THis Week's Key Question This Week's Guests Peter Fuchs is CEO and co-founder of Ascent AeroSystems. Ascent AeroSystems d...

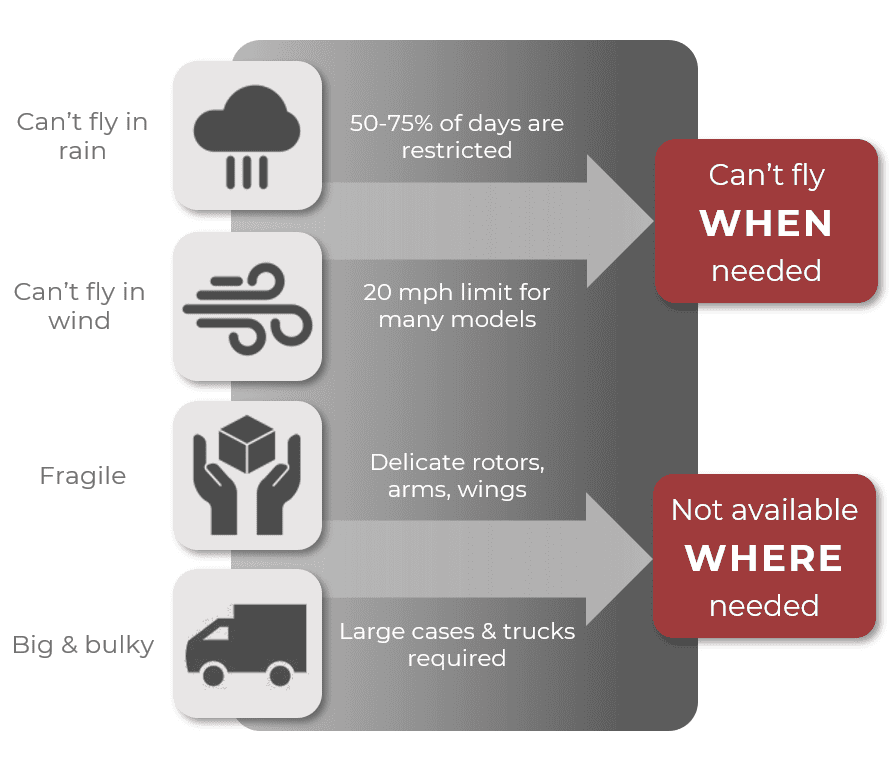

Problem

Drones can't fly whenever or wherever they're needed

To support real-world commercial, public safety and defense operations, drones need to fly anytime, anywhere.

Today, they can't.

Consumer models and upgraded "enterprise" versions are great to demonstrate how drones can do things faster, better, cheaper and safer. But when it's time to move beyond carefully controlled pilot programs and operate in the real world, things are different.

In the real world, operators don't have the luxury of choosing when and where to fly. They need a reliable airborne platform compact enough to be easily carried to remote locations and rugged enough to get the job done regardless of wind, rain, sand or dust.

Solution

The Ascent AeroSystems Coaxial

Ascent AeroSystems' high performance coaxial UAVs are specifically designed for enterprise operations in harsh environments.

| COMPACT | Easier to transport where needed. As much as 75% smaller & 50% lighter vs. comparable conventional multirotors. |

| RUGGED | Withstand harsh environments and weather. Simpler structure is inherently stronger and easier to seal & protect. |

| EFFICIENT | Fly faster, farther, longer, and carry more. Up to 2x faster, 4x farther, 40% longer, 2x more payload. |

| VERSATILE | Highly modular design: Cylindrical form makes storage, launch, recovery and reconfiguration easier from stationary and moving platforms. |

With a simple cylindrical configuration that reduces the airframe structure to an absolute minimum, Ascent's MADE IN THE USA coaxial drones are simply a better platform for mission-critical applications.

Product

Spirit: The ultimate aerial utility vehicle

Ascent AeroSystems' third generation, multi-mission Spirit is an aerial utility vehicle with the rugged flexibility of a Humvee, the efficiency of a Prius, and the performance of a Ferrari.

- Rugged airframe is protected against contamination so it can operate reliably in nearly any type of weather, even heavy rain, sleet, snow, dust and sand.

- With almost 10 pounds available for batteries and payloads, The Spirit sets the new standard for performance in its weight class.

- The highly streamlined airframe has a top speed of over 60 MPH and can operate in winds that would ground other UAVs.

- Setup is quick and easy, allowing for operations from nearly any type of terrain.

- Open-source autopilot allows for access to all critical systems and easy development of custom payloads, and Spirit can be adapted to use other, third-party ground control systems.

- A highly modular design allows operators to use exactly the sensors and batteries needed for the mission. Available development kit makes custom payloads easy.

- All Spirits are assembled in the USA, and "US only" editions are available

Learn much more on our website here.

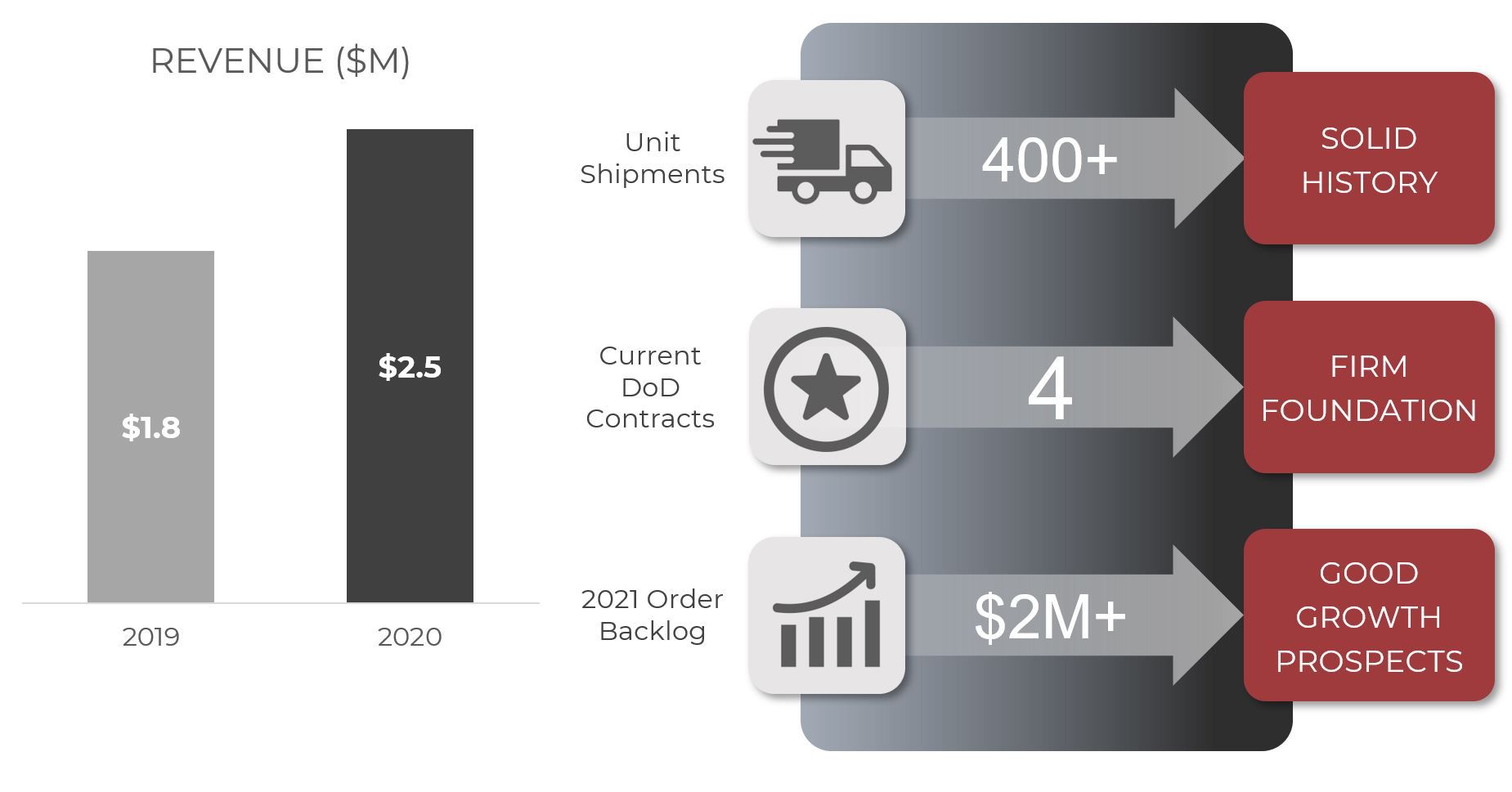

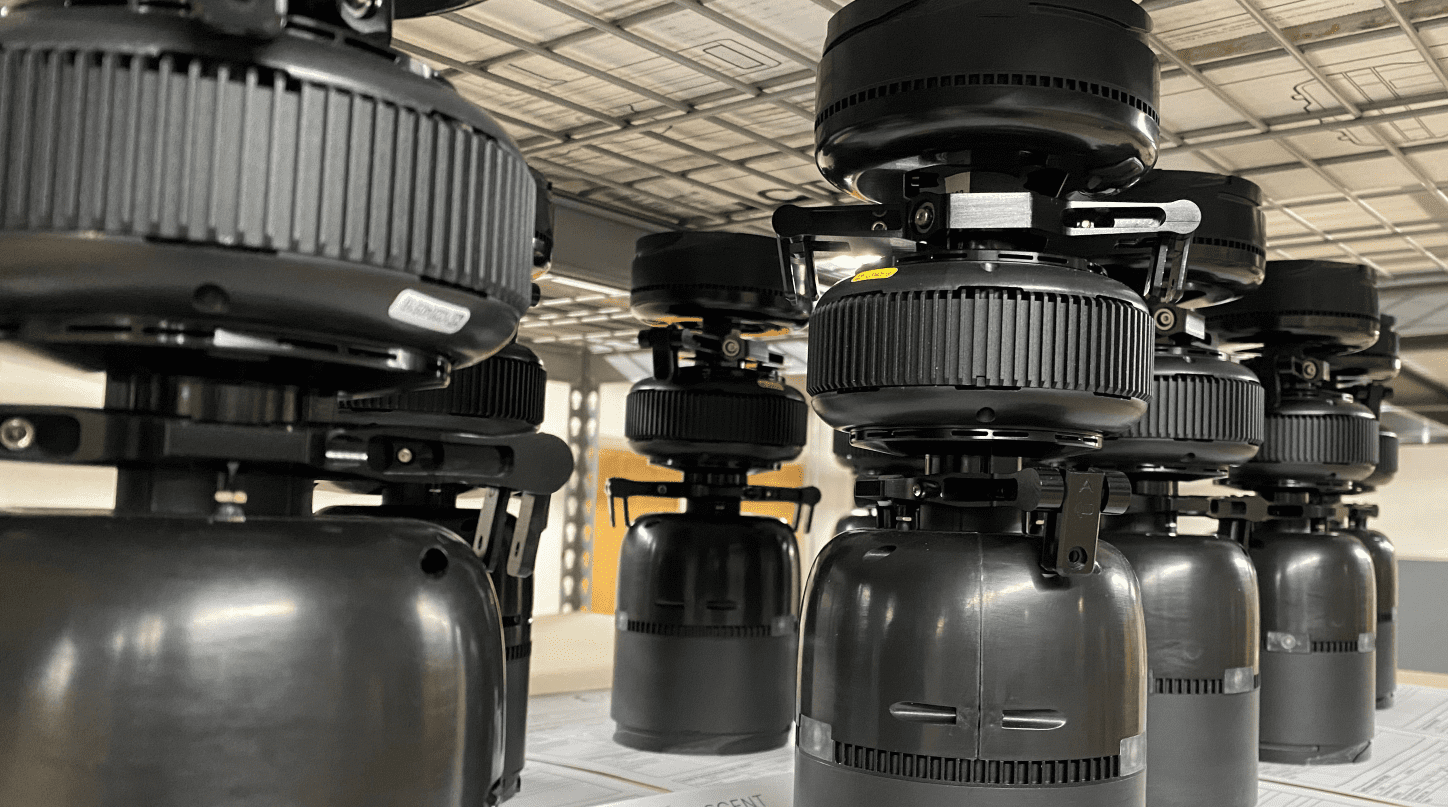

Traction

Focused, disciplined growth

Ascent AeroSystems began as a successful Kickstarter campaign in 2015. After delivering the final campaign Sprite in 2018, the company exited the consumer segment to focus on mission-critical applications in the defense, public safety and industrial markets. Since its founding, Ascent AeroSystems has been laser-focused, highly disciplined, hyper-lean and capital efficient. Revenue was up to approximately $2.5M in 2020, and the company has shown a cumulative profit over the 2019-2020 period. With very little spent on marketing since 2015, brand awareness remains limited and represents significant untapped potential.

Now shipping its third generation Spirit system, the company has found solid product-market fit in the defense segment and is now beginning to expand into public safety and industrial markets.

Customers

Enthusiastic support across defense, public safety and industrial markets

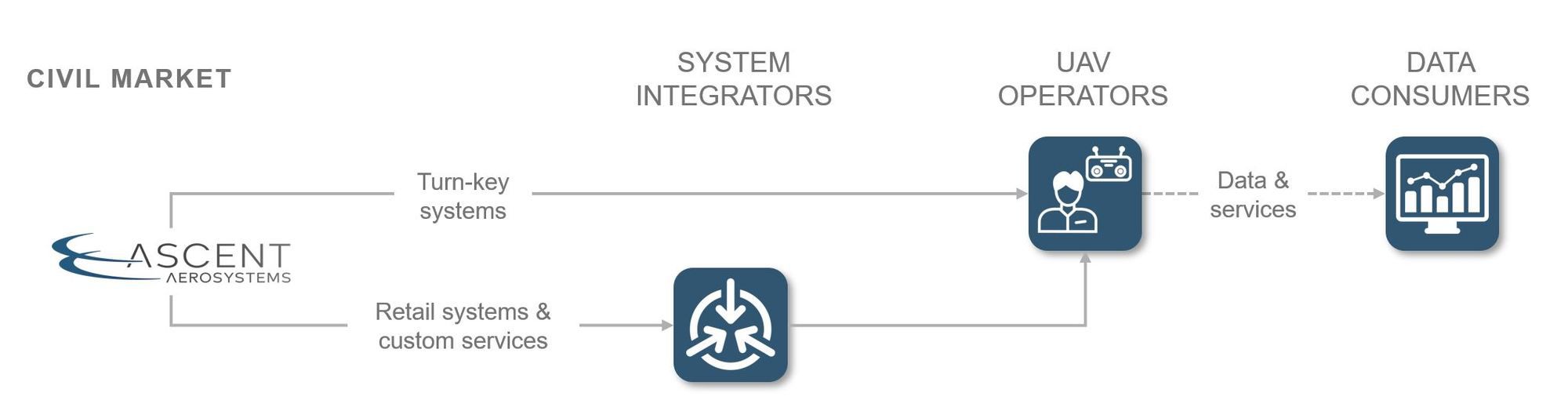

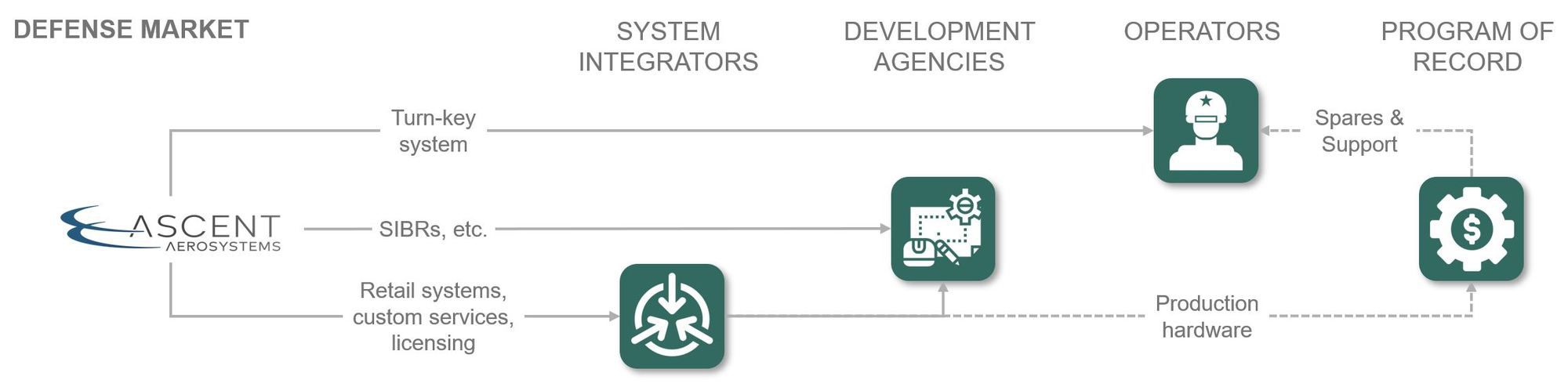

Ascent AeroSystems has two types of customers, drone operators and system integrators. (Sometimes a customer is both). While most prefer to remain confidential, current customers include the US Army, Navy and Air Force, advanced technology development agencies, public safety organizations, international defense organizations, as well as large and small businesses.

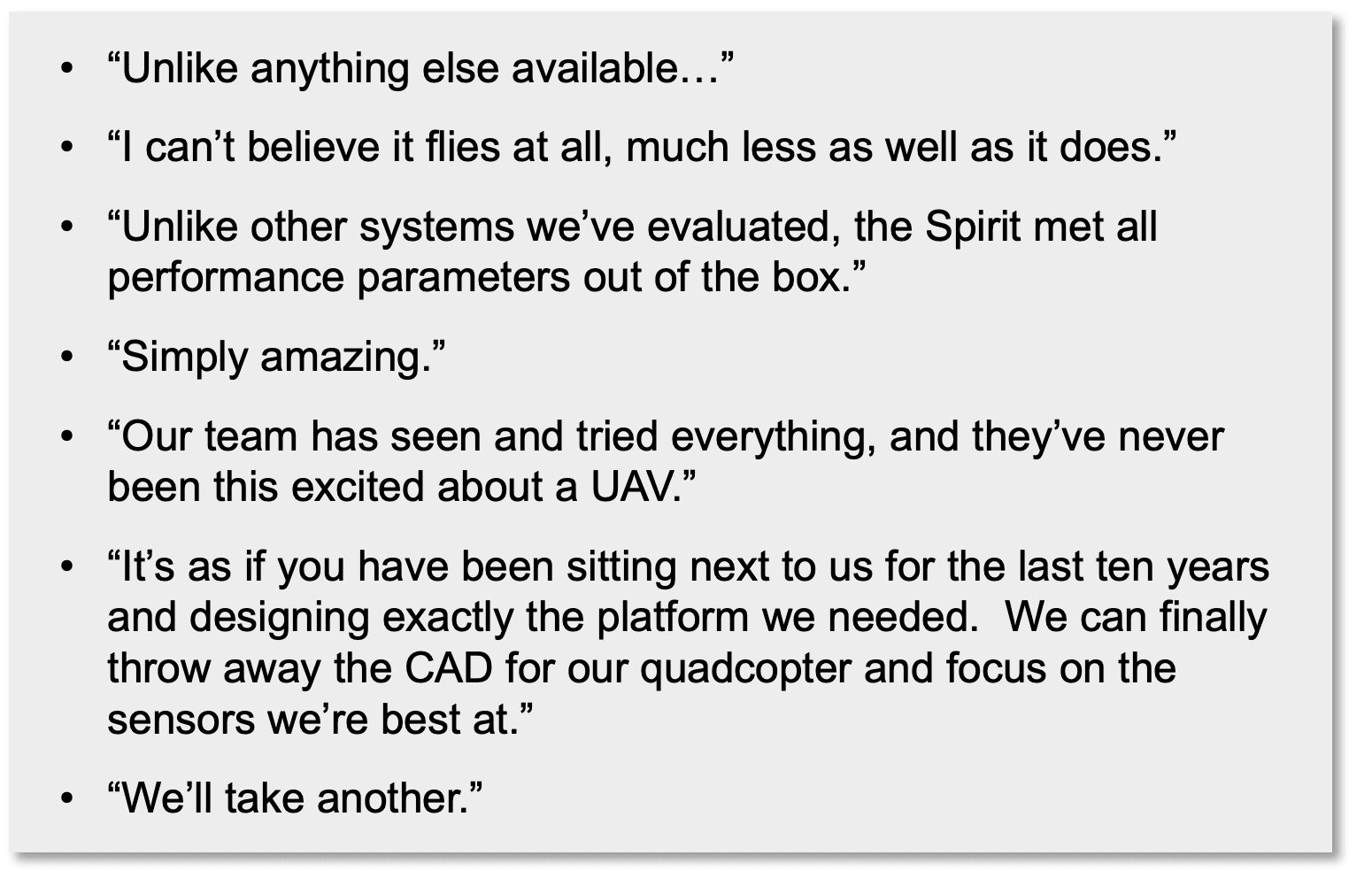

Customer Comments

Customer Type 1: Drone Operators

Compact and easily launched from the ground, air, and sea, Ascent AeroSystems’ coaxials can support a diverse range of operations, from frontline soldiers to first responders, public safety and other industrial professionals who don’t have the luxury of choosing when or where they fly. To these customers we offer turn-key, ready-to-fly systems with a variety of camera and controller options.

INDUSTRIAL |

|

PUBLIC SAFETY |

|

DEFENSE |

|

Customer Type 2: System Integrators

As adoption increases in defense, public safety and industrial markets, new applications for drone technology are being discovered. New payloads and new services being introduced at an incredible rate.

The companies that develop these new airborne sensor systems and the organizations that operate them both need a reliable UAV that will allow flights to continue regardless of the conditions or the weather. Rather than using commercial-off-the-shelf multirotors with marginal performance or investing in the development of a custom design of their own, these organizations can use coaxials made by Ascent AeroSystems.

Putting Ascent's coaxials to work: Customer examples

- Major US defense contractor & system integrator. Click here for recent news

"Ascent’s strengths run deeper than their technologies. Their commitment to product support is truly impressive. The people on their team have proven that they have both the expertise and the personal commitment needed to make our projects successful."

Simulated mission concept

Building the Future of Forestry

- Treeswift is developing a next-generation forest monitoring system using state-of-the-art robotic and machine learning technology to provide forest stakeholders with precision data and analyses for carbon capture estimation, timber value estimation, deforestation monitoring, advanced growth forecasting, and forest management

- Selected Ascent AeroSystems' Spirit UAS as an airborne platform in an effort to improve data collection processes in remote locations and austere environments

High-resolution LiDAR generated point cloud of a forest

High-resolution LiDAR generated point cloud of a forest

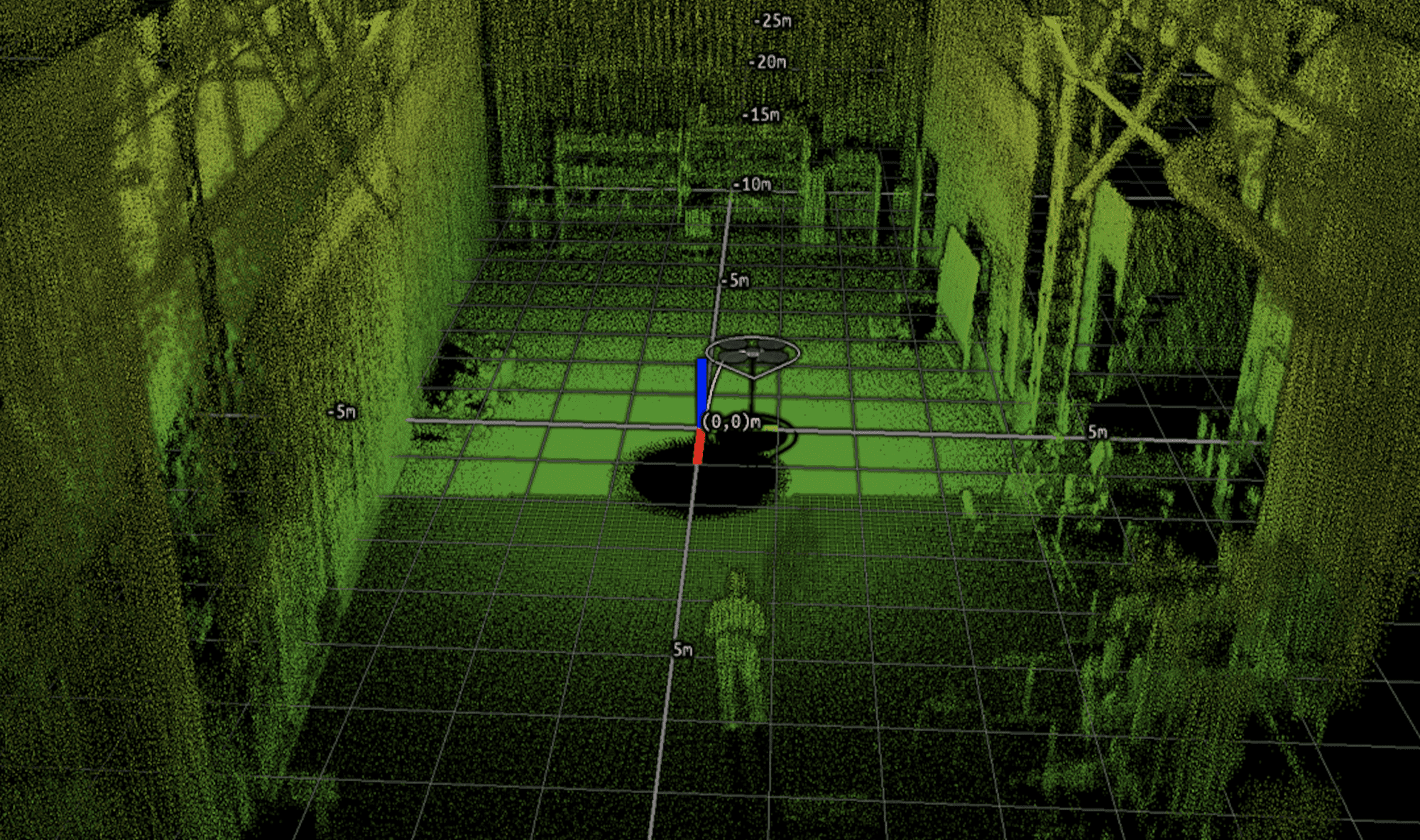

Exyn develops solutions to enable autonomous flight for aerial systems in complex, GPS-denied environments:

- Generates precise 3D maps to quickly assess dangerous environments

- Exyn's solution will enable flexible deployment of a Spirit UAV that can intelligently navigate and dynamically adapt to complex environments in real-time

- Broad industry applications including Defense, Public Safety, and Industrial markets

Indoor point cloud generated by an Exyn-equipped Spirit

Indoor point cloud generated by an Exyn-equipped Spirit

Business model

Systems, services & more

Ascent AeroSystems has been generating revenue in three primary business areas:

Hardware: We offer complete, ready-to-fly systems like the Spirit for purchase to support mission-critical operators in the public safety, industrial and defense markets. Because our coaxials are inherently rugged, we offer a subscription service that includes a damage-exchange option. As described in the Customer section above, we also sell airframes as a high performance, all-weather alternative platforms that manufacturers can use to replace existing fixed-wing and conventional multirotor systems. We have previously delivered smaller and larger models, and our product roadmap includes a variety of vehicle sizes.

Services: Ascent AeroSystems offers custom development and engineering support services to support customers who need to adapt our technology to meet the demands of their specific mission objectives. These services are usually through firm-fixed-price contracts or "time & material" arrangements.

Licensing: Certain uses of our technology are best suited for development by highly specialized system integrators. We are generating revenue from existing agreements, some of which are exclusive, that include provisions for Ascent AeroSystems to be paid license fees and royalties.

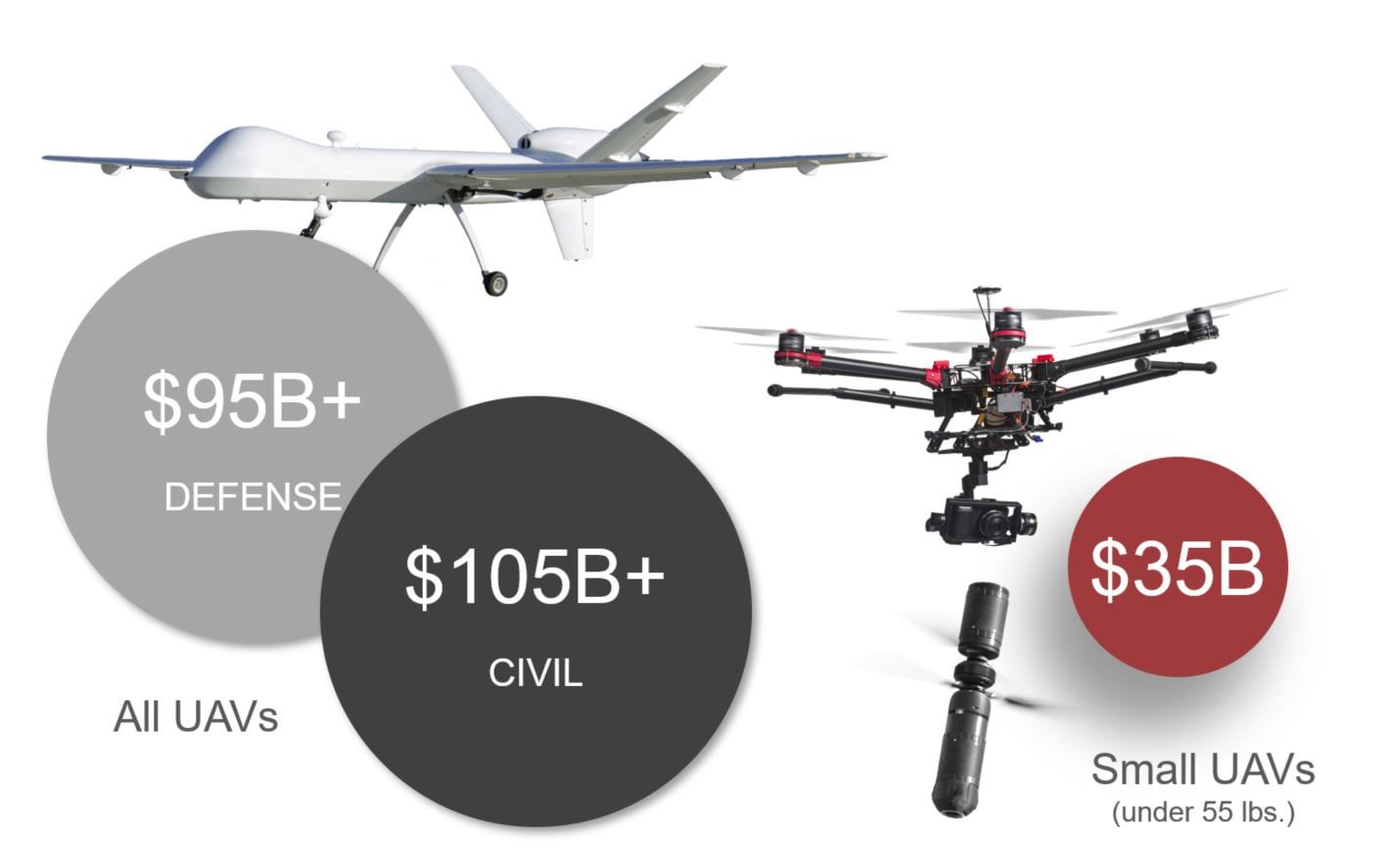

Market

With a $200B+ TAM, drones are more than just a market

Whether operated in defense, public safety or other industrial settings, drones are useful for two purposes:

MATERIAL TRANSPORT | DATA COLLECTION |

| |

For moving things from A to B, bigger drones are better. | For collecting data, smaller drones are better. |

While some big names are focused on material transport, Ascent AeroSystems' coaxials are ideally suited for data collection. We believe that the need to observe, inspect, sample and document our world more often, more quickly, more economically and more safely will grow dramatically over the coming years, and that the market opportunity for data collection far exceeds that for material delivery.

The Future

To be economically viable at scale, future enterprise operations are likely to be highly automated, and we believe that coaxials are a better platform for automation. The coaxial's simple cylindrical shape makes it easier to launch, recover and reset without human intervention. Unlocking even more applications, Ascent's cylindrical coaxials have been successfully launched from stationary and moving platforms on the ground, on the water, and in the air. Try that with a quadcopter!

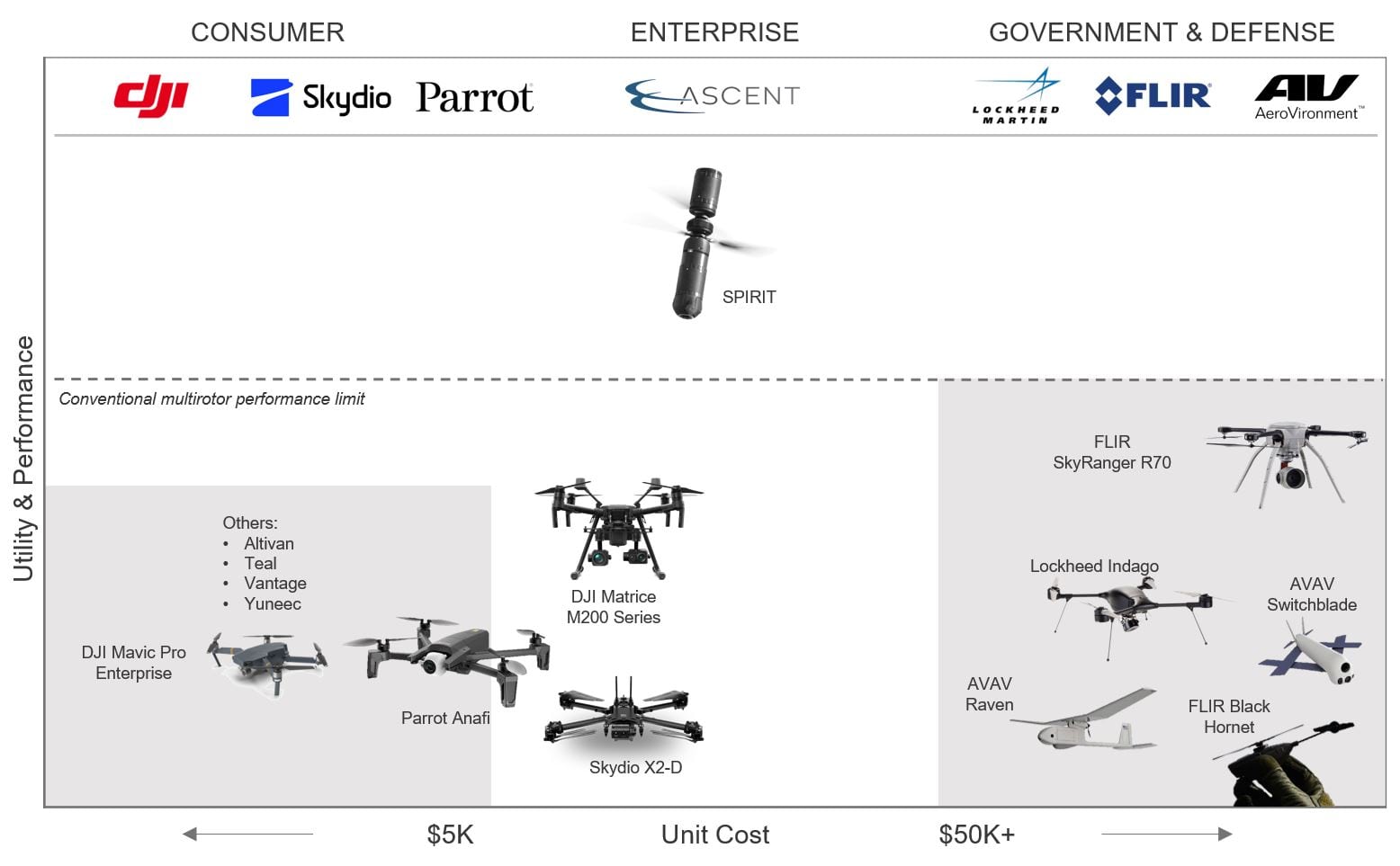

Competition

Disrupting the drone disruption...

Coaxials have been used on full-scale rotorcraft for decades, and they're the standard for many basic helicopter toys. But while designing one to maintain hovering flight is relatively straightforward, it takes an entirely new approach to achieve the kind of speed and agility possible with Ascent AeroSystems' coaxials.

With more than seven years of development the company has a portfolio of intellectual property that includes an issued patent and pending applications in the United States and other jurisdictions, as well as trade secrets. We are not aware of any other commercial source for multipurpose coaxial drones.

We currently compete against a wide range of other drone manufacturers, including DJI, a Chinese-based company that dominates most civil drone markets worldwide. Here in the United States, cybersecurity concerns and trade politics strongly favor domestic manufacturers like us. We expect this trend to continue.

The U.S. defense market for small UAVs is currently dominated by AeroVironment. Companies including Lockheed Martin, FLIR, Skydio, Teal, Vantage, Parrot and others are moving to take advantage of government efforts to upgrade existing operational capabilities and support American manufacturers.

But when operations move beyond “proof of concept” and must operate in a real-world environment, we believe only the coaxial can provide the combination of size, durability, performance and utility needed to dependably support operations at scale.

Vision and strategy

Delivering the most reliable and productive airborne platforms

We believe Ascent AeroSystems' coaxial technology is the key to unlocking the commercial and public safety drone markets. We intend to deliver the most reliable, most productive airborne platforms to drone operators and system integrators, regardless of their market focus. With your investment, Ascent AeroSystems will work to change the future of drone technology.

Funding

Growth to date funded mostly by operations

Since its founding, Ascent AeroSystems has been highly disciplined, laser-focused, hyper-lean and capital efficient. After raising approximately $400K on Kickstarter in 2015 and successfully shipping commitments to backers, the company raised $600K in 2017 and otherwise has been funded by our business operations.

Aside from the founders, major stakeholders on our cap table include CenterState CEO GeniusNY Accelerator ($600K for 5% warrant), DreamIt Ventures ($250K convertible note for in-kind services, no cash received), as well as stock options held by advisors and employees. We're currently raising additional funds to support company growth, especially R&D, marketing and business development and other corporate operations.

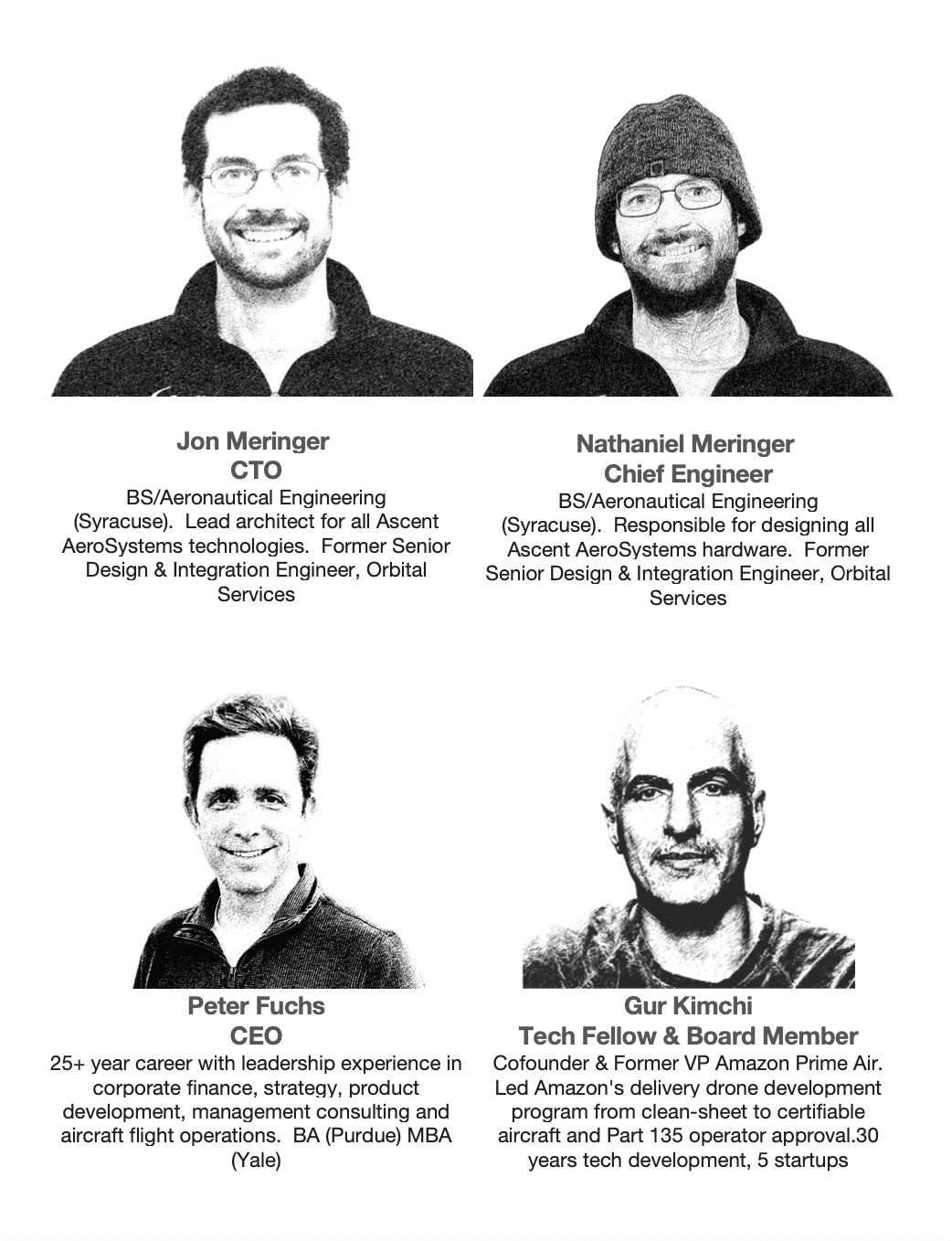

Founders

Leading industry experts, demonstrated grit, ready to scale

What happens when a couple of rocket scientists, a tech genius, and brilliant, hardworking engineers work together?

Our Values

Our Values

As we look forward, we believe we're at the beginning of a new technology age in which drones will play a very important role. We plan to be right in the middle of that ecosystem, developing wide-reaching technologies and assembling them right here in the USA. We're grateful for all the support we've had along the way, and we're looking forward to all the positive impact we have yet to make.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...