Problem

Miners are still air-cooled in a liquid-cooled world

Almost all crypto mining rigs are air-cooled, just like an old VW bug or boring beige computer.

Modern cars and gaming PC´s have gone liquid-cooled, and for good reason: it’s cheaper and more reliable to cool with liquid than with air. Even Tesla batteries are liquid-cooled.

—

Crypto's sustainability problem

Crypto mining is routinely criticized for being environmentally unfriendly. Bitcoin mining consumes 0.5% of all electricity used globally—that’s more than the entire population of Finland’s 5.5 million people.

Solution

Liquid-cooled mining powered by renewable energy

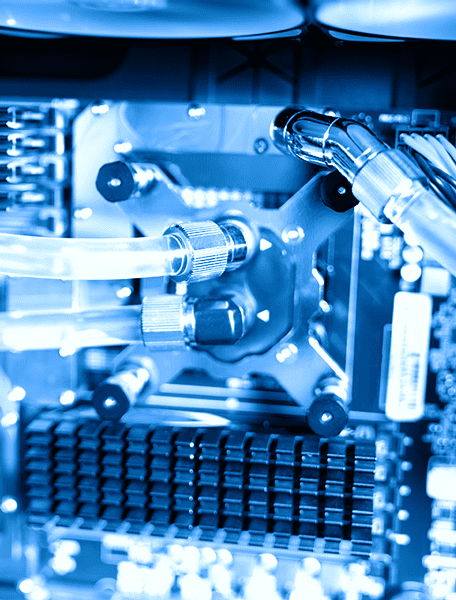

With a liquid-cooled mining rig, the ASICs (Application-Specific Integrated Circuits) can reliably be run cool. Maintaining a narrower and more predictable temperature range extends their longevity, while running higher sustained loads for greater efficiency. This consumes less overall power for a given hashrate and increases the overall profitability of operations.

—

Renewable energy can cost less

The average electricity rate in the U.S. is $0.1042 per kilowatt-hour, but hydroelectric power can be bought in quantity for as low as $0.06/kWh—including hosting—and even less without.

Product

Efficient to maximize results

- We run a mix of commercially available miners, both ASIC and GPU.

- We use liquid cooling, a mix of both waterblock and immersion. This gives us increased efficiency and results.

- We dynamically select the coin/algorithm to mine based upon current profitability calculations.

- We hold the results: both BTC and staking ETH 2.0.

- Would you rather just hold cryptocurrencies, or mine more every day?

—

Types of cooling

- Waterblock cooling generally requires custom waterblocks for each type of miner. We are working with third party partners to supply these. Waterblocks are readily available for GPU's but are pretty much custom development work for ASIC's.

- Bitmain has announced a liquid cooled miner straight from the factory ... we'll see when we can actually get our hands on them, we're not going to wait.

- In the meanwhile, you can take any liquid cooled computing device and unceremoniously dump it in a tank of mineral oil and it will run fine—even better, it will run cooler. You still need to cool that mineral oil, but we have a way to start mining liquid cooled right out of the gate.

This is all a lot of work, and highly technical, and easy to get wrong, but we do this so our shareholders don't have to. Shareholders own a piece of the company and the company mines crypto every day.

Traction

UPDATES:

Our key team members have mined crypto as far back as 2011 and built custom liquid cooled mining rigs by hand ourselves. We are taking things up a level and doing it all by best practices and at scale.

We raised our first $5M Reg CF when crypto prices were much higher than they are today. Then, as prices of BTC/ETH/etc started falling, the prices of mining equipment, etc. started falling too. We found ourselves sitting pretty with fiat currency in the bank while other operators had set themselves up with operational costs that were only sustainable at the higher crypto prices.

We got to work right away:

1) We started staking ETH.

- We did this 32ETH at a time to run our own validators. We think we did this in the most efficient way possible with Lighthouse and Erigon running at state of the art host powered by wind and hydro power.

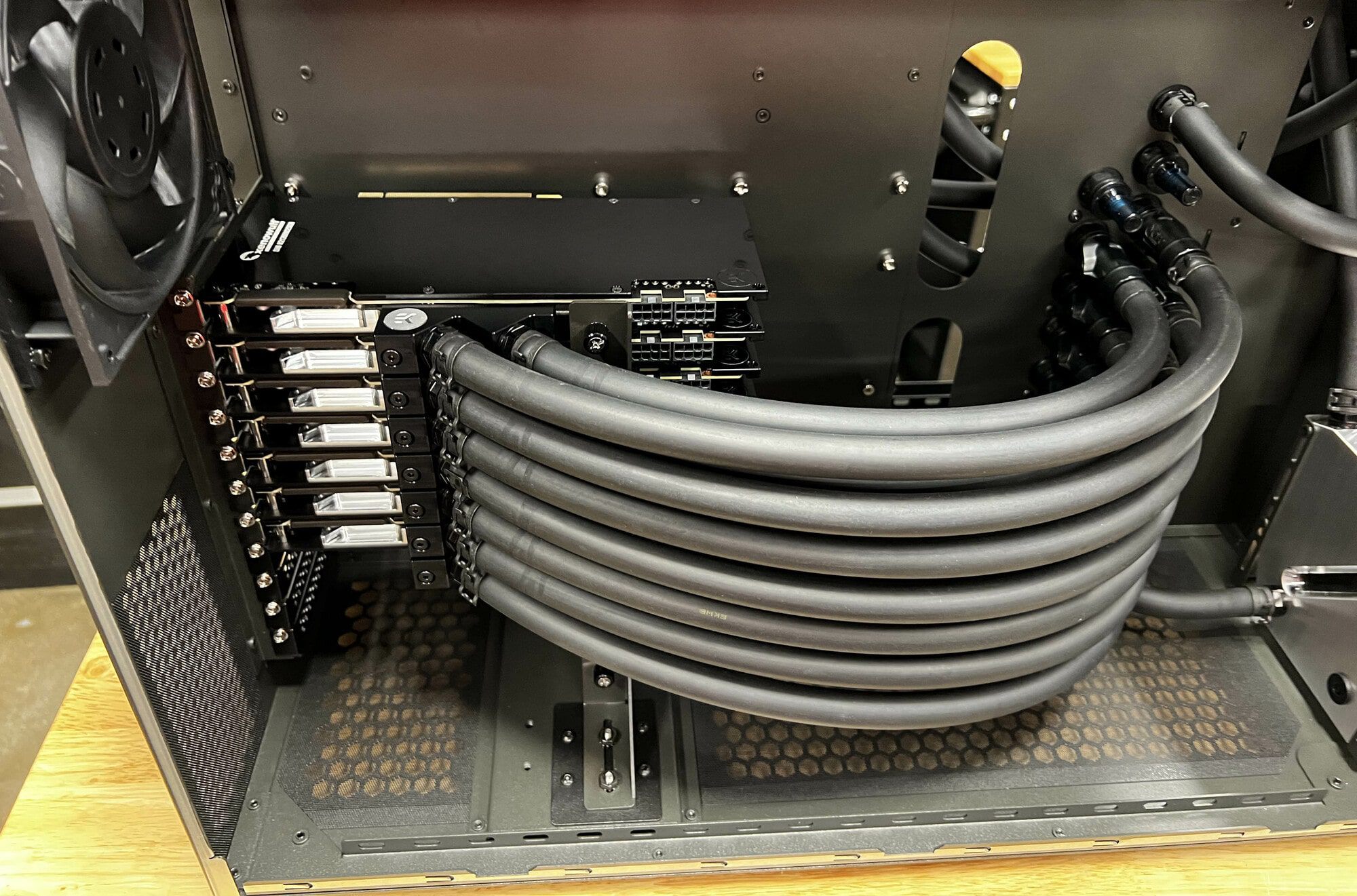

2) We built our first liquid cooled GPU mining rig

- ...and is a thing of beauty.

- This is what SEVEN (seven!!!) RTX3090's look like in a single case. We plan to upgrade them to RTX4090's and deploy them at scale as we lock in our own power and facilities.

3) We got the power!

- Electrical energy costs, generally measured in kilowatt*hours (kWh) is the fundamental operating cost of any crypto mining facility. If you're paying a penny more per kWh than your competitors, you could well go out of business while they turn a profit.

- We initially identified central Washington State as the area with the cheapest power and, we thought, locked in 2.8 cents per KWh (U.S. average is 10.42 cents/kWh and goes well over 30 cents).

- Then ... got the rug pulled. The utilities in Washington State that had the cheapest hydro power started penalizing crypto miners by jacking their rates. Our 2.8 cents/kWh quickly turned into over 5 cents all in, add on rent and it was getting closer to 8 cents/kWh.

- We doubled down on our search and are closing in on properties in Oregon and Montana, both with what is the cheapest hydroelectric power we can find in the nation -- under or near 5 cents a kWh. We have LOI's out on two properties now and are negotiating the deals. We are looking at both buying and renting but, at least for our manufacturing base HQ, we will likely buy.

4) We bought 200 BTC miners and have them up and running.

- S19J Pro's, basically the most efficient BTC miners made (depending on cooling, clock rates, etc.). We're running these air-cooled right now, getting ready to move them over to

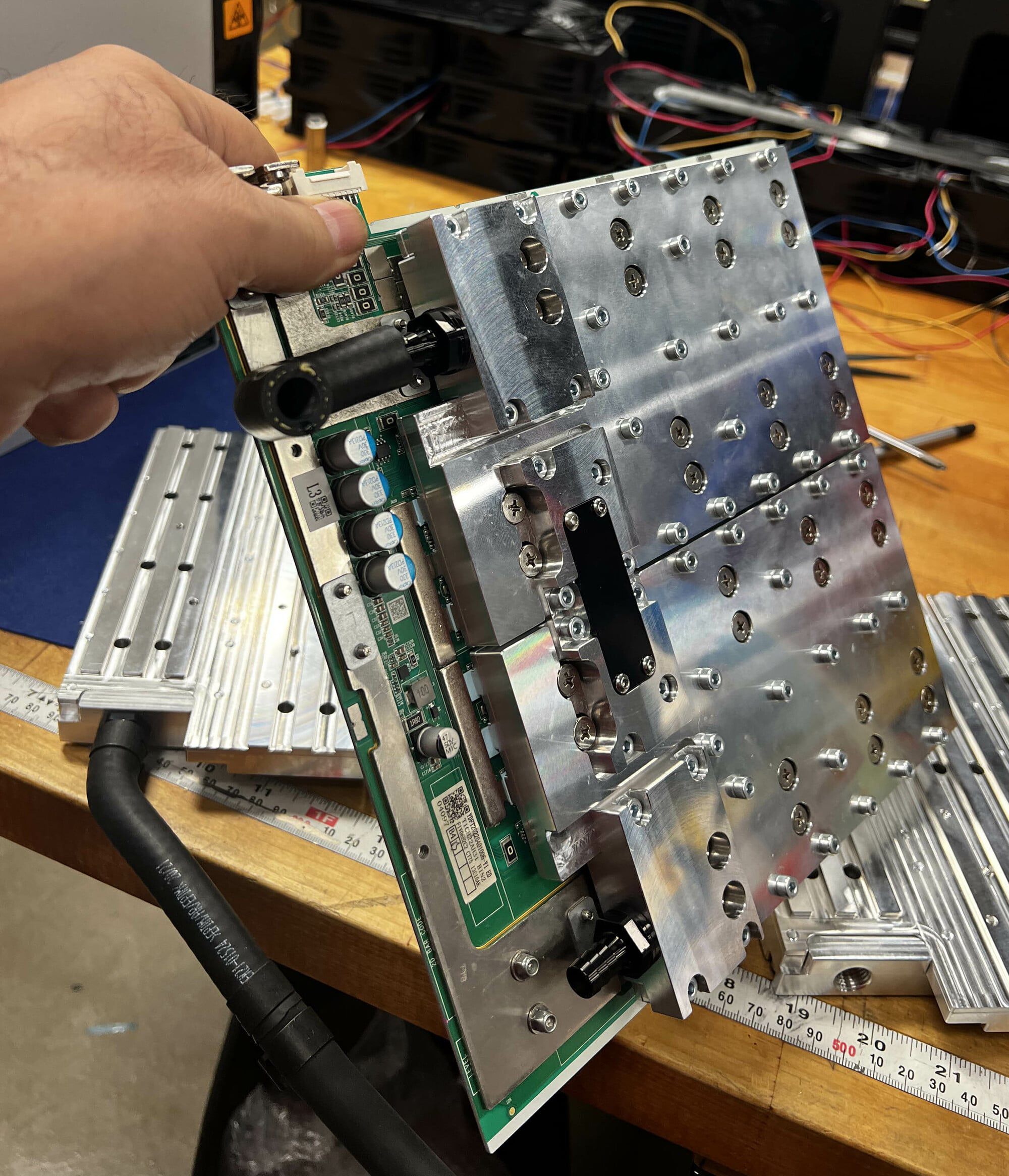

5) Our FIRST WATERBLOCKS!

- Most liquid cooling for crypto has been immersion cooling, where you dump the whole miner in a tub full of oil and then figure out how to cool the oil. It's messy and takes up a lot of space.

- Waterblock cooling, like Bitmain keeps advertising on the S19 Hydro (but never seem to ship), and like you see on high end PC Gaming Rigs, high end computational clusters for AI etc., we think is the way to go. No one was making waterblocks for ASIC miners, though, so ... we made our own.

- Look at that sexy hunk of aluminum! We need to nail down our manufacturing space and then we'll be slapping these things on S19 miners all day long.

6) Shipping containers.

- We have a patent pending process to liquid cool crypto miners in pairs of shipping containers: one container holds the miners, the other the radiators and fans. This, we believe, is the most efficient system possible as it maximizes surface area and airflow over the radiators for cooling.

- This is hard to do. It requires a HUGE amount of power distribution (over a Megawatt per container), and then all that heat goes into the liquid which has to be pumped to the container with the radiators and the fans, and the whole thing needs monitoring of electrical consumption, temperature and pressure at pretty much every miner...

- Safety is key, the electricity in these things could make a human bug zapper flash in a fraction of a second; water and electricity don't mix well, so even the plumbing needs to be done exactly right; then you can't just leave a container full of a million dollars worth of mining equipment next to a dam by a river without some real security precautions.

- Once we have this done, though, we can ship containers out to wherever the cheapest power in the world happens to be at the time. The ideal situation would be at a hydro dam "behind the meter", which means at the dam and before the electricity goes out to the highly government regulated grid (and the price goes way up). This is the goal, but we're considering other power sources too.

- We have purchased four containers already, 2 x 20' and 2 x 40', and are working on design and build out now.

CONCLUSION: we're busting out!

The next step is locking in our manufacturing property, building out containers, slapping the waterblocks on miners, and ramping up to scale.

We think we got it all figured out and we're ready to stomp on the gas pedal.

Customers

The beauty of crypto mining is that you don't have customers per se. We make the miners, we run the miners, we get crypto. It's all algorithmically guaranteed, with no sales team required.

Business model

How we all make money

We mine crypto, mostly BTC on ASIC but some other coins on GPU (with algorithms that select whatever is most profitable at the time). We "hodl" in BTC and stake Ethereum.

Note that ASICS are the fastest miners and are well suited for BTC. Ethereum, and similar cryptos, are made to be "ASIC-resistant" and is best mined on GPU.

BTC. Ethereum, and similar cryptos, are made to be "ASIC-resistant" and is best mined on GPU.

We have to buy mining rigs and apply liquid cooling to them, this is where most of the capital goes. The listed prices of miners rarely reflect the actual price and delivery dates promised can get delayed for months. We've even heard of the manufacturers running the gear themselves when prices are high, for months at a time, and only shipping when the price drops.

Competition

Why we're excited

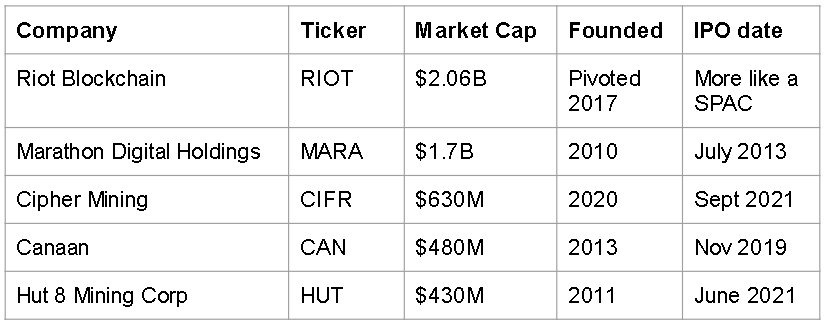

Mining crypto has been lucrative for other companies that operate in this space, and the stock prices of the publicly traded companies in the space reflect that. *market caps as of 24 March 2023

*market caps as of 24 March 2023

(reference: https://capital.com/biggest-global-crypto-bitcoin-mining-companies-ranking-btc)

China banned crypto mining in 2021. Russia became the second largest crypto mining country in 2023, behind only the US.

We're helping the US keep the lead — we believe the efficiencies from liquid cooling will give our company the edge.

Vision and strategy

Our mission

To become the most technically advanced and efficient crypto mining company on the planet...

...scaling in size to the top of our industry...

...all while maintaining a sustainable energy footprint.

Impact

For better or worse, Cryptocurrency mining takes a lot of power. The U.S. Government estimates total global electricity usage for crypto assets are between 120 and 240 BILLION kilowatt-hours per year, that's 120-240 TRILLION watt-hours (terawatt-hours) per year. That's more than the entire countries of Argentina or Australia use.

Let's imagine that we can increase efficiency by 10% with liquid cooling, or that we can move 10% of that to total amount to renewable energy. What would just 10% save?

Well, that would save 12-24 BILLION kilowatt-hours per year of energy consumption. That's more than about 100 countries on the planet each use every year.

That much energy savings would save over 10 MILLION metric tons of greenhouse gas emissions. We don't even know what that equates to in sea level rise or polar bears saved, but it's gotta be a bunch.

Funding

We raised $5M in 22hrs on Republic on our first Reg CF just a year ago (there is a $5M/yr limit on Reg CF's). We did a little more on a Reg D too (Reg D's are for accredited investors).

We're looking to do a Reg A+ later, that raises the amount you can raise per year to $75M, but these things take a lot of time.

In the meanwhile, we are rolling out our second Reg CF at what we expect will be an intermediate price between the last one and whatever comes next.

Founders

Experienced miners and successful entrepreneurs

Rick Bentley: Chairman/CEO

Rick Bentley has a long history of leadership and innovation in Silicon Valley. He was first mining crypto in 2015 while working full time at Google. When Ethereum came out he was mining on liquid-cooled GPU rigs of his own design.

He’s started several tech companies: one was backed by Softbank and bought by Uber. He's also CEO at Cloudastructure, which has had two successful Reg CF rounds, on Republic and Wefunder, and a Reg A+ fundraise of over $35M. Mr. Bentley has a B.A. in Physics and a Masters in Engineering from University of California at Berkeley.

—

James McCormick: CFO

James McCormick has over 30 years of experience in finance, operations and administration including CEO, CFO and COO positions at public and private companies. He has been instrumental in raising over $1B in funds for companies he has been involved with, including IPO’s, sales to strategic investors, investments by VC’s and securities sales through capital markets. He has been involved in numerous M&A activities, both on buy-side and sell-side transactions. His experience has ranged from managing start-up companies to complex, multi-national entities.

Prior to Hydro Hash, Mr. McCormick was President and COO of LTA Research, a leading aerospace research and development company building experimental and certified manned and remotely piloted airships. McCormick’s responsibilities included management of manufacturing, flight operations, purchasing, quality, finance, IT, legal and business development. He holds a BBA from the University of Toledo and a MBA from the University of Michigan.

—

Brad Degnan: CTO

Brad Degnan has a long history of Systems Administration in Silicon Valley. He has managed servers and networks for Electronic Arts, deCarta (bought by Uber), IronPort Systems, Cisco, Thoughtmatrix, Enmetric Systems and Redaptive. He first started mining BTC in 2011.

—

James McGibney: Advisor

James has a long track record of successful startup experience. James founded SecuraTrak, Cheaterville, and Bullyville. His work has gotten him interviews on Dr. Phil, ABC Nightline, Anderson Cooper and others. Most recently he has been featured on Netflix as the guy who helped bring down the "most hated man on the Internet". He's now working on his own TV show. He has also been a Senior Director of Cybersecurity at Rosendin since 2013. He has a Cybersecurity Certification from Harvard University, a Masters degree from Boston University, is a current Doctoral Candidate at Pepperdine University, and was a United States Marine from 1992-2000.

Summary

We raised $5M in 22hrs in our last Reg CF.

We're doing another Reg CF now and are planning on other, larger, raises in the future.

We've since built custom GPU mining rigs, ASIC waterblocks, are efficiently staking ETH, are building our own liquid cooled crypto mining containers, and are honing in on our own manufacturing property in an area with cheap hydroelectric power.

Our team is experienced.

We are ready to scale.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...