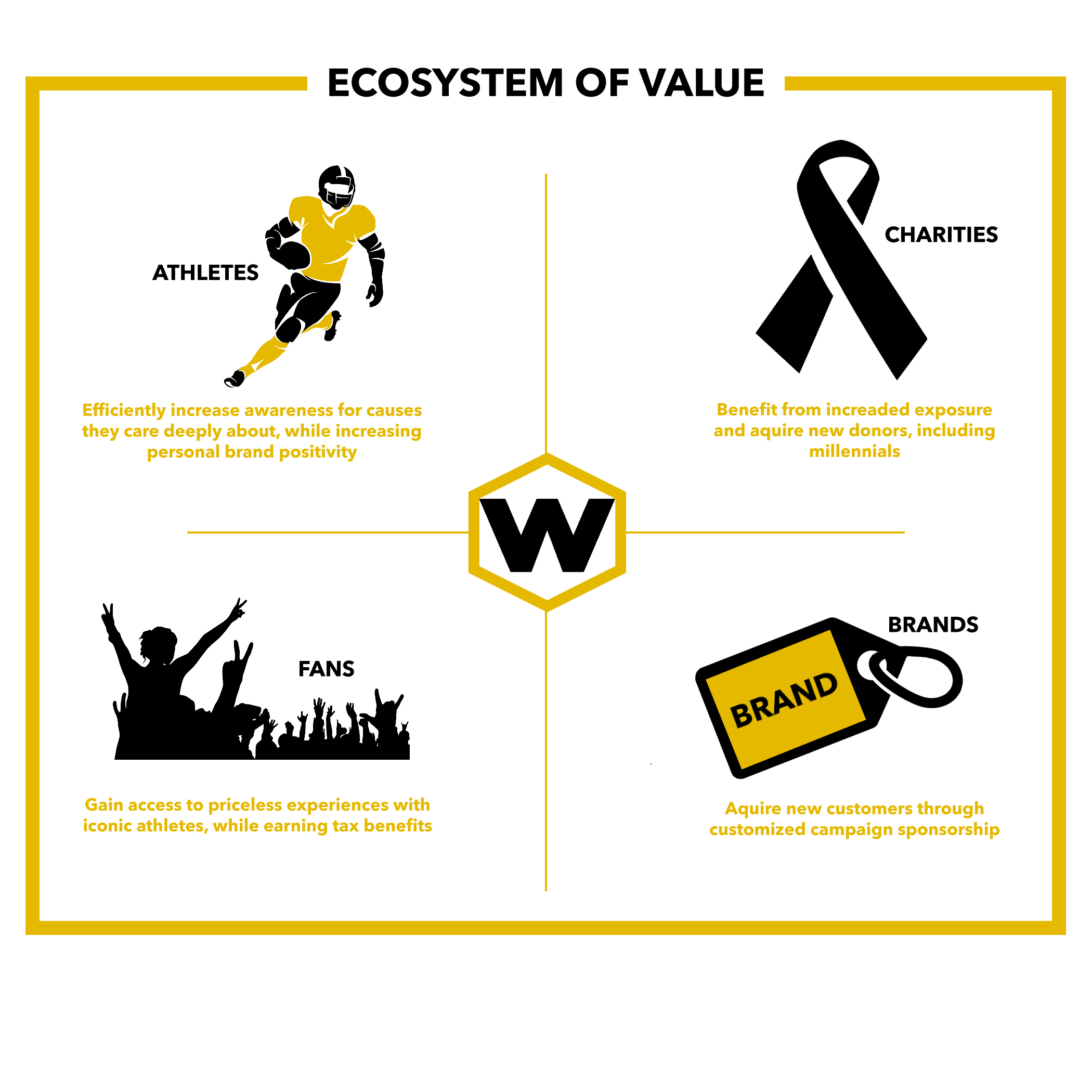

Value exchange across the board

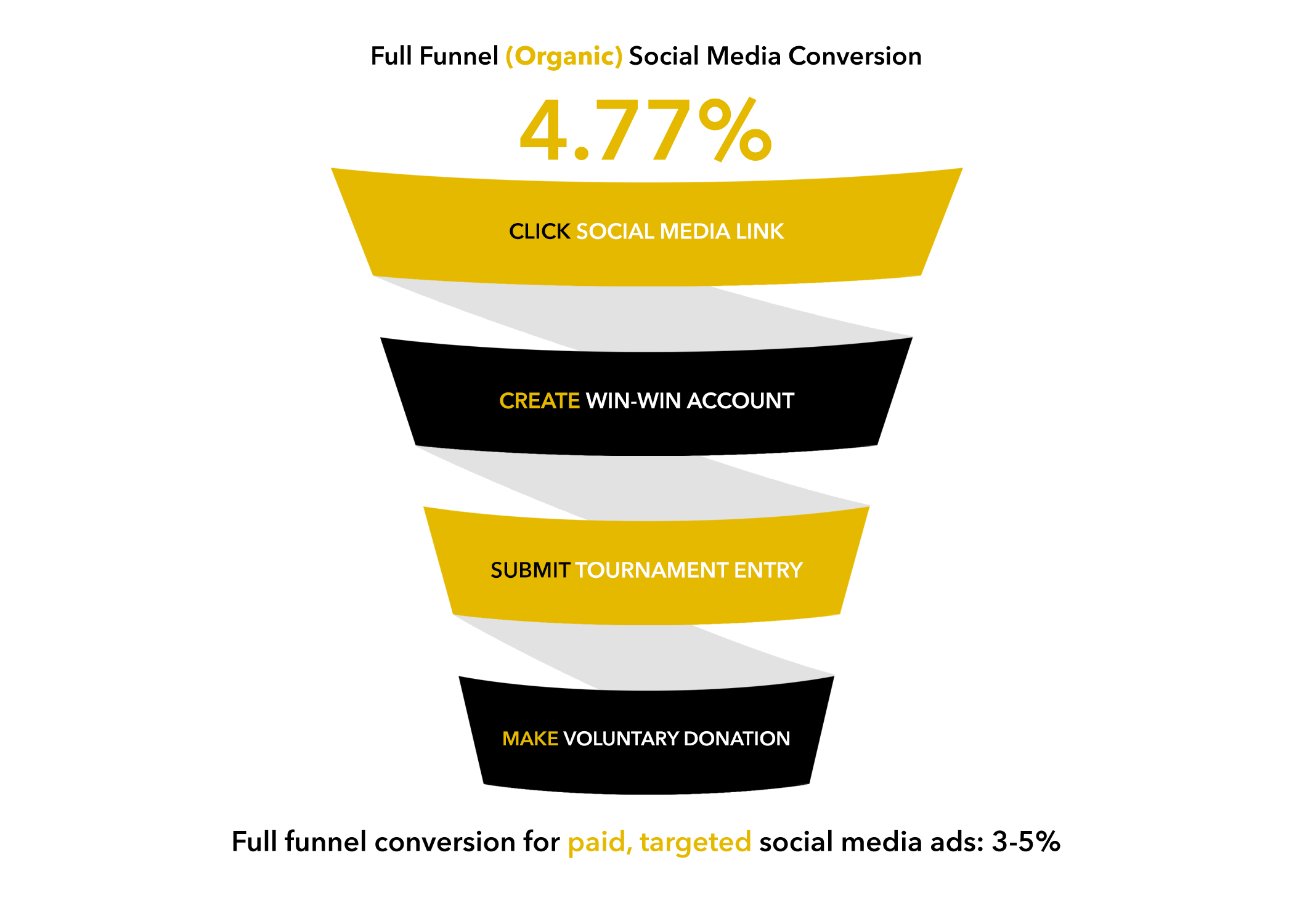

Creating an ecosystem of value that engages fans, influencers, charitable organizations, and brands

Our platform truly benefits all parties involved, enabling each to simultaneously deliver and extract desired value.

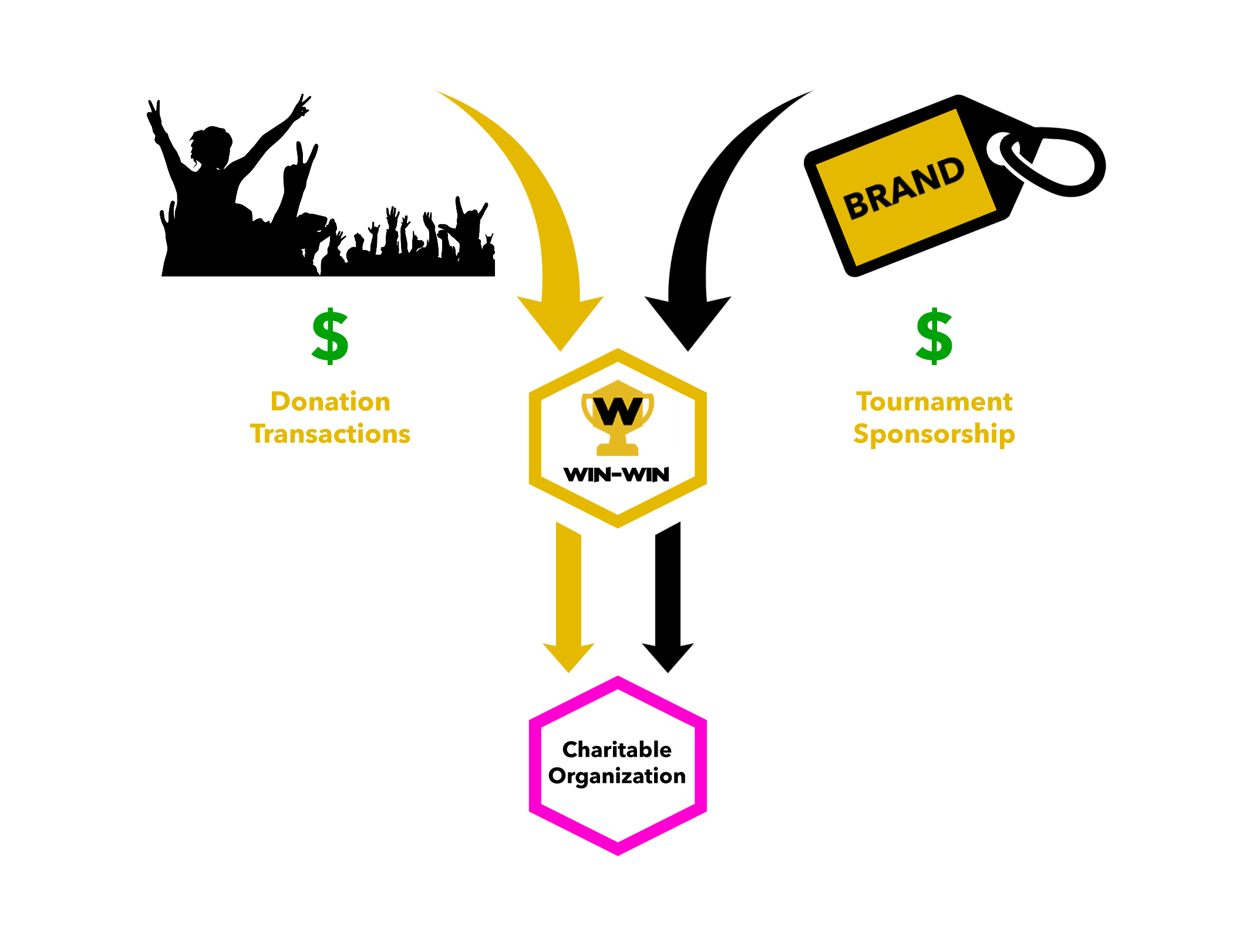

We have two revenue streams

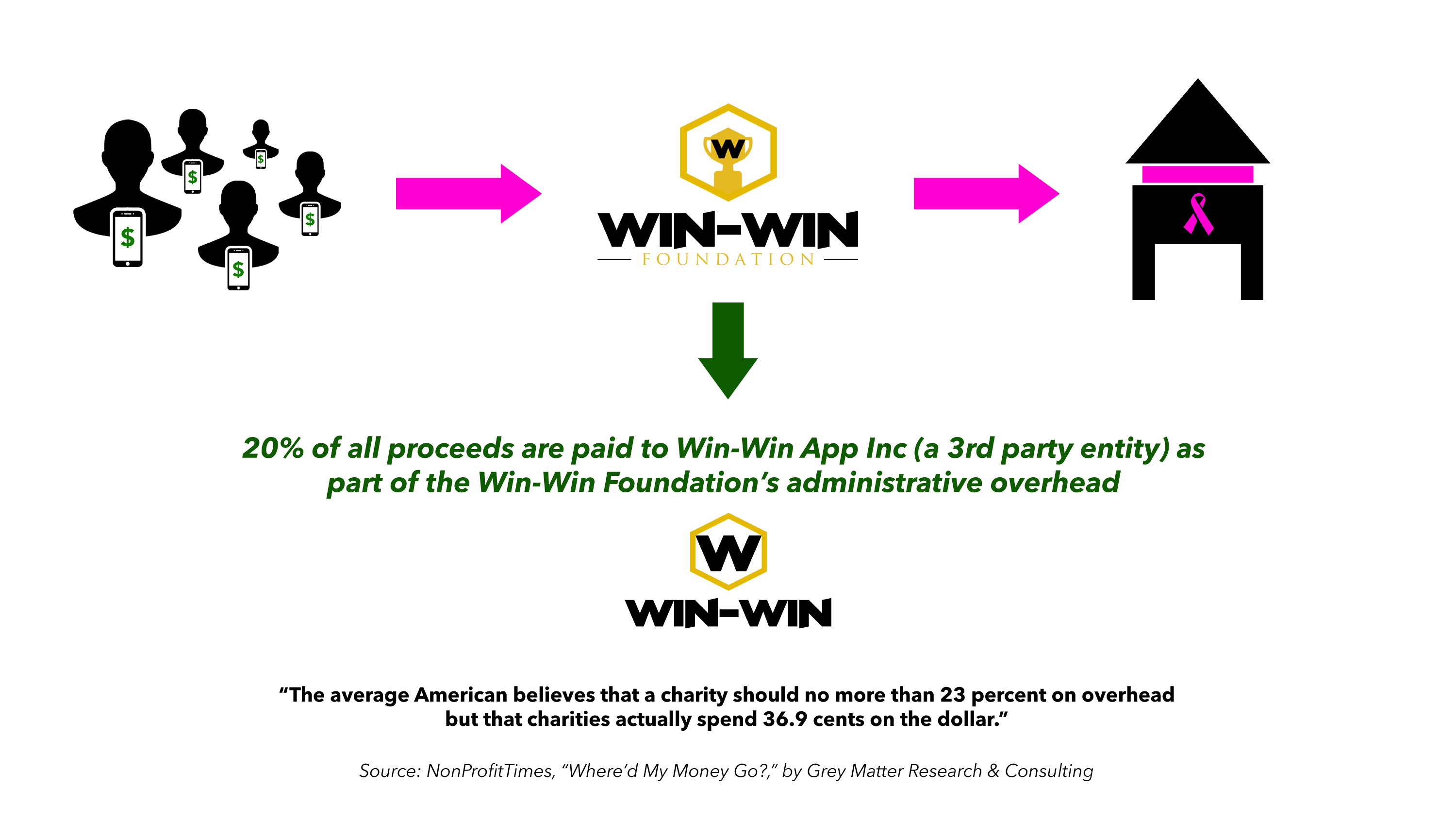

1. Win-Win retains 20% of every donor transaction

2. Brands pay recurring sponsorship fees for custom campaign integration

Donation model

Win-Win implements a unique structure, partnering with Win-Win Foundation to offer donors the maximum tax deduction allowed by law.

Pro athletes are only the beginning

The Win-Win ecosystem of value is built for any `entity of influence`

Our platform was developed with expansion in mind, ensuring opportunities for massive scale.

With our high funnel conversion rates, we expect to scale revenue (and impact!) as we onboard partners with massive social media reach.

Win-Win aims to become THE go-to platform for any individual or entity with a fanbase or audience, seeking to raise funds for a cause or initiative. As partner expansion occurs, we will begin introducing new game formats more relevant to our new non-athlete partner types.

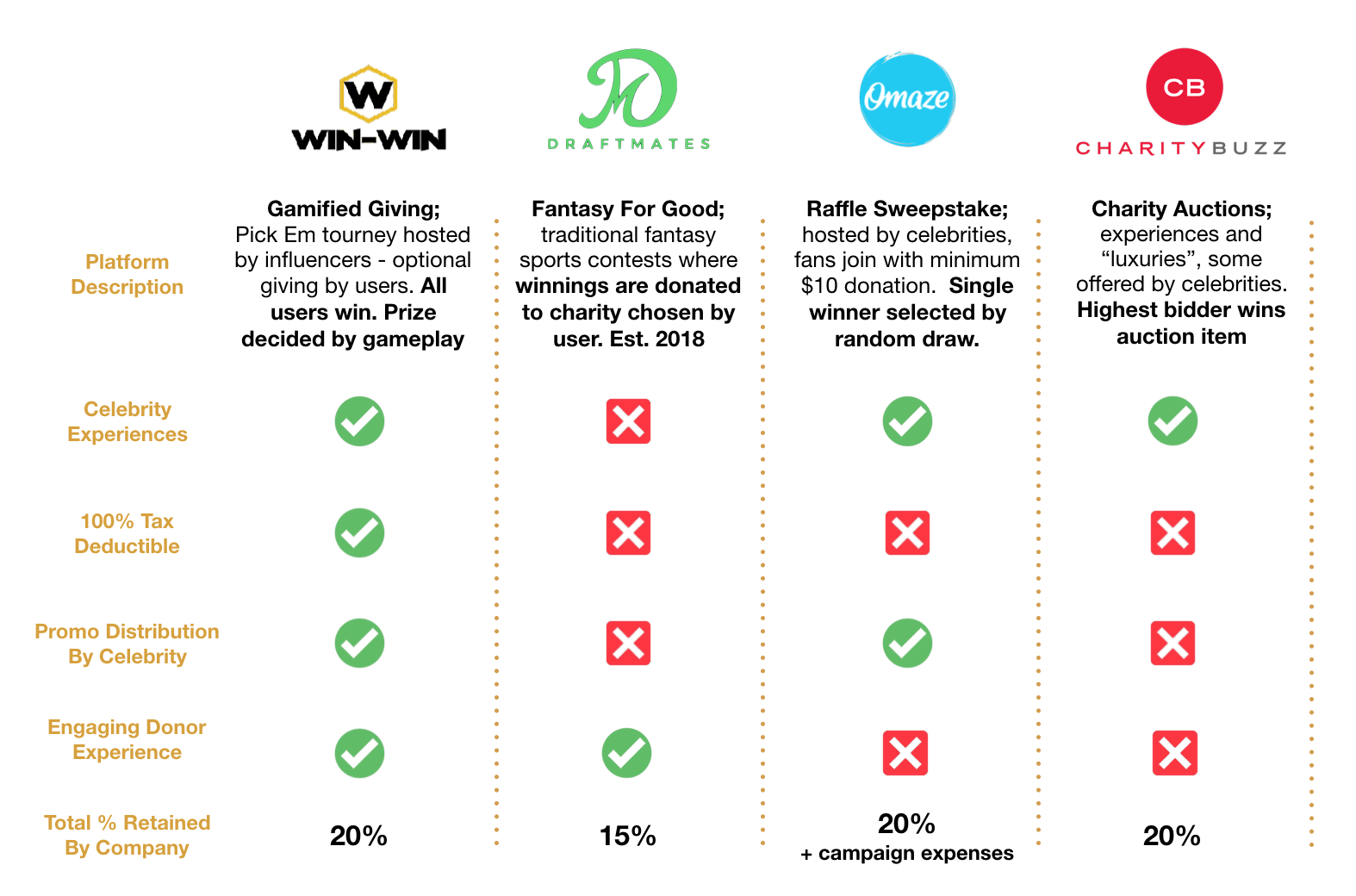

Competitors

Within charitable giving, our direct competitors offer a different format to potential donors and varying business models.

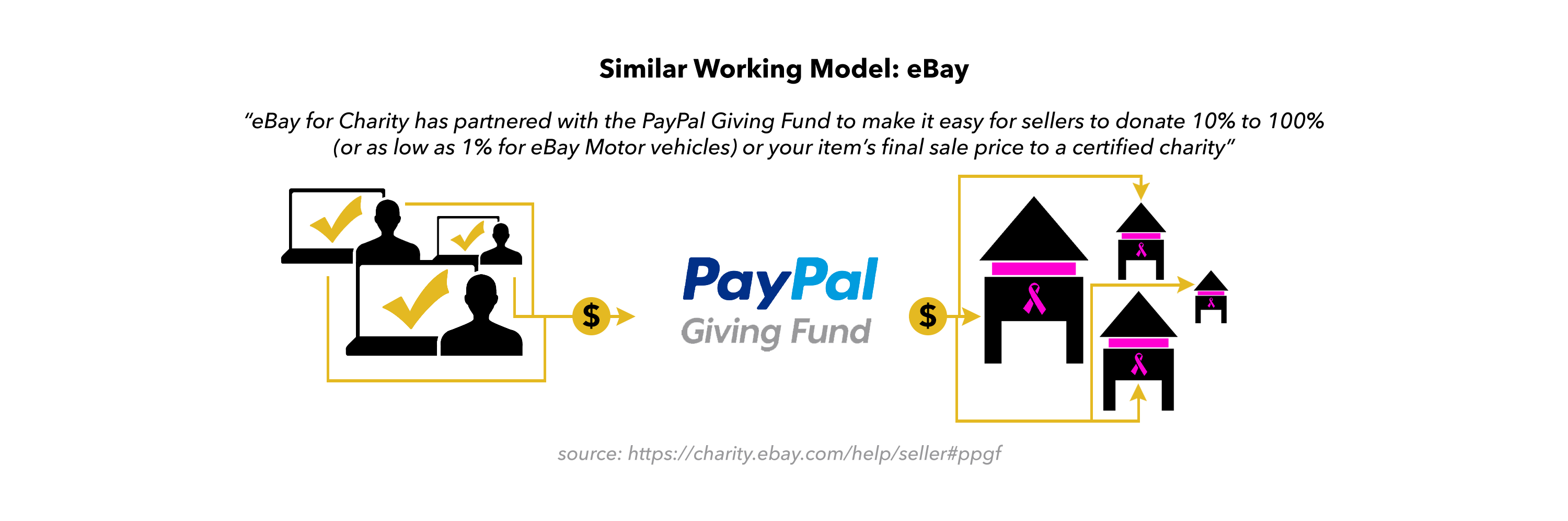

Comparables

Within brand sponsorships, there are companies with similar models that would indicate Win-Win’s value proposition to brands.

Over $1.2M raised in pre-seed funding

Win-Win features a great group of early investors, who each add significant value

Select investors:

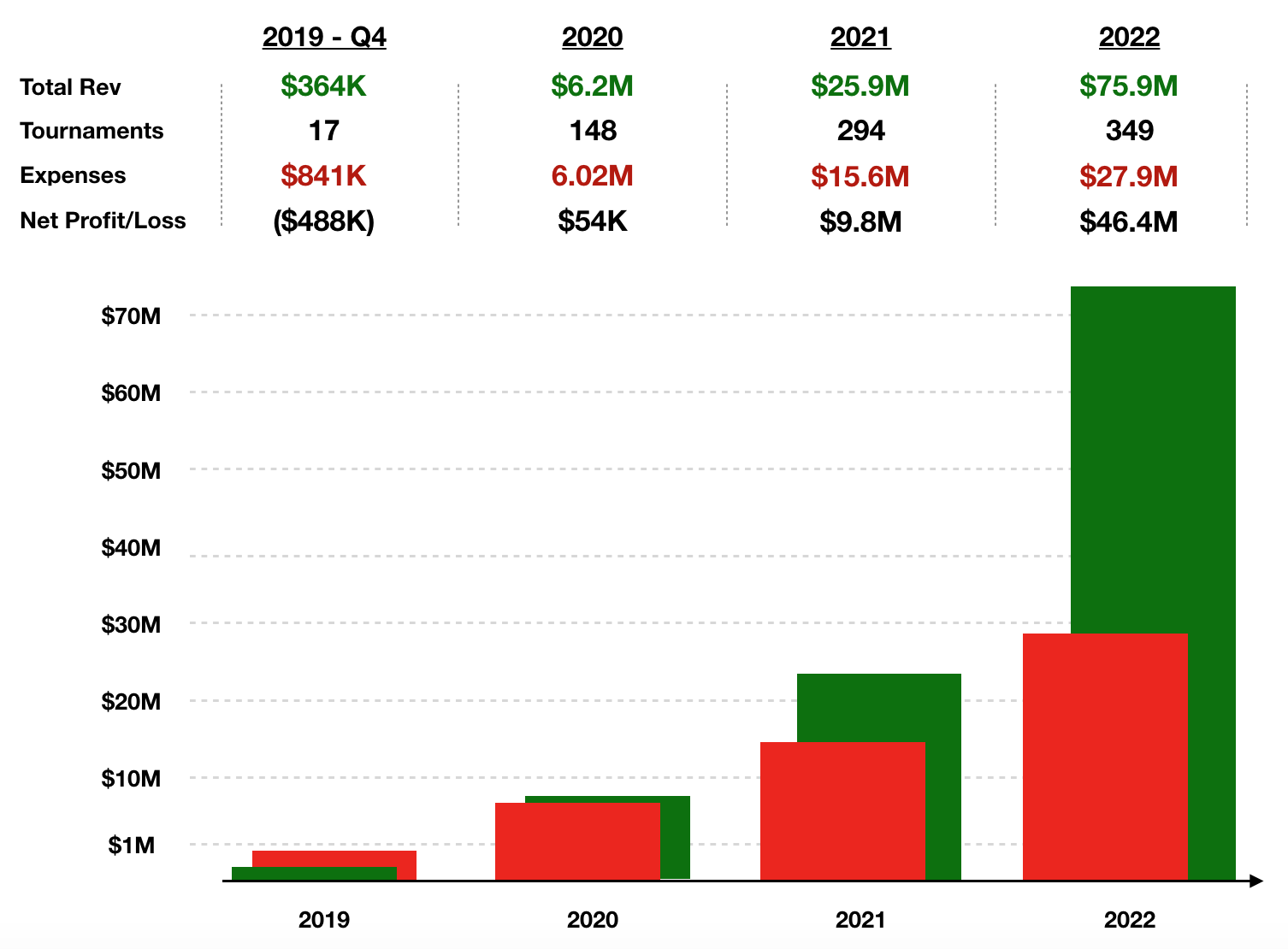

Win-Win 2019 full scale launch

With validated product-market fit, we are now preparing to scale operations and marketing to drive hyper-growth!

“Total Revenue” only consists of Win-Win’s portion of charitable proceeds and projected revenue from brand sponsorships. Total charitable dollars is not reflected.

Win-Win Houston homecoming

With established roots in Silicon Valley, Win-Win is relocating to the country’s new SportsTech hub!

In March 2019, we finalized an exciting partnership deal with Cannon Ventures, which results in our relocation to Houston, TX in July 2019. Win-Win’s new home will be within the world’s largest tech co-working space in the world, a 120,000 square foot facility called The Cannon. The facility sits on a 32-acre entrepreneurial campus within Houston’s newly established “Founders District”.

Note from the Founder:

Hello there!

First, thank you for coming to take a look at our Republic campaign page and learning about Win-Win. I’m so excited to be offering an opportunity for you to join us on this journey! I’m the type of person who puts in the necessary work and goes to lengths most people wouldn’t dare, for the purpose of representing my family, accomplishing my goals, and inspiring others. My life experiences and, the accomplishments throughout, are a testament to my work ethic, and I pride myself on breaking down walls and overcoming adversity -- I’ve had to do it my entire life.

This is why I’m so excited! I know the work that I’ve put in, the great work our growing team has put in, and the valuable time our investors and advisors have invested in us. The world is getting ready to see the fruits of that labor, and our continued labor, so I’d like to welcome you aboard before we take off!

My wife and our two kids, MJ and Leila

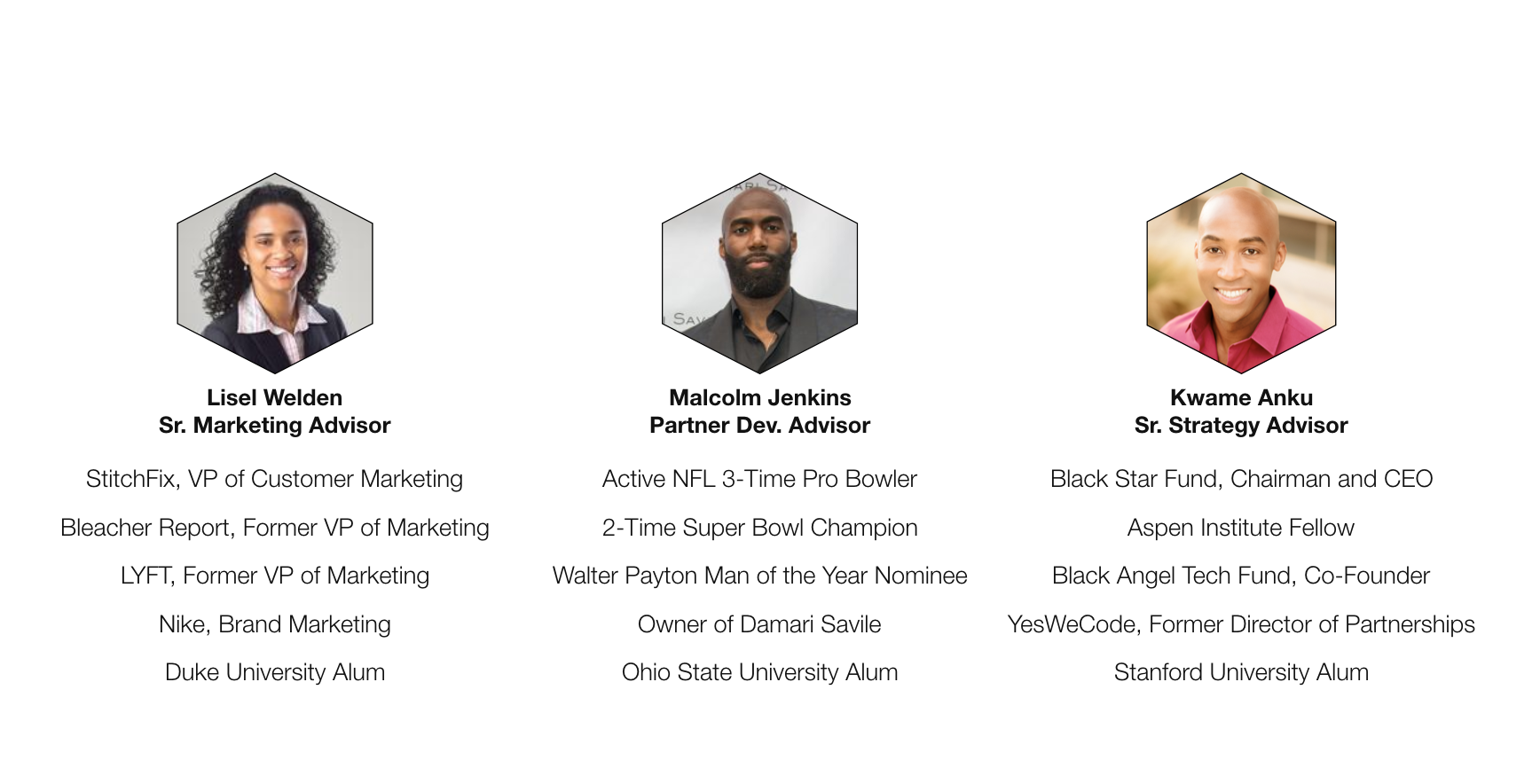

Advisors

Join the Winning team!

Your investment will help us be the future of fundraising!

Deal terms

$10,000,000

The maximum valuation at which your investment converts

into equity shares or cash.

Learn more

20%

If a trigger event for Win-Win occurs, the discount provision

gives investors equity shares (or equal value in cash) at a reduced price.

Learn more.

$1.07M

Win-Win must achieve its minimum goal of $25K before the deadline. The maximum amount the offering can raise is $1.07M.

Learn more

Learn more

Crowd SAFE

A SAFE allows an investor to make a cash investment in a company, with rights to receive certain company stock at a later date, in connection with a specific event.

·

Learn more

Documents

Form C

SEC.gov

Form C

SEC.gov

Bonus perks

- A feature in the commemorative "Win-Win Investor Book", hardcover kept in Win-Win HQ forever + digital version on the Win-Win website

- The above perk + a limited edition Win-Win swag pack, including a Win-Win T-Shirt, Win-Win sunglasses, and an exclusive "Thinking Cap" (not available for sale)

- All of the above perks + "Win-Win Elite" profile status on the Win-Win platform for 12 months (elite level prizes, expedited shipping, 2x Karma Coins, etc)

- All of the above perks + personal phone call from our founder + regular investor update emails with deeper insights on company status and progress

- All of the above perks + join a future Win-Win experience as a featured special guest (ex: go to a game and meet the host athlete after)

- All of the above perks + a special invitation to private Win-Win Super Bowl 2020 Party with athlete partners (location: Miami, transportation not included)

- All of the above perks + a special invitation to our annual, private Win-Win Investor Dinner -- with all of our existing investors including venture capitalists, athletes, and executives (location: Houston, transportation not included)

- All of the above perks + join regularly scheduled, private investor conference calls and provide feedback during brainstorming/strategy sessions

Why others invested

See all reviews (0) See all (0)I believe sports are not used enough to bring value to other fields. This is a great approach to charitable giving that's also accessible. I would love to see sports professionals involved in other industries such as healthcare.

I believe in the future that Mike and his team see for tapping into the reciprocity of humankind through technology, community, and gamification. Everyone's due for a win here.

Saw the investment pitched with founder and I strongly believe he has a competitive advantage in market place. Also, I believe I can contribute as an investor to help see the Win-Win success.

About Win-Win

Win-Win Team

Everyone helping build Win-Win, not limited to employees

This site (the "Site") is owned and maintained by OpenDeal Inc., which is not a registered broker-dealer. OpenDeal Inc. does not give investment advice, endorsement, analysis or recommendations with respect to any securities. All securities listed here are being offered by, and all information included on this Site is the responsibility of, the applicable issuer of such securities. The intermediary facilitating the offering will be identified in such offering’s documentation.

All funding-portal activities are conducted by OpenDeal Portal LLC doing business as Republic, a funding portal which is registered with the US Securities and Exchange Commission (SEC) as a funding portal (Portal) and is a member of the Financial Industry Regulatory Authority (FINRA). OpenDeal Portal LLC is located at 149 E 23rd St #1314, New York, NY 10010, please check out background on FINRA’s Funding Portal page.

All broker-dealer related securities activity is conducted by OpenDeal Broker LLC, an affiliate of OpenDeal Inc. and OpenDeal Portal LLC, and a registered broker-dealer, and member of FINRA | SiPC, located at 1345 Avenue of the Americas, 15th Floor, New York, NY 10105, please check our background on FINRA’s BrokerCheck.

Certain pages discussing the mechanics and providing educational materials regarding regulation crowdfunding offerings may refer to OpenDeal Broker LLC and OpenDeal Portal LLC collectively as “Republic”, solely for explanatory purposes.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC make investment recommendations and no communication, through this Site or in any other medium should be construed as a recommendation for any security offered on or off this investment platform. Investment opportunities posted on this Site are private placements of securities that are not publicly traded, involve a high degree of risk, may lose value, are subject to holding period requirements and are intended for investors who do not need a liquid investment. Past performance is not indicative of future results. Investors must be able to afford the loss of their entire investment. Only qualified investors, which may be restricted to only Accredited Investors or non-U.S. persons, may invest in offerings hosted by OpenDeal Broker.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC, nor any of their officers, directors, agents and employees makes any warranty, express or implied, of any kind whatsoever related to the adequacy, accuracy or completeness of any information on this Site or the use of information on this site. Offers to sell securities can only be made through official offering documents that contain important information about the investment and the issuers, including risks. Investors should carefully read the offering documents. Investors should conduct their own due diligence and are encouraged to consult with their tax, legal and financial advisors.

By accessing the Site and any pages thereof, you agree to be bound by the Terms of Use and Privacy Policy. Please also see OpenDeal Broker’s Business Continuity Plan and Additional Risk Disclosures. All issuers offering securities under regulation crowdfunding as hosted by OpenDeal Portal LLC are listed on the All Companies Page. The inclusion or exclusion of an issuer on the Platform Page and/or Republic’s Homepage, which includes offerings conducted under regulation crowdfunding as well as other exemptions from registration, is not based upon any endorsement or recommendation by OpenDeal Inc, OpenDeal Portal LLC, or OpenDeal Broker LLC, nor any of their affiliates, officers, directors, agents, and employees. Rather, issuers of securities may, in their sole discretion, opt-out of being listed on the Platform Page and Homepage.

Investors should verify any issuer information they consider important before making an investment.

Investments in private companies are particularly risky and may result in total loss of invested capital. Past performance of a security or a company does not guarantee future results or returns. Only investors who understand the risks of early stage investment and who meet the Republic's investment criteria may invest.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC verify information provided by companies on this Site and makes no assurance as to the completeness or accuracy of any such information. Additional information about companies fundraising on the Site can be found by searching the EDGAR database, or the offering documentation located on the Site when the offering does not require an EDGAR filing.

To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. Therefore, when you use the Services we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver's license, passport or other identifying documents.

Republic and its affiliates are not and do not operate or act as a bank. Certain banking services are provided by BankProv, member FDIC / member DIF. Digital (crypto) assets and investment products are not insured by the FDIC, may lose value, and are not deposits or other obligations of BankProv and are not guaranteed by BankProv. Terms and conditions apply.

Made in SF/NYC