Problem

The crypto-age investor is rejecting financial advisors

as fast as they rejected taxis.

Solution

We use our data platform to build a network of educated investors;

then, we give them the tools to

manage their financial outcomes.

MyWallSt is a multi-award-winning business that is accelerating the transfer of power from brokers, analysts, and advisors to the consumer by simplifying the source of Wall Street's power — financial data.

Our purpose is to inspire people to own their financial future. Our services empower a new generation of investors to manage their outcomes. MyWallSt is changing financial outcomes for the underserved investor, regardless of race, gender or status.

We're ready to fuel this rocket with an optimised and proven business, and we'd love to have you on board.

Product

We provide a clear path for anyone to go from beginner to knowledgeable investor...

...with a suite of digital products that are scalable, defensible, and built for recurring revenue.

Our platform provides exciting and engaging education and analysis content, stock market advice and money management services for the everyday investor who is underserved by existing wealth management offerings.

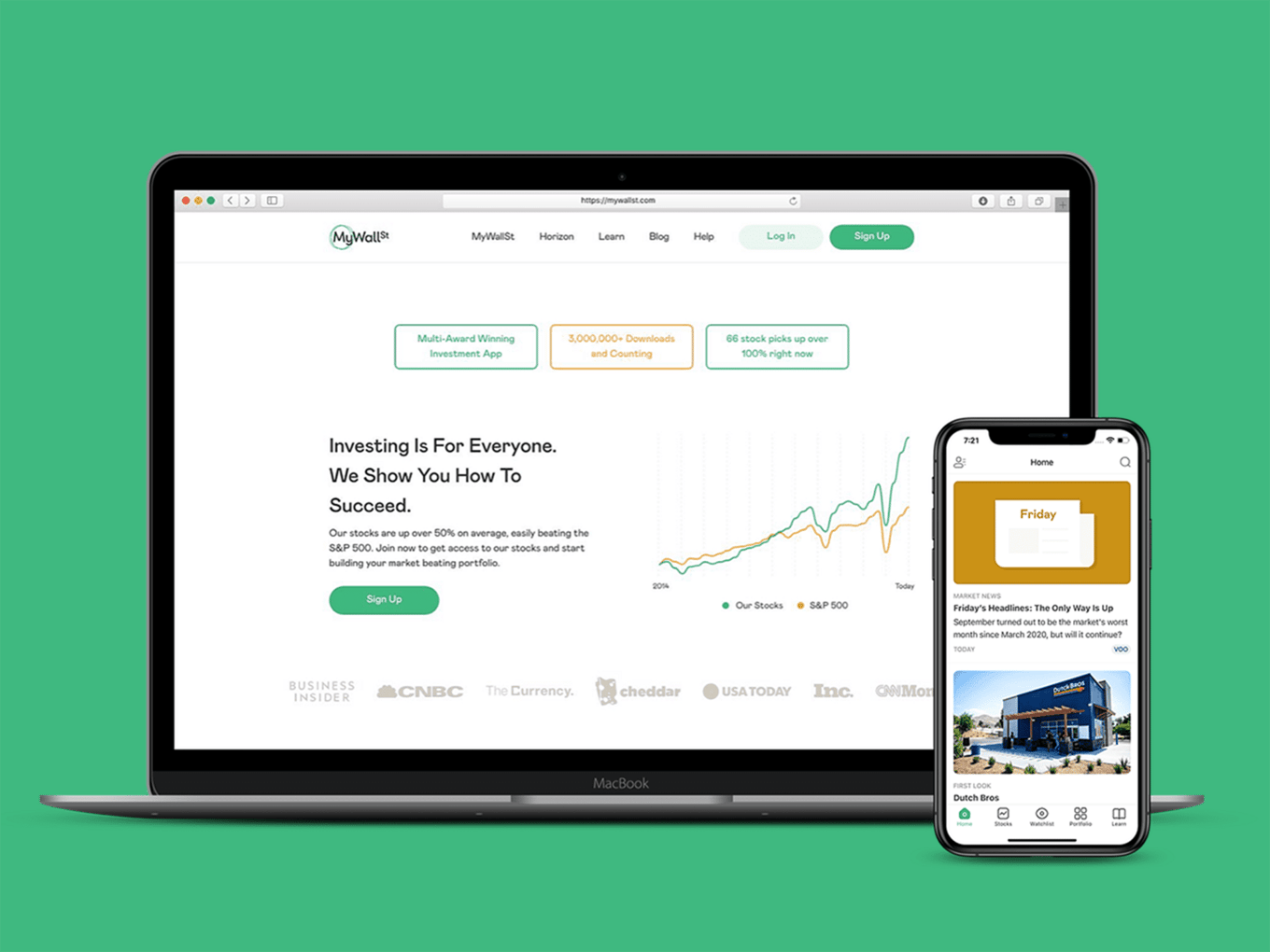

MyWallSt

The MyWallSt mobile investing companion helps DIY investors learn and explore well-researched stocks. Our analytics team delivers concise, jargon-free breakdowns on our preferred stocks available in the US markets, as well as Stock of the Month, a monthly deep-dive into one stock from our list that we are most excited about.

MyWallSt Horizon

MyWallSt Horizon is a premium service that invites clients to invest alongside co-founder and Chief Investor Emmet Savage. It includes on-camera stock analysis, access to Emmet's Watchlist, and an invitation to join the Horizon Community of engaged investors.

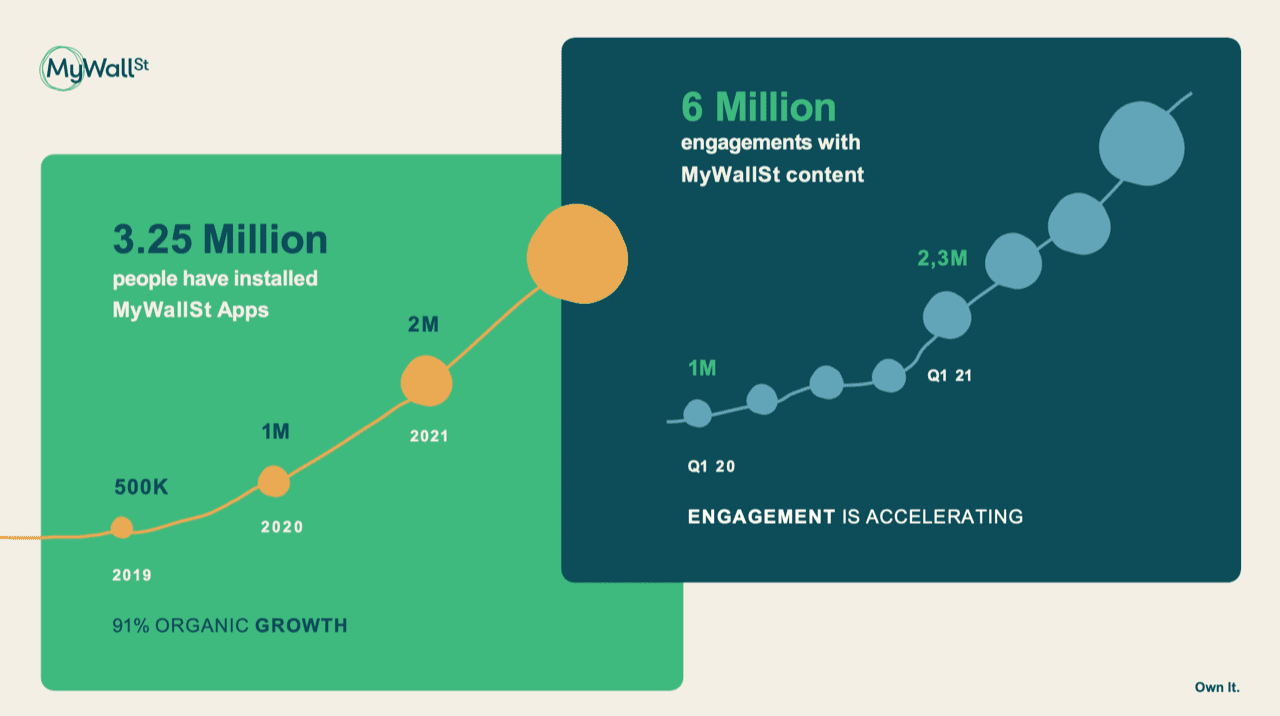

Traction

MyWallSt's substantial accomplishments

Founders inducted to the Wall Street 50

Winner of The Grand Prix at the Golden Spiders awards

Leadership comprising of ex-Google, Vodafone & PwC.

Chief Strategy Officer of ARK Invest joined the board in March 2022

Paying retail customers in 65 countries

Provider of daily branded content to Revolut, one of the fastest-growing and best-known financial megs-apps in the world

Other B2B customers range from Africa-based investment app Bamboo to USA-based Salem University

Investment and a channel relationship from one of the US's leading consumer financial research firms: The Motley Fool.

Fast-growing podcast and social engagement with 6M engagements in Q4 2021

Customers

The largest generation in history is just starting their lifelong investing journey

We address 331 million underserved people with less than $1M to invest and their $59T in assets. We power their financial freedom by giving them the knowledge and tools to invest successfully.

Business model

A suite of monetized platforms

Currently, we have two core monetised education and research platforms that sit adjacent to the crowded field of low-cost and zero-fee brokerages, with a third in production:

MyWallSt — our mobile research companion for the modern DIY investor.

Horizon — our premium service to follow along with and learn directly from an experienced investor.

Stellar [working title] — to be unveiled in Q3.

Across these core platforms, we have amassed thousands of subscribers in more than 165 countries that know and trust us to deliver the high-quality information they need to make investment decisions.

We have secured B2B contracts with several notable brands, with more to come.

Now, we are positioned to launch what we believe could be our most important product offering.

Market

Globally, there are 331M people with less than $1M

to invest. This amounts to $59T in assets underserved by traditional financial advisors.

While our main markets at present are the US, the UK and Ireland, our total user base spans 165 countries, with paid subscribers in over 65 countries.

Digital wealth management AUM in North America reached $330B in 2019 and is expected to grow to $830B by 2024. Stock ownership is rising again among under-35s in the US; as of 2019, 47.8% own stocks, rising from 38.6% in 2013.

We have cultivated an engaged customer base who shows high

levels of advocacy for the product and brand, as evidenced by a leading NPS of 46 and an average CSAT score of 91%.

Our successful engagement of our target market has helped us build a partnership with Revolut, as a provider of daily investing content to their 18m users.

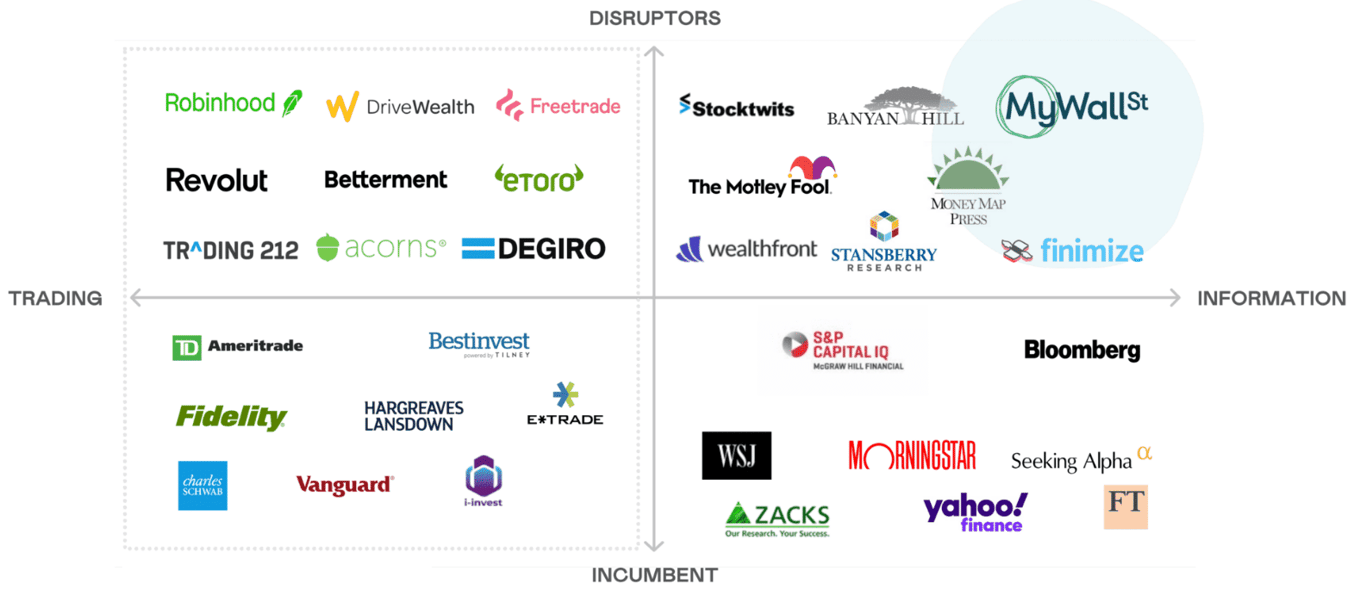

Competition

Vision

Raising to power-

charge our growth

We have proven that we can attract subscribers, that we can retain subscribers, and that we can increase the value of our subscriptions with additional offerings. Now we are raising to power-charge our growth.

Use of funds

Proceeds will be used to recruit in engineering & marketing and continue product expansion.

In 2023 we plan to raise a large investment to leverage our global platform, continue to drive growth in our subscriber base, and build, market, and scale our nascent wealth management products.

We have forecast $1.16 billion total ARR in 2026 subject to our 2023 large raise.*

We have support from some of the world's leading venture funds, and we have an investment and advisory board filled with domain and venture expertise.

The time is right for our raise in 2022 as our products are well-positioned to meet the accelerating demand of our growing customer base.

We are the right team at the right time and the right place to build a new brand that’s loved the world over.

* Click here for important information regarding Financial Projections which are not guaranteed.

Funding

Over $11M raised since foundation

Backed by Motley Fool Ventures

Founders

Meet our team

As a team, our mission is to get the world investing successfully. Every one of us is an investor, which means that we have first-hand experience on how investing has improved our financial futures, while also genuinely understanding the concerns of our customers. We’re dedicated to sharing the possibilities of success with everyone.

Emmet Savage

Emmet Savage

Chief Investor & Co-Founder

Emmet’s passion is the stock market. Emmet had his personal portfolio professionally audited and achieved a 24% annual return for more than a decade – over triple what the S&P 500 returned.

John Tyrrell

John Tyrrell

CEO & Co-Founder

John’s mission in life is to achieve simplicity through technology. He believes investing grows long-term wealth and wants MyWallSt.com to create the simplest technology solution so that investing can be for everyone.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...