Problem

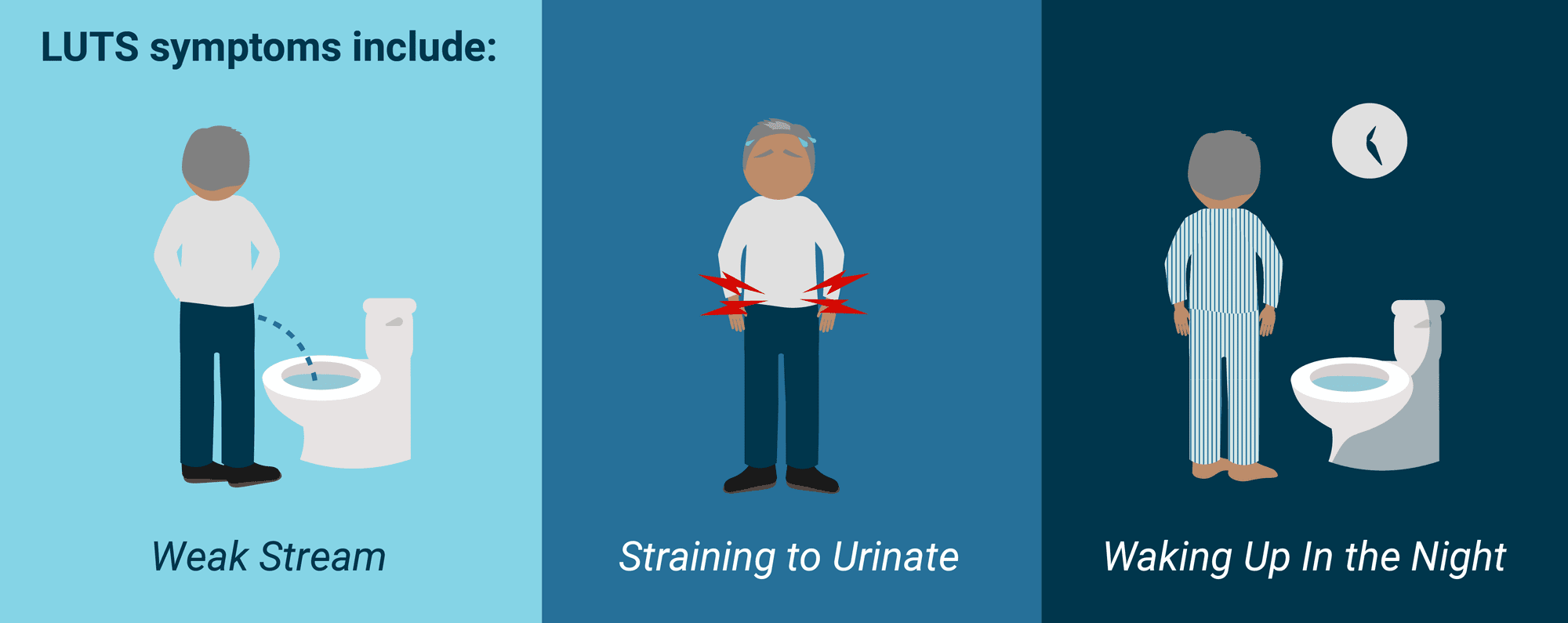

50% of men over 50 suffer from Lower Urinary Tract Symptoms (LUTS)

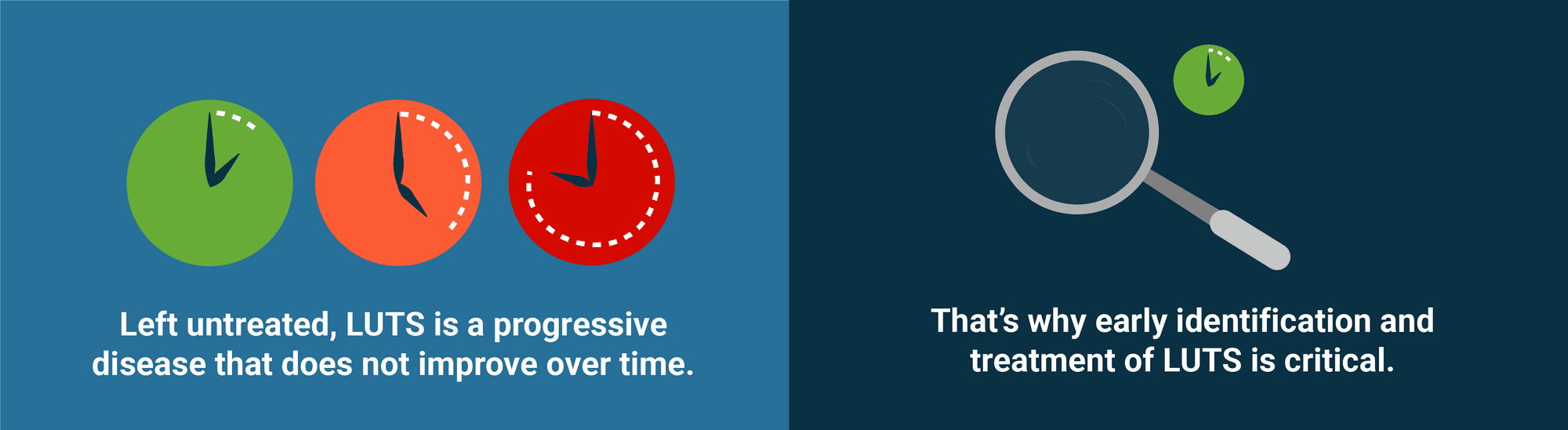

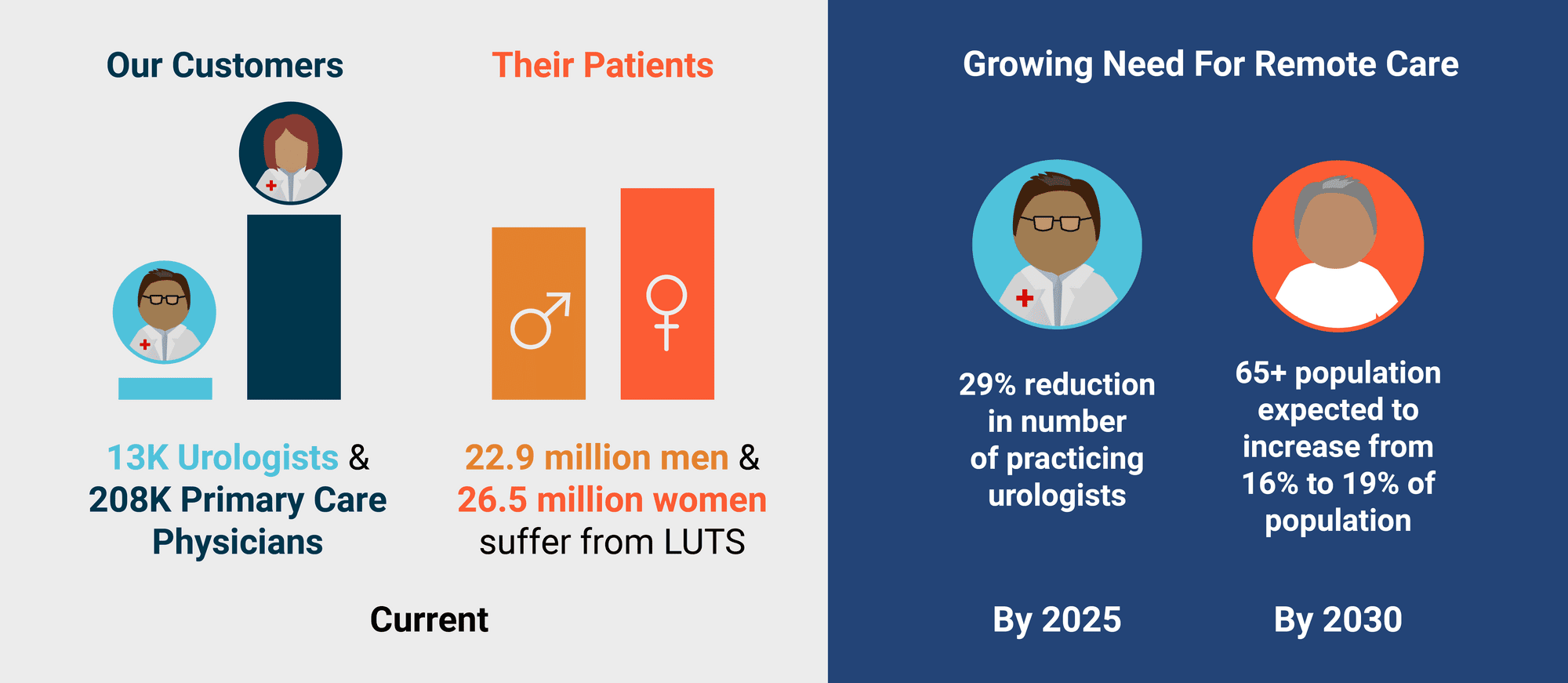

Lower Urinary Tract Symptoms (LUTS) is one of the most common diagnosis made by urologists for men aged 45-74 in the U.S. and results in more than half a billion dollars of unnecessary emergency room visits per year.

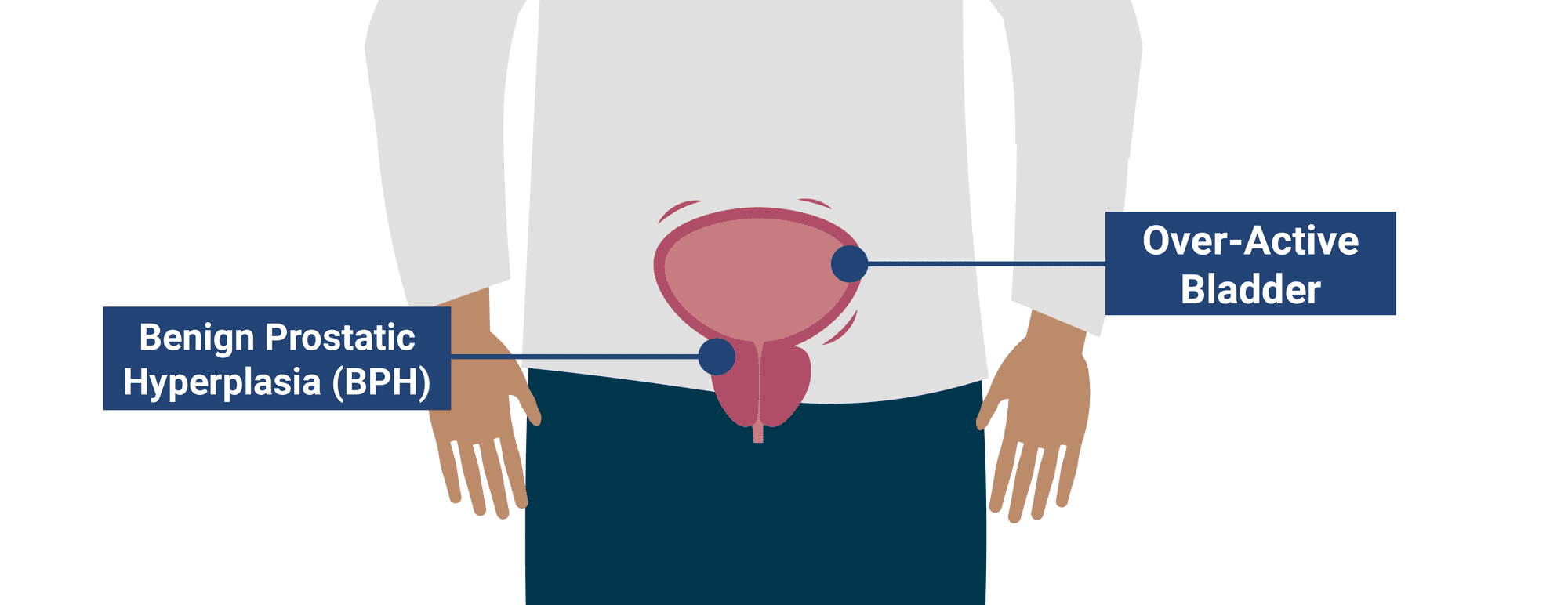

Common causes of LUTS are underlying conditions such as BPH and an over-active bladder.

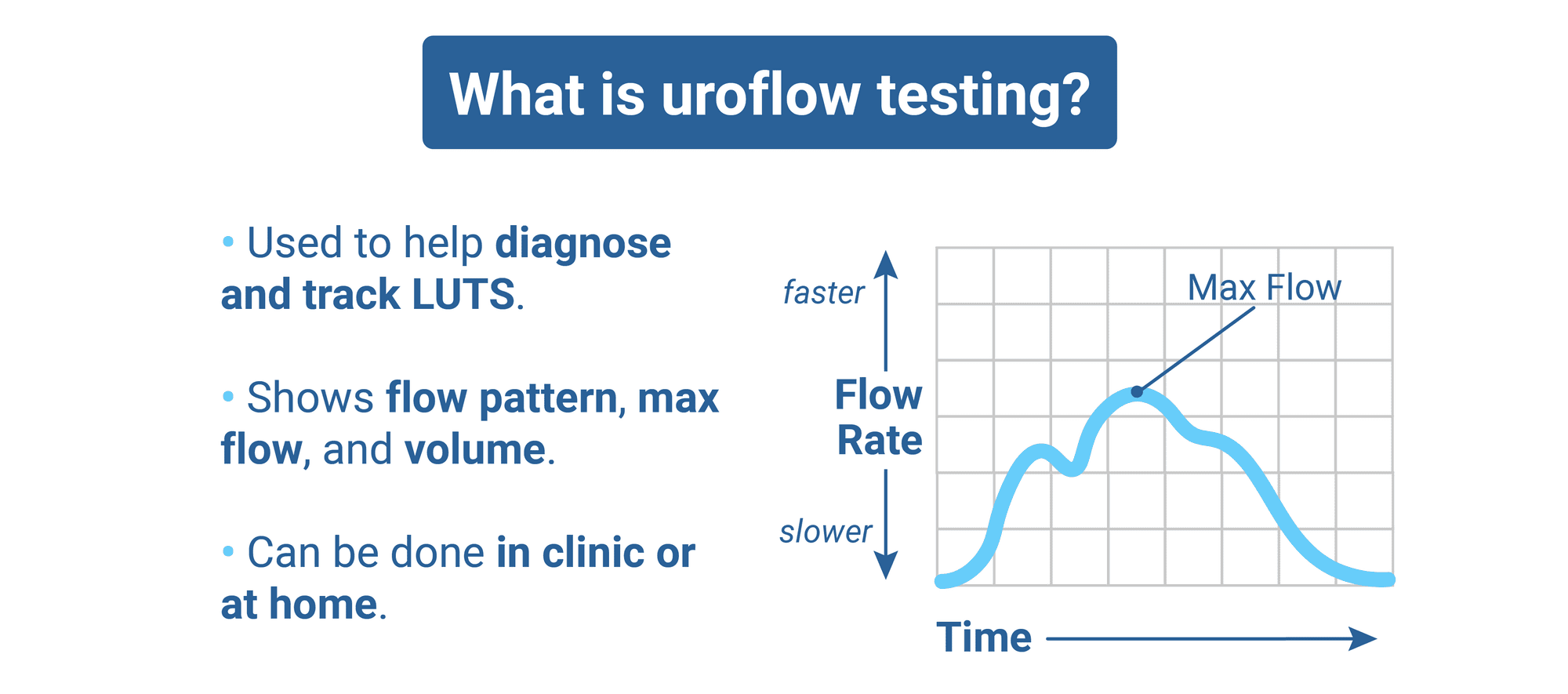

One tool that urologists use to diagnose LUTS is a uroflow test.

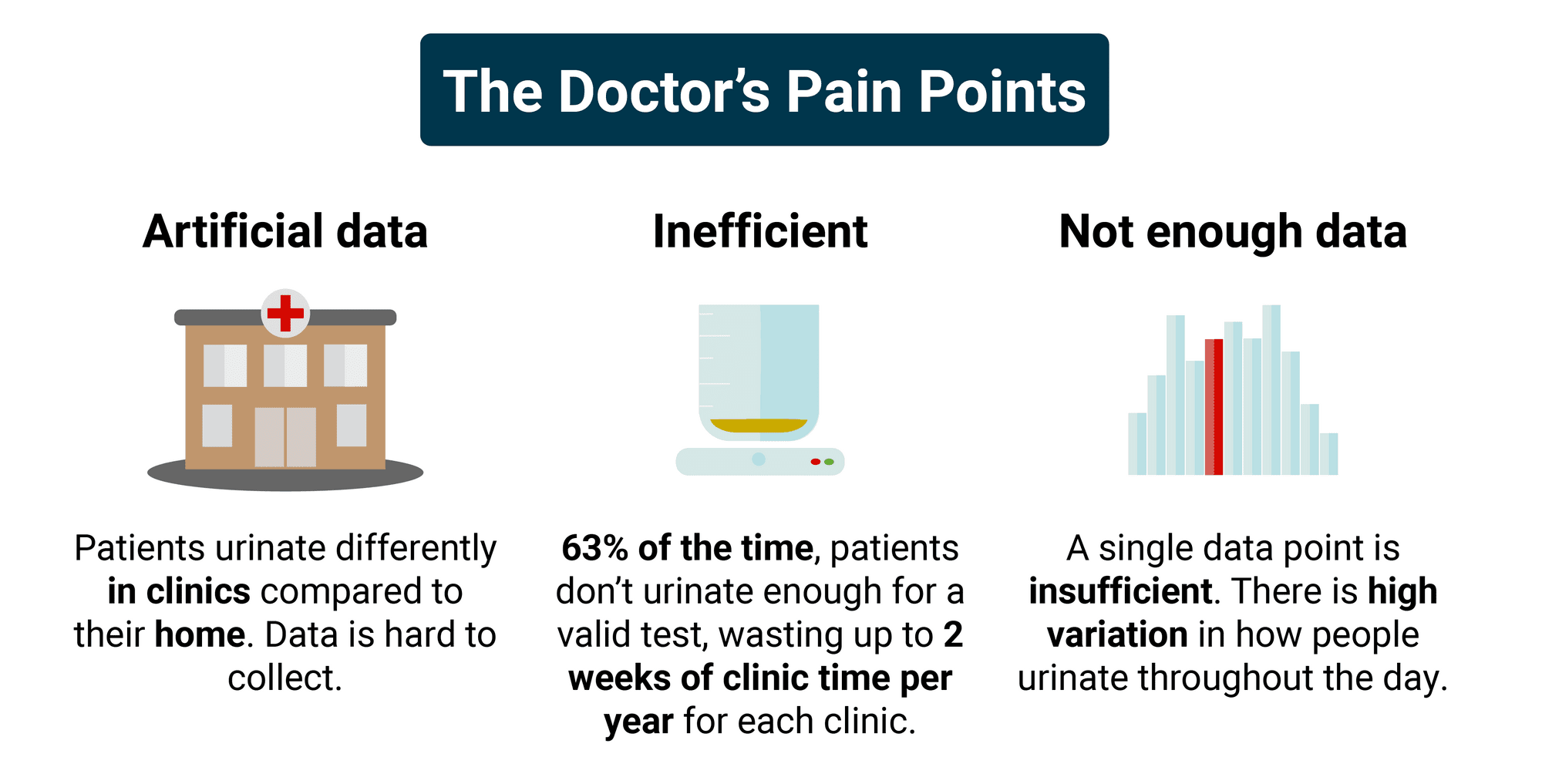

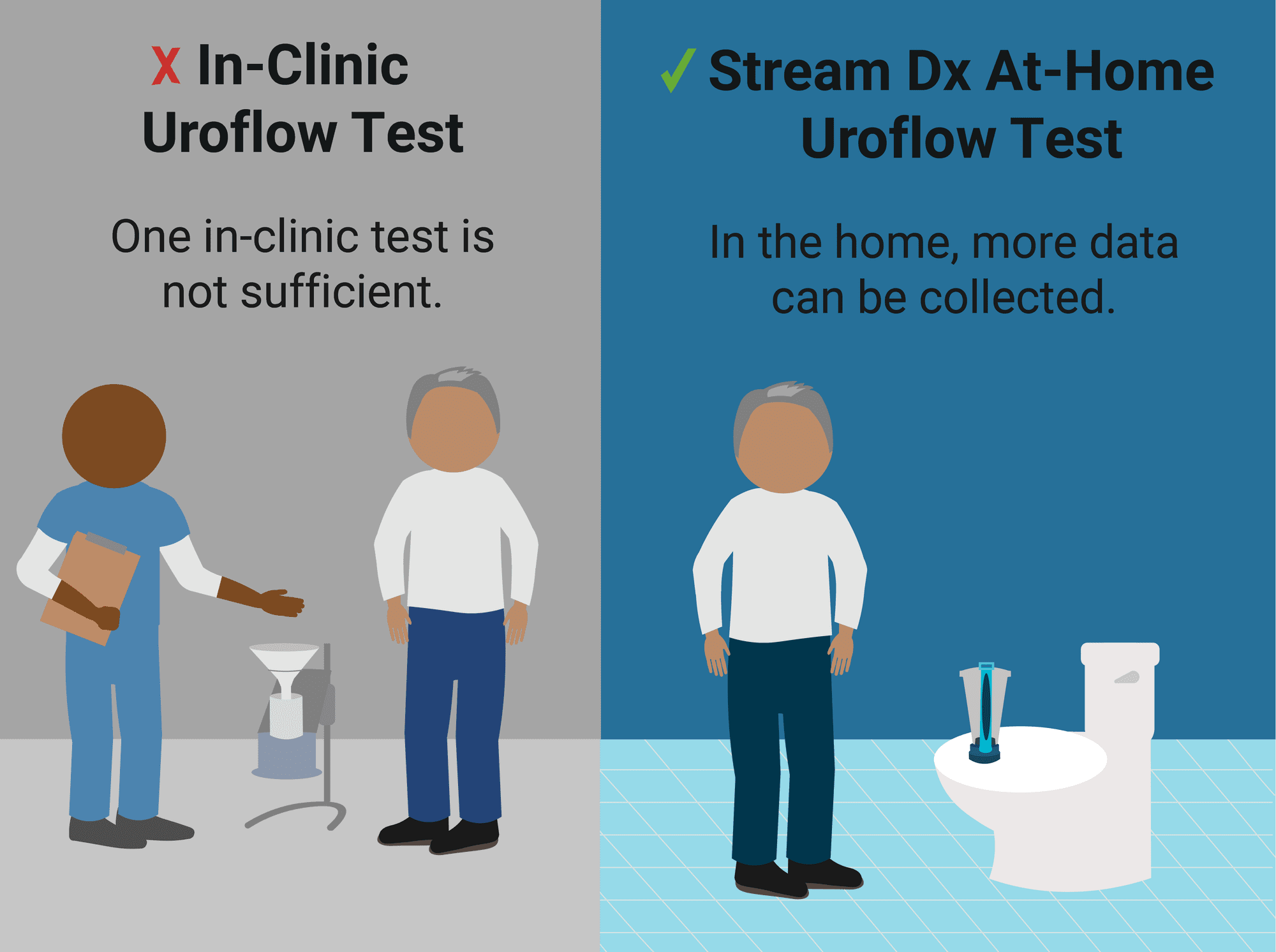

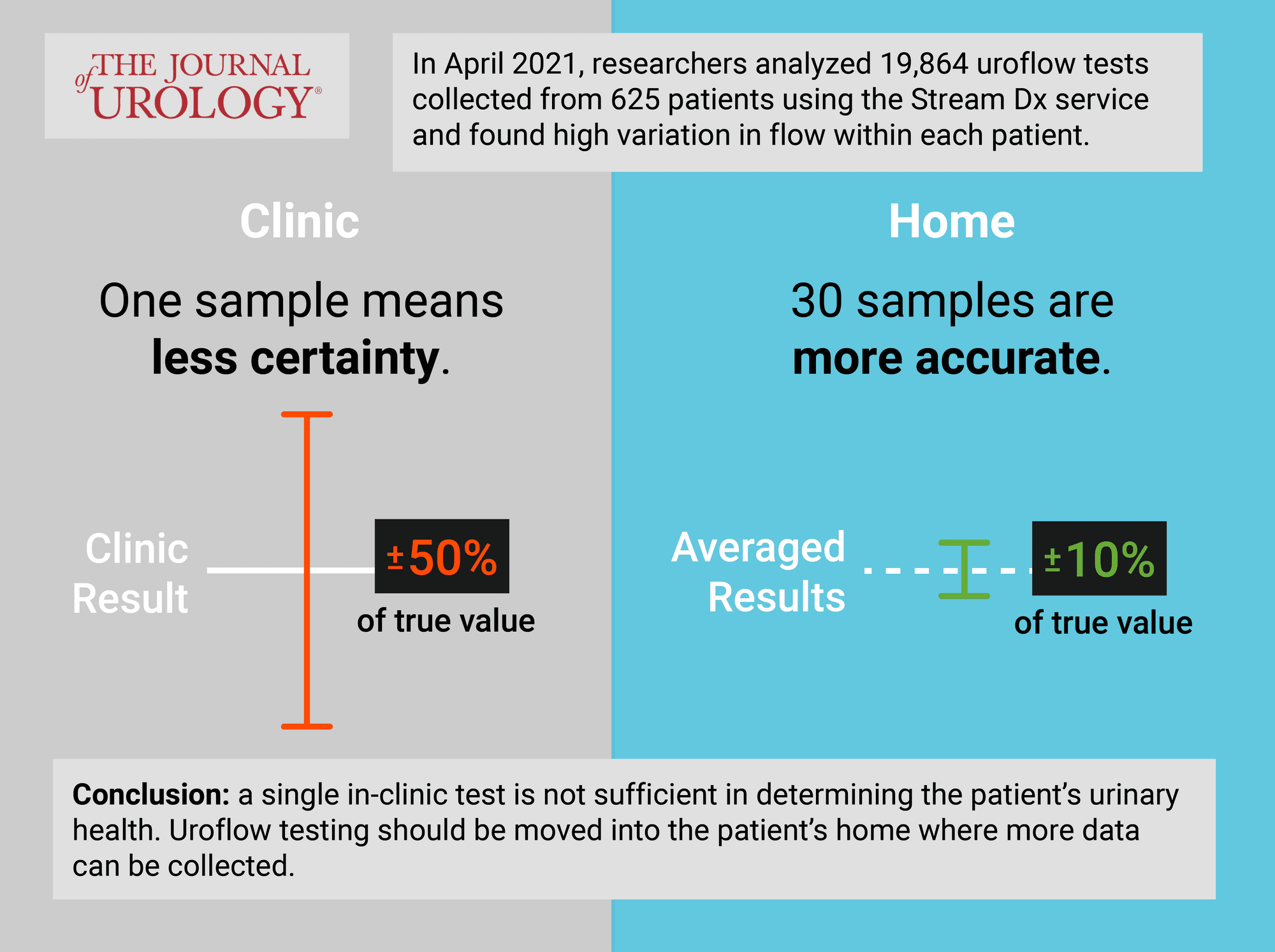

In-clinic uroflow tests are inefficient and do not provide sufficient data

Until recently, uroflow testing has only been available in a clinic setting where it hinders workflow.

Solution

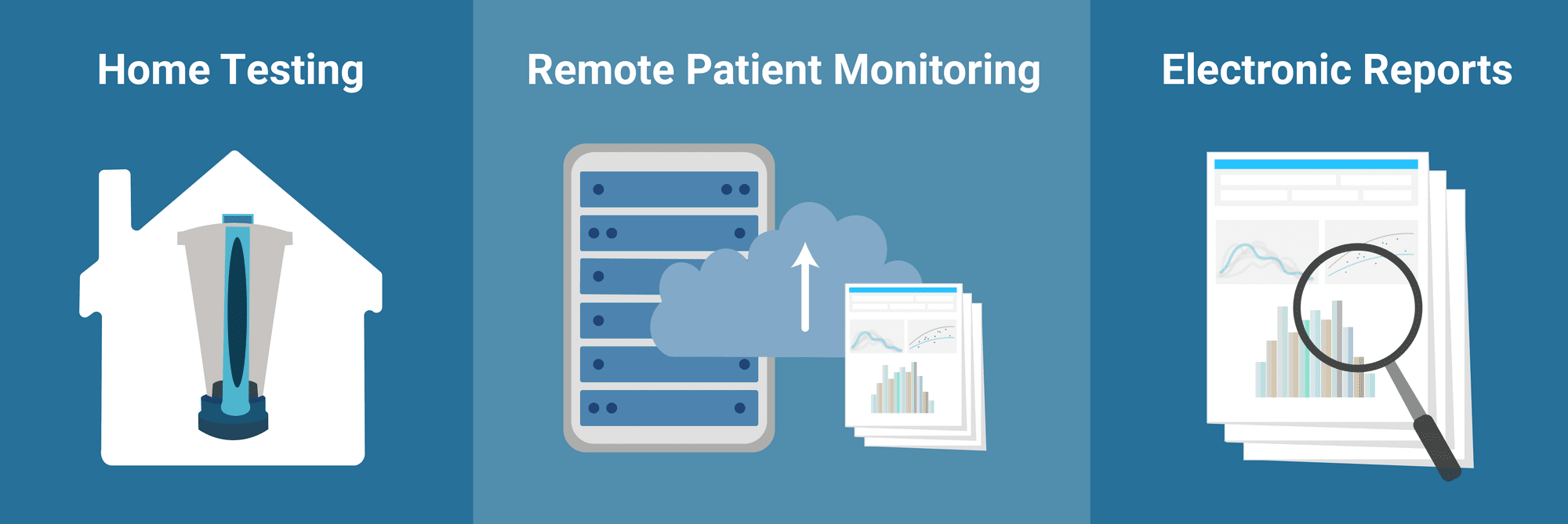

Stream Dx enables the doctors to perform uroflow testing at home

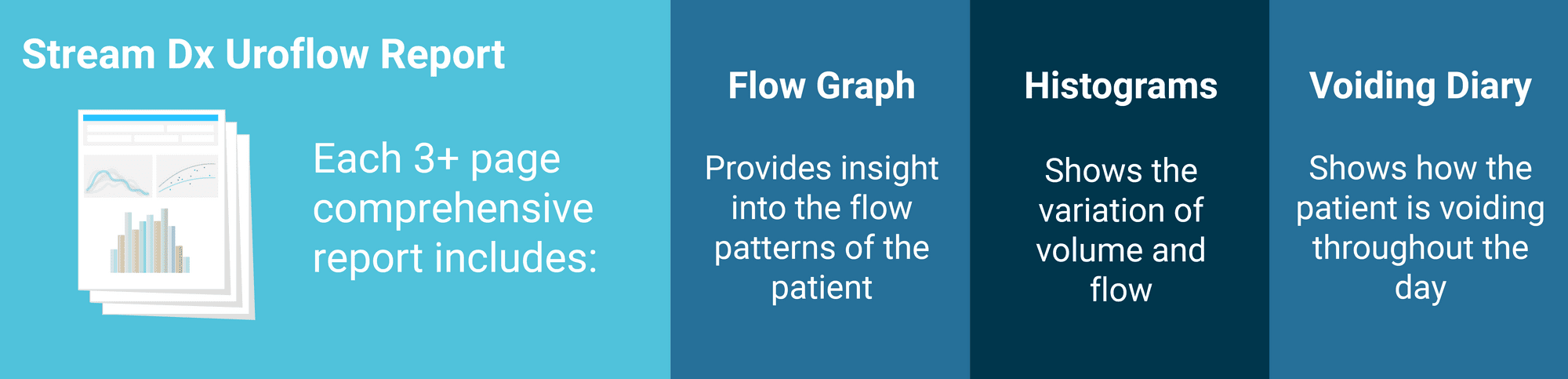

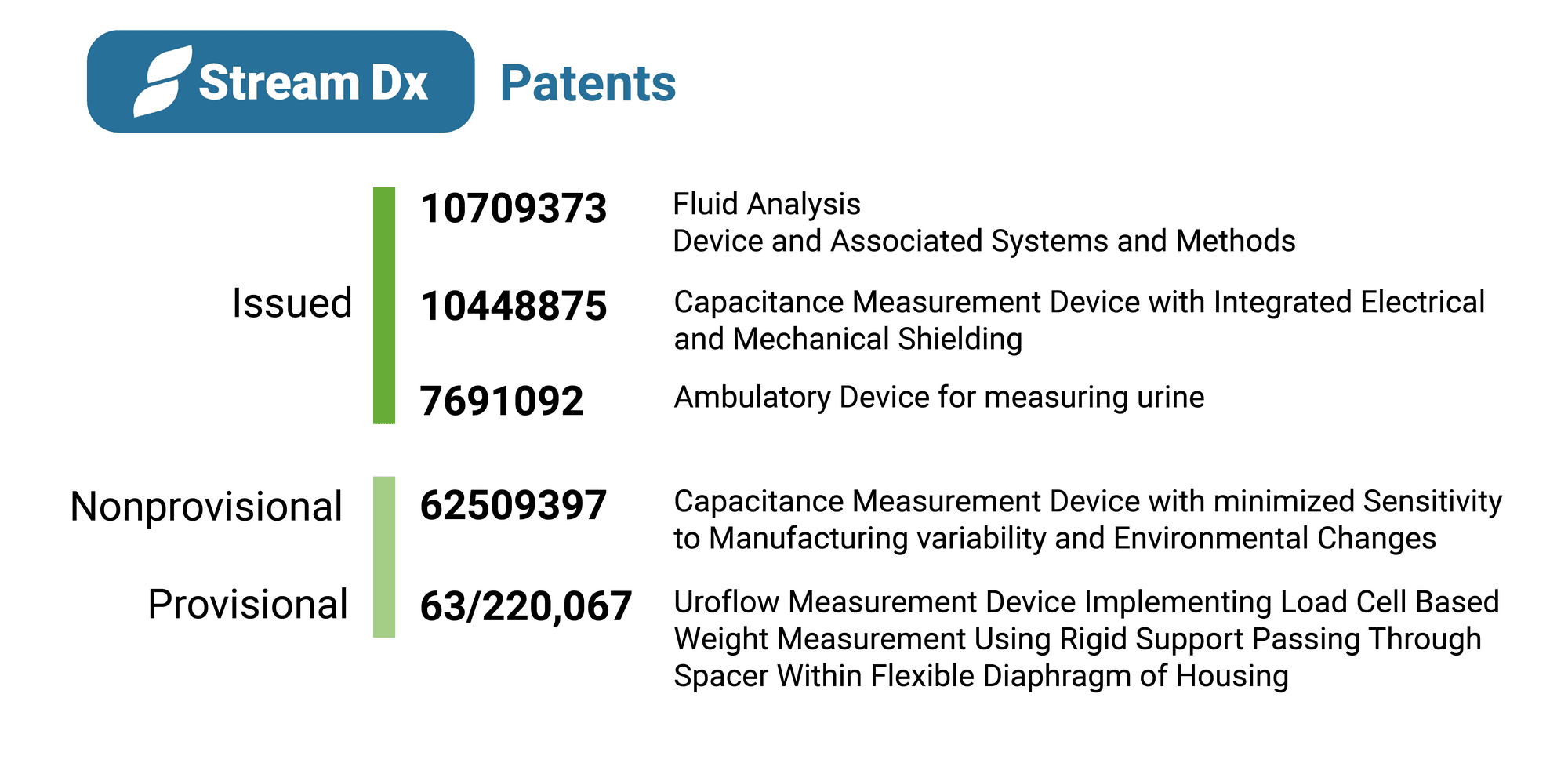

Stream Dx provides doctors the ability to offer home uroflow testing as a service. The data is collected using the Stream Dx Home Uroflowmeter, a patented, FDA registered, point of care device designed by Stream Dx to measure the flow rate, flow pattern, total volume, and time of day of urination.

Doctors like our service because we provide them with more and better data to help develop individualized treatment plans, as well as quantify the efficacy of medication therapies and surgical procedures.

The need for the Stream Dx Home Uroflow Service is even more relevant today, as Medicare and other insurance companies place more emphasis on Telehealth and Remote Patient Monitoring.

Product

Stream Dx allows for data collection from the comfort of one's home

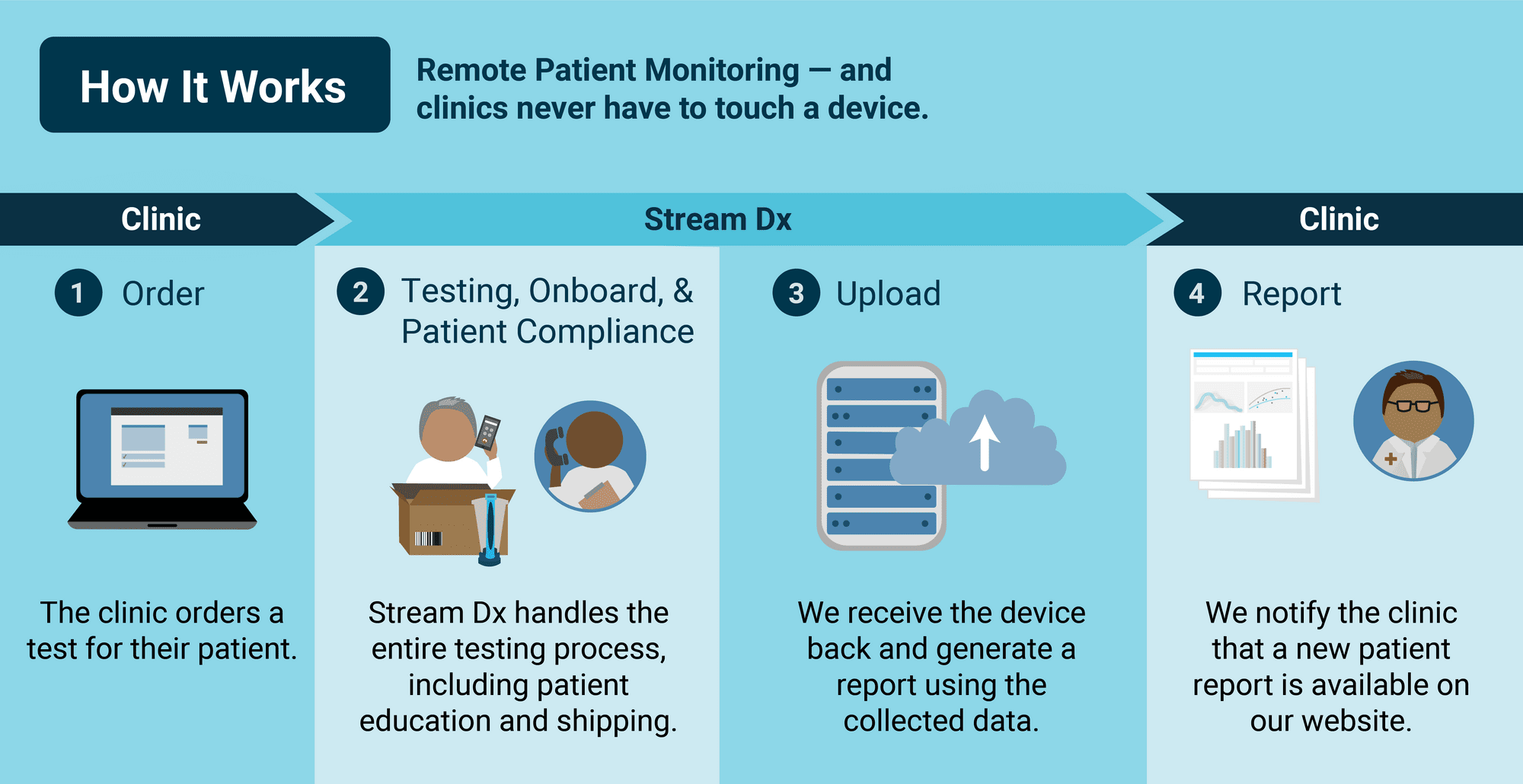

Our home uroflow testing service improves clinic workflow because the doctor and their staff never have to handle a single device. The only thing a doctor has to do is order the test and then review the results once available.

We handle the entire testing process, including contacting the patient to go over instructions, shipping the device to the patient, following up with the patient to ensure compliance, and generating a detailed report for doctors to review.

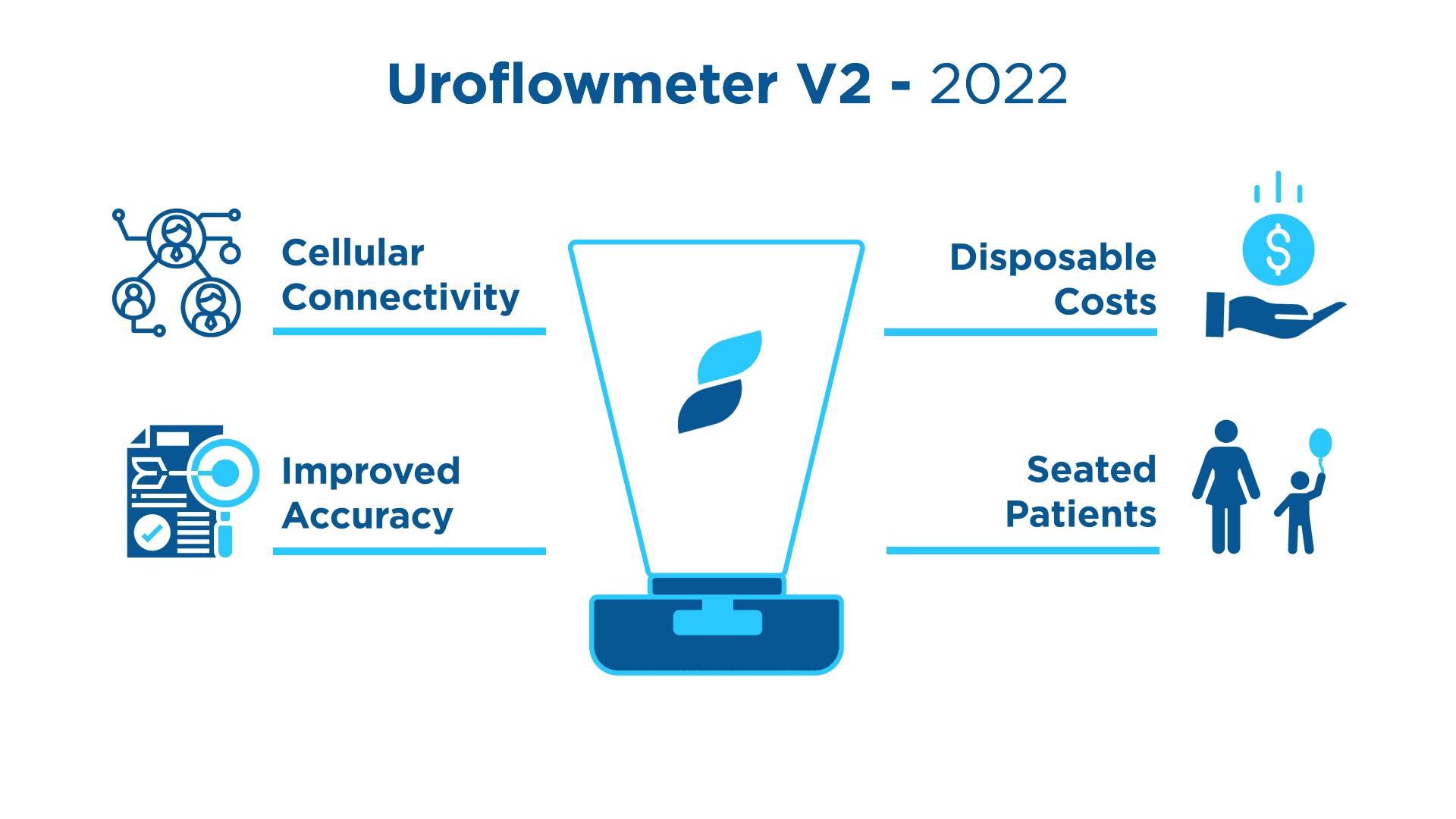

We are always improving our home testing service. We will introduce Version 2 of our Uroflowmeter in 2022. The new design will allow us to enter into new segments of the LUTS markets.

Traction

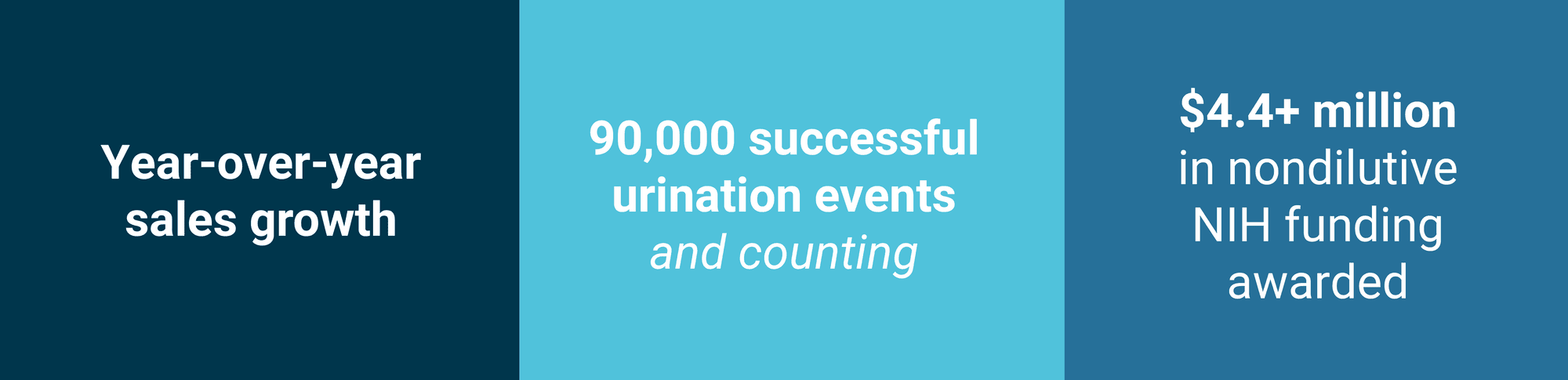

YoY sales growth, and recipient of 2 NIH grants worth $4.4M+ combined

Stream Dx generated $21K in revenue in 2019 and $91K in 2020.

Patients have successfully recorded over 90K urination events using the Stream Dx home testing service.

Stream Dx has been awarded $4.4M in nondilutive National Institute of Health (NIH) SBIR grants to cover R&D expenses for the development of our Version 1 and Version 2 Uroflowmeters. Both grant awards were scientifically and commercially peer reviewed.

Customers

More data. Less hassle.

Stream Dx handles every step of the data collection process, so physicians can focus on delivering quality care to their patients.

Business model

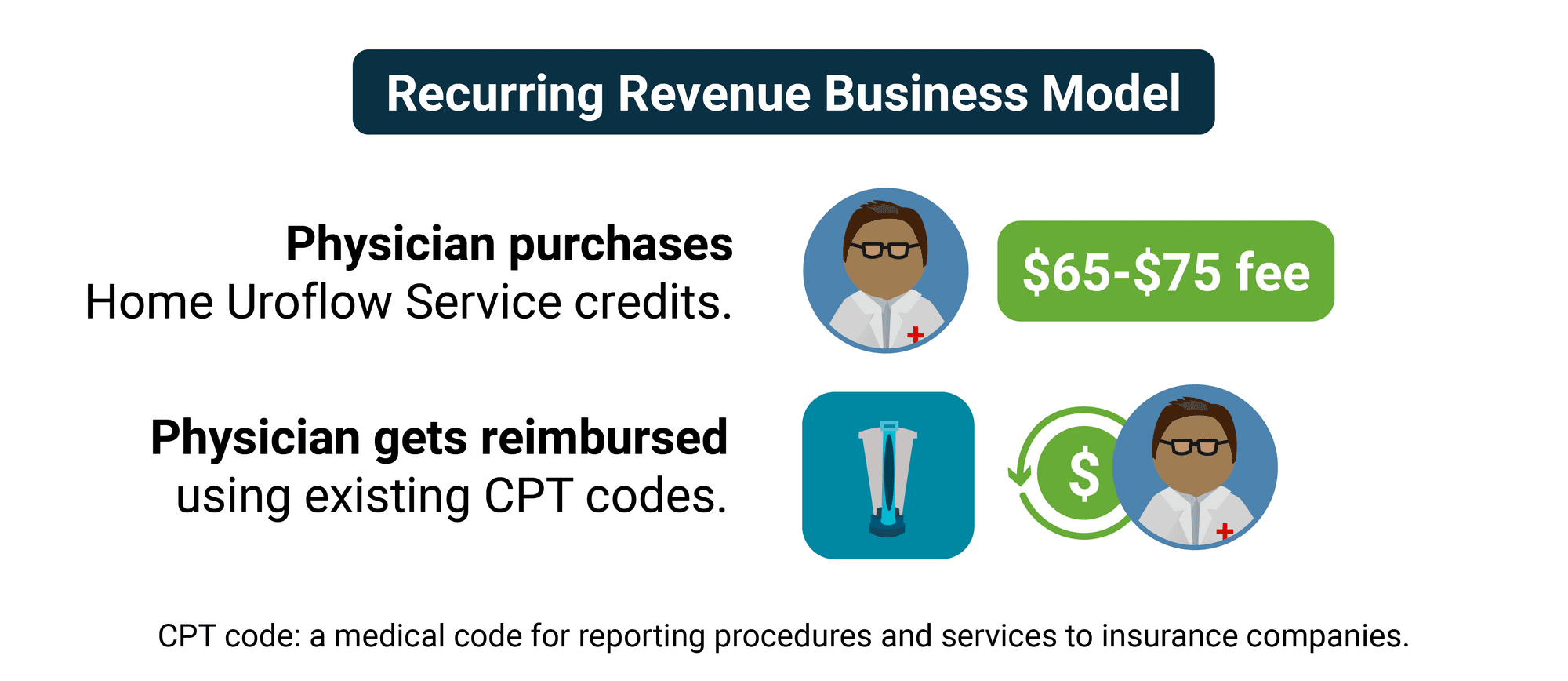

Recurring revenue fee-based service model

Stream Dx’s business model is a recurring revenue fee-based service model. Stream Dx generates income by charging physicians a fee of $65-$75 per use of the Home Uroflow Service. A physician purchases Home Uroflow Service credits, which are used each time a test is ordered.

Market

Over 1B males suffer from LUTS worldwide

Stream Dx is initially focusing on the $250M US male LUTS market. We will roll out our home uroflow testing service to targeted states over the next two years. We also plan to enter into the addressable worldwide male LUTS market consisting of over 1B men.

Competition

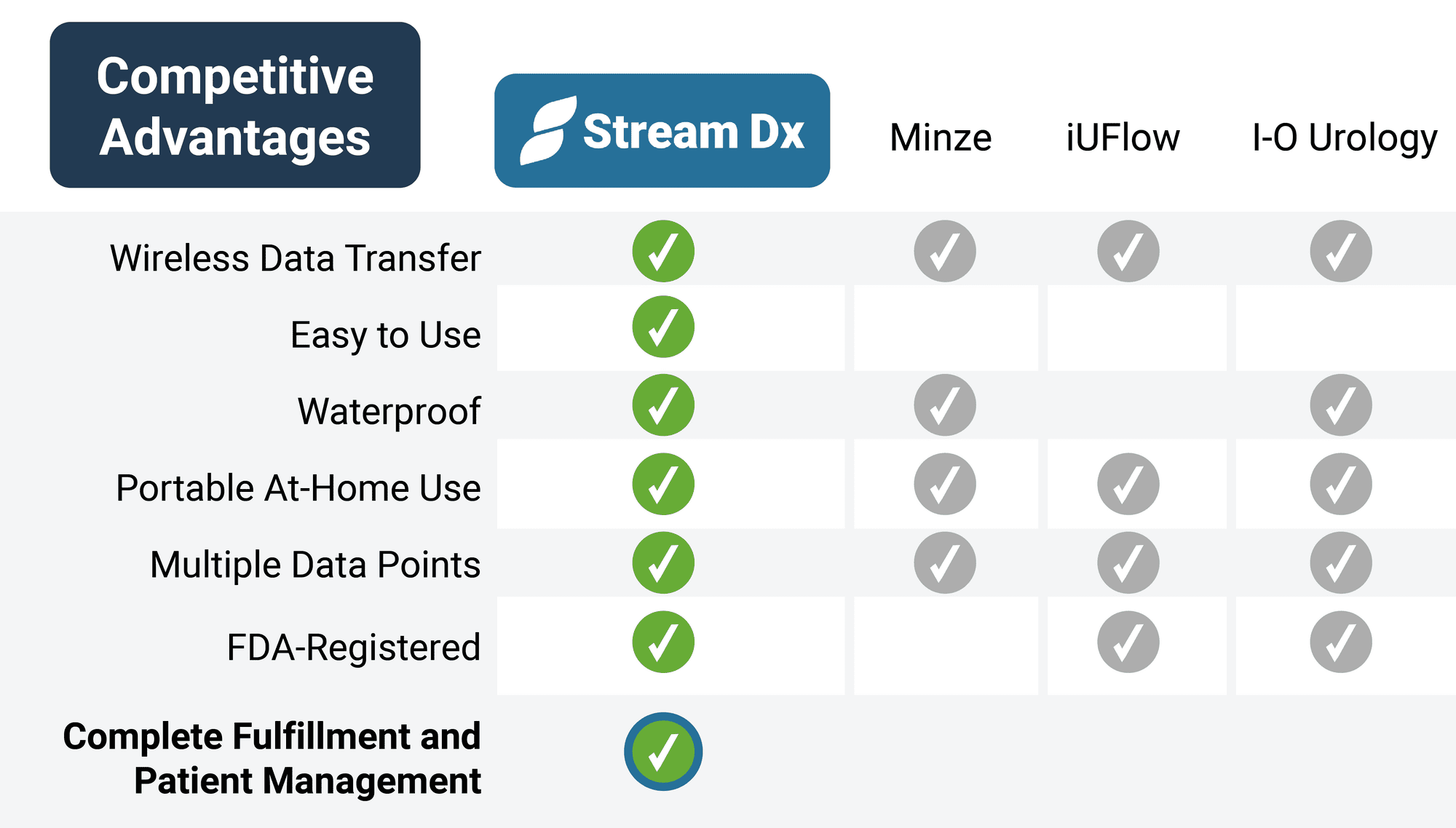

Best in class performance

Stream Dx is currently one of the only FDA-registered, at-home urinary testing products available in the U.S. Unlike our competitors, we provide complete fulfillment and patient management services.

Vision and strategy

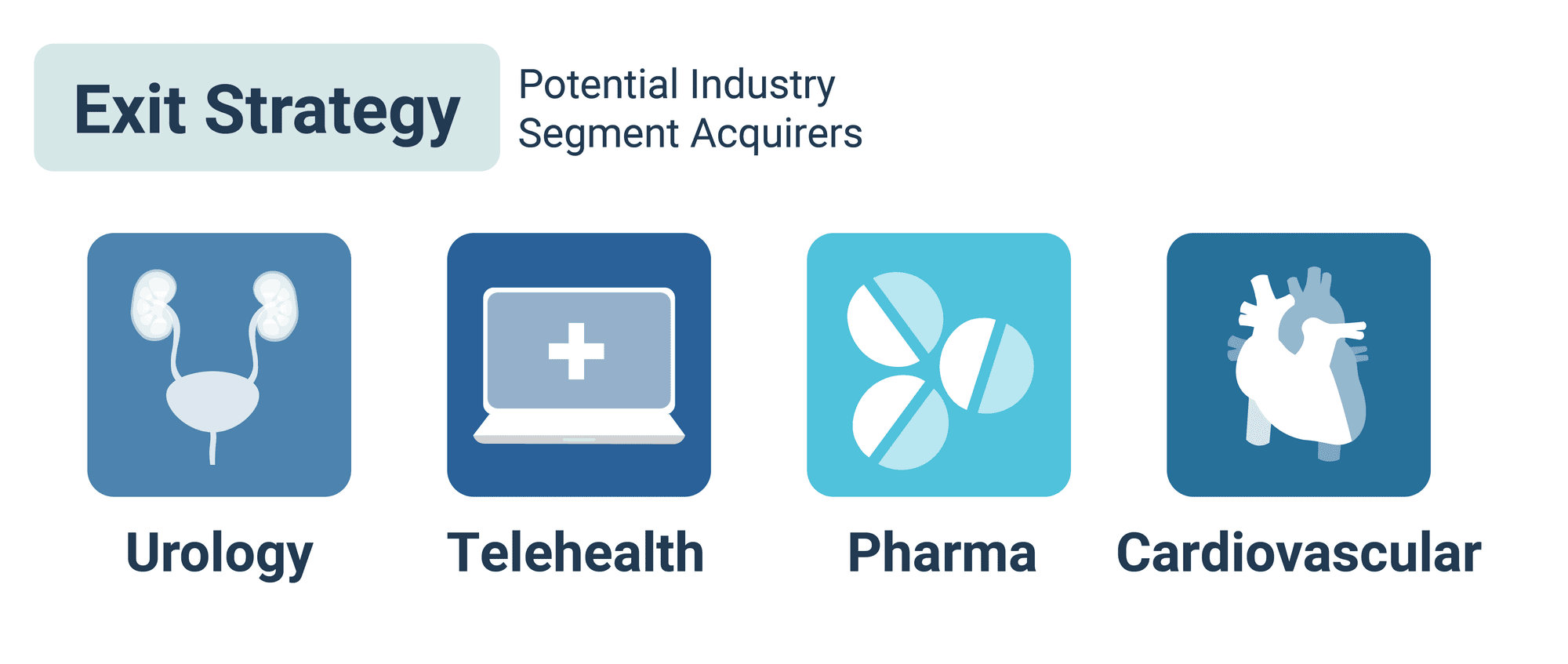

Plans to exit within 5 years

Stream Dx is planning a possible exit in the next 3 to 5 years. We have identified four market segments that both have a use and a need for our service.

Funding

$1.9M raised from accredited angel investors

In addition to our grant funding, Stream Dx has raised $1.9M from accredited angel investors, urologists, and founders.

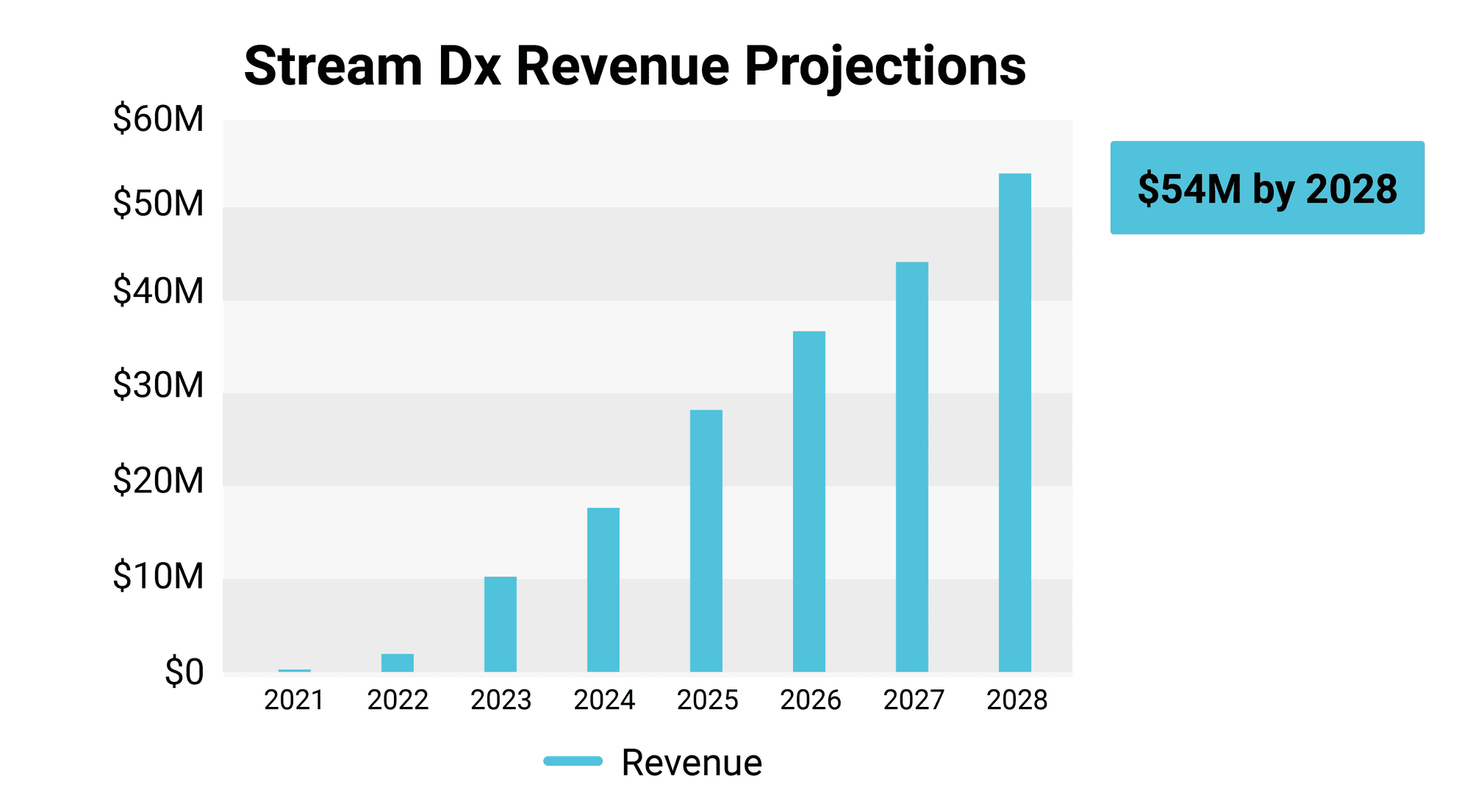

We are now raising funds to scale our sales and production to meet our revenue projections.

We are now raising funds to scale our sales and production to meet our revenue projections.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...