In recent weeks a VISA card made by blockchain company has been grabbing headlines across major crypto publications. Thei...

Problem

Banking system technology is 50 years old

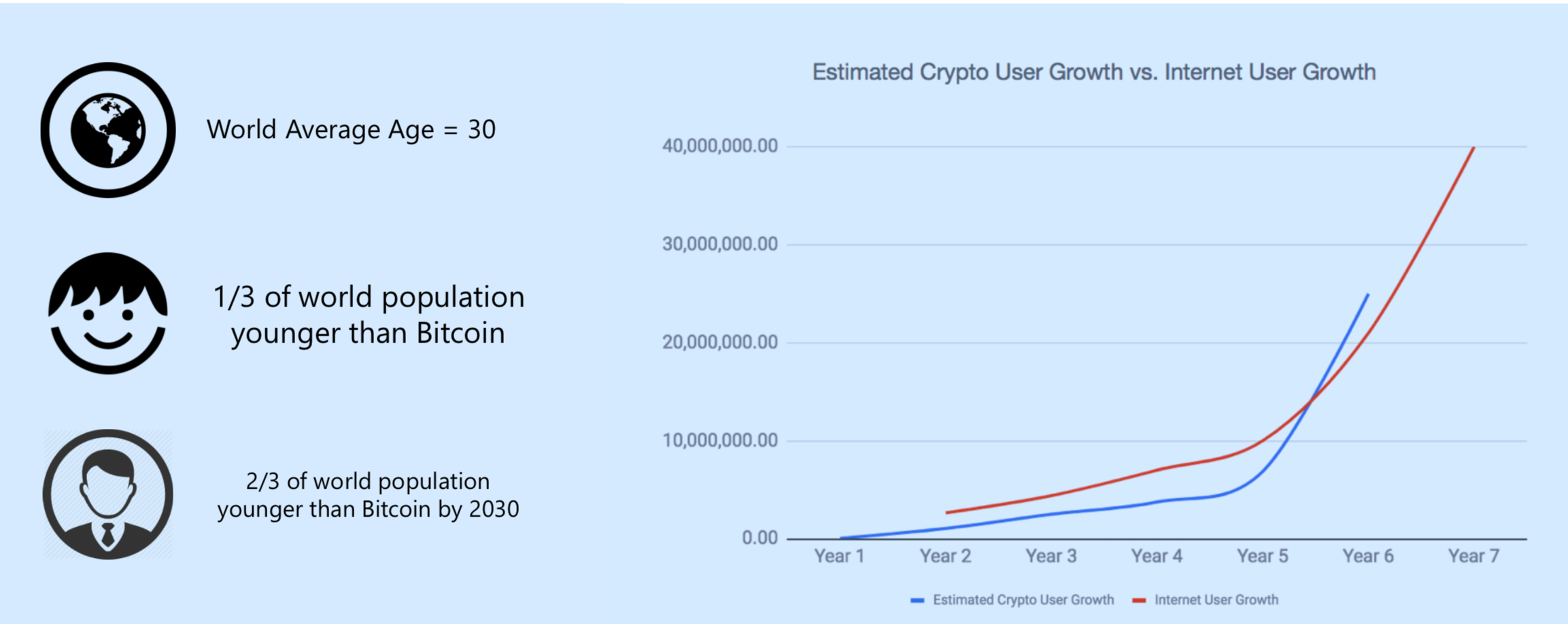

The banking system is slow and expensive. Cryptocurrencies give people control over their own money in a way that was never possible whether for cross border remittance or just sending money to friends any day of the week. The problem is that it’s challenging to use cryptocurrencies in the real world i.e. Wal-Mart doesn’t accept cryptocurrency. The number of people using cryptocurrencies doubled in 2018 and is very much in line with the growth of the internet in the 90’s.

BUT... cryptocurrencies can be confusing, complicated and are lacking interconnectivity with the real world. The next generation of blockchain technology companies will need to provide tools for users that make for a seamless and easy to use experience.

People need to be able to interact with cryptocurrencies in the same convenient way they interact with traditional payments systems. More importantly, there will need to be products that allow for an indistinguishable convergence of the crypto and banking systems side by side in one easy to use platform.

Solution

The platform to move money instantly

Ternio provides white-label products to enterprise customers giving blockchain and cryptocurrency real world application.

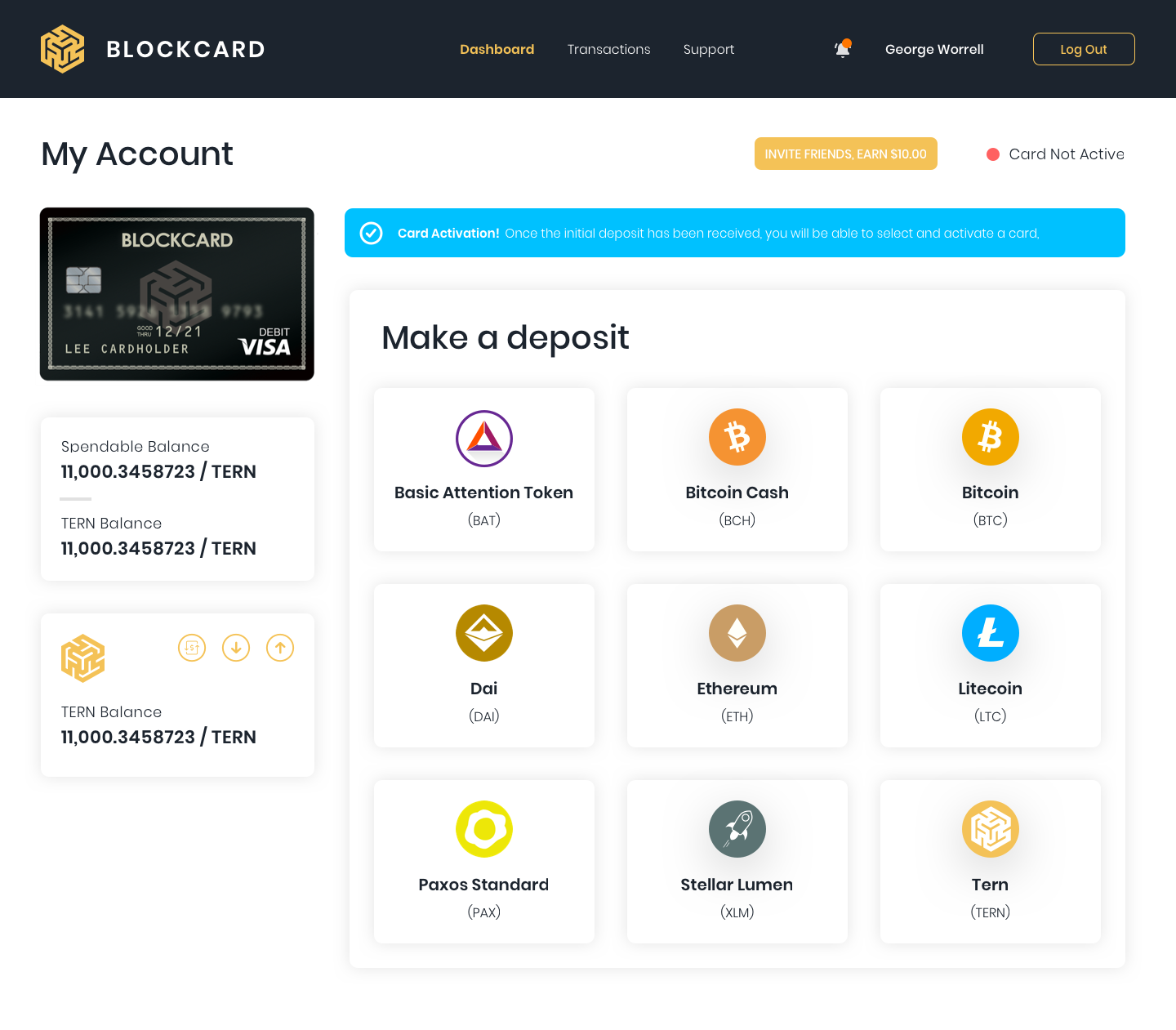

BlockCard allows people to buy what they want with crypto at over 50 million merchants that accept VISA; however, the BlockCard platform is more than just a crypto debit card. It’s an evolving suite of tools that makes it easier, faster, and more convenient for users to purchase cryptocurrency and use it in their daily life.

Today, the BlockCard VISA debit card is the most efficient way to make a purchase with crypto or convert crypto to cash at ATMs. Within minutes a user can create a BlockCard account, deposit 12+ cryptocurrencies in 1 transaction, pass KYC, and immediately get a virtual card to use while a physical card is mailed to them.

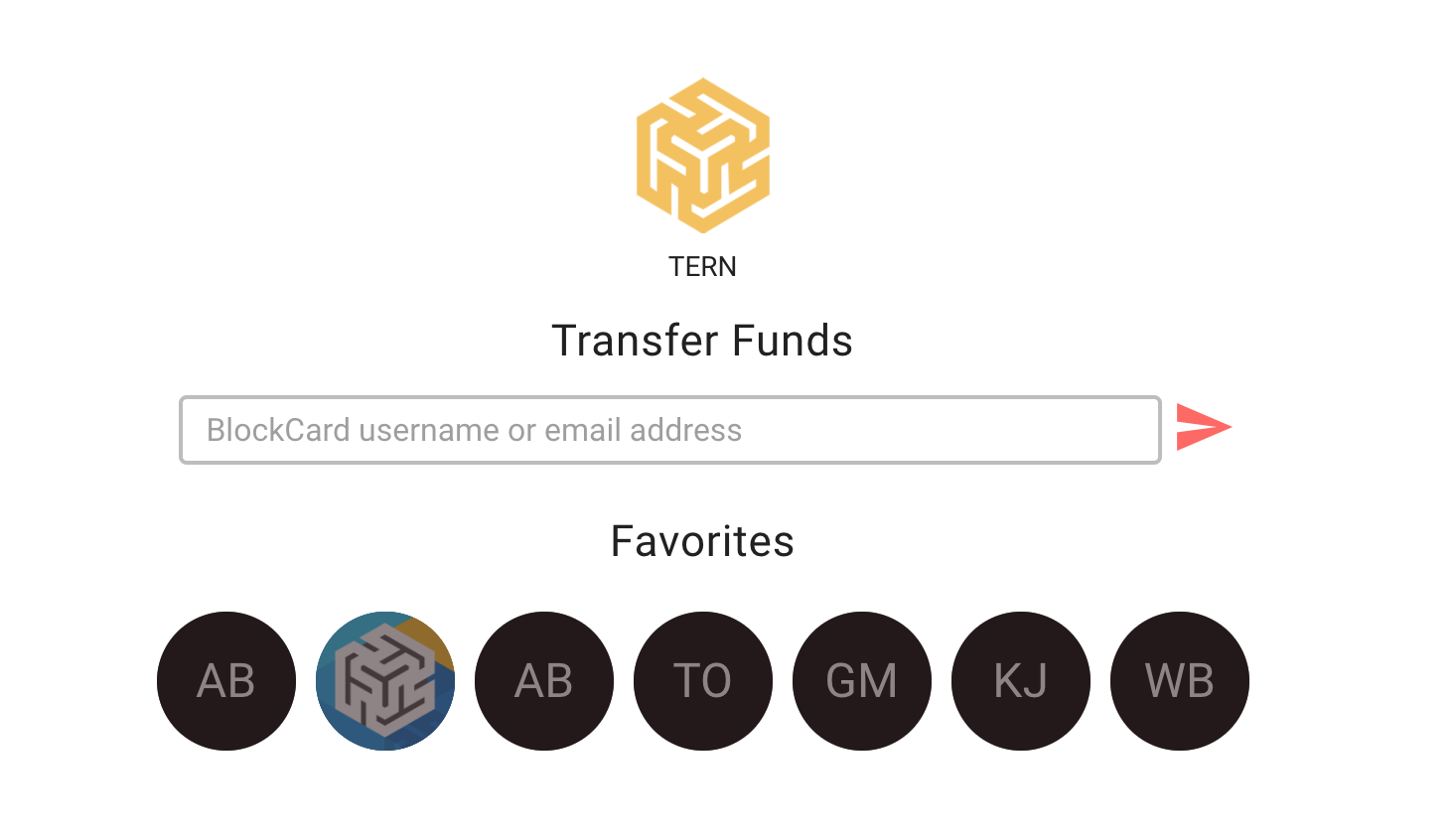

Our platform also enables anyone to send funds anywhere in the world with just a username or email address (even if they don’t have a Blockcard account already).

Example: A chinese exchange student is studying in the United States and needs money to buy books or meals. Cross border payments take time, but with BlockCard, a family member could send funds via their email and that student can get a virtual BlockCard in minutes. No more waiting days to receive funds or paying pricey exchange rates.

Try BlockCard now! Republic Exclusive: Use this link to Get $10 free with your first deposit on BlockCard

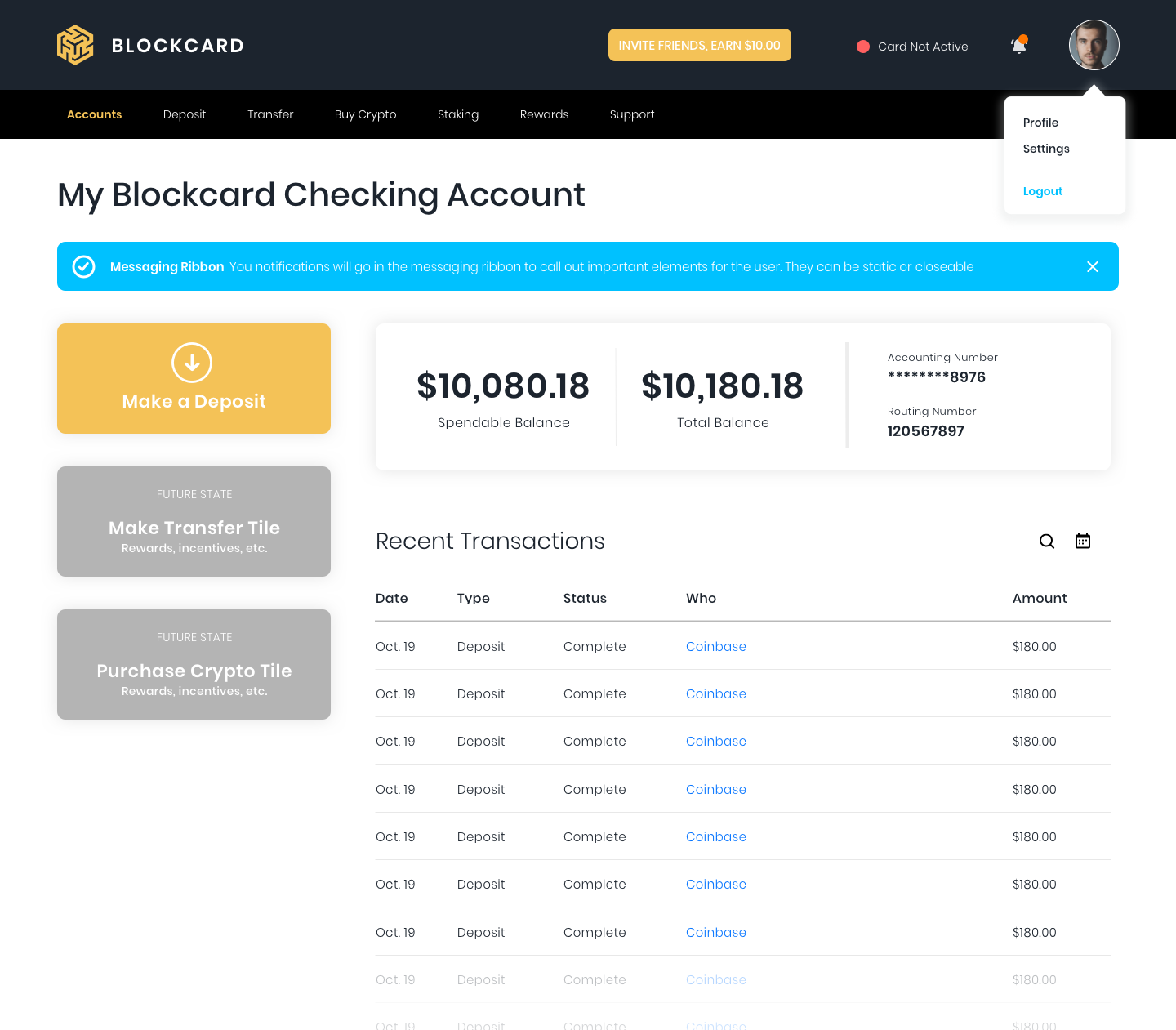

In the near future - Ternio intends to offer virtual checking account functionality. A user’s BlockCard account will connect to both a VISA card and also an FDIC insured checking account that enables users to purchase cryptocurrency with FIAT currencies. This will provide a full on-ramp and off-ramp for BlockCard users to get in and out of cryptocurrency quickly and easily!

Product

US residents can start using Ternio’s platform right now by registering for a BlockCard!

- Register at GetBlockCard.com ($10 Bonus for Republic Visitors).

- Make a cryptocurrency deposit over $100

- Fill in your KYC details and you will instantly get a response (no waiting!)

- On passing, you will immediately get a virtual card to use while your physical card is mailed to your address!

Ternio already has bank partners who support residents in 31 European countries as well as non-US and UK sanctioned countries. Ternio intends to support BlockCard functionality in a majority of countries in the world in the next 6 months!

Important! Ternio’s business model is white-labeling our platform for other companies (not only have BlockCard as a brand). This is why companies like the Litecoin Foundation have partnered with Ternio to get all the great features seen on BlockCard but designed in the look and experience that Litecoin Foundation wants. As Ternio rolls out new features like checking accounts paired to BlockCard VISA, the Litecoin VISA card will get those same great features!

Ternio’s opinion is that the best way to drive crypto mass adoption is to let all cryptocurrency companies participate and win!

Traction

BlockCard

Ternio already has tens of thousands of BlockCard users and is on track for over a 600% user growth in the first year of operation. There is strong demand for a cheap and fast off-ramp that still gives the user the option to stay in crypto.

White-label Partners

Our white-label partners continue to grow with over 11 partners signed and many more in active discussion. Based on our existing signed whitelabel partners - we’re projecting tens of millions of users in the next few years. Some of the partners below we can share, while some prefer to remain confidential.

Litecoin Foundation & BiBox Exchange

Maxwell StableCoin by Medsis

finance.yahoo.com/news/medsis-announces-launch-maxwell-stablecoin-131600789.html

Midas Protocol and Vinex

blog.midasprotocol.io/midas-vinex-partner-with-blockcard/

Cornerstone Global Management

And 7 other partners

Customers

BlockCard Customers

Social media

|  |  |  |

Videos

White-label partners:

“Bibox has always positioned ourselves as being on the forefront of crypto adoption,” said Aries Wang, Co-Founder of Bibox. “By partnering with the Litecoin Foundation and Ternio we are able to leverage Bibox’s robust exchange platform to help bring consumers more options to spend cryptocurrency with unprecedented ease”.

“This is an exciting partnership for us as it furthers the Litecoin Foundation’s mission to create more use cases for spending Litecoin in everyday life,” said Charlie Lee, creator of Litecoin and Managing Director of the Litecoin Foundation. “Leveraging Ternio’s BlockCard platform with Bibox’s exchange engine gives Litecoin holders unparalleled access to use their LTC at merchants around the world.”

Dr. Alex Nguyen, Midas CSO commented: "We are happy to collaborate with Blockcard to contribute to greater adoption of cryptocurrencies and to access to new markets through the partnership."

Business model

Ternio shares in all fees generated from the users who interact with our platform either through BlockCard or our white-label partnerships.

Monthly Subscription:

Monthly Subscription Fee : $5.00 unless you spend $750 or more (then it's free!)

PIN Transaction Fee (Domestic) : $1.00

PIN Transaction Fee (Int’l) : $2.00

ATM Cash Withdrawal Fee (Domestic) : $3.00

ATM Cash Withdrawal Fee (Int’l) : $3.50

ATM Balance Inquiry Fee (Domestic) : $0.50

Card Fee : $10.00 (plastic) / $50.00 (metal)

Card Replacement Fee : $10.00 (plastic) / $50.00 (metal)

Account Closure/Balance Refund Fee : $10.00

*Fees are subject to change at any time.

Interchange Fees:

Credit card companies like VISA have negotiated interchange fees with merchants. These typically range between 1-3% of the consumer’s purchase. Ternio shares in these interchange fees that the merchants pay, so as the spend increases on the platform, the total revenue generated from fees does as well.

Future Fees:

There are several additional revenue streams we expect to have as part of our roadmap as we release products such as virtual checking accounts, buying/selling cryptocurrencies, and financing. Our strategy is to focus on product innovation, user experience, direct response marketing and competitive pricing to drive growth and profitability.

Market

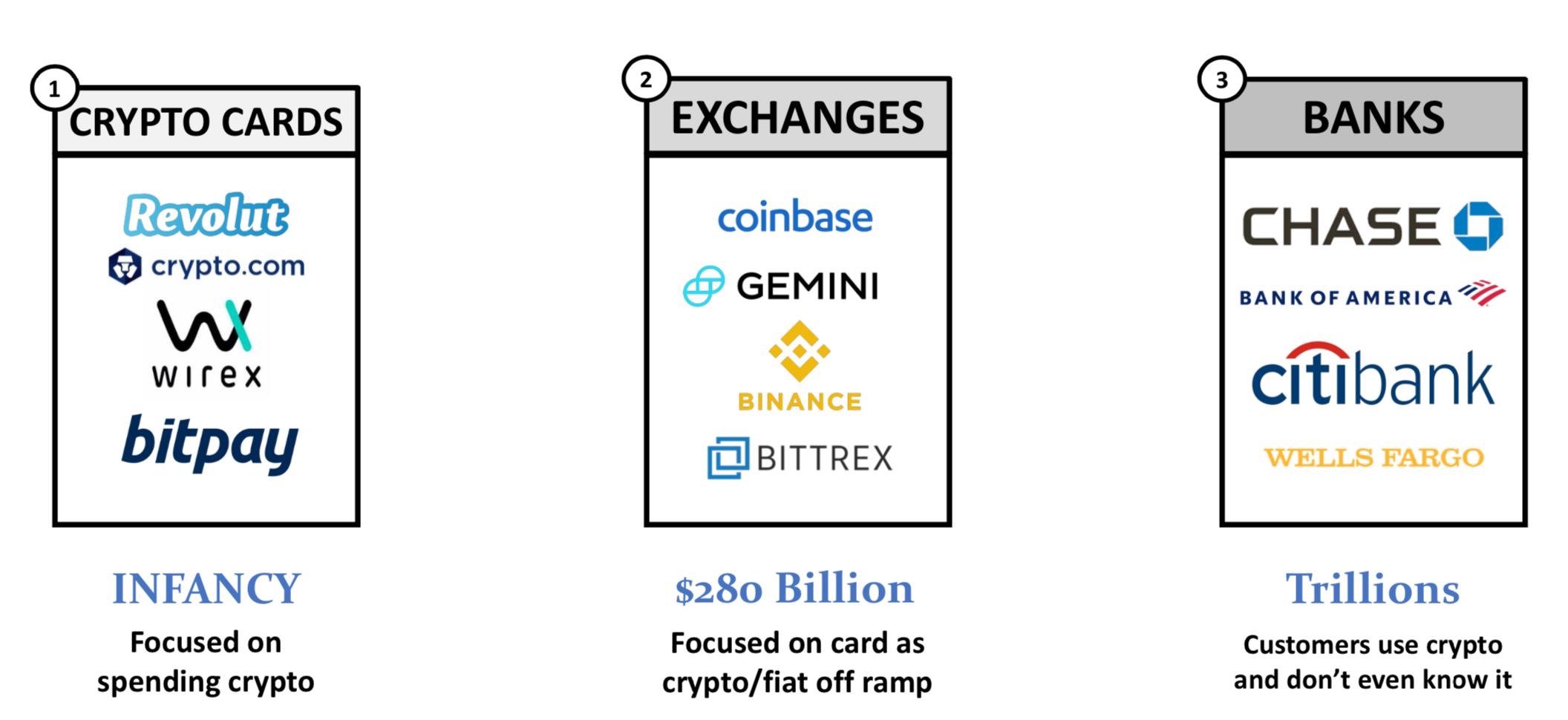

This is asymmetrical warfare and the opportunity size is in the trillions

We are taking the antiquated ACH or SWFT payment system that is closed loop and opening it up to the blockchain rails - where payments are cheap and fast.

Cryptocurrency adoption is rapidly increasing (hitting almost $700b in 2017) but the market is still in its infancy. In order to get the next 200 million people interacting with crypto, they needs tools that they are familiar with - like BlockCard.

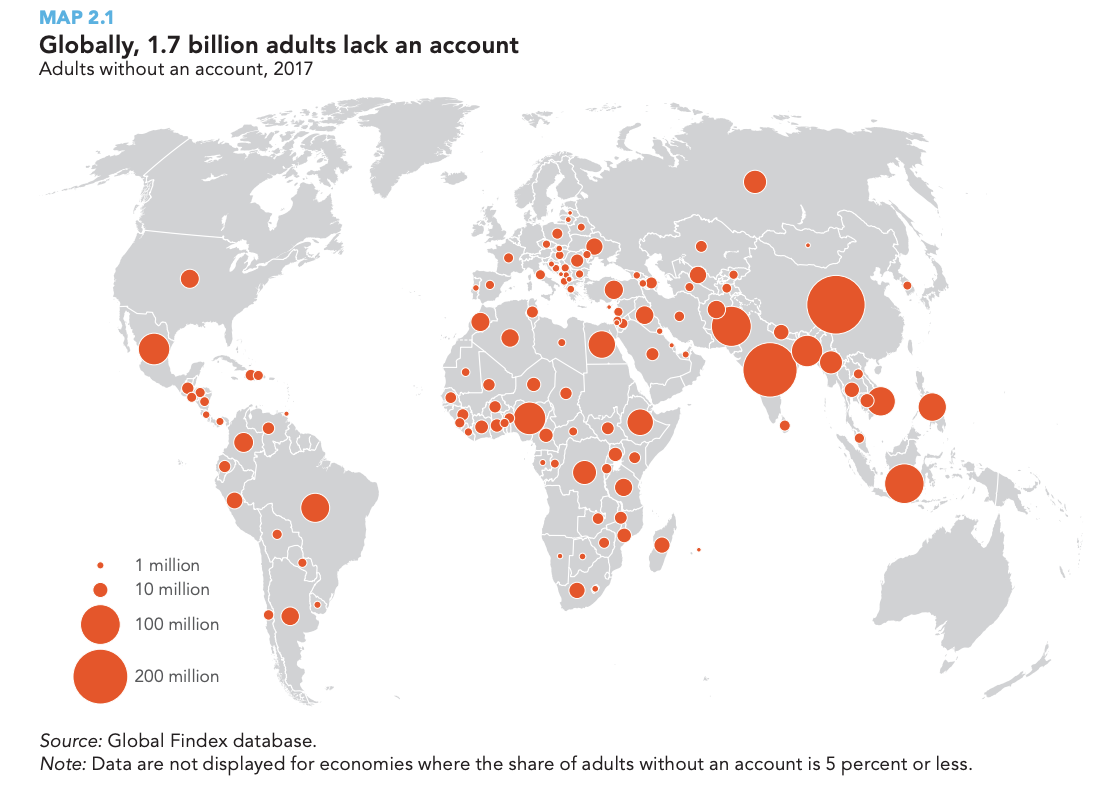

According to the WorldBank, 1.7 billion adults remain unbanked, yet two-thirds of them own a mobile phone that could help them access financial services.

Sources:

Competition

Today, Ternio's BlockCard is compared against other crypto card companies, but we see our longer term vision as more competitive with Revolut. London headquartered Revolut last raised $250m in early 2018 at a valuation of $1.7b. Revolut is a digital banking alternative that includes a pre-paid debit card, currency exchange, and peer-to-peer payments.

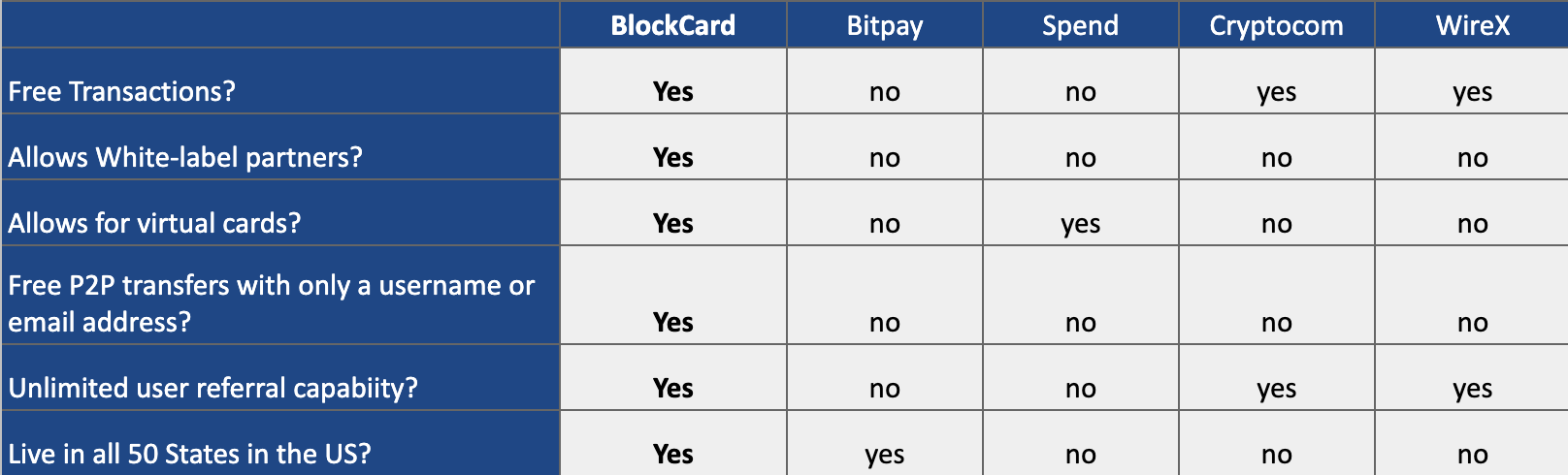

However, here is how BlockCard stacks up against today's card alternatives.

Vision and strategy

With a successful raise on Republic we have aggressive plans to scale our team and accelerate the deployment of many other features that are currently in the works. Our funds would be focused around marketing, product development and adding staff.

Launch platform to on-board residents in 31 European countries

Launch platform for “Global program” that reaches as many as 150 countries

Redesign of BlockCard dashboard for better user experience

Offer a metal version of BlockCard physical debit card

Release Apple/Google/Samsung pay support of BlockCard

Release virtual checking account features paired with VISA card

Open up “buy crypto” portal enabling users to purchase cryptocurrency

Offer loans to users with BlockCard accounts, making it a full credit card

Offer “Crypto Back” rewards at National Retailers when using the card

Mobile app offering unique features not available on BlockCard mobile website

Funding

Outside of the two Founders — Ternio has only 1 angel investor with an investment of $300,000 at a valuation of $15,000,000. That is the same valuation cap that Republic investors will qualify for today, but with a 20% SAFE discount. With the exception of that investment — Ternio has grown organically.

Founders

We started Ternio almost two years ago and it's been an amazing journey. We have consistently executed on what others told us was "impossible" or would "take years" to accomplish. Through a lot of personal sacrifice, 7 day work weeks, and 18+ hour days, we have been able to get Ternio to where it is today.... BUT the best part is that we're only getting started!

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...