I just got back from a fantastic few days in Baltimore attending Natural Products Expo East, the organic industry's secon...

Problem

Breakfast is the most important meal of the day – but it tends to be routinely skipped

Mornings are hectic for most people, especially for parents, students, and workers on the go. Unfortunately, the morning rush usually also means that breakfast gets neglected. Meals either require too much time to prepare (the classic breakfast fry-up) or lack nutritional value and are loaded with sugars (such as bland ready-made cereals). Consumers struggle to find suitable breakfast solutions, forcing them to compromise on less tasty or nutritious convenient solutions, default to regular go-to's, or skip breakfast altogether. What if you could make your breakfast the night before and have it waiting for you in the morning with no prep required?

Solution

Introducing Real Made Overnight Oats

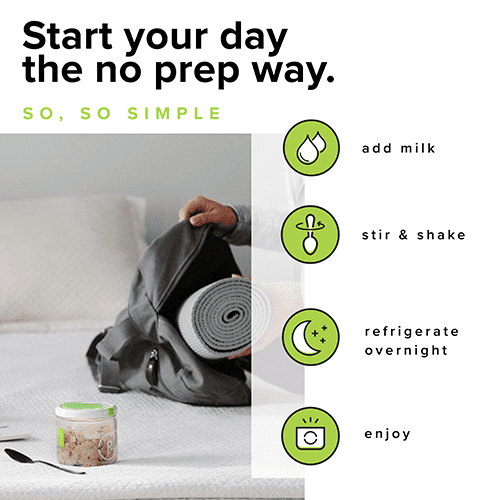

Real Made Overnight Oats provides a better-for-you breakfast experience that doesn't compromise on taste, nutrition, or convenience — so you can always start the day right. Real Made Overnight Oats has created a line of amazing organic, no sugar added, non-GMO, and plant-based breakfasts that can be prepared the night before. No cooking, no clean up, and you can even take it on-the-go!

Product

Organic, non-GMO, vegan, no-sugar added breakfast for people on the go

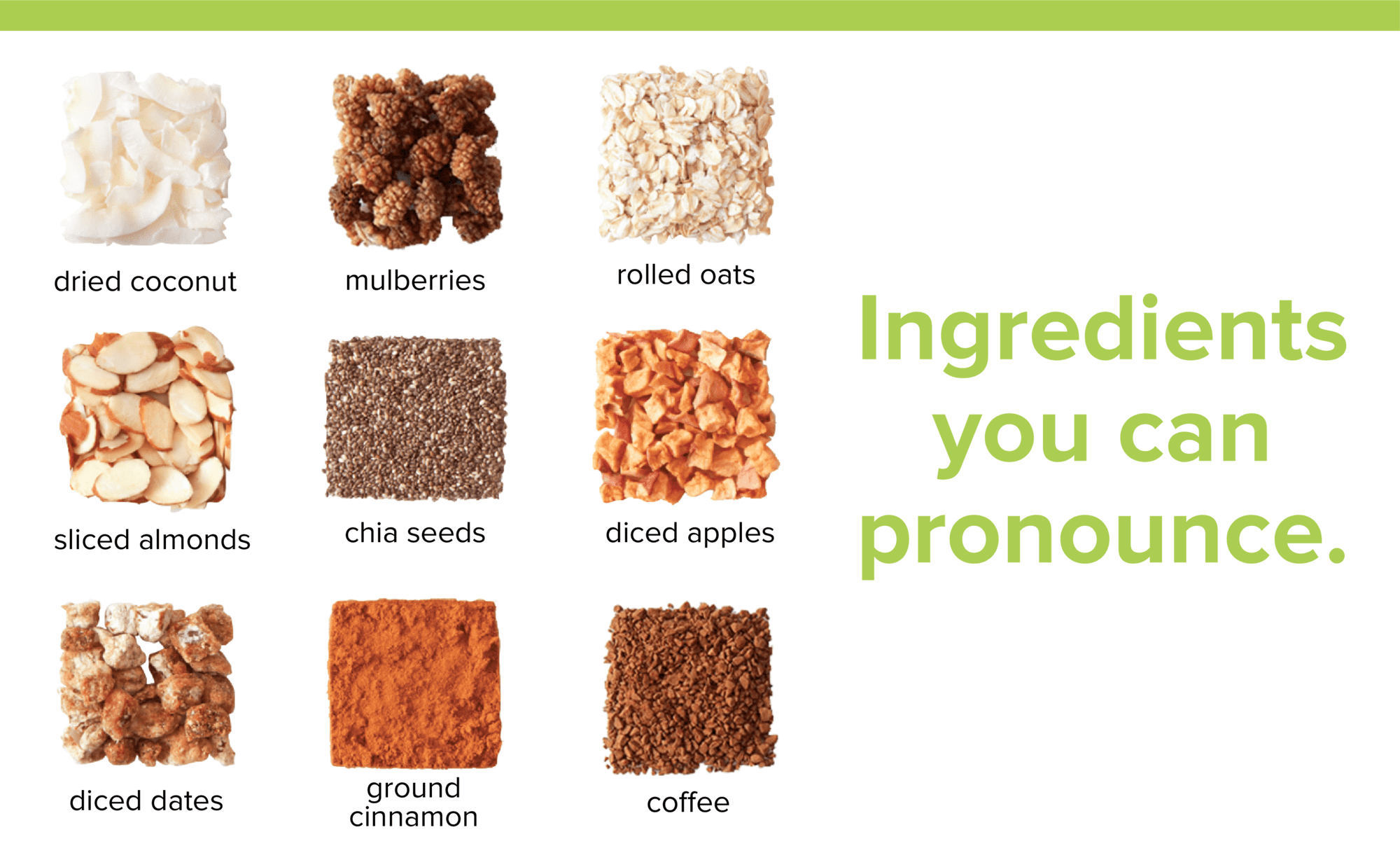

Real Made Overnight Oats comes in three flavors: Apple & Coconut, Mulberry & Chia, and Banana & Coffee. All of our Real Made Overnight Oats recipes are USDA Organic, Vegan Action Certified, and Non-GMO Project Verified. Our products taste great without adding any sugar. The only sugar in our products comes from dried organic fruits and nuts. We only use clean and simple ingredients. Most importantly, it's easy to make – all that’s needed is to add your favorite milk or nut milk to the oats and soak overnight in the fridge. Go to sleep happy knowing that when you wake up, a wholesome and filling breakfast awaits.

Traction

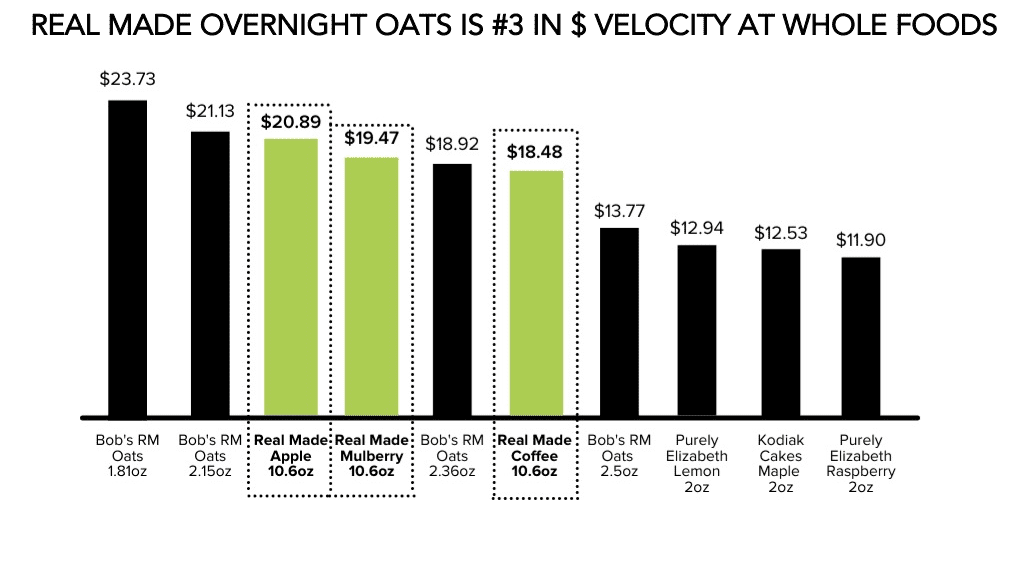

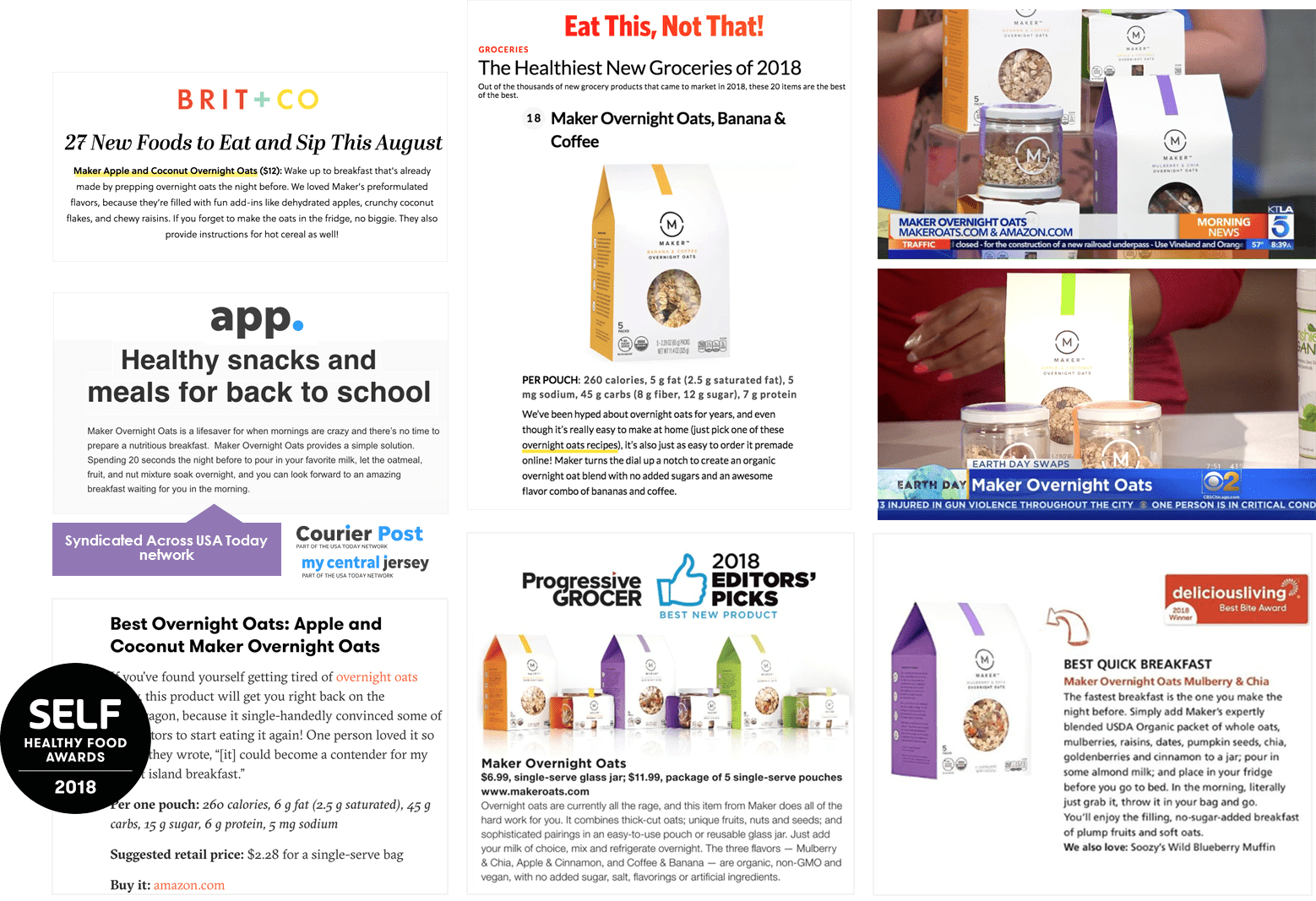

A leading brand in dollar velocity at Whole Foods

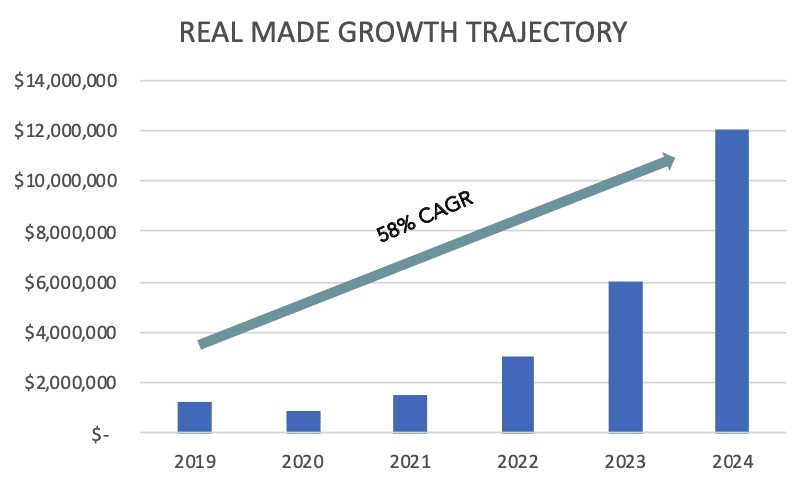

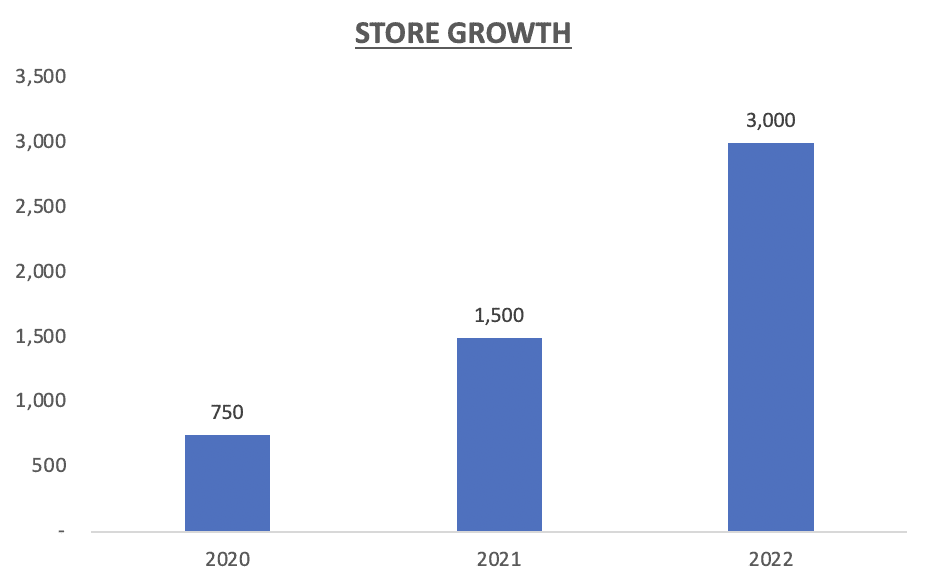

Real Made Overnight Oats is a certified Women’s Business Enterprise currently retailing at over 750 stores across the country through national chains such as Whole Foods, Sprouts, and Safeway, amongst others. We're also a leading brand in dollar velocity at Whole Foods with distribution in 3 regions. Since launching our own online store in late July, we've had steady growth without any marketing initiatives. We're witnessing this same e-commerce sales traction through Amazon, with over $180,000 in sales in 2020 and a 5-star rating. We expect to generate $3M in revenue in 2022, and continue to grow at a rate of 58% CAGR, reaching $12MM by 2024. We're also getting recognition in the media!

Customers

Our consumers love our wholesome products

Real Made Overnight Oats appeals to health-conscious individuals looking for a sustaining and healthy breakfast that cuts down on prep time. Our consumers trend towards the young professional or millennial demographic who are looking for easy ways to integrate healthier eating choices into their lives. We’ve received 5-star reviews on every platform for our organic, filling, tasty, and convenient breakfast solution.

Business model

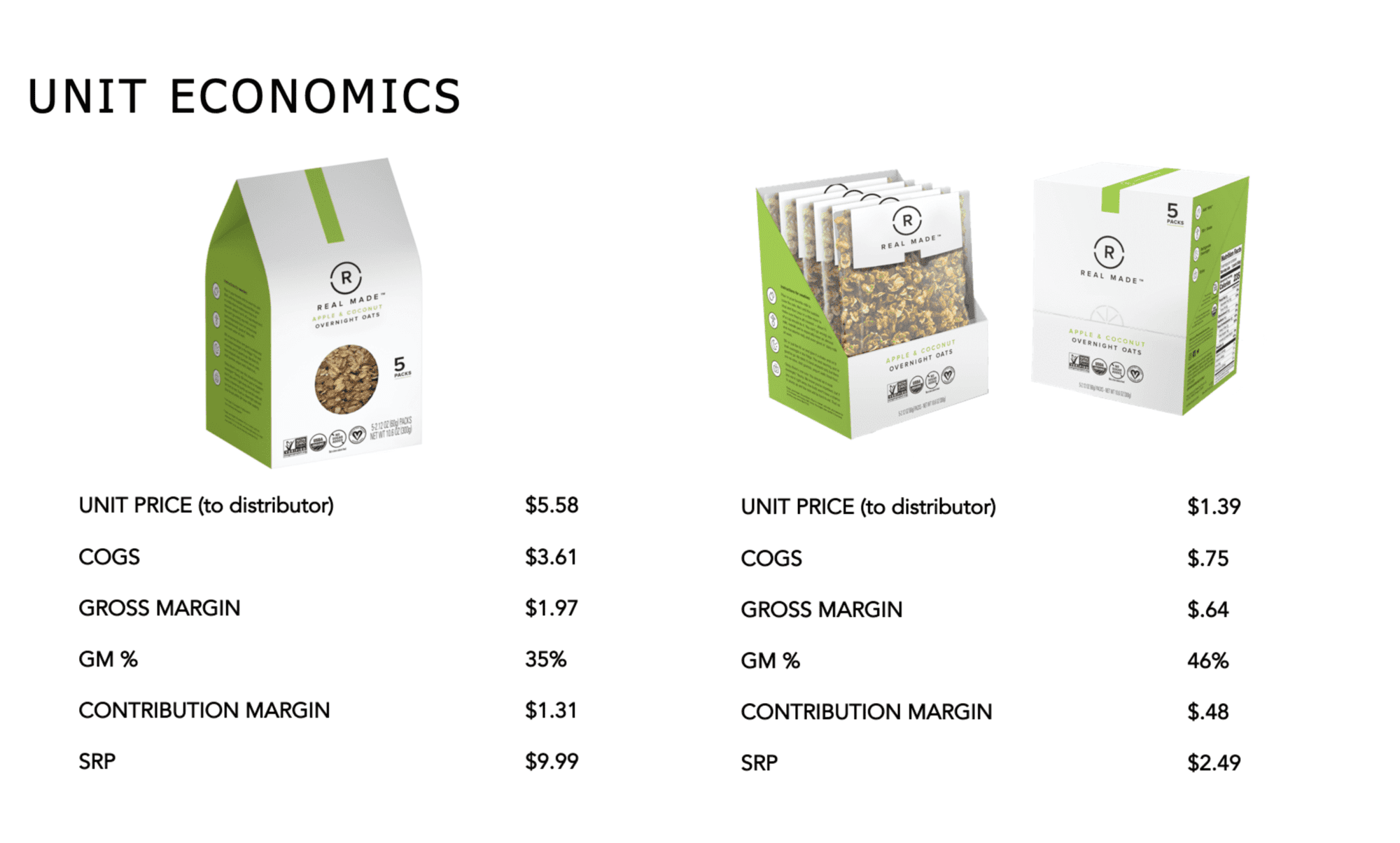

Omnichannel platform with distribution at key shopper destinations

Real Made Overnight Oats has 3 successful distribution channels. We're currently retailing nationally through e-commerce platforms, conventional and natural-food stores, and non-traditional distribution channels such as Sun Basket and SnackNation. KeHE and UNFI are our two national distributors. The blended gross margin is 41%; and there's a path to a 50%+ gross margin at $10M in revenue.

Our growth plan is to increase velocities at existing stores, add new customers with prospects like Meijer and HEB, and scale product volume on existing e-commerce platforms. Our target is for Real Made Overnight Oats to be in 3K+ brick & mortar stores by the end of 2022.

Market

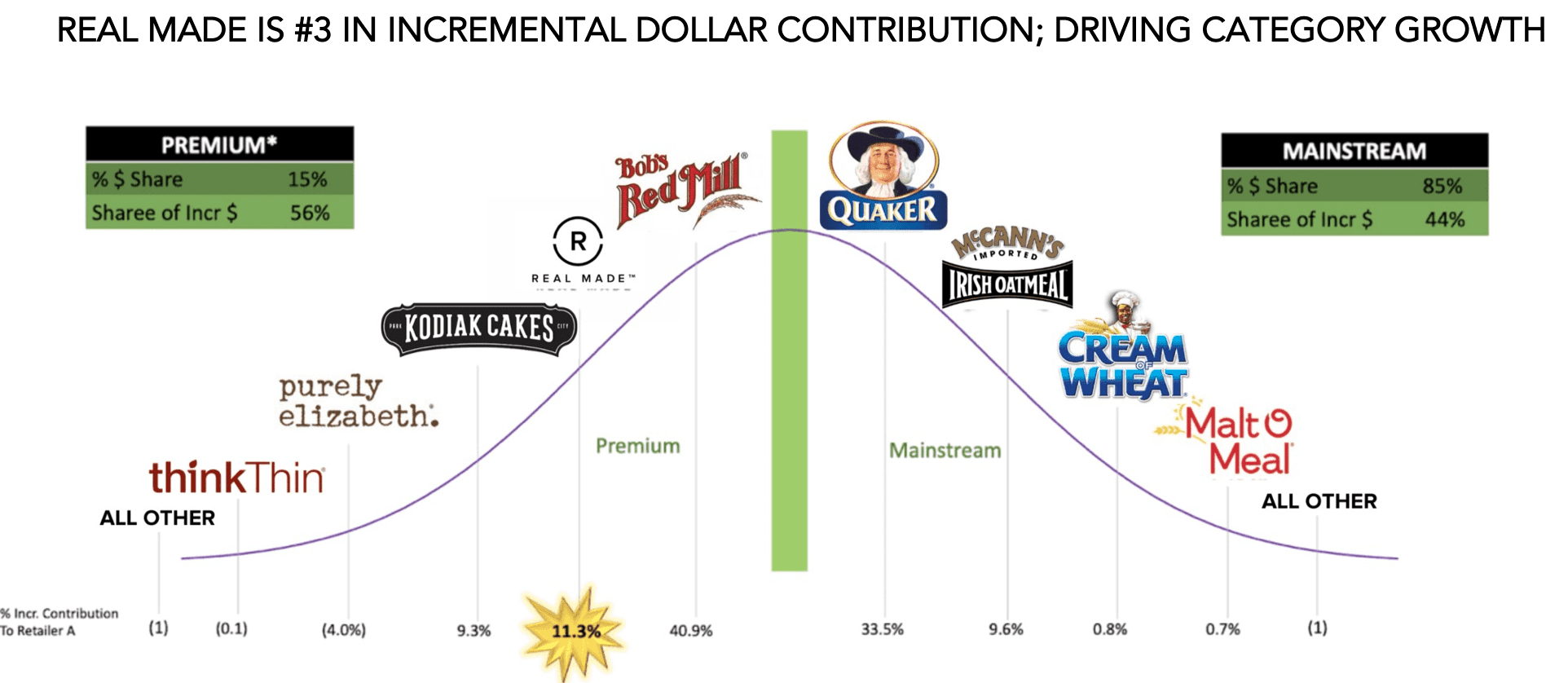

A $1.3B market in desperate need of innovation

The hot cereal market category is valued at $1.3B annually, but has had relatively flat growth overall. Mainstream brands in this category have been slow to capitalize on shifting consumer interests or reinvent their products. As a result, premium brands such as Real Made Overnight Oats are driving growth in the hot cereal category.

Competition

Our key distinction is our commitment to vegan, organic, and natural products

Real Made Overnight Oats’ market distinction lies in our commitment to using sustainable packaging, organic products, and vegan, no sugar added recipes. We successfully outcompete traditional brands in the hot cereal category. Our commitment to clean label products with minimal ingredients, coupled with unique ingredients from around the world and unique flavor combinations, also gives us a competitive advantage in the premium brand niche.

Vision and strategy

Becoming a brand leader in tasty, convenient, nutritious product solutions

We plan to become a brand leader by 2024; and we're already getting recognized in the media. We will launch a three-pronged marketing campaign to Meet Real Made, Taste Real Made, and Share Real Made. We will ramp up social media advertising, place targeted ads with Amazon, Walmart, and Thrive Market, and conduct in-store sampling to drive trial and purchase. We'll leverage influencers and expand our ambassador program. Real Made Overnight Oats plans to diversify its product portfolio to maximize market stickiness. We'll also expand our footprint into new categories, always providing products that are organic, vegan, no sugar added, and non-GMO.

Funding

Raising $1M to propel growth

Real Made Overnight Oats is raising $1M to provide an 18-month runway. Funding will go towards working capital needs, new hires, and marketing campaigns. So far, our product has required very little marketing. We believe that scaling these efforts will allow us to successfully grow revenue to $12M by 2024. Invest in Real Made now!

Founders

Over a decade of experience in consumer packaged goods

Jess is a packaged goods General Manager with 15+ years running businesses. She's helped name brands like Quaker and Hillshire Farm innovate and provide consumers more nutritious solutions, and is excited to start something from scratch with Real Made Foods.

Barry cofounded Honest Tea because it was difficult to find ready-to-drink iced tea that tasted like real tea. He's also the cofounder of Kombrewcha, a slightly alcoholic version of kombucha. Now with the creation of Real Made Oats, he's fulfilled his dream of becoming a cereal entrepreneur (and bad pun artist). Although a tea guy, Barry's favorite Maker Oats flavor is Banana & Coffee.

Note: Real Made Oats originally launched as Maker Oats. We changed our name but still have the same great recipes and cereal entrepreneurs.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...