"For instance on the 31st October Gold shot up to 1950 USD per ounce but then it dropped on the news of the Cure for Covi...

Problem

There is a decline in the trust in paper money and traditional banking

Trust in fiat (government-issued) paper currency is declining. Inflation slowly erodes the value of government-issued fiat currencies. Banks put your money at risk and the US Dollar has devalued over 85% in the last 50 years. Bank interest rates are minimal and, in some cases, negative. Meanwhile, the price of gold has risen from $35 per ounce in 1971 to around $1800 per ounce today**. Gold, one of the most proven and trusted stores of value has increased by over 500%.

* While Glint strongly believes that gold is the fairest and most reliable currency on the planet, it should be pointed out that it isn’t 100% risk free. Whilst we have seen a steady increase in its value over time, the price of gold can fall, as well as increase, which means the purchasing power of the customer can also fall.

** at 21st April 2021

It is widely accepted that Governments around the world are piling up debt and engaging in “quantitative easing” (AKA “printing money”). Total global debt has now reached $281 trillion, which is 356% of total global GDP. Some economists believe this will lead to additional inflation in the future.

A recent poll of 1,000 U.S. adults asked “How much trust do you have in the Federal Reserve to look out for the best interests of you and your family?” 39% of U.S. adults answered that they trust the Fed “a great deal” or “a fair amount”. 60% of respondents answered “not very much” or “none at all.”

Solution

Save and spend in physical gold

Gold has been a trusted store of value, as well as a premium means of exchange for thousands of years. Even when paper money became widely used in the 19th and 20th centuries, many government-issued currencies, like the US Dollar, were backed by gold or silver, that could be redeemed for bullion at an official exchange rate. Since the early 1970s, paper money has not been backed by anything, meaning that it is “fiat” currency and can be printed at the whim of those in charge.

Gold is a rare element, created when two neutron stars collide, it is immutable and, unlike most metals, does not degrade over time.

Gold has a history of retaining value and acting as a hedge against inflation. Since the beginning of 2000, the price of gold has risen from $290 per ounce to around $1,800 per oz today***.

Gold is traditionally a “store of value” asset. It has no yield, but its price has proven to rise over time. Unfortunately for the investor, buying and selling gold has historically been a static process, once bought, it sits in a vault, slowly increasing in value over time, but until now it has never been a very good medium of exchange. Gold is heavy and cumbersome, easy to steal, when not in a vault; it’s also difficult to spend, until Glint came along it would never have been a consideration to use it to spend on everyday goods or services, to spend online or in-store at the checkout.

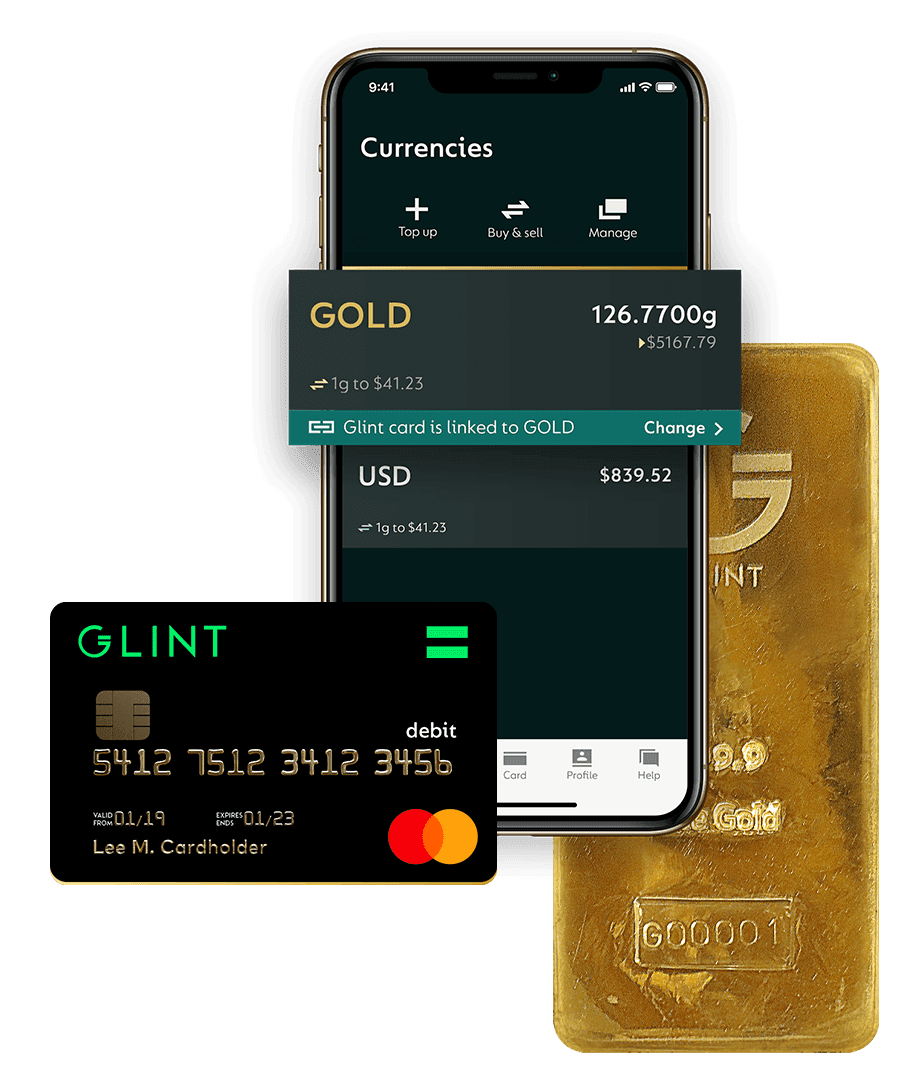

Glint allows its clients to store money in the form of real gold, and easily spend it using their Glint Mastercard® or through the Glint App, available for iOS from the App Store, as well as for Android at Google Play.

Gold is automatically sold and turned into local currency, which is then used to pay for the transaction. Glint has built a gold liquidity engine that makes it fast and affordable to buy and sell small or large amounts of gold. When a Glint client spends a portion of their physical gold on a purchase, the correct amount of gold, sitting in their named and allocated account in the Swiss vault, is automatically sold to settle the transaction.

Product

The future of money

Glint has developed proprietary technology that makes buying, selling, and transferring gold and currency simple, fast, and affordable. The platform is built on a scalable microservices architecture (small independent services that communicate over well-defined APIs) hosted on the Amazon cloud.

The functionality is similar to Paypal, Square Cash, or Venmo. The difference is that Glint allows users to store their money as grams of gold instead of fiat money. Customers can easily spend their saved gold by using the Glint Mastercard or through the payment app. Glint charges a 0.5% fee on gold transactions.

Glint makes it easy for people to hold savings in gold, dollars, and other currencies. Clients’ dollars are held by Sutton Bank in Attica, Ohio, while their gold is held in a Brinks vault in Switzerland, in personally-allocated accounts. Gold holdings are insured by Lloyds of London.

Traction

Thousands of clients and growing

Glint’s scalable platform is live and available in 200 countries around the world and Glint Mastercards can be issued in 37 different countries. The Glint App is available for both iOS and Android and Glint accounts can be topped up by either Bank Transfer or connected debit card, for both platforms.

Highlights as of 31st March 2021:

- $36,753,977 in gold stored through Glint (this is a dollar conversion using GGM/USD 31st March)

- 76,197 registered users

- 15,928 active clients

- User base is now growing at a rate of 40% per quarter

- 2020 revenue: $300,000

Glint has partnerships with Mastercard, Brinks, Lloyds Bank, and Sutton Bank.

Customers

Fans of hard money

Glint is targeting the growing number of consumers who are looking at alternative ways to store and access their money, outside of the traditional banking system. This may include those who are currently risking much more volatile markets in cryptocurrencies or the Stock Market.

Business model

A gold-based financial system

Glint is a digital payments and savings platform. Glint is one of a very few companies that equip customers to execute retail electronic transactions denominated in gold, at the checkout. Glint turns an age-trusted store of value into a contemporary medium of exchange by giving instant liquidity to real, solid gold. Enabling its clients to save in a medium that is proven to increase in value over time, whilst having the added benefit of allowing instant, simple spending at the same time. There are very few currencies that can rival that liquidity.

The company currently generates revenue in the following ways:

0.5% fees on gold transactions

0.2% to 1% merchant interchange fee, i.e. a share of debit card transaction fees

0.5% foreign exchange fees

Annual gold storage fee of 0.125% to 0.2%

Currently, Glint has gold payments enabled for USD, EUR and GBP, but plans to soon include JPY, SEK, CAD, SFR and, eventually, 17 other currencies. Gold and national currencies can be spent in 150 countries worldwide at the real exchange rate and a small 0.5% fee.

In the future, Glint plans to develop:

Corporate Products

Tiered Subscriptions

Premium Card and account products (e.g. Solid Gold card)

Gold Savings Products e.g. Pension Wrappers, School Fees

3rd Party corporate and client payments

Market

A unique offering: gold as money

Digital payment platforms have become a large and important part of the global economy. In the U.S., the market leaders include Paypal, Venmo, and Square Cash. Glint offers a differentiated product in this market by building its financial ecosystem around gold.

Today, the size of the digital-enabled gold market is small, and mostly exists in the form of ETFs and other long-term investment instruments. Glint’s goal is to transform gold into a widely used, liquid form of currency around the world.

Vision and strategy

Glint’s vision is to become a global, gold-based alternative to banking, payments, and inflation-prone fiat money. Its mission is to allow anyone, anywhere to buy gold and then save, send, exchange, and spend it like cash, with much lower fees than credit cards, and the peace of mind that comes with having the world’s most stable currency at their fingertips.

Glint aims to bring reliable and independent gold-as-currency to everyone in the world.

Funding

Backed by notable firms

Glint has raised $27 million to date including notable global investors.

Sprott : A global asset manager with $16B under management and 200,000 clients. Focused on precious metals

TOCOM: The Tokyo Commodity Exchange, a large Japanese commodity futures and gold exchange

NEC Capital Solutions: Japanese multinational information technology and electronics company, headquartered in Tokyo

Glint is raising $6-$8 million in this round of funding at a pre-money valuation of $35.9 million.

Use of Proceeds:

Growth marketing

Product innovation

New key hires.

Working capital/other OpEx

Founders

Jason Cozen | Founder & Chief Executive Officer

Jason has 20 years of experience within the eCommerce technology and digital marketing sector. Founder of digital agencies Visuality and Bite and online gold bullion dealer GoldMadeSimple.

Disclaimers

Risks of early stage investment. Not an offer to buy or sell securities. This is a long-term speculative illiquid investment. Investment is not FDIC insured.

This site (the "Site") is owned and maintained by OpenDeal Inc., which is not a registered broker-dealer. OpenDeal Inc. does not give investment advice, endorsement, analysis or recommendations with respect to any securities. All securities listed here are being offered by, and all information included on this Site is the responsibility of, the applicable issuer of such securities. The intermediary facilitating the offering will be identified in such offering’s documentation.

All funding-portal activities are conducted by OpenDeal Portal LLC doing business as Republic, a funding portal which is registered with the US Securities and Exchange Commission (SEC) as a funding portal (Portal) and is a member of the Financial Industry Regulatory Authority (FINRA). OpenDeal Portal LLC is located at 335 Madison Avenue, 16th Floor, New York, NY 10017, please check out background on FINRA’s Funding Portal page.

All broker-dealer related securities activity is conducted by OpenDeal Broker LLC, an affiliate of OpenDeal Inc. and OpenDeal Portal LLC, and a registered broker-dealer, and member of FINRA | SiPC, located at 1345 Avenue of the Americas, 15th Floor, New York, NY 10105, please check our background on FINRA’s BrokerCheck. Investments in private companies are particularly risky and may result in total loss of invested capital. Past performance of a security or a company does not guarantee future results or returns. Only investors who understand the risks of early stage investment and who meet the Republic's investment criteria may invest. Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC verify information provided by companies on this Site and makes no assurance as to the completeness or accuracy of any such information. Additional information about companies fundraising on the Site can be found by searching the EDGAR database, or the offering documentation located on the Site when the offering does not require an EDGAR filing.

Certain pages discussing the mechanics and providing educational materials regarding regulation crowdfunding offerings may refer to OpenDeal Broker LLC and OpenDeal Portal LLC collectively as “Republic”, solely for explanatory purposes.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC make investment recommendations and no communication, through this Site or in any other medium should be construed as a recommendation for any security offered on or off this investment platform. Investment opportunities posted on this Site are private placements of securities that are not publicly traded, involve a high degree of risk, may lose value, are subject to holding period requirements and are intended for investors who do not need a liquid investment. Past performance is not indicative of future results. Investors must be able to afford the loss of their entire investment. Only qualified investors, which may be restricted to only Accredited Investors or non-U.S. persons, may invest in offerings hosted by OpenDeal Broker.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC, nor any of their officers, directors, agents and employees makes any warranty, express or implied, of any kind whatsoever related to the adequacy, accuracy or completeness of any information on this Site or the use of information on this site. Offers to sell securities can only be made through official offering documents that contain important information about the investment and the issuers, including risks. Investors should carefully read the offering documents. Investors should conduct their own due diligence and are encouraged to consult with their tax, legal and financial advisors.

By accessing the Site and any pages thereof, you agree to be bound by the OpenDeal Portal’s Terms of Use and Privacy Policy and/or OpenDeal Broker’s Terms of Use and Privacy Policy. Please also see OpenDeal Broker’s Business Continuity Plan and Additional Risk Disclosures.

Investors should verify any issuer information they consider important before making an investment.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...