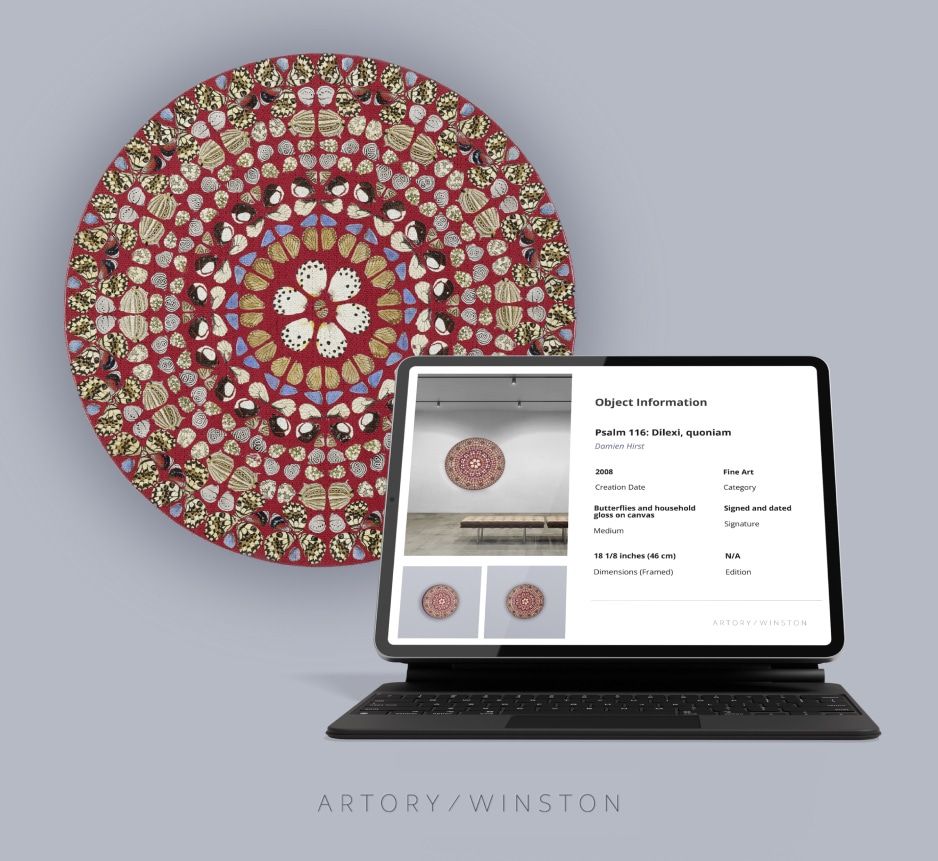

Artwork

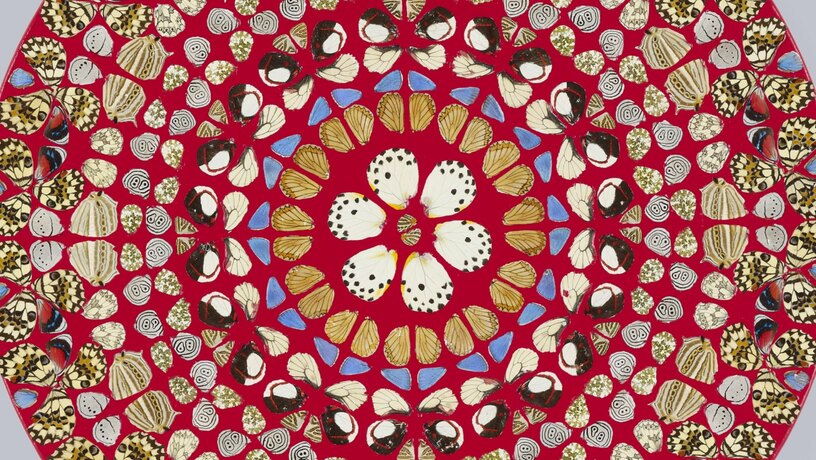

Psalm 116: Dilexi, quoniam

by Damien Hirst (British, b. 1965)

Butterflies and household gloss on canvas

Diameter: 18 1/8 inches (46 cm)

Step into the exciting world of art collecting with Psalm 116: Dilexi, quoniam (2008) by legendary artist, Damien Hirst.

Why we chose this artwork for you

Our specialists have worked closely with Damien Hirst's artworks, and believe Psalm 116 is an excellent candidate for this exclusive investment opportunity.

Psalm 116: Dilexi, quoniam (Latin for “I loved, because”) is an example of Hirst’s signature use of butterflies in his art. The artist incorporated 400 butterfly wings onto a glossy painted surface.

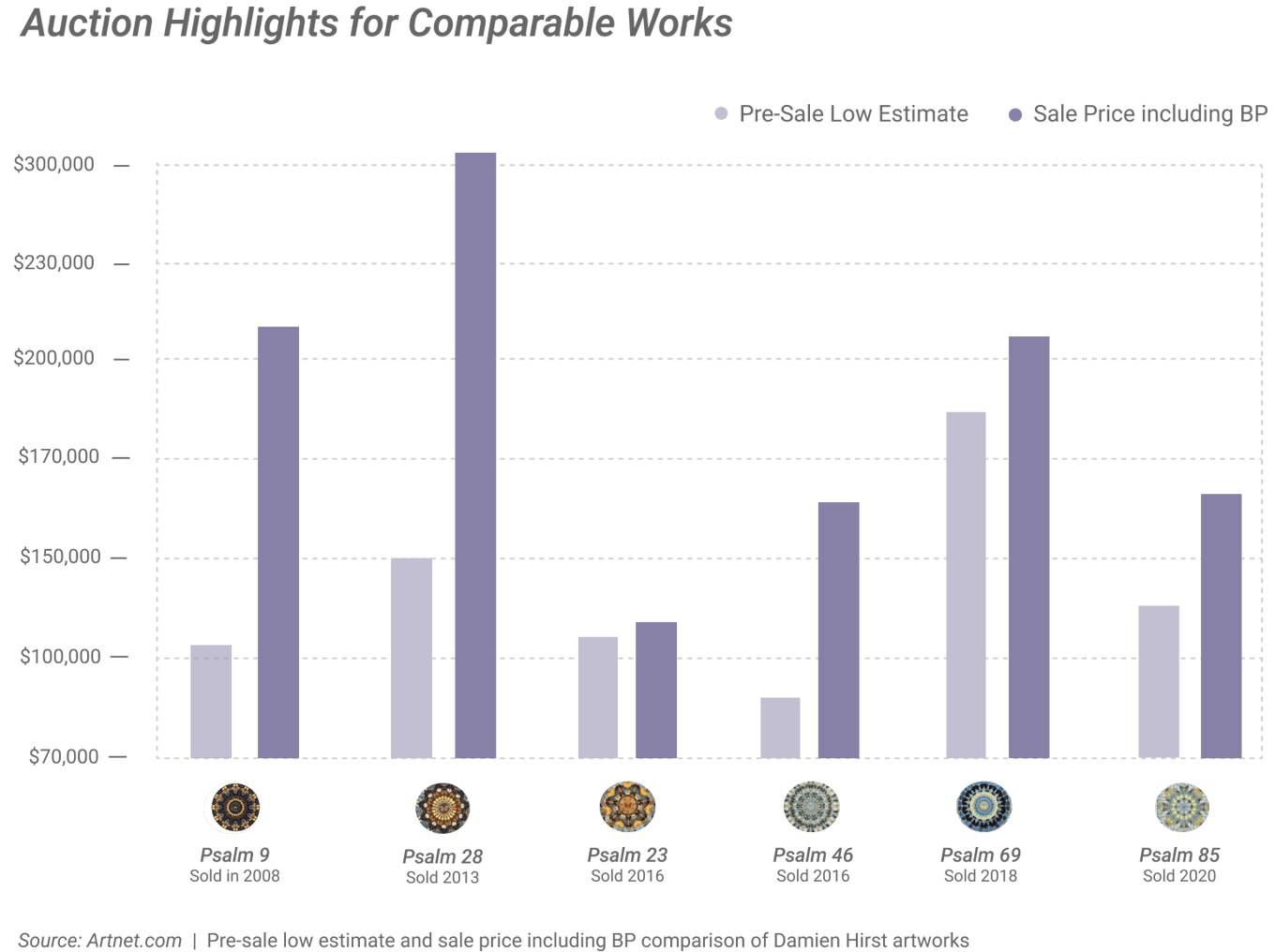

Hirst's Psalm series is a rare and coveted body of work. Of the 150 individual Psalm paintings, only 27 have ever gone to auction. The remaining 123 Psalm paintings are in Hirst's studio or private collections around the world.

Some versions of Hirst's highly recognizable butterfly paintings have sold for upwards of $2M at auction; works in the Psalm series have sold for $300K+*.

The work has both universal appeal and a large market of potential buyers. Named for Old Testament Psalms, Hirst’s mesmerizing butterfly paintings have been compared to stained-glass windows as well as Hindu and Buddhist mandalas.

* Past performance of artist's works do not guarantee future results

Artist

Damien Hirst is one of the world’s most successful artists...

...and has dominated the art scene since the 1980s.

From massive sharks in formaldehyde to delicate butterfly wings on household paint, Damien Hirst is famous for his artworks inspired by nature.

In 2007, Hirst's work Lullaby Spring sold for $19.1M, the second most expensive work by a living artist at the time. Just one year later, he sold a series of new works at Sotheby’s that totaled $200M. Both his old and new works are fixtures at auctions each year and consistently exceed estimates.

* Past performance of artist's works do not guarantee future results

Offering

Investors receive equity shares in Psalm 116

With your investment, you will receive:

- Financial interest in Psalm 116: Dilexi, quoniam (2008) by Damien Hirst;

- A comprehensive report on the artwork due diligence information that is secured on the blockchain;

- Sophisticated, independent market analyses and data products to help track your investment and learn more about the art world.

Annual Prospective Return: 10-14% *

* Past performance is no guarantee of future results, and there are significant differences between investing in art and investing in stock, bonds, and other asset classes. See important disclosures.

Investment opportunity

Make Investing Collecting with Artory/Winston

Start your collection with Artory/Winston. When you purchase shares of Psalm 116: Dilexi, quoniam by Damien Hirst, you receive partial ownership of the artwork and can add this exclusive alternative asset to your investment portfolio. The expert team at Artory/Winston monitors the market daily for ideal opportunities to sell the artwork, and you can benefit if the artwork sells at a higher price. Artory/Winston will share their market data and expertise with you throughout the holding period for the artwork, so you can follow Psalm 116's market and have confidence in your investment.

Past performance is no guarantee of future results, and there are significant differences between investing in art and investing in stock, bonds, and other asset classes. See important disclosures.

Team

Team up with art experts

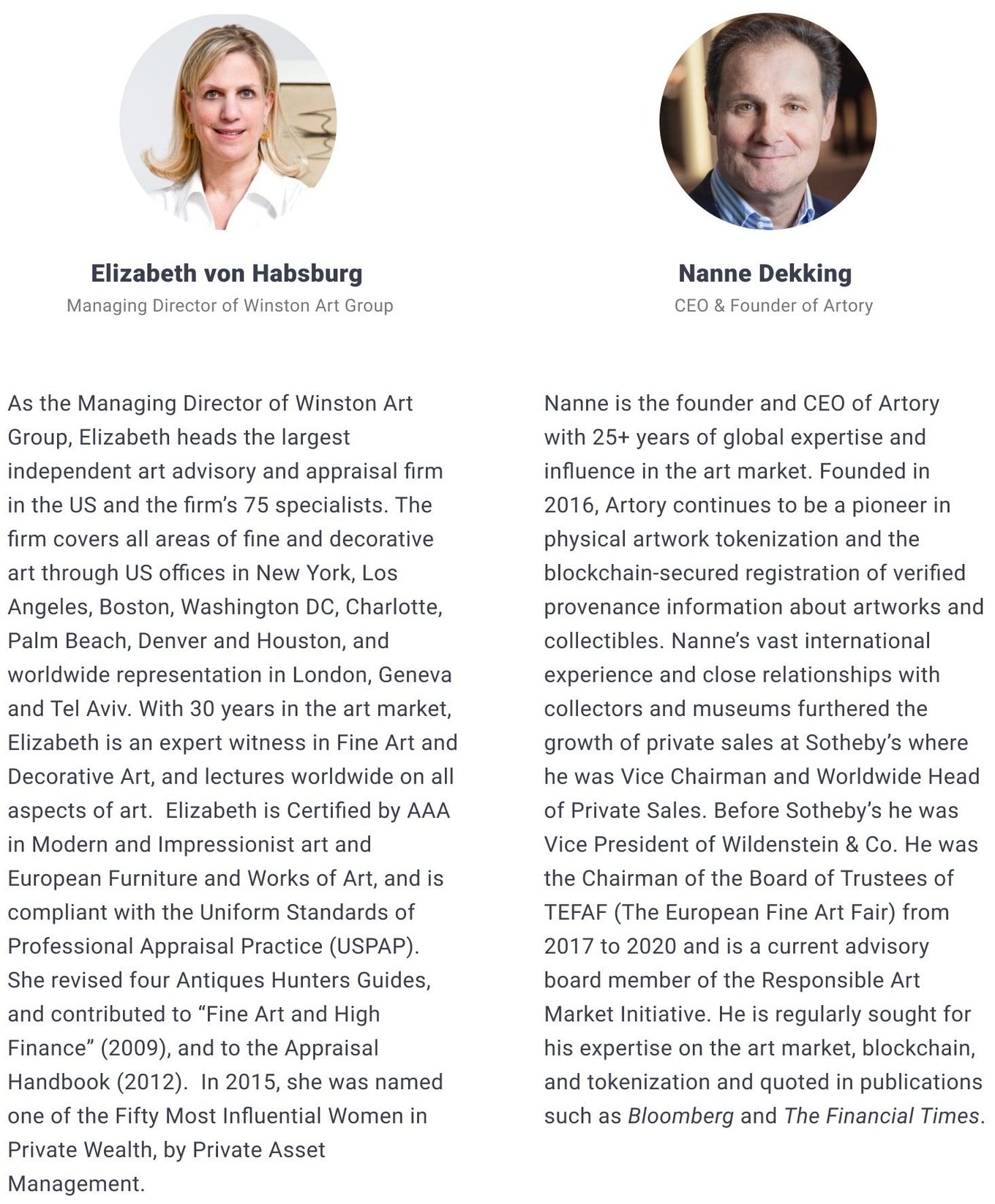

Artory/Winston is a joint venture between two leaders in the art world, creating unique investment opportunities by sourcing the finest artworks with high potential to grow in value and generate strong returns for our investors. Winston sources, Artory certifies, you invest with confidence.

- Winston Art Group is one of the largest independent art advisory and appraisal firm in the US, with 75 specialists and over 11 offices around the world. They appraise an average of $10B worth of art annually.

- Artory's world-leading platform and technology is used to capture the artworks' due diligence data on the blockchain, providing investors with digital certification of artworks' immutable records, verified provenance, and due diligence.

- Combining Artory's industry-leading art registry technology with Winston Art Group's deep market expertise, we select artworks at the right valuation with verified provenance.

We know how & when to sell

Artory/Winston has a team of art experts with years of experience identifying trends and utilizing data in the art market to determine the best times to buy, sell, or hold onto an artwork. Winston Art Group's long-standing relationships with their clients and the world's most prominent art institutions, galleries, and auction houses are at the core of their history of predicting the appreciation of works of art. These relationships help the Artory/Winston team build insider art market knowledge, and give them the potential to access prime sale opportunities through the primary market, secondary market, and private sales around the world.

You stay in the know

With unrivaled analyses from independent experts and Artory’s unparalleled database, Artory/Winston works to increase efficiency and inclusivity in a market that has historically been challenging to navigate for investors.

Psalm 116 has gone through a high-standard due diligence, and is also independently appraised and inspected. Diligence information is blockchain-secured through Artory and available to investors to increase transparency. Here’s how we do it:

- Specialists at Winston Art Group select iconic artworks for investors based on their market history and potential.

- Winston Art Group carries out the highest standard of due diligence on the artwork.

- The due diligence is captured in an Algorand-based, blockchain-secured, Due Diligence Certificate through Artory.*

- Artory's blockchain-secured Due Diligence Certificate ensures this valuable artwork information is protected and readily available to investors.

- Exclusive updates and sophisticated market analytics are delivered to investors throughout the lifecycle of the offering.

[Artory/Winston] seeks to combine Winston’s expertise in authentication and due diligence with Artory’s facility with tokenization and fractionalization to transform physical artworks into robust, accessible financial products that appeal to investors in crypto and real alternative assets alike.Eileen Kinsella, Spring 2022 Artnet Intelligence Report

*Investors should still conduct their own due diligence of the offering

Track record

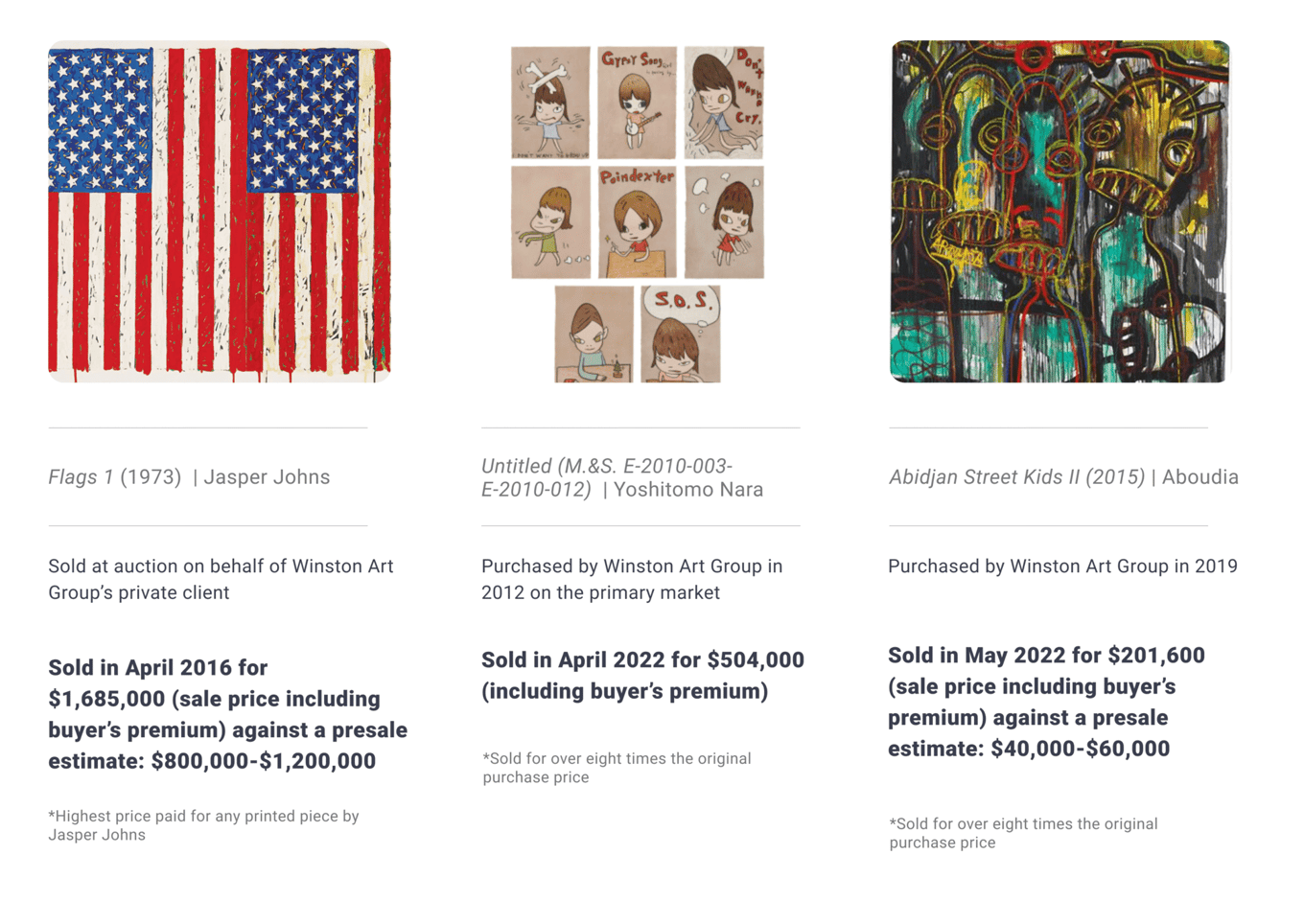

Proven track record

Past artwork transactions managed by Winston Art Group have sold for over 8X the original price

Past performance is no guarantee of future results, and there are significant differences between investing in art and investing in stock, bonds, and other asset classes. See important disclosures.

Our fees

Artory/Winston works carefully to preserve and build Psalm 116’s value and identify ideal market opportunities for delivering potential returns to investors. As such, nearly all fees are in service of the ownership, care, and eventual sale of the artwork. Expenses include storage, insurance, and annual third-party appraisals, as well as audits, legal, management fees and platform fee, and tax filings.

Unlike other art investment offerings, Artory/Winston does not take a membership fee or a commission fee on the purchase or sale of the artworks, leaving more of the investment gains for investors.

For more details on our fees, please see our Form C.

Leadership

Elizabeth von Habsburg & Nanne Dekking

The art market is difficult to maneuver on your own. By teaming up with market insiders and specialists, you can collect and enjoy iconic works of art while receiving returns on your investment. Elizabeth von Habsburg and Nanne Dekking are the leaders behind this offering on Republic.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...