It may not come as a surprise, but The University of Texas at Austin campus is teeming with entrepreneurial activity. Bet...

Problem

There is no easy and affordable way to legally pass on your online accounts and digital assets

Digital assets are anything people own online: email, social media, cloud storage, crypto-currency, e-commerce, music, video, rewards points, and more

Digital assets are anything people own online: email, social media, cloud storage, crypto-currency, e-commerce, music, video, rewards points, and more

Traditional wills offer a boilerplate statement regarding digital assets. Service providers (i.e. Google, Facebook, Paypal, etc.) may want more specifics according to a set of laws called RUFADAA (Revised Uniform Fiduciary Access to Digital Assets Act), which is adopted by 46 states and counting.

Why do you need a RUFADAA-compliant will for your online accounts?

By sharing passwords, you may be violating privacy laws.

You may think that it is easy to simply hand off your spreadsheet full of your passwords, but sharing passwords may be in violation of privacy laws. Even if you use a password manager that may allow emergency access to your account to your designated heirs, you still need a will to make this assignment "legal".

Not being prepared can have a devastating impact on your family.

There is currently no easy way to consolidate and store your important information, assign your beneficiaries, manage who has assigned you to be their beneficiary, and stay connected with loved ones.

Solution

Clocr is your easy-to-use, affordable, and secure digital legacy planning solution

With Clocr, you can easily create a will for your online accounts, manage your beneficiaries, and stay connected with your loved ones.

Easy to use, effortless, and affordable

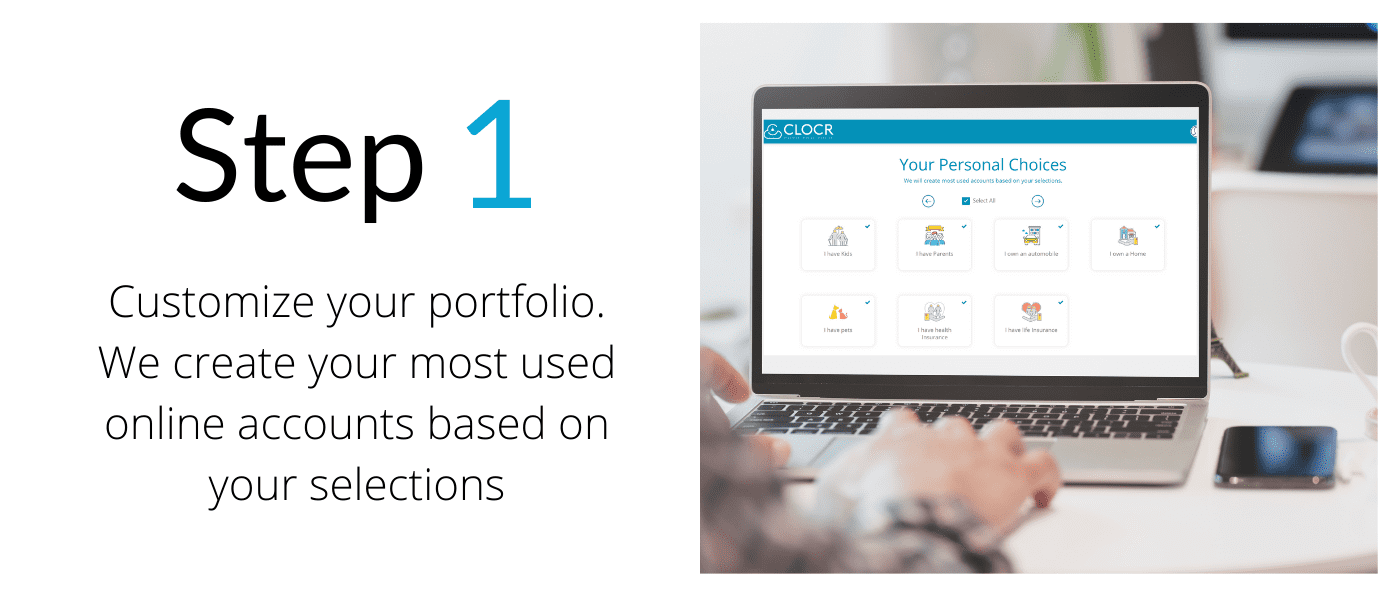

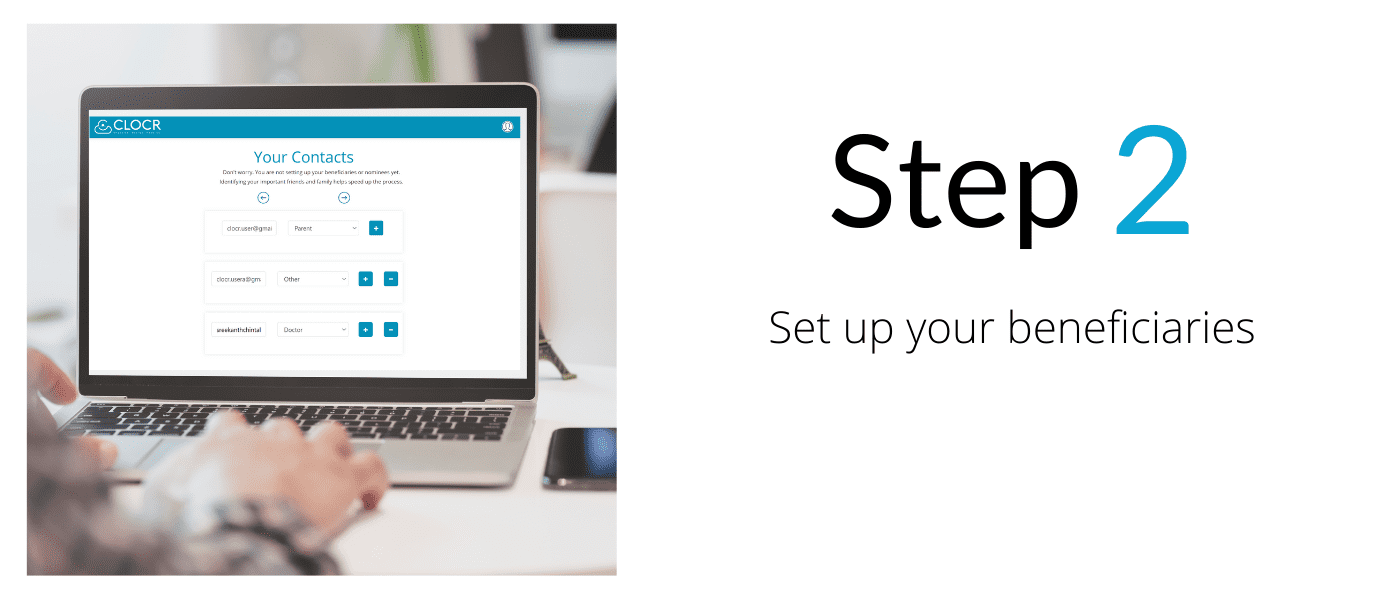

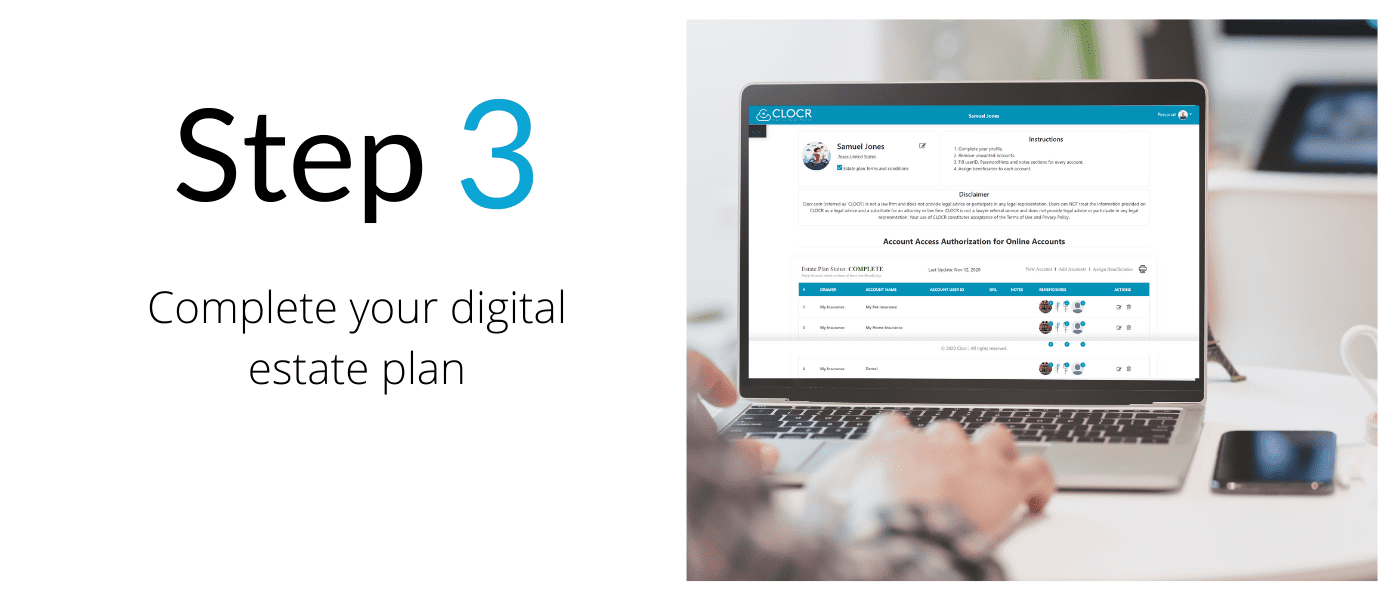

Clocr’s TurboTax style onboarding process walks you through our services and helps you create your digital estate. In just a few clicks, we set up your accounts and get you ready to assign your beneficiaries.

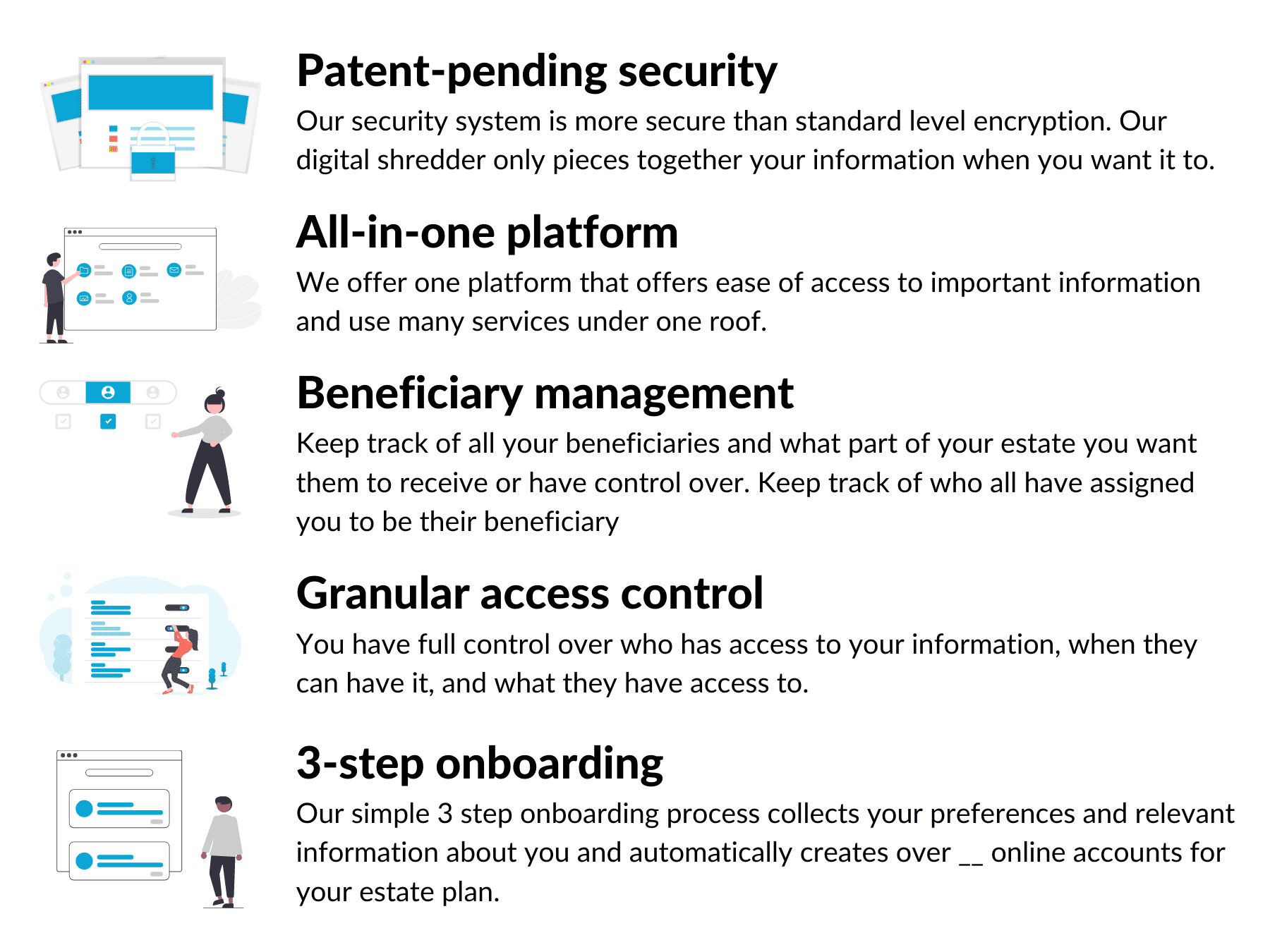

Patent-pending security*

*For two patents, the Company entered into a Patent Assignment Agreement, effective as of January 1, 2021, with our Chief Executive Officer and Director, Apoorva Chintala as the Inventor and initial applicant of the patent, under which Ms. Chintala assigned all right, title and interest, therein and thereto. The Company intends to file the appropriate documents with the United States Patent and Trademark Office to reflect such assignment. For the third patent, the patent application identifies Chief Executive Officer and Director, Apoorva Chintala as the Inventor and Applicant, who then assigned all rights thereunder to Aimkara LLC, which intends to assign, or grant a license, to the Company upon issuance of the patent. See the Form C for more information.

Legally-compliant

Your beneficiaries and you as a beneficiary

All-in-one platform

Stay connected with your family

Built by a family, for your family

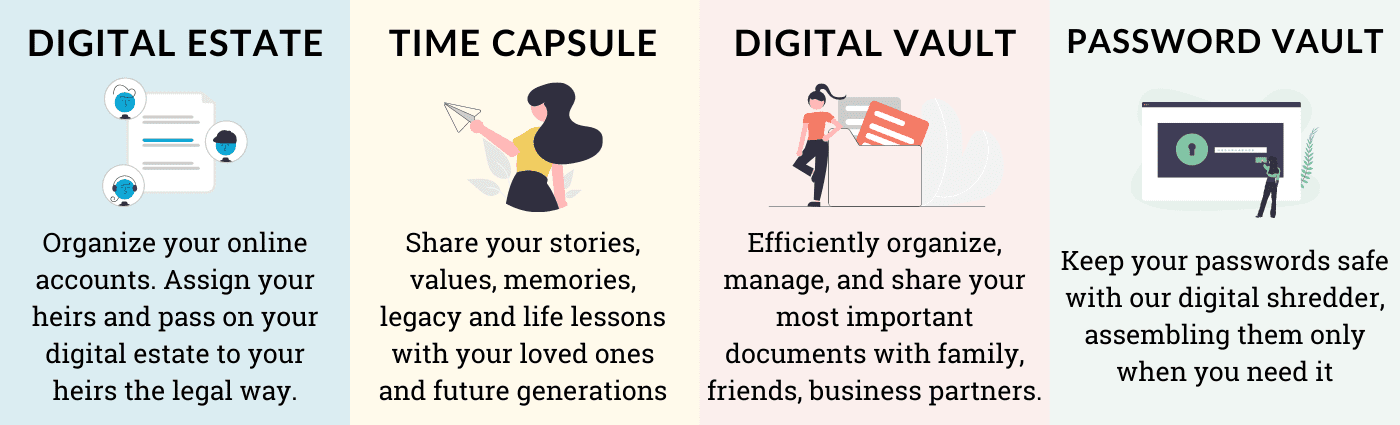

Product

Clocr is your one-stop shop for all your digital legacy planning needs

Easy-to-use, TurboTax-style onboarding process enables you to set up your online account portfolio and beneficiaries in minutes

Your beneficiaries (family, friends, business partners, etc.) can have legal access to your digital property

A personal, digital safety deposit box for important documents with patent-pending security

- Keep track of who designated you as their beneficiary. Never lose sight of your responsibilities

- Automatic notifications and alerts

Traction

Media mentions and validation from Forbes, SXSW, SoGal, Meet the Drapers, and more

Since our launch in September 2020, Clocr has been making waves in the industry. We’ve been featured in and honored by publications such as Forbes, Entrepreneur, and techconnect.

In 2020, Clocr won and placed at 8 pitch competitions and raised over $15,000 in non-dilutive funding.

Clocr has additionally caught the eye of Silicon Valley billionaire titan, Tim Draper, a member of the legendary Draper family, and a major investor in numerous disruptive technologies and companies such as Twitter, Robinhood, and Skype.

Clocr is proud to be featured in Season 4 of Meet the Drapers, hosted by members of the Draper family.

Customers

We enable you to protect and pass on your digital legacy

Clocr has partnered with organizations such as the Female Advisor Network and Global Women for Wellbeing to offer services to their members. We are also in conversations with several law firms and financial planners to offer our services to their clients.

We are offering our services directly to families or through their financial planners and estate lawyers.

Clocr has received tremendous positive responses from financial planners and estate lawyers. We plan to expand to senior living, employee benefits, pre-paid legal services, etc.

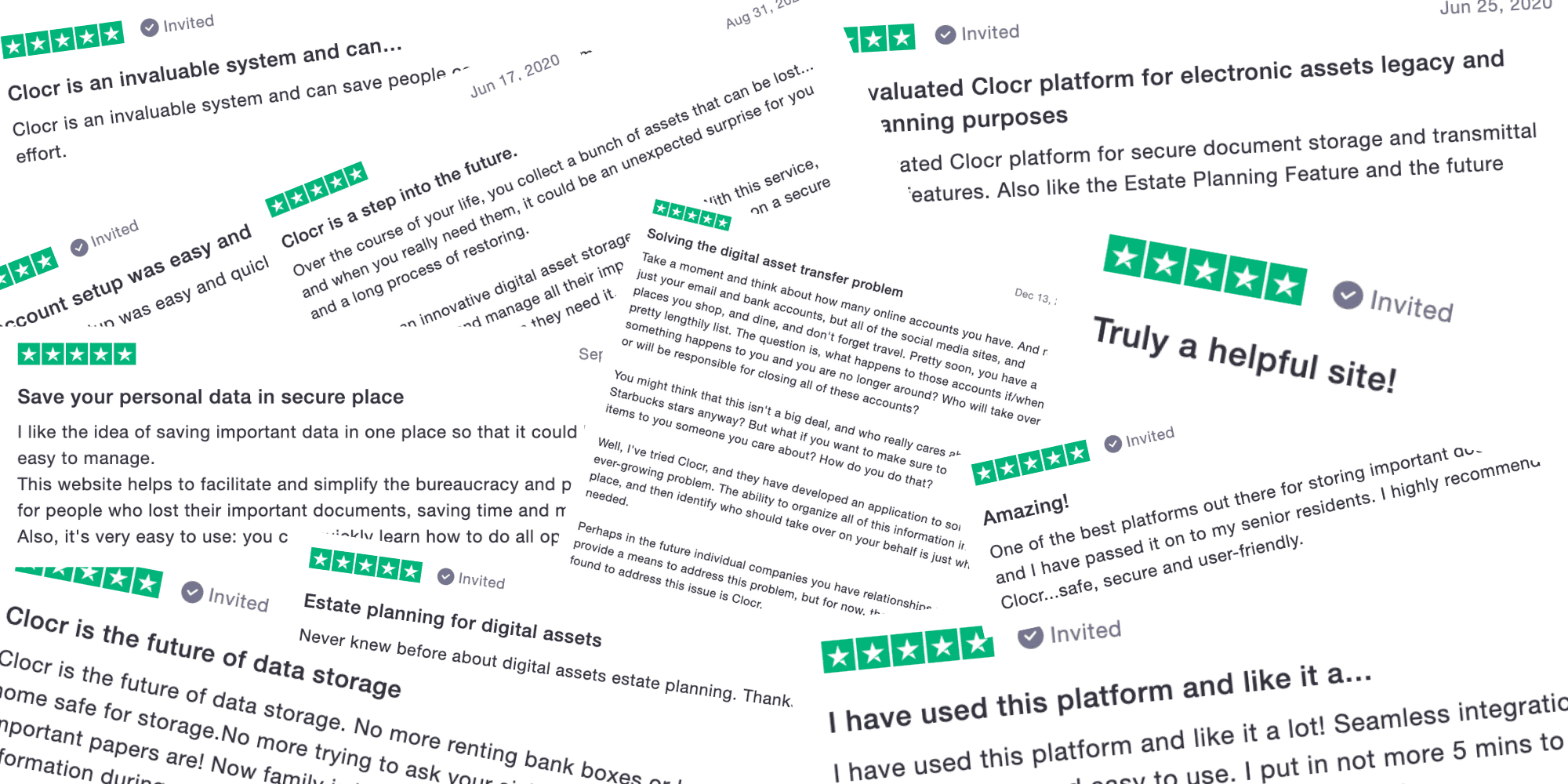

Check out a few of our Trustpilot reviews below:

Business model

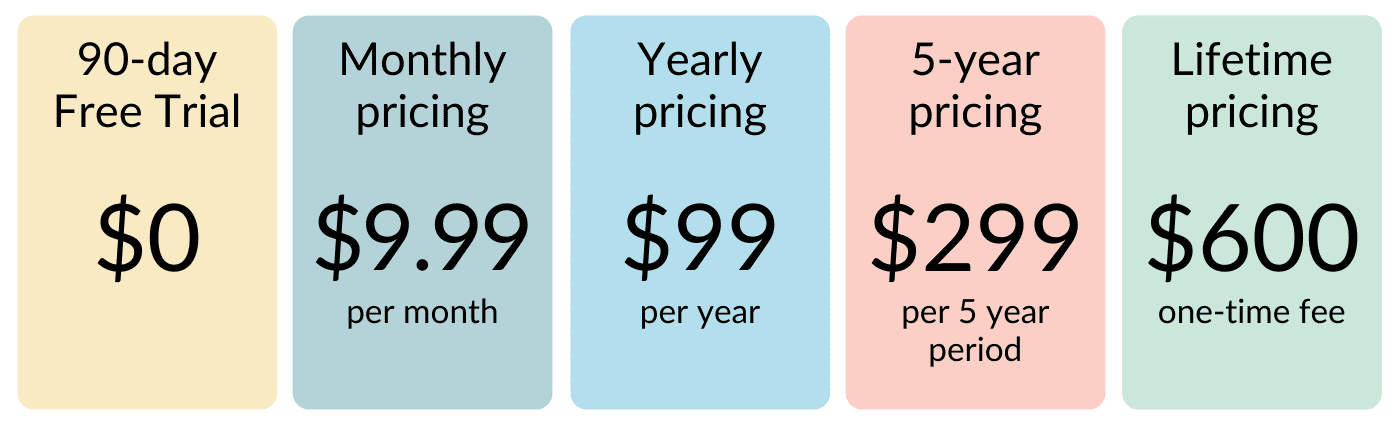

We offer freemium and paid subscriptions and custom pricing for businesses

Direct to Consumer (B2C)

These are list prices, and we plan to offer heavy discounts during the first year to encourage adoption

These are list prices, and we plan to offer heavy discounts during the first year to encourage adoption

Business to Business (B2B)

Clocr offers custom pricing based on businesses' needs to ensure clients are not locked into a fixed-price model. We provide value-added services and increase customer engagement with channel partners.

There are the industries we have received the most interest from, and we plan to expand to additional industries in the future

There are the industries we have received the most interest from, and we plan to expand to additional industries in the future

We estimate every customer will add around 3 beneficiaries to their portfolio, creating a natural fly-wheel of virality.

Market

A $300B opportunity

There are 3.2B upper-middle class consumers around the world. Even at a $100 lifetime subscription fee, this makes the digital legacy planning industry more than a $300B opportunity.

What do we know about this market:

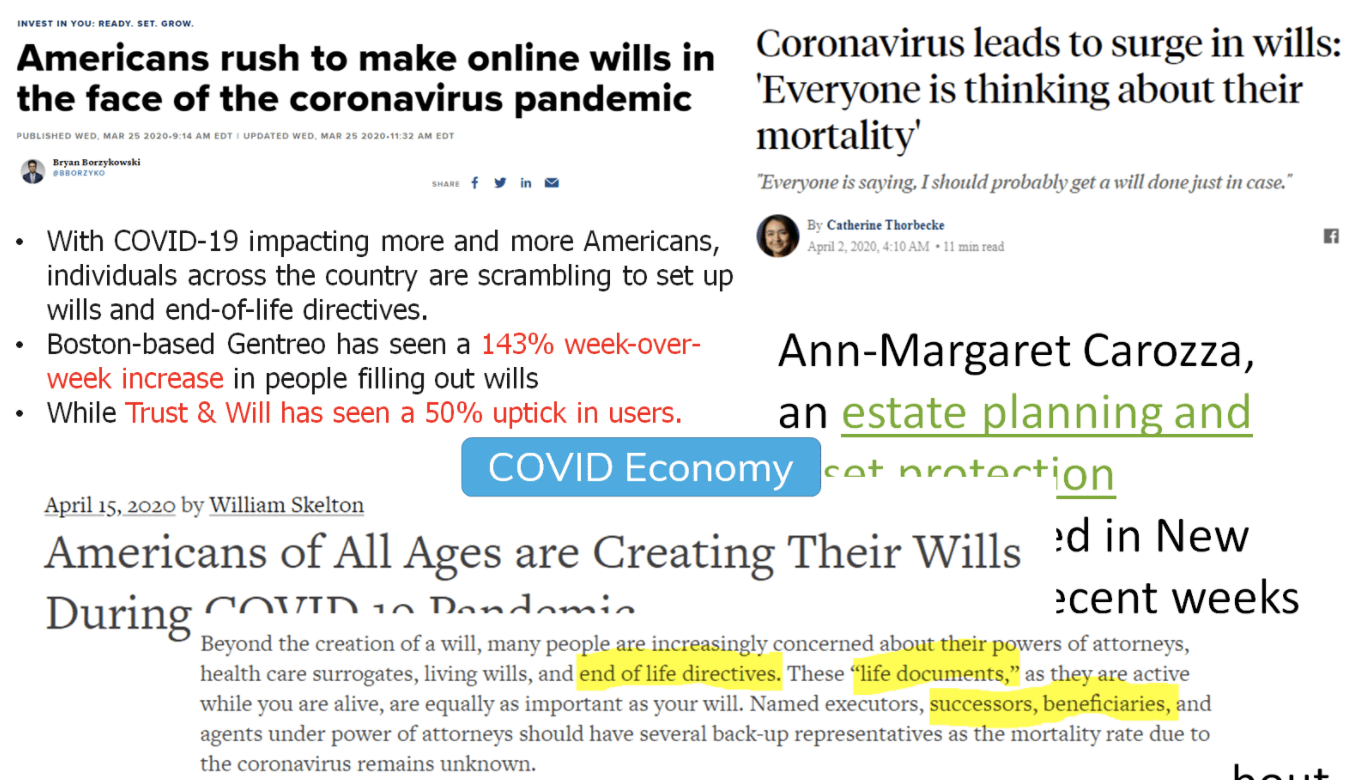

Digital dependency is on the rise, and COVID-19 has further accelerated the adoption

Accelerated digital adoption poses a major challenge to digital estate planning, because people own several dozens of online accounts and many digital assets.

The pandemic has shown us how disaster and tragedy can strike at any time, so it has become all the more critical for families to begin thinking about how to protect and pass on their legacy for future generations and creating a legacy plan for digital assets

Surge in estate planning

Awareness of estate planning has never been higher. COVID-19 has created an urgency for estate planning and an appetite to plan ahead. More people than ever are aware of the uncertainty of life and are preparing for the worse case scenario.

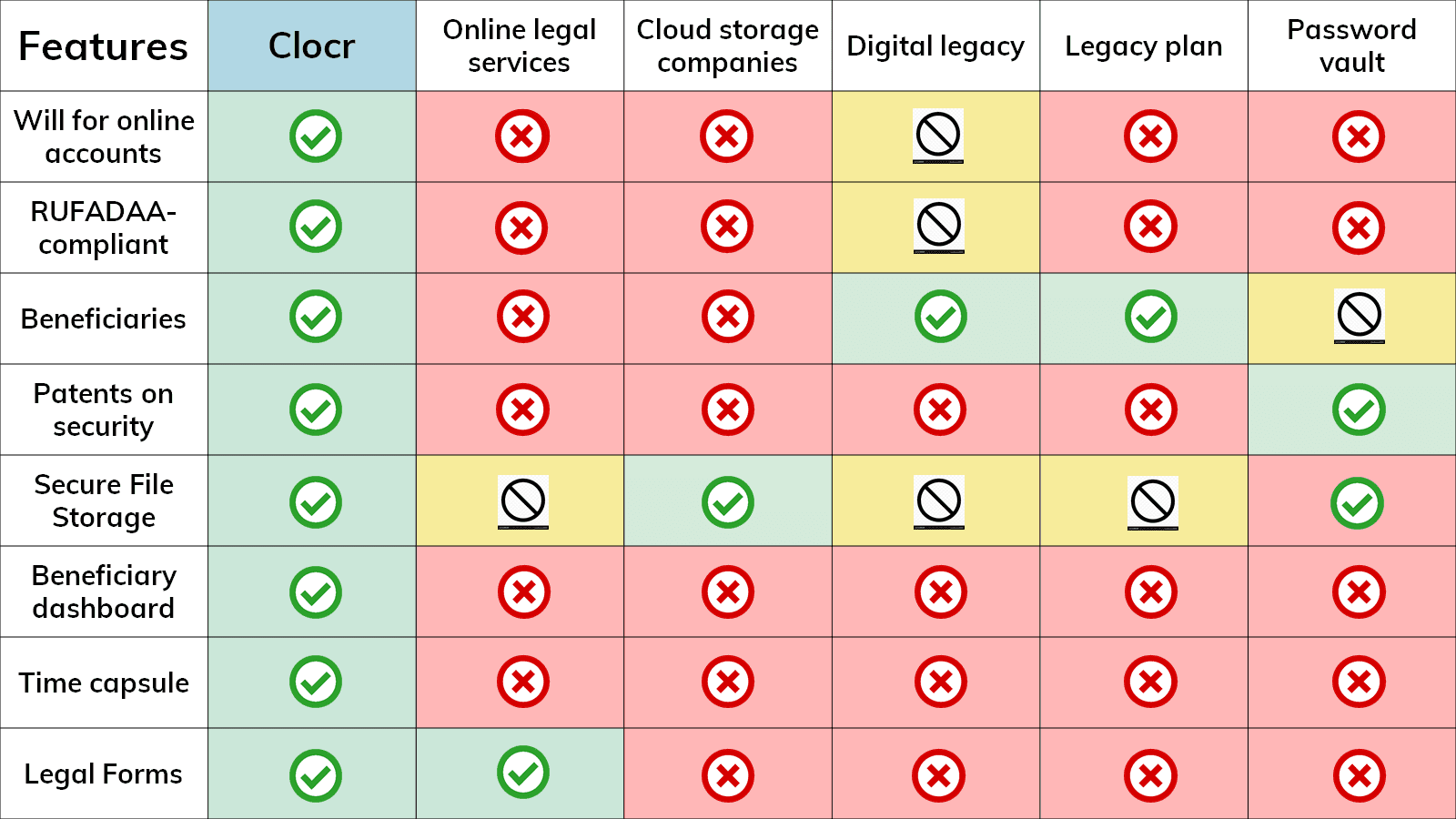

Competition

An all-inclusive solution

There are a few solutions in the market that offer one or two capabilities. However, our solution offers all-inclusive legacy planning features, patent-pending security, and a simple user interface. We offer many important features on a single platform to make it easy for you to protect your family in the long run.

Competitive landscape

Vision and strategy

Providing peace of mind

Our focus is providing the premier, all-in-one life planning solution and eliminating the need for multiple services. Until 2021, Clocr has been bootstrapped, and we built and released our 2.0 commercially-viable product. Our roadmap includes adding new service lines that will enhance our product offering, going through security certification, and growing our team.

Our vision is to continue building our platform and utilize new technologies that ease the process of digital legacy planning.

We are just getting started in modernizing this age-old industry, and we invite you to join us on our mission to protect families world-wide.

Funding

Clocr has raised over $300k from private investors in 2021

This past year has been tremendous for us. We bootstrapped the company until last year, and released Clocr 2.0 in September 2020, pivoting from our digital vault service to an end-to-end digital legacy platform. Since this pivot, we've received amazing validation through pitch competitions, and have also garnered interest from angel investors and VCs.

We raised a seed round to support our platform development and geographic expansion. Our upcoming plans include expanding our sales and marketing teams, increasing outreach to channel partners, building our brand on social media, and launching our services in the UK, Canada, and India.

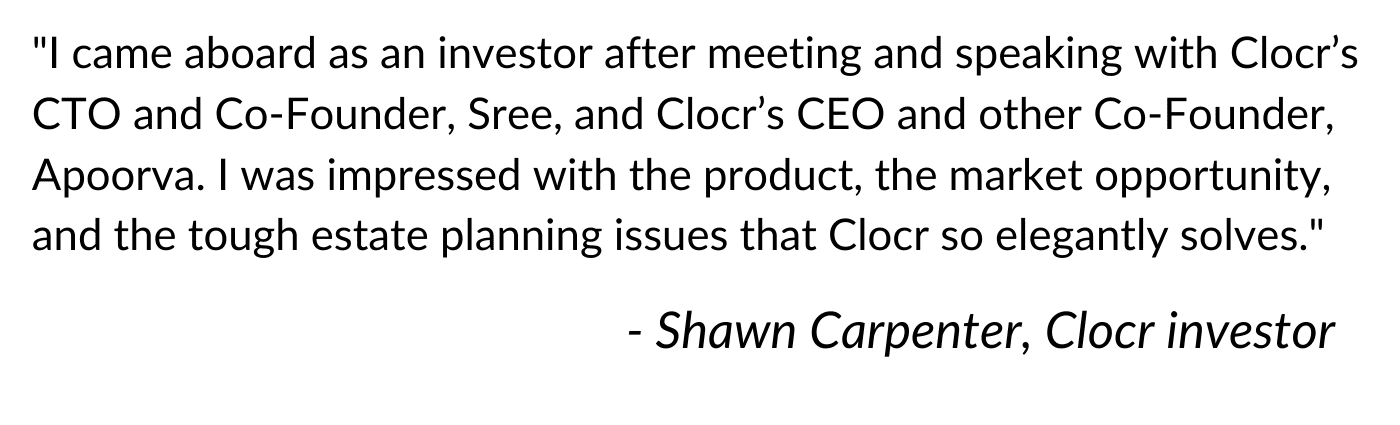

Meet Shawn Carpenter, one of Clocr's seed investors

Shawn Carpenter is a seasoned and successful early-stage technology investor with 30+ successful placements, 7 exits, and zero failures thus far.

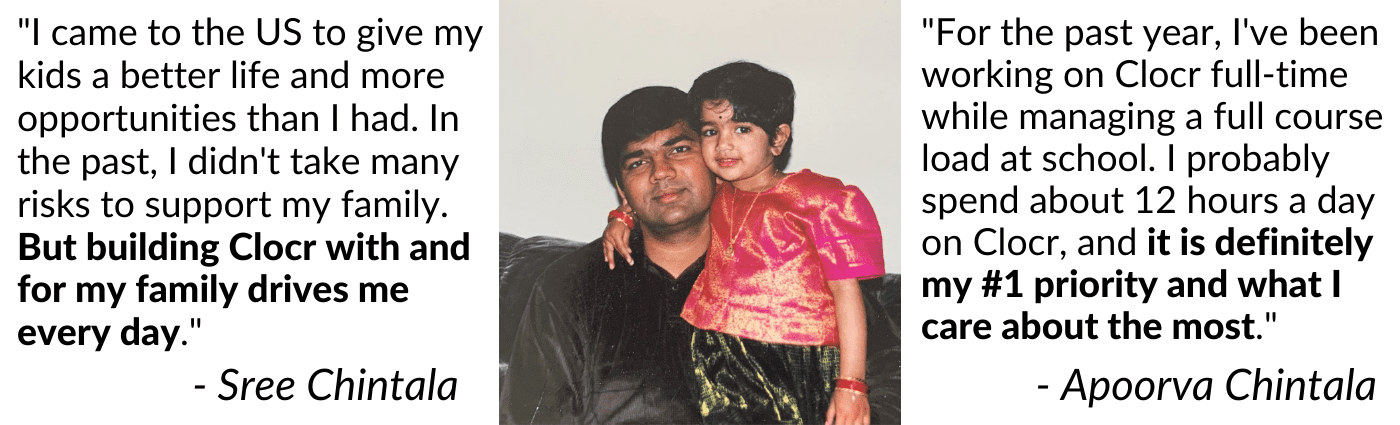

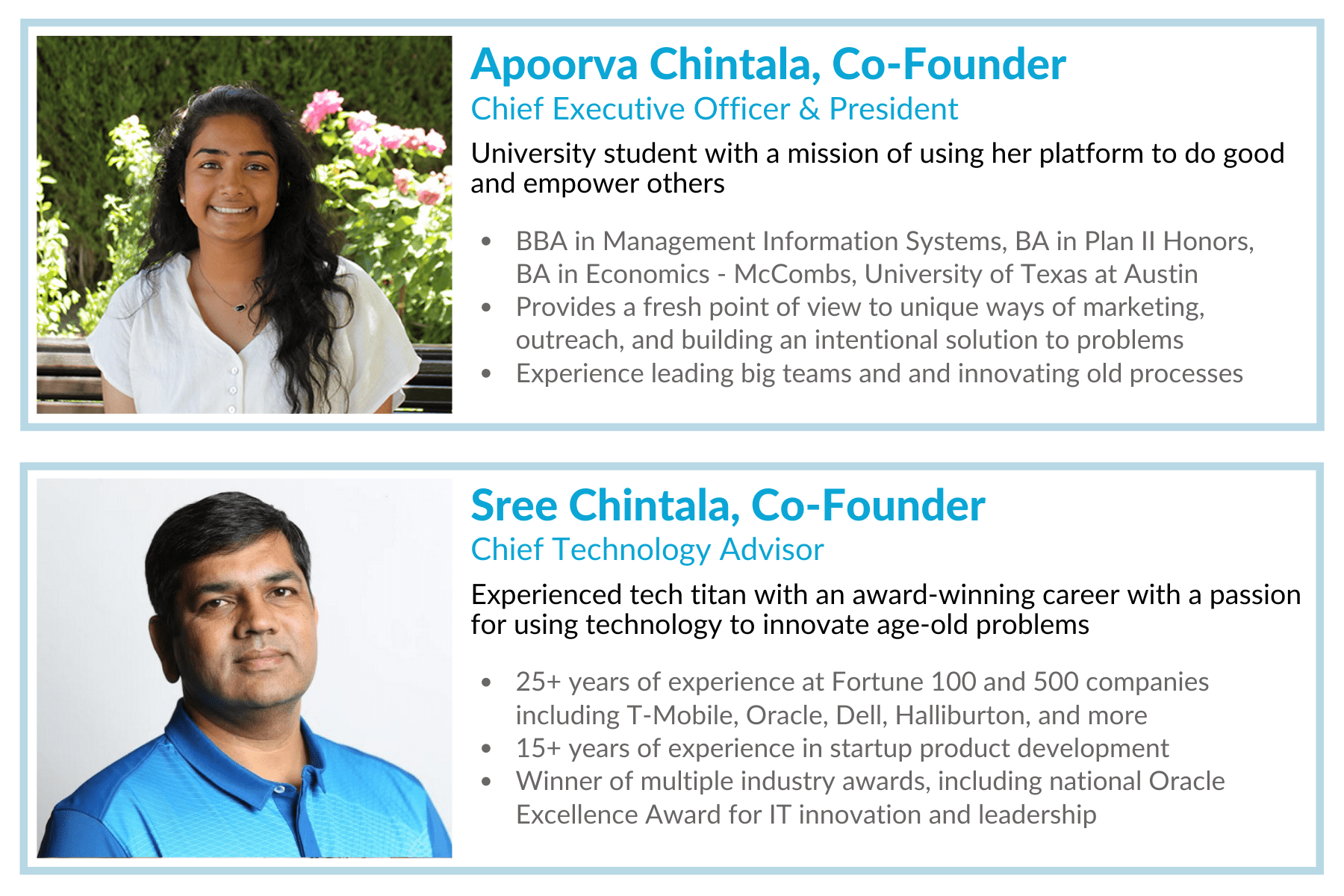

Founders

A family-centric solution run by a family team that has your best interests at heart

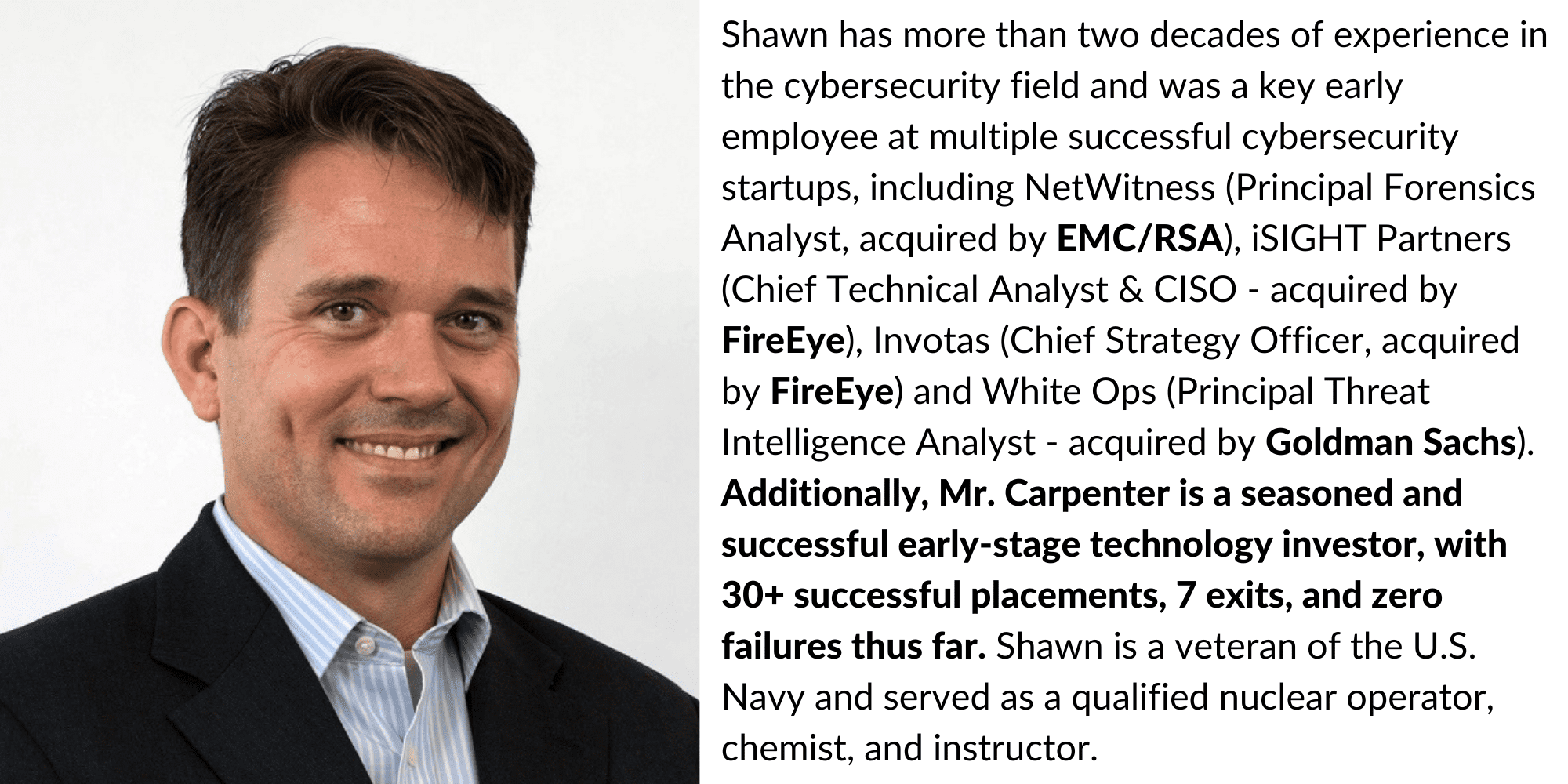

Clocr was founded by a father-daughter team, Sree and Apoorva. The idea for Clocr was born after the death of Apoorva’s grandfather. As the eldest son, Sree was tasked with handling the estate.

Apoorva and her grandfather, the inspiration and motivation behind Clocr and its mission to provide peace of mind to families world-wide.

Apoorva and her grandfather, the inspiration and motivation behind Clocr and its mission to provide peace of mind to families world-wide.

This wasn't easy, considering the emotional burden a death in the family can have and how disorganized all the paperwork was. Apoorva and Sree started Clocr to help families prepare in advance for such events and avoid the pain and frustration that they experienced.

A few words from the founders

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...