Custom boat builder Rob Innes has revealed his newest semi-submersible boat, the Jet Shark Model Q.

Opportunity

Invest in a revolutionary new marine experience

Jet Shark brings the three dimensional capabilities of an aircraft to the boating world, allowing people to enjoy the ocean the way aquatic creatures do. Jet Shark is not a submarine that slowly "sinks" beneath the water. Instead, it "flies" underwater, remaining positively buoyant at all times.

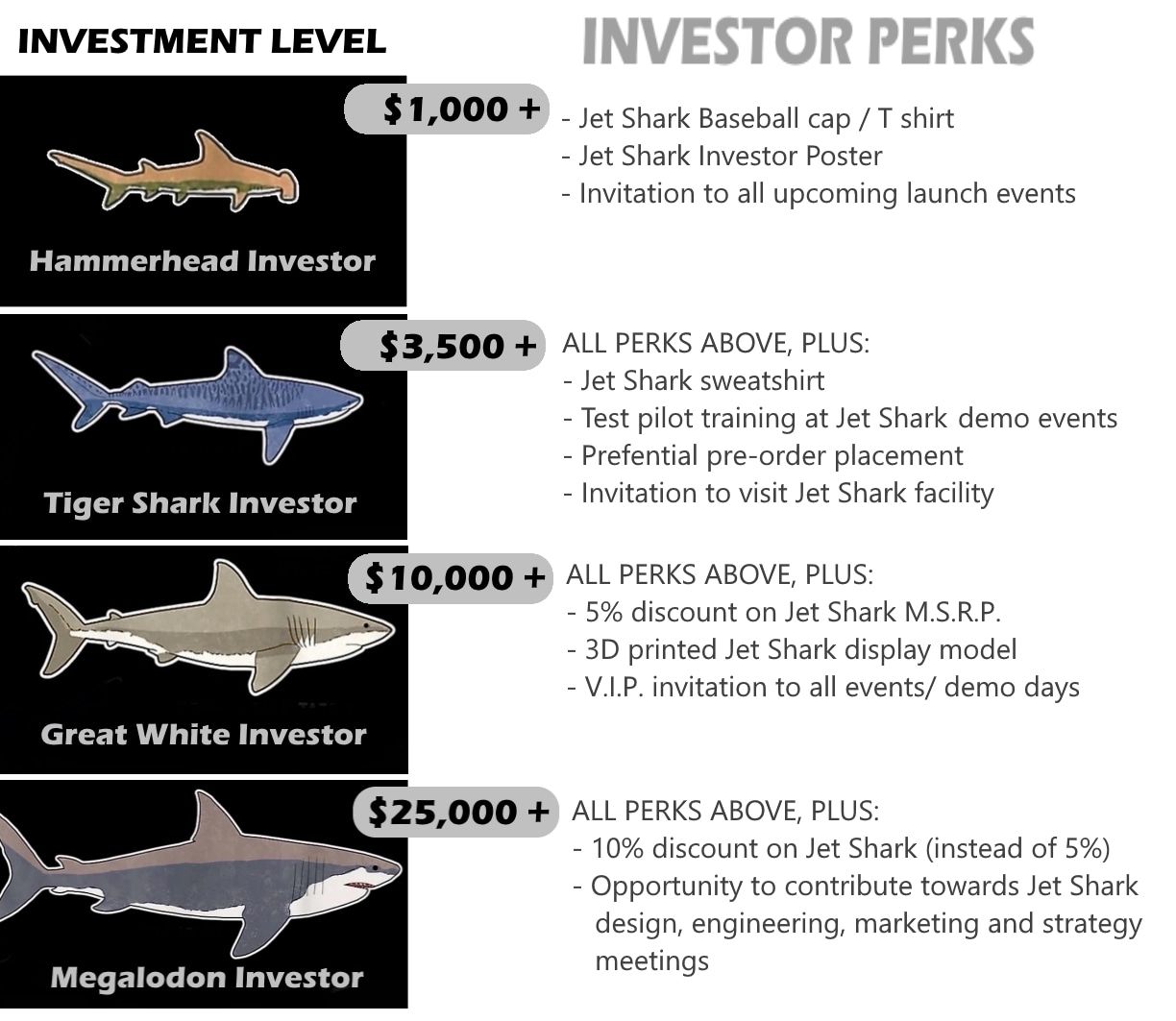

Now, we are offering investors the opportunity to support Jet Shark Inc; an all new, startup company with a huge growth potential! Your investment will help to bring this exciting new vessel to the mass market, and allow you to share in the prosperity along the way. So, what type of Investor Shark are you?

Problem

Limitations of previous vessels

Although the Seabreacher (predecessor to the Jet Shark) have achieved huge commercial success, they do have several limitations:

- The Seabreacher cockpit is relatively small for the two occupants and does not have on-board air conditioning.

- Extensive pilot training is required to operate, and with only single front seat controls.

- Build time can be lengthy due to the high level of customization of every unique vessel.

Solution

Jet Shark is the solution the market has been asking for

Comfort, practicality, and simplicity of operation

- Comfortable seating for 4 full-sized adults, with 5 and 6 seat versions coming soon.

- Simple, intuitive flight controls available in both front seats.

- Spacious, air-conditioned, dry cockpit.

- Built like a conventional high-production boat, with easy operation and maintenance.

- Worldwide dealer network offering bank financing and insurance to customers and operators.

Product

The Jet Shark builds on the success of the amazing Seabreacher!

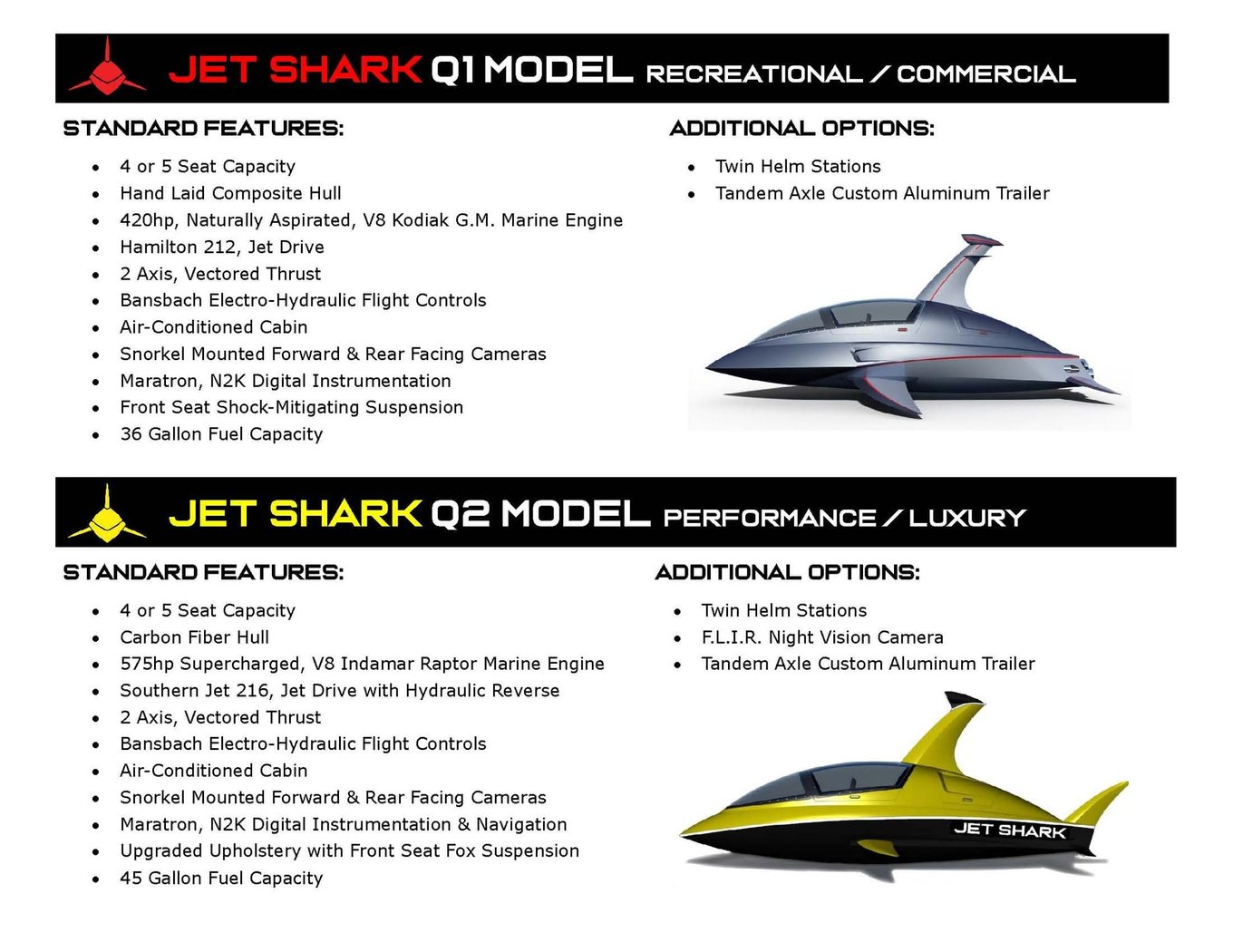

JET SHARK Models, Specifications, and Options

Traction

These vessels have gained global media attention

- Founders previous company has grossed over $20M in lifetime sales!

- 175+ Custom Vessels previously built and delivered to over 35 different countries, via extensive dealership network

- 10+ commercial passenger-ride ventures operating worldwide, with over 200,000 rides given to date

- Over 500 million viral video views of Seabreacher and Jetovator (Founders previous marine products)

- Featured in major motion pictures, TV shows, and commercials

Featured in:

Business model

Engineered for recreational and commercial use

The all new Jet Shark is specifically designed tor both the recreational and commercial tourist market. It is larger, has a greater capacity, is comfortable, reliable and more profitable for dealers and commercial operators!

Recreational market:

- $11 million worth of pre-orders for recreational Jet Sharks (signed L.O.I.s from pre-qualified customers and dealers).

- 10,000+ Mega Yachts capable of holding a Jet Shark onboard.

- An exciting and competitively priced alternative in the 20 foot Sport Boat Market.

Commercial market:

- $4 million worth of pre-orders for commercial Jet Sharks (with signed L.O.I.s from pre-qualified operators).

- All existing Seabreacher commercial operations have committed to adding Jet Sharks. Over 150,000 Seabreacher commercial passenger rides given to date.

- 20,000+ tourist locations suitable for setting up Jet Shark ride operations.

We are THE dominating force in the high-performance, submersible watercraft market. Our previous vessels have had an impeccable safety record and are US Coast Guard and European CE compliant; just like any regular boat. No special license or registration is required to own or operate these unique boats!

Designing, testing, and refining numerous vessels over the last 25 years has given us the exclusive knowledge, technology, and expertise in this highly specialized market.

Jet Shark Inc. is anticipating huge growth in 2024 and this is the perfect time for savvy investors to jump in on this new expanding market!

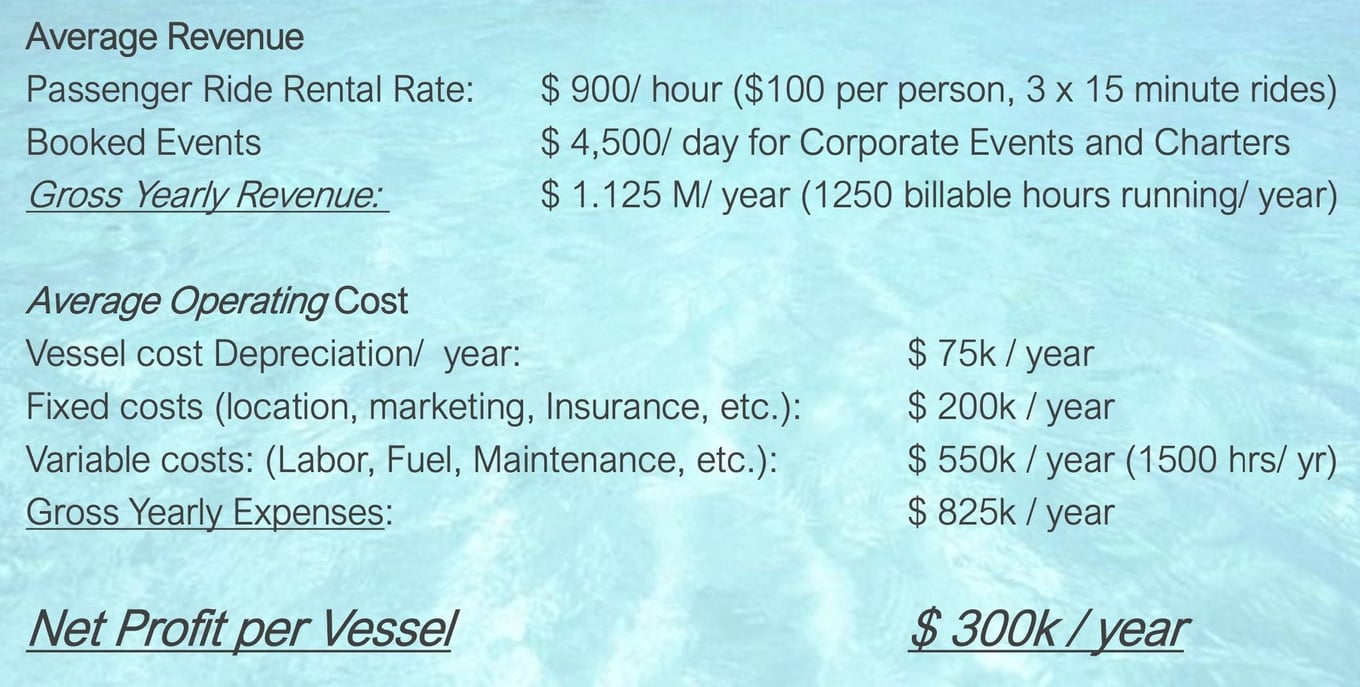

Projected yearly profits of commercial tourist operations

Leadership

A long history of innovation in the marine industry

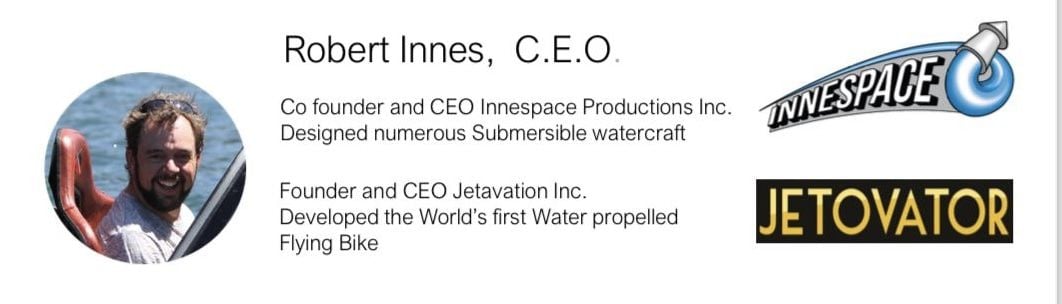

Jet Shark Inc. Founder and CEO, Rob Innes has had a successful career bringing unique boats and water sports toys to market. In 2008, he was the co-founder of Innespace Productions Inc.; the builder of the hugely popular SEABREACHER submersible watercraft. He also founded Jetavation Inc. in 2015, designing and building the JETOVATOR; the world’s first water-propelled, flying bike.

Rob has designed and built several vessels for the Film and TV industry and worked with movie director James Cameron on developing bespoke diving / flying watercraft for the AVATAR movies. He has also worked on several military projects for USSOCOM and the Navy Seals, including designing and building a submersible Jet ski prototype.

Sub-contractor build team

The crew at Innespace Productions Inc. have been custom building submersible watercraft for over fifteen years. They will be a key asset in the production and delivery of the first Jet Shark vessels.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...