While the stock market has recovered since its sharp 30% downturn in March at the onset of the coronavirus pandemic in th...

Bonus Perks

Any investor will be eligible to receive the perks below for their existing or future AltoIRA account created and funded by December 31, 2020. All investors in our Republic campaign who create and fund an AltoIRA by December 31, 2020 will receive 3 months free! Additional perks are as follows:

- Invest $5,000 and your first 6 months of account admin fees will be waived

- Invest $10,000 and your first 9 months of account admin fees will be waived

- Invest $25,000 and account admin fees for the first year will be waived

- Invest $50,000 and account admin fees for the first two years will be waived

- Invest $100,000 and account admin fees for the first three years will be waived

*AltoIRA fee waivers awarded as perks are not transferable or redeemable for cash.

Problem

Retirement in America is broken

The largest and traditional IRA custodians — Fidelity, Schwab, eTrade, etc. — offer IRA investments in liquid, publicly-traded securities. But we can't liquidate and distribute cash from our IRAs before turning 59.5 years old without incurring penalties and taxes! As a result, investors are forced to forfeit the opportunity to invest in higher-yielding assets in exchange for liquidity they don’t need. And why? Because somewhere along the way we were taught that investing conservatively with your retirement savings was the “right thing to do.”

And maybe in a different era it was:

Then | Now |

Companies went public as quickly as possible | Companies stay private as long as possible |

There were over 8000 public companies | There are roughly 4000 public companies |

Interest rates were near double digits | Interest rates are close to zero |

Public market portfolio diversification was enough | Public market portfolio diversification is insufficient |

The business landscape has changed and alternative investment choices are more abundant. Investment options need to adapt and expand to unlock those choices and empower investors to achieve true portfolio diversification.

Solution

Alto helps bring wealth-generating alternatives into your retirement portfolio.

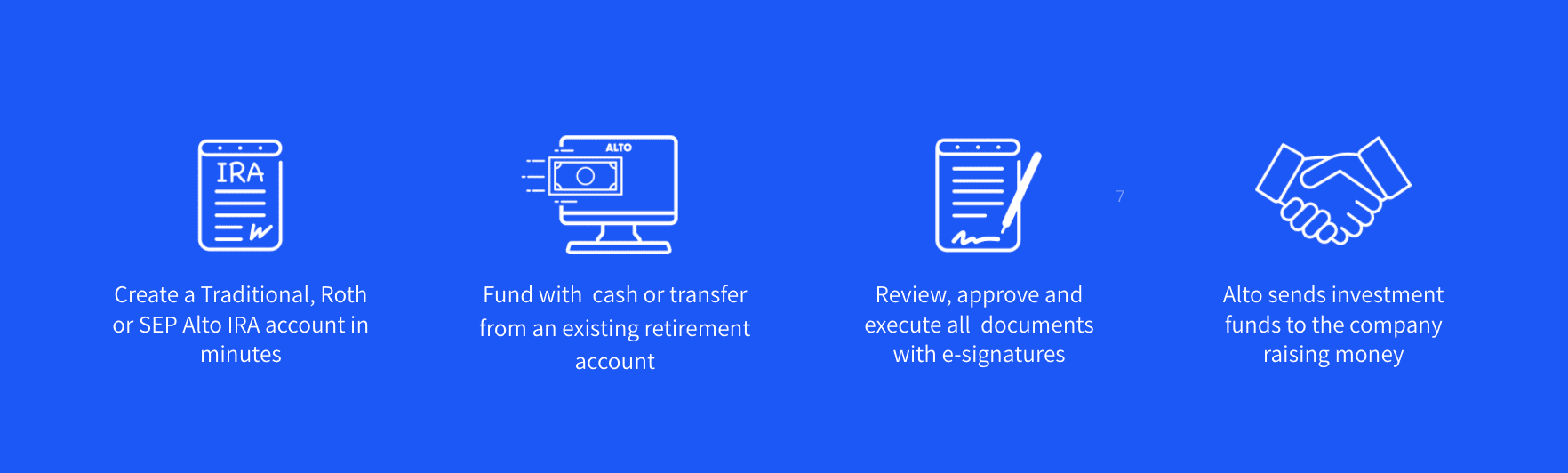

Enter Alto and The Alternative IRA®. We have created our software platform to enable people to easily set up an IRA meant for investing in alternative assets — private equity, real estate investments, venture capital, private funds, cryptocurrency, securitized art, and more. Not only do we streamline the setup process, but we simplify the investing process as well, by connecting to 21 platform partners offering these alternative asset investments. We have taken what once was a time-intensive, paper-burdened and expensive process and made it easy, fast, and cost-effective, opening the door to this type of investing — using an IRA — to anyone.

Product

Easily invest in alternatives using your IRA

Alto is disrupting the IRA space in two ways:

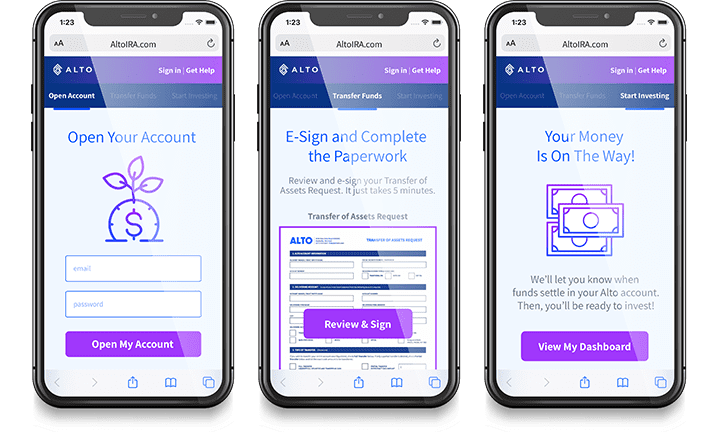

First, through its proprietary technology, Alto makes the process of creating, funding, and using a self-directed IRA for alternative investments easy and inexpensive relative to legacy industry players.

Second, through our technology platform, Alto provides issuers - including startups, funds, and investment platform partners, funding portals, cryptocurrency providers and secondary market platforms — with a new, cost-effective, and hassle-free way to connect with IRA and 401(k) investors. Connecting investors to issuers through Alto's platform unlocks a vast pool of capital for private offerings previously hidden from many issuers. Alto customers now have access to investments offered through 21 partners, including AngelList, Republic, MasterWorks, and EquityZen, as well as cryptocurrency trading directly through the Coinbase exchange.

One Platform, Multiple Account Types, Wide Asset Selection

Alto Traditional, Roth and SEP IRAs can be used to invest in a wide range of assets and investments. For example, we enable investors to set up distinct IRAs for cryptocurrency trading, and separate investment vehicles allowing for “checkbook control”, especially useful for real estate investments.

|

|  |

Alto IRA | Alto CryptoIRA | Checkbook+ IRA |

Use your Alto IRA™ to invest online in the things you know and care about: startups, growth companies, loans, and more. | Buy cryptocurrency 24/7 through the Coinbase exchange - using tax-advantaged retirement dollars. | It's your money, your IRA, and your investment decisions. With Checkbook+ IRA, you gain check-writing control for better management of your real estate investments. |

How it works:

We provide a simple, automated, and cost-effective self-directed IRA solution for investors

Traction

$75M+ in active investments to date

Alto has 1,230+ active, funded accounts with approximately 3,000 active investments and more than $75M in assets under custody. We have established 21 partnerships with some of the biggest names in the investment platform space, including Republic, AngelList, Masterworks, and more.

Customers

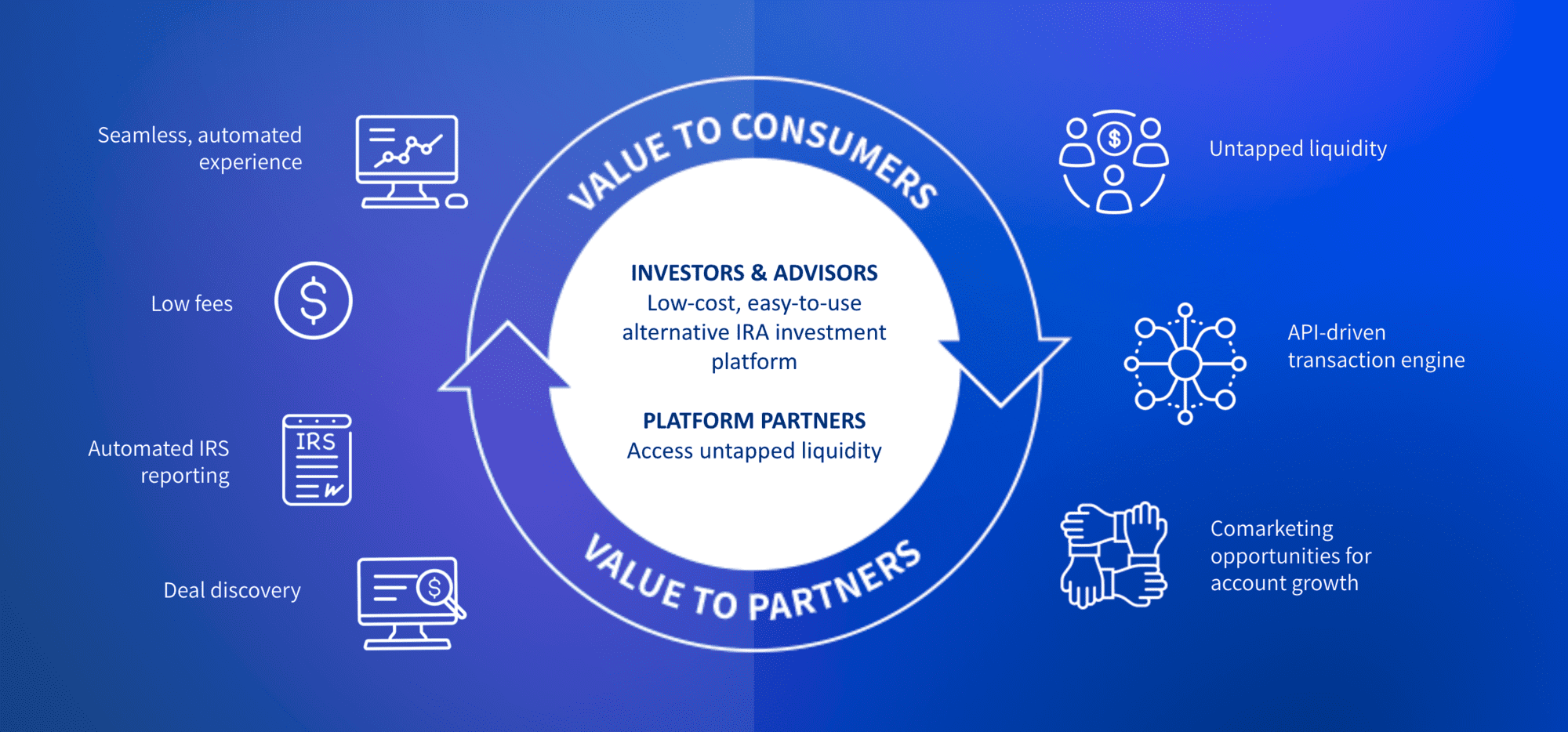

The Alto Platform gets the flywheel spinning

Alto benefits both private equity and debt investors and issuers. Investors get a low-cost, easy-to-use alternative IRA investment platform. Issuers, investment sites, and crypto exchanges get access to untapped liquidity. We bring both actors together in a cost-effective, secure, and diversified space.

Business model

Recurring and transactional revenue

Alto currently generates revenue from investor fees:

Annual recurring account fees, and

Transaction fees paid with each IRA investment

As we expand our solutions for issuers and financial advisors, we expect additional sources of revenue.

Market

Unlocking a $17T Market

There are currently $30 trillion dollars sitting in retirement savings, including over $17 trillion in IRAs and 401(k)s. Yet it’s estimated that less than 5% of those funds are invested in alternatives, while professional investors and pension funds allocate 20% or more to alternative investments. This suggests approximately $2.5 trillion now sitting in retirement accounts reasonably could be allocated to alternative investments, if individual investors had the tools to do it.

The self-directed IRA industry is dominated by antiquated players leveraging pre-Internet technology to facilitate these investments through paper-based processes. These processes have discouraged and hindered issuers from accessing this tremendous source of capital.

Our strategic market initiatives involve expanding into issuer and financial advisor focused products. By connecting issuers, investors and advisors through our marketplace, we plan to create additional revenue channels.

Competition

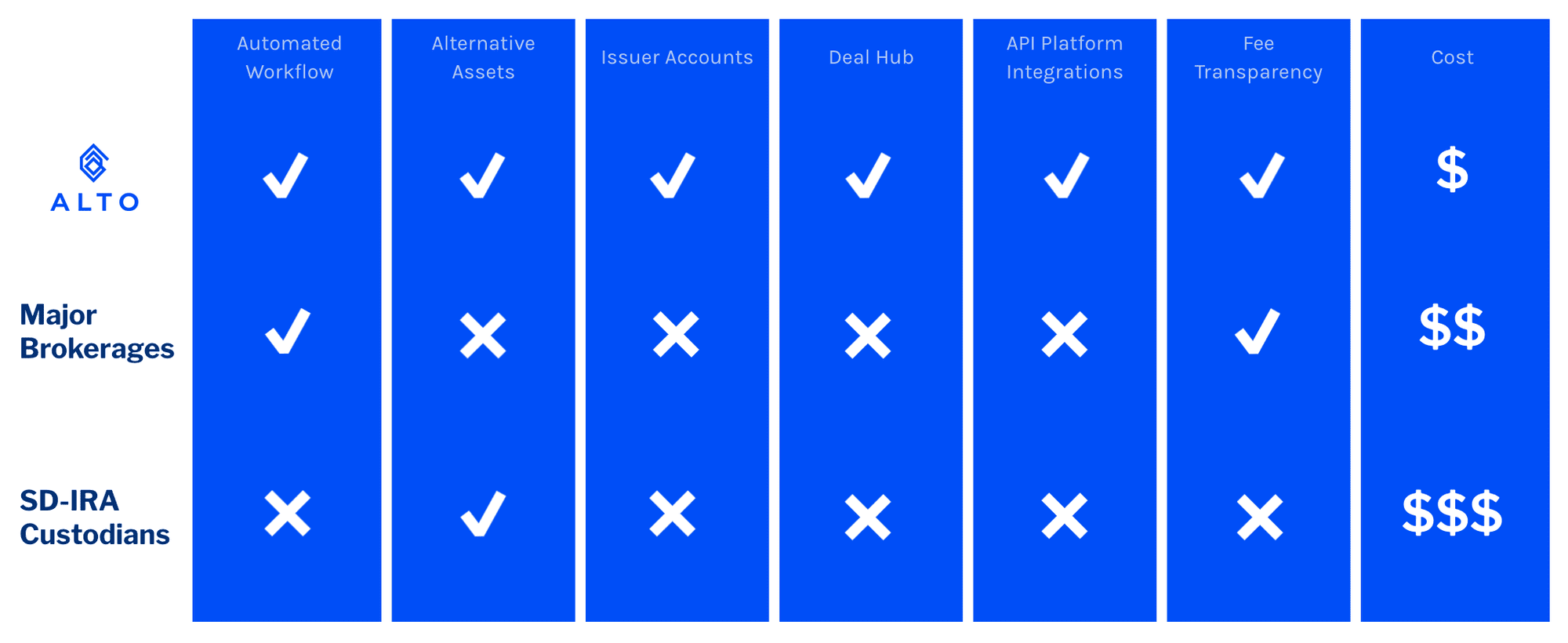

Major white space in competitive landscape

Alto occupies a unique space in the existing market offering technology-forward products that enable automation and scale with integrated partners like Republic, AngelList, WeFunder and Masterworks.

Our goal is to remain the most cost-efficient, full service, comprehensive platform within the competitive landscape.

Vision and strategy

Alto vision and values

We envision a world where a clear path to successful retirement, by investing in the broadest possible range of assets, is achievable and filled with empowerment.

We want every person to have that option to retire when they are ready. And we want every person who has set this priority to have greater control over their destiny. People can invest in what they choose, control their retirement dollars, and educate themselves when they are unsure of what’s next. Transparency, trust, education, forgiveness, and accountability come together to paint a better investment landscape

Our Values

|  |  |

|  |  |

|  |  |

Funding

Backed by prominent venture investors

We've secured over $9.8M in funding to date from prominent investors like Moment Ventures, Jefferson River Capital (Vice-Chair of Blackstone Tony James’s Family Office), T.H. Lee, Sequoia Scout, Foundation Capital, Amplify LA, and Alumni Venture Group.

Founders

Meet Eric Satz, Founder and CEO

Alto’s founder and CEO, Eric Satz, is a serial entrepreneur. His first business, while still in high school, was selling frozen lemonade from an unairconditioned van in Miami, FL. After earning his Bachelor of Arts in Economics from Amherst College, where he graduated from lemonade to The Boston Globe and The New York Times, he sold his paper route and moved to NYC to work in investment banking, where he was jealous of his clients: company founders.

Currenex, the first foreign currency exchange business designed to level the currency trading playing field and later purchased by State Street; online grocery and home delivery business Plumgood Food; and Tennessee Community Ventures, a VC firm, are a few of the businesses Eric co-founded.

Following 12 years in NYC and San Francisco, Eric and his family moved to Nashville, known as the healthcare capital, Music City, and Alto’s global HQ! Always looking to encourage entrepreneurship, Eric founded “The FEW: The Future Entrepreneurs Workshop,” to teach entrepreneurship and innovation to Nashville high school students, eventually expanding to 5 schools in the workshop’s 3rd year.

Appointed by President Obama, Eric served on the board of the Tennessee Valley Authority, the country’s largest utility serving approximately 9MM people across 7 states, from 2015-2019.

When he’s not breathing life into start-ups, Eric loves to ski, play soccer, and practice yoga. Eric and his wife, Kate, have been married for 24 years and have two awesome kids.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...