This definitive guide to the best coffee makers of 2020 covers everything you need to know before you buy your next morni...

Problem

Home brewed coffee lacks the quality and ease of a coffee shop

With the Work from Home trend increasing, it's even more important to be able to make great coffee at home without heading out to a cafe. Coffee enthusiasts often have to choose between a complex brewing method (quality over simplicity) or an overly simplistic one (convenience over quality) to get their morning brew. What's more, many of today's home coffee makers don't add up to the quality, taste, and look of a cup you get at a local cafe.

Solution

Ratio: Making the best part of your day even better

Ratio was founded to create a home brew coffee solution that marries beauty, simplicity, and quality into a single experience. We design and manufacture envy-inducing, intuitive machines that automate much of what a talented barista does to make a great cup of coffee.

Product

Enjoy convenience without compromising quality

We make delicious home brew easy for every coffee lover to enjoy.

Simplify your routine.

The Ratio removes variables like water temperature, extraction time, and pour over pattern so you can worry less about making your coffee, and more about drinking it.

Elevate your taste.

Making coffee at home or office shouldn’t feel like a compromise. We’ve engineered a pour over style system with the precision of high-end espresso machines. You’ll taste the difference.

Enjoy it for life.

No plastic screws, tubes, or environmentally harmful pods. Ratio 8 is hand assembled in the USA from cast metal, borosilicate glass, and real hardwoods, and is backed by a 5-year warranty.

Traction

A home coffee maker in high demand

After many years of hard work, we have a solid supply chain in place with multi-year relationships in electronics, metal, glass, wood, ceramics, and injectables. The Eight launched in 2015 and is now a leader in its category of home coffee makers, with best of class coffee quality, industrial design, and materials. Over 5K+ customers have paid $345-$795 and with little discounting to get into a Ratio coffee maker. Our newest model, the Ratio Six, launched in January 2020 and is seeing monthly growth rates of over 100%.

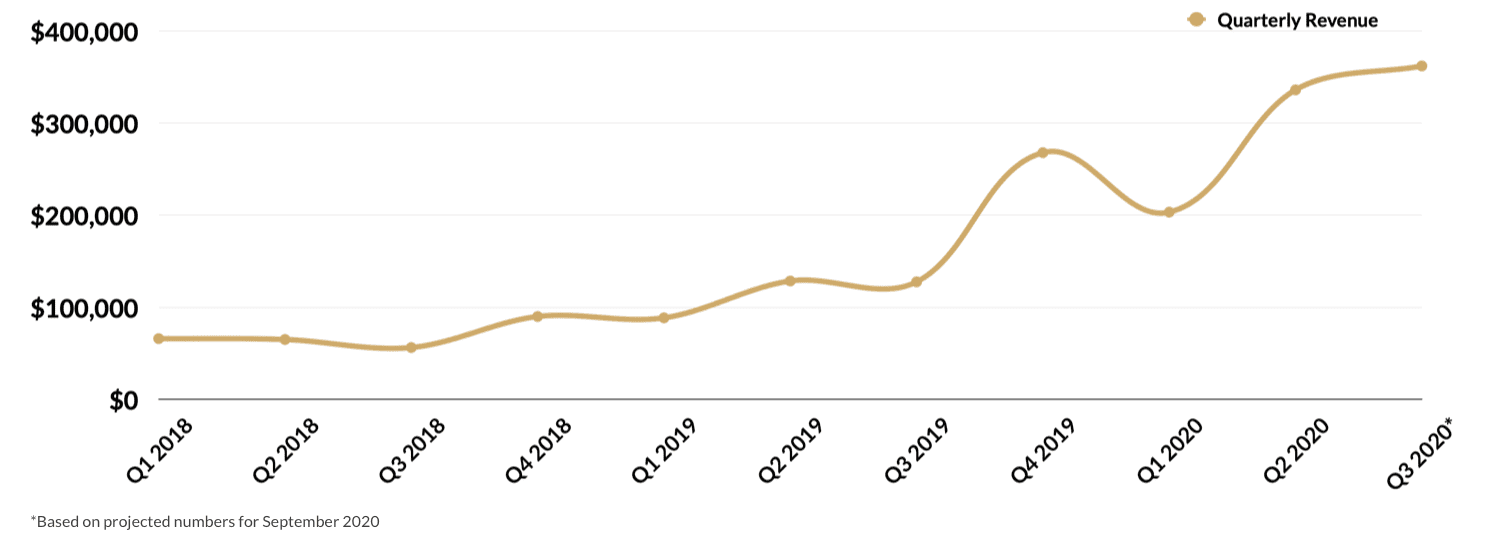

Our loyal and enthusiastic following is growing. We have over 19K Instagram followers and 12K email followers with 5% conversion rates. Our DTC revenue increased 322% in 2020 (YTD August) over the same period in 2019. With over 5K units on the market, we achieved our first profitable month in December of 2019 and are on track to see $1.5M in revenue by the end of 2020 with consistent profitability.

Available at select retail partners:

Customers

Adored by coffee enthusiasts and coffee lovers everywhere

Ratio brings exquisite coffee to your kitchen without sacrificing convenience or taste.

4.6/5 Stars, 200+ Reviews

4.6/5 Stars, 200+ Reviews

Both the Ratio Eight and Ratio Six consistently average near 5-star ratings across hundreds of customer reviews.

From the Press

"Perfection in a Chemex is hard to come by," writes Daniel Modlin of Wired. "Too many variables, not enough constants. Then I saw a coffee maker that could make consistently delicious Chemex-style pour over, staring at me across the room. The Ratio Eight is a pour-over Chemex-style machine with a built-in robot brain that has been programmed to eliminate human error from one of the most difficult brewing techniques out there. It also looks damn good doing it."

Business model

Direct to customer sales

Our primary products retail from $345 - $895. Our website traffic, revenue, and conversion rates have all seen strong improvement through 2020 and even more dramatically since the COVID-19 pandemic, as more people are making coffee at home. We reached monthly profitability in December of 2019 and are on track to see more than $1.5M in revenue by the end of 2020, by which point we expect over 210% growth year over year.

Revenue by Quarter

Marketing Performance Highlights

- DTC marketing is driving more than 4x growth in DTC sales

- Cost-efficient marketing campaigns: CPA or CAQ is $12.04, down 43% from 2019

- Return on Ad Spend (ROAS) on DTC Marketing is 2,169%, up 63% from 2019

- Our online Conversion Rate is up 34% year-over-year (YTD)

Market

Coffee: a household staple

Industry research shows approximately 58M coffee makers were sold globally in 2019. COVID-19 is only driving sales up, especially in urban markets as people have had to work from home. We do not expect this trend to change any time soon, and we are working to gain market share from our competitors who are dealing with the fallout of their retail store channels.

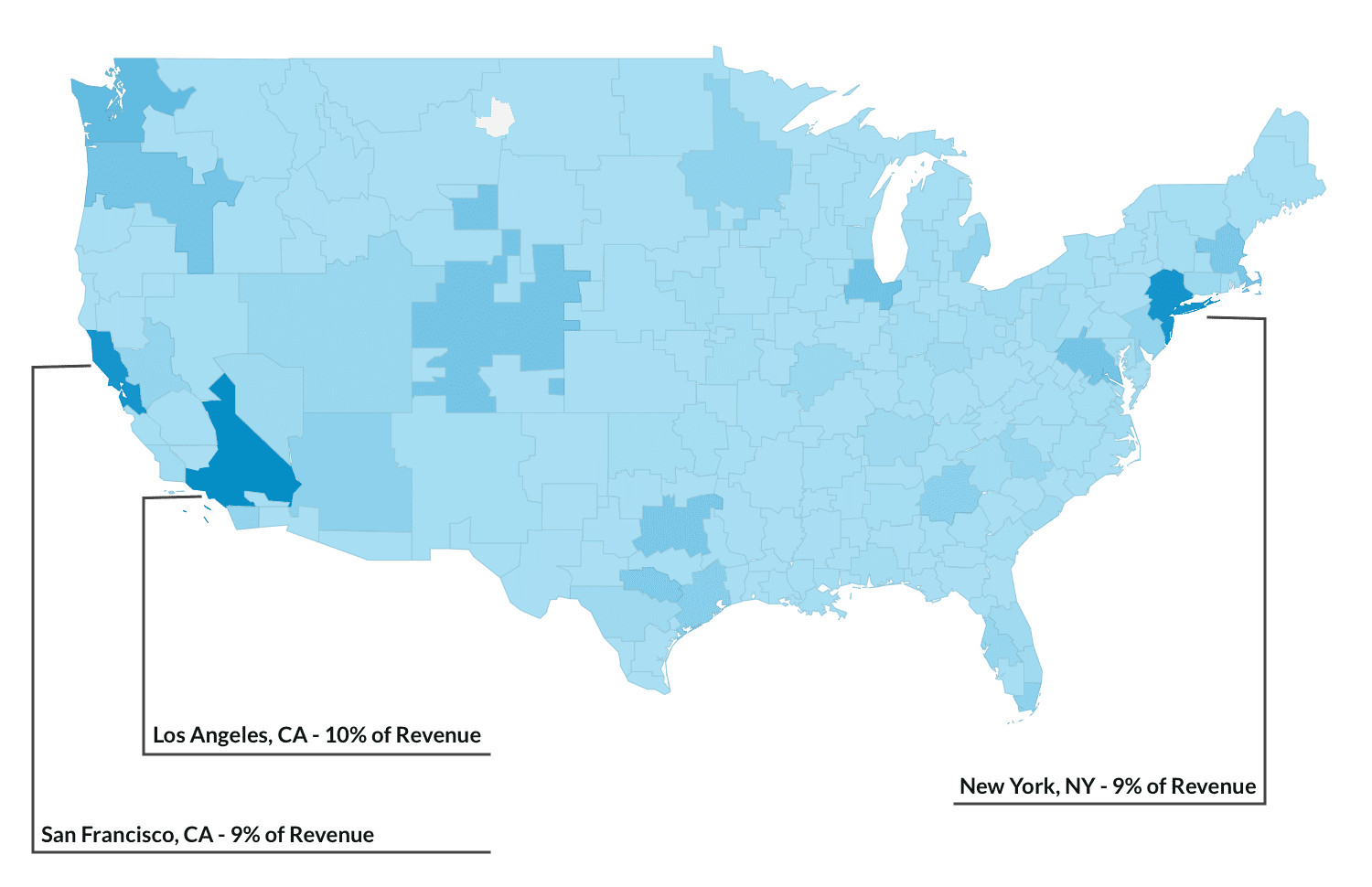

Top Markets

| Market | Revenue Share | YoY % Change |

|---|---|---|

| Los Angeles, CA | 10.0% | +297% |

| New York, NY | 9.1% | +96% |

| San Francisco, CA | 9.0% | +149% |

| Seattle, WA | 4.4% | +286% |

| Chicago, IL | 3.5% | +161% |

| Washington DC | 3.2% | +209% |

| Portland, OR | 3.2% | +75% |

| Denver, CO | 3.2% | +231% |

| Dallas, TX | 3.0% | +186% |

| Boston, MA | 2.8% | +421% |

Competition

Breakthrough company offering a modern take on coffee

Our nearest competitor, Technivorm of Holland, is a legacy company established in 1964. Technivorm has an admirable commitment to quality, but our hardware is superior in design and materials. Other competitors either offer commodity-grade products that don’t make good coffee and are "future landfill", or they’re manual, tedious pour over products. We balance convenience with quality.

One button operation.

The Ratio detects the water in the tank and changes the brew cycle automatically given the amount of liquid. Just one touch and it all magically comes together. Our competitors usually have complicated programming menus and cheap buttons.

Strength of character.

We believe quality design deserves the best materials. That’s why we built the Ratio with precision-machined aluminum and borosilicate glass, as well as a selection of premium hardwoods. All our coffee makers include a 5 year warranty. Our competitors usually use plastic frames wrapped in thin stainless sheet and offer a 1 year warranty.

Under the hood.

A die-cast aluminum element heats water to an ideal extraction temperature. The water flows through a stainless steel shower head designed for even distribution over the grounds. Our competitors rarely optimize for a perfect extraction, leading to coffee that is bitter and needs cream & sugar to be palatable.

Deliciously simulated pour over.

The Ratio Eight coffee maker simulates a skilled barista pour over, precisely metering the water flow during both the bloom and brew phases. All the taste without the work required for a proper pour over. Our competitors tend to design primarily for convenience and low cost, rather than focusing on quality.

Vision and strategy

Growing internationally with new product launches and recurring revenue

In October 2020, we are launching in Europe with a direct to consumer strategy. Other international markets will follow.

We will soon launch a subscription option for high quality, precision-ground coffee that is perfectly dosed for Ratio coffee makers. It will include fully compostable packaging. This is a sustainable, delicious alternative to pods, K-Cups, and other convenient-yet-marginal options on the market. Markets we can sell into include home, WFH office, offices, boutique and large luxury hotels, Airbnb hosts, and small restaurants offering quality brewed coffee. The recurring revenue will likely comprise a significant part of our business, with great profit margins and additional enterprise value when we are acquired.

New products are in development, bringing the Ratio design approach to various price points and customer segments.

We want to grow to at least 50K units of machines a year before seeking a strategic exit. The most likely acquiring company would be a larger coffee equipment brand that wants to gain access to the high-end of the market.

Funding

Angel investors, strategic value

We have raised money solely through angel investors that bring strategic value to the company at this early stage.

Our Investors Include:

Commercial Coffee Equipment Expertise:

Brant Curtis spent nearly a decade at his family business, the Wilbur Curtis Company, an industry leader in the design and manufacturing of coffee brewing equipmentHe is co-founder and principal of Common Collabs, a major provider of specialty beverages for national fast-casual restaurants and convenience stores. Common Collabs is Ratio's partner in high quality pre-ground coffee, launching at the end of 2020.

(Brant's LinkedIn)

Office Coffee Expertise:

Michael Klassen owns and has interest in coffee businesses all around the world. Michael contributes product and market knowledge for future Ratio products being developed for the light-commercial/office categories.

(Michael's LinkedIn)

Conversion Optimization Expertise:

Gabe Winslow focuses on technology and systems to automate and solve high-level problems. Gabe was a co-founder of SQ1 Agency and is the founder and CEO of Smart Pickle, an AI-driven marketing platform. Gabe directly advises Ratio on strategy and tactics on paid media and conversion optimizations.

(Gabe's LinkedIn)

Founders

Experienced Leadership, Coffee Nerds

Mark Hellweg, Founder and CEO

Mark is the founder of Ratio and Clive Coffee, which together have sold over $25M of coffee equipment since 2008. Mark is the product visionary behind LUCCA espresso machines, Ratio Eight and Six coffee makers, and several other electric coffee maker products currently in development. Mark has raised over $4M of private placement investment.

(Mark's LinkedIn)

Brad Walhood, COO

Brad is the integrator at Ratio, managing all product development, supply chain, and logistics, in addition to overseeing Ratio’s Portland, Oregon factory. Brad has over two decades of experience in high-end consumer brands, manufacturing, e-commerce, and retail store development.

(Brad's LinkedIn)

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...