Please note: The valuation cap of $80,000,000 does not apply to the Crowd SAFE until after the first anniversary and will not apply if the Crowd SAFE is converted or terminated before that date.

A message from The Kangaroo Team

We're excited to have Kangaroo users and customers as investors in our company — alongside our team and major VC firms like Lerer Hippeau and Greycroft. With your investment, you'll be offered a free 1-year subscription to Kangaroo and a full security system. After investing, you'll be asked to register for the subscription plan on our website.

Kangaroo reserves the right to cancel the investment commitment for anyone who does not register for their free 1-year subscription plan before issuing the Crowd SAFEs offered. The campaign is open exclusively to U.S. investors

Problem

Home security headaches

Despite surging consumer interest in home security, the solutions available — installed and DIY — remain too complex, and cost-prohibitive. As a result, the vast majority of U.S. homes remain unsecured, even as nearly 66% of American adults report high category awareness and safety considerations.

Solution

A cloud-based smart home infrastructure

Kangaroo is redefining the security industry with a complete ecosystem of simple, affordable, hubless and privacy-focused products that seamlessly bring the physical and digital worlds together.

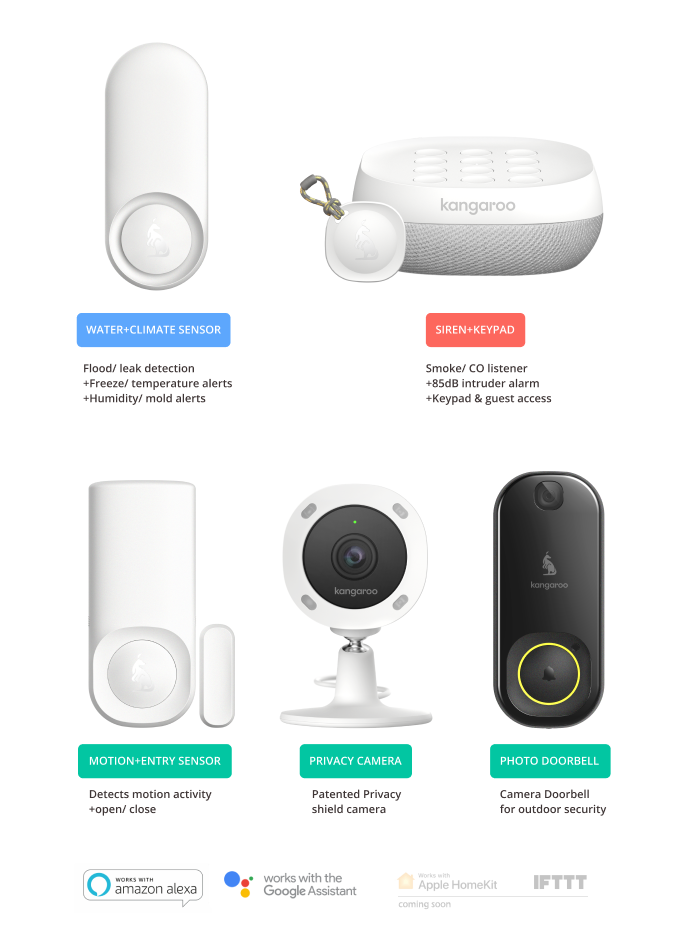

Product

Products with inherent demand

Our hub-less, app-based DIY security solutions are designed to be the most affordable, complete, and easy-to-use. We also offer 24/7 professionally-monitored service for just $10/month. We've addressed all the major pain points in the market so that our products have inherent demand. Total security made simple.

Introducing our newest products:

The Privacy Camera

In 2018, 54M security cameras were sold and this number is expected to increase to reach 120M/yr by 2023. However, many consumers are cost-sensitive and concerns about maintaining privacy remain prevalent. Our new Privacy Camera solves those issues. It is active when armed and private when disarmed.

Photo Doorbell

Ring just spent big money educating the world on why doorbells are awesome. Too bad more than 80% of people can't afford it. An estimated 24M doorbells will be sold in 2020 and cost is a primary concern. Available for as little as $20, our product ditches the unnecessary excess and focuses on the essentials.

How it works:

Traction

20K+ users since launch

From our initial testing phases to now, we've had over 20,000 users and we have over 1,500 Daily Active Users.

Our products are currently available at major retailers like Office Depot, QVC, and Micro Center. We are also currently in conversations with Walmart and Home Depot. In addition, we have a partnership with insurance provider Hippo and have 27 more insurance partnerships in the pipeline.

Customers

"The best starter kit for a new homeowner"

Our customers appreciate the ease of Kangaroo. Our smart home security systems give them peace of mind without breaking the bank.

Hear what they have to say:

Business model

Recurring revenue subscriptions

At Kangaroo, we like to say that we're in the DTS (direct-to-subscriber) business. We're building a recurring revenue subscription business using low-cost hardware as an acquisition tool. Our hybrid business model combines low-cost profitable hardware business and high margin subscription business.

Market

A market on the verge of explosion

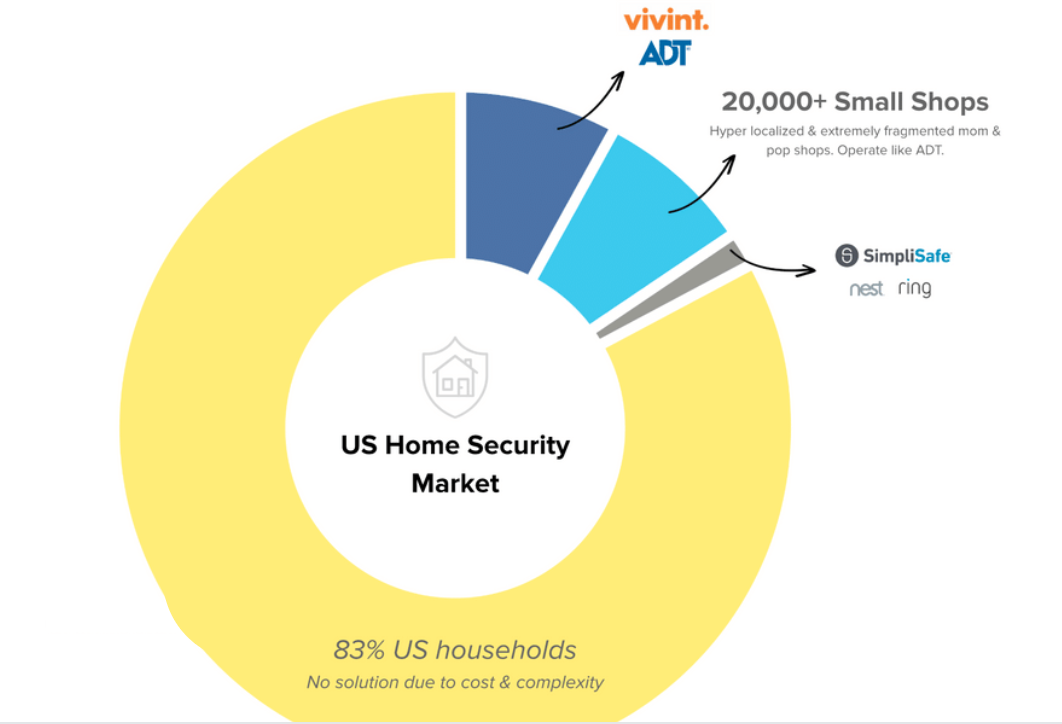

We are cracking into a $3B unaddressed market. 1.6B homes are unprotected globally. Over 480M of these homes have smartphones and WiFi but don't have a compatible home security system. In the United States, this figure is a whopping 49M homes. That's where we come in. With our innovative, cloud-based solution to home security, we will be able to drastically improve access to smart home security. With our new suite of products, we will be ready to take on this expanding market opportunity.

Competition

Existing solutions only address 17% of U.S. households

Competing home security systems are expensive ($500+ on average), use old technology, require professional installation and have a poor user interface. Kangaroo is affordable and its mobile first design makes security seamless.

Key Differentiators:

- Simple: We make sophisticated products easy to use and love.

- Affordable: We provide the best value in home security products and services, which includes professional monitoring for just $99/year.

- Secure: We protect users' homes, and safeguard their data with products like Privacy Camera, which adds an extra layer of personal security.

We've engineered our organization to enable Kangaroo to put security within reach for everyone.

Vision and strategy

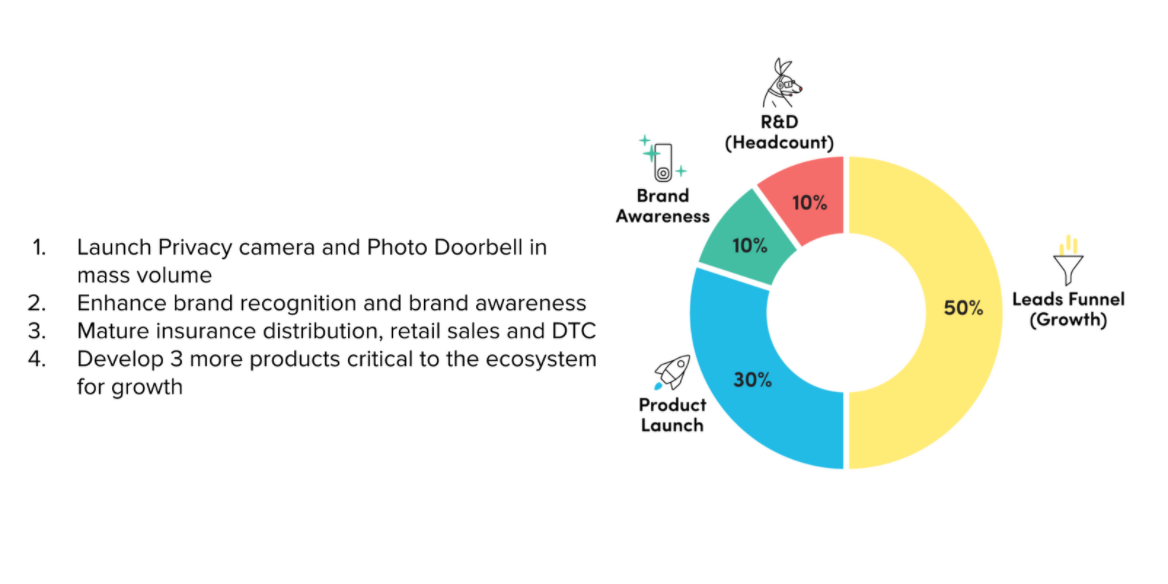

A year of growth

Over our first two years, we built the infrastructure and team to enable our strong and widely-accessible market position, but we are constantly pushing ourselves forward. We have now built our complete introductory product suite and core ops/marketing/sales infrastructure. We've tested go to market via various programs and now understand where the market is and what channels best work for us. Now, we are planning to raise capital to go to market and grow tremendously in the next 12 months.

Our Goals

Funding

$18M raised to date

Greycroft and Lerer Hippeau are our current lead investment partners.

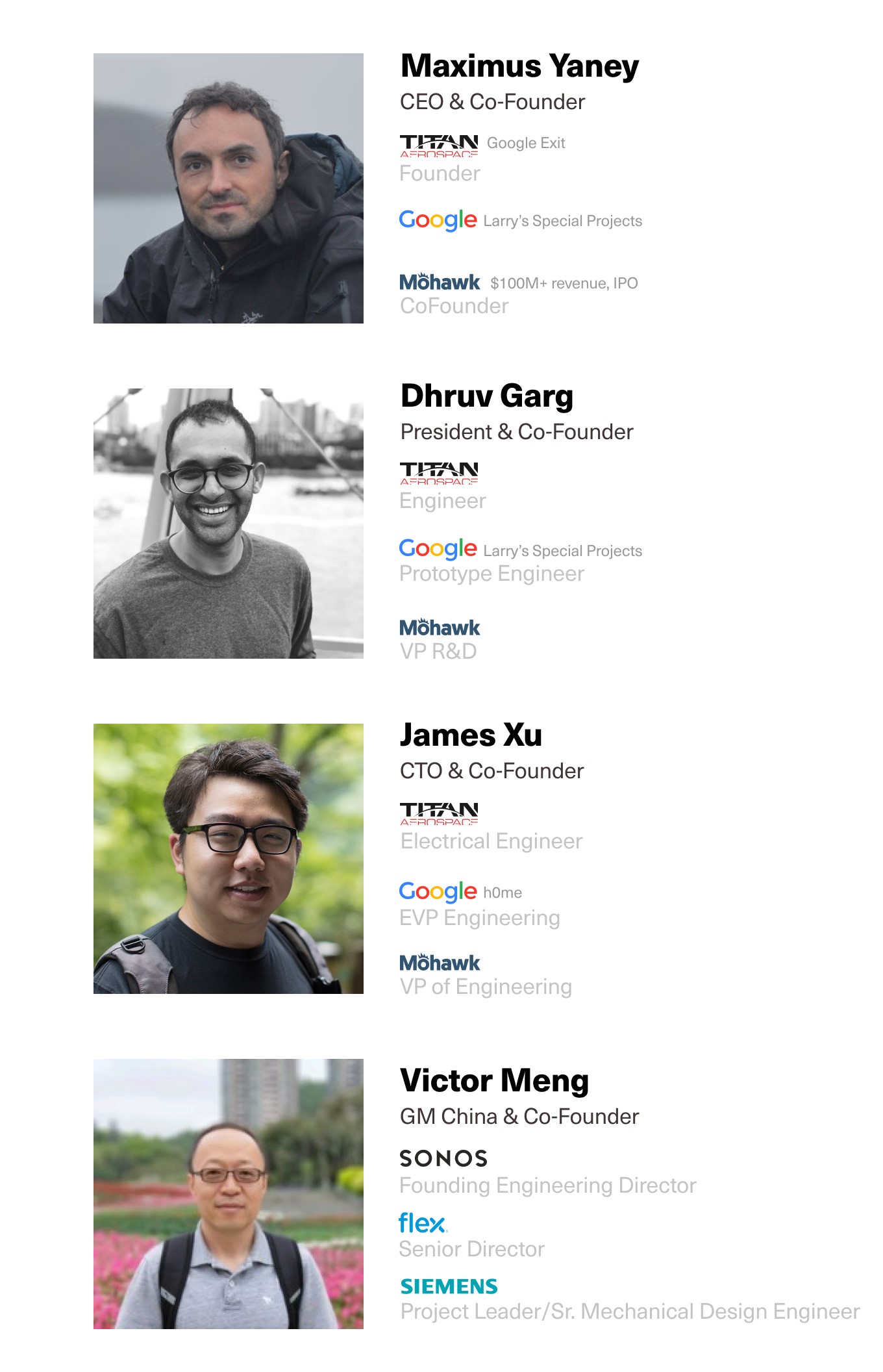

Founders

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...