Performlive Patent application filing covers solution for Context Aware Chat Categorization for Live Commerce Tweet this ...

Problem

Livestream e-commerce is a growing but fragmented market

Online shopping is old news. Increasingly, customers aren’t satisfied with the flat experience of scrolling through product descriptions to shop. Live commerce is trending—blending the convenience of online shopping with the engaging, in-the-moment experience of live streams. In 2021, the global market for live commerce is expected to double, reaching $125B+.

However, the market is still fragmented. An average social media user has 8.4 accounts, which means that streamers and customers alike have to master multiple platforms. What’s more, individual platforms may only support monetization of product sales or skilled services, but not both—if they even support commerce at all.

Solution

PerformLive puts creators and sellers at the center

PerformLive is a platform for individuals, businesses and brands to monetize their talent and products via interactive live stream. We bring all the tools that creators and sellers need into one, easy-to-use interface:

Our Simulcast feature broadcasts live streams across multiple social media platforms

Multiple monetization options support both product sales (like e-stores) and skilled streamers (like health & wellness coaches)

Augmented reality technology allows customers to try products virtually

Interactivity features encourage community building and a loyal audience

PerformLive combines live interaction, augmented reality, community, social selling, and e-commerce all in one place.

Product

A comprehensive, integrated, live commerce platform

PerformLive offers sellers and creators a robust suite of e-commerce and streaming tools:

Live interactive streams, either free or paid

Broadcast to all social media channels during Live Stream

Rich paywall with five options for monetizing skills and products

Support for crypto payments

Commercial support, including product inventory and shipping labels

Analytics dashboard

AI-powered chat analytics—a patent-ready technology

PerformLive also offers two final, essential advantages: a streamlined, easy-to-use interface, and a competitive fee structure that helps users maximize their earnings.

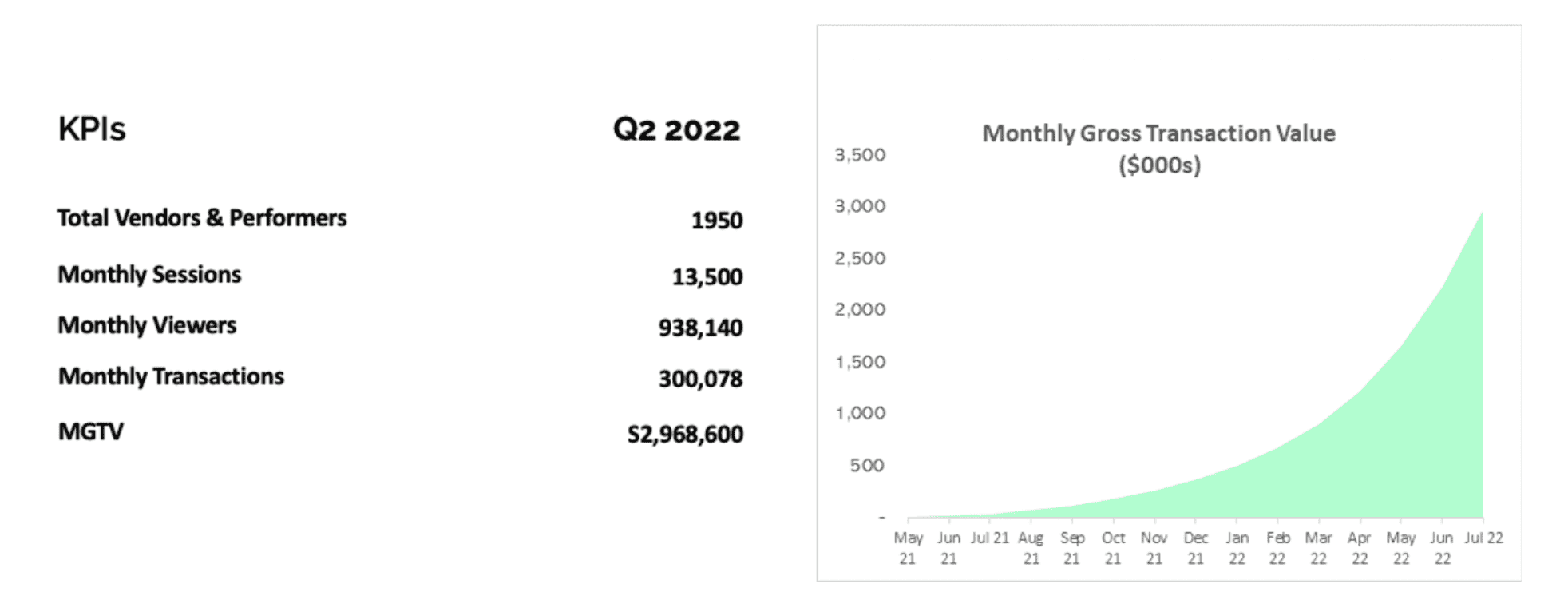

Traction

Tracking early success

PerformLive Beta launched in April 2021. We have been carefully monitoring our user activity and feedback over the first six weeks of organic growth, and so far have seen impressive results:

576 sign ups

71 Performances

40% repeat rate

Customers

Opportunity in the health and wellness segment

We’ve identified health and wellness streamers as an under-addressed market segment. We’ll initially focus on engaging these streamers as potential PerformLive users.

We intend to acquire 50+ customers per month for the first 3 months, and then shift gears and accelerate growth. As we grow our user base deliberately, we will be able to effectively respond to feedback and platform data.

Business model

PerformLive platform drives multiple revenue streams

We have a competitive fee structure for creators and sellers:

$29 and up for creator subscriptions

$0.99 transaction fee per product

7.5% commission on sales, including products, services, and paid live streams

We don’t charge fees to consumers and audience members directly. However, augmented reality and gamification options will be introduced as optional in-app purchases.

Market

A regional trend goes global

China has been at the vanguard of e-commerce live streaming since its inception. The industry there is estimated to reach $305B GMV by the end of 2021.

The US market has been slower to catch on, but that’s changing. In the past two years, Amazon, Instagram, Walmart, Google, and Shopify have all launched live streaming initiatives. Newer players like Popshop Live and ShopShop have joined the fray as well.

Driven by changing smartphone habits, technology developments like 5G, and pandemic-era shopping, live commerce is reaching an inflection point in the US. The domestic market is expected to grow from 5B in 2021 to over 25B by 2023.

Competition

Unique focus and features in the live commerce space

Live commerce platforms like PopShop and incumbent platforms such as Amazon have one thing in common: a focus on product sales, at the expense of monetizing skill- and service-based streaming. PerformLive is targeting streamers who are broadly in the health and wellness industry as our natural first customer base.

Our platform’s robust feature set and proprietary technology give us an edge over our direct competitors. For incumbent platforms, meanwhile, live streaming is just an afterthought—they don’t offer an experience tailored to creators and sellers.

Vision and strategy

Investing in growth

We’re raising up to $1M to invest in key areas of our company:

Key hires, including CMO, head of growth, and head of partnership & affiliate programs

Product development and IP

Wellness market fit and growth

With these strategic investments, we aim to implement additional features & scale our customer base exponentially in the course of the next year.

Funding

Support alongside VCs and angels

We’ve raised $815K from VC and Angel investors, including Golden Seeds Venture Fund, 37 Angels, Next Act, and Smart Hub Ventures.

Founders

A proven team with multiple exits

PerformLive is the latest creation of a 16-year working relationship building products and teams.

In just the last 4 years, Oksana Sokolovsky (CEO) and Rohit Mahajan (CTO) have 4 products, 10 patent filings, and 2 exits under their belts, including:

Io-Tahoe (acquired by British Gas, 2017)

Chartbuster Games (acquired by LTV Games, 2020)

ROAR Augmented Reality (pivoted to PerformLive, 2021)

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...