Problem

Speaker cables are inconvenient and expensive

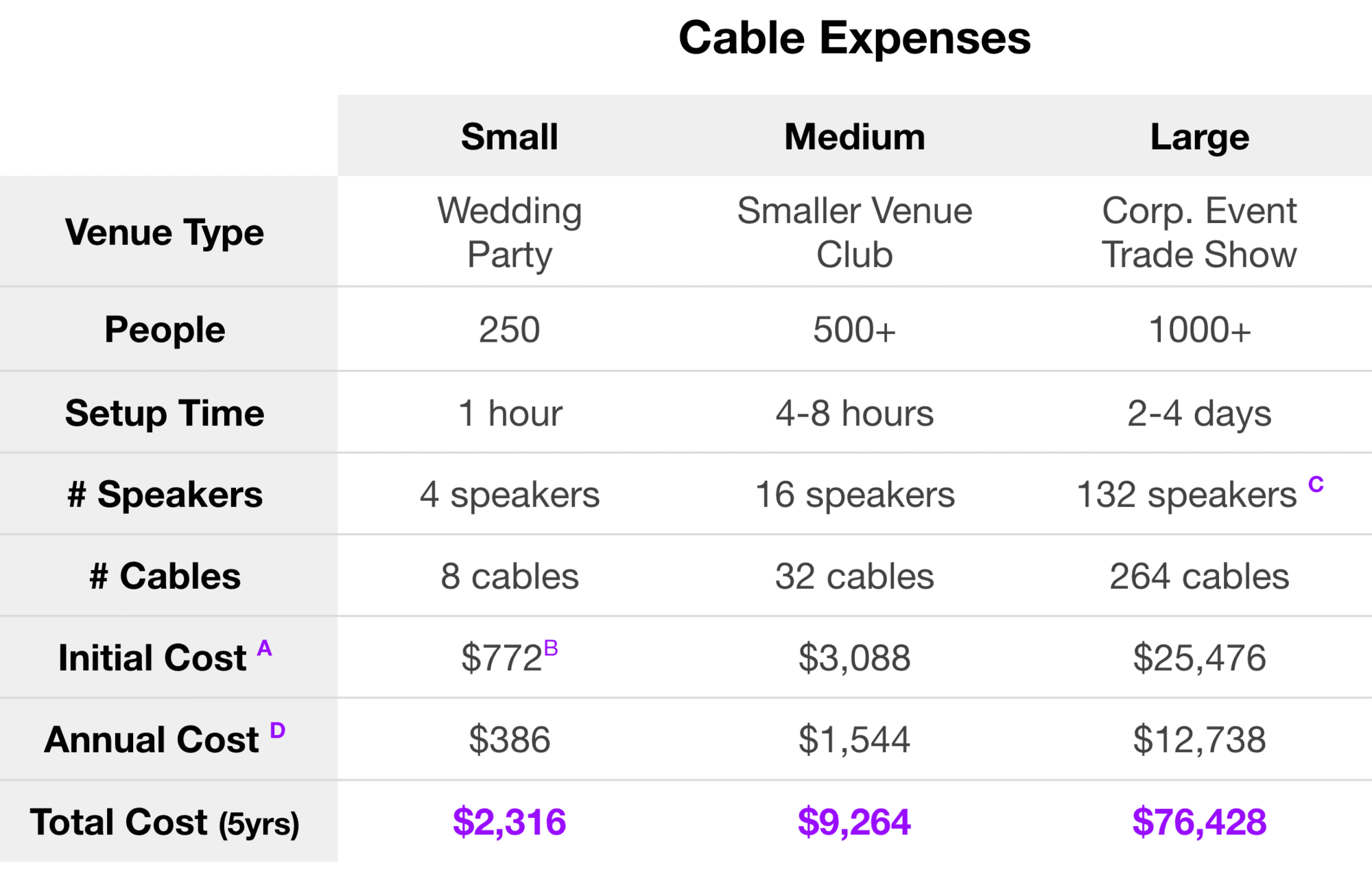

Cables are time-consuming, expensive, and need to be replaced every year.

We traveled around the country, interviewed and set up events alongside select customers. We found that the time and expenses associated with cables increase proportionately with the number of speakers used.

A Retail price of Livewire 100 ft XLR cable is $129 & Livewire 50 ft Power cable is $64

B Each speaker requires 1x XLR & 1x Power cable, e.g. 4 speakers x ( $129 + $64) = $772

C 132 speakers quoted for PHP Agency Vision 2020 Tradeshow

D Cables are replaced throughout the year because they are damaged or lost. Customers interviewed indicated they replace ½ - ¾ of their xlr and power cables within 12 month period.

Solution

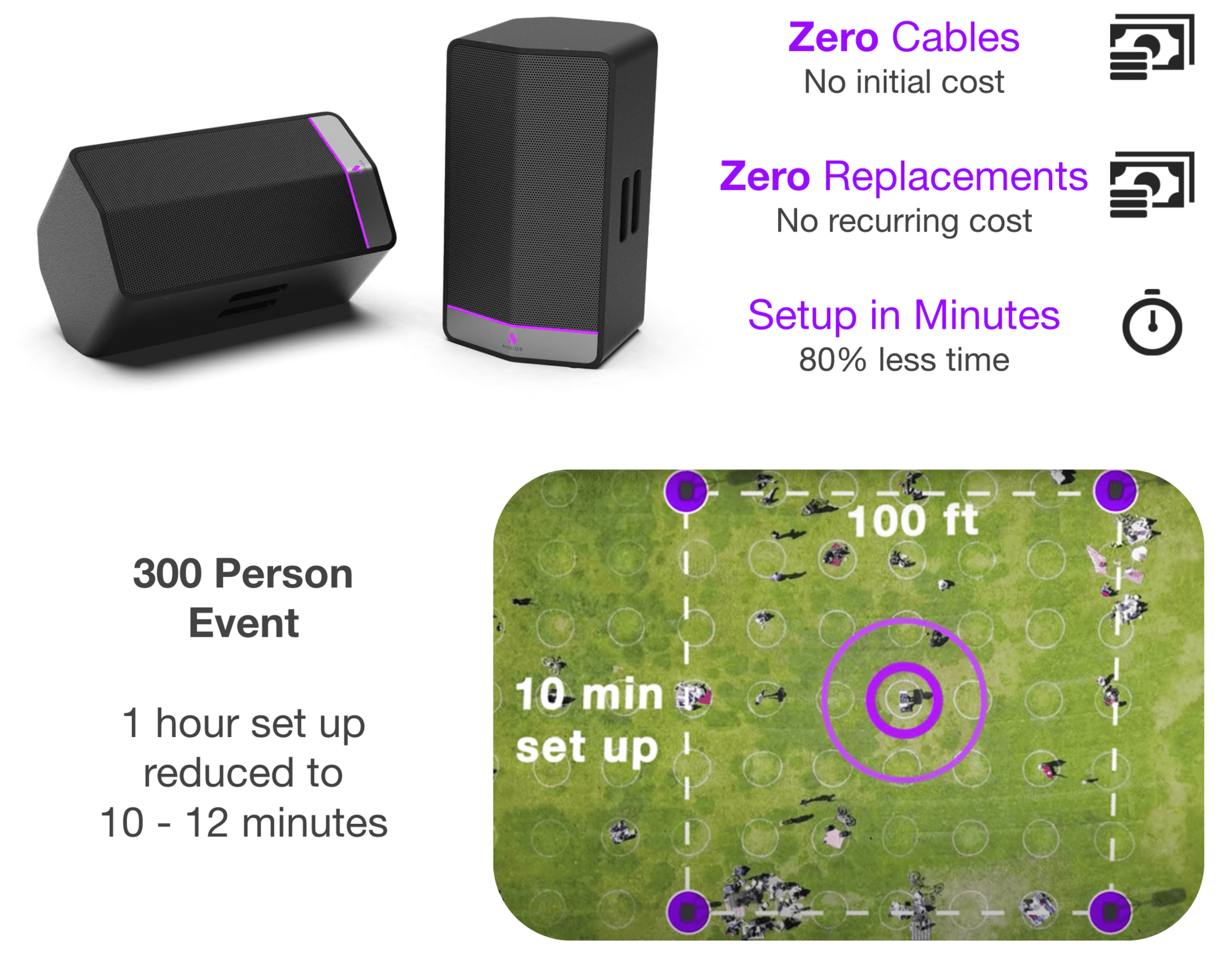

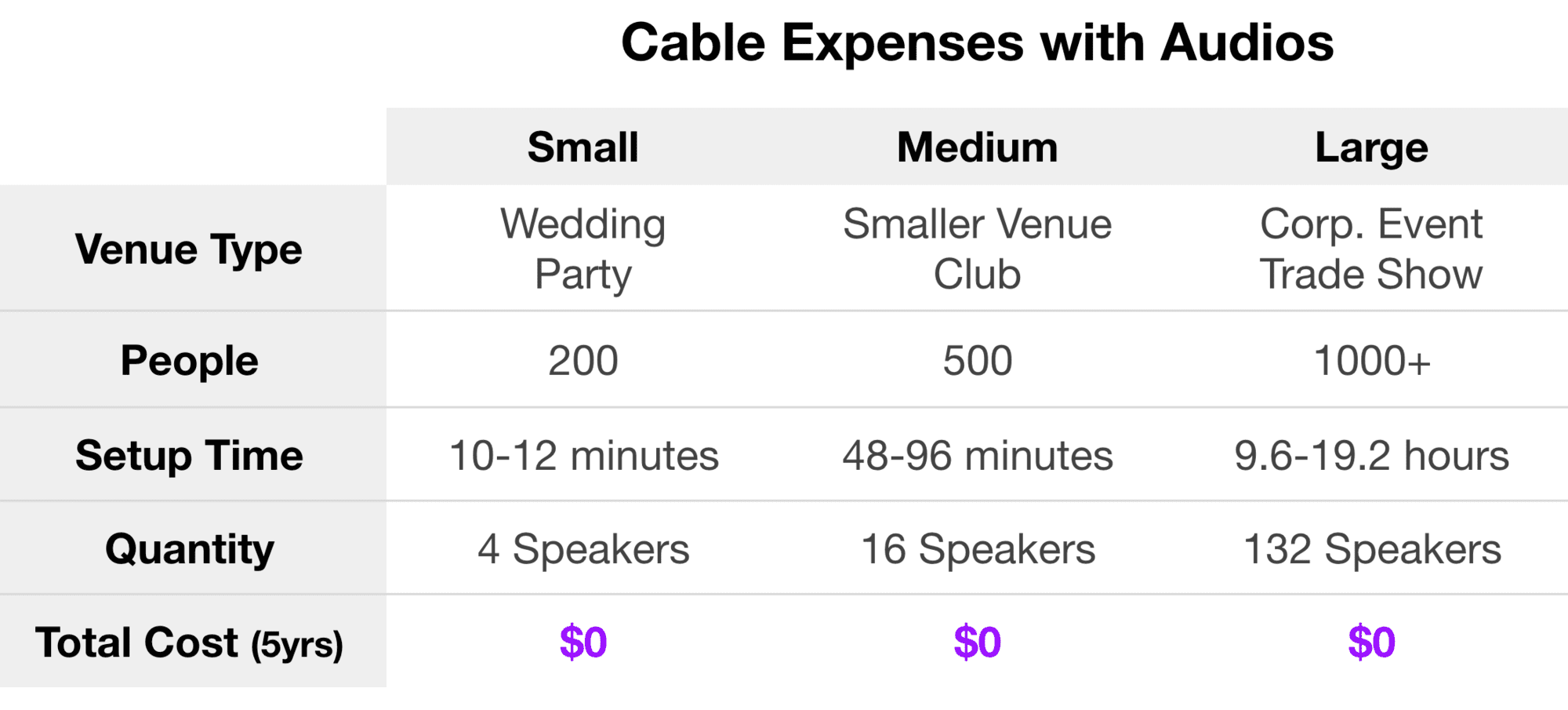

Audios loudspeakers save time and money

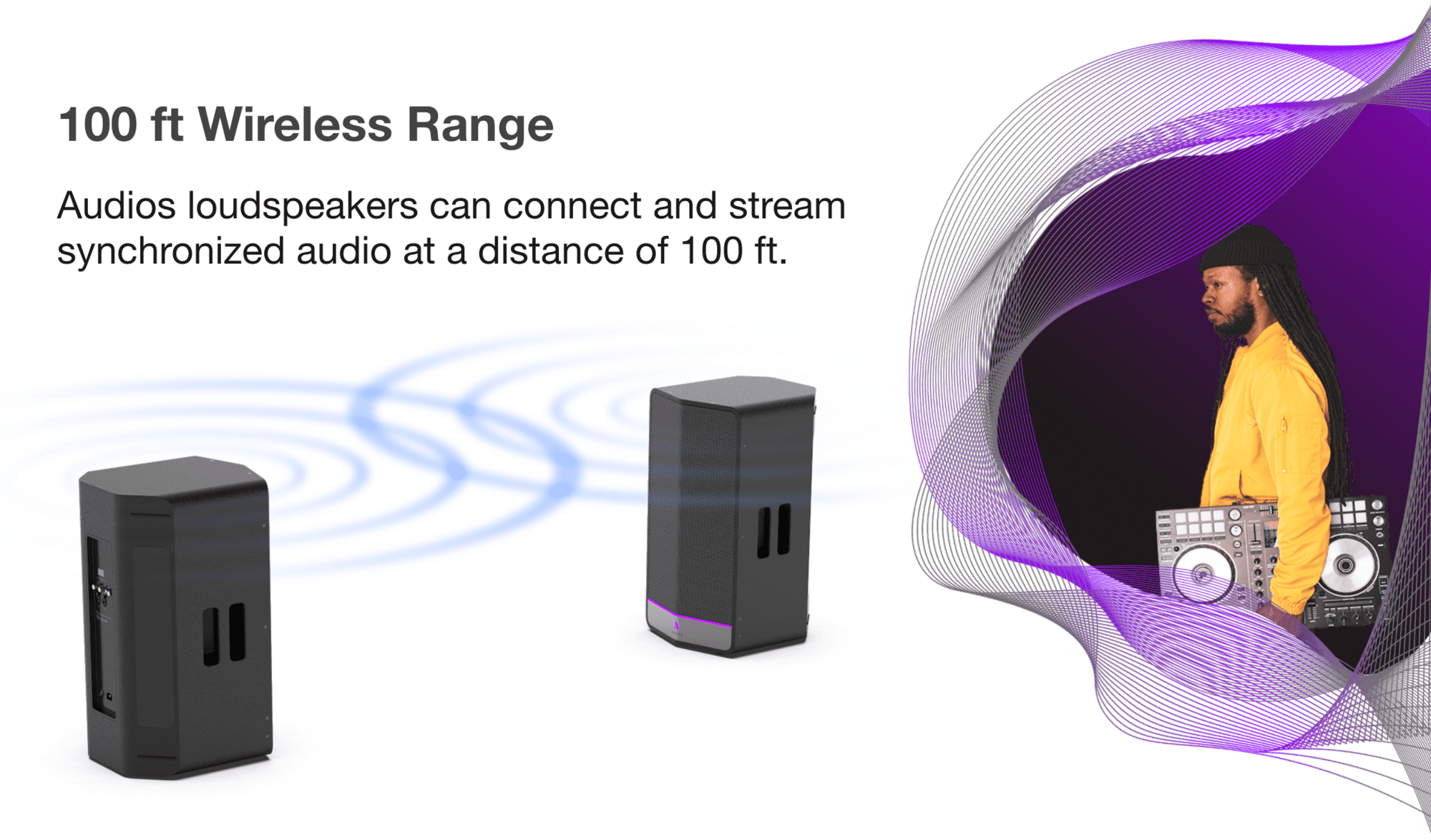

Audios wireless loudspeakers are cable-less, battery-powered, and don’t require a Wi-Fi router or Bluetooth connection. Anyone can set up an Audios system, exactly like the professionals do.

Anyone using Audios can reduce the time and eliminate the expenses associated with setting up complicated cable systems.

Product

Set up like the pros with Audios wireless connectivity

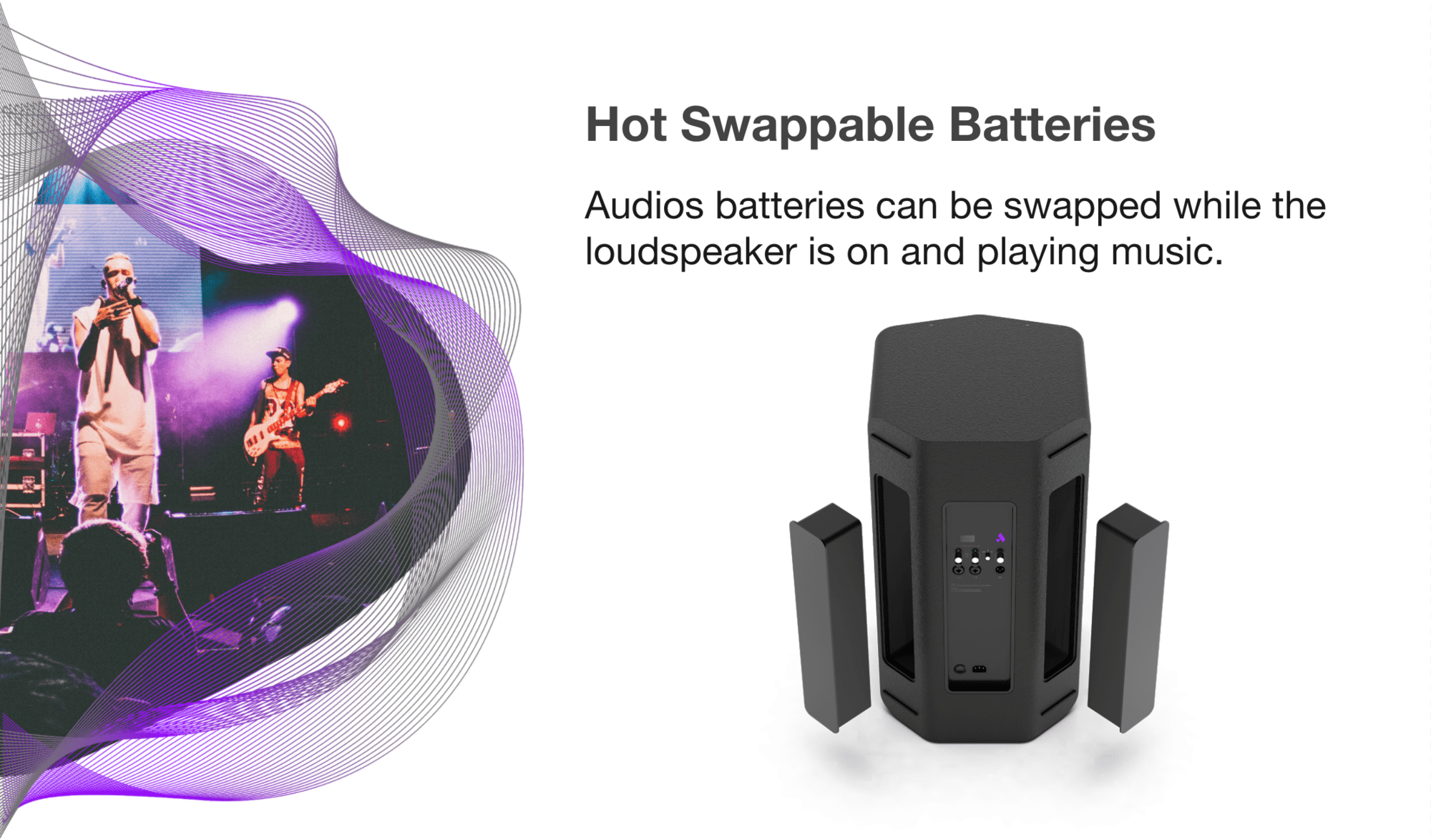

At its core, Audios wireless connectivity technology offers convenience and cost savings by eliminating the need for cables.

Perks

Traction

Product-Market-Fit verified, B2B partnerships established

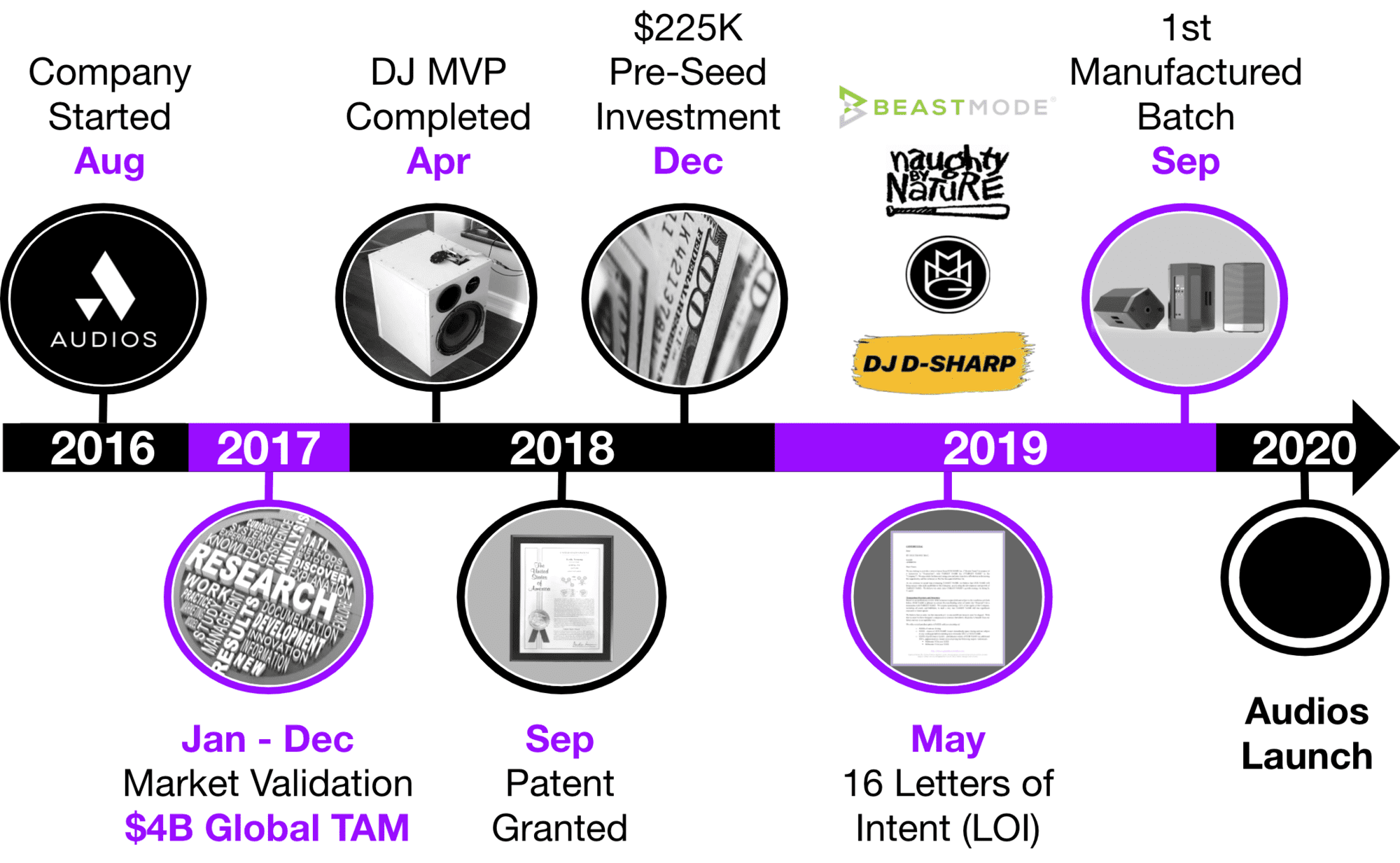

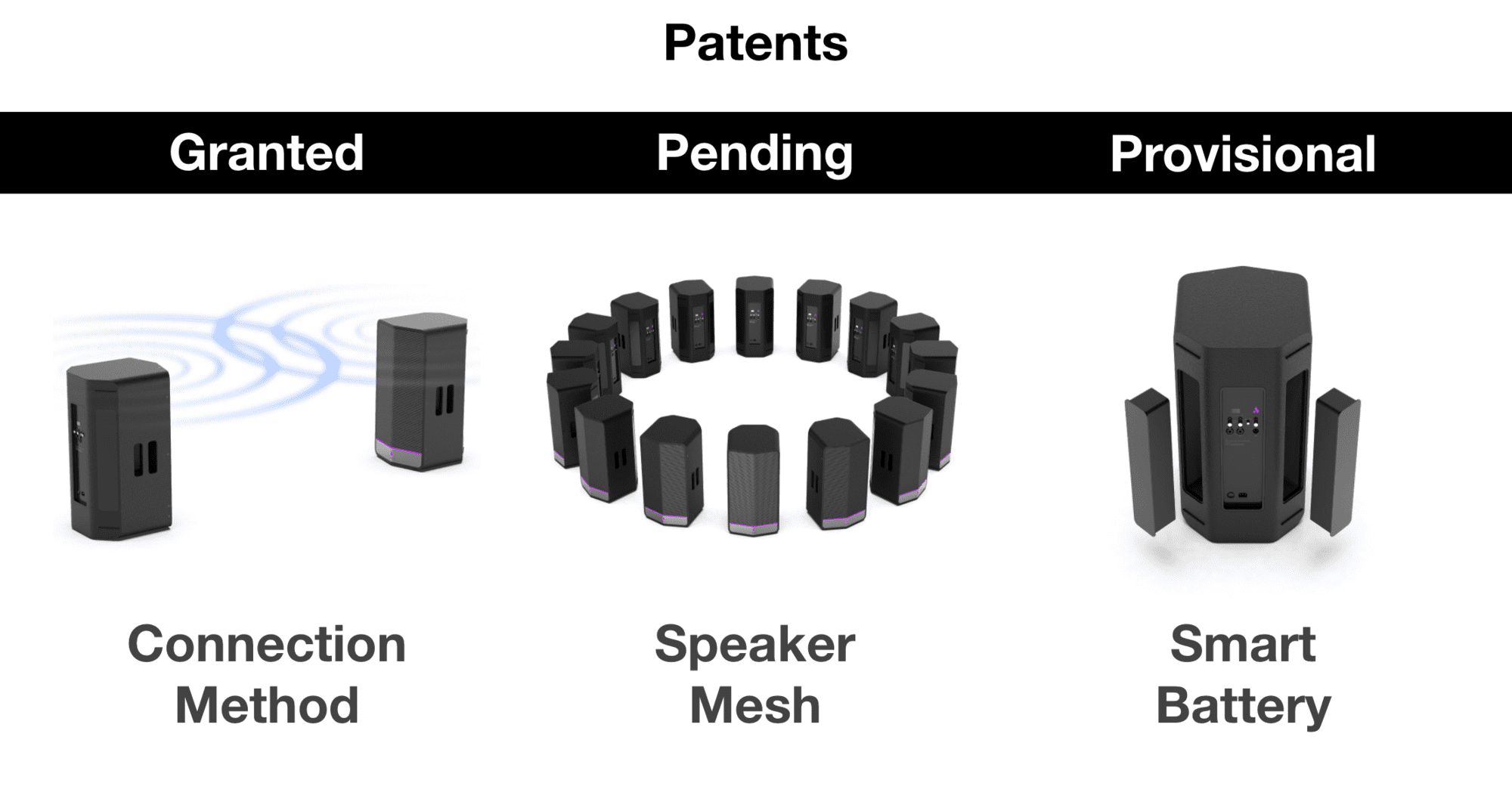

Our investors verified we have achieved product-market-fit. We have 1 licensable patent granted, 2 patents pending, and are in early discussions with a Global 500 competitor about licensing our technology. We also established B2B partnerships with Moor Productions in Miami, and PBE in Las Vegas to refine and execute our scalable business model.

Our initial R&D began in 2016. Since then, we've received a patent, a $225k+ pre-seed investment, and letters of intent from artists and event and production companies across the U.S. such as Naughty By Nature and PBE.

As seen in:

Customers

Audios is a great fit for anyone who needs sound amplification

Our target customers will expand as we progress through several phases of our long term B2B and B2C rentals and sales strategy. The testimonials below are from current customers.

Business model

A business model adapted to the COVID-19 new norm

COVID-19 related shutdowns have drastically reduced or reversed speaker companies' growth because of limited events, declining sales, and high operating costs. Audios, however, is in a perfect position to weather an extended shutdown, should it come.

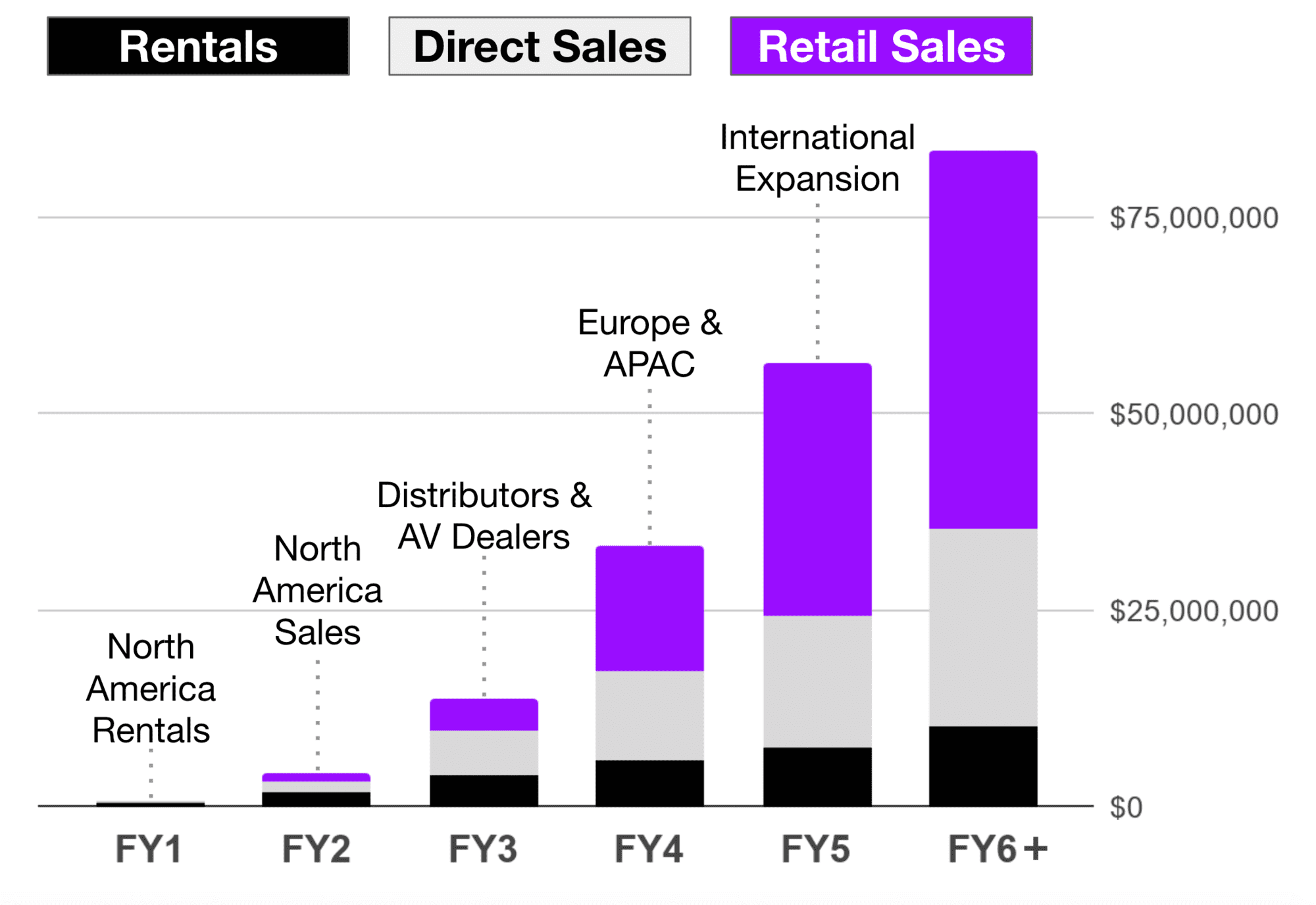

Many competitors have fixed operating expenses related to housing thousands of speakers and accessories in their inventory. In contrast, as long as social distancing and shutdowns are required, Audios will operate lean and scale with demand by using a build-to-order sales strategy. We will also use a hybrid business model that includes both rentals and sales broken down into multiple phases.

The goals are simple: (1) remain lean, (2) focus on customer retention in the North American loudspeaker market, and (3) scale on demand into the larger market segments post COVID.

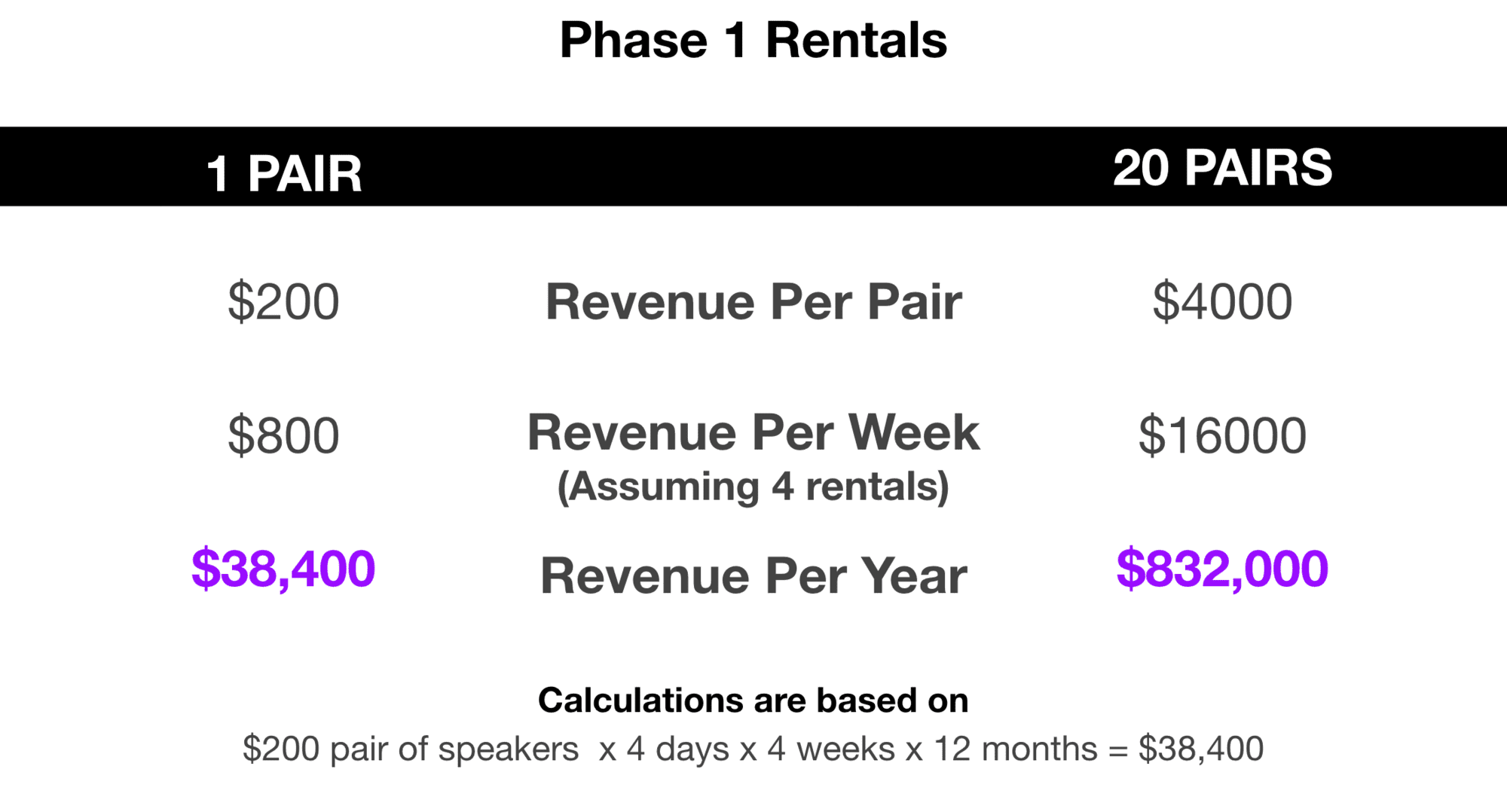

Audios will start with speaker rentals as the rentals have high margins, require fewer upfront costs, and allow us to optimize for cash flow before we scale. With our business model, we project an initial ARR of $50k/mo/city.

Market

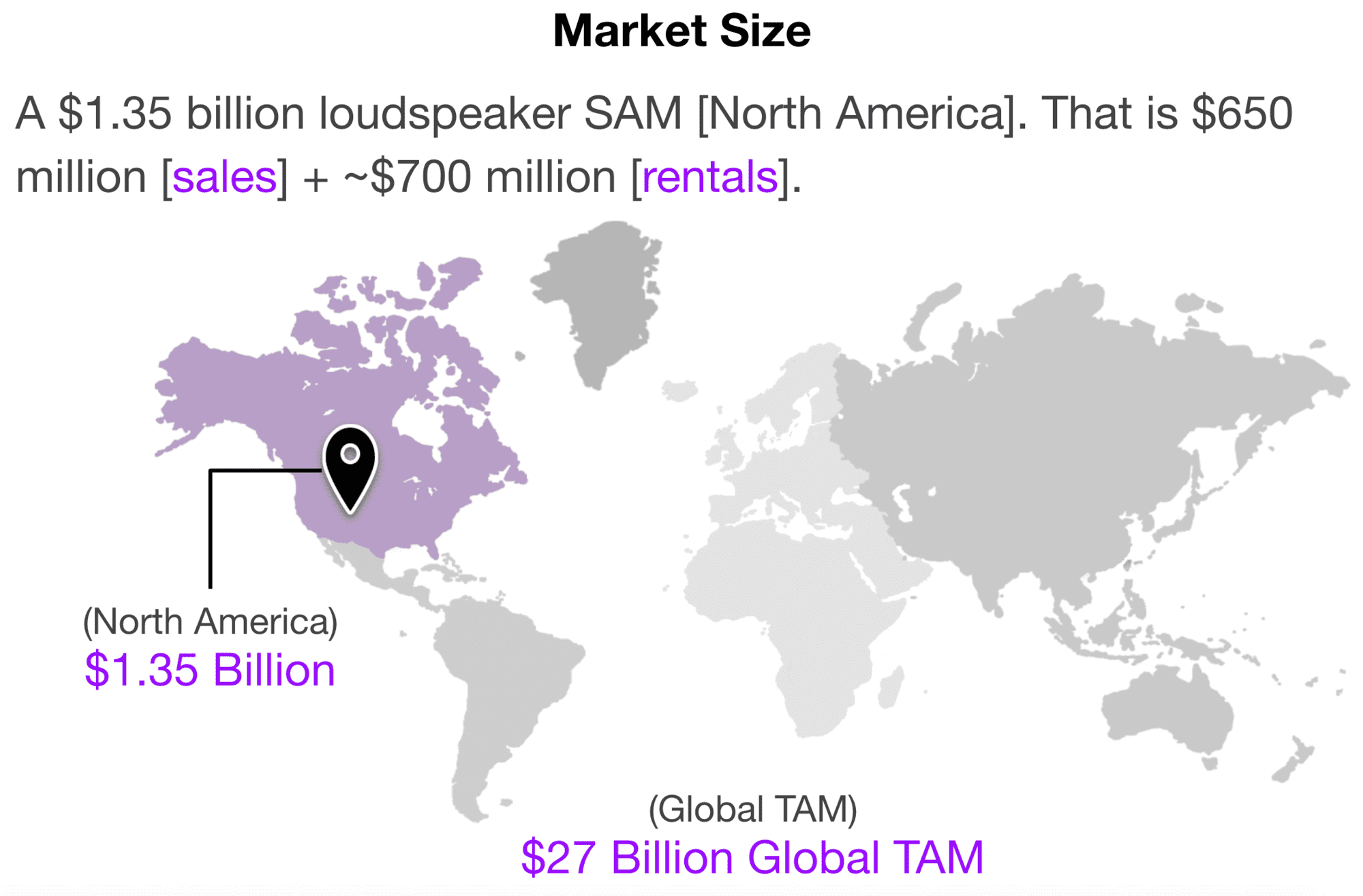

Targeting the $27B wireless speaker market

By 2023, the global wireless speaker market will reach $27 billion, with a CAGR growth of over 17%. Audios will target the $4B loudspeaker segment prior to expanding to the $27B market.

As a result of COVID-19, we adjusted our go-to-market strategy to (1) remain lean, (2) focus on customer retention in the North American loudspeaker market prior to, (3) scaling and expanding into the larger market segments.

The $1.35B+ North American loudspeaker market can be further broken down into a $650M sales market and a $700M rental market. We plan to focus on rentals prior to scaling via sales.

Competition

A complete audio solution

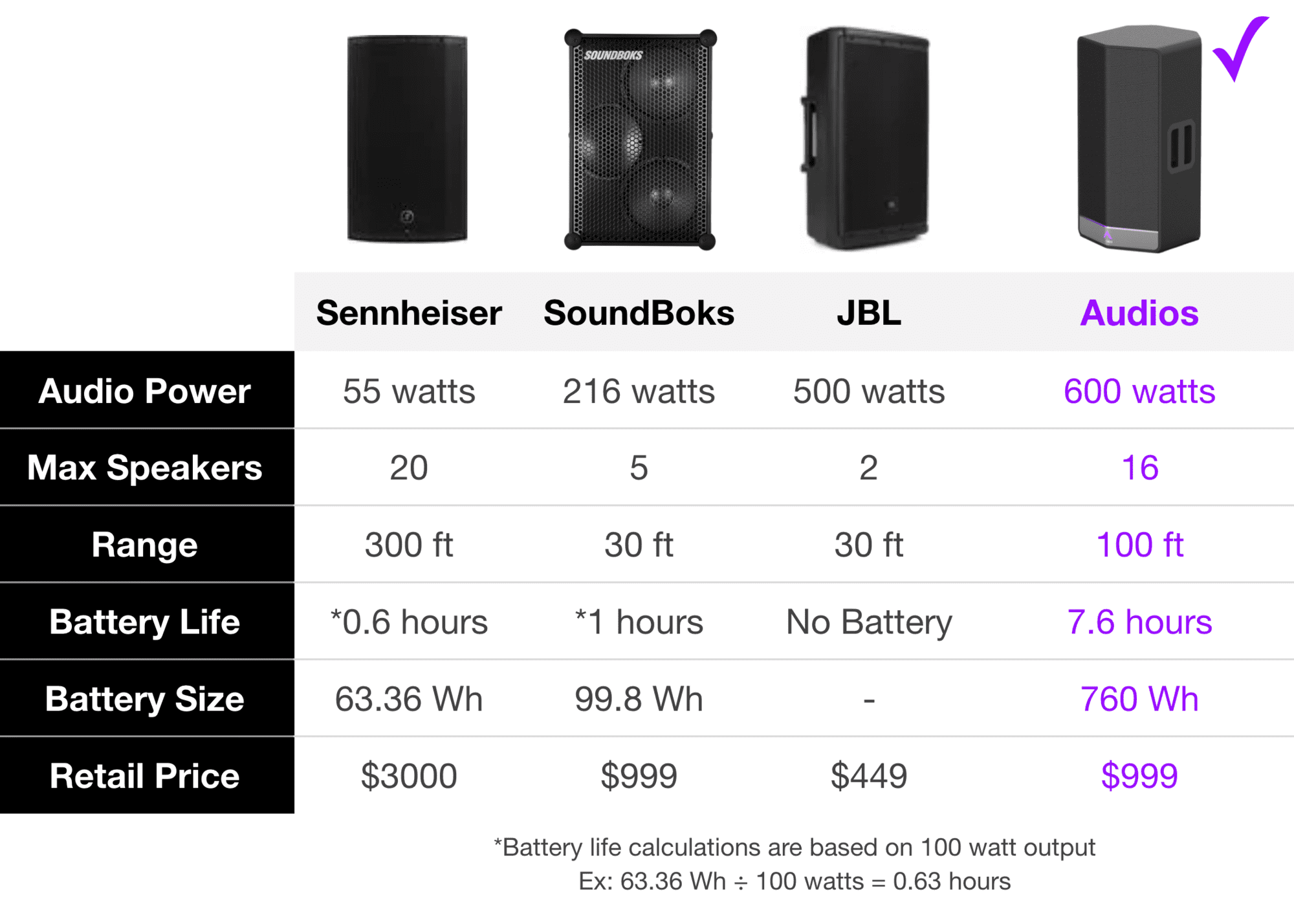

Audios is one of two large scale speaker companies that provides a completely wireless audio solution to venues. The speaker’s range, battery life, battery size and audio power outpace competitors and is competitively priced.

We also have a competitive advantage in our defensive and licensable patent(s).

Vision and strategy

Our long term vision extends beyond speakers

Audios is committed to achieving long-term growth and becoming a leader in the professional audio industry. By reaching our fundraising goal, we plan to expand operations, which will increase our brand presence, direct and retail sales globally.

Our long term vision is to expand beyond the commercial audience and develop a consumer product line featuring speakers, headphones, and smart home devices.

Funding

Backed by investors with proven track records

Our lead investor is Charles Huang, the co-creator of the Guitar Hero, one of the top-selling video game franchises of all time which has grossed over 4 billion dollars.

“Innovations in the way that people consume music are frequently billion-dollar opportunities … [Audios has] patented technologies that I think can improve, not just speakers, but smart home products and smart office products as well.”

- Charles Huang

Our co-lead Investor is Andy Rachleff, the co-founder of Benchmark and founder and CEO of Wealthfront. He is also well known for coining the term product-market fit.

Andy’s firm invested $6.7 million in eBay for 22.1% ownership and $12 million in Uber for 11% ownership. The Uber investment is now worth $7 billion.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...