Opportunity

North Carolina

real estate portfolio

Managed by local founders

Plat Capital Fund I is a portfolio of beach vacation rental investment properties managed by founders who are local to the North Carolina market.

The company plans to acquire, manage, and dispose of a portfolio of single-family homes vacation rentals along the coast of North Carolina. Our intended strategy is to focus on acquiring properties that:

- Have strong vacation rental demand based on proximity to beaches and other vacation attractions

- Have competitive amenities (i.e. pools or volleyball court)

- Have low acquisition costs compared US market averages

- Have significant potential for capital appreciation

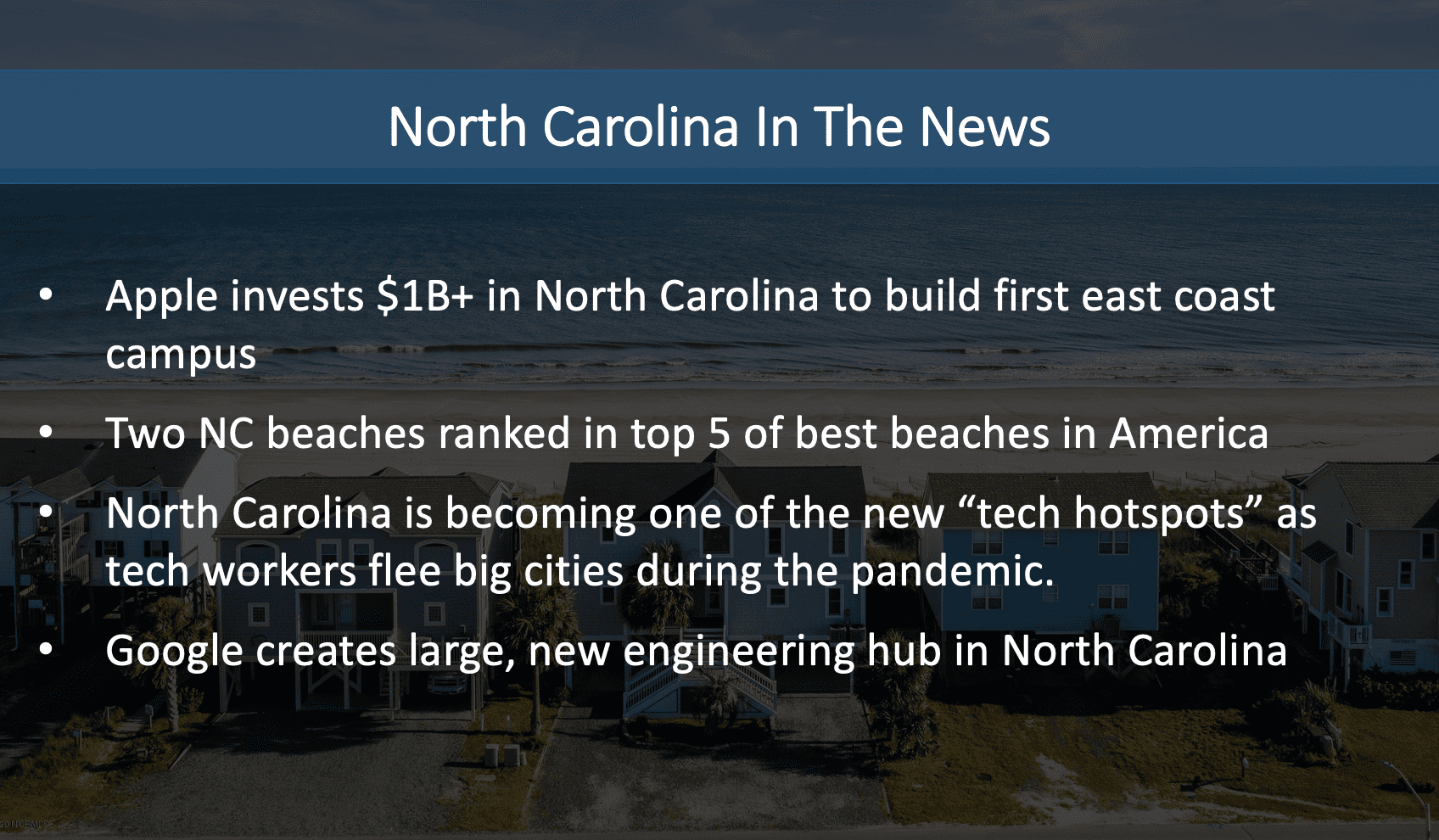

Our thesis is that North Carolina will be at the center of innovation and growth for years to come. Major tech companies like Apple are investing billions into campuses across the state.

This will increase appreciation of all property types, and drive major traffic to all the vacation hotspots along the coast.

Market

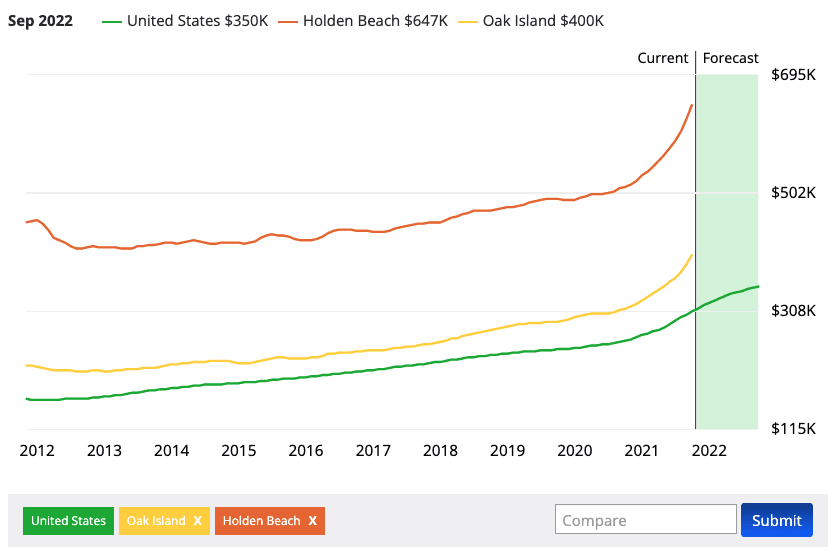

NC coastal towns set to outpace other large markets across the US

Some unique facts about North Carolina:

- As of Oct 2021, Zillow's home value index shows that home values have appreciated by 22.7% in the last year across the state of North Carolina.

- In 2021, the average sale price of homes in our target market of Brunswick County, NC went up by 21.6%.

- There are 3 North Carolina cities in the top 25 best places to live in America, according to US News Real Estate. This provides a steady flow of vacationers who frequently visit the NC beaches for weekend trips or family getaways.

North Carolina in the news:

Strategy

Experienced & selective management team

Plat Capital has years of experience acquiring and managing residential real estate along the coast of NC and throughout the rest of the state.

We primarily source properties from our local state-wide network and paid online and offline marketing campaigns. We are very selective about choosing properties that fit our investment thesis mentioned above.

We have deep experience sourcing evaluating, negotiating, structuring, closing, renovating, and managing such acquisitions of single-family homes, and intend to leverage this strategy for this offering.

Offering

Investment opportunity

We are offering up to 750,000 membership units of our Company for $1.00 each. The proceeds of the offering will be used to acquire and manage properties during the anticipated hold period of 3-5 years.

We are targeting an IRR of 12%-18% with a fund structure that includes the following benefits to investors:

- Exposure to vacation rental income

- Preferred return - which means investors get paid before Plat Capital gets any profits

- Exposure to appreciation

Management Fee

The Manager shall be entitled to 10% of gross revenues (as defined below) to help cover the cost of property management by Plat Capital Fund I, LLC. “Gross Revenues” is the amount of total revenue each year that is generated from the properties through rental income.

Track record

Previous deals

#1: Beach vacation rental

- 288 Brunswick Ave., Holden Beach, NC

- Purchase price : $275,000

- Gross revenue: $44,652

- Expense and financing: $23,556

- Cash flow: $21,096

- Cash-on-cash return: 38.35%

- View Airbnb listing

#2: Beach vacation rental

- 926 E. Beach Dr., Oak Island, NC

- Purchase price: $625,000

- Gross revenue: $87,652

- Expense and financing: $47,004

- Cash flow: $40,648

- Cash-on-cash return: 32.5%

- View Airbnb listing

#3: Small town vacation rental

- 1020 Danely Road, Pilot Mountain, NC

- Gross revenue: $15,533.15

- Expense and financing: $10,044

- Cash flow: $5,289.15

- Cash-on-cash return: 18.5%

- View Vrbo listing

Team

Norman Simon

Winston Salem, NC

Completed 18 real estate transactions in the past 3 years

Completed 18 real estate transactions in the past 3 years- Transacted $5.3M+ in real estate deals

- Experience in creative deal structuring, fix & flips, long-term rentals, and short-term rentals

- Co-host: Pure Capital podcast

- Managed teams of 25+ people and implemented $10M+ in projects for Altec Industries

- West Virginia University engineering alumni

James Carnes

Austin, TX

- Co-Founder & CTO of Iconic Air, Inc.

- Forbes 30 Under 30 lister

- Raised $5M+ from private investors, and secured $1M+ in government contracts for Iconic Air

- Completed $1.7M+ in real estate transactions

- Co-host: Pure Capital podcast

- West Virginia University engineering alumni

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...