ZELF in the news

- Yahoo: ZELF, "Bank of the Metaverse", Launches in the US Bridging Dollars, NFTs, and Gaming Loot

- Cointribune: ZELF Democratizes Web3 with the Apple Watch

- American Banker: 4 Ways Banks are Experimenting in the Metaverse

- Retail Banker International: Gen Z Neobank ZELF Partners with Discord on Banking for Gamers

- Product Hunt: The Bank of the Metaverse

- Techcrunch: Lightweight 'banking via messaging' services are getting Gen-Z Buzz

Summary

Investing in Product Hunt's favorite fintech

Nominated as Product Hunt's Best Fintech in 2020 Golden Kitty Awards, named as Product of the Month, Week, and most recently Product of the Day, during NFT.NYC in June 2022, ZELF is the community's favorite neobank.

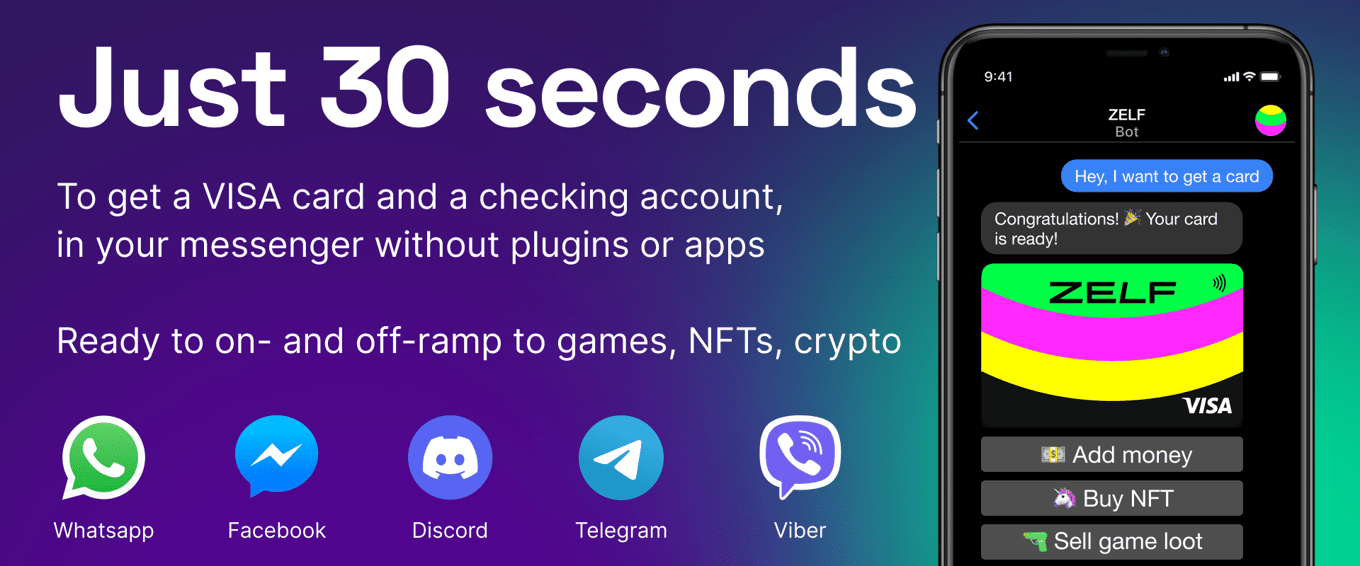

ZELF is available in all major messengers: WhatsApp,

Facebook Messenger, Discord, Telegram, and Viber

Product

Access to banking as easy as sending a text

Onboarding is the #1 problem for banking, crypto and GameFi.

It takes 5-7 days to issue a credit card in a traditional bank, and there are often many cumbersome steps to set up a crypto wallet.

ZELF delivers a checking account and virtual VISA card via instant messenger in less than 30 seconds, experience it yourself.

—

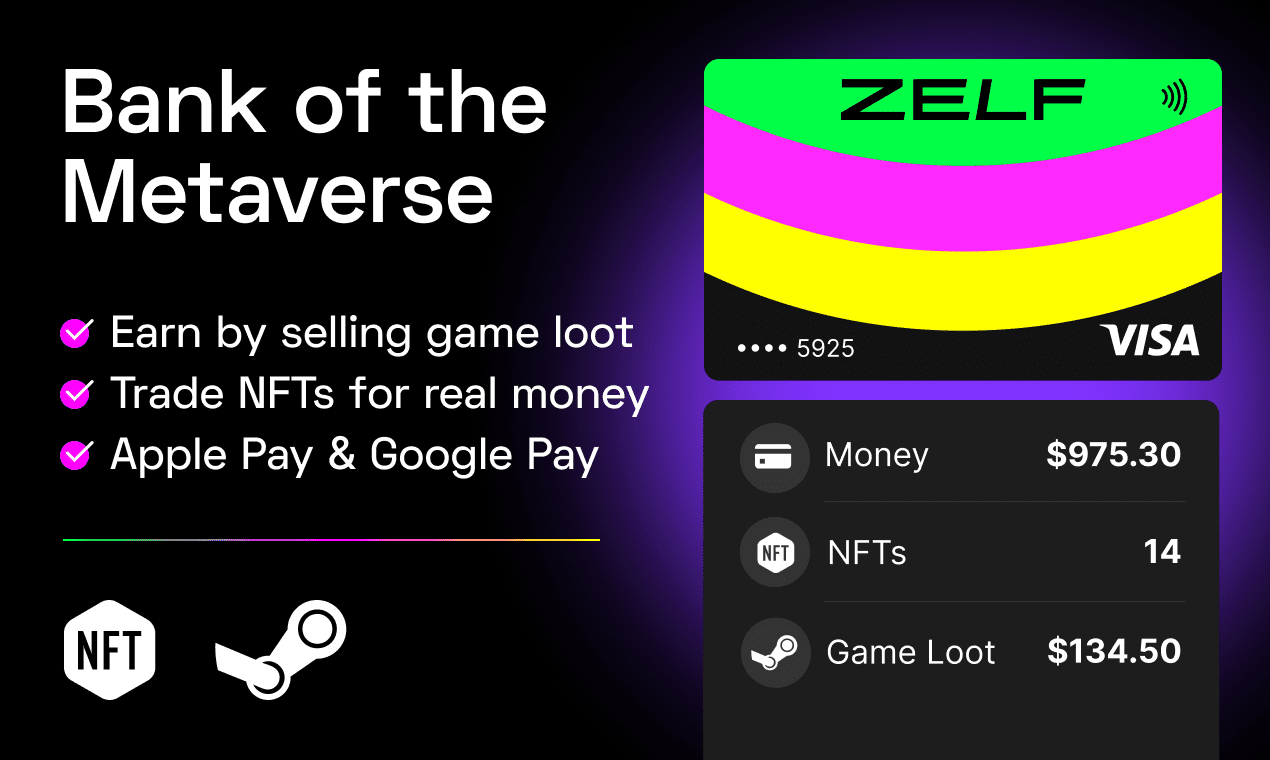

Players earn by selling game items through ZELF

ZELF makes the trading of items amongst players outside games easy and safe by acting as a trusted escrow agent, charging a 10% transaction fee.

—

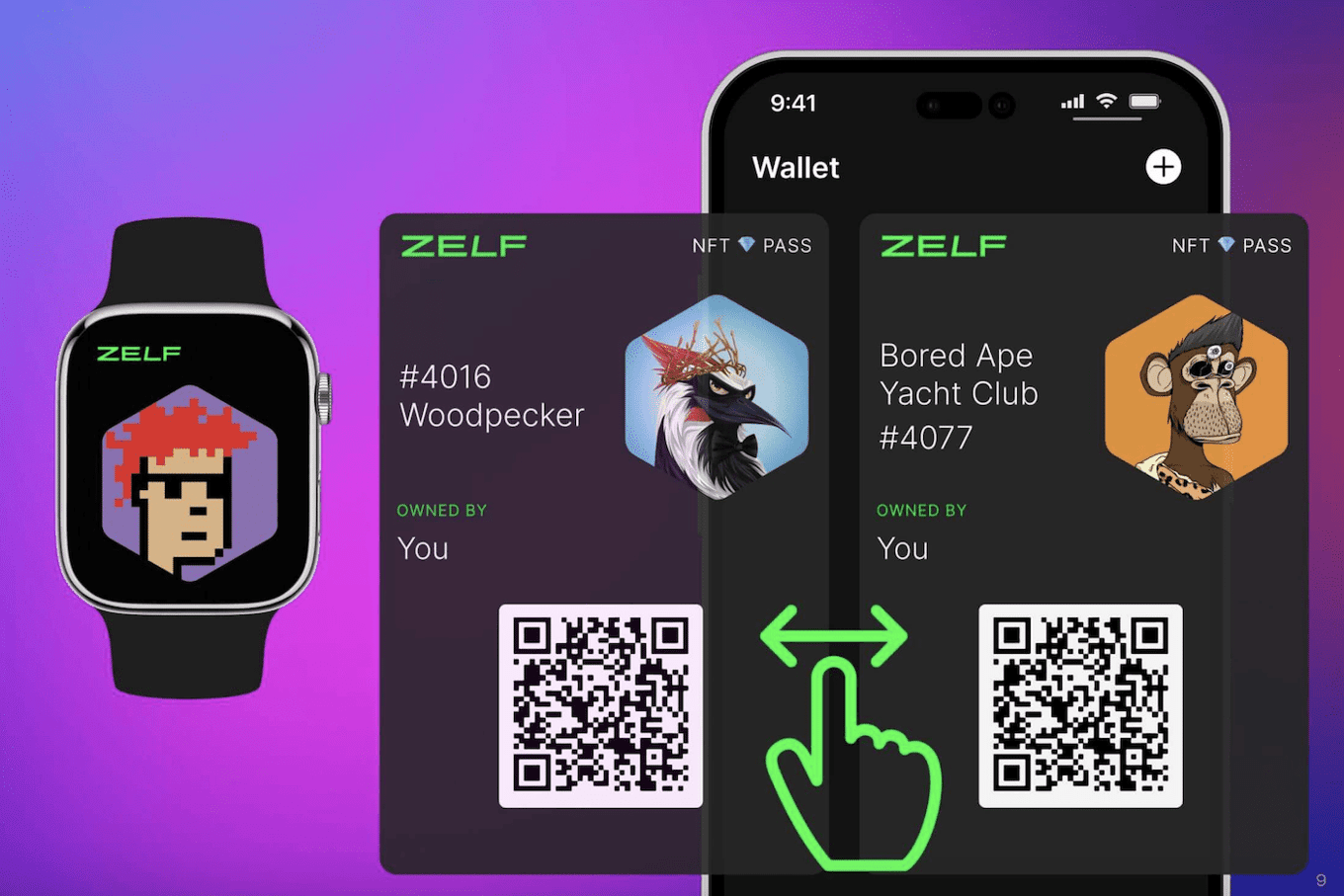

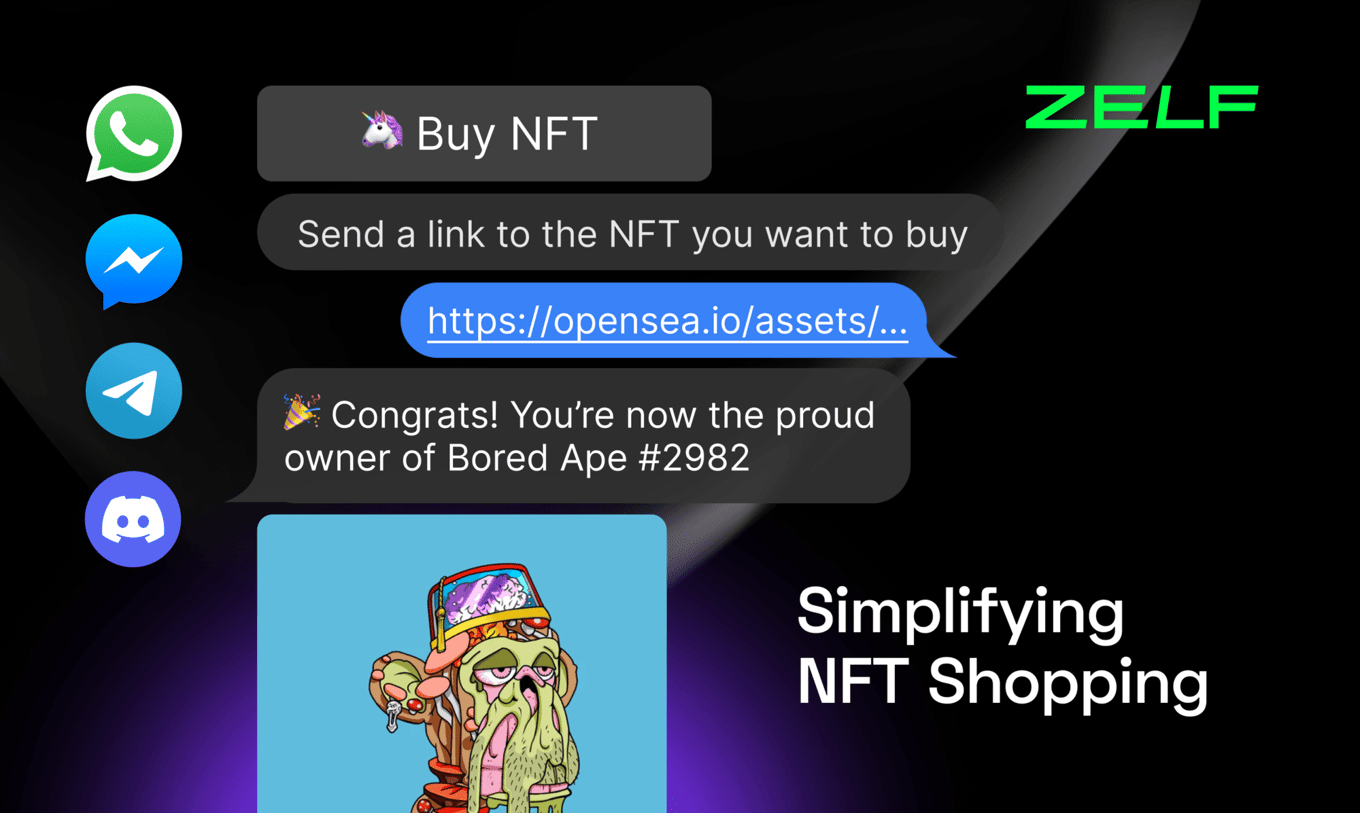

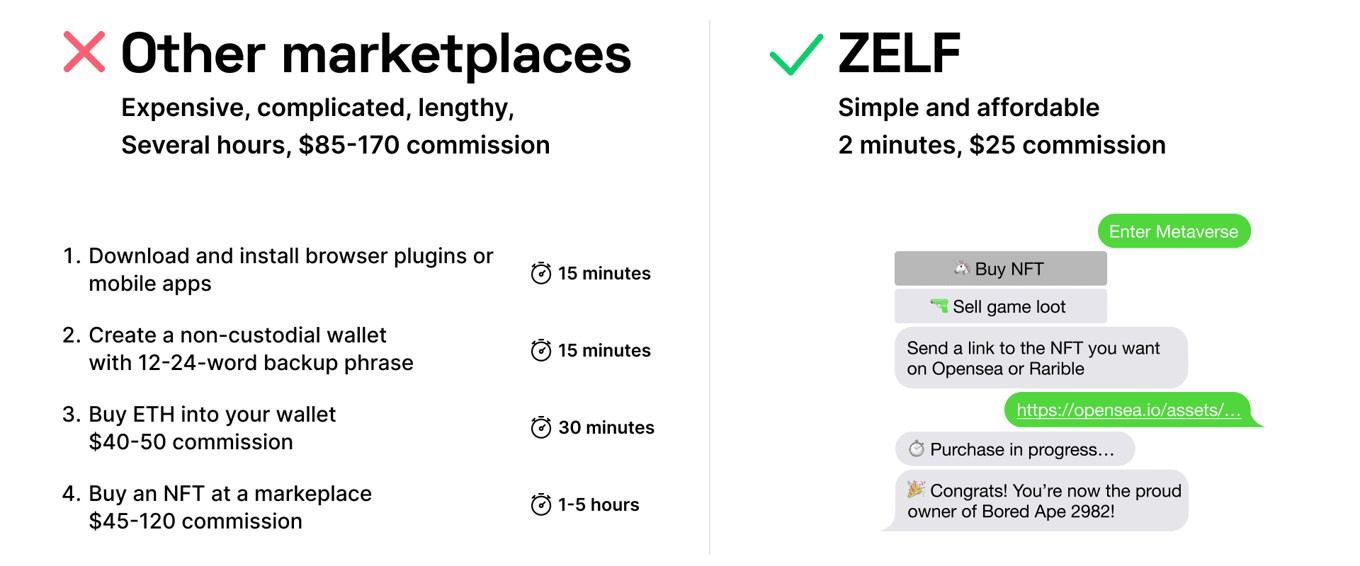

Making NFT trading fast and simple for everyone

ZELF is integrated with the top NFT trading platforms, OpenSea, Rarible, and MagicEden for non-geeks to buy NFTs in less than 2 minutes — compared to several hours in other marketplaces.

Traction

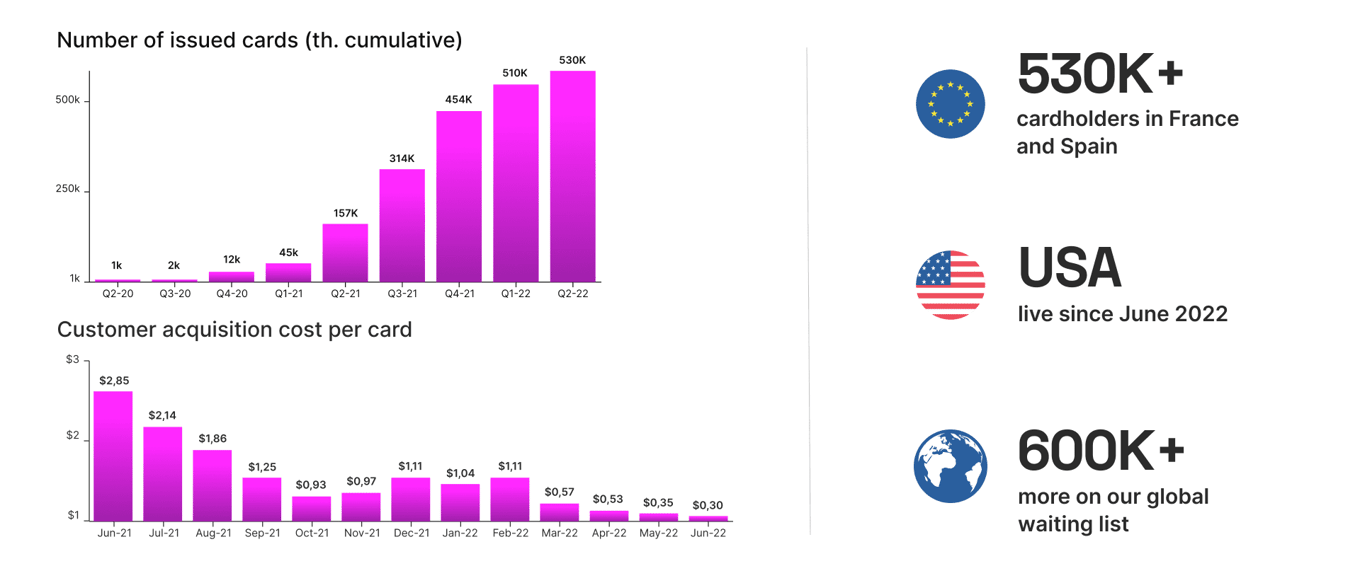

1M+ registered users

and growing

ZELF has acquired 500K+ cardholders in Europe and a total 1M+ users worldwide prior to launching in the USA. The Company plans to grow its customer base to 5M+ by the end of 2023.

—

Customer acquisition cost

50x lower than competition

Messenger-based banking without branches, plastic cards or logistics yields customer acquisition cost (CAC) below $1

Messenger-based banking without branches, plastic cards or logistics yields customer acquisition cost (CAC) below $1

Market

Unique market position

Bringing game items, NFTs and fiats under one neobanking roof, ZELF benefits from these rapidly evolving markets:

- The global Digital Payments Market is estimated to reach $204.1 Billion by 2028 at CAGR 15.1%

- The global Play-to-Earn NFT Games is projected to reach $3,618.4 million by 2028 at a CAGR of 21.3%.

- The global Non Fungible Token (NFT) market is projected to reach $7390.8 Million by 2028 at a CAGR of 24.4%.

Business model

Revenue streams

Building a financial institution for the Web3 economy, ZELF targets the Play-to-Earn community where game items are not only used or stored in inventory, but can also be sold or traded. ZELF is also integrated with Steam, the leading video-game distribution platform with 25M+ concurrent users and 30,000+ games.

ZELF makes the trading of items amongst players outside games easy and safe by acting as a trusted escrow agent, charging a 10% transaction fee.

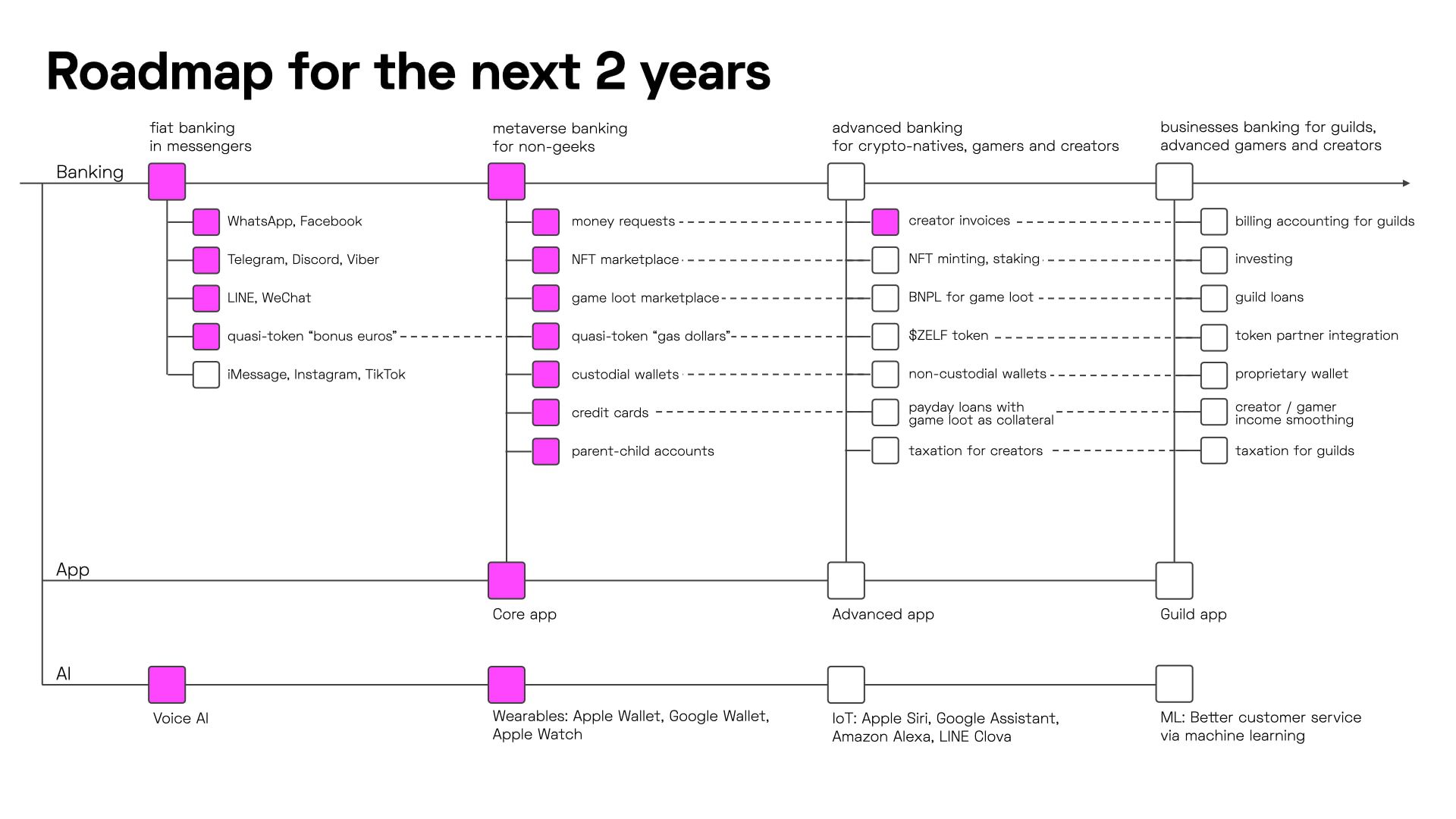

Vision and strategy

Bank of the Metaverse

New types of ownership in game worlds lead to emergence of new types of loans — payday loans secured with game items, buy-now pay-later for video game skins or mortgages for the virtual real estate.

ZELF is focused on these opportunities and is regularly featured alongside JPMorgan, HSBC and American Express in American Banker and The Banker of the Financial Times Ltd.

We brought the tech of Apple and Google Wallet, previously used only for banking, to enable new ways of storing and displaying these virtual assets, making NFTs tangible, visual, and exciting like Panini cards or Pokemon cards.

“The ultimate goal is a completely agnostic banking experience, a truly integrated bank, from the most primitive and inclusive SMS interfaces, to bots and fully AI-powered voice interaction.” - says Goykhman, Founder of ZELF.

Funding

Use of funds

The funds will be used to gain customer acquisition momentum to reach a critical mass of users in ZELF's internal marketplace for NFTs and game items.

The proceeds will also serve to accelerate their roadmap and build the technology of secured loans in the Metaverse, poised to generate the highest ROI.

Lastly, the financing will help make the following key hires: Head of Gaming Business Development and Head of Banking Partnerships. These seasoned professionals will locate and structure win-win partnerships with banks, game publishers and play-to-earn multiverses.

Founders

Elliot Goykhman, father of three boys acutely aware of the need to balance kids’ desire for financial independence with parents’ demands for control and accountability, left directorship roles in 2017 after decades at world's largest banks to build a bank for Gen Z.

Disclaimers

In addition to the carried interest Republic Deal Room Advisor LLC is entitled to for the syndicated investments it organizes, certain principals of Republic Deal Room Advisor LLC may have a personal interests in these investments, as disclosed below. When making an investment decision please review any applicable disclosures as they represent pre-existing financial interests held by those principals of Republic Deal Room Advisor LLC.

Except where otherwise indicated, the information contained in this presentation is based on matters as they exist as of the date of preparation of such material and not as of the date of distribution or any future date. This document does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make their own evaluation of the proposals and services described herein, any risks associated therewith and any related legal, tax, accounting or other material considerations. Recipients should not rely on this material in making any future investment decision. To the extent that the reader has any questions regarding the applicability of any specific issue discussed above to their specific portfolio or situation, prospective investors are encouraged to consult with the professional advisor of their choosing. Private investments are inherently illiquid and may result in a risk of total loss.

We do not represent that the information contained herein is accurate or complete, and it should not be relied upon as such. Opinions expressed herein are subject to change without notice. Certain information contained herein (including any forward-looking statements and economic and market information) has been obtained from and/or prepared by the Company or other third-party sources and in certain cases has not been updated through the date hereof. While such sources are believed to be reliable, Republic Deal Room Advisor LLC does not assume any responsibility for the accuracy or completeness of such information. Republic Deal Room Advisor LLC does not undertake any obligation to update the information contained herein as of any future date.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...