On the show today Scott is then joined with the Managing Partner of Lightbank, Victor Pascucci III to ride shotgun. Victo...

Problem

It’s no secret that student debt is a huge issue in the U.S. As college tuition continues to rise, it’s becoming increasingly difficult to pay for school. After exhausting their savings and federal loan options, students are forced to turn to private loans that come with high, inflexible monthly payments—assuming they even qualify. Most private loans on the market require a credit score, co-signer, or collateral, which can be difficult for students just starting out on their own.

Solution

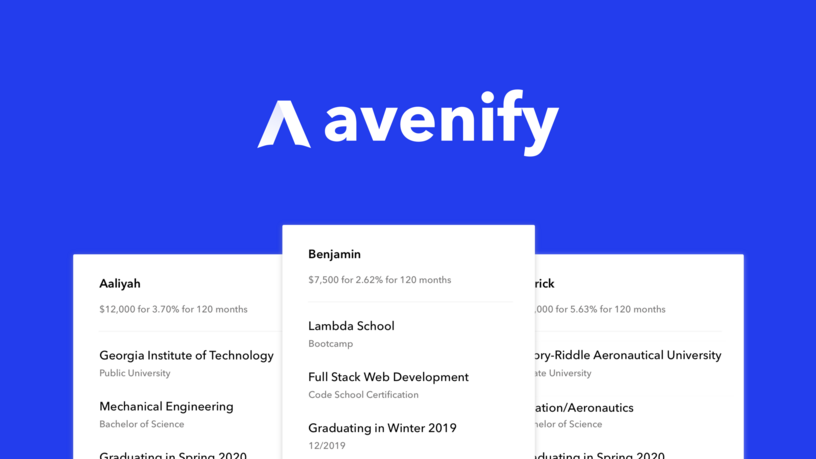

Avenify: a marketplace lending platform for ISAs

Avenify is transforming the student financing industry by providing students the opportunity to fund their education with an ISA instead of a traditional loan. Students can borrow up to $15,000 per semester, and owe nothing back until they’re employed and making more than $20,000. Unlike a loan, ISAs don’t have a balance or interest owed. Instead, students pledge to share a fixed percentage of their income for a fixed period of time.

As students who’ve been affected by student loans ourselves, we wanted to build financing that was affordable, transparent, interest-free, outcome-based, and incentive-aligned.

Product

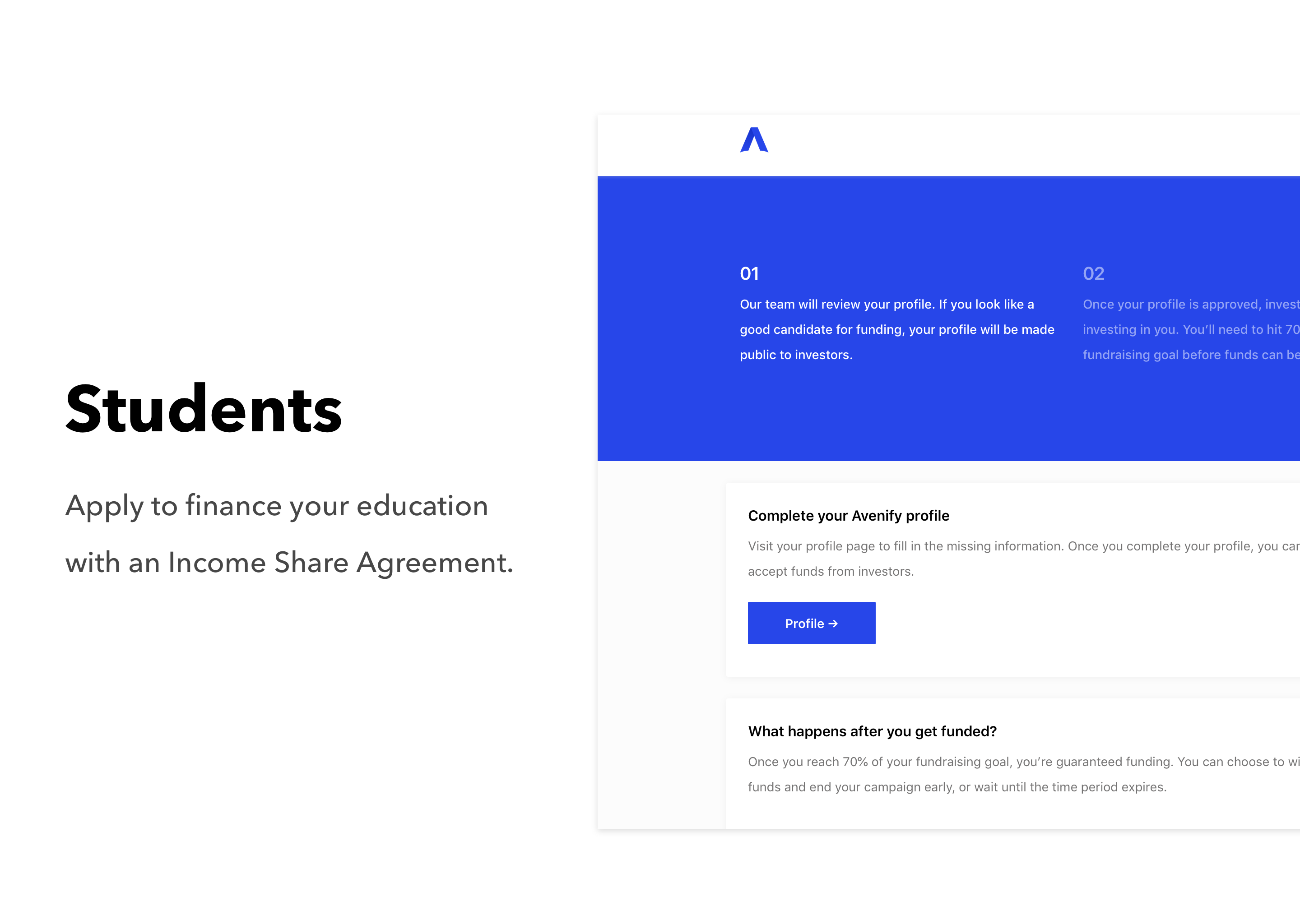

Students apply to finance their education with an ISA

How it works:

A student applies for funding, and sets up their profile. We collect information like school of attendance, degree and major, expected graduation date, resume, and transcript. In addition, we allow students to upload three supporting documents that give our investors a better picture of who they are and what they can accomplish.

Our team reviews the application, and underwrites the ISA with our model. We use thousands of data points to project each student’s earning potential and set the terms. Our standard income shares range between 1-5% for 120 months.

After accepting the terms, the student receives funding. Funding is disbursed directly to the student’s bank account, so they can use the funds to pay for anything, whether it’s tuition, room and board, meals, or supplies.

Once the student leaves school, their payback period begins. Payments start six months after graduation, and are calculated by multiplying their income share by their pre-tax income. They’ll continue making payments until they reach the end of the payback period, or they can opt to pay off their ISA early by paying up to our progressive payback cap.

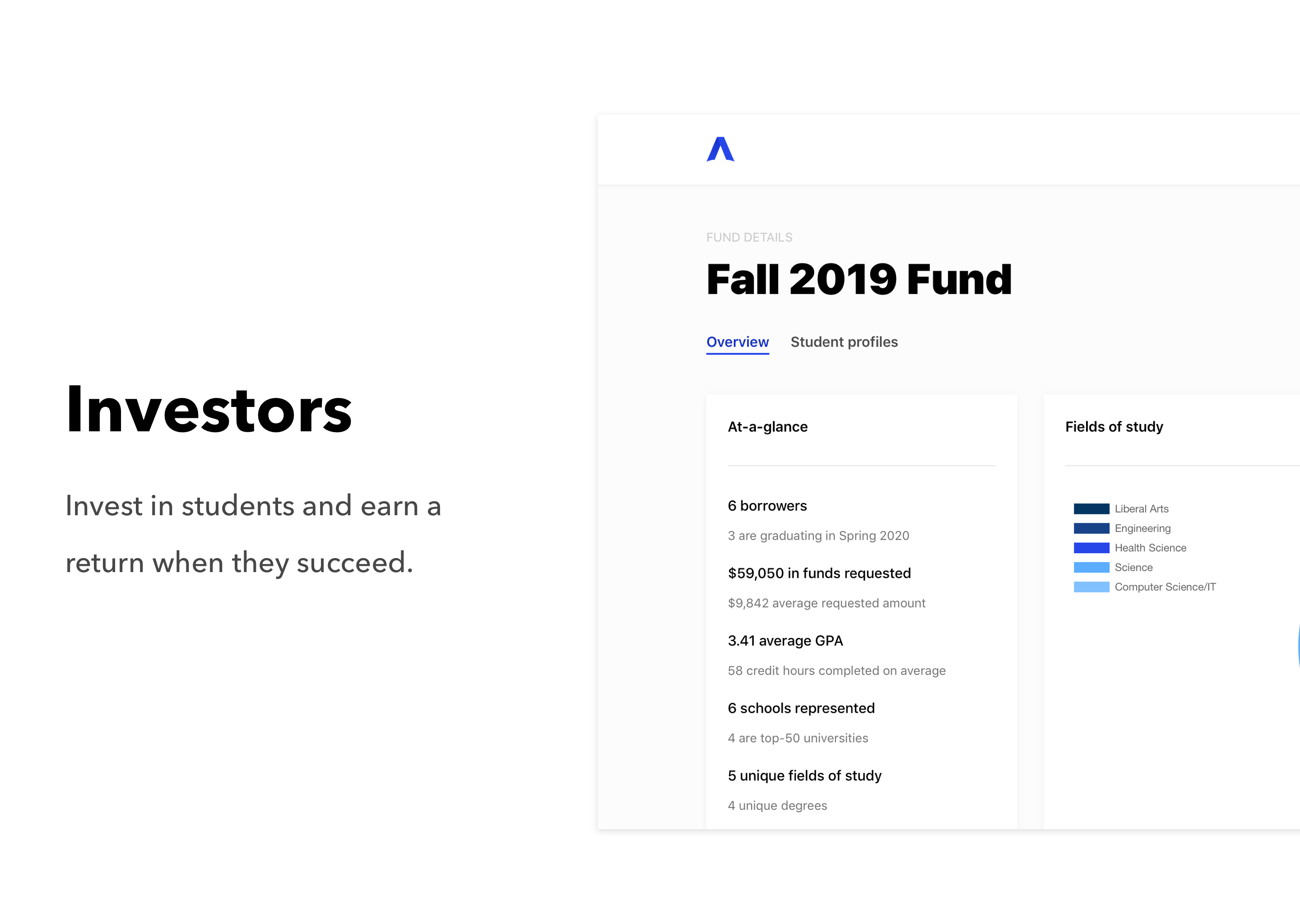

Investors invest in students and earn a return when they succeed

Avenify provides investors with the opportunity to invest in students and earn a return when they succeed. Investors can invest in a pooled fund of students (individual investments coming soon), and start earning dividends when borrowers begin making payments.

Investors can view information on each student including their GPA, major, degree, and graduation date. For the Spring fund, investors will be able to view a more comprehensive student profile, including short-answer questions and career plans.

Traction

On track to reach 10,000 students over the next year

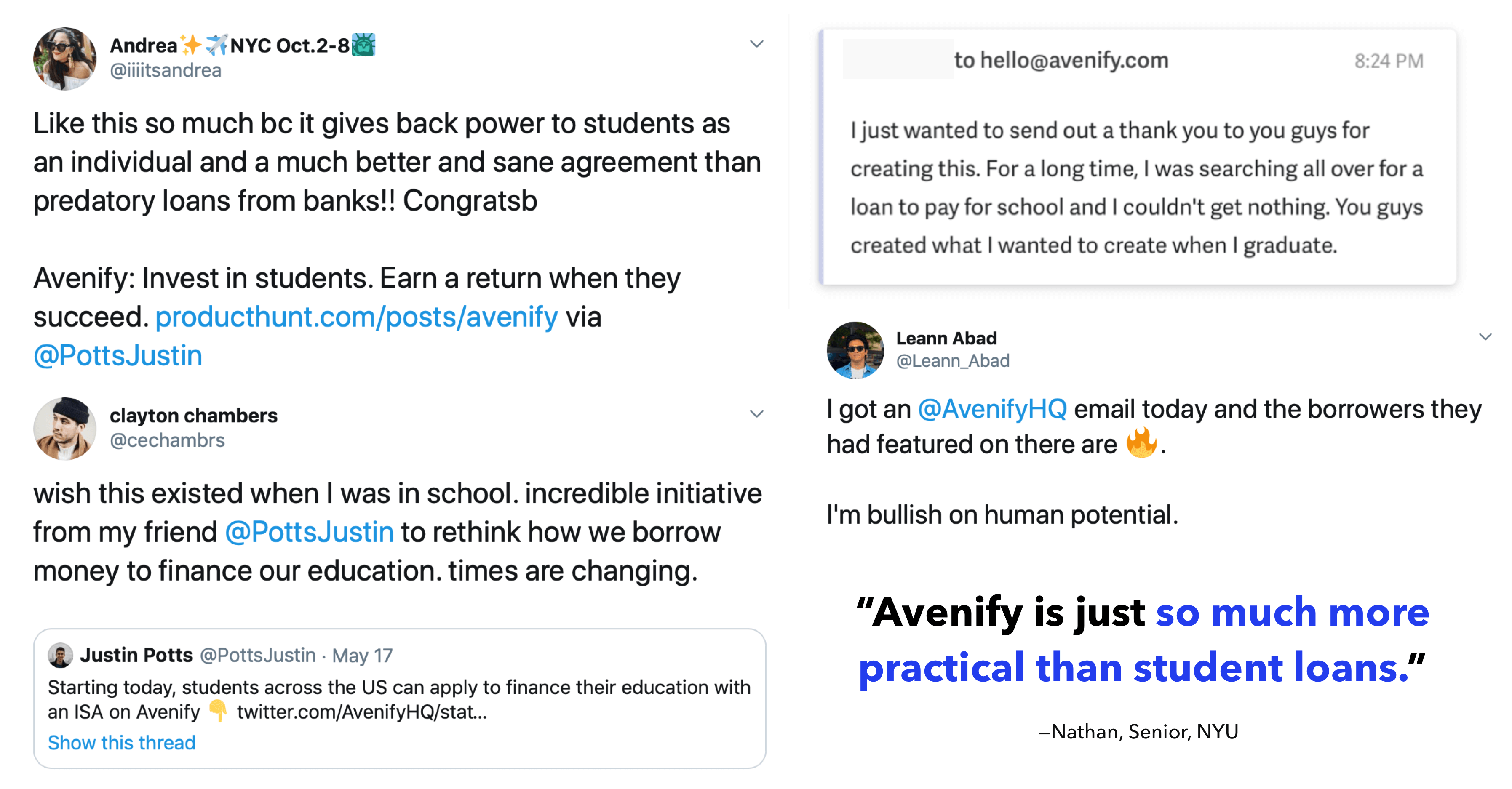

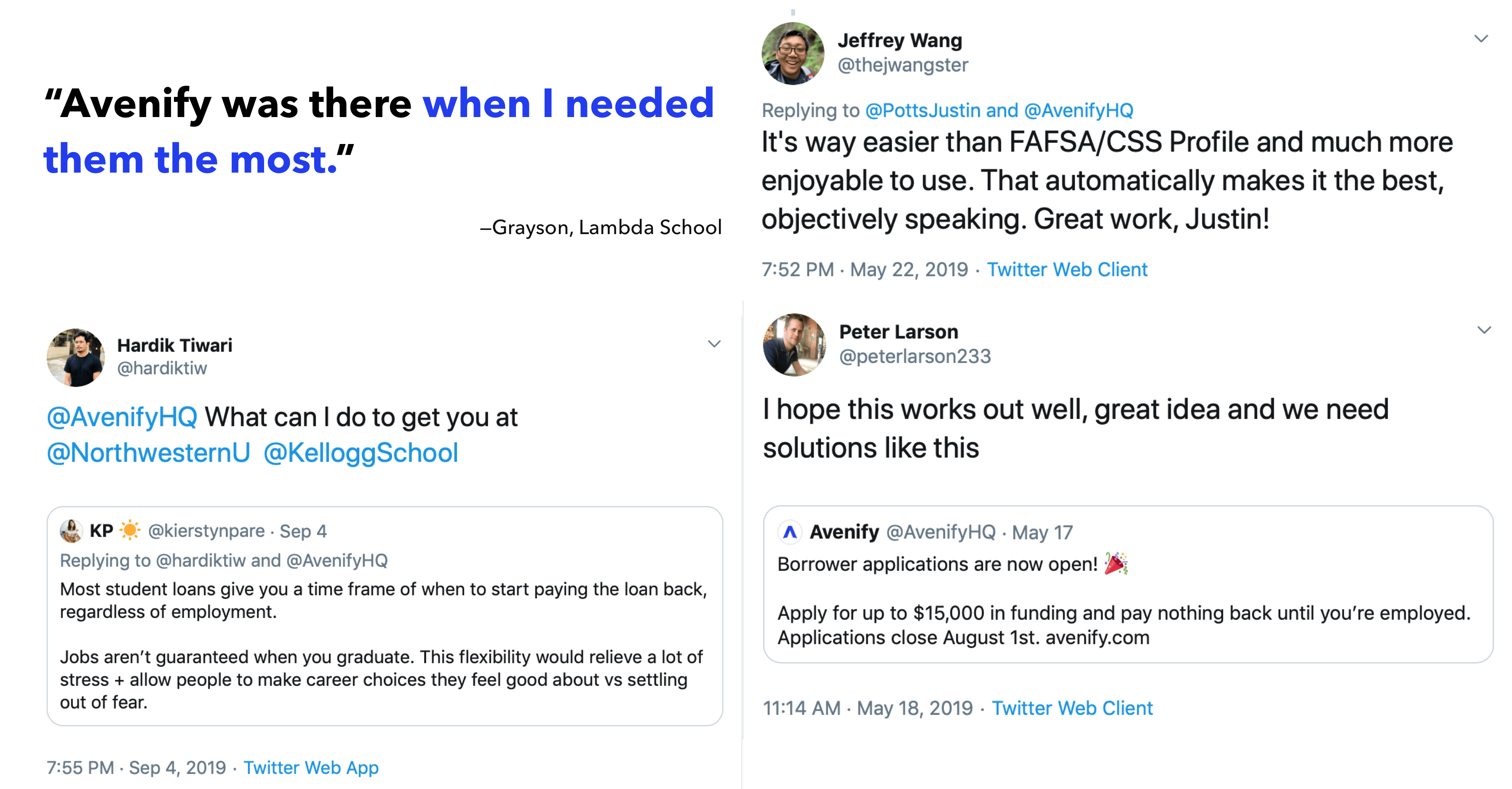

Since launching to students in May 2019, Avenify has grown to over 2,000 student signups and processed over 500 applications for funding, from schools including Cornell University, the University of Pennsylvania, and Lambda School. We’re on track to reach 10,000 students and process 2,500 applications in 2020.

We launched to investors in late July and grew organically to over 100 investors in just three weeks. To support the student demand, we’re focused on growing our investor base to 1,000 investors, and are in active conversations with institutions focused on backing ISA programs.

We plan on issuing at least 250 ISAs each semester, averaging $10,000 each.

Customers

Creating new opportunities for investors and students

Before Avenify, a student looking to finance their education with an ISA would have to be attending a university with an ISA program (Purdue University, University of Utah), or a bootcamp that offers ISAs as an alternative to tuition (Lambda School, Flockjay).

Our model allows students to receive the funding they need to pursue their college degrees, with flexible, student-friendly terms. We also serve investors, who can make an impact with their investment, diversify their portfolio, and earn a return.

Business model

Earning a percentage of investments and repayments

We take 2% of the amount invested upfront, and 1.5% of all student payments. We’re projecting $100,000 in revenue in 2020 from upfront investor fees.

Market

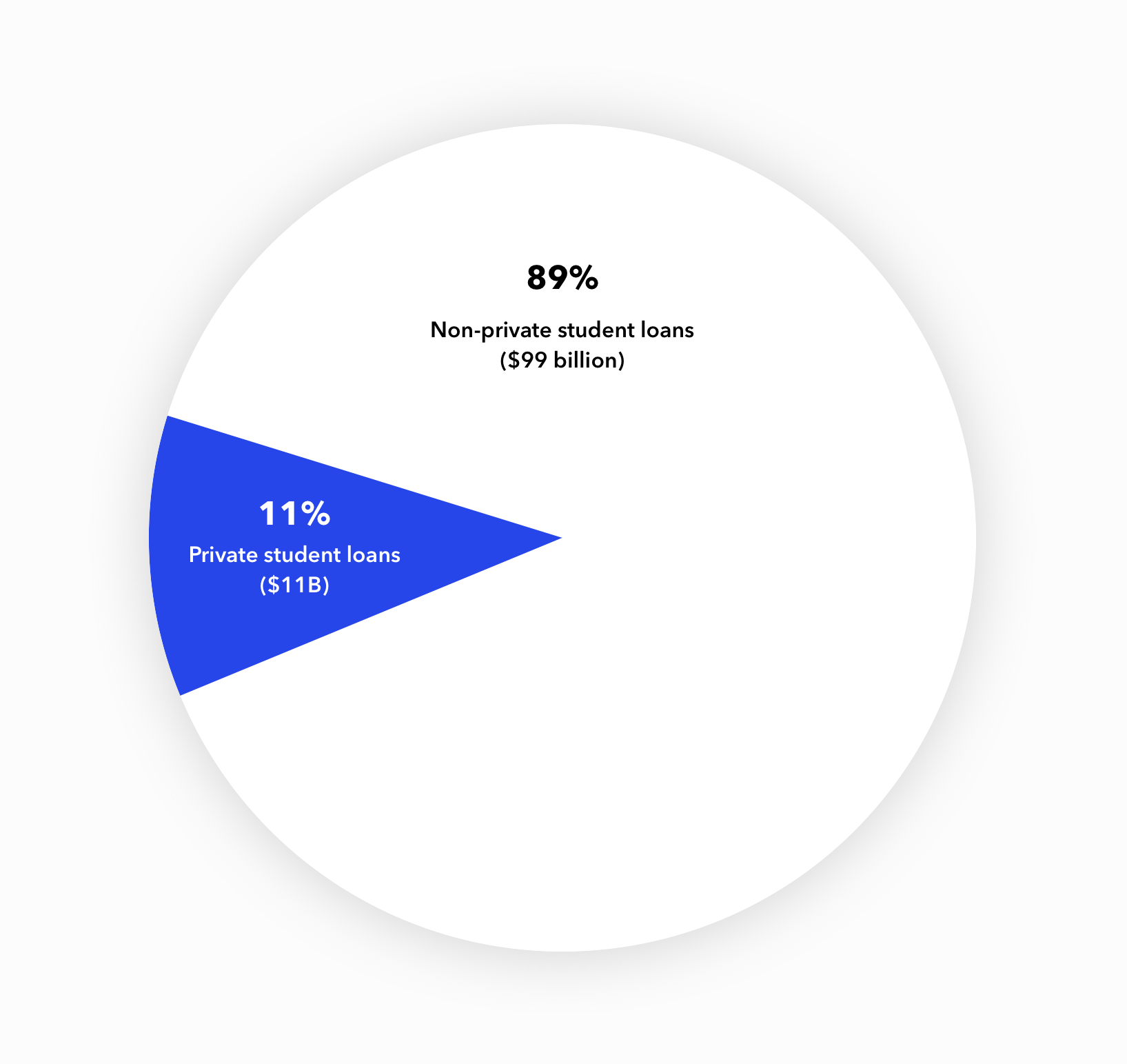

$11 billion market opportunity

The market for student loans is huge and continues to grow. While federal loans account for the majority of this market, private companies make up 7.75% of the outstanding balance, and 11% of all student loans disbursed each year.

The price of college is only increasing, making it harder to pay for school, especially for those who don’t qualify for traditional loans. There’s an immediate need for alternative loan solutions, and we believe that Avenify can be a pioneer in this field.

Competition

Avenify is a true ISA marketplace

While the ISA space is growing, Avenify is one of only a few consumer ISA companies. Avenify is the only full-stack ISA marketplace, providing a way for borrowers to apply and make payments, and investors to view the funds and back students.

As ISAs become more popular, we expect more direct competitors to enter the space. Because the long-term success of ISAs relies on data, we have a strong early-mover advantage in acquiring data on investor and borrower habits, validating our underwriting model, and improving outcomes for our borrowers.

Vision and strategy

Building Avenify to be the leader in the consumer ISA space

Over the next 12 months, we’re issuing 500 ISAs, with $5 million in funding from retail and institutional investors. To do this, we’ll be expanding investment opportunities and hiring a VP of Capital Markets, a data scientist, and a marketing manager.

As we collect more data on the performance of our ISAs, and continue to build relationships with institutional lenders, we’ll be able to transition to direct lending, through a debt facility or warehouse line of credit.

We’re building Avenify to be the leader in the consumer ISA space, and student loans are just the beginning.

Funding

We've made it this far with just under $100K

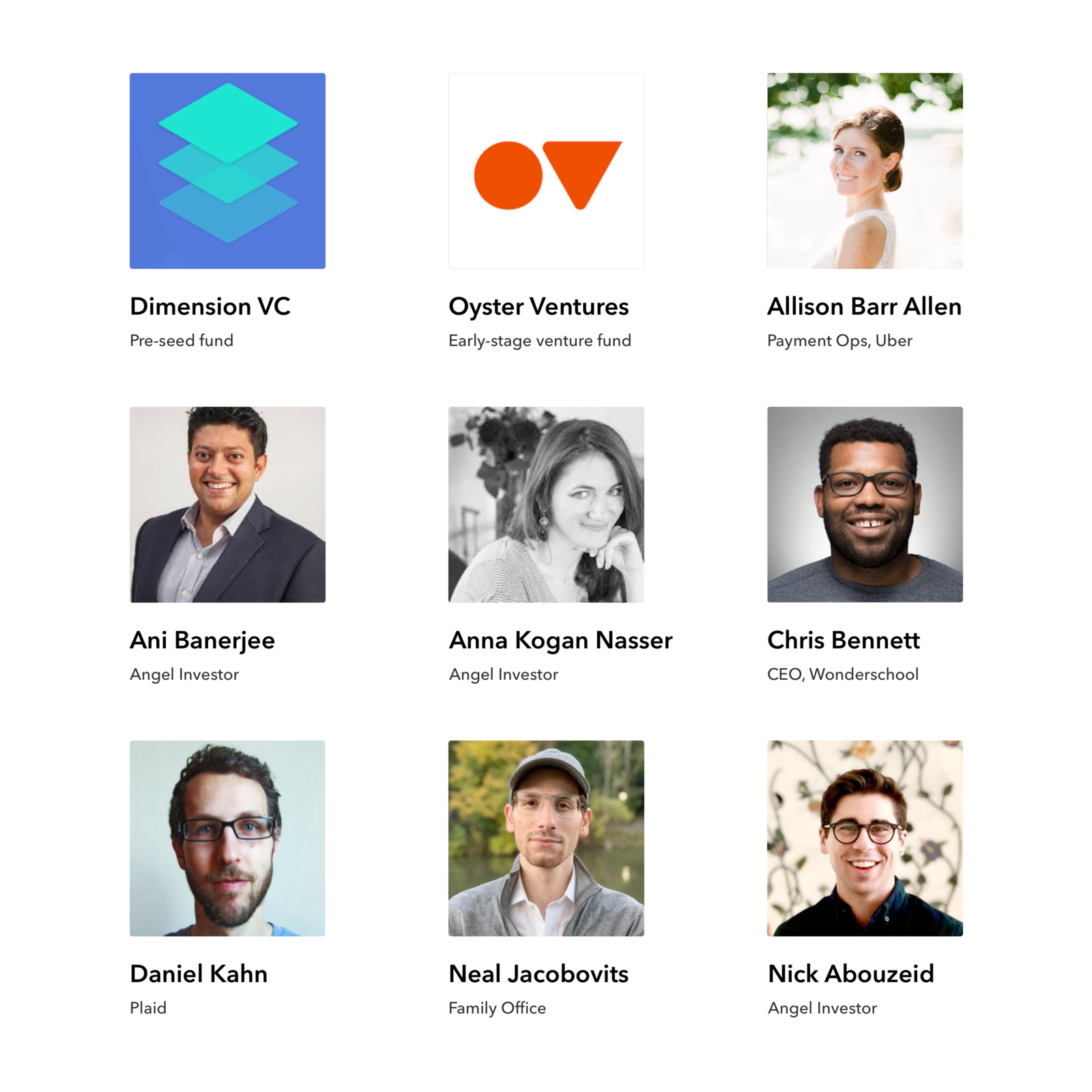

We've raised $98.5K from a combination of angel investors and early-stage funds excited about building the future of financing. Our investors have a wide range of backgrounds and experiences, from scaling payment operations at Uber, to raising institutional funding for consumer lending platforms, to growing and advising startups like Clearbit and Forge.

Founders

We met two years ago, and have been jamming on ideas together ever since

We met two years ago at the University of Oklahoma while interning at a student consultancy working with small businesses and startups. As students, we weren’t happy with our financing options. Some of our friends worked multiple jobs to afford school. Others took out huge sums of loans.

We set out to build something better -- something we would want to use. Avenify is built by students, for students.

Justin Potts, CEO

Justin studied at the University of Oklahoma, where he met his co-founder, Timo. He transferred to a business school in San Francisco after a year and a half, and began interning at Product Hunt. After taking a leave of absence from school, Justin left Product Hunt to join Republic full-time.

Timo Sheridan, CTO

Timo was previously a software engineer and team lead at the Center for the Creation of Economic Wealth, a student consultancy program where students work with Oklahoma-based small businesses and startups to develop go-to-market strategies, build financial models, craft their stories, and develop products. He graduated from the University of Oklahoma with a degree in Economics, and minors in Math and Computer Science.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...