Universal Transit CEO George Milorava was named as one of the winners of the 2024 Pros to Know award by Supply & Demand C...

Problem

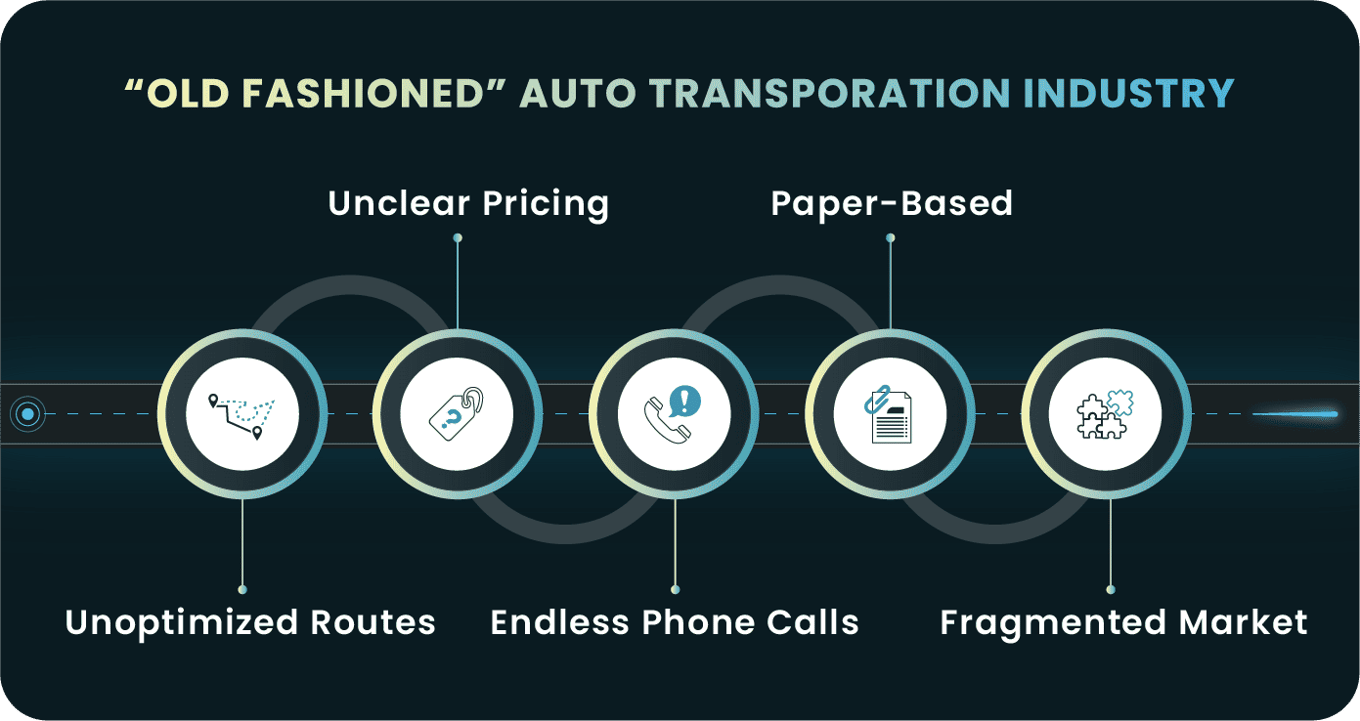

Modern Challenges Demand Modern Logistics Solutions

Trying to keep cars shipping fast, cost-effectively, and with any level of predictability, is challenging enough in conventional times. Add to that the instability and disruptions in today’s supply chain, and the challenges can appear almost overwhelming.

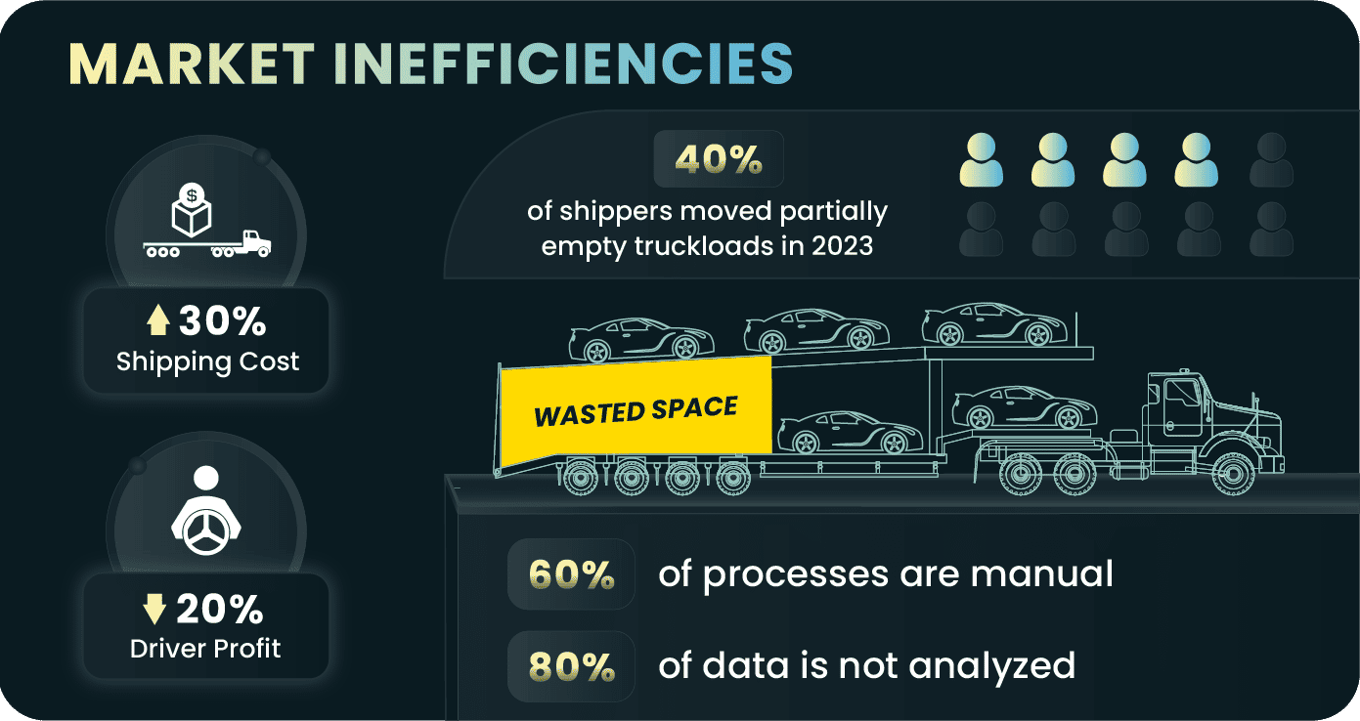

With over 40% of trucks running partially empty on each trip and billions of dollars in earnings lost yearly, it's easy to see that the auto transportation industry has a problem with utilization.

Yet, only about 20% of industry players are reaching maximum operational performance, with the remainder struggling to optimize operations and maximize profits.

Solution

Ushering in a New Era of Efficient and Profitable Auto Transportation

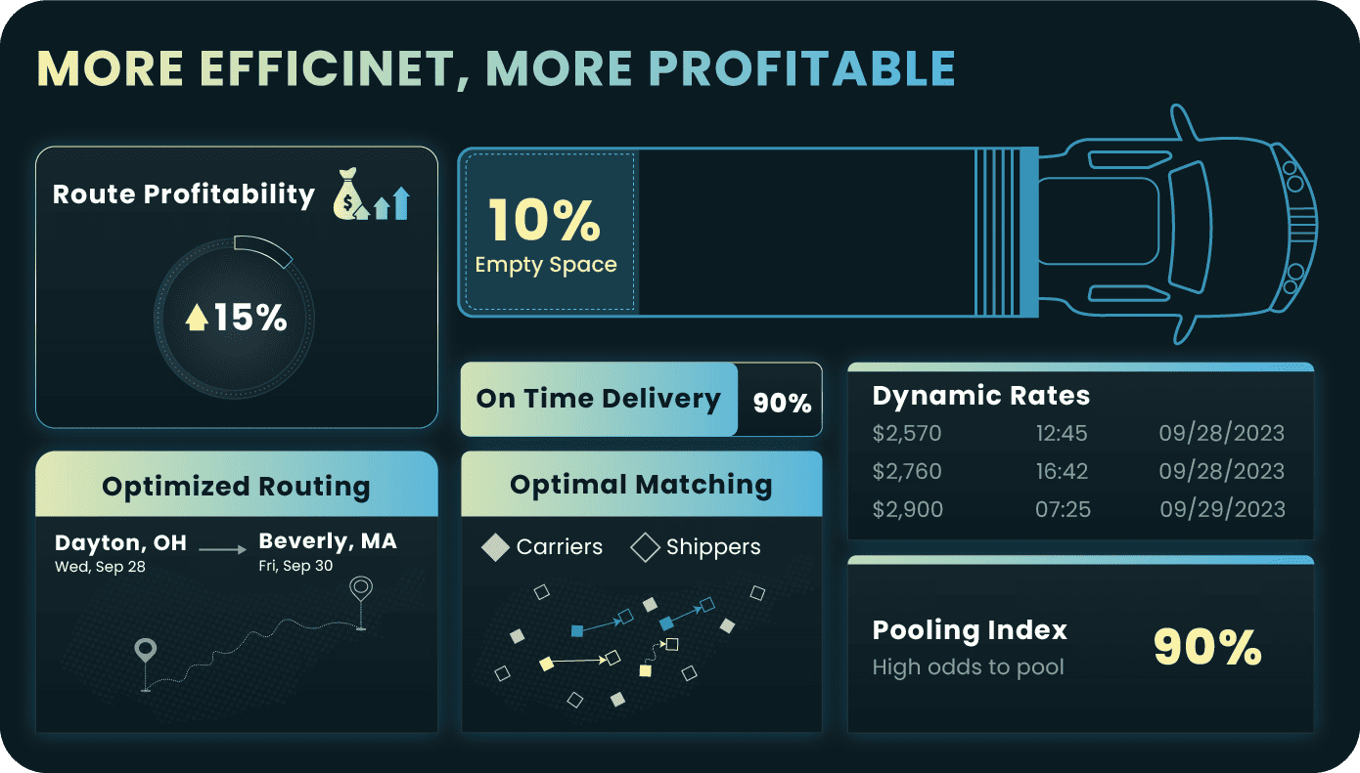

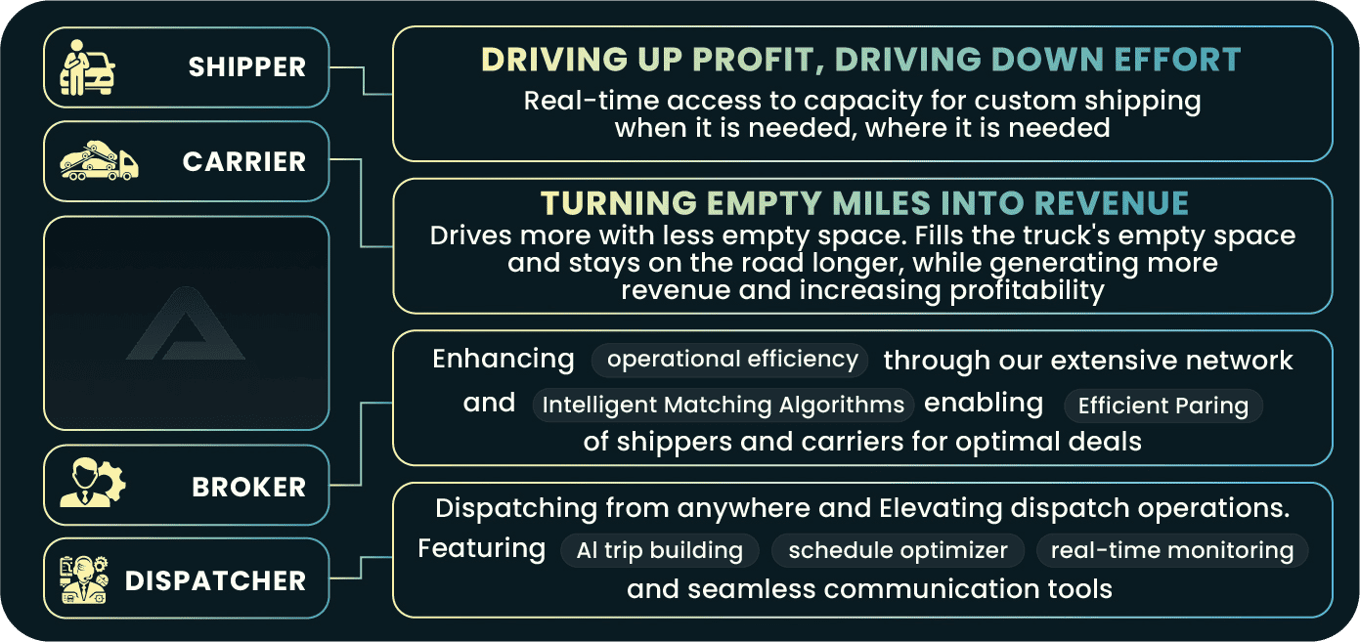

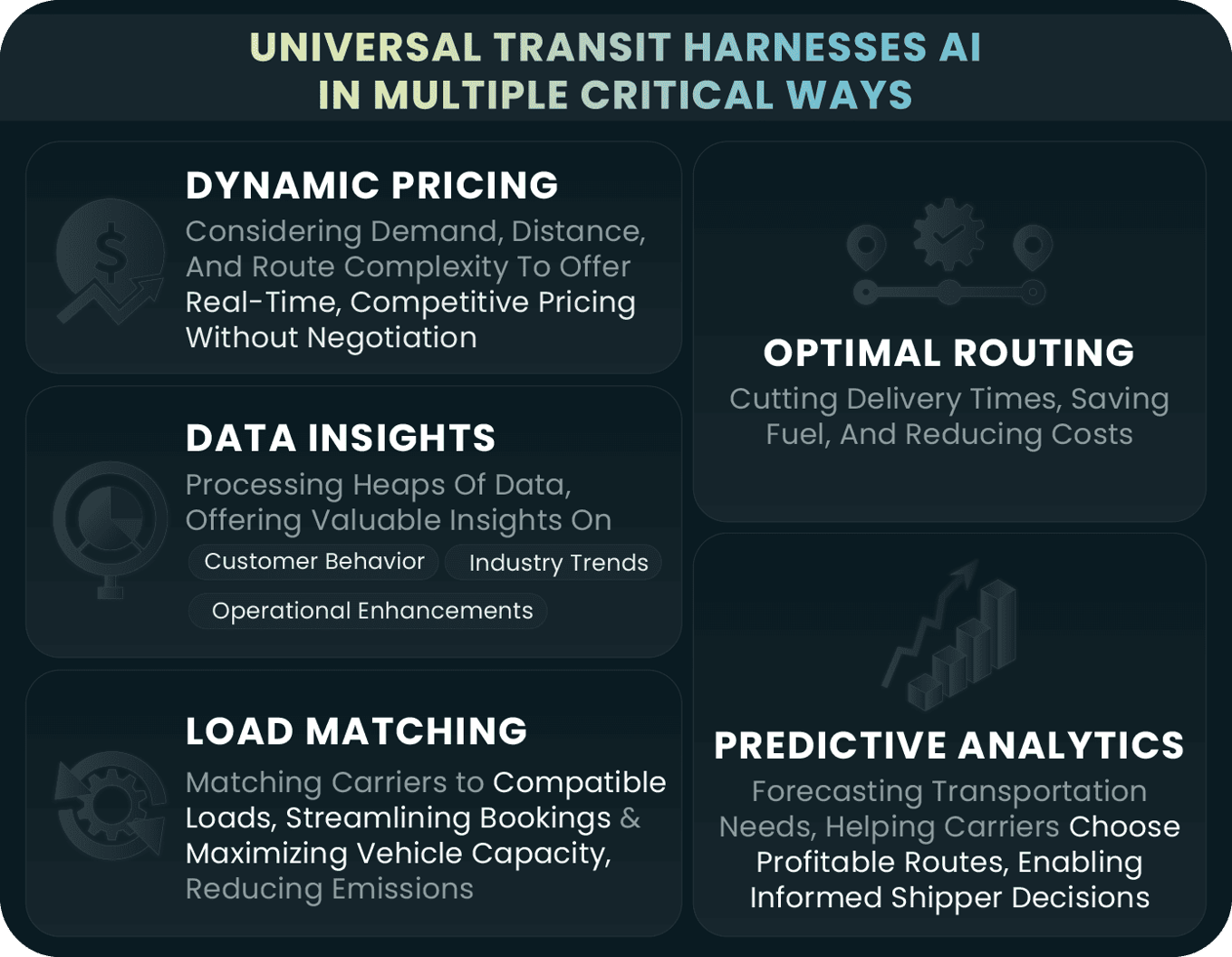

At Universal Transit, we’re combining human expertise with sophisticated machine intelligence to help our customers adeptly navigate through this dynamic auto transportation market and stay on top of this ever-changing landscape. With unparalleled market insights and cutting-edge AI solutions, we create a robust and scalable network strategy that balances immediate predictability and long-term flexibility.

Our advanced technology drives outstanding performance across all key metrics, including on-time pickups and deliveries, as well as a significantly enhanced load carrying capacity rate and route profitability.

We Make the Process Easier: Where Simplicity Meets Efficiency

Product

Tech-Driven Unified Platform

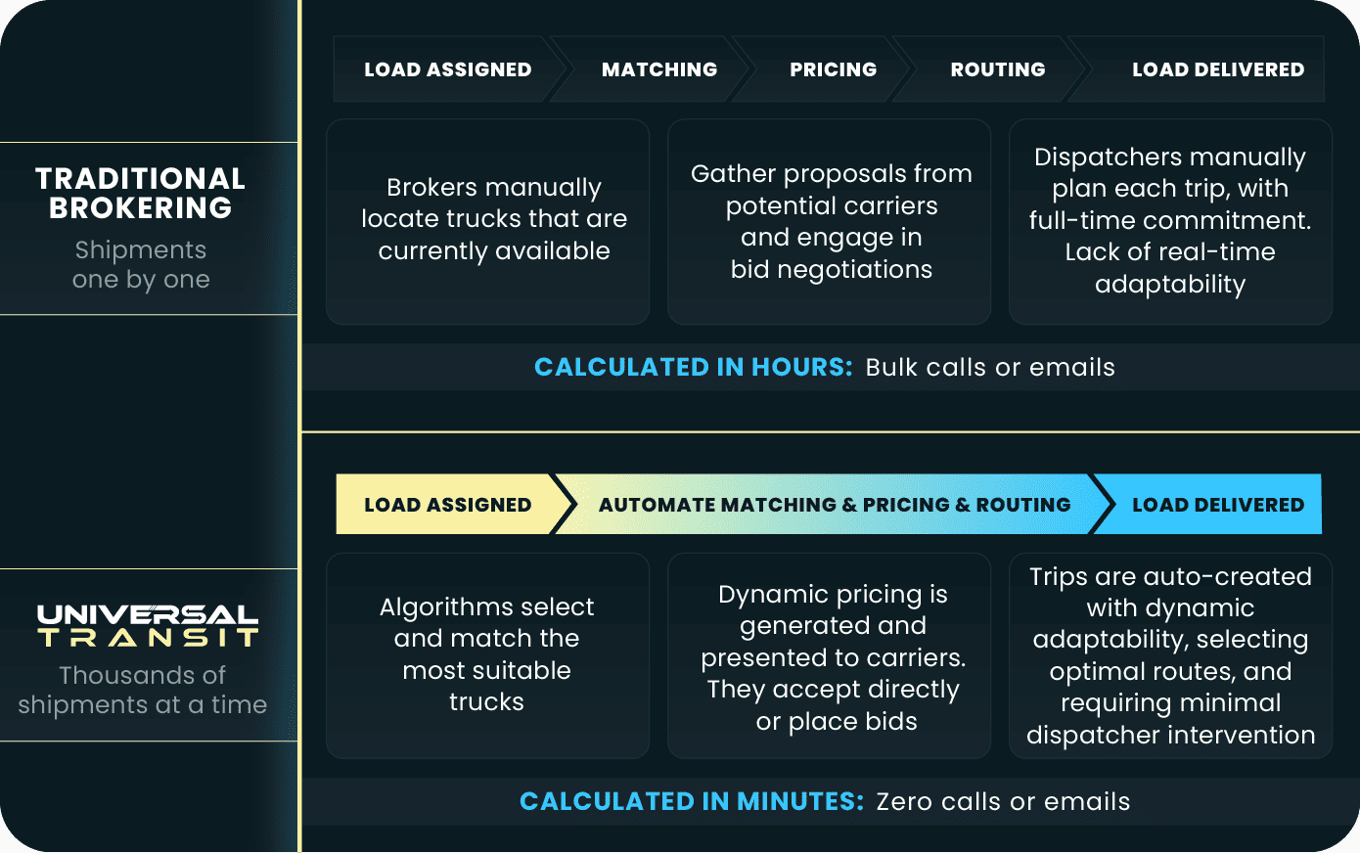

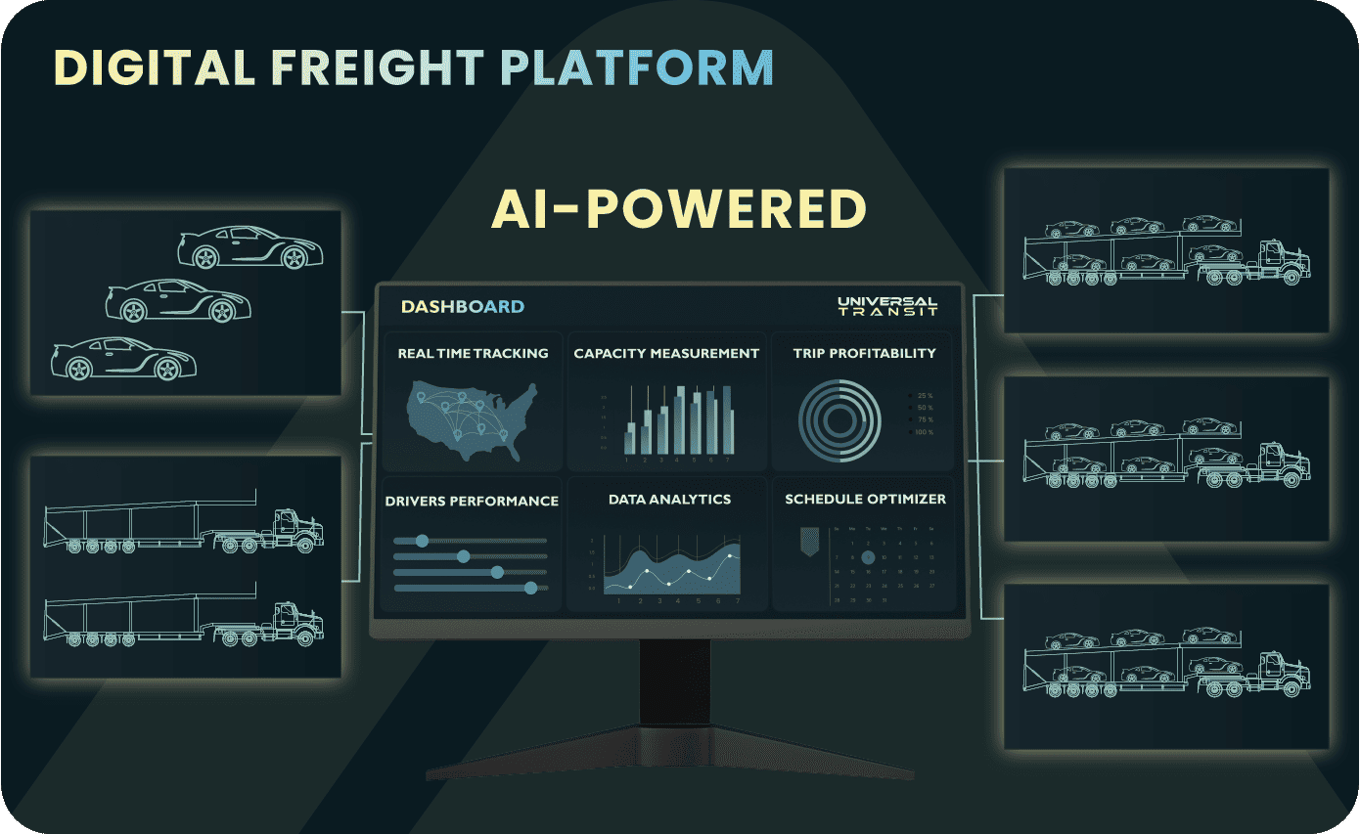

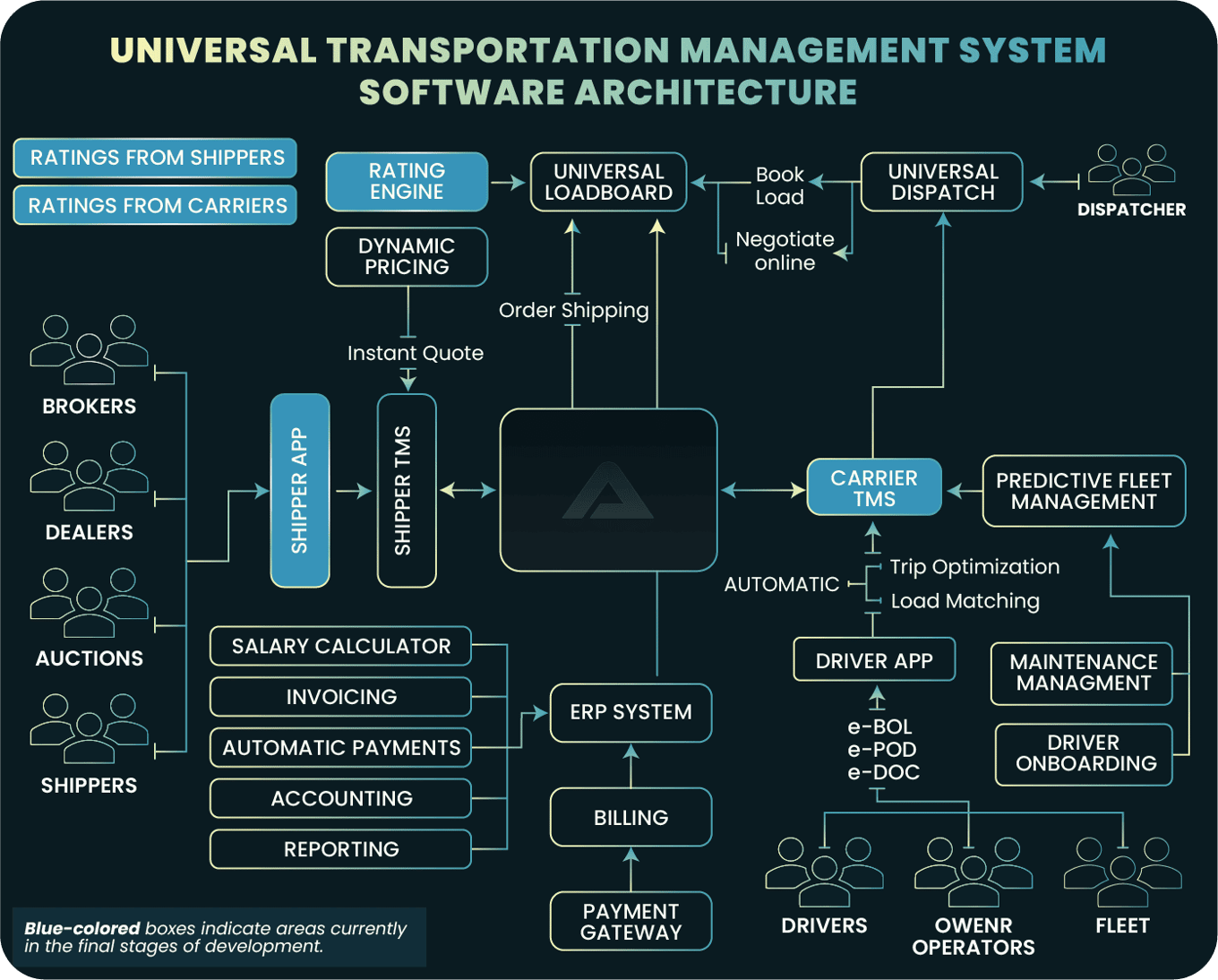

We are transforming auto transport through efficiency and innovation, achieving unparalleled operational excellence, and ensuring seamless integration within Universal Transit's unified intelligence platform.

With our many-to-many, AI-driven load matching system, dynamic pricing, advanced automation tools, and data-driven insights, our all-in-one platform is tech-empowered to elevate performance for all involved parties.

Designed to synchronize the auto transport sector, our ecosystem ties all stakeholders together, from brokers to fleet operators, ensuring seamless logistics and unparalleled user experiences.

Traction

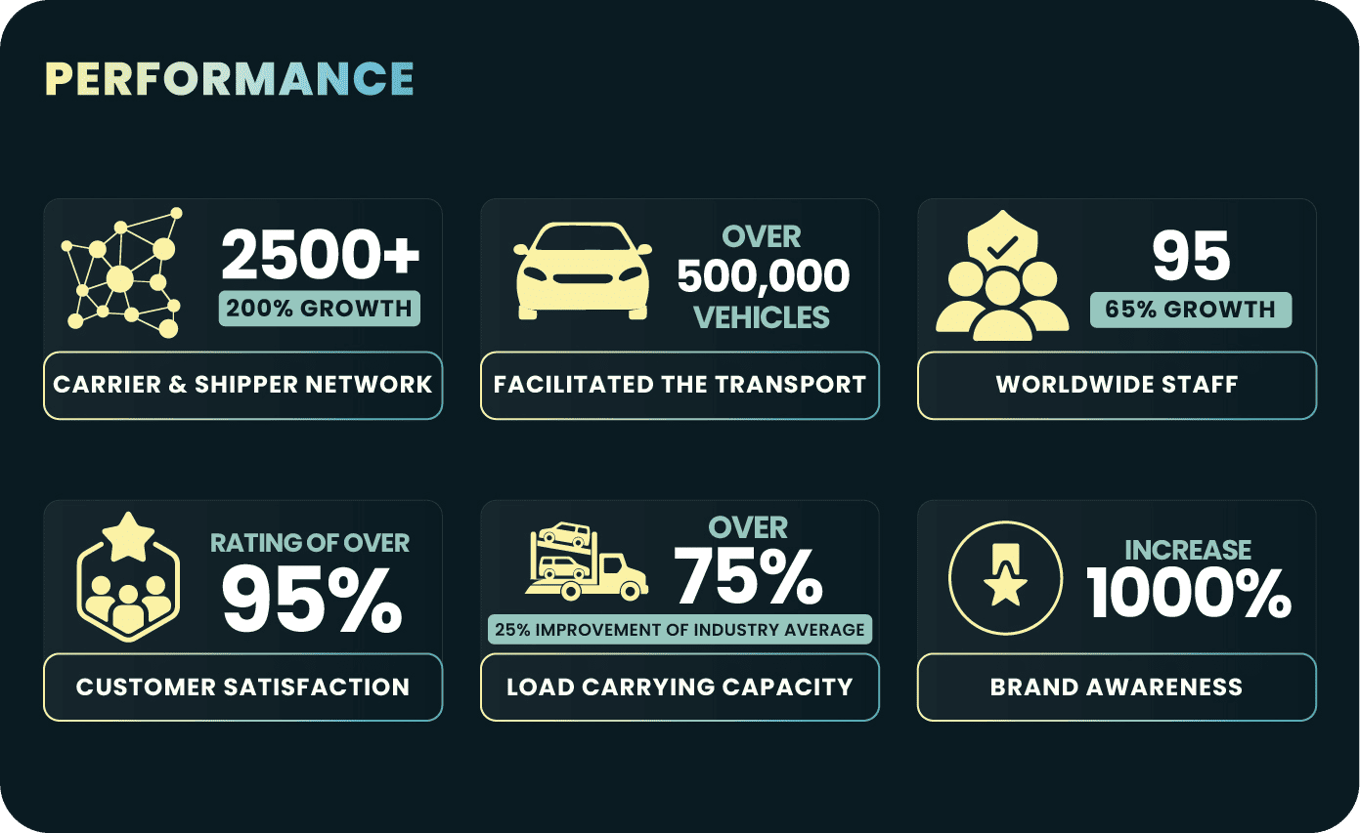

We Act, We Show, We Prove

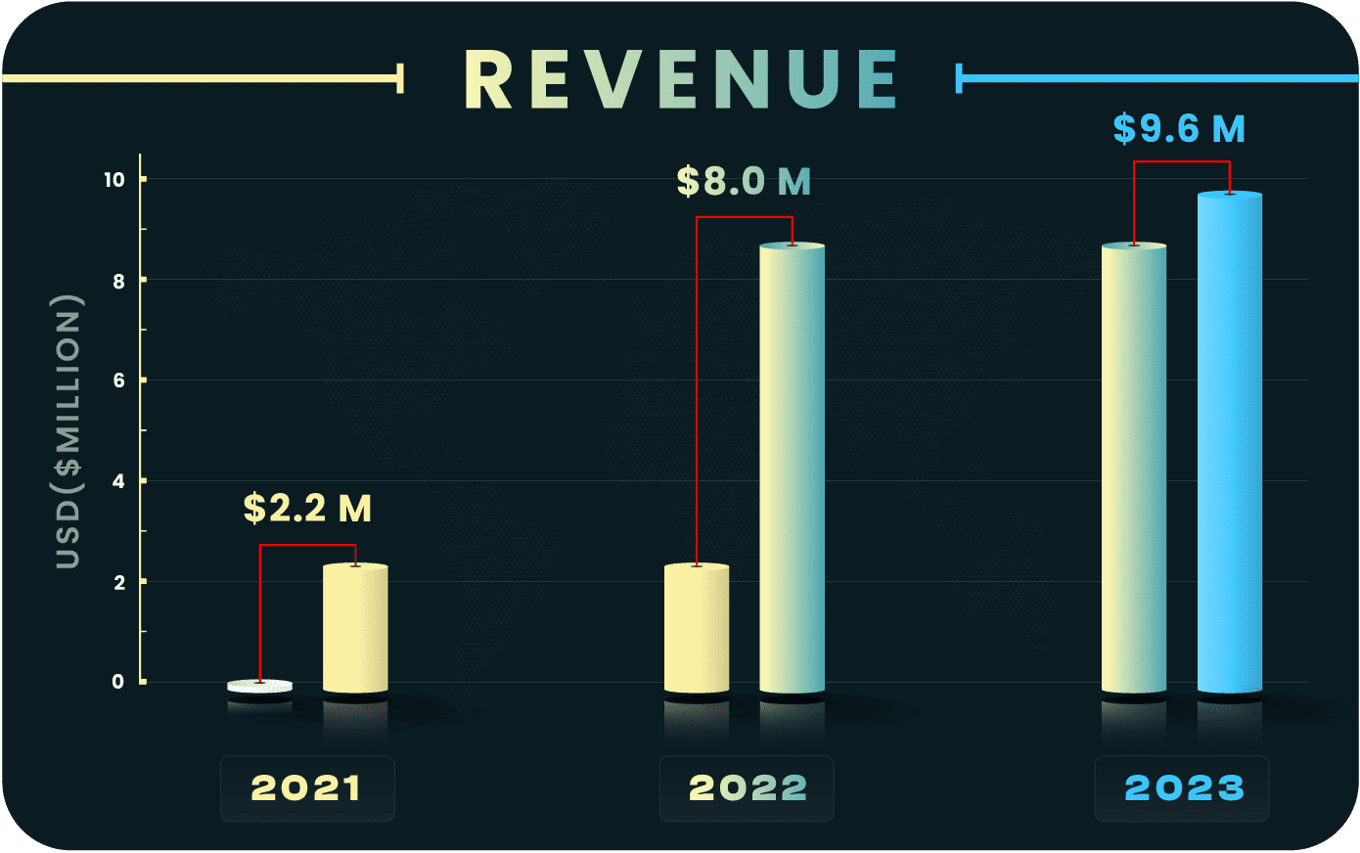

We have the demand, and we're already witnessing significant revenue growth, achieved independently without external funding.

The remarkable performance in all key metrics highlights our strategic alignment with market needs, operational excellence, and dedicated commitment to customer satisfaction.

In 2023 alone, we...

Universal Transit Named 2023 Top Tech Startup by Supply & Demand Chain Executive and Food Logistics.

This award spotlights top software and technology startups in the supply chain and logistics space, implementing tools such as AI, Automation, Real-Time Transportation Visibility and Smart Data Capture.

Business model

Hybrid Model Blends Tech & Service for Complete Transport Solutions

Universal Transit's Hybrid Model merges technology and diverse services for comprehensive auto transport solutions. Our cloud-based SaaS platform supports owner-operators and fleet owners, while our B2B and B2C solutions assist shippers in optimizing their custom auto transportation needs.

The core is a tech-based car shipping marketplace, profiting from the margin in 'buy' and 'sell' prices, alongside our trucking operations.

Additionally, our Universal Dispatch SaaS product offers a subscription-based TMS for real-time fleet and freight management.

Revenue streams include Car Shipping Charges, TMS Subscriptions, Brokerage & Carrier Management Fees.

Market

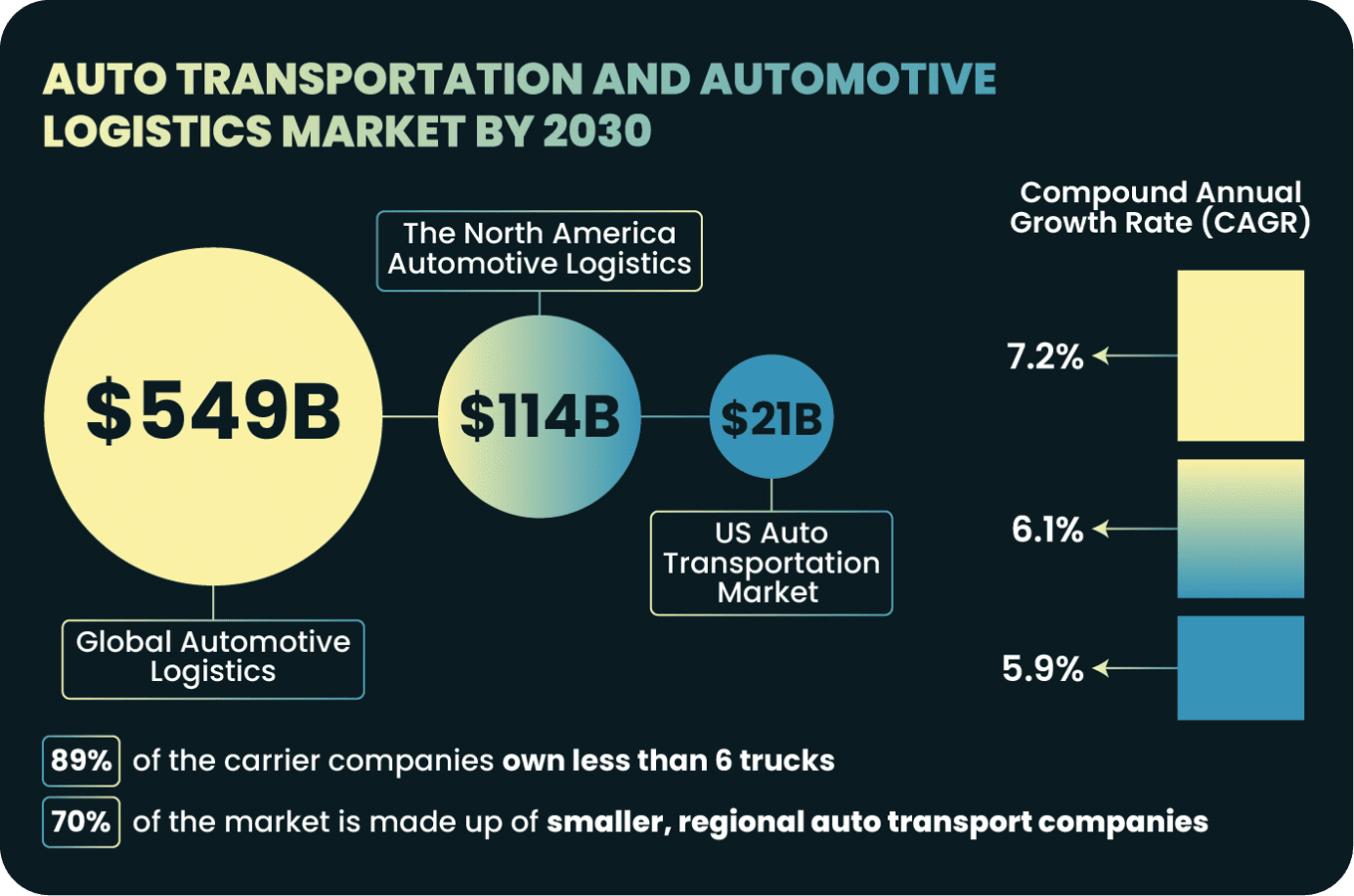

The Market is Massive and is Only Getting Bigger!

Auto transportation in the U.S. is not just a necessity but a preferred choice for many. In fact, with over 283 million vehicles registered, and 10 million new and 6,9 million imported vehicles in 2022 alone, the industry reflects a significant trend. Moreover, the vibrant used vehicle market, with nearly 40 million vehicles changing hands, underscores this preference.

Remarkably, about 75% of these vehicles are transported by trucks, indicating a massive reliance on this mode of transport in the American lifestyle.

Competition

Unique AI-Driven Tools for Shippers and Carriers

We believe we've got a significant advantage over our competitors: Universal Transit stands out in auto transportation with AI-driven technologies. This approach excels over traditional brokering and emerging tech competitors, and offers tailored, efficient solutions for shippers and carriers.

Vision

Universal Transit Exists to Make the Vehicle Logistics Better

At Universal Transit, we're driven to remove the complexity from logistics and ship the world’s cars through innovations.

One of our nearest goals is to reduce empty truck miles in our network by up to 90%, addressing an issue that costs the industry billions of dollars and significantly impacts emissions. In concert with this, we aim to reduce operational costs by up to 15%, further enhancing our efficiency and cost-effectiveness.

With our sights set on growth that parallels the expansion of the multi-billion-dollar North America Automotive Logistics Market, we are poised to become the premier choice for vehicle hauling within the next three years.

Founders

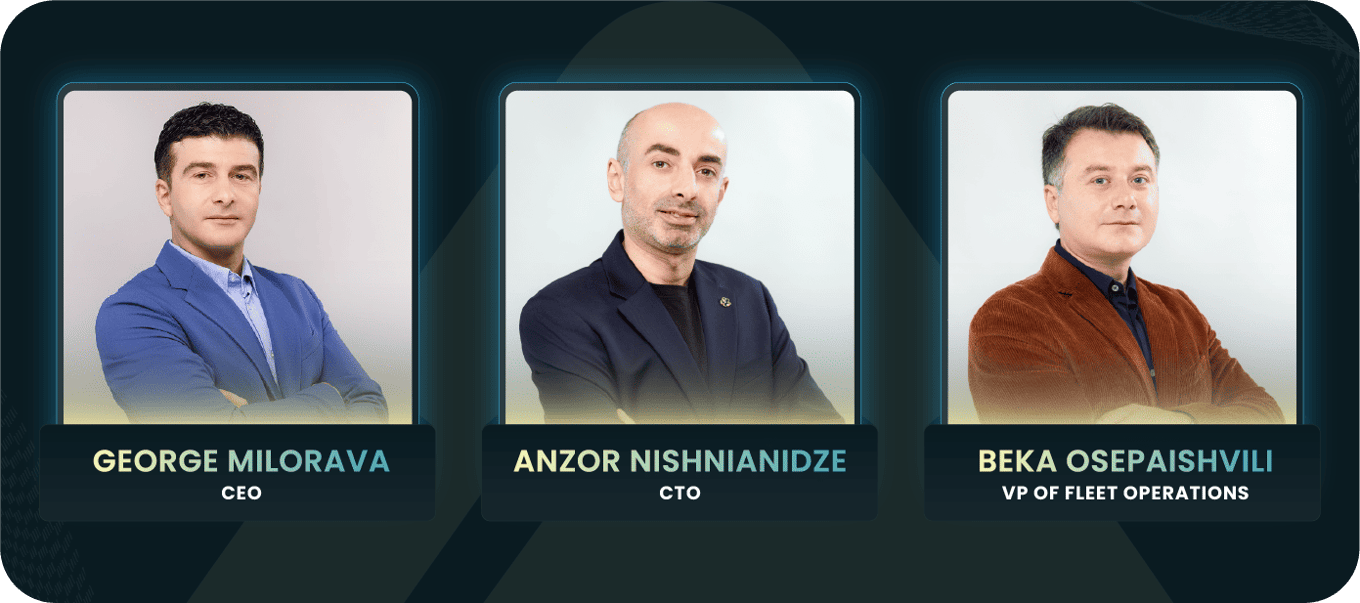

We invested $210,000 of our own money, aiming to establish Universal Transit as a game-changer in auto transportation.

We founded Universal Transit with a clear mission: to revolutionize the way cars are booked, priced, and shipped.

Our team of seasoned professionals has over 10 years of experience in automation, high-tech, and fleet management. We are deeply involved in the day-to-day operations, always looking for new ways to solve modern challenges with innovative solutions.

We’re not just investors in this company; we are its driving force.

Summary

Let’s Transform the Way Vehicles Ship Together!

Imagine a world where logistics transcends its limitations, where each truck ride is not just efficient but enjoyable, where logistics are simple and sustainable, and where every step of the truck journey feels like a leap forward. This is the world Universal Transit is crafting, one innovative solution at a time.

This isn't just innovation; it's a fundamental reimagining of automotive logistics and car shipping. Most importantly, we believe our technology is for everyone who hauls car, from small fleets to large carriers.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...