When Whim launched two years ago, it was based on a straightforward idea: What if a dating app was focused on enabling re...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Open for investment

Documents

Form C

SEC.gov

Form C

SEC.gov

Deal highlights

- Backed by 500 Startups/ Dave McClure

- Company pioneering the next evolution of online dating

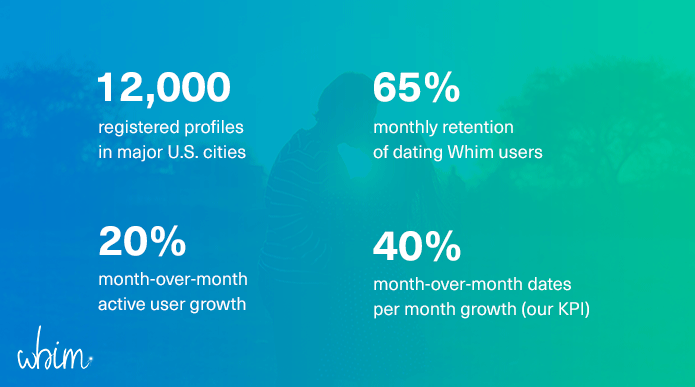

- 12,000 registered profiles as of Oct. 2016/ Growing 20% month-over-month

- $2+ billion growing market with proven revenue models

- Exclusive opportunity to invest at an early stage

- Founded by a passionate Stanford/Berkeley/OkCupid Labs alum with domain expertise and unique insight

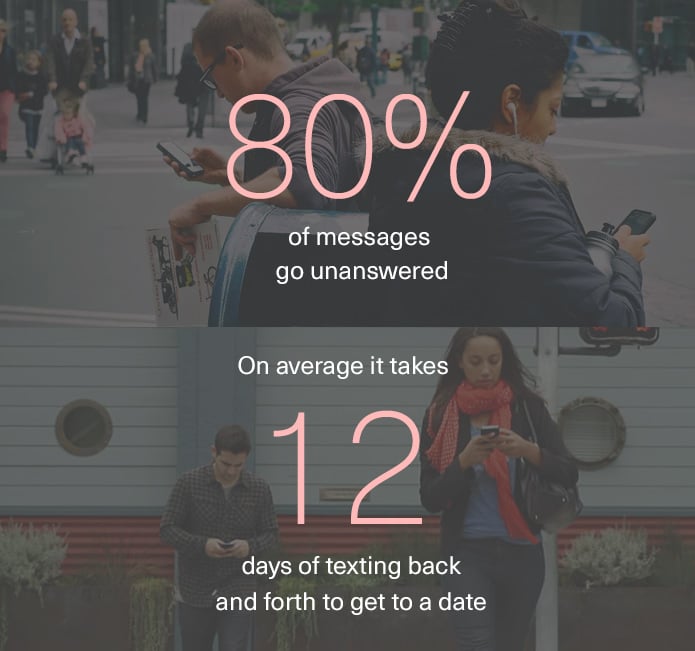

The Problem: On today's dating apps, less than 11% of matches result in actual dates!

People spend most of their time and energy swiping and texting, instead of connecting face-to-face. The majority of users want dates, but apps force them to play a game of matching, messaging, scheduling, and waiting. This leads to widespread frustration, high user churn, and a sentiment commonly known as “dating app fatigue.”

Technology shouldn’t get in the way of connection; it should make it easier.

Whim achieves this goal by ditching the chat-centric model, and replacing it with an actual date setup service.

The chat-centric model is a relic from the 1990s. In 2016, technology-driven meetup coordination is not only possible, but also expected from a generation of mobile app users who get almost everything “on demand.” Whim uses scheduling tools, matching and venue algorithms to set users up on dates with the people they want to meet, at a time and place that's convenient for them.

The Result: On Whim, users' chances of meeting in real life are more than 6x that of other dating apps.

Whim is the only app that genuinely prioritizes meaningful, real-life interactions. 70% of matches on Whim result in actual dates, versus less than 11% on other apps:

How It Works

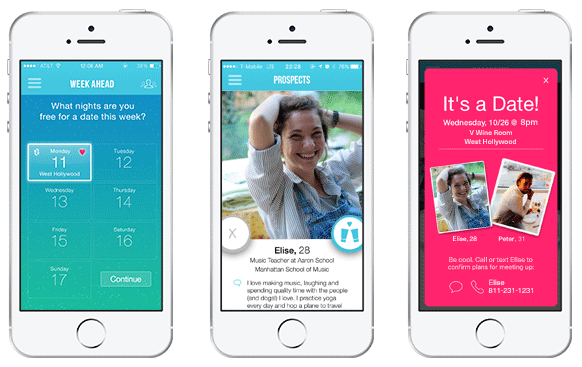

Whim makes dates happen based on when and where you're free, and whom you want to meet. Simply:

Open the app

Indicate when you're free

Match with someone you like

Whim takes care of the rest!

Whim schedules your date and alerts both of you via text message. Upon opening the app, you find a recommendation for a specific cocktail bar, wine bar, or cafe located roughly equidistant from the two of you, as well as your date’s contact information so that you can be in touch just to confirm the details. Seamlessly, you find yourself out on a real-life date in as little as a few hours later -- without any significant work or buildup.

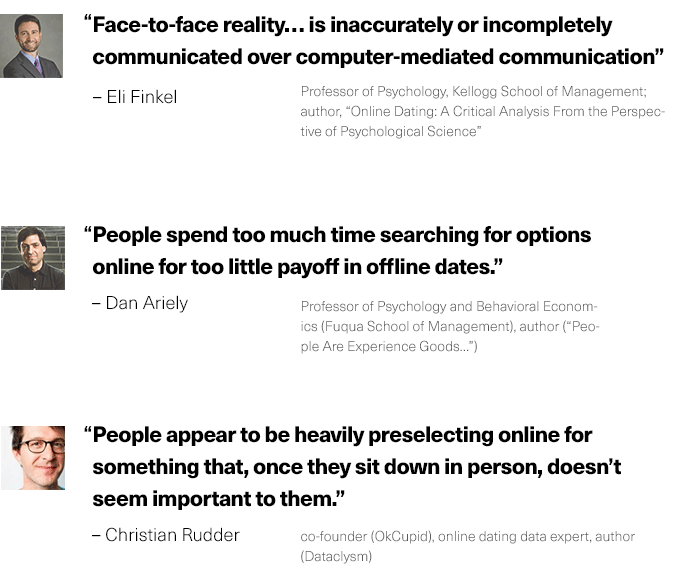

Backed by Scientific Research

Social science experts agree that other dating apps’ emphasis on predictive matching algorithms and virtual online interactions is misguided. Along with frustrated singles everywhere, they too are calling for a solution that puts the emphasis back on in-person interactions.

Aziz talks about this all the time!

Our Story

We started working on Whim in 2014, when we realized that the current slew of dating apps was actually causing significant frustration for relationship-seeking singles. A lot of hard work, testing, iterating, consulting with experts, user interviews, and research went into building our MVP (minimum viable product). Dave McClure’s 500 Startups accelerator recognized the value in our first product and admitted us into Batch 10, in spite of being much earlier stage than they typically allow into their program.

App Launch + Instant Traction

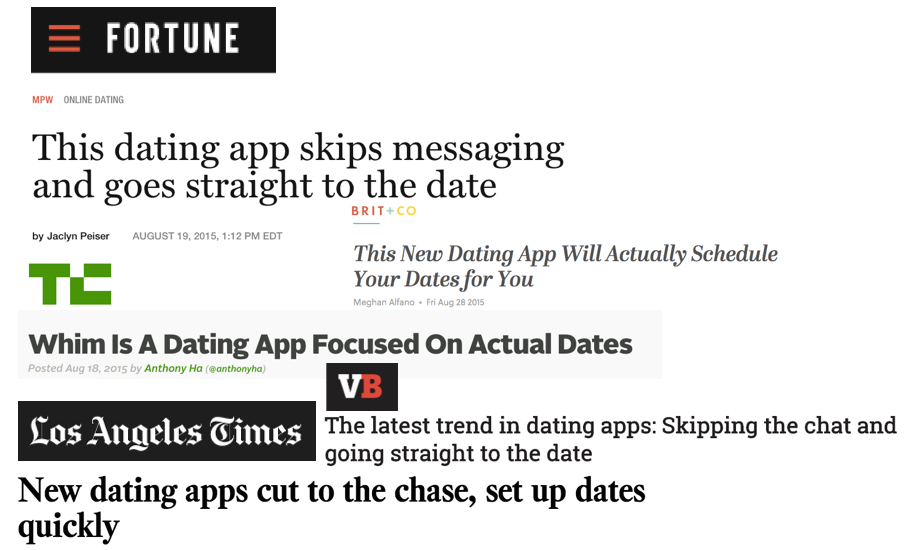

After 500 Startups’ coaching and continued iteration, Whim launched in the App Store to San Francisco and New York City in 2015. The app instantly gained organic traction, accumulating thousands of users in those cities based purely on earned media and word-of-mouth. 3,500 users signed up for Whim in its first month, and we quickly earned nods in TechCrunch, Fortune, ProductHunt, Los Angeles Times, and more.

Growing Through Word-of-Mouth

For the past year, we have continued to grow almost exclusively through organic sharing. Our metrics tell the story:

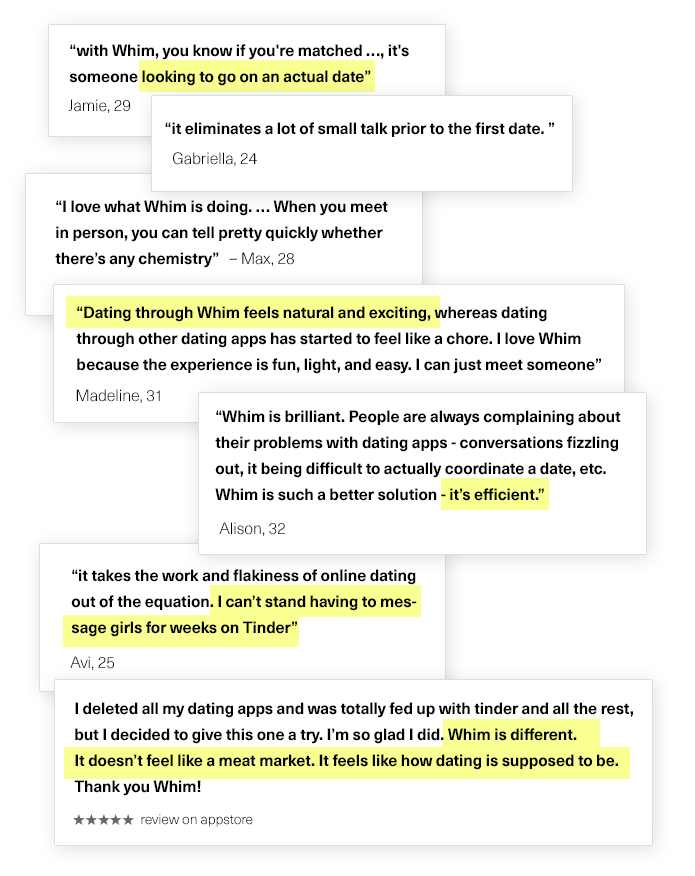

Our Users Love Us

Direct feedback proves that we are headed in the right direction:

What's next

Whim 2.0

Building upon the success of Whim 1.0, we’re currently hard at work on our second major release. Among countless improvements based on both qualitative and quantitative data from our users, Whim 2.0 will include:

A new subscription revenue model and a move toward more premium experience positioning

Built-in incentives for dating follow-through and accountable behavior, and disincentives against “flaking”

A simplified scheduling process, balancing the need for planning with the desire for spontaneity

Brand new UI/UX by one of the Valley’s top designers

- A platform that enables sponsored venue partners, unlocking a potentially lucrative second revenue stream

Why Invest

We know what we're doing

Whim has already accomplished impressive traction with very little funding to date. We’ve been covered by major media outlets and have received an overwhelmingly positive response from our users.

The market is huge, and growing

Online dating is a $2+ billion industry in the U.S. alone, growing 14% year-over-year. Internationally, the space is still relatively unsaturated and has even greater potential for growth.

We're on a mission

Our mission is to influence dating and social culture in a positive way. We believe people are better off meeting each other in real life versus endlessly swiping, texting on their phones, and going nowhere. By investing in Whim, you’re supporting a movement of love and genuine connection.

Use of Funds

We are raising at least $50,000.

Your investment in Whim will allow us to:

- Complete development of version 2.0

- Increase growth and acquisition 3x

- Earn meaningful early revenue

If we exceed our minimum fundraising goal, our plan is to:

Accelerate development

Accelerate growth and acquisition

Release Whim for Android

Terms of the Deal

Investing in this crowdfunding opportunity through Republic allows you to be an angel investor in Whim under the provisions of Title III of the Jumpstart Our Business Startups Act of 2012 (known as the “JOBS Act”) and Regulation Crowdfunding. The financial instrument for your investment chiamata a Crowd Safe. With a Crowd Safe, your investment automatically converts into stock when Whim undergoes a liquidity event - in other words, when we are acquired or have an IPO.

The valuation cap specifies the maximum valuation under which your investment will convert into shares. Whim's valuation cap for this round is $5 million. If the company is acquired for less than the valuation cap amount, the discount provision gives you a discount to the valuation. The discount provision for this round is 20%.

What the Press Is Saying About Whim

"By putting the emphasis back on actual dates, Whim users are 10 times more likely to meet someone than those utilizing other dating sites."

- Brit+Co: This New Dating App Will Actually Schedule Your Dates for You

"Whim’s design can get you from behind your phone screen into that cute art gallery you’ve been meaning to check out without a massive (and ultimately fruitless) time-suck."

- Glamour: Dating App Culture is Being Reconsidered, and We're All About It

"There’s … Whim for people who are tired of all the chatting in the current batch of dating apps.... Whim is particularly absolutist in its approach to setting up actual dates."

- TechCrunch: Whim is a Dating App Focused on Actual Dates

"Whim was born out of women's frustration with being trapped in texting purgatory with guys who would ghost when it was time to meet."

- Marie Claire: Can Women Fix Dating?

"Whim tells both users when and where — yes, it picks a date location for you — the date will take place."

- VentureBeat: The Latest Trend in Dating Apps: Skipping the Chat and Going Straight to the Date

"Forget rummaging through in-depth profiles and messaging back and forth. If two people are interested in each other, they're going on a date."

- LA Times: New Dating Apps Cut to the Chase, Set Up Dates Quickly

"Whim, a new app from OkCupid alum Eve Peters, wants to take daters back to the basics, but with the modern spin. Instead of just swiping and chatting, the app sets up actual, face-to-face dates."

- Fortune: This Dating App Skips Messaging and Goes Straight to the Date

"For the uncoupled among us who’d rather gaze into each other’s eyes than a busted-up iPhone..."

- Boston Globe: Clickworthy: An App for Every Love Interest

Founder’s Story

Eve Peters, Founder and CEO of Whim

I have been involved in the online dating space - as both a product designer and a customer - for nearly a decade. Two years out of Stanford and single in San Francisco, I began in 2006 as a user of Match.com. From early on, I lamented the time and energy wasted in moving past the messaging zone and into the real-life zone. On a regular basis, I found myself spending over an hour a day managing messages with potential dates, with only a fraction of those conversations culminating in actual meetups. When I did eventually meet these people, most of them disappointed after the back-and-forth text messaging buildup.

In a day and age where mobile technology enables us to get almost anything “on-demand,” I wondered why dating apps still felt so exhausting and inefficient. In search of answers, I founded my first dating startup in 2008, earned a nod as a TechCrunch50 nominee, and went on later to lead product development at OKCupid Labs. In 2014, armed with learnings from that first venture and my time at OkCupid, I took the entrepreneurial leap again. I rounded up an awesome development team, built our MVP, got into 500 Startups, and officially launched the following year.

My team's philosophy – which is supported by sociologists like Eric Klinenberg and Eli Finkel (not to mention your grandmother, by the way!) – is that face-to-face interaction (not algorithms, and not texting), is the best way to get to know someone and see if there’s chemistry. With that in mind, we go to work every day with a goal to make getting to that meaningful in-person moment as efficient, delightful, and worthwhile as possible.

These days I'm single, and I love using Whim to meet people in a way that feels effective, fun and even a bit magical. I'm excited to be crowdfunding for this company. This is modern dating, funded by the people, for the people! I hope you'll join us.

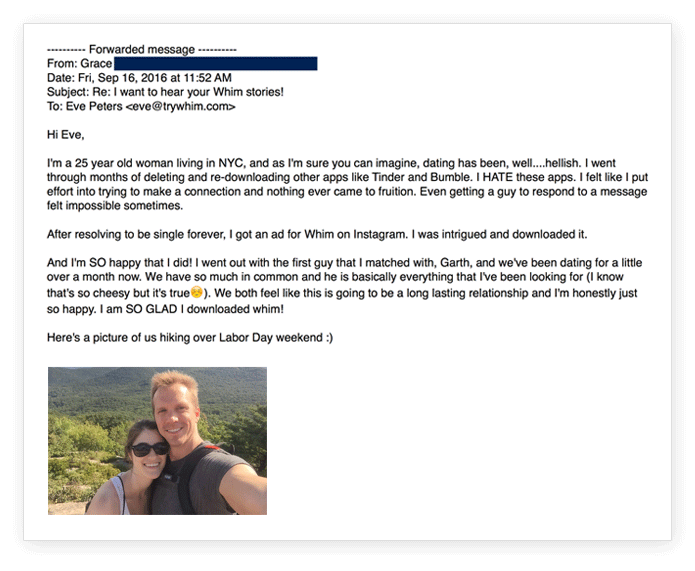

P.S. Happy Whim Success Story

We wanted to share this recent email from one of our users:

Let's create more stories like this one!

Deal terms

$5,000,000

The maximum valuation at which your investment converts

into equity shares or cash.

Learn more

20%

If a trigger event for Whim occurs, the discount provision

gives investors equity shares (or equal value in cash) at a reduced price.

Learn more.

$500K

Whim must achieve its minimum goal of $50K before the deadline. The maximum amount the offering can raise is $500K.

Learn more

Learn more

Crowd SAFE

A SAFE allows an investor to make a cash investment in a company, with rights to receive certain company stock at a later date, in connection with a specific event.

·

Learn more

Documents

Form C

SEC.gov

Form C

SEC.gov

Bonus perks

- Special badge on your Whim profile, our heartfelt gratitude, and a mention on our website

- Early access to Whim 2.0 + special badge on your Whim profile, our heartfelt gratitude, and a mention on our website

- Set of Whim stickers + early access to Whim 2.0 + special badge on your Whim profile, our heartfelt gratitude, and a mention on our website

- 3 months of Whim Star Membership + set of Whim stickers + early access to Whim 2.0 + special badge on your Whim profile, our heartfelt gratitude, and a mention on our website

- Lifetime of Whim Star Membership + set of Whim stickers + early access to Whim 2.0 + special badge on your Whim profile, our heartfelt gratitude, and a mention on our website

- Personalized dating/relationship advice from Whim's CEO + all previous perks

- Lunch with Whim's founder + all previous perks

- Dinner party with Whim's founder and other $15k+ investors + all previous perks

About Whim

Whim Team

Everyone helping build Whim, not limited to employees

Press

This site (the "Site") is owned and maintained by OpenDeal Inc., which is not a registered broker-dealer. OpenDeal Inc. does not give investment advice, endorsement, analysis or recommendations with respect to any securities. All securities listed here are being offered by, and all information included on this Site is the responsibility of, the applicable issuer of such securities. The intermediary facilitating the offering will be identified in such offering’s documentation.

All funding-portal activities are conducted by OpenDeal Portal LLC doing business as Republic, a funding portal which is registered with the US Securities and Exchange Commission (SEC) as a funding portal (Portal) and is a member of the Financial Industry Regulatory Authority (FINRA). OpenDeal Portal LLC is located at 149 E 23rd St #1314, New York, NY 10010, please check out background on FINRA’s Funding Portal page.

All broker-dealer related securities activity is conducted by OpenDeal Broker LLC, an affiliate of OpenDeal Inc. and OpenDeal Portal LLC, and a registered broker-dealer, and member of FINRA | SiPC, located at 1345 Avenue of the Americas, 15th Floor, New York, NY 10105, please check our background on FINRA’s BrokerCheck.

Certain pages discussing the mechanics and providing educational materials regarding regulation crowdfunding offerings may refer to OpenDeal Broker LLC and OpenDeal Portal LLC collectively as “Republic”, solely for explanatory purposes.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC make investment recommendations and no communication, through this Site or in any other medium should be construed as a recommendation for any security offered on or off this investment platform. Investment opportunities posted on this Site are private placements of securities that are not publicly traded, involve a high degree of risk, may lose value, are subject to holding period requirements and are intended for investors who do not need a liquid investment. Past performance is not indicative of future results. Investors must be able to afford the loss of their entire investment. Only qualified investors, which may be restricted to only Accredited Investors or non-U.S. persons, may invest in offerings hosted by OpenDeal Broker.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC, nor any of their officers, directors, agents and employees makes any warranty, express or implied, of any kind whatsoever related to the adequacy, accuracy or completeness of any information on this Site or the use of information on this site. Offers to sell securities can only be made through official offering documents that contain important information about the investment and the issuers, including risks. Investors should carefully read the offering documents. Investors should conduct their own due diligence and are encouraged to consult with their tax, legal and financial advisors.

By accessing the Site and any pages thereof, you agree to be bound by the Terms of Use and Privacy Policy. Please also see OpenDeal Broker’s Business Continuity Plan and Additional Risk Disclosures. All issuers offering securities under regulation crowdfunding as hosted by OpenDeal Portal LLC are listed on the All Companies Page. The inclusion or exclusion of an issuer on the Platform Page and/or Republic’s Homepage, which includes offerings conducted under regulation crowdfunding as well as other exemptions from registration, is not based upon any endorsement or recommendation by OpenDeal Inc, OpenDeal Portal LLC, or OpenDeal Broker LLC, nor any of their affiliates, officers, directors, agents, and employees. Rather, issuers of securities may, in their sole discretion, opt-out of being listed on the Platform Page and Homepage.

Investors should verify any issuer information they consider important before making an investment.

Investments in private companies are particularly risky and may result in total loss of invested capital. Past performance of a security or a company does not guarantee future results or returns. Only investors who understand the risks of early stage investment and who meet the Republic's investment criteria may invest.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC verify information provided by companies on this Site and makes no assurance as to the completeness or accuracy of any such information. Additional information about companies fundraising on the Site can be found by searching the EDGAR database, or the offering documentation located on the Site when the offering does not require an EDGAR filing.

To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. Therefore, when you use the Services we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver's license, passport or other identifying documents.

Republic and its affiliates are not and do not operate or act as a bank. Certain banking services are provided by BankProv, member FDIC / member DIF. Digital (crypto) assets and investment products are not insured by the FDIC, may lose value, and are not deposits or other obligations of BankProv and are not guaranteed by BankProv. Terms and conditions apply.

Made in SF/NYC