The idea behind CoverUS is to harness as much health data as possible—from self-reported data to automatically generated ...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

CoverUS

Open for investment

Documents

Form C

SEC.gov

Form C

SEC.gov

Deal highlights

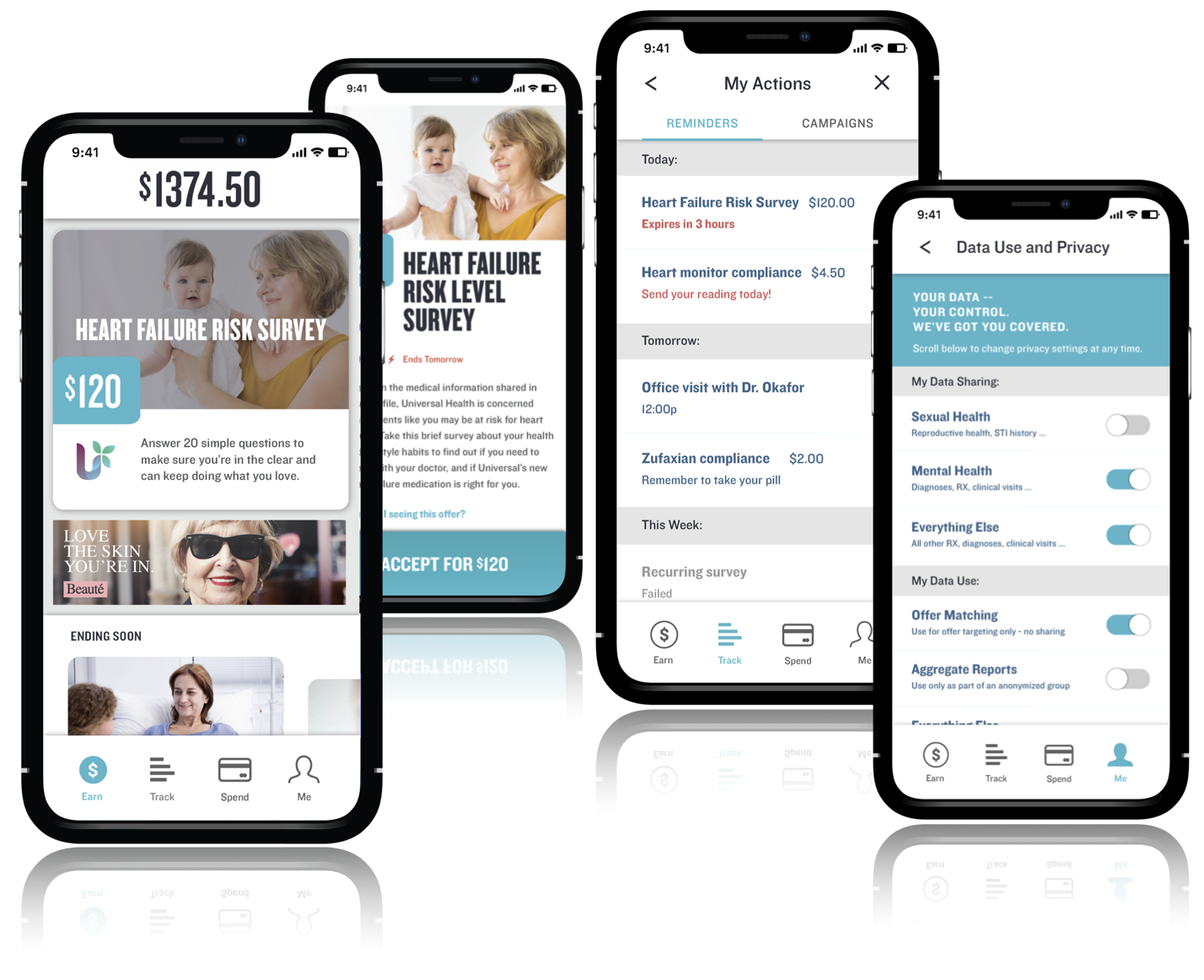

- New mobile app that allows people to protect and profit from their health data

- Launching pilot targeting 1.5 million member patient community in Q2 of 2019

- Total addressable market size of ~$80B by 2020

- Winner of '17 Consensys Blockchain Hackathon and part of Startup Health accelerator

- CEO is an ex-NASA scientist, and a serial tech entrepreneur with multiple exits

- President worked directly with global entrepreneurs including Pete Peterson, Jim Balsillie, Bill Janeway, and others on the Forbes 400 list

- Advisory Board includes former CTO of US Health Department, former Global Board Chair of Planned Parenthood, and former CFO/CIO of Covance

- Raised Pre-Seed round from strategic investors including blockchain VC Centrality

THE PROBLEM

The healthcare market is inefficient

It's expensive

Healthcare is projected to be a nearly $9 trillion dollar global market by 2020. In 2016 alone, the US spent $3.3 trillion (17% of GDP) on healthcare-related expenditures. It is estimated that more than $1 trillion is wasted every year to health system inefficiencies.

There are major financial gaps

37% of Americans can't afford a $100 medical bill, and that's a huge problem. 64% of patients are delaying health treatment until they have the money to pay for it, resulting in poor health outcomes and skyrocketing national health costs. Financial barriers to care are even more crippling in transition economies, which drive 7.5% of the total growth in global health spending.

Your health data is bought and sold daily, without your knowledge or consent

Not only is this an invasion of privacy, it's bad business. Lack of direct patient engagement makes it difficult for the healthcare industry to conduct highly targeted marketing campaigns, to incentivize people to take healthy actions, and to collect real-time, real-world health data from patients at scale. This leads to higher costs for research and development, advertising and medication non-adherence. Health information is more valuable to industry buyers if it's connected to you, and if it can be used to engage you in the conversation.

THE SOLUTION

CoverUS is creating a new health data business – powered by you

Rather than accepting the status quo of third-party data brokers collecting and profiting from your most private information, the CoverUS App will enable you to take control of your health data and earn money.

Note: The CoverUS app and platform described in the video at the top of the page are still under development; the features and business capabilities demonstrated here are not yet functional and may require acceptance by various organizations in the health and financial industries in order to be successful.

CoverUS solves big problems for the healthcare industry

Not comfortable with complete strangers knowing your most intimate medical details? Neither are we.

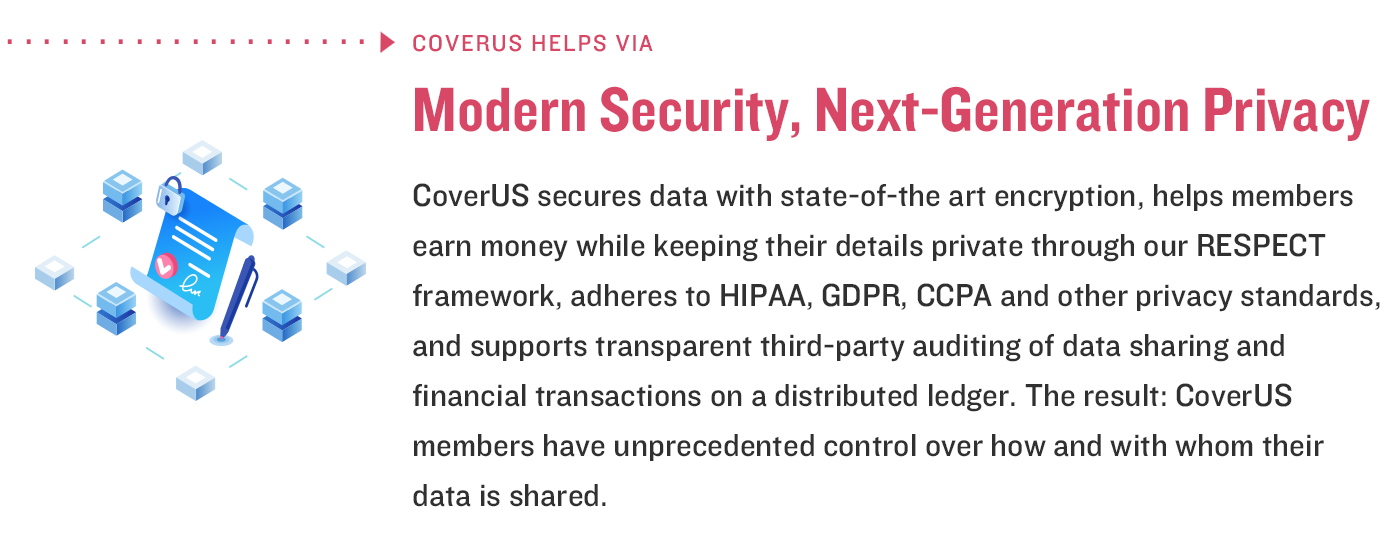

Widespread hacking of personal data – from Yahoo!, to eBay, to Equifax – and the high value of health information has made healthcare the industry most affected by data breaches. With sweeping new European privacy laws providing global challenges, and US states like California following suit, companies handling sensitive data must embrace innovative solutions to increase transparency, security, and privacy.

CoverUS has you covered. Our RESPECT data governance framework allows CoverUS members to decide what data they want to share and with whom they want to share it. They can also adjust sharing permissions over time. This ensures compliance with strict data standards like HIPAA and GDPR.

HOW IT WORKS

CoverUS is putting your health data to work

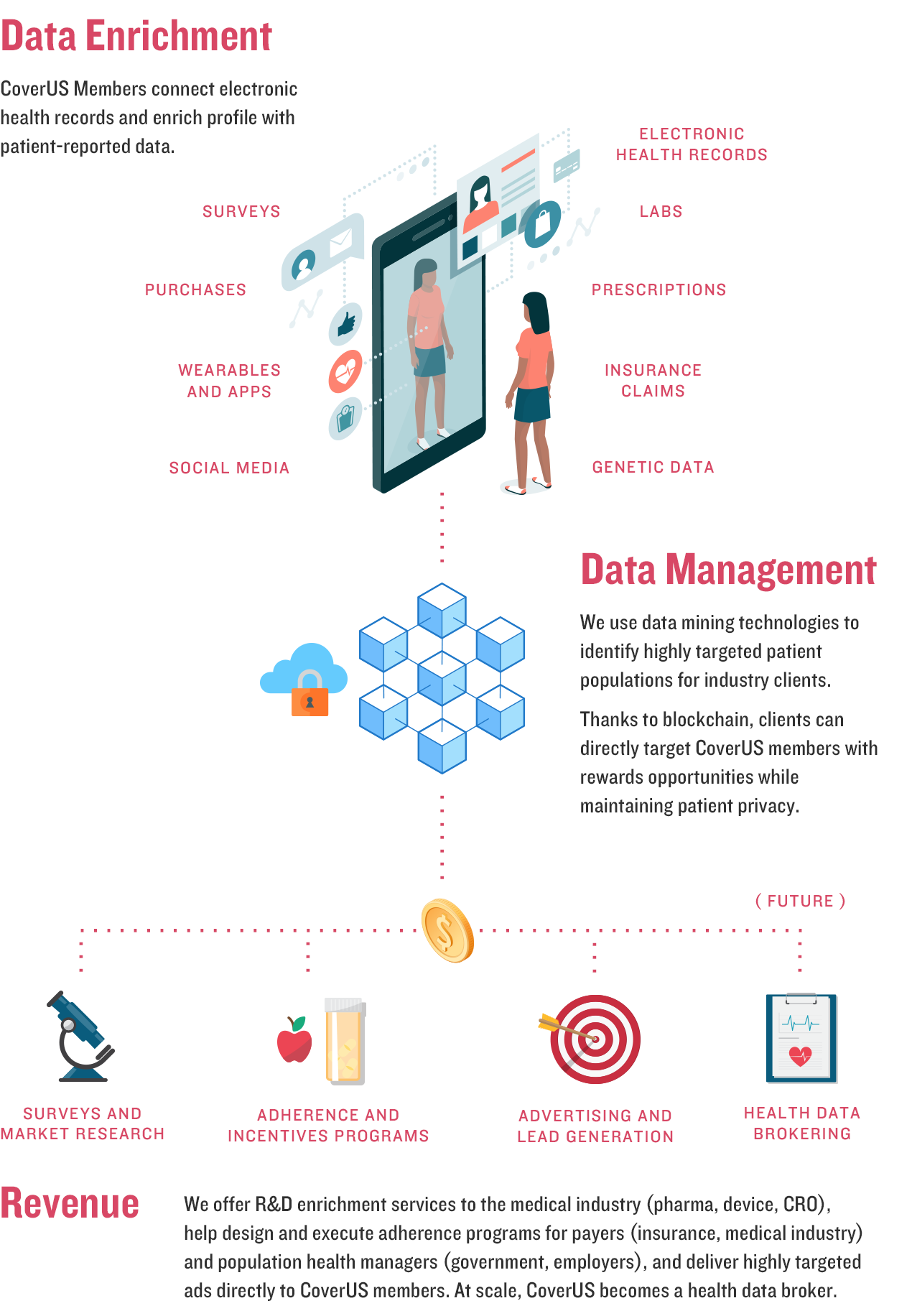

CoverUS is creating a two-sided marketplace between consumers and healthcare companies:

- Companies pay you for sharing health data, responding to targeted ads, and engaging in healthy behaviors.

- Individuals can earn money while protecting their privacy using the CoverUS App.

Business model

CoverUS makes money when members create uniquely rich health data profiles and respond to targeted, revenue-earning offers from the healthcare industry. Our transaction fee model means we only profit when our members do.

Our plan is to become the world's leading health data broker with direct patient consent – selling custom data and insights to the healthcare industry and creating a regular stream of income for all CoverUS members who opt in.

First pilot on the way

Launching with access to a 1.5 million patient population and driving adoption by strategic partners

CoverUS achieves scale by working with distribution partners in healthcare and beyond. We are developing our first GTM partnership with an online patient community of 1.5 million people suffering from one of the more costly chronic diseases. Additional partnerships are being negotiated with leading medical, advertising, and health IT companies. We will leverage our experience in working with governments and large issue-based organizations with the goal of bringing the CoverUS app to everyone, everywhere.

Tapping into a ~$80B market

CoverUS will target global markets including Electronic Health Records (EHRs / EMRs), Mobile Health, and Telehealth. These sectors are projected to grow at an average compound annual growth rate (CAGR) of 19.15%.

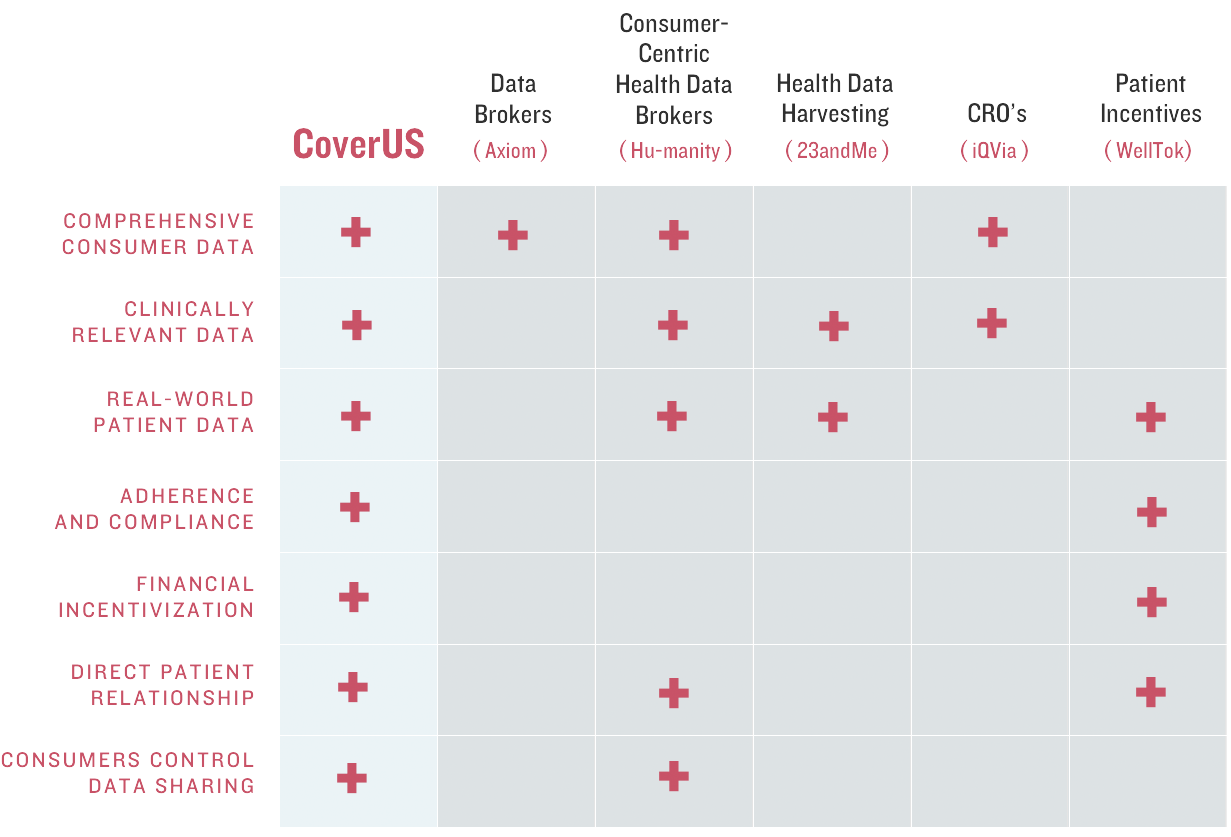

Competitive landscape

If recent growth in the personal data market is any indication, multiple major players will emerge in the health data space. Our team has been empowering and engaging consumers at scale for decades, and CoverUS is well positioned to not only compete with, but to also collaborate with several of the companies listed below.

What we've done and where we're going

Your investment will power CoverUS into its next phase

Having completed phase I product ideation and design, the CoverUS App is in the development stage. We will use the funds from our Crowdfunding round as follows*:

- App development and maintenance: Expand the CoverUS app's feature set beyond the pilot phase to commercial use.

- Regulation, compliance, and privacy: Work with our strong team of lawyers and data privacy experts to refine the CoverUS RESPECT framework for data sovereignty, and incorporate it into the first public version of our app.

- Business development and sales: Expand our sales team, adding distribution partners and revenue-generating industry clients.

- Marketing and operations: Targeted marketing to increase product awareness, drive individual sign ups, and build relationships via our thought leadership in data security and privacy.

*Note that funds raised up to our minimum funding goal will be devoted primarily to Marketing and Operations (including for the crowdfunding campaign itself), while the other categories will receive proportionally a greater allocation of the proceeds if we raise more than the minimum goal.

An investor-friendly opportunity

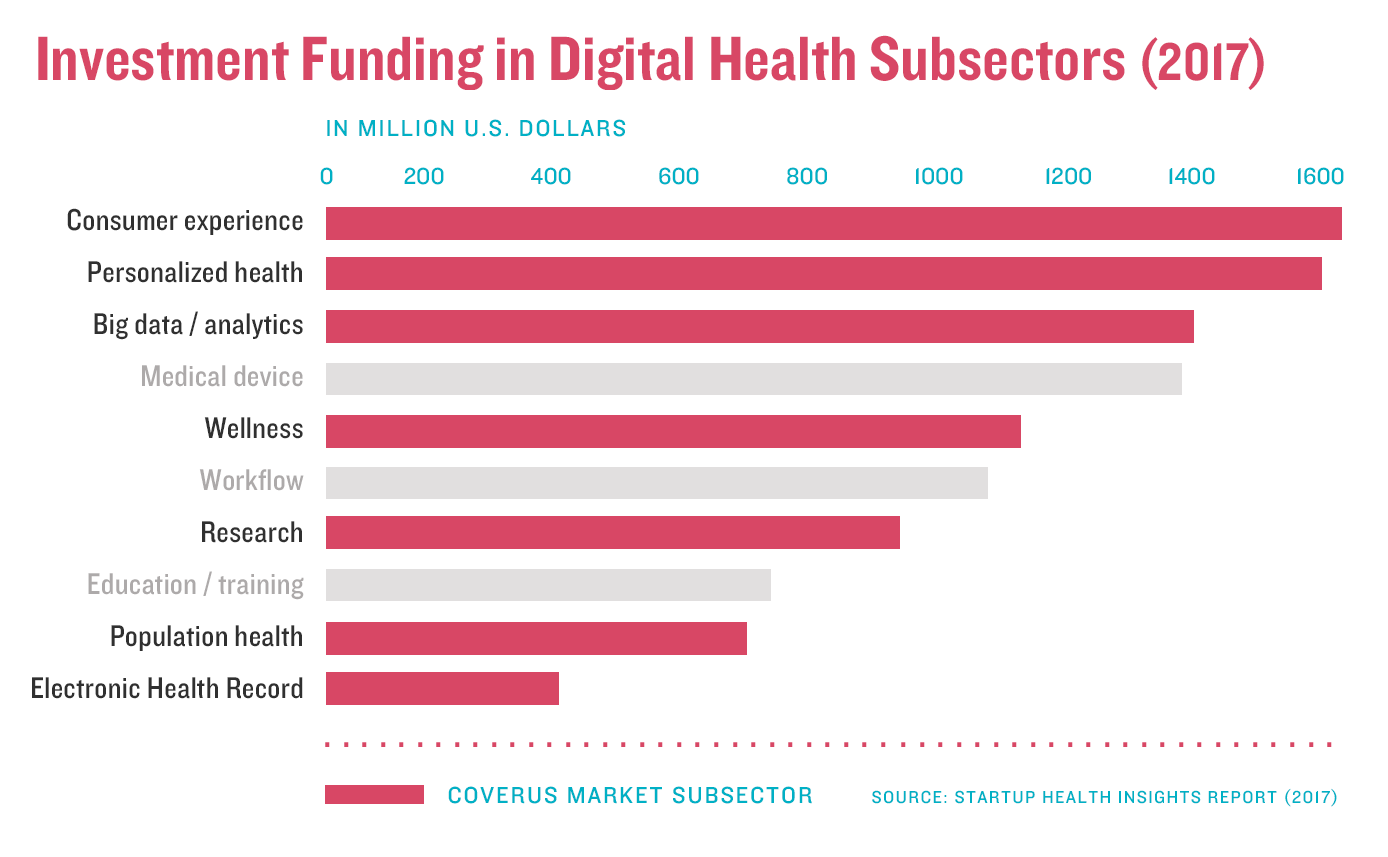

Digital health is known to be one of the hottest markets for venture capital. Our unique value proposition places us directly in 7 of the 10 most active sub-sectors for investments in the digital health industry:

We couldn't (and wouldn't) do this without you

The CoverUS team has experience in creating, growing, and exiting successful startups.

We launched this equity crowdfunding campaign because we believe that you should have the opportunity to own not just your data – but also a piece of the company that is putting the power of data in your hands.

Join CoverUS – this is what the future looks like.

Deal terms

$8,000,000

The maximum valuation at which your investment converts

into equity shares or cash.

Learn more

10%

If a trigger event for CoverUS occurs, the discount provision

gives investors equity shares (or equal value in cash) at a reduced price.

Learn more.

$1.07M

CoverUS must achieve its minimum goal of $25K before the deadline. The maximum amount the offering can raise is $1.07M.

Learn more

Learn more

Crowd SAFE

A SAFE allows an investor to make a cash investment in a company, with rights to receive certain company stock at a later date, in connection with a specific event.

·

Learn more

Documents

Form C

SEC.gov

Form C

SEC.gov

Bonus perks

- Access to CoverUS Online Investor Portal

- All of the above + Limited edition CoverUS Investor T-Shirt

- All of the above + CoverUS Fitbit

- All of the above + Invite to attend interactive semi-annual investor calls + CoverUS Apple Watch (in place of Fitbit)

- All of the above + Tickets to all CoverUS events & associate conferences + Visit to CoverUS HQ @New Lab in Brooklyn + Lunch with Co-Founders

About CoverUS

CoverUS Team

Everyone helping build CoverUS, not limited to employees

Press

This site (the "Site") is owned and maintained by OpenDeal Inc., which is not a registered broker-dealer. OpenDeal Inc. does not give investment advice, endorsement, analysis or recommendations with respect to any securities. All securities listed here are being offered by, and all information included on this Site is the responsibility of, the applicable issuer of such securities. The intermediary facilitating the offering will be identified in such offering’s documentation.

All funding-portal activities are conducted by OpenDeal Portal LLC doing business as Republic, a funding portal which is registered with the US Securities and Exchange Commission (SEC) as a funding portal (Portal) and is a member of the Financial Industry Regulatory Authority (FINRA). OpenDeal Portal LLC is located at 149 E 23rd St #1314, New York, NY 10010, please check out background on FINRA’s Funding Portal page.

All broker-dealer related securities activity is conducted by OpenDeal Broker LLC, an affiliate of OpenDeal Inc. and OpenDeal Portal LLC, and a registered broker-dealer, and member of FINRA | SiPC, located at 1345 Avenue of the Americas, 15th Floor, New York, NY 10105, please check our background on FINRA’s BrokerCheck.

Certain pages discussing the mechanics and providing educational materials regarding regulation crowdfunding offerings may refer to OpenDeal Broker LLC and OpenDeal Portal LLC collectively as “Republic”, solely for explanatory purposes.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC make investment recommendations and no communication, through this Site or in any other medium should be construed as a recommendation for any security offered on or off this investment platform. Investment opportunities posted on this Site are private placements of securities that are not publicly traded, involve a high degree of risk, may lose value, are subject to holding period requirements and are intended for investors who do not need a liquid investment. Past performance is not indicative of future results. Investors must be able to afford the loss of their entire investment. Only qualified investors, which may be restricted to only Accredited Investors or non-U.S. persons, may invest in offerings hosted by OpenDeal Broker.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC, nor any of their officers, directors, agents and employees makes any warranty, express or implied, of any kind whatsoever related to the adequacy, accuracy or completeness of any information on this Site or the use of information on this site. Offers to sell securities can only be made through official offering documents that contain important information about the investment and the issuers, including risks. Investors should carefully read the offering documents. Investors should conduct their own due diligence and are encouraged to consult with their tax, legal and financial advisors.

By accessing the Site and any pages thereof, you agree to be bound by the Terms of Use and Privacy Policy. Please also see OpenDeal Broker’s Business Continuity Plan and Additional Risk Disclosures. All issuers offering securities under regulation crowdfunding as hosted by OpenDeal Portal LLC are listed on the All Companies Page. The inclusion or exclusion of an issuer on the Platform Page and/or Republic’s Homepage, which includes offerings conducted under regulation crowdfunding as well as other exemptions from registration, is not based upon any endorsement or recommendation by OpenDeal Inc, OpenDeal Portal LLC, or OpenDeal Broker LLC, nor any of their affiliates, officers, directors, agents, and employees. Rather, issuers of securities may, in their sole discretion, opt-out of being listed on the Platform Page and Homepage.

Investors should verify any issuer information they consider important before making an investment.

Investments in private companies are particularly risky and may result in total loss of invested capital. Past performance of a security or a company does not guarantee future results or returns. Only investors who understand the risks of early stage investment and who meet the Republic's investment criteria may invest.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC verify information provided by companies on this Site and makes no assurance as to the completeness or accuracy of any such information. Additional information about companies fundraising on the Site can be found by searching the EDGAR database, or the offering documentation located on the Site when the offering does not require an EDGAR filing.

To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. Therefore, when you use the Services we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver's license, passport or other identifying documents.

Republic and its affiliates are not and do not operate or act as a bank. Certain banking services are provided by BankProv, member FDIC / member DIF. Digital (crypto) assets and investment products are not insured by the FDIC, may lose value, and are not deposits or other obligations of BankProv and are not guaranteed by BankProv. Terms and conditions apply.

Made in SF/NYC